Key Insights

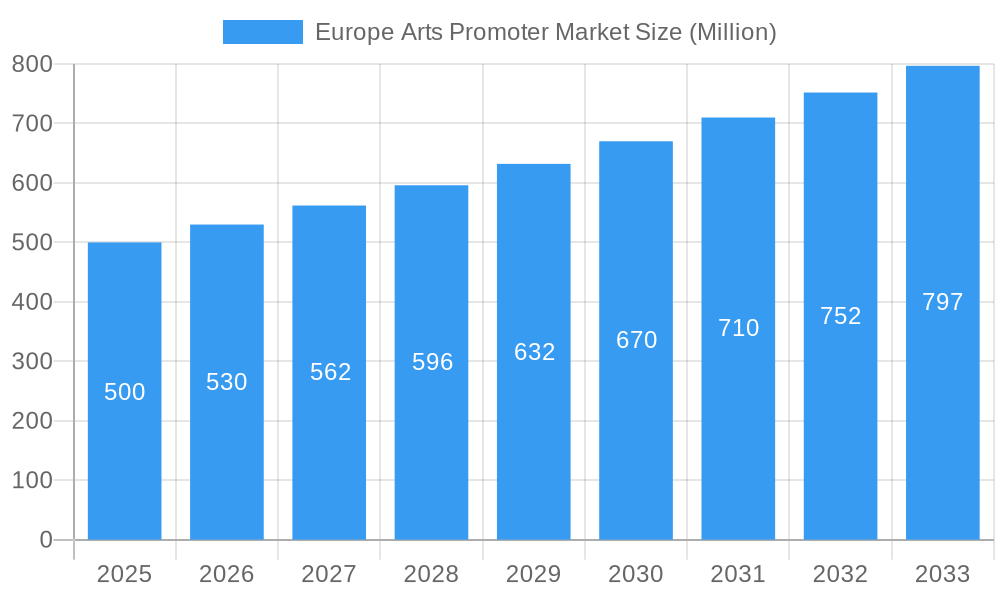

The European arts promoter market, currently experiencing robust growth with a CAGR exceeding 6%, presents a compelling investment opportunity. The market's value, while not explicitly stated, can be reasonably estimated based on comparable markets and the provided CAGR. Assuming a 2025 market size of €500 million (a plausible figure given the prominence of major players like Sotheby's and Christie's), the market is projected to surpass €750 million by 2033. This growth is fueled by several key drivers. Increasing disposable incomes across Europe, coupled with a rising appreciation for art and culture, are significantly boosting demand for art promotion services. The growing popularity of online art platforms and digital marketing strategies is further expanding the market's reach and accessibility. Furthermore, government initiatives supporting the arts and increased corporate sponsorship are contributing to this positive trajectory. However, the market also faces certain challenges. Economic downturns can impact consumer spending on non-essential items like art, potentially slowing market growth. Additionally, intense competition among numerous established and emerging art promoters requires continuous innovation and adaptation to retain market share. Segmentation within the market includes various types of art promotion services (e.g., gallery representation, auction services, online marketing, event organization), each catering to specific artist needs and clientele. Leading players, including The Art Wolf, Europe's Art, Artshead, Marshall Art, Art Basel, Perrotin, Sotheby's, MTArtAgency, David Wade Fine Art, and Christie's, are actively shaping market dynamics through their innovative strategies and extensive networks. Their continued influence will be crucial in navigating the opportunities and challenges of this dynamic sector.

Europe Arts Promoter Market Market Size (In Million)

The competitive landscape is characterized by a mix of established auction houses with global reach and smaller, specialized firms catering to niche markets. The success of individual players hinges on their ability to cultivate strong artist relationships, leverage digital marketing effectively, and strategically position themselves within the evolving preferences of art collectors and enthusiasts. Geographical variations in market demand exist, with key regions likely exhibiting higher growth rates than others depending on economic conditions and cultural trends. Future growth will depend on adapting to changing consumer behavior, embracing digital technologies, and continuing to foster the broader appreciation for art and culture across Europe.

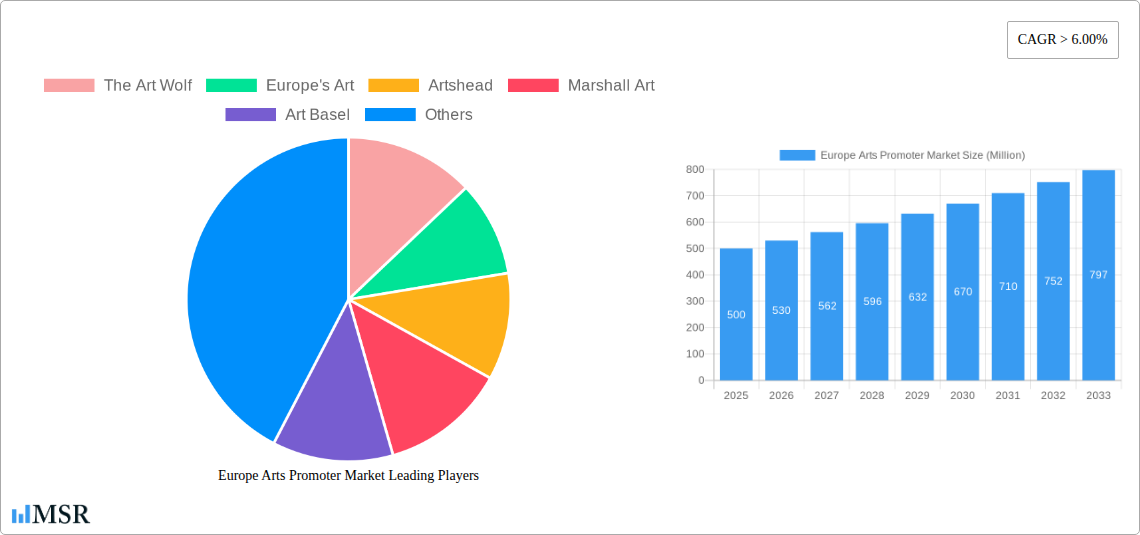

Europe Arts Promoter Market Company Market Share

Europe Arts Promoter Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Europe Arts Promoter Market, covering the period 2019-2033, with a focus on the base year 2025 and a forecast period of 2025-2033. The report delves into market dynamics, industry trends, key players, and emerging opportunities, offering actionable insights for industry stakeholders. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. This report is essential for investors, art promoters, galleries, auction houses, and anyone seeking to understand the complexities and future potential of this dynamic market.

Europe Arts Promoter Market Market Concentration & Dynamics

The European arts promoter market presents a moderately concentrated landscape, with established giants like Sotheby's, Christie's, and Perrotin commanding a significant share. This concentration is balanced by a vibrant ecosystem of numerous smaller, specialized promoters who collectively contribute substantially to the market's overall volume. The market share held by the top 5 players is currently estimated at xx%, a figure that reflects both the ongoing trend of consolidation and the enduring presence of specialized niche players within the industry.

- Innovation Ecosystems: The market is characterized by a dynamic innovation ecosystem, propelled by rapid technological advancements. This includes the burgeoning digital art sector, the evolution of online auction platforms offering enhanced user experiences, and the integration of virtual reality for immersive viewing. This confluence of innovation fosters a climate of both intense competition and collaborative ventures, serving as a primary engine for market growth.

- Regulatory Frameworks: The diverse and often intricate national regulatory landscapes across Europe, encompassing art taxation, import/export protocols, and intellectual property rights, exert a considerable influence on market dynamics. These varying frameworks can create both strategic opportunities for agile operators and significant challenges for those engaged in cross-border transactions.

- Substitute Products: The emergence of digital art and Non-Fungible Tokens (NFTs) represents a significant new category of substitute products. While these digital assets challenge traditional art promotion models, they simultaneously unlock novel avenues for engagement, artist representation, and revenue generation, thus broadening the market's scope.

- End-User Trends: Key drivers of market expansion include the sustained interest in art as an investment vehicle among high-net-worth individuals and the increasing engagement of younger demographics with art through digital channels. This evolving collector base is shaping demand and influencing promotional strategies.

- M&A Activities: The market is witnessing notable M&A activity, exemplified by the merger of Maestro Arts and Sullivan Sweetland in June 2023. This event signifies a trend towards consolidation, particularly among smaller entities seeking to expand their reach and diversify their service offerings. The number of M&A deals observed in the historical period (2019-2024) is estimated at xx, with a projected xx deals anticipated during the forecast period (2025-2033).

Europe Arts Promoter Market Industry Insights & Trends

The European arts promoter market is experiencing robust growth, driven by a confluence of factors. The increasing affluence of high-net-worth individuals fuels demand for high-value art pieces, boosting the revenue of prominent auction houses and art promoters. Simultaneously, a growing appreciation for art amongst younger demographics, coupled with the accessibility of online art platforms, is widening the market’s consumer base. The market size was valued at xx Million in 2024 and is projected to reach xx Million by 2025, showcasing a substantial year-on-year growth. The significant increase in the digital art market, fueled by NFT technology, contributes significantly to the overall market expansion. Technological disruptions, such as the adoption of blockchain technology for provenance tracking and the use of AI for art valuation, are further transforming the industry landscape. Evolving consumer behaviors, including a growing preference for personalized experiences and access to curated digital art collections, also shape the market's growth trajectory.

Key Markets & Segments Leading Europe Arts Promoter Market

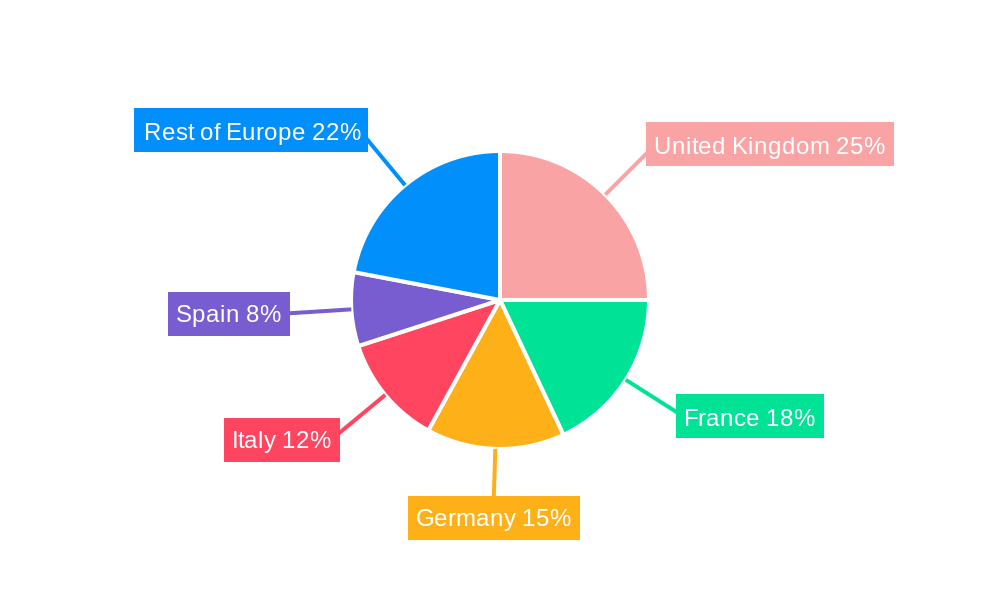

The United Kingdom, France, and Germany are the dominant markets within Europe, accounting for over xx% of the total market value. Their prominence is attributed to several factors:

- United Kingdom: Strong established art market infrastructure, high concentration of high-net-worth individuals, and a thriving art scene.

- France: Rich artistic heritage, substantial government support for the arts, and a large number of art galleries and auction houses.

- Germany: Growing demand for art investment and a developing digital art scene.

Other key segments driving market growth include:

- High-Value Art: This segment continues to dominate, driven by the ever-increasing demand from high-net-worth collectors.

- Contemporary Art: Growing popularity of contemporary artists and the rise of online art platforms further boost this segment.

- Digital Art and NFTs: The rapid expansion of the digital art market, particularly NFTs, represents a significant emerging segment.

Europe Arts Promoter Market Product Developments

Recent product innovations are reshaping the art promotion landscape. These include the development of sophisticated online auction platforms that integrate augmented reality (AR) and virtual reality (VR) technologies, offering collectors highly immersive and interactive viewing experiences. The implementation of blockchain technology is further enhancing market integrity by providing robust provenance tracking and improving security measures, thereby fostering greater trust and transparency among participants. Moreover, the proliferation of digital art platforms dedicated to NFT sales has opened up unprecedented opportunities for artists to reach global audiences and for collectors to acquire unique digital assets, thereby expanding the service offerings of art promoters and sharpening their competitive edge.

Challenges in the Europe Arts Promoter Market Market

The European arts promoter market navigates a complex set of challenges, including:

- Economic Fluctuations: Global economic downturns can disproportionately affect the high-value art market, leading to a reduction in demand and impacting sales volumes significantly.

- Regulatory Complexity: The patchwork of varied and often intricate regulatory frameworks across European countries presents substantial hurdles for international art transactions, requiring meticulous navigation and compliance.

- Supply Chain Disruptions: Issues pertaining to the specialized transportation and logistics of art pieces can result in considerable delays and escalating costs, impacting the efficiency of sales and exhibitions.

- Competitive Pressures: The market is characterized by intense competition from both established auction houses and a growing number of agile art promoters. This necessitates continuous innovation, strategic adaptation, and a keen understanding of evolving market trends to maintain relevance and market share.

Forces Driving Europe Arts Promoter Market Growth

Several forces are driving the growth of the Europe Arts Promoter Market:

- Technological advancements: Digitalization and the integration of new technologies are enhancing market efficiency and expanding accessibility to wider audiences.

- Economic growth: Sustained economic growth in certain European nations fuels increased disposable income and investment in art.

- Government support: Government initiatives promoting arts and culture further encourage market growth.

- Increased global interest: A growing global interest in European art contributes to market expansion.

Challenges in the Europe Arts Promoter Market Market

The European arts promoter market navigates a complex set of challenges, including:

- Economic Fluctuations: Global economic downturns can disproportionately affect the high-value art market, leading to a reduction in demand and impacting sales volumes significantly.

- Regulatory Complexity: The patchwork of varied and often intricate regulatory frameworks across European countries presents substantial hurdles for international art transactions, requiring meticulous navigation and compliance.

- Supply Chain Disruptions: Issues pertaining to the specialized transportation and logistics of art pieces can result in considerable delays and escalating costs, impacting the efficiency of sales and exhibitions.

- Competitive Pressures: The market is characterized by intense competition from both established auction houses and a growing number of agile art promoters. This necessitates continuous innovation, strategic adaptation, and a keen understanding of evolving market trends to maintain relevance and market share.

Emerging Opportunities in Europe Arts Promoter Market

The European arts promoter market is poised to capitalize on several emerging opportunities:

- Expansion into New Markets: Targeting and developing the growing art markets in Eastern Europe and other under-penetrated regions presents a significant growth avenue.

- Development of Specialized Services: Catering to niche art segments, such as sustainable art, digital art, and emerging artist representation, allows for differentiated offerings and targeted client acquisition.

- Leveraging Social Media: The strategic utilization of social media platforms for targeted marketing campaigns, community building, and direct engagement with art enthusiasts and potential collectors is becoming increasingly vital.

Key Milestones in Europe Arts Promoter Market Industry

- June 2023: Maestro Arts and Sullivan Sweetland announced their merger, creating a more substantial and diversified artist management entity within the European market.

- June 2023: Sotheby's achieved a significant milestone by selling a Gustav Klimt painting for USD 108.4 Million, setting a new European auction record and highlighting the enduring strength of the high-end art market.

Strategic Outlook for Europe Arts Promoter Market Market

The Europe Arts Promoter Market is poised for continued growth, driven by technological advancements, evolving consumer preferences, and strategic partnerships. Opportunities lie in capitalizing on the growing digital art market, expanding into new geographical markets, and leveraging data analytics to improve market efficiency. Companies that successfully adapt to these evolving dynamics and invest in innovative solutions will be best positioned for long-term success.

Europe Arts Promoter Market Segmentation

-

1. Type

- 1.1. Sculpture

- 1.2. Painting

- 1.3. Visual Art

- 1.4. Fine Arts

- 1.5. Other Types

-

2. Revenue Source

- 2.1. Media Rights

- 2.2. Merchandising

- 2.3. Tickets

- 2.4. Sponsoring

Europe Arts Promoter Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Arts Promoter Market Regional Market Share

Geographic Coverage of Europe Arts Promoter Market

Europe Arts Promoter Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.62% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 United Kingdom

- 3.2.2 France and Germany Driving the Market

- 3.3. Market Restrains

- 3.3.1 United Kingdom

- 3.3.2 France and Germany Driving the Market

- 3.4. Market Trends

- 3.4.1. Rising High Net Worth Individuals In Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Arts Promoter Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Sculpture

- 5.1.2. Painting

- 5.1.3. Visual Art

- 5.1.4. Fine Arts

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Revenue Source

- 5.2.1. Media Rights

- 5.2.2. Merchandising

- 5.2.3. Tickets

- 5.2.4. Sponsoring

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Art Wolf

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Europe's Art

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Artshead

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Marshall Art

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Art Basel

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Perrotin

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sothebys

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 MTArtAgency

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 David Wade Fine Art

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Christies**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 The Art Wolf

List of Figures

- Figure 1: Europe Arts Promoter Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Europe Arts Promoter Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Arts Promoter Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Europe Arts Promoter Market Revenue undefined Forecast, by Revenue Source 2020 & 2033

- Table 3: Europe Arts Promoter Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Europe Arts Promoter Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Europe Arts Promoter Market Revenue undefined Forecast, by Revenue Source 2020 & 2033

- Table 6: Europe Arts Promoter Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Arts Promoter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Arts Promoter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: France Europe Arts Promoter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Arts Promoter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Arts Promoter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Arts Promoter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Arts Promoter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Arts Promoter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Arts Promoter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Arts Promoter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Arts Promoter Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Arts Promoter Market?

The projected CAGR is approximately 6.62%.

2. Which companies are prominent players in the Europe Arts Promoter Market?

Key companies in the market include The Art Wolf, Europe's Art, Artshead, Marshall Art, Art Basel, Perrotin, Sothebys, MTArtAgency, David Wade Fine Art, Christies**List Not Exhaustive.

3. What are the main segments of the Europe Arts Promoter Market?

The market segments include Type, Revenue Source.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

United Kingdom. France and Germany Driving the Market.

6. What are the notable trends driving market growth?

Rising High Net Worth Individuals In Europe.

7. Are there any restraints impacting market growth?

United Kingdom. France and Germany Driving the Market.

8. Can you provide examples of recent developments in the market?

June 2023: Maestro Arts, a United Kingdom-based art promoter, joined forces with Sullivan Sweetland, resulting in the establishment of a mid-sized artist management company. This strategic merger enhanced their ability to support emerging artistic talent, execute ambitious projects, and significantly expand their roster of artists while increasing their project capacity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Arts Promoter Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Arts Promoter Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Arts Promoter Market?

To stay informed about further developments, trends, and reports in the Europe Arts Promoter Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence