Key Insights

The European casino gambling market is poised for significant expansion, projecting a Compound Annual Growth Rate (CAGR) of 14.18%. This dynamic sector is anticipated to reach a market size of $80.13 billion by 2025. Key drivers fueling this growth include the increasing prevalence of online casino platforms, enhanced by mobile accessibility and high-speed internet connectivity. Furthermore, the integration of innovative technologies such as virtual reality (VR) and augmented reality (AR) is elevating player engagement and attracting diverse consumer segments. Strategic marketing initiatives and collaborations with leading sports entities also bolster market ascent. Nevertheless, the market navigates challenges, including varying national gambling regulations and persistent concerns surrounding responsible gaming practices. The competitive arena features established entities like Flutter Entertainment and Bet365, alongside burgeoning new entrants. Market segmentation spans game types (slots, table games, live dealer), platforms (online, mobile, land-based), and distinct geographic regions exhibiting varied growth rates influenced by regulatory frameworks and economic factors.

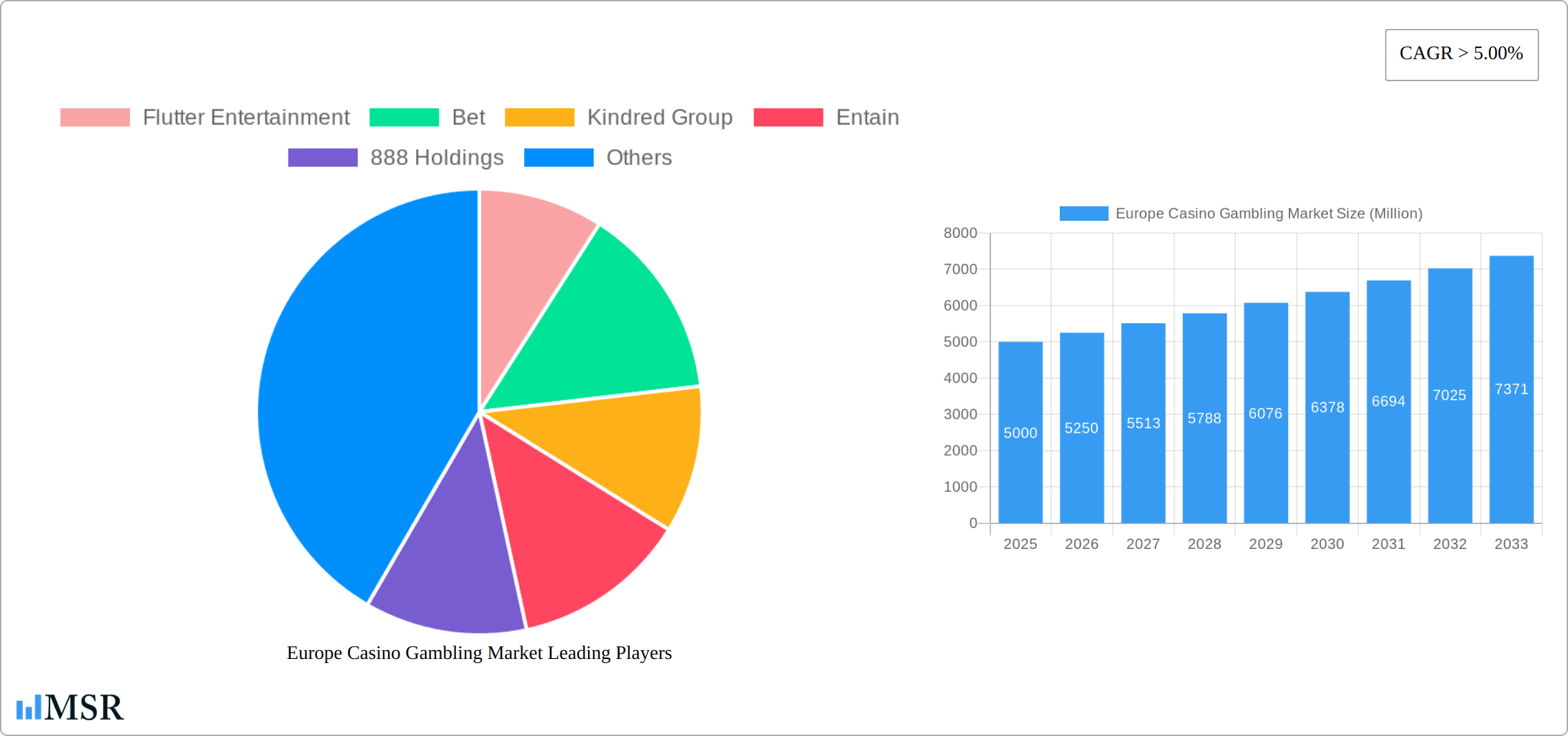

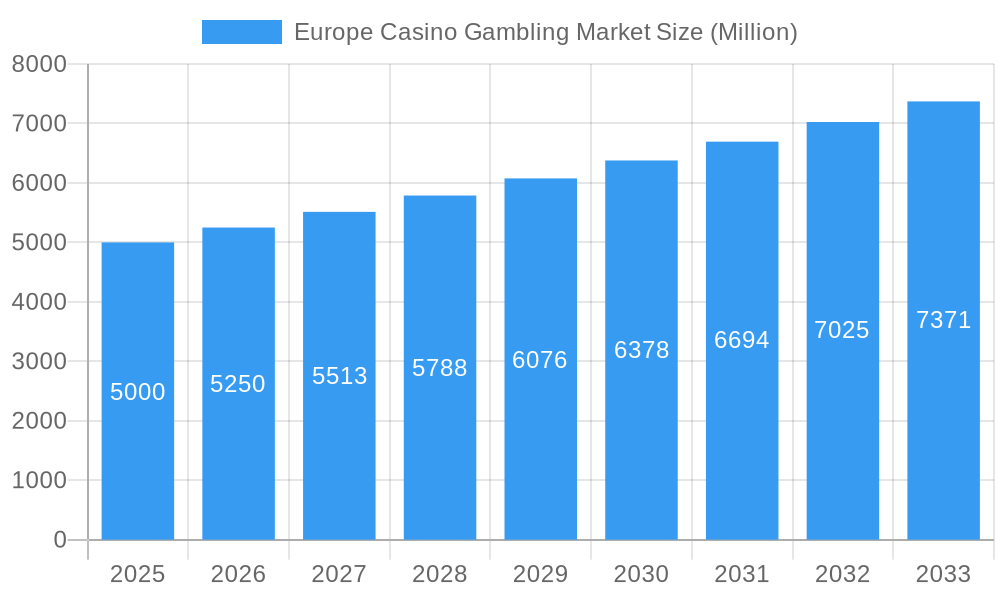

Europe Casino Gambling Market Market Size (In Billion)

Despite regulatory complexities, the European casino gambling market demonstrates a promising trajectory. Ongoing technological innovation, the implementation of targeted marketing strategies, and a commitment to responsible gaming initiatives are expected to sustain market growth. The diversification of gaming portfolios and the incorporation of esports betting are expanding the market's appeal. A growing preference for mobile gaming and the deployment of advanced analytical tools for improved customer experiences are set to significantly influence the industry's future development.

Europe Casino Gambling Market Company Market Share

Europe Casino Gambling Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the European casino gambling market, covering market dynamics, key players, emerging trends, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report is essential for industry stakeholders, investors, and anyone seeking to understand this dynamic and lucrative market.

Europe Casino Gambling Market Market Concentration & Dynamics

The European casino gambling market exhibits a moderately concentrated landscape, with several major players holding significant market share. Market concentration is influenced by factors such as stringent regulatory frameworks varying across different European nations, the prevalence of established brands, and the ongoing consolidation through mergers and acquisitions (M&A). Innovation, particularly in online gaming technologies and responsible gambling initiatives, significantly shapes market dynamics. The substitution of traditional land-based casinos with online platforms is an ongoing trend, driving the evolution of the industry. End-user preferences, shifting towards mobile gaming and personalized experiences, necessitate continuous adaptation from market participants.

- Market Share: Top 5 players hold an estimated xx% of the market (2025).

- M&A Activity: An estimated xx deals were recorded between 2019 and 2024, indicating a dynamic and consolidating market. Examples include Flutter Entertainment's recent acquisition of a stake in MaxBet.

- Innovation Ecosystem: Strong emphasis on technological advancements, including VR/AR integration, AI-driven personalization, and blockchain-based solutions.

- Regulatory Landscape: Diverse regulatory environments across European countries present both opportunities and challenges for operators, impacting market entry and operational strategies.

Europe Casino Gambling Market Industry Insights & Trends

The European casino gambling market is experiencing robust growth, fueled by a confluence of factors. Rising disposable incomes across several key European nations provide increased discretionary spending, while the ubiquitous presence of smartphones has dramatically increased access to mobile gaming, significantly boosting online and mobile casino participation. Technological advancements are revolutionizing the landscape; the rise of eSports betting presents exciting new avenues, and the integration of virtual reality (VR) and augmented reality (AR) is creating immersive and engaging gaming experiences unlike anything previously seen. Furthermore, evolving consumer behavior, marked by a demand for personalized experiences and seamless cross-platform accessibility, is reshaping the industry's competitive dynamics. Market estimates place the market size at an impressive €xx Million in 2025, with a projected Compound Annual Growth Rate (CAGR) of xx% anticipated throughout the forecast period (2025-2033). This growth trajectory is further supported by the increasing adoption of cryptocurrencies and the expansion of payment options for online casino transactions.

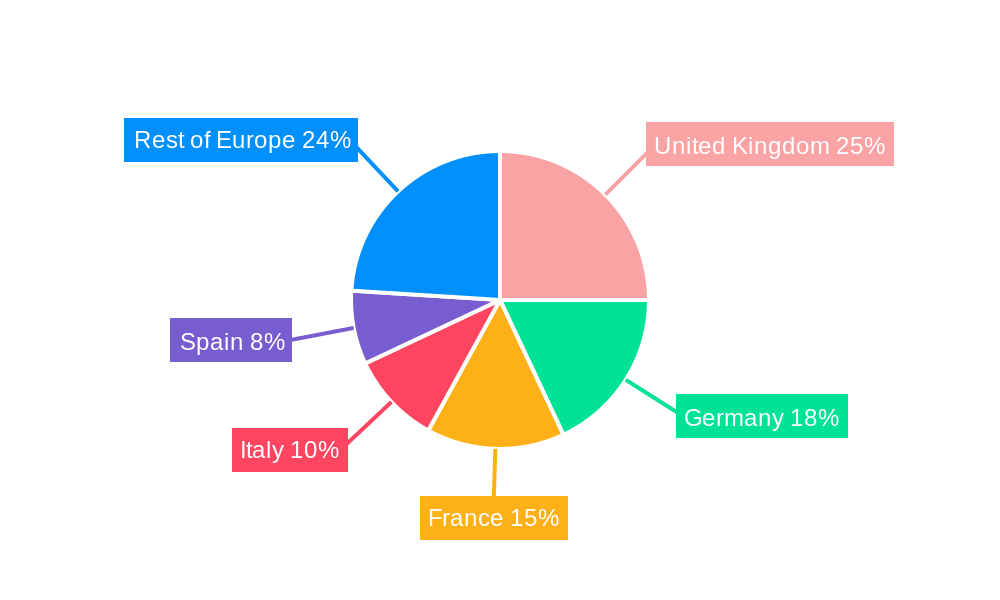

Key Markets & Segments Leading Europe Casino Gambling Market

The United Kingdom, Germany, and France are currently the dominant markets within the European casino gambling sector. This dominance stems from a combination of factors:

- United Kingdom: High levels of disposable income, mature regulatory frameworks, and established gaming culture contribute to the UK's leading position.

- Germany: A significant population base coupled with increasing online gambling adoption fuels market growth.

- France: While facing stricter regulations, the French market shows potential for growth through the evolution of its regulatory environment and online accessibility.

Drivers of Dominance:

- Strong Economic Growth: High disposable incomes in key markets drive increased spending on entertainment, including casino gambling.

- Developed Infrastructure: Robust digital infrastructure and high internet penetration support the growth of online gambling platforms.

- Favorable Regulatory Frameworks (in specific regions): Relaxed or evolving regulations in certain countries encourage market expansion.

Europe Casino Gambling Market Product Developments

Innovation is a key driver in the dynamic European casino gambling market. We are witnessing the development of truly immersive VR and AR gaming experiences, which provide unparalleled levels of player engagement. AI-powered personalized recommendations are tailoring gaming experiences to individual preferences, increasing player satisfaction and retention. The integration of blockchain technology is enhancing security and transparency in transactions, building trust and encouraging participation. Furthermore, the continued emphasis on mobile-first designs ensures accessibility and convenience for players, aligning perfectly with evolving consumer behavior. The incorporation of gamification techniques and loyalty programs also enhances the overall player experience and encourages continued engagement.

Challenges in the Europe Casino Gambling Market Market

The European casino gambling market faces several challenges, including:

- Stringent Regulatory Hurdles: Varying and evolving regulations across different European countries create compliance complexities and restrict market access for some operators.

- Competitive Pressures: The market is highly competitive, requiring continuous innovation and investment to maintain a strong market position. This includes competition from both established players and new entrants.

- Responsible Gambling Initiatives: The increasing emphasis on responsible gambling practices necessitates robust player protection measures, which can impact profitability and operational strategies.

Forces Driving Europe Casino Gambling Market Growth

Several key factors are synergistically driving the growth of the European casino gambling market:

- Technological Advancements: Innovations such as VR/AR, AI, and mobile-first designs significantly enhance the player experience, attracting a broader and more engaged customer base. The adoption of new payment technologies, such as cryptocurrencies, also contributes to this growth.

- Economic Growth & Disposable Incomes: Rising disposable incomes in key European markets fuel increased spending on entertainment and leisure activities, with casino gambling benefitting from this increased discretionary spending.

- Evolving Regulatory Landscapes: The gradual liberalization of gambling regulations in several European countries is creating new opportunities for market expansion and attracting increased investment.

- Increased Accessibility & Convenience: The proliferation of online and mobile platforms, combined with easily accessible payment methods, has expanded the market's reach and lowered barriers to entry.

Long-Term Growth Catalysts in the Europe Casino Gambling Market

Long-term growth will be fueled by strategic partnerships, expansion into new markets, and continued technological innovations. Collaborations between gaming operators and technology providers will be crucial to leverage emerging technologies and deliver enhanced player experiences. Expansion into underpenetrated markets within Europe will offer significant growth potential.

Emerging Opportunities in Europe Casino Gambling Market

Emerging opportunities include:

- Expansion into Regulated Markets: New opportunities exist as more European countries regulate and open their markets to online gambling.

- Leveraging Esports Betting: The growing popularity of eSports creates significant potential for betting operators.

- Adoption of Emerging Technologies: Virtual Reality (VR) and Augmented Reality (AR) offer immersive gaming experiences, presenting growth prospects.

Leading Players in the Europe Casino Gambling Market Sector

- Flutter Entertainment

- Bet365

- Kindred Group

- Entain

- 888 Holdings

- MyStake

- PlayOJO

- Spin Casino

- Evolution Gaming

- International Game Technology

- Aristocrat

- DraftKings

Key Milestones in Europe Casino Gambling Market Industry

- September 2023: Flutter Entertainment acquires a 51% stake in MaxBet for €141 Million, expanding its reach in Serbia and potentially other markets.

- July 2023: Bet365 extends its sponsorship agreement with UFC, strengthening its brand presence across multiple European countries.

Strategic Outlook for Europe Casino Gambling Market Market

The European casino gambling market is poised for continued robust growth, driven by the synergistic effects of technological innovation, evolving player preferences, and the expansion of regulated markets. Strategic partnerships, substantial investments in research and development, and a steadfast commitment to responsible gambling practices will be paramount for operators seeking to capitalize on emerging opportunities and successfully navigate the dynamic regulatory landscape. The market's strong potential for growth is further underscored by the ongoing technological advancements and the ever-increasing number of online players embracing this form of entertainment.

Europe Casino Gambling Market Segmentation

-

1. Type

- 1.1. Live Casino

- 1.2. Baccarat

- 1.3. Blackjack

- 1.4. Poker

- 1.5. Slots

- 1.6. Other Types

-

2. Application

- 2.1. Online

- 2.2. Offline

Europe Casino Gambling Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Rest of Europe

Europe Casino Gambling Market Regional Market Share

Geographic Coverage of Europe Casino Gambling Market

Europe Casino Gambling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.18% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Internet Penetration is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Internet Penetration is Driving the Market

- 3.4. Market Trends

- 3.4.1. Online Casino Gambling is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Europe Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Live Casino

- 5.1.2. Baccarat

- 5.1.3. Blackjack

- 5.1.4. Poker

- 5.1.5. Slots

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Italy

- 5.3.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Live Casino

- 6.1.2. Baccarat

- 6.1.3. Blackjack

- 6.1.4. Poker

- 6.1.5. Slots

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Online

- 6.2.2. Offline

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Kingdom Europe Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Live Casino

- 7.1.2. Baccarat

- 7.1.3. Blackjack

- 7.1.4. Poker

- 7.1.5. Slots

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Online

- 7.2.2. Offline

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. France Europe Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Live Casino

- 8.1.2. Baccarat

- 8.1.3. Blackjack

- 8.1.4. Poker

- 8.1.5. Slots

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Online

- 8.2.2. Offline

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Italy Europe Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Live Casino

- 9.1.2. Baccarat

- 9.1.3. Blackjack

- 9.1.4. Poker

- 9.1.5. Slots

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Online

- 9.2.2. Offline

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Europe Europe Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Live Casino

- 10.1.2. Baccarat

- 10.1.3. Blackjack

- 10.1.4. Poker

- 10.1.5. Slots

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Online

- 10.2.2. Offline

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Flutter Entertainment

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bet

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kindred Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Entain

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 888 Holdings

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 MyStake

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 PlayOJO

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Spin Casino

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Evolution Gaming

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 International Game Technology

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Aristocrat

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Draft Kings**List Not Exhaustive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Flutter Entertainment

List of Figures

- Figure 1: Global Europe Casino Gambling Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Germany Europe Casino Gambling Market Revenue (billion), by Type 2025 & 2033

- Figure 3: Germany Europe Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: Germany Europe Casino Gambling Market Revenue (billion), by Application 2025 & 2033

- Figure 5: Germany Europe Casino Gambling Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: Germany Europe Casino Gambling Market Revenue (billion), by Country 2025 & 2033

- Figure 7: Germany Europe Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: United Kingdom Europe Casino Gambling Market Revenue (billion), by Type 2025 & 2033

- Figure 9: United Kingdom Europe Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: United Kingdom Europe Casino Gambling Market Revenue (billion), by Application 2025 & 2033

- Figure 11: United Kingdom Europe Casino Gambling Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: United Kingdom Europe Casino Gambling Market Revenue (billion), by Country 2025 & 2033

- Figure 13: United Kingdom Europe Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: France Europe Casino Gambling Market Revenue (billion), by Type 2025 & 2033

- Figure 15: France Europe Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: France Europe Casino Gambling Market Revenue (billion), by Application 2025 & 2033

- Figure 17: France Europe Casino Gambling Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: France Europe Casino Gambling Market Revenue (billion), by Country 2025 & 2033

- Figure 19: France Europe Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Italy Europe Casino Gambling Market Revenue (billion), by Type 2025 & 2033

- Figure 21: Italy Europe Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Italy Europe Casino Gambling Market Revenue (billion), by Application 2025 & 2033

- Figure 23: Italy Europe Casino Gambling Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Italy Europe Casino Gambling Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Italy Europe Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of Europe Europe Casino Gambling Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Rest of Europe Europe Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Rest of Europe Europe Casino Gambling Market Revenue (billion), by Application 2025 & 2033

- Figure 29: Rest of Europe Europe Casino Gambling Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Rest of Europe Europe Casino Gambling Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Rest of Europe Europe Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Europe Casino Gambling Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Europe Casino Gambling Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Europe Casino Gambling Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Europe Casino Gambling Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Europe Casino Gambling Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Europe Casino Gambling Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Europe Casino Gambling Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global Europe Casino Gambling Market Revenue billion Forecast, by Application 2020 & 2033

- Table 9: Global Europe Casino Gambling Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Europe Casino Gambling Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global Europe Casino Gambling Market Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Global Europe Casino Gambling Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Europe Casino Gambling Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Europe Casino Gambling Market Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Global Europe Casino Gambling Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Europe Casino Gambling Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global Europe Casino Gambling Market Revenue billion Forecast, by Application 2020 & 2033

- Table 18: Global Europe Casino Gambling Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Casino Gambling Market?

The projected CAGR is approximately 14.18%.

2. Which companies are prominent players in the Europe Casino Gambling Market?

Key companies in the market include Flutter Entertainment, Bet, Kindred Group, Entain, 888 Holdings, MyStake, PlayOJO, Spin Casino, Evolution Gaming, International Game Technology, Aristocrat, Draft Kings**List Not Exhaustive.

3. What are the main segments of the Europe Casino Gambling Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 80.13 billion as of 2022.

5. What are some drivers contributing to market growth?

Internet Penetration is Driving the Market.

6. What are the notable trends driving market growth?

Online Casino Gambling is Driving the Market.

7. Are there any restraints impacting market growth?

Internet Penetration is Driving the Market.

8. Can you provide examples of recent developments in the market?

September 2023: Flutter made the acquisition of an initial 51% stake in MaxBet, Serbia's omni-channel sports betting and gaming operator, for a cash consideration of euros 141 million. MaxBet will likely provide Flutter with the platform to access fast-growing markets via a podium brand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Casino Gambling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Casino Gambling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Casino Gambling Market?

To stay informed about further developments, trends, and reports in the Europe Casino Gambling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence