Key Insights

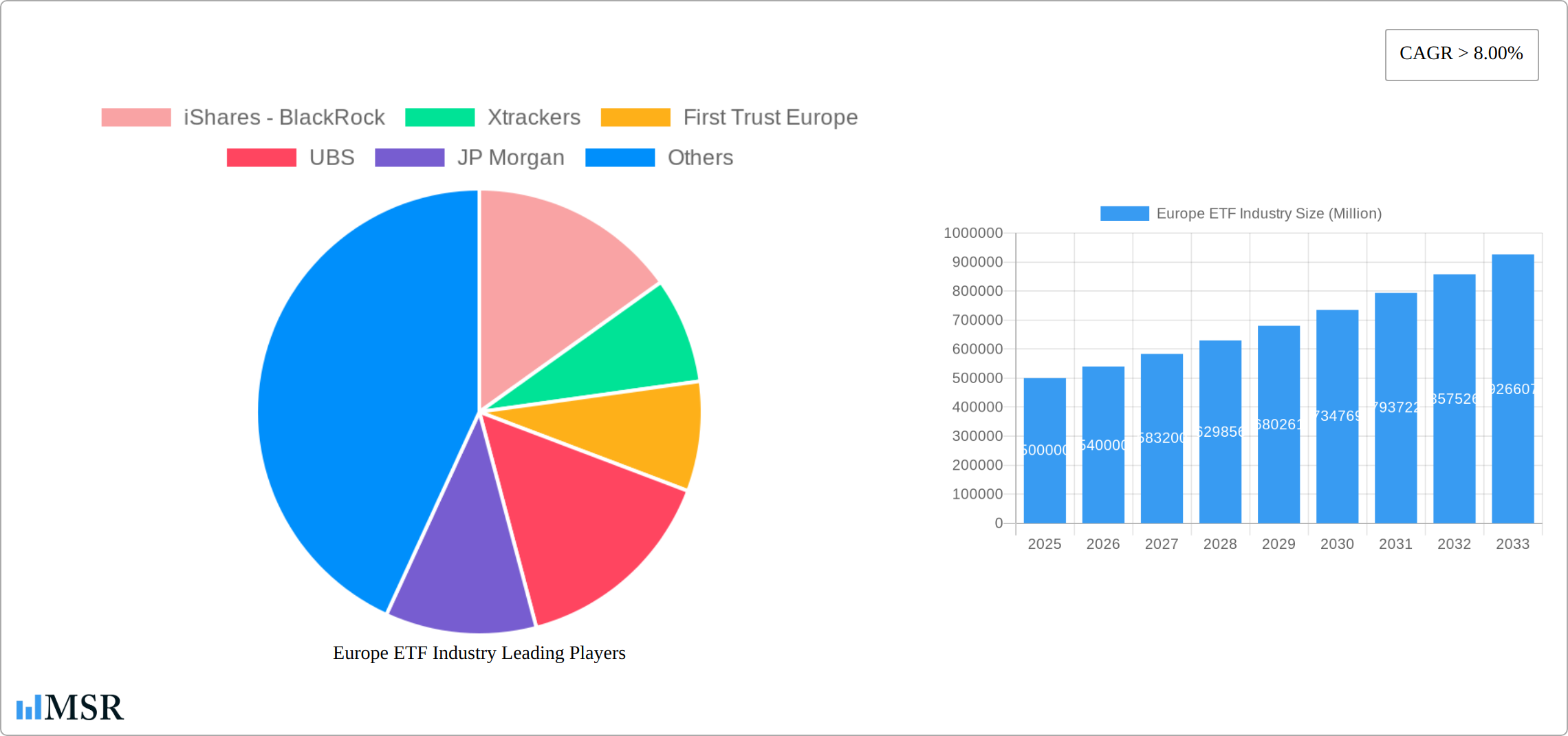

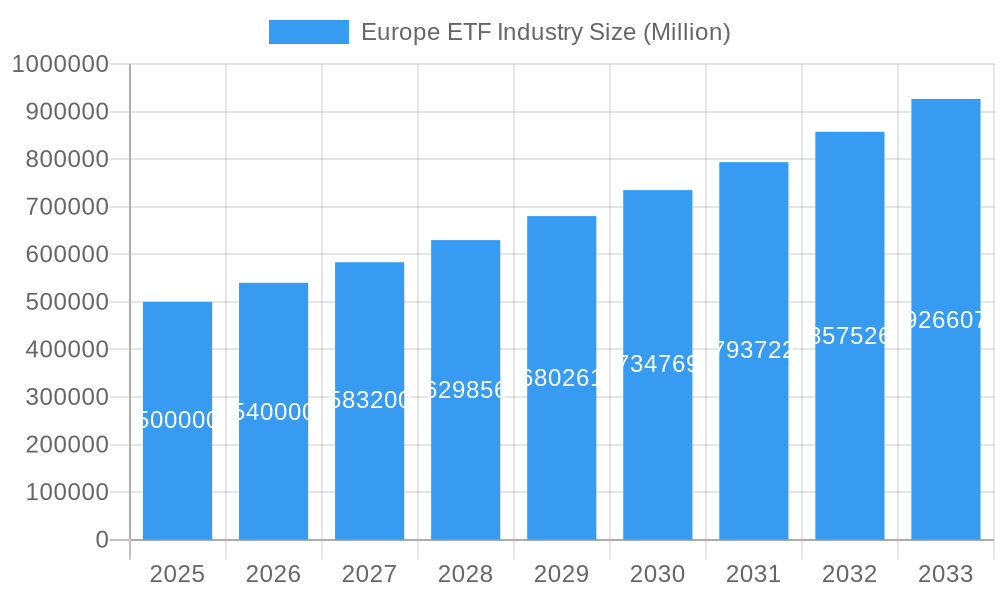

The European ETF (Exchange-Traded Fund) industry is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 8% from 2025 to 2033. This expansion is fueled by several key drivers. Increased investor interest in diversified, low-cost investment vehicles is a significant factor. The rising popularity of passive investment strategies, compared to actively managed funds, further contributes to ETF market expansion. Regulatory changes promoting transparency and investor protection in the European Union also positively impact market growth. Furthermore, the increasing availability of specialized ETFs catering to niche market segments, such as sustainable investing and thematic ETFs focused on sectors like technology or renewable energy, is driving innovation and attracting new investors. Competition among major players like iShares (BlackRock), Xtrackers, First Trust Europe, UBS, JP Morgan, Vanguard, Invesco, State Street, WisdomTree, and Franklin Templeton (among others) is fierce, fostering innovation and price competitiveness, ultimately benefiting investors.

Europe ETF Industry Market Size (In Billion)

The market size in 2025 is estimated to be substantial (a precise figure isn't provided, but industry reports suggest figures in the hundreds of billions of euros are plausible given the CAGR and existing market size). However, challenges remain. Geopolitical instability, macroeconomic uncertainty (such as inflation and interest rate fluctuations), and potential regulatory changes could pose headwinds. Despite these potential restraints, the long-term outlook for the European ETF market remains positive, driven by the continuing shift towards passive investing and the expansion of product offerings. The industry's ongoing evolution suggests further growth, particularly within the specialized ETF segments. The projected CAGR suggests a significant increase in market value over the forecast period. The diverse range of asset classes and investment strategies offered through ETFs, combined with their accessibility and transparency, makes them an attractive option for a wide range of investors.

Europe ETF Industry Company Market Share

Europe ETF Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe ETF industry, covering market dynamics, key players, emerging trends, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report offers invaluable insights for investors, industry stakeholders, and strategic decision-makers. The forecast period extends from 2025 to 2033, encompassing historical data from 2019 to 2024. Expect detailed analysis of market size, CAGR, and key performance indicators for a complete understanding of this dynamic sector.

Europe ETF Industry Market Concentration & Dynamics

The European ETF market exhibits a concentrated landscape, dominated by a few major players, but with a vibrant ecosystem of innovation and increasing competition. Market share data reveals that iShares - BlackRock holds a significant lead, followed by Xtrackers, Vanguard, and others. However, the market is witnessing increasing competition from smaller, niche players focusing on specific segments or innovative strategies. Mergers and acquisitions (M&A) activity has been moderate, with xx M&A deals recorded in the historical period (2019-2024). This activity is expected to increase in the forecast period as larger players seek to consolidate market share and expand their product offerings.

- Market Concentration: High, with top 5 players holding approximately xx% of the market share in 2024.

- Innovation Ecosystem: Active, with a focus on ESG investing, thematic ETFs, and technological advancements in trading platforms.

- Regulatory Framework: Evolving, with increasing regulatory scrutiny on transparency and investor protection, impacting product development and distribution.

- Substitute Products: Mutual funds and other investment vehicles pose a competitive threat, but ETFs maintain an advantage in terms of cost-efficiency and transparency.

- End-User Trends: Growing demand for passive investment strategies, particularly among retail investors, is a key driver of market growth.

- M&A Activities: Moderate historical activity (xx deals 2019-2024), predicted to increase to xx deals during 2025-2033 driven by consolidation and expansion strategies.

Europe ETF Industry Industry Insights & Trends

The European ETF industry experienced substantial growth in the historical period (2019-2024), with the market size reaching USD xx Million in 2024. This growth is attributed to several factors, including increasing investor interest in passive investment strategies, the rise of robo-advisors, and the growing popularity of thematic and ESG-focused ETFs. Technological advancements, such as the development of fractional share trading and improved trading platforms, have further facilitated market expansion. Evolving consumer behavior, characterized by a preference for cost-effective and transparent investment solutions, also contributes to the industry’s robust growth. The industry is expected to continue its strong growth trajectory, with a projected CAGR of xx% during the forecast period (2025-2033), reaching USD xx Million by 2033. This growth will be driven by factors including increasing digitalization, growing adoption of ETFs by institutional investors, and continued product innovation.

Key Markets & Segments Leading Europe ETF Industry

The German ETF market stands as the current powerhouse in Europe, propelled by a confluence of robust economic expansion, a sophisticated and well-established financial infrastructure, and a substantial base of discerning investors. This dynamic ecosystem fosters innovation and adoption of ETF products.

- Key Drivers of German Market Dominance:

- Sustained strong economic growth providing a fertile ground for investment.

- A highly developed and efficient financial infrastructure that facilitates smooth ETF operations.

- A significant population of sophisticated investors with a deep understanding of financial instruments.

- Proactive and increasing regulatory support that champions the growth and adoption of ETFs.

- A burgeoning domestic asset management industry actively developing and distributing ETF products.

- Dominance Analysis: Germany's resilient economy and its advanced financial markets cultivate an exceptionally favorable environment for the flourishing of ETFs. The presence of leading global ETF providers alongside a substantial and active retail investor base further solidifies the market's leadership position. While other significant markets, including the United Kingdom, France, and Italy, are also experiencing considerable growth, their pace lags behind Germany. It is anticipated that Germany's dominance will persist, though the competitive landscape may gradually narrow the gap.

- Emerging Market Trends: Beyond Germany, other European nations are showing promising growth trajectories. The Nordics, for instance, are demonstrating a keen interest in thematic and factor-based ETFs. Southern European markets like Spain and Portugal are also witnessing increased adoption, driven by efforts to democratize investment access and introduce more sophisticated product offerings.

Europe ETF Industry Product Developments

Recent product innovations include the introduction of thematic ETFs focused on specific sectors or trends (e.g., sustainable energy, artificial intelligence), and ESG-integrated ETFs that align with environmental, social, and governance principles. These developments enhance investor choice and cater to growing demand for specialized investment strategies. Technological advancements in ETF trading platforms, such as improved algorithms and fractional share trading, have enhanced the overall efficiency and user experience in the market. These advancements provide competitive advantages by lowering trading costs and providing greater accessibility.

Challenges in the Europe ETF Industry Market

The European ETF industry navigates a landscape marked by increasing regulatory complexity, particularly concerning the stringent demands for Environmental, Social, and Governance (ESG) disclosures and comprehensive reporting. Beyond regulatory hurdles, global economic uncertainties and persistent supply chain disruptions can impact the timely availability and pricing of certain underlying assets, potentially affecting ETF performance and investor confidence. Furthermore, intense competition from both established giants and agile new entrants exerts considerable pressure on profit margins and necessitates continuous innovation. These collective challenges can act as a significant impediment to market growth, potentially slowing the pace of innovation and elevating operational costs. While a precise quantifiable impact is challenging to ascertain, projections suggest a potential reduction in annual growth rates by approximately 5-7% if these critical challenges are not effectively addressed through collaborative industry efforts and proactive policy measures.

Forces Driving Europe ETF Industry Growth

Technological advancements, such as the development of more sophisticated trading algorithms and the rise of robo-advisors, are significantly accelerating the adoption of ETFs. Favorable economic conditions in certain European countries drive investor confidence and increase demand for diverse investment solutions. Supportive regulatory frameworks, promoting the growth of passive investment strategies, encourage further expansion. For instance, the increased regulatory focus on ESG mandates compels the creation of new products to meet the needs of investors seeking more sustainable investment options.

Long-Term Growth Catalysts in the Europe ETF Industry

Long-term growth will be driven by continuous innovation in product offerings, such as the development of niche ETFs targeting specific market segments. Strategic partnerships between ETF providers and financial technology (fintech) companies will expand reach and enhance efficiency. The expansion of the ETF market into new European countries with less developed financial markets will tap into untapped growth potential. These factors cumulatively contribute to a positive outlook, ensuring sustained market expansion.

Emerging Opportunities in Europe ETF Industry

The European ETF landscape is rich with emerging opportunities, most notably the surging demand for sustainable and responsible investing (SRI) products. Investors are increasingly seeking to align their portfolios with their values, creating a significant runway for ESG-focused ETFs. The expansion of ETFs into novel and alternative asset classes, such as infrastructure, private equity, and real estate, presents compelling diversification opportunities and access to previously illiquid markets. Furthermore, the strategic tailoring of ETF offerings to cater to the distinct and evolving investment needs of both retail and institutional investors will unlock substantial market share. The progressive integration of blockchain technology holds immense potential to revolutionize ETF operations by enhancing transparency, improving efficiency, and fortifying security across the entire value chain.

Leading Players in the Europe ETF Industry Sector

- iShares - BlackRock

- Xtrackers

- First Trust Europe

- UBS Asset Management

- JP Morgan Asset Management

- Vanguard

- Invesco

- State Street Global Advisors

- WisdomTree

- Franklin Templeton

- Amundi

- Lyxor (now part of Amundi)

Key Milestones in Europe ETF Industry Industry

- February 2023: Vontobel launched two emerging market bond funds. This strategic move signifies a growing investor appetite for diversifying fixed-income portfolios with instruments that offer higher yields, albeit with potentially increased risk. The introduction of these funds underscores the company's agility in responding to evolving market demands and investor preferences for more sophisticated fixed-income solutions. This development highlights a broader trend towards exploring higher-return opportunities within emerging market debt.

- February 2023: Mapfre Asset Management strategically increased its stake in La Financière Responsable (LFR). This acquisition significantly bolsters Mapfre's ESG capabilities and expands its distribution network, particularly within the French market. The move is a clear indicator of the escalating importance of ESG considerations in shaping investment strategies and product development across the European ETF ecosystem. This strategic enhancement of ESG offerings positions Mapfre more robustly within the competitive European ETF landscape, catering to a growing demand for sustainable investments.

- March 2023: Lyxor Asset Management, now part of Amundi, announced the expansion of its ESG ETF range with several new product launches, focusing on areas like sustainable technology and impact investing. This signifies a continued commitment from major players to broaden accessible ESG investment options for European investors.

Strategic Outlook for Europe ETF Industry Market

The European ETF market is poised for sustained growth, fueled by increasing investor demand for cost-effective and diversified investment solutions. The rising adoption of passive investment strategies and the continued development of innovative products, particularly in the ESG space, will drive market expansion. The strategic focus on technological advancements and partnerships will further enhance market efficiency and reach. The long-term outlook remains positive, with significant growth potential across diverse segments and geographies within Europe.

Europe ETF Industry Segmentation

-

1. ETF type

- 1.1. Equity ETFs

- 1.2. Fixed Income ETFs

- 1.3. Commodity ETFs

- 1.4. Alternatives ETFs

- 1.5. Money Market ETFs

- 1.6. Mixed Assets ETFs

- 1.7. Others

Europe ETF Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

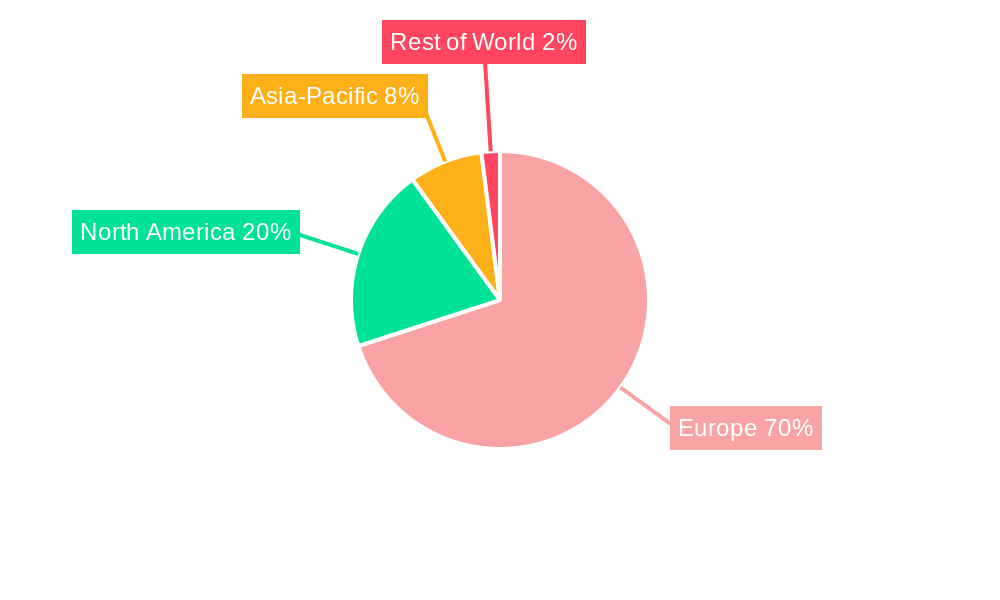

Europe ETF Industry Regional Market Share

Geographic Coverage of Europe ETF Industry

Europe ETF Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 8.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Equity Funds occupied the Major percentage in ETF Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe ETF Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by ETF type

- 5.1.1. Equity ETFs

- 5.1.2. Fixed Income ETFs

- 5.1.3. Commodity ETFs

- 5.1.4. Alternatives ETFs

- 5.1.5. Money Market ETFs

- 5.1.6. Mixed Assets ETFs

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by ETF type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 iShares - BlackRock

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Xtrackers

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 First Trust Europe

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 UBS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 JP Morgan

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Vanguard

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Invesco

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 State Street

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 WisdomTree

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Franklin**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 iShares - BlackRock

List of Figures

- Figure 1: Europe ETF Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe ETF Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe ETF Industry Revenue Million Forecast, by ETF type 2020 & 2033

- Table 2: Europe ETF Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Europe ETF Industry Revenue Million Forecast, by ETF type 2020 & 2033

- Table 4: Europe ETF Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United Kingdom Europe ETF Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Germany Europe ETF Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: France Europe ETF Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Italy Europe ETF Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Spain Europe ETF Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Netherlands Europe ETF Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Belgium Europe ETF Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Sweden Europe ETF Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Norway Europe ETF Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Poland Europe ETF Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Denmark Europe ETF Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe ETF Industry?

The projected CAGR is approximately > 8.00%.

2. Which companies are prominent players in the Europe ETF Industry?

Key companies in the market include iShares - BlackRock, Xtrackers, First Trust Europe, UBS, JP Morgan, Vanguard, Invesco, State Street, WisdomTree, Franklin**List Not Exhaustive.

3. What are the main segments of the Europe ETF Industry?

The market segments include ETF type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Equity Funds occupied the Major percentage in ETF Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Vontobel launches two emerging market bond funds in response to increased investor interest. One of the two funds (Vontobel Fund - Emerging Markets Investment Grade) aims to provide clients with access to fixed income through a lower-risk version of Vontobel's existing hard currency funds. The other fund (Vontobel Fund - Asian Bond) is Asia-focused and primarily invests in corporate bonds across the region with different maturities in various hard currencies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe ETF Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe ETF Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe ETF Industry?

To stay informed about further developments, trends, and reports in the Europe ETF Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence