Key Insights

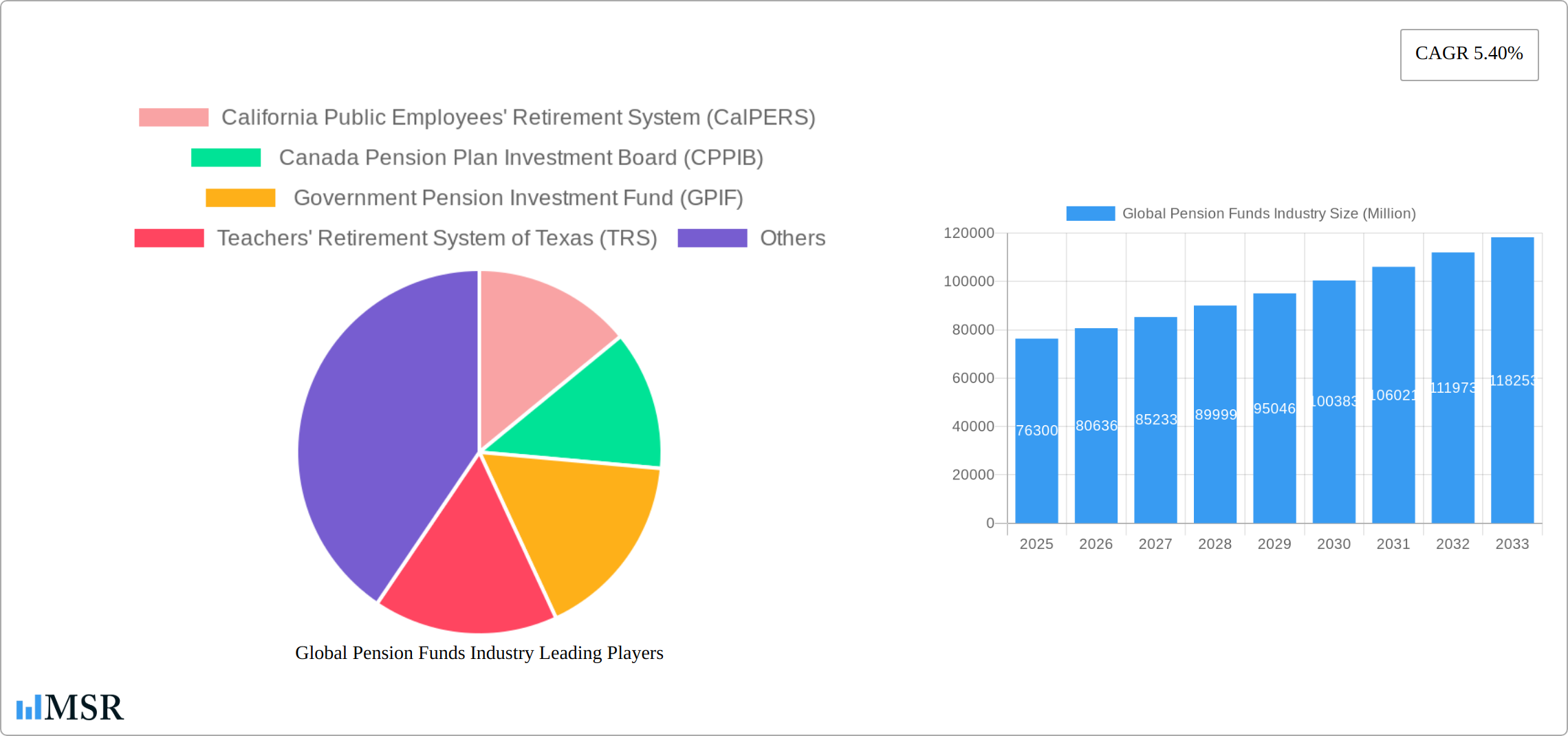

The global pension funds industry, currently valued at $76.30 billion in 2025, is projected to experience robust growth, with a compound annual growth rate (CAGR) of 5.40% from 2025 to 2033. This growth is fueled by several key factors. Increasing life expectancy globally necessitates larger retirement savings, driving higher contributions to pension funds. Simultaneously, government initiatives promoting retirement planning and favorable regulatory environments in several regions are fostering industry expansion. Furthermore, the ongoing shift towards defined contribution plans, offering greater individual control over investment choices, is a significant growth driver. The industry is witnessing innovative investment strategies, including increased allocations to alternative assets like private equity and infrastructure, to enhance returns and diversify portfolios. However, challenges persist, including volatility in global markets impacting investment performance, and the ongoing need to manage risks associated with longevity and inflation. Competition among fund managers is intensifying, requiring constant adaptation and innovation to attract and retain investors.

Global Pension Funds Industry Market Size (In Billion)

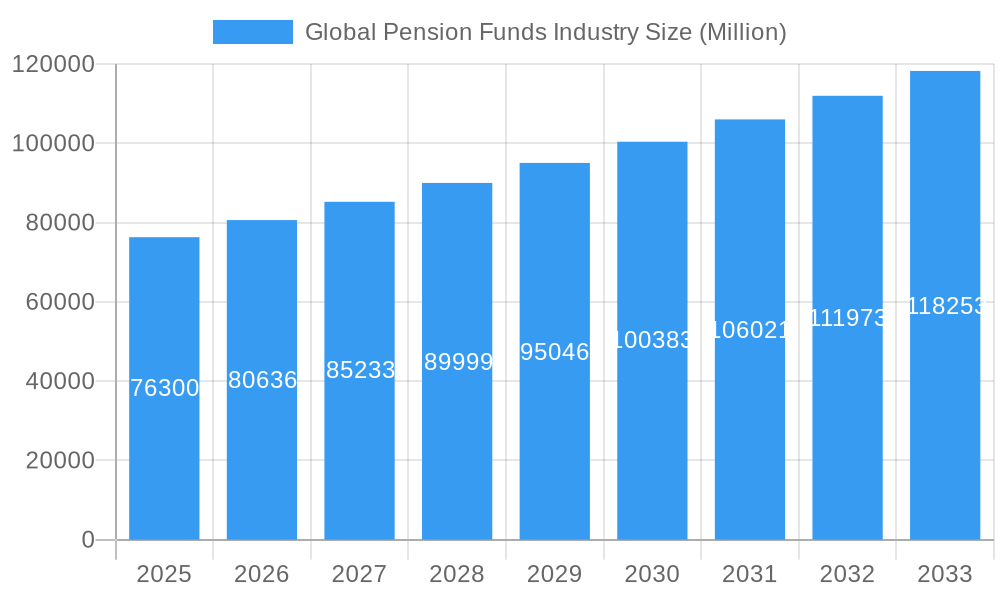

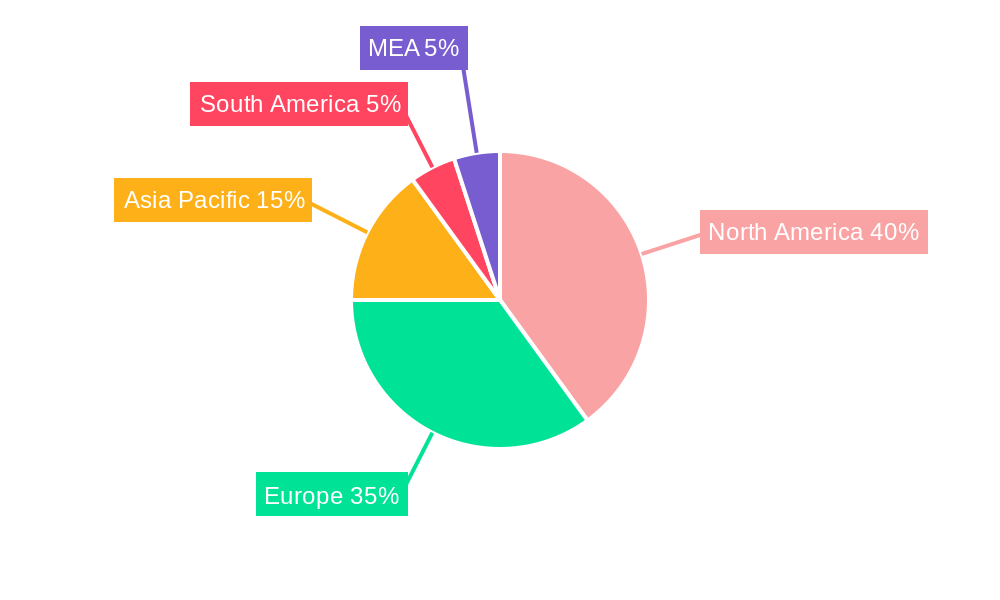

The industry's segmentation reveals a dynamic landscape. Distributed contribution plans, where employees actively participate in investment decisions, are gaining traction, alongside distributed benefit plans providing a more predictable payout. Reserved fund plans maintain a significant market share due to their inherent stability, while hybrid models combine elements of different plan types, catering to diverse investor needs. Geographically, North America and Europe currently hold substantial market shares, but the Asia-Pacific region is poised for significant growth, driven by rising disposable incomes and increasing awareness of retirement planning. Key players like CalPERS, CPPIB, GPIF, and TRS are shaping the industry landscape through their investment strategies and influence on market trends. The forecast period (2025-2033) presents ample opportunities for industry players to capitalize on the growing demand for retirement solutions while navigating the complexities of managing long-term liabilities and volatile market conditions.

Global Pension Funds Industry Company Market Share

Global Pension Funds Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global pension funds industry, offering invaluable insights for investors, stakeholders, and industry professionals. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, key players, emerging trends, and future growth prospects. The study incorporates data from major players such as California Public Employees' Retirement System (CalPERS), Canada Pension Plan Investment Board (CPPIB), Government Pension Investment Fund (GPIF), and Teachers' Retirement System of Texas (TRS), providing a robust understanding of the industry landscape. The report's detailed segmentation by plan type (Distributed Contribution, Distributed Benefit, Reserved Fund, Hybrid) allows for a granular analysis of market opportunities. Download now to gain a competitive edge!

Global Pension Funds Industry Market Concentration & Dynamics

The global pension funds industry presents a moderately concentrated market structure, dominated by several key players holding substantial market share. In 2025, the top five firms collectively controlled an estimated 35% of the market. This dynamic landscape is shaped by a complex interplay of factors, including continuous innovation in investment strategies, evolving regulatory environments across various jurisdictions, and the increasing integration of alternative asset classes. Competitive pressure arises from substitute products like individual retirement accounts (IRAs) and annuities; however, the scale and intricacy of pension fund management often favor institutional solutions. End-user preferences are shifting towards greater transparency, sustainable investment options, and personalized retirement planning, fueling demand for tailored solutions and sophisticated risk management strategies. Mergers and acquisitions (M&A) activity has remained consistent, with an estimated xx M&A deals annually between 2019 and 2024, primarily driven by strategic expansion and diversification objectives. Projections indicate a potential increase in M&A activity in the coming years (2025-2033).

- Market Concentration: Top 5 players hold approximately 35% market share (2025), indicating significant consolidation.

- Innovation Ecosystems: A strong focus on ESG (Environmental, Social, and Governance) investing, AI-driven portfolio management, and the exploration of diverse alternative asset classes are shaping the industry's future.

- Regulatory Frameworks: Significant regional variations in regulatory frameworks impact investment strategies and operational efficiency, demanding adaptability from firms.

- Substitute Products: Competition from IRAs, annuities, and other individual retirement savings plans necessitates continuous innovation and competitive pricing.

- End-User Trends: Growing demand for transparency, personalized retirement planning solutions, and sustainable investments is reshaping service offerings.

- M&A Activity: Approximately xx deals annually (2019-2024), with a projected xx% increase anticipated from 2025 to 2033, driven by growth and diversification strategies.

Global Pension Funds Industry Industry Insights & Trends

The global pension funds industry is experiencing robust growth, driven by several key factors. The aging global population, coupled with increasing life expectancy, is fueling demand for retirement savings solutions. Technological advancements, such as the increasing adoption of artificial intelligence (AI) and big data analytics in portfolio management, are transforming the industry. Furthermore, the growing awareness of environmental, social, and governance (ESG) factors is driving a significant shift towards sustainable investments. The global market size in 2025 is estimated to be $xx Million, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth reflects the evolving consumer behaviors that emphasize long-term financial security and a preference for professionally managed retirement plans. Evolving regulatory landscapes are also shaping the industry, demanding greater transparency and accountability from pension fund managers.

Key Markets & Segments Leading Global Pension Funds Industry

North America currently dominates the global pension funds industry, accounting for approximately xx% of the market in 2025. This dominance is attributed to a large and mature market, robust regulatory frameworks, and the significant presence of major pension funds like CalPERS and CPPIB. However, the Asia-Pacific region is expected to witness substantial growth during the forecast period, driven by rapid economic expansion and increasing government initiatives to promote retirement savings.

- By Plan Type:

- Distributed Contribution: This segment is experiencing significant growth due to its flexibility and adaptability to individual needs, particularly in developing economies.

- Distributed Benefit: This traditional segment remains a dominant force, particularly in developed markets with established social security systems.

- Reserved Fund: This segment is expected to see slower growth compared to other plan types, due to its limited scope and applicability.

- Hybrid: This segment is gaining traction as it offers a combination of benefits from different plan types, tailored to specific needs.

Drivers for Dominance in North America:

- Strong economic growth and high per capita income

- Well-established regulatory framework and investor confidence

- Large pool of assets under management by major pension funds

- Developed financial infrastructure and access to advanced technologies

Global Pension Funds Industry Product Developments

Technological advancements are revolutionizing the pension funds industry. Sophisticated algorithms for portfolio optimization, risk management, and fraud detection are enhancing investment performance and reducing operational costs. The emergence of robo-advisors and digital platforms is democratizing access to pension fund management for individuals and smaller businesses. Firms embracing these technological innovations gain a significant competitive edge, fostering greater efficiency and transparency across the industry. This includes the rise of blockchain technology for enhanced security and transparency in transactions.

Challenges in the Global Pension Funds Industry Market

The pension funds industry faces numerous challenges. Stringent regulatory compliance demands place significant operational burdens, particularly on smaller firms. Global market volatility and economic uncertainty pose substantial risks to investment portfolios, requiring robust risk mitigation strategies. Intensifying competition from alternative investment products and the need to adapt to evolving consumer preferences, including the increasing focus on ESG investments, present significant obstacles for pension fund managers. Addressing these challenges requires continuous innovation and adaptation to ensure long-term viability and competitiveness.

Forces Driving Global Pension Funds Industry Growth

Several factors contribute to the growth of the global pension funds industry. Technological advancements, such as AI-powered portfolio management and data analytics, are enhancing investment strategies. Growing global populations and increasing life expectancies necessitate larger retirement savings pools. Government regulations promoting retirement savings plans and private pensions also stimulate growth. Furthermore, the rising prevalence of defined contribution plans adds to the overall expansion of the industry.

Challenges in the Global Pension Funds Industry Market

The pension funds industry faces numerous challenges. Stringent regulatory compliance demands place significant operational burdens, particularly on smaller firms. Global market volatility and economic uncertainty pose substantial risks to investment portfolios, requiring robust risk mitigation strategies. Intensifying competition from alternative investment products and the need to adapt to evolving consumer preferences, including the increasing focus on ESG investments, present significant obstacles for pension fund managers. Addressing these challenges requires continuous innovation and adaptation to ensure long-term viability and competitiveness.

Emerging Opportunities in Global Pension Funds Industry

The increasing adoption of ESG investing offers significant opportunities for pension funds, aligning investments with sustainability goals. The expansion into emerging markets with growing populations and increasing middle classes represents a lucrative opportunity. Technological innovation, particularly in areas like AI and blockchain, presents avenues for enhanced efficiency and transparency. Personalized retirement planning solutions tailored to individual needs are becoming increasingly in demand.

Leading Players in the Global Pension Funds Industry Sector

- California Public Employees' Retirement System (CalPERS)

- Canada Pension Plan Investment Board (CPPIB)

- Government Pension Investment Fund (GPIF)

- Teachers' Retirement System of Texas (TRS)

- Other significant players [Add other relevant players here]

Key Milestones in Global Pension Funds Industry Industry

- 2020: Increased focus on ESG investing by major pension funds.

- 2021: Several significant M&A transactions reshaped the industry landscape.

- 2022: Growing adoption of AI-driven portfolio management solutions.

- 2023: Introduction of new regulatory frameworks in key markets.

- 2024: Expansion of digital platforms for pension fund management.

Strategic Outlook for Global Pension Funds Industry Market

The global pension funds industry is poised for sustained growth, fueled by technological advancements, demographic shifts, and evolving investor priorities. Strategic opportunities abound in leveraging technological innovation, expanding into untapped markets, and navigating evolving regulatory landscapes effectively. Pension funds prioritizing sustainability, transparency, and personalized services will be best positioned to capitalize on future market potential. The industry's future hinges on its ability to embrace innovation and adapt to the dynamic needs of a growing and increasingly diverse global population.

Global Pension Funds Industry Segmentation

-

1. Plan Type

- 1.1. Distributed Contribution

- 1.2. Distributed Benefit

- 1.3. Reserved Fund

- 1.4. Hybrid

Global Pension Funds Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Switzerland

- 2.3. Netherlands

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. Australia

- 3.2. Japan

- 3.3. Rest of Asia Pacific

- 4. Rest of the World

Global Pension Funds Industry Regional Market Share

Geographic Coverage of Global Pension Funds Industry

Global Pension Funds Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Guaranteed Protection Drives The Market

- 3.3. Market Restrains

- 3.3.1. Long and Costly Legal Procedures

- 3.4. Market Trends

- 3.4.1. Distributed Contribution Plans are Settling as a Dominant Global Model

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pension Funds Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Plan Type

- 5.1.1. Distributed Contribution

- 5.1.2. Distributed Benefit

- 5.1.3. Reserved Fund

- 5.1.4. Hybrid

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Plan Type

- 6. North America Global Pension Funds Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Plan Type

- 6.1.1. Distributed Contribution

- 6.1.2. Distributed Benefit

- 6.1.3. Reserved Fund

- 6.1.4. Hybrid

- 6.1. Market Analysis, Insights and Forecast - by Plan Type

- 7. Europe Global Pension Funds Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Plan Type

- 7.1.1. Distributed Contribution

- 7.1.2. Distributed Benefit

- 7.1.3. Reserved Fund

- 7.1.4. Hybrid

- 7.1. Market Analysis, Insights and Forecast - by Plan Type

- 8. Asia Pacific Global Pension Funds Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Plan Type

- 8.1.1. Distributed Contribution

- 8.1.2. Distributed Benefit

- 8.1.3. Reserved Fund

- 8.1.4. Hybrid

- 8.1. Market Analysis, Insights and Forecast - by Plan Type

- 9. Rest of the World Global Pension Funds Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Plan Type

- 9.1.1. Distributed Contribution

- 9.1.2. Distributed Benefit

- 9.1.3. Reserved Fund

- 9.1.4. Hybrid

- 9.1. Market Analysis, Insights and Forecast - by Plan Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 California Public Employees' Retirement System (CalPERS)

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Canada Pension Plan Investment Board (CPPIB)

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Government Pension Investment Fund (GPIF)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Teachers' Retirement System of Texas (TRS)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.1 California Public Employees' Retirement System (CalPERS)

List of Figures

- Figure 1: Global Pension Funds Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Global Pension Funds Industry Share (%) by Company 2025

List of Tables

- Table 1: Global Pension Funds Industry Revenue Million Forecast, by Plan Type 2020 & 2033

- Table 2: Global Pension Funds Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Pension Funds Industry Revenue Million Forecast, by Plan Type 2020 & 2033

- Table 4: Global Pension Funds Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Global Pension Funds Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Global Pension Funds Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Rest of North America Global Pension Funds Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Pension Funds Industry Revenue Million Forecast, by Plan Type 2020 & 2033

- Table 9: Global Pension Funds Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: United Kingdom Global Pension Funds Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Switzerland Global Pension Funds Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Global Pension Funds Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Europe Global Pension Funds Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Pension Funds Industry Revenue Million Forecast, by Plan Type 2020 & 2033

- Table 15: Global Pension Funds Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Australia Global Pension Funds Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Japan Global Pension Funds Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Asia Pacific Global Pension Funds Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Pension Funds Industry Revenue Million Forecast, by Plan Type 2020 & 2033

- Table 20: Global Pension Funds Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Pension Funds Industry?

The projected CAGR is approximately 5.40%.

2. Which companies are prominent players in the Global Pension Funds Industry?

Key companies in the market include California Public Employees' Retirement System (CalPERS) , Canada Pension Plan Investment Board (CPPIB) , Government Pension Investment Fund (GPIF) , Teachers' Retirement System of Texas (TRS).

3. What are the main segments of the Global Pension Funds Industry?

The market segments include Plan Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 76.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Guaranteed Protection Drives The Market.

6. What are the notable trends driving market growth?

Distributed Contribution Plans are Settling as a Dominant Global Model.

7. Are there any restraints impacting market growth?

Long and Costly Legal Procedures.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Pension Funds Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Pension Funds Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Pension Funds Industry?

To stay informed about further developments, trends, and reports in the Global Pension Funds Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence