Key Insights

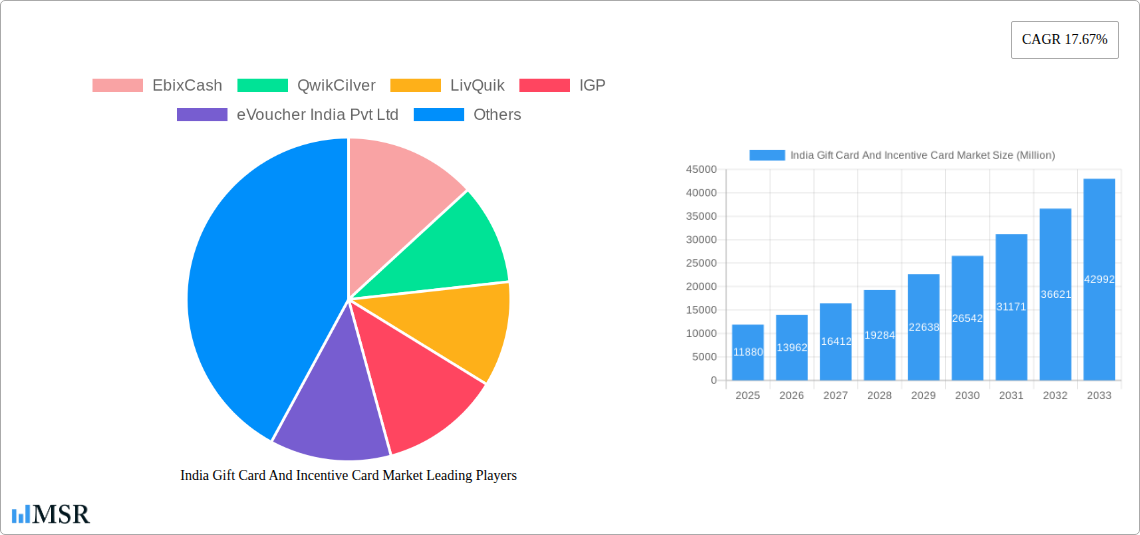

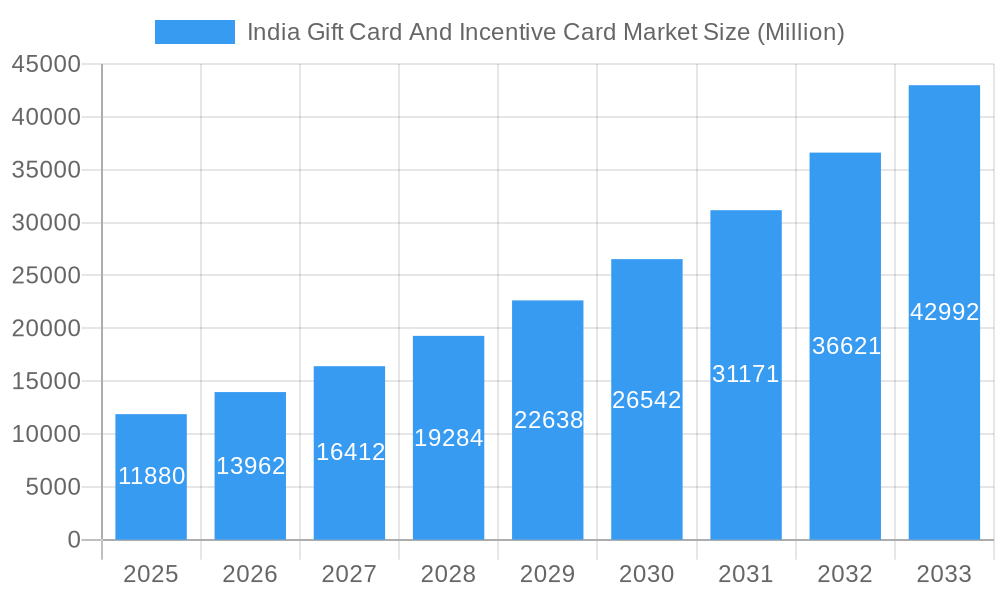

The India gift card and incentive card market exhibits robust growth, projected to reach \$11.88 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 17.67% from 2025 to 2033. This expansion is fueled by several key drivers. The rising disposable incomes and increasing consumer spending, particularly among younger demographics, significantly contribute to the market's growth. A shift towards digitalization and the increasing adoption of e-commerce platforms have broadened the accessibility and convenience of gift card purchases and redemptions. Furthermore, the strategic utilization of incentive cards by corporations for employee motivation and customer loyalty programs fuels market expansion. The market is segmented by card type (physical vs. digital), distribution channel (online vs. offline), and target customer segments (individuals vs. corporations). Leading players like EbixCash, QwikCilver, LivQuik, and others leverage technological advancements to enhance user experience and expand their market reach. However, challenges like security concerns surrounding digital gift cards and the prevalence of counterfeit cards pose potential restraints to the market's growth. Overcoming these challenges through robust security measures and increased regulatory oversight will be crucial for sustained market expansion.

India Gift Card And Incentive Card Market Market Size (In Billion)

The forecast period of 2025-2033 presents significant opportunities for market players. Strategic partnerships between gift card providers and retailers will be essential to expand the acceptance network and enhance convenience for users. Innovations in gift card designs, personalized offers, and loyalty program integrations will drive customer engagement and loyalty. Furthermore, expanding into underserved regions and tapping into the potential of niche gift card markets will offer lucrative avenues for growth. The competitive landscape is characterized by both established players and emerging startups, leading to innovation and price competitiveness, ultimately benefiting the consumer.

India Gift Card And Incentive Card Market Company Market Share

India Gift Card and Incentive Card Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India Gift Card and Incentive Card Market, offering valuable insights for stakeholders across the industry. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, growth drivers, challenges, and emerging opportunities. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

India Gift Card And Incentive Card Market Market Concentration & Dynamics

The Indian gift card and incentive card market exhibits a moderately concentrated landscape, with key players like EbixCash, QwikCilver, LivQuik, IGP, eVoucher India Pvt Ltd, Woohoo, Zingoy, Giftstoindia24x, GyFTR, and You Got a Gift holding significant market share. However, the market also accommodates numerous smaller players, fostering competition. The market’s dynamics are shaped by several factors:

- Market Concentration: The top 5 players account for approximately xx% of the market share in 2025, indicating a moderately consolidated market.

- Innovation Ecosystems: Continuous innovation in digital platforms, mobile wallets, and loyalty programs drives market expansion. New features like customizable gift cards and integrated reward systems are enhancing user experience.

- Regulatory Frameworks: Government regulations concerning digital payments and data privacy influence market operations and security protocols.

- Substitute Products: The rise of alternative digital reward systems and peer-to-peer payment platforms creates subtle competitive pressure.

- End-User Trends: A growing preference for digital gift cards and e-vouchers, fueled by increasing smartphone penetration and online shopping habits, is a key market driver.

- M&A Activities: The number of M&A deals in this sector has been steadily increasing, with xx deals recorded between 2019 and 2024, reflecting consolidation and expansion strategies amongst players.

India Gift Card And Incentive Card Market Industry Insights & Trends

The Indian gift card and incentive card market is experiencing robust growth, driven by several factors. The increasing adoption of digital payments, the expansion of e-commerce, and the growing preference for experience-based gifting are significantly contributing to market expansion. The market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033, demonstrating a robust CAGR of xx%. Several key trends are shaping the market:

- Technological Disruptions: The integration of blockchain technology and AI-powered personalization engines are revolutionizing the gift card and incentive program landscape.

- Evolving Consumer Behaviors: The preference shift from physical gift cards towards digital options is prominent, particularly amongst younger demographics. Consumers are also increasingly demanding personalized and flexible reward programs.

- Market Growth Drivers: Factors like rising disposable incomes, increasing corporate spending on employee incentives, and the festive season demand are key growth drivers.

Key Markets & Segments Leading India Gift Card And Incentive Card Market

The Indian gift card and incentive card market is geographically diverse, with significant contributions from metropolitan areas and tier-1 cities. However, tier-2 and tier-3 cities are exhibiting rapid growth potential. The key segments driving the market are:

- Corporate Gifting: This segment remains a substantial revenue contributor, with companies increasingly using gift cards and incentive programs for employee rewards, client appreciation, and promotional activities.

- E-commerce Platforms: The integration of gift cards directly into e-commerce platforms and marketplaces significantly contributes to market growth.

- Retail: Retail stores and businesses leverage gift cards to boost sales and increase customer loyalty.

Drivers of Dominance:

- High Smartphone Penetration: Widespread smartphone adoption facilitates easy access and usage of digital gift cards and mobile wallets.

- Growing E-commerce Market: The burgeoning online retail sector contributes to the increased demand for digital gift cards.

- Favorable Government Policies: Supportive government policies promoting digital payments foster the growth of the market.

India Gift Card And Incentive Card Market Product Developments

Recent product innovations include the emergence of multi-brand gift cards, personalized digital gift cards with customizable options, and integration with loyalty programs. These advancements offer enhanced flexibility and personalization, making the offerings more appealing to consumers. The incorporation of advanced security features like fraud detection and enhanced encryption further improves consumer trust and confidence.

Challenges in the India Gift Card And Incentive Card Market Market

Several challenges hinder market growth. These include:

- Regulatory Hurdles: Navigating the complex regulatory environment concerning digital payments and data security can pose operational challenges.

- Supply Chain Issues: Maintaining efficient supply chains for physical gift cards can be logistically demanding.

- Competitive Pressures: The competitive landscape necessitates continuous innovation and strategic differentiation to maintain market share. This could result in reduced profit margins for some players.

Forces Driving India Gift Card And Incentive Card Market Growth

Key growth drivers include:

- Technological Advancements: Innovations in digital payment technologies and mobile wallets directly contribute to market expansion.

- Economic Growth: Rising disposable incomes and increased consumer spending power fuel demand for gift cards and incentives.

- Government Initiatives: Supportive government policies promoting digital payments and financial inclusion create a favorable environment for market growth.

Long-Term Growth Catalysts in the India Gift Card And Incentive Card Market

Long-term growth will be fueled by ongoing technological innovation, strategic partnerships between players across different industries, and the expansion of the market into less-penetrated regions and demographics.

Emerging Opportunities in India Gift Card And Incentive Card Market

Emerging opportunities include:

- Expansion into Tier 2 and 3 Cities: Untapped potential exists in these regions, driven by increasing smartphone penetration and rising internet connectivity.

- Focus on Niche Segments: Catering to specific customer preferences through tailored gift card offerings.

- Integration with Metaverse and Web 3.0: Innovative usage of gift cards and loyalty programs within virtual environments and decentralized ecosystems.

Leading Players in the India Gift Card And Incentive Card Market Sector

- EbixCash

- QwikCilver

- LivQuik

- IGP

- eVoucher India Pvt Ltd

- Woohoo

- Zingoy

- Giftstoindia24x

- GyFTR

- You Got a Gift

Key Milestones in India Gift Card And Incentive Card Market Industry

- December 2023: Pine Labs’ Qwikcilver and Foodpanda launched Foodpanda Gift Cards, enhancing convenience for customers.

- October 2023: YES Bank partnered with ONDC to launch the ONDC Network Gift Card, expanding accessibility to various brands and sellers.

Strategic Outlook for India Gift Card And Incentive Card Market Market

The Indian gift card and incentive card market exhibits significant future potential. Strategic opportunities lie in leveraging technological advancements, expanding into new market segments, and forging strategic partnerships to capture market share. Focusing on personalized experiences and enhanced security features will be crucial for maintaining a competitive edge.

India Gift Card And Incentive Card Market Segmentation

-

1. Card Type

- 1.1. E-Gift card

- 1.2. Physical card

-

2. Consumer Type

- 2.1. Retail Consumer

- 2.2. Corporate Consumer

-

3. Distribution Channel

- 3.1. Online

- 3.2. Offline

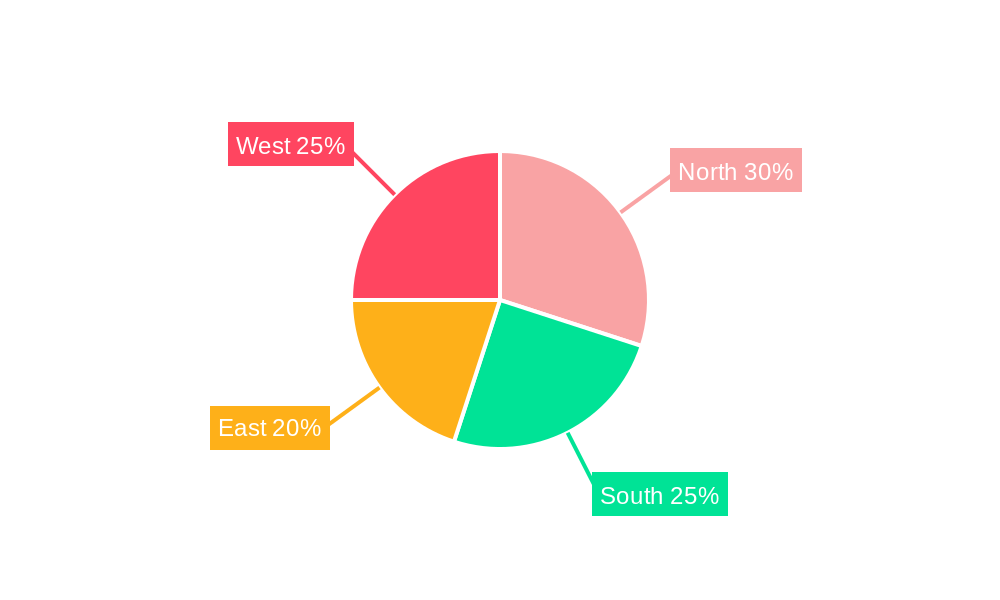

India Gift Card And Incentive Card Market Segmentation By Geography

- 1. India

India Gift Card And Incentive Card Market Regional Market Share

Geographic Coverage of India Gift Card And Incentive Card Market

India Gift Card And Incentive Card Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Strong Growth in the E-Commerce Market is Driving the Gift Card Industry

- 3.3. Market Restrains

- 3.3.1. Strong Growth in the E-Commerce Market is Driving the Gift Card Industry

- 3.4. Market Trends

- 3.4.1. The Thriving E-Commerce Market is Fueling the Growth of the Gift Card Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Gift Card And Incentive Card Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Card Type

- 5.1.1. E-Gift card

- 5.1.2. Physical card

- 5.2. Market Analysis, Insights and Forecast - by Consumer Type

- 5.2.1. Retail Consumer

- 5.2.2. Corporate Consumer

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Card Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 EbixCash

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 QwikCilver

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 LivQuik

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 IGP

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 eVoucher India Pvt Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Woohoo

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Zingoy

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Giftstoindia24x

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 GyFTR

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 You Got a Gift**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 EbixCash

List of Figures

- Figure 1: India Gift Card And Incentive Card Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Gift Card And Incentive Card Market Share (%) by Company 2025

List of Tables

- Table 1: India Gift Card And Incentive Card Market Revenue Million Forecast, by Card Type 2020 & 2033

- Table 2: India Gift Card And Incentive Card Market Volume Billion Forecast, by Card Type 2020 & 2033

- Table 3: India Gift Card And Incentive Card Market Revenue Million Forecast, by Consumer Type 2020 & 2033

- Table 4: India Gift Card And Incentive Card Market Volume Billion Forecast, by Consumer Type 2020 & 2033

- Table 5: India Gift Card And Incentive Card Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: India Gift Card And Incentive Card Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: India Gift Card And Incentive Card Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: India Gift Card And Incentive Card Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: India Gift Card And Incentive Card Market Revenue Million Forecast, by Card Type 2020 & 2033

- Table 10: India Gift Card And Incentive Card Market Volume Billion Forecast, by Card Type 2020 & 2033

- Table 11: India Gift Card And Incentive Card Market Revenue Million Forecast, by Consumer Type 2020 & 2033

- Table 12: India Gift Card And Incentive Card Market Volume Billion Forecast, by Consumer Type 2020 & 2033

- Table 13: India Gift Card And Incentive Card Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: India Gift Card And Incentive Card Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: India Gift Card And Incentive Card Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: India Gift Card And Incentive Card Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Gift Card And Incentive Card Market?

The projected CAGR is approximately 17.67%.

2. Which companies are prominent players in the India Gift Card And Incentive Card Market?

Key companies in the market include EbixCash, QwikCilver, LivQuik, IGP, eVoucher India Pvt Ltd, Woohoo, Zingoy, Giftstoindia24x, GyFTR, You Got a Gift**List Not Exhaustive.

3. What are the main segments of the India Gift Card And Incentive Card Market?

The market segments include Card Type, Consumer Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Strong Growth in the E-Commerce Market is Driving the Gift Card Industry.

6. What are the notable trends driving market growth?

The Thriving E-Commerce Market is Fueling the Growth of the Gift Card Industry.

7. Are there any restraints impacting market growth?

Strong Growth in the E-Commerce Market is Driving the Gift Card Industry.

8. Can you provide examples of recent developments in the market?

In December 2023, Pine Labs’ Qwikcilver and Foodpanda collaborated to introduce Foodpanda Gift Cards, a more advanced solution that allows Foodpanda customers to redeem and check their purchases conveniently.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Gift Card And Incentive Card Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Gift Card And Incentive Card Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Gift Card And Incentive Card Market?

To stay informed about further developments, trends, and reports in the India Gift Card And Incentive Card Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence