Key Insights

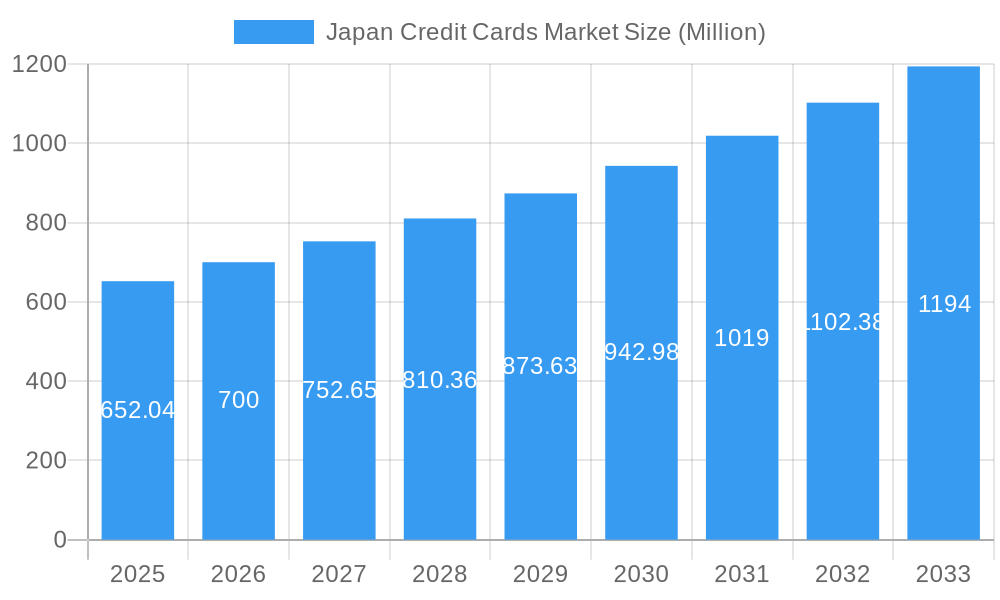

The Japan credit card market, valued at $652.04 million in 2025, is projected to experience robust growth, driven by increasing consumer spending, rising digitalization, and the expanding e-commerce sector. The market's Compound Annual Growth Rate (CAGR) of 7.36% from 2025 to 2033 indicates a significant expansion opportunity. Key players like Rakuten Card, Mitsubishi UFJ Financial Group, and Sumitomo Mitsui Financial Group are leveraging technological advancements to enhance customer experiences and expand their market share. Government initiatives promoting financial inclusion and a shift towards cashless transactions further fuel market growth. However, factors such as stringent regulatory compliance requirements and concerns about data security pose challenges to market expansion. The market is segmented based on card type (e.g., debit, credit, prepaid), payment network (e.g., Visa, Mastercard, JCB), and user demographics (e.g., age, income). Growth is expected across all segments, with the premium credit card segment potentially witnessing faster expansion due to increasing disposable incomes and the desire for enhanced rewards programs. The competitive landscape is characterized by intense rivalry among established players and the emergence of fintech companies offering innovative payment solutions.

Japan Credit Cards Market Market Size (In Million)

The forecast period (2025-2033) anticipates continuous growth, fueled by increasing consumer confidence and the sustained adoption of digital payment methods. Expansion into rural areas and the development of targeted marketing campaigns will play a critical role in maximizing market penetration. While existing players are consolidating their positions through strategic partnerships and technological upgrades, the potential for disruptive innovation from fintech startups cannot be overlooked. Maintaining customer trust through robust data security protocols and adhering to evolving regulatory frameworks will be crucial for long-term success in this dynamic market. Future projections suggest a market size exceeding $1 billion by 2033, showcasing the considerable potential for sustained expansion and investment in the Japan credit card market.

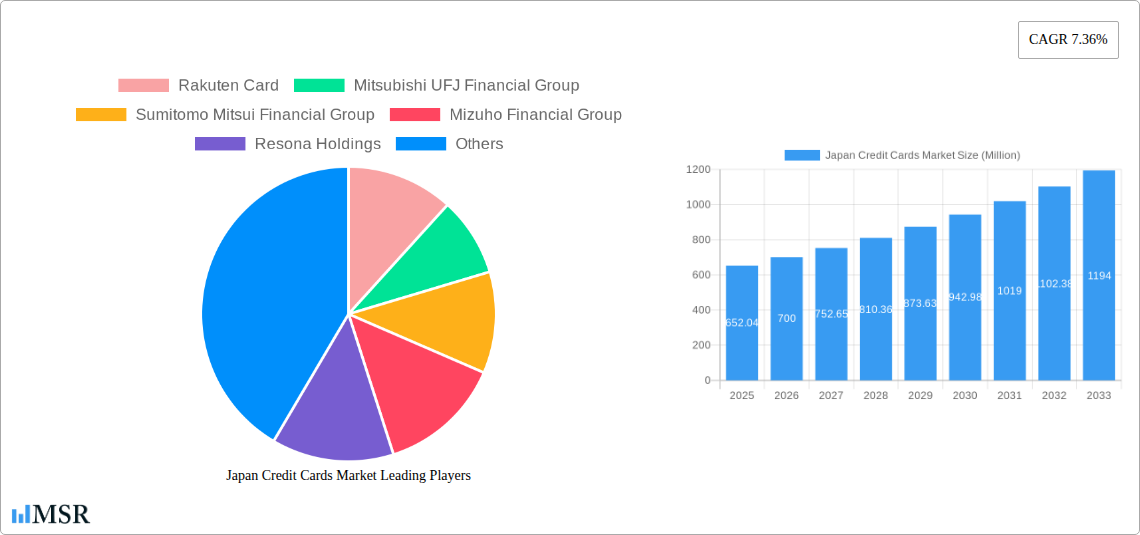

Japan Credit Cards Market Company Market Share

Japan Credit Cards Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Japan Credit Cards Market, covering market dynamics, industry trends, key players, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is crucial for industry stakeholders, investors, and anyone seeking a thorough understanding of this dynamic market. The report incorporates data and insights to help you make informed business decisions.

Japan Credit Cards Market Market Concentration & Dynamics

This section analyzes the competitive landscape of the Japanese credit card market, encompassing market concentration, innovative ecosystems, regulatory frameworks, substitute products, end-user trends, and M&A activities. The market is moderately concentrated, with key players holding significant market share. However, the presence of numerous smaller players contributes to a dynamic competitive environment.

Market Share: Rakuten Card holds an estimated xx% market share, followed by Mitsubishi UFJ Financial Group (xx%), Sumitomo Mitsui Financial Group (xx%), and Mizuho Financial Group (xx%). The remaining market share is distributed amongst numerous smaller players, including Resona Holdings, Japan Post Bank, Aozora Bank, Norinchukin Bank, Shizuoka Bank, and JCB (Japan Credit Bureau). (Note: These percentages are estimates)

M&A Activity: The number of M&A deals within the Japan credit card market averaged xx per year during the historical period (2019-2024). This indicates a moderate level of consolidation.

Regulatory Framework: The Japanese government's regulatory framework for the credit card industry is relatively robust, focusing on consumer protection and financial stability. Recent regulatory changes have focused on promoting competition and innovation.

Innovation Ecosystems: Collaboration between financial institutions, fintech companies, and technology providers is driving innovation in areas such as mobile payments, digital wallets, and personalized financial services.

Japan Credit Cards Market Industry Insights & Trends

The Japan Credit Cards Market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), reaching a market size of xx Million in 2024. This growth is primarily driven by increasing consumer spending, rising adoption of digital payment methods, and expanding e-commerce. The market is expected to continue its growth trajectory, with a projected CAGR of xx% during the forecast period (2025-2033), reaching xx Million by 2033.

Several factors contribute to this growth, including:

Growing E-commerce: The increasing popularity of online shopping is fueling the demand for credit cards as a preferred payment method.

Digitalization of Payments: The adoption of mobile payment systems and digital wallets is significantly impacting consumer behavior, leading to increased credit card usage.

Government Initiatives: Government initiatives aimed at promoting digital financial inclusion are creating a favorable environment for the growth of the credit card market.

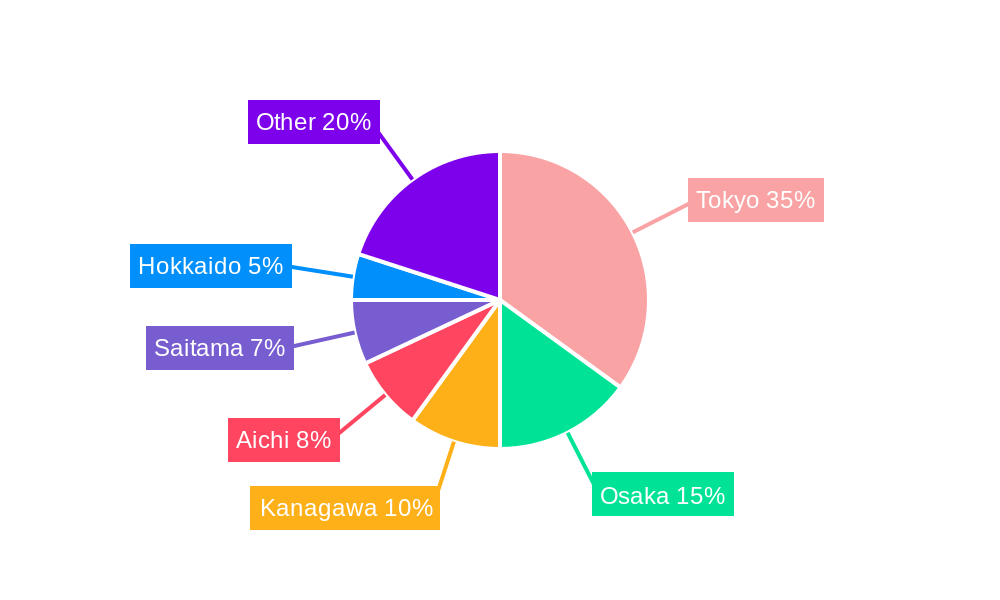

Key Markets & Segments Leading Japan Credit Cards Market

The dominant segment within the Japan Credit Cards Market is the consumer segment, driven by increased purchasing power and consumer confidence. The key regions driving market growth include major metropolitan areas like Tokyo, Osaka, and Nagoya, due to higher population density and spending power.

- Drivers of Growth in Dominant Regions:

- High population density

- Strong economic activity

- Developed infrastructure for financial transactions

- High level of financial literacy

The dominance of these urban areas stems from higher disposable incomes, greater access to financial services, and a higher propensity for credit card usage. Furthermore, robust e-commerce infrastructure in these regions further enhances the adoption of credit cards.

Japan Credit Cards Market Product Developments

Recent product developments in the Japanese credit card market have focused on enhancing customer convenience and security, incorporating features such as contactless payments, mobile wallets integration, and advanced fraud detection systems. The integration of loyalty programs and reward schemes is another key area of innovation, further boosting customer engagement and usage.

Challenges in the Japan Credit Cards Market Market

The Japan Credit Cards Market faces certain challenges, including:

Intense Competition: The market is characterized by intense competition among numerous established players and emerging fintech companies.

Regulatory Scrutiny: Strict regulatory requirements and compliance costs pose challenges for credit card issuers.

Economic Fluctuations: Economic downturns can negatively impact consumer spending and credit card usage.

Forces Driving Japan Credit Cards Market Growth

Several factors drive the growth of the Japan Credit Cards Market:

Increasing Digitalization: The rapid adoption of digital technologies and mobile payments fuels demand for credit card usage.

Rising Consumer Spending: Growing consumer purchasing power and confidence contribute to increased credit card transactions.

Government Support: Favorable government policies and initiatives promote the growth of the digital financial sector.

Long-Term Growth Catalysts in Japan Credit Cards Market

Long-term growth in the Japan Credit Cards Market is likely fueled by:

Further technological advancements in payment security and efficiency, strategic partnerships between financial institutions and fintech companies, and expanding credit card acceptance across various industries are expected to propel growth. Expansion into new market segments, such as the small and medium-sized enterprise (SME) sector, also presents significant opportunities.

Emerging Opportunities in Japan Credit Cards Market

Emerging opportunities in the Japan Credit Cards Market include:

Growth of Fintech: The integration of fintech solutions and innovations in payments and lending offers potential for market expansion.

Expansion into SMEs: Increased penetration of credit card usage among SMEs presents a significant opportunity for growth.

Development of Niche Products: Catering to specific demographic or industry segments offers lucrative prospects.

Leading Players in the Japan Credit Cards Market Sector

- Rakuten Card

- Mitsubishi UFJ Financial Group

- Sumitomo Mitsui Financial Group

- Mizuho Financial Group

- Resona Holdings

- Japan Post Bank

- Aozora Bank

- Norinchukin Bank

- Shizuoka Bank

- JCB (Japan Credit Bureau)

- List Not Exhaustive

Key Milestones in Japan Credit Cards Market Industry

May 2023: Sumitomo Mitsui Banking Corporation invested USD 10 Million in Closed Loop Partners' Circular Plastics Fund, signifying a commitment to environmental sustainability and potentially influencing future credit card production practices.

May 2023: Mizuho Financial Group acquired Greenhill & Co., Inc. for approximately USD 550 Million. This acquisition strengthens Mizuho's position in investment banking and could influence its strategic direction within the credit card market.

Strategic Outlook for Japan Credit Cards Market Market

The Japan Credit Cards Market presents significant growth potential, driven by the ongoing digital transformation of the financial sector and increased consumer adoption of digital payment methods. Strategic partnerships, product diversification, and a focus on enhancing customer experience will be key to success in this competitive market. The market is poised for continued growth, with opportunities for both established players and innovative fintech companies to capture market share.

Japan Credit Cards Market Segmentation

-

1. Card Type

- 1.1. General Purpose Credit Cards

- 1.2. Specialty & Other Credit Cards

-

2. Application

- 2.1. Food & Groceries

- 2.2. Health & Pharmacy

- 2.3. Restaurants & Bars

- 2.4. Consumer Electronics

- 2.5. Media & Entertainment

- 2.6. Travel & Tourism

- 2.7. Other Applications

-

3. Provider

- 3.1. Visa

- 3.2. MasterCard

- 3.3. Other Providers

Japan Credit Cards Market Segmentation By Geography

- 1. Japan

Japan Credit Cards Market Regional Market Share

Geographic Coverage of Japan Credit Cards Market

Japan Credit Cards Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.36% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Usage of Credit Card give the bonus and reward points

- 3.3. Market Restrains

- 3.3.1. Usage of Credit Card give the bonus and reward points

- 3.4. Market Trends

- 3.4.1. Increasing in Number of Credit Card issued

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Credit Cards Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Card Type

- 5.1.1. General Purpose Credit Cards

- 5.1.2. Specialty & Other Credit Cards

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food & Groceries

- 5.2.2. Health & Pharmacy

- 5.2.3. Restaurants & Bars

- 5.2.4. Consumer Electronics

- 5.2.5. Media & Entertainment

- 5.2.6. Travel & Tourism

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Provider

- 5.3.1. Visa

- 5.3.2. MasterCard

- 5.3.3. Other Providers

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Card Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Rakuten Card

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mitsubishi UFJ Financial Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sumitomo Mitsui Financial Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mizuho Financial Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Resona Holdings

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Japan Post Bank

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Aozora Bank

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Norinchukin Bank

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Shizuoka Bank

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 JCB (Japan Credit Bureau)**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Rakuten Card

List of Figures

- Figure 1: Japan Credit Cards Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan Credit Cards Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Credit Cards Market Revenue Million Forecast, by Card Type 2020 & 2033

- Table 2: Japan Credit Cards Market Volume Billion Forecast, by Card Type 2020 & 2033

- Table 3: Japan Credit Cards Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Japan Credit Cards Market Volume Billion Forecast, by Application 2020 & 2033

- Table 5: Japan Credit Cards Market Revenue Million Forecast, by Provider 2020 & 2033

- Table 6: Japan Credit Cards Market Volume Billion Forecast, by Provider 2020 & 2033

- Table 7: Japan Credit Cards Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Japan Credit Cards Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Japan Credit Cards Market Revenue Million Forecast, by Card Type 2020 & 2033

- Table 10: Japan Credit Cards Market Volume Billion Forecast, by Card Type 2020 & 2033

- Table 11: Japan Credit Cards Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Japan Credit Cards Market Volume Billion Forecast, by Application 2020 & 2033

- Table 13: Japan Credit Cards Market Revenue Million Forecast, by Provider 2020 & 2033

- Table 14: Japan Credit Cards Market Volume Billion Forecast, by Provider 2020 & 2033

- Table 15: Japan Credit Cards Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Japan Credit Cards Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Credit Cards Market?

The projected CAGR is approximately 7.36%.

2. Which companies are prominent players in the Japan Credit Cards Market?

Key companies in the market include Rakuten Card, Mitsubishi UFJ Financial Group, Sumitomo Mitsui Financial Group, Mizuho Financial Group, Resona Holdings, Japan Post Bank, Aozora Bank, Norinchukin Bank, Shizuoka Bank, JCB (Japan Credit Bureau)**List Not Exhaustive.

3. What are the main segments of the Japan Credit Cards Market?

The market segments include Card Type, Application, Provider.

4. Can you provide details about the market size?

The market size is estimated to be USD 652.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Usage of Credit Card give the bonus and reward points.

6. What are the notable trends driving market growth?

Increasing in Number of Credit Card issued.

7. Are there any restraints impacting market growth?

Usage of Credit Card give the bonus and reward points.

8. Can you provide examples of recent developments in the market?

May 2023: Sumitomo Mitsui Banking Corporation announced a USD 10 million investment in U.S.-based Closed Loop Partners' Circular Plastics Fund. The Closed Loop Circular Plastics Fund is managed and operated by Closed Loop Partners, an investment firm dedicated to advancing the circular economy. The fund provides catalytic debt and equity financing into solutions and infrastructure that advance the recovery and recycling of plastics, helping keep more materials in circulation while reducing greenhouse gas emissions and leading a shift to the circular economy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Credit Cards Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Credit Cards Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Credit Cards Market?

To stay informed about further developments, trends, and reports in the Japan Credit Cards Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence