Key Insights

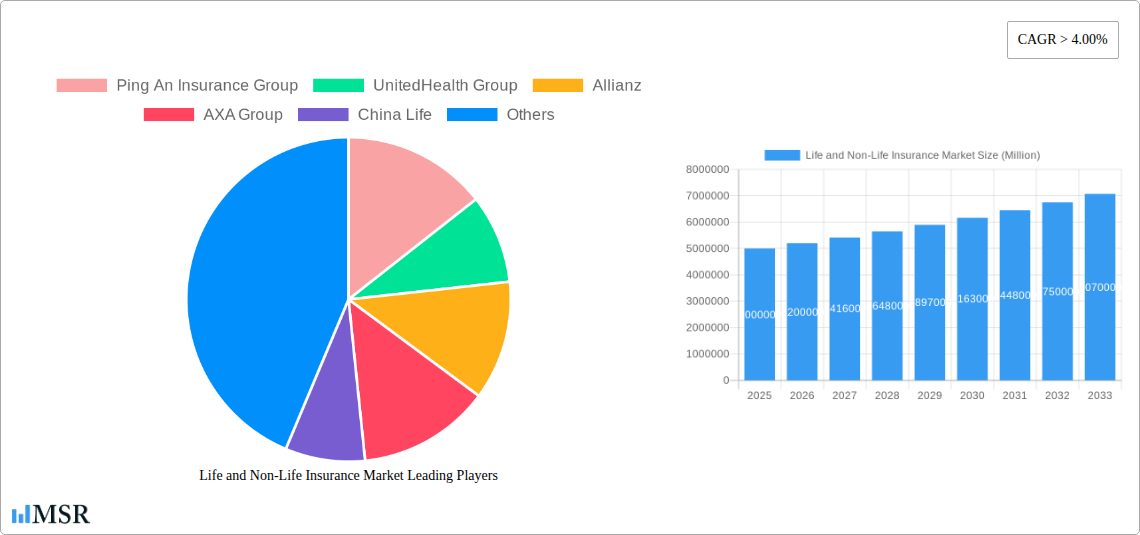

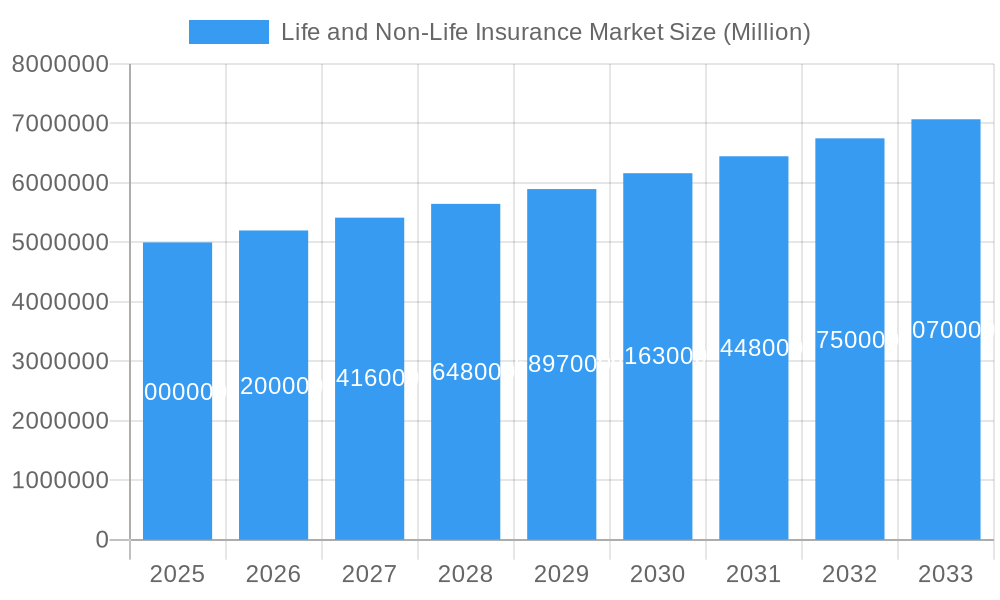

The global life and non-life insurance market is experiencing robust growth, fueled by a confluence of factors. A compound annual growth rate (CAGR) exceeding 4% from 2019 to 2033 indicates a significant expansion, driven primarily by increasing health consciousness, rising disposable incomes in emerging economies, and the growing prevalence of chronic diseases necessitating comprehensive health insurance. The aging global population also plays a significant role, boosting demand for life insurance products and long-term care solutions. Technological advancements, including the adoption of Insurtech solutions for streamlined processes and personalized offerings, are further accelerating market growth. However, challenges remain, including regulatory hurdles in certain regions, intense competition among established players and new entrants, and the need to address cybersecurity risks associated with digitalization. Market segmentation reveals a dynamic landscape, with life insurance dominating in mature markets and non-life insurance witnessing strong growth in developing nations experiencing rapid urbanization and industrialization. Leading players like Ping An Insurance Group, UnitedHealth Group, and Allianz are strategically positioning themselves to capitalize on these opportunities through product diversification, geographical expansion, and strategic partnerships.

Life and Non-Life Insurance Market Market Size (In Million)

The market's segmentation shows a nuanced picture, with varying growth trajectories across life and non-life sectors. While life insurance benefits from a growing awareness of financial security needs, the non-life segment is experiencing significant traction due to increased demand for property, casualty, and motor vehicle insurance in burgeoning economies. The competitive landscape is intensely competitive, with established global players and regional insurers vying for market share. Successful strategies involve a balance between offering competitive pricing, providing exceptional customer service, and leveraging technological innovation to improve operational efficiency and enhance customer engagement. Future growth will depend on the ability of insurers to adapt to evolving customer preferences, navigate regulatory changes, and effectively manage risks associated with climate change and emerging global health crises. Assuming a 2025 market size of $5 trillion (a reasonable estimate based on industry reports and the provided CAGR), the market is projected to reach approximately $7.2 trillion by 2033, representing substantial opportunities for industry players.

Life and Non-Life Insurance Market Company Market Share

Life and Non-Life Insurance Market Report: 2019-2033 Forecast

This comprehensive report provides a detailed analysis of the global Life and Non-Life Insurance Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033 (Study Period: 2019–2033, Base Year: 2025, Estimated Year: 2025, Forecast Period: 2025–2033, Historical Period: 2019–2024), this report delves into market dynamics, growth drivers, challenges, and emerging opportunities. Key players such as Ping An Insurance Group, UnitedHealth Group, Allianz, AXA Group, China Life, AIA Group, MetLife, Zurich Insurance, and Cigna (list not exhaustive) are analyzed in detail. The report also explores significant industry developments, including recent mergers and acquisitions.

Life and Non-Life Insurance Market Market Concentration & Dynamics

The global life and non-life insurance market exhibits a moderately concentrated structure, with a few dominant players commanding significant market share. Ping An Insurance Group and Allianz, for instance, hold substantial portions of the global market, estimated at xx% and xx%, respectively, in 2024. However, the market also features numerous regional and specialized insurers, creating a dynamic competitive landscape. Market concentration is influenced by factors such as regulatory frameworks, which vary significantly across jurisdictions, impacting market entry and expansion strategies. The market exhibits a robust innovation ecosystem, with ongoing developments in areas such as Insurtech, AI-driven risk assessment, and personalized insurance products. The rising adoption of digital technologies is driving the demand for innovative solutions. Substitute products, including self-insurance and alternative risk transfer mechanisms, pose a degree of competition, yet the core need for risk mitigation and financial security continues to support market growth. End-user trends show a growing preference for customized insurance products and convenient digital platforms.

- Market Share (2024): Ping An Insurance Group (xx%), Allianz (xx%), Others (xx%)

- M&A Deal Count (2019-2024): xx

- Key Innovation Areas: Insurtech, AI, Personalized Insurance

Life and Non-Life Insurance Market Industry Insights & Trends

The global life and non-life insurance market is experiencing significant growth, driven by several key factors. The market size reached an estimated USD xx Million in 2024 and is projected to expand at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Rising disposable incomes, particularly in emerging economies, and increasing awareness of financial security are fueling demand for insurance products. Technological disruptions, particularly the rise of Insurtech and the widespread adoption of digital platforms, are reshaping the industry, creating opportunities for innovation and efficiency gains. Evolving consumer behaviors, such as a preference for personalized and digitally accessible solutions, are driving insurers to adopt new strategies and technologies. The increasing prevalence of chronic diseases, combined with an aging global population, contributes to a rising demand for health insurance. The market is also influenced by macroeconomic factors, such as interest rates and economic growth, which affect investment returns and consumer spending. Furthermore, changing regulatory environments and evolving government policies can significantly affect insurance companies' operational capabilities and profitability.

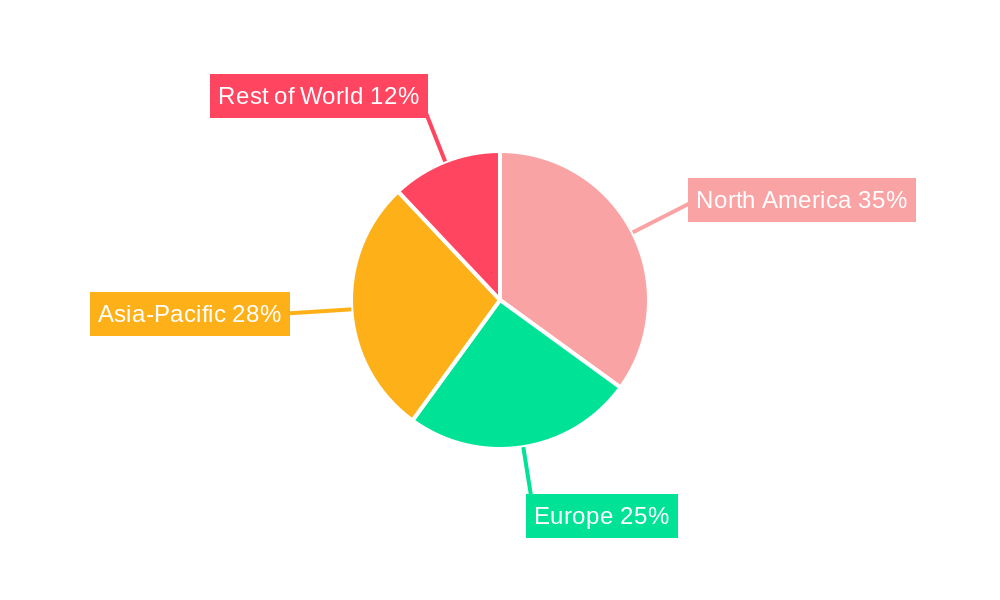

Key Markets & Segments Leading Life and Non-Life Insurance Market

The Asia-Pacific region currently holds the largest market share in the life and non-life insurance sector, driven by factors such as rapid economic growth, a large and growing population, and increasing urbanization. China, in particular, is a key market, characterized by both strong growth potential and intense competition.

- Drivers for Asia-Pacific Dominance:

- Rapid economic growth

- Increasing disposable incomes

- Growing middle class

- Expanding insurance awareness

- Favorable government policies

Within the life and non-life insurance market, health insurance is witnessing particularly robust growth, fueled by increasing healthcare costs and the desire for comprehensive medical coverage. The growth of this segment is further supported by technological advancements, allowing for more efficient and comprehensive healthcare management.

Life and Non-Life Insurance Market Product Developments

Recent product innovations in the life and non-life insurance market focus on integrating technology to enhance customer experience and operational efficiency. This includes the development of AI-powered risk assessment tools, personalized insurance offerings based on individual risk profiles, and the utilization of big data analytics for fraud detection and claims processing. These innovations aim to provide more tailored, accessible, and cost-effective insurance solutions, ultimately increasing the overall market competitiveness. Telematics technology in automotive insurance, for example, is proving to be highly relevant, offering customized premiums based on driving behavior.

Challenges in the Life and Non-Life Insurance Market Market

The life and non-life insurance market faces several challenges, including increasingly stringent regulatory compliance requirements that increase operational costs and complexities. Supply chain disruptions, particularly those relating to global events and economic uncertainty, can affect the availability and cost of reinsurance. The intense competition among established players and emerging Insurtech companies also puts pressure on pricing and profit margins. The quantification of these challenges is difficult due to their varied nature, however, these challenges can contribute to reduced market growth rate.

Forces Driving Life and Non-Life Insurance Market Growth

Several factors are driving the growth of the life and non-life insurance market. Technological advancements, such as AI and machine learning, are improving risk assessment, fraud detection, and customer service, leading to increased efficiency and personalized products. Favorable economic conditions, such as rising disposable incomes and increasing consumer spending, increase demand for insurance solutions. Supportive regulatory environments that promote market stability and consumer protection can foster market growth. Specifically, government initiatives promoting financial inclusion encourage more people to utilize insurance services.

Challenges in the Life and Non-Life Insurance Market Market

Long-term growth in the life and non-life insurance market hinges on the adoption of advanced technologies, fostering strategic partnerships with technology companies, and expanding into new and emerging markets. Innovation in areas such as personalized insurance solutions and the integration of wearable technology into health insurance will be key.

Emerging Opportunities in Life and Non-Life Insurance Market

Emerging opportunities exist in untapped markets, particularly in developing countries with growing middle classes, as well as the development and adoption of new technologies such as blockchain for enhanced security and transparency in transactions. The integration of AI and machine learning into insurance processes promises further efficiencies and opportunities for product customization. New consumer preferences for bundled insurance products and digital-first solutions also present significant opportunities.

Leading Players in the Life and Non-Life Insurance Market Sector

Key Milestones in Life and Non-Life Insurance Market Industry

- June 2022: UnitedHealthcare's USD 1.5 Billion acquisition of EMIS Group, a leading UK health technology company, signals a significant move towards integrating technology into healthcare and insurance services.

- February 2022: Allianz SE's acquisition of a 72% stake in European Reliance General Insurance Company SA expands its presence in the Greek insurance market, highlighting the ongoing consolidation within the industry.

Strategic Outlook for Life and Non-Life Insurance Market Market

The future of the life and non-life insurance market is bright, driven by technological innovation, expanding global markets, and a growing need for risk management. Strategic opportunities abound for companies that embrace digital transformation, leverage data analytics effectively, and develop innovative products tailored to evolving consumer preferences. Further consolidation through mergers and acquisitions is also expected, shaping the competitive landscape and driving further market expansion.

Life and Non-Life Insurance Market Segmentation

-

1. Insurance Type

-

1.1. Life Insurance

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non-life Insurance

- 1.2.1. Home

- 1.2.2. Motor

- 1.2.3. Other Non-life Insurances

-

1.1. Life Insurance

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Agency

- 2.3. Banks

- 2.4. Other Distribution Channels

Life and Non-Life Insurance Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Rest of the Middle East

Life and Non-Life Insurance Market Regional Market Share

Geographic Coverage of Life and Non-Life Insurance Market

Life and Non-Life Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Cyber Insurance is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Life and Non-Life Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 5.1.1. Life Insurance

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non-life Insurance

- 5.1.2.1. Home

- 5.1.2.2. Motor

- 5.1.2.3. Other Non-life Insurances

- 5.1.1. Life Insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Banks

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6. North America Life and Non-Life Insurance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6.1.1. Life Insurance

- 6.1.1.1. Individual

- 6.1.1.2. Group

- 6.1.2. Non-life Insurance

- 6.1.2.1. Home

- 6.1.2.2. Motor

- 6.1.2.3. Other Non-life Insurances

- 6.1.1. Life Insurance

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Direct

- 6.2.2. Agency

- 6.2.3. Banks

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Insurance Type

- 7. Europe Life and Non-Life Insurance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Insurance Type

- 7.1.1. Life Insurance

- 7.1.1.1. Individual

- 7.1.1.2. Group

- 7.1.2. Non-life Insurance

- 7.1.2.1. Home

- 7.1.2.2. Motor

- 7.1.2.3. Other Non-life Insurances

- 7.1.1. Life Insurance

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Direct

- 7.2.2. Agency

- 7.2.3. Banks

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Insurance Type

- 8. Asia Pacific Life and Non-Life Insurance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Insurance Type

- 8.1.1. Life Insurance

- 8.1.1.1. Individual

- 8.1.1.2. Group

- 8.1.2. Non-life Insurance

- 8.1.2.1. Home

- 8.1.2.2. Motor

- 8.1.2.3. Other Non-life Insurances

- 8.1.1. Life Insurance

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Direct

- 8.2.2. Agency

- 8.2.3. Banks

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Insurance Type

- 9. South America Life and Non-Life Insurance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Insurance Type

- 9.1.1. Life Insurance

- 9.1.1.1. Individual

- 9.1.1.2. Group

- 9.1.2. Non-life Insurance

- 9.1.2.1. Home

- 9.1.2.2. Motor

- 9.1.2.3. Other Non-life Insurances

- 9.1.1. Life Insurance

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Direct

- 9.2.2. Agency

- 9.2.3. Banks

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Insurance Type

- 10. Middle East Life and Non-Life Insurance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Insurance Type

- 10.1.1. Life Insurance

- 10.1.1.1. Individual

- 10.1.1.2. Group

- 10.1.2. Non-life Insurance

- 10.1.2.1. Home

- 10.1.2.2. Motor

- 10.1.2.3. Other Non-life Insurances

- 10.1.1. Life Insurance

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Direct

- 10.2.2. Agency

- 10.2.3. Banks

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Insurance Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ping An Insurance Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 UnitedHealth Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Allianz

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 AXA Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 China Life

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AIA Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 MetLife

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Zurich Insurance

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Cigna**List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Ping An Insurance Group

List of Figures

- Figure 1: Global Life and Non-Life Insurance Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Life and Non-Life Insurance Market Revenue (Million), by Insurance Type 2025 & 2033

- Figure 3: North America Life and Non-Life Insurance Market Revenue Share (%), by Insurance Type 2025 & 2033

- Figure 4: North America Life and Non-Life Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 5: North America Life and Non-Life Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Life and Non-Life Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Life and Non-Life Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Life and Non-Life Insurance Market Revenue (Million), by Insurance Type 2025 & 2033

- Figure 9: Europe Life and Non-Life Insurance Market Revenue Share (%), by Insurance Type 2025 & 2033

- Figure 10: Europe Life and Non-Life Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 11: Europe Life and Non-Life Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Life and Non-Life Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Life and Non-Life Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Life and Non-Life Insurance Market Revenue (Million), by Insurance Type 2025 & 2033

- Figure 15: Asia Pacific Life and Non-Life Insurance Market Revenue Share (%), by Insurance Type 2025 & 2033

- Figure 16: Asia Pacific Life and Non-Life Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific Life and Non-Life Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific Life and Non-Life Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Life and Non-Life Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Life and Non-Life Insurance Market Revenue (Million), by Insurance Type 2025 & 2033

- Figure 21: South America Life and Non-Life Insurance Market Revenue Share (%), by Insurance Type 2025 & 2033

- Figure 22: South America Life and Non-Life Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: South America Life and Non-Life Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Life and Non-Life Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Life and Non-Life Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Life and Non-Life Insurance Market Revenue (Million), by Insurance Type 2025 & 2033

- Figure 27: Middle East Life and Non-Life Insurance Market Revenue Share (%), by Insurance Type 2025 & 2033

- Figure 28: Middle East Life and Non-Life Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Middle East Life and Non-Life Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East Life and Non-Life Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East Life and Non-Life Insurance Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Life and Non-Life Insurance Market Revenue Million Forecast, by Insurance Type 2020 & 2033

- Table 2: Global Life and Non-Life Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Life and Non-Life Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Life and Non-Life Insurance Market Revenue Million Forecast, by Insurance Type 2020 & 2033

- Table 5: Global Life and Non-Life Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Life and Non-Life Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Life and Non-Life Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Life and Non-Life Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Life and Non-Life Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Life and Non-Life Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Life and Non-Life Insurance Market Revenue Million Forecast, by Insurance Type 2020 & 2033

- Table 12: Global Life and Non-Life Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Life and Non-Life Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Germany Life and Non-Life Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Life and Non-Life Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: France Life and Non-Life Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Russia Life and Non-Life Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Spain Life and Non-Life Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Life and Non-Life Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Life and Non-Life Insurance Market Revenue Million Forecast, by Insurance Type 2020 & 2033

- Table 21: Global Life and Non-Life Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global Life and Non-Life Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: India Life and Non-Life Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: China Life and Non-Life Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Life and Non-Life Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Life and Non-Life Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Life and Non-Life Insurance Market Revenue Million Forecast, by Insurance Type 2020 & 2033

- Table 28: Global Life and Non-Life Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 29: Global Life and Non-Life Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Brazil Life and Non-Life Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Argentina Life and Non-Life Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of South America Life and Non-Life Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Global Life and Non-Life Insurance Market Revenue Million Forecast, by Insurance Type 2020 & 2033

- Table 34: Global Life and Non-Life Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global Life and Non-Life Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: United Arab Emirates Life and Non-Life Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Saudi Arabia Life and Non-Life Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of the Middle East Life and Non-Life Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Life and Non-Life Insurance Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Life and Non-Life Insurance Market?

Key companies in the market include Ping An Insurance Group, UnitedHealth Group, Allianz, AXA Group, China Life, AIA Group, MetLife, Zurich Insurance, Cigna**List Not Exhaustive.

3. What are the main segments of the Life and Non-Life Insurance Market?

The market segments include Insurance Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Cyber Insurance is Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

June 2022: UnitedHealthcare announced the plans of acquiring EMIS Group. The EMIS Group is a leading health technology company based in the UK. The deal is expected to be an all-cash deal of GBP 1.24 billion (USD 1.5 billion).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Life and Non-Life Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Life and Non-Life Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Life and Non-Life Insurance Market?

To stay informed about further developments, trends, and reports in the Life and Non-Life Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence