Key Insights

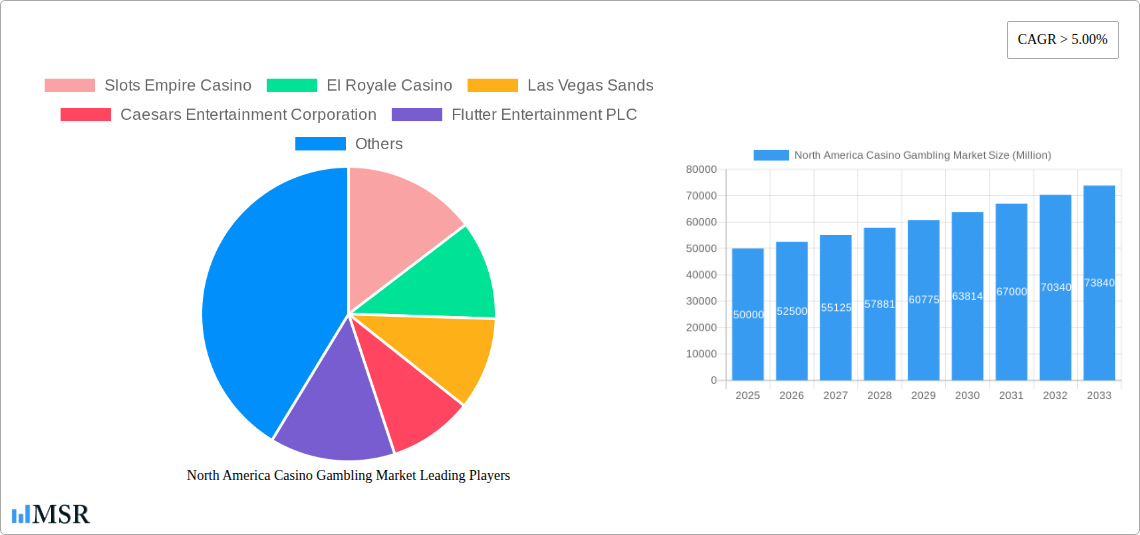

The North American casino gambling market, a dynamic sector characterized by substantial growth, is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 5% from 2025 to 2033. This expansion is fueled by several key drivers, including the increasing popularity of online casino gaming, particularly among younger demographics, the legalization of sports betting in several states, and the continuous innovation in gaming technology offering enhanced player experiences. The market's segmentation reveals a diverse player base, encompassing casual, recreational, and professional gamblers, each contributing to the overall market value. Live casinos, baccarat, blackjack, poker, and slots remain dominant segments, with the online segment experiencing accelerated growth due to improved accessibility and convenience. While regulatory hurdles and concerns surrounding responsible gaming present certain restraints, the overall market outlook remains positive, driven by consistent technological advancements and evolving consumer preferences.

North America Casino Gambling Market Market Size (In Billion)

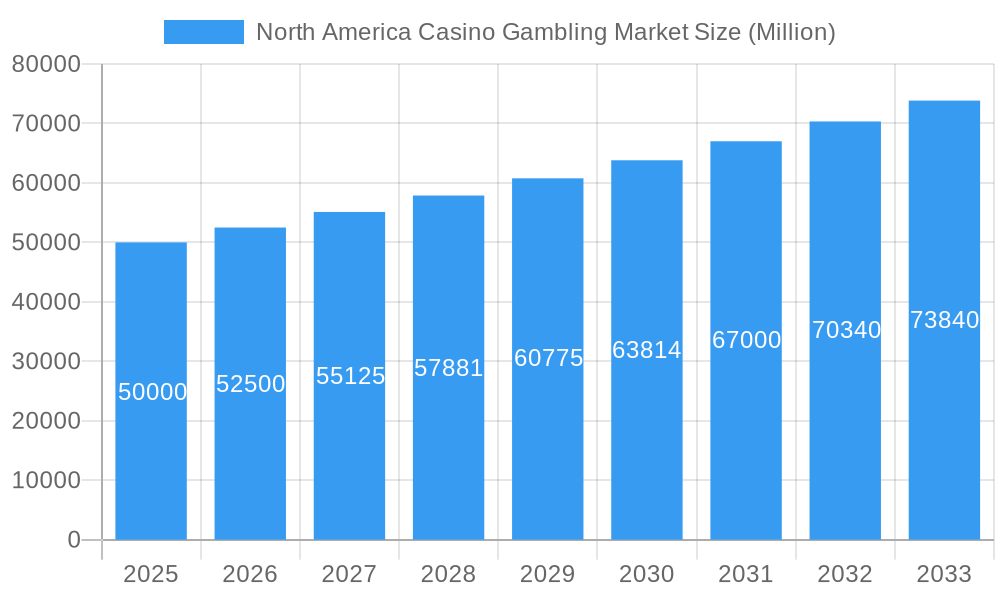

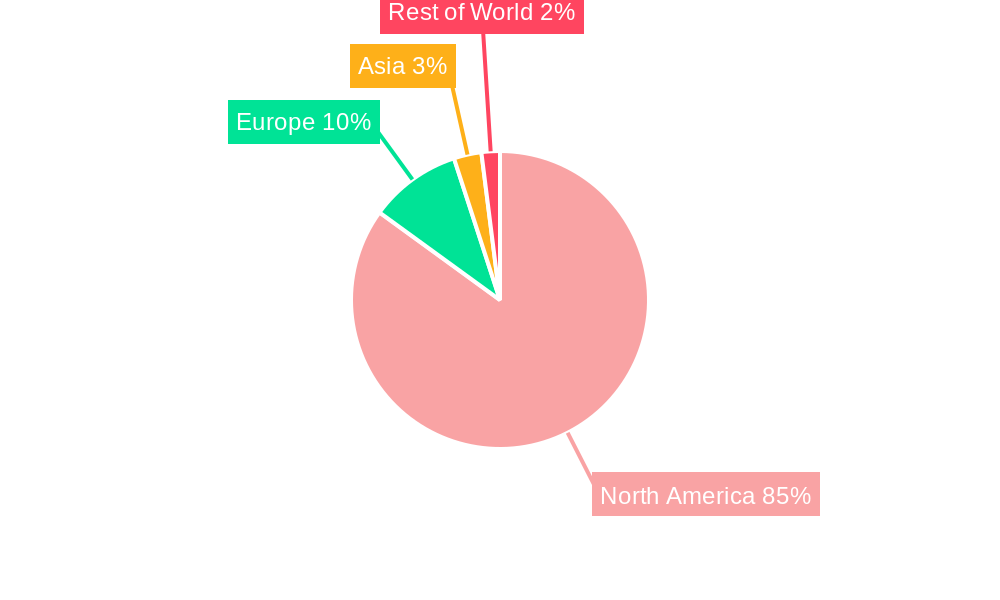

The competitive landscape is intense, with established players like Las Vegas Sands, Caesars Entertainment, and MGM Resorts International competing alongside newer entrants and online-focused operators like DraftKings and Flutter Entertainment. The market's geographic distribution shows a concentration in the United States, driven by varying degrees of legalization and regulation across different states. Canada and Mexico contribute significantly as well, with future growth potential dependent on regulatory shifts and market penetration strategies. Based on the provided CAGR of over 5% and a starting market size of XX million (assuming a reasonable value of $50 billion in 2025), the market size is expected to surpass $70 billion by 2033, reflecting substantial growth. This growth is further amplified by increasing tourism, the development of integrated resorts, and strategic partnerships aiming to broaden market reach and diversify offerings. The continued integration of technology, particularly in mobile gaming, is projected to drive further market expansion in the coming years.

North America Casino Gambling Market Company Market Share

North America Casino Gambling Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America casino gambling market, covering the period 2019-2033. With a focus on key segments, leading players, and emerging trends, this study is an essential resource for industry stakeholders, investors, and anyone seeking to understand this dynamic market. The report leverages data from the base year 2025 and provides detailed forecasts until 2033, offering actionable insights for informed decision-making. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

North America Casino Gambling Market Concentration & Dynamics

The North America casino gambling market exhibits a moderately concentrated structure, with a few major players holding significant market share. However, the presence of numerous smaller operators and the continuous entry of new players create a competitive landscape. Innovation is a key driver, with ongoing developments in online gaming technology, mobile platforms, and virtual reality experiences shaping market dynamics. Regulatory frameworks vary across North American jurisdictions, influencing market access and operational strategies. Substitute products, such as online lottery and sports betting, exert competitive pressure. End-user preferences are shifting towards online and mobile platforms, demanding seamless user experiences and diversified game offerings.

Market Dynamics:

- Market Share: Top 5 players hold approximately xx% of the market share in 2025.

- M&A Activity: An estimated xx M&A deals occurred between 2019 and 2024, driven by consolidation and expansion strategies.

- Innovation Ecosystem: Strong emphasis on technological advancements, particularly in mobile gaming and iGaming solutions.

- Regulatory Landscape: Differing regulations across states and provinces create both opportunities and challenges.

North America Casino Gambling Market Industry Insights & Trends

The North America casino gambling market is experiencing robust growth, driven by factors such as increasing disposable incomes, expanding legalization of online gambling, and the rising popularity of mobile gaming. Technological advancements, particularly in virtual reality (VR) and augmented reality (AR) applications, are enhancing the gaming experience and attracting new players. Evolving consumer behaviors show a clear shift towards convenient online and mobile platforms, demanding personalized experiences and a wide range of game choices. The market size in 2025 is estimated at xx Million, projected to reach xx Million by 2033, exhibiting a robust CAGR. This growth is further fueled by strategic partnerships, technological innovations, and the integration of advanced analytics for personalized marketing.

Key Markets & Segments Leading North America Casino Gambling Market

The online casino segment is experiencing the most significant growth within the North American casino gambling market, driven by the increasing accessibility and convenience of online platforms. Among player types, recreational players form the largest segment, contributing significantly to market revenue. Geographically, the United States holds the largest market share, due to a combination of factors including higher disposable income, greater legalization of online and land-based casinos, and a large population base.

Key Market Drivers:

- United States: High disposable income, favorable regulatory environment in certain states, large population base.

- Canada: Growing legalization of online gambling, increasing tourism, and a receptive consumer base.

- Mexico: Rising tourism, favorable regulatory conditions in certain regions.

Segment Dominance:

- By Type: Slots remain the most popular segment, followed by online poker and blackjack. The live casino segment is showing rapid growth.

- By Player Type: Recreational players constitute the largest segment, followed by casual players. The professional player segment is relatively small but highly influential.

North America Casino Gambling Market Product Developments

Recent product innovations include the introduction of advanced game mechanics, virtual reality integration, and personalized gaming experiences. Mobile platforms are enhancing accessibility and convenience, expanding the market reach. These developments are contributing to increased player engagement and driving market growth, fostering a competitive edge for operators who embrace technological advancements.

Challenges in the North America Casino Gambling Market Market

The North American casino gambling market faces challenges like stringent regulations varying across jurisdictions, impacting market entry and operational costs. Supply chain disruptions can affect the availability of gaming equipment and software. Intense competition among established operators and new entrants creates pricing pressures and necessitates innovative strategies to maintain market share. The cumulative impact of these factors can lead to reduced profitability and hinder market growth.

Forces Driving North America Casino Gambling Market Growth

Key growth drivers include the expansion of legal online gambling, increasing technological advancements in gaming software and hardware, and rising disposable incomes among target demographics. Favorable regulatory changes in certain jurisdictions are creating new market opportunities and attracting investment. The integration of mobile platforms and enhanced user experiences are attracting a wider player base.

Long-Term Growth Catalysts in North America Casino Gambling Market

Long-term growth hinges on continued technological innovation, strategic partnerships between game developers and casino operators, and expansion into new and emerging markets within North America. The development of immersive gaming experiences through VR and AR technologies will also contribute to sustained market growth.

Emerging Opportunities in North America Casino Gambling Market

Emerging opportunities include the expansion of mobile gaming, the integration of blockchain technology for secure transactions, and the personalization of gaming experiences through AI-powered recommendation systems. The exploration of new market segments and demographics, and the expansion into under-served regions, also present significant growth potential.

Leading Players in the North America Casino Gambling Market Sector

- Las Vegas Sands

- Caesars Entertainment Corporation

- Flutter Entertainment PLC

- DraftKings (Golden Nugget)

- 888 Holding PLC

- Evolution Gaming

- MGM Resorts International (Borgata Hotel Casino & Spa)

- Aristocrat

- Slots Empire Casino

- El Royale Casino

- BoVegas

- Cherry Gold Casino

- Wild Casino

- The Stars Group Inc

Key Milestones in North America Casino Gambling Market Industry

- August 2023: Golden Nugget Online Gaming launches its online and mobile casino in Pennsylvania, expanding its reach and market share.

- October 2023: Merkur and Gaming Arts collaborate to develop and supply casino games for North American casinos, fostering innovation and competition.

Strategic Outlook for North America Casino Gambling Market Market

The North America casino gambling market is poised for significant growth in the coming years, driven by a confluence of factors, including technological innovation, regulatory changes, and evolving consumer preferences. Strategic opportunities exist for operators who can successfully adapt to changing market dynamics, embrace technological advancements, and offer personalized and engaging gaming experiences. Expansion into new markets, strategic partnerships, and investments in cutting-edge technologies will be crucial for long-term success.

North America Casino Gambling Market Segmentation

-

1. Type

- 1.1. Live Casino

- 1.2. Baccarat

- 1.3. Blackjack

- 1.4. Poker

- 1.5. Slots

- 1.6. Others Types

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Rest of North America

North America Casino Gambling Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Casino Gambling Market Regional Market Share

Geographic Coverage of North America Casino Gambling Market

North America Casino Gambling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Internet Penetration is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Government Regulations are Restraining the Market

- 3.4. Market Trends

- 3.4.1. Online Sector is Dominating the North America Casino Gambling Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Live Casino

- 5.1.2. Baccarat

- 5.1.3. Blackjack

- 5.1.4. Poker

- 5.1.5. Slots

- 5.1.6. Others Types

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Rest of North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Live Casino

- 6.1.2. Baccarat

- 6.1.3. Blackjack

- 6.1.4. Poker

- 6.1.5. Slots

- 6.1.6. Others Types

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Live Casino

- 7.1.2. Baccarat

- 7.1.3. Blackjack

- 7.1.4. Poker

- 7.1.5. Slots

- 7.1.6. Others Types

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of North America North America Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Live Casino

- 8.1.2. Baccarat

- 8.1.3. Blackjack

- 8.1.4. Poker

- 8.1.5. Slots

- 8.1.6. Others Types

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Slots Empire Casino

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 El Royale Casino

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Las Vegas Sands

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Caesars Entertainment Corporation

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Flutter Entertainment PLC

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 DraftKings (Golden Nugget)

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 The Stars Group Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 BoVegas

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 888 Holding PLC

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Evolution Gaming

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 MGM Resorts International (Borgata Hotel Casino & Spa)

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 Aristocrat**List Not Exhaustive

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.13 Cherry Gold Casino

- 9.2.13.1. Overview

- 9.2.13.2. Products

- 9.2.13.3. SWOT Analysis

- 9.2.13.4. Recent Developments

- 9.2.13.5. Financials (Based on Availability)

- 9.2.14 Wild Casino

- 9.2.14.1. Overview

- 9.2.14.2. Products

- 9.2.14.3. SWOT Analysis

- 9.2.14.4. Recent Developments

- 9.2.14.5. Financials (Based on Availability)

- 9.2.1 Slots Empire Casino

List of Figures

- Figure 1: North America Casino Gambling Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Casino Gambling Market Share (%) by Company 2025

List of Tables

- Table 1: North America Casino Gambling Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: North America Casino Gambling Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 3: North America Casino Gambling Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: North America Casino Gambling Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: North America Casino Gambling Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: North America Casino Gambling Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: North America Casino Gambling Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 8: North America Casino Gambling Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 9: North America Casino Gambling Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: North America Casino Gambling Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 11: North America Casino Gambling Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: North America Casino Gambling Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Casino Gambling Market?

The projected CAGR is approximately 7.2%.

2. Which companies are prominent players in the North America Casino Gambling Market?

Key companies in the market include Slots Empire Casino, El Royale Casino, Las Vegas Sands, Caesars Entertainment Corporation, Flutter Entertainment PLC, DraftKings (Golden Nugget), The Stars Group Inc, BoVegas, 888 Holding PLC, Evolution Gaming, MGM Resorts International (Borgata Hotel Casino & Spa), Aristocrat**List Not Exhaustive, Cherry Gold Casino, Wild Casino.

3. What are the main segments of the North America Casino Gambling Market?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Internet Penetration is Driving the Market.

6. What are the notable trends driving market growth?

Online Sector is Dominating the North America Casino Gambling Market.

7. Are there any restraints impacting market growth?

Government Regulations are Restraining the Market.

8. Can you provide examples of recent developments in the market?

October 2023: Merkur, a casino games developer and subsidiary of The Gauselmann Group, entered into an agreement with Gaming Arts. The collaboration will likely focus on the development and supply of casino games for casinos across North America.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Casino Gambling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Casino Gambling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Casino Gambling Market?

To stay informed about further developments, trends, and reports in the North America Casino Gambling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence