Key Insights

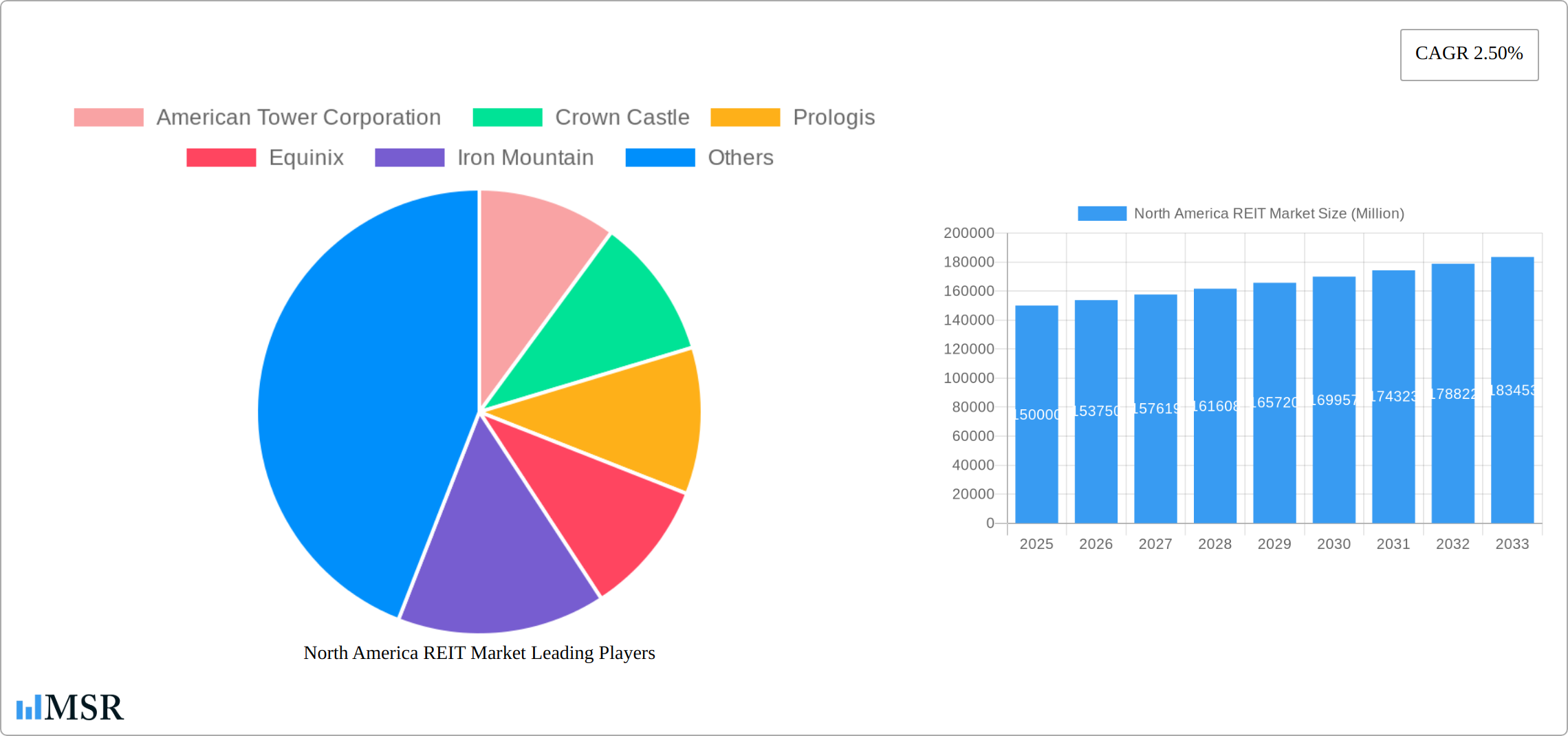

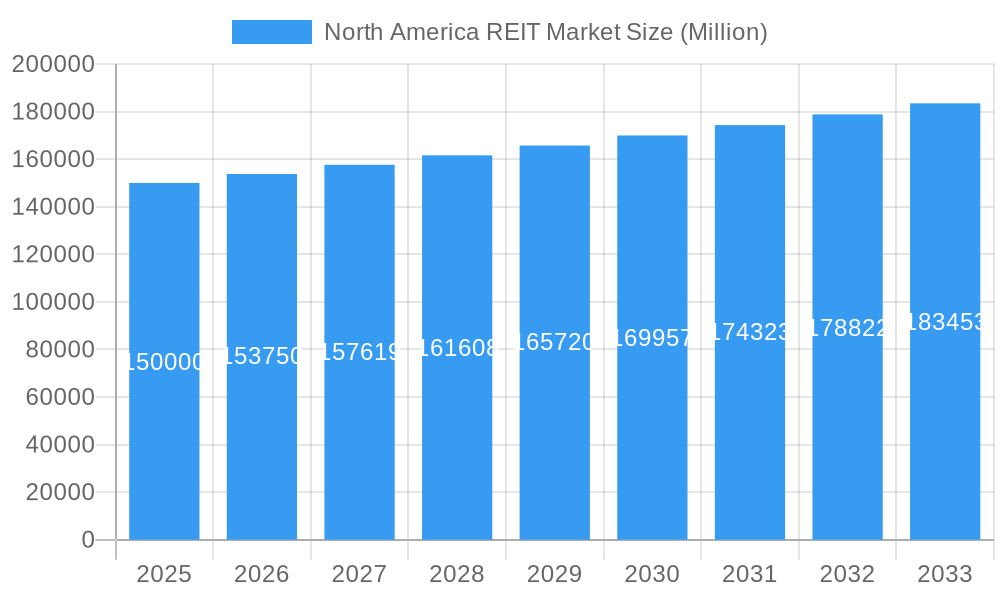

The North American Real Estate Investment Trust (REIT) market, encompassing the United States, Canada, and Mexico, presents a robust investment landscape with significant growth potential. Driven by factors such as increasing urbanization, a growing population, strong demand for commercial and residential properties, and favorable government policies supporting real estate development, the market exhibits a steady Compound Annual Growth Rate (CAGR) of 2.50%. The segmentation reveals a diverse market, with Equity REITs, Mortgage REITs, and Hybrid REITs catering to different investor profiles. Within property sectors, the industrial and residential segments are expected to lead growth, fueled by the e-commerce boom and an expanding population requiring housing. Office REITs may experience moderate growth, impacted by evolving work patterns and remote work trends. Retail REITs face challenges related to e-commerce competition, however, strategic adaptation and the rise of experience-based retail may mitigate some of these headwinds. Leading players such as American Tower Corporation, Crown Castle, Prologis, Equinix, Iron Mountain, and Public Storage dominate the market, leveraging their extensive portfolios and strong brand recognition.

North America REIT Market Market Size (In Billion)

Looking ahead to 2033, the North American REIT market is poised for sustained expansion, although the rate of growth might fluctuate year-on-year reflecting broader economic conditions and sector-specific performance. The ongoing need for modern infrastructure, coupled with continued investment in logistics and data centers, will likely stimulate growth in the industrial and technology-related REIT segments. The residential sector's performance will be closely tied to population growth, mortgage interest rates, and overall economic stability. Careful analysis of regional variations within North America is crucial, considering differing market dynamics across the United States, Canada, and Mexico. This includes factors such as regulatory environments, economic development, and population density which will influence the performance of REITs within specific geographic areas. Overall, the North American REIT market remains a dynamic and attractive investment opportunity, offering diversified growth prospects across various sectors and geographical regions.

North America REIT Market Company Market Share

North America REIT Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the North America REIT market, encompassing historical data (2019-2024), current estimations (2025), and future projections (2025-2033). It offers invaluable insights for investors, industry stakeholders, and strategic decision-makers seeking to navigate the dynamic landscape of the real estate investment trust sector. The report covers key segments, leading players like American Tower Corporation, Crown Castle, Prologis, Equinix, Iron Mountain, and Public Storage, and examines the forces shaping the market's growth trajectory.

North America REIT Market Concentration & Dynamics

The North America REIT market exhibits a moderately concentrated structure, with a handful of dominant players commanding significant market share. The market share of the top 5 players in 2025 is estimated at 60%, reflecting consolidation through mergers and acquisitions (M&A) activity. The historical period (2019-2024) witnessed approximately xx M&A deals annually, with a noticeable increase in the latter half driven by favorable economic conditions and investor confidence. Innovation within the REIT sector is primarily focused on technology adoption, data analytics, and sustainable building practices. Regulatory frameworks, including tax regulations and environmental policies, significantly influence investment decisions. Substitute products, such as private real estate investments, compete for investor capital. End-user trends, such as the growing demand for flexible workspaces and e-commerce logistics, are reshaping the market's demand dynamics.

- Market Concentration: Top 5 players hold ~60% market share (2025 estimate)

- M&A Activity: xx deals annually (2019-2024), increasing in recent years.

- Innovation: Focus on technology, data analytics, and sustainable practices.

- Regulatory Influence: Tax codes and environmental regulations impact investment.

North America REIT Market Industry Insights & Trends

The North America REIT market is experiencing robust growth, driven by several factors. The market size reached xx Million in 2025 and is projected to grow at a CAGR of xx% from 2025 to 2033, reaching xx Million. Strong economic growth in key markets, particularly the United States, is a primary catalyst. Technological advancements, such as the adoption of PropTech solutions and data-driven asset management, are enhancing operational efficiency and attracting investors. Evolving consumer behaviors, including the shift towards experience-based retail and the increasing demand for flexible workspaces, are reshaping the demand landscape for various REIT property types. However, challenges such as rising interest rates and economic uncertainty could moderate growth in the coming years.

Key Markets & Segments Leading North America REIT Market

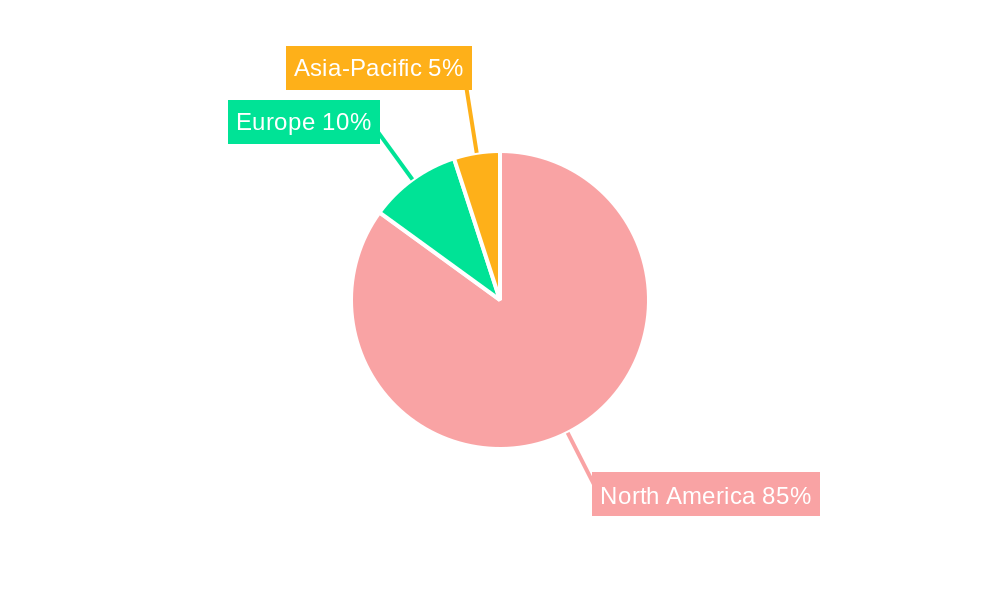

The North American REIT market, largely dominated by the United States (representing approximately 85% of the total market capitalization in 2025), is a dynamic landscape shaped by diverse investment strategies and property sectors. Within the investment holdings segment, Equity REITs constitute the most significant share, followed by Hybrid and Mortgage REITs. The Industrial property sector exhibits the most robust growth trajectory, fueled by the surge in e-commerce and ongoing supply chain restructuring. This rapid expansion is further amplified by the increasing demand for logistics and distribution facilities to support the ever-growing online retail market.

- Dominant Region: United States (85% market share in 2025)

- Dominant Segment (Investment Holdings): Equity REITs, characterized by their focus on owning and operating income-producing real estate.

- Fastest-Growing Segment (Property Sector): Industrial, driven by e-commerce growth, supply chain optimization, and nearshoring trends.

- Emerging Segments: Data centers, life sciences, and renewable energy are witnessing significant investment and growth, reflecting evolving market demands and investor preferences.

Key Drivers:

- United States: Strong economic fundamentals, substantial infrastructure investments, and a robust and diverse real estate market.

- Industrial: E-commerce boom, supply chain diversification, and the increasing need for efficient logistics and warehousing solutions.

- Equity REITs: Stable cash flows, attractive dividend yields, and a history of delivering consistent returns to investors. Their transparency and liquidity also contribute to their appeal.

- Technological Advancements: The integration of PropTech solutions enhances operational efficiency, improves asset management, and attracts tech-savvy investors.

North America REIT Market Product Developments

Recent innovations in the North America REIT market include the integration of smart building technologies, improved data analytics for asset management, and the development of sustainable building practices. These advancements enhance operational efficiency, reduce costs, and attract environmentally conscious investors. The increasing adoption of PropTech solutions provides competitive advantages to REITs that embrace technological innovation.

Challenges in the North America REIT Market Market

Significant challenges facing the North America REIT market include rising interest rates impacting borrowing costs, increasing construction costs, and intense competition among REITs. Regulatory changes and potential economic downturns also pose risks. These factors could collectively constrain market growth and profitability.

Forces Driving North America REIT Market Growth

Key growth drivers include sustained economic expansion, increasing demand for logistics and data center spaces, and technological advancements enhancing operational efficiency. Favorable government policies supporting real estate investment also contribute positively to market growth.

Challenges in the North America REIT Market Market

Long-term growth catalysts include continued technological innovation, strategic partnerships between REITs and technology companies, and expansion into new markets and property sectors (e.g., renewable energy infrastructure).

Emerging Opportunities in North America REIT Market

Emerging opportunities include the growing demand for sustainable and resilient infrastructure, the expansion of data centers to support the digital economy, and the development of innovative real estate solutions addressing changing consumer needs.

Leading Players in the North America REIT Market Sector

Key Milestones in North America REIT Market Industry

- 2020: Increased adoption of remote work models leads to shifts in office space demand.

- 2021: Significant increase in M&A activity within the data center sector.

- 2022: Growing interest in sustainable REIT investments from ESG-focused investors.

- 2023: Several major REITs announce investments in renewable energy infrastructure.

Strategic Outlook for North America REIT Market Market

The North America REIT market is poised for continued growth, driven by long-term trends such as urbanization, technological innovation, and the increasing demand for specialized real estate assets. Strategic opportunities exist for REITs to capitalize on these trends through strategic acquisitions, technological advancements, and expansion into new markets.

North America REIT Market Segmentation

-

1. Investment Holdings

- 1.1. Equity REITs

- 1.2. Mortagage REITs

- 1.3. Hybrid REITs

-

2. Property Sector

- 2.1. Office

- 2.2. Retail

- 2.3. Residential

- 2.4. Industrial

- 2.5. Others

North America REIT Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America REIT Market Regional Market Share

Geographic Coverage of North America REIT Market

North America REIT Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Fund Inflows is Driving the ETF Market

- 3.3. Market Restrains

- 3.3.1. Underlying Fluctuations and Risks are Restraining the Market

- 3.4. Market Trends

- 3.4.1. REITs prominence in Senior Housing & Care Market in United States

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America REIT Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Investment Holdings

- 5.1.1. Equity REITs

- 5.1.2. Mortagage REITs

- 5.1.3. Hybrid REITs

- 5.2. Market Analysis, Insights and Forecast - by Property Sector

- 5.2.1. Office

- 5.2.2. Retail

- 5.2.3. Residential

- 5.2.4. Industrial

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Investment Holdings

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 American Tower Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Crown Castle

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Prologis

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Equinix

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Iron Mountain

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Public Storage

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 American Tower Corporation

List of Figures

- Figure 1: North America REIT Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America REIT Market Share (%) by Company 2025

List of Tables

- Table 1: North America REIT Market Revenue Million Forecast, by Investment Holdings 2020 & 2033

- Table 2: North America REIT Market Revenue Million Forecast, by Property Sector 2020 & 2033

- Table 3: North America REIT Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: North America REIT Market Revenue Million Forecast, by Investment Holdings 2020 & 2033

- Table 5: North America REIT Market Revenue Million Forecast, by Property Sector 2020 & 2033

- Table 6: North America REIT Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States North America REIT Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada North America REIT Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America REIT Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America REIT Market?

The projected CAGR is approximately 2.50%.

2. Which companies are prominent players in the North America REIT Market?

Key companies in the market include American Tower Corporation , Crown Castle, Prologis , Equinix , Iron Mountain , Public Storage.

3. What are the main segments of the North America REIT Market?

The market segments include Investment Holdings, Property Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Fund Inflows is Driving the ETF Market.

6. What are the notable trends driving market growth?

REITs prominence in Senior Housing & Care Market in United States.

7. Are there any restraints impacting market growth?

Underlying Fluctuations and Risks are Restraining the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America REIT Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America REIT Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America REIT Market?

To stay informed about further developments, trends, and reports in the North America REIT Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence