Key Insights

The North American sports teams and clubs market is projected for significant expansion, driven by increasing sports popularity, enhanced media coverage, and rising consumer disposable incomes. Strategic investments in infrastructure, player development, and fan engagement, alongside the growing influence of social media, are key growth catalysts. While economic fluctuations and competitive pressures present challenges, the enduring passion for sports ensures a positive growth trajectory.

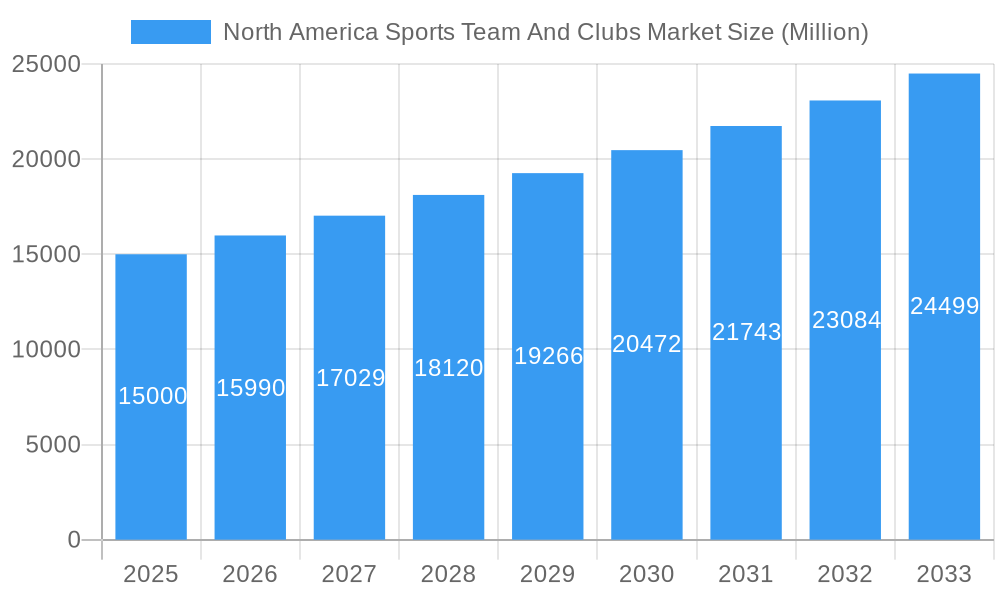

North America Sports Team And Clubs Market Market Size (In Billion)

Market segmentation includes diverse sports such as soccer, motorsports, baseball, and hockey, with significant concentration in major metropolitan areas across the US and Canada. The robust presence of media giants like ESPN and Fox Sports highlights the critical role of broadcasting rights and media partnerships. The forecast period anticipates sustained growth, with potential variations influenced by macroeconomic factors and league performance. Innovation in fan experience, strategic alliances, and audience retention will be crucial for future market success.

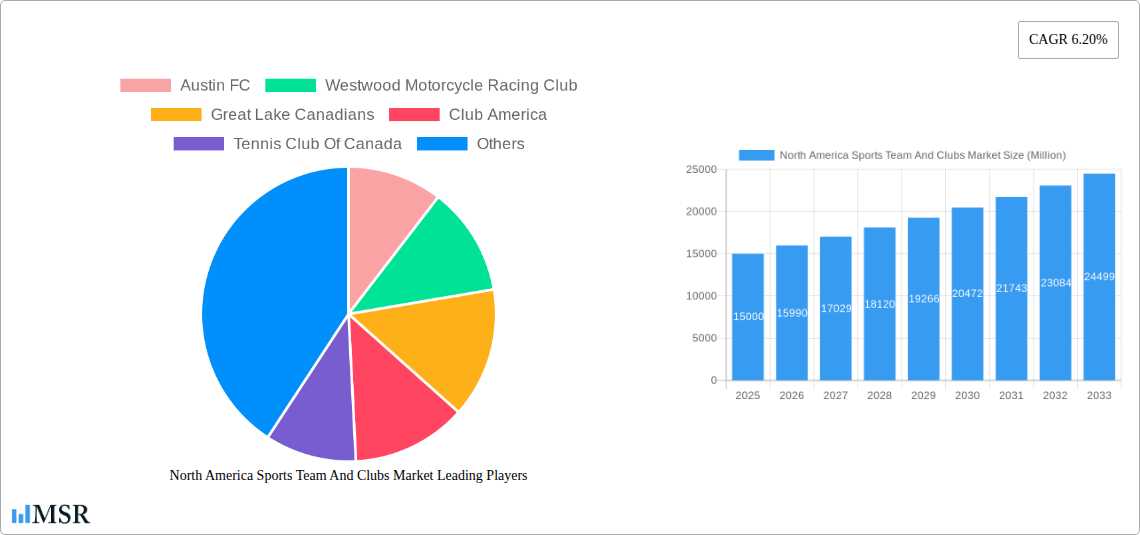

North America Sports Team And Clubs Market Company Market Share

North America Sports Team & Clubs Market Analysis: 2025-2033

This comprehensive report offers in-depth analysis of the North America Sports Team & Clubs Market, providing critical insights for investors and stakeholders. Spanning the forecast period of 2025-2033, with a base year of 2025, the report details market dynamics, growth drivers, challenges, and opportunities. Key players, including Austin FC, Westwood Motorcycle Racing Club, and Toronto FC, are examined, alongside major entities like ESPN and Coca-Cola, to provide actionable market intelligence. The market is estimated at 48.9 billion in 2025 and is expected to grow at a CAGR of 8.6% through 2033.

North America Sports Team And Clubs Market Market Concentration & Dynamics

The North America Sports Team & Clubs Market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. However, a thriving ecosystem of smaller clubs and teams contributes to market vibrancy. Innovation is driven by technological advancements in fan engagement (e.g., virtual reality experiences, data analytics for player performance), while regulatory frameworks surrounding athlete contracts, broadcasting rights, and stadium construction influence market dynamics. Substitute products, like esports and alternative entertainment options, pose a competitive challenge, necessitating continuous innovation within traditional sports. End-user trends, including the increasing demand for personalized experiences and immersive fan engagement, are shaping market growth. Mergers and acquisitions (M&A) activity, although not at exceptionally high volumes (xx deals in the past 5 years), is reshaping the competitive landscape, with strategic acquisitions aiming to expand reach and diversify offerings.

- Market Share: Top 5 players hold approximately xx% of the market.

- M&A Activity: An average of xx M&A deals per year between 2019 and 2024.

- Innovation Focus: Data analytics, fan engagement technologies, and improved player training methods.

- Regulatory Landscape: Focus on fair play, athlete welfare, and broadcasting rights.

North America Sports Team And Clubs Market Industry Insights & Trends

The North America Sports Team & Clubs Market is experiencing robust growth, driven primarily by increasing disposable incomes, rising popularity of sports, and significant investments in sports infrastructure. The market size was valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%. Technological disruptions, such as the rise of streaming services and fantasy sports platforms, are transforming fan engagement, creating new revenue streams and altering traditional business models. Evolving consumer behaviors, such as a preference for personalized experiences and digital interactions, are significantly influencing marketing strategies and fan loyalty programs. This growth is further fueled by increased media coverage, robust sponsorships, and growing investment in youth sports development. The market has also witnessed a surge in popularity of niche sports and leagues, leading to market diversification.

Key Markets & Segments Leading North America Sports Team And Clubs Market

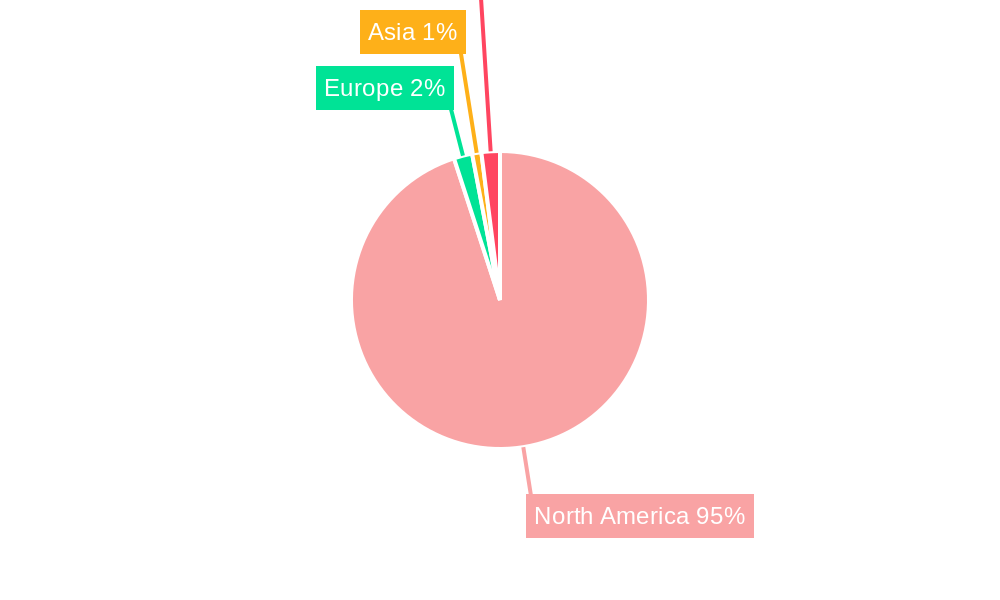

The United States dominates the North America Sports Team & Clubs Market, followed by Canada and Mexico. This dominance is attributable to several key factors:

- Drivers in the US:

- Large and affluent population base with high disposable incomes.

- Extensive sports infrastructure, including stadiums, arenas, and training facilities.

- Strong media landscape and extensive broadcasting rights.

- High level of corporate sponsorship and investment in professional sports.

- Drivers in Canada:

- Growing participation in various sports, particularly hockey and ice sports.

- Increasing government support for sports development and infrastructure.

- Robust fan base and increasing media attention.

- Dominance Analysis: The US market’s sheer size and mature sports industry infrastructure contribute to its leading position. Canada's strong sporting culture and government initiatives further contribute to the regional dominance.

North America Sports Team And Clubs Market Product Developments

Recent product innovations focus on enhancing fan experience, including mobile applications for ticketing and live updates, virtual reality and augmented reality applications for immersive game viewing, and the use of data analytics to improve player performance and team strategies. These advancements are creating competitive edges by fostering deeper fan engagement and offering new value propositions. Further developments include new sponsorship and merchandising opportunities.

Challenges in the North America Sports Team And Clubs Market Market

Key challenges include increasing operating costs, stringent regulatory compliance requirements, and the growing threat of substitute products. Supply chain disruptions related to equipment sourcing and stadium construction contribute to cost volatility. Intense competition among teams and leagues necessitates constant innovation and strategic investment. The economic impact of these challenges may be estimated at xx Million annually.

Forces Driving North America Sports Team And Clubs Market Growth

Several factors fuel market growth: rising disposable incomes supporting increased ticket sales and merchandise purchases; technological advancements improving fan experience and operational efficiency; and favorable government policies promoting sports development and infrastructure. The continued growth of media rights and sponsorships also contributes significantly.

Challenges in the North America Sports Team And Clubs Market Market

Long-term growth will depend on adapting to shifting consumer preferences, investing in technological advancements, and fostering strong strategic partnerships. Expanding into new markets and diversifying revenue streams are critical for sustainable growth in the long-term.

Emerging Opportunities in North America Sports Team And Clubs Market

Emerging opportunities lie in leveraging digital technologies for enhanced fan engagement, exploring new revenue streams through esports and fantasy sports, and expanding into international markets. The growing popularity of niche sports and the development of sustainable and inclusive practices present further avenues for growth.

Leading Players in the North America Sports Team And Clubs Market Sector

- Austin FC

- Westwood Motorcycle Racing Club

- Great Lake Canadians

- Club America

- Tennis Club Of Canada

- ESPN

- Fox Sports

- Coca Cola

- Dallas Cowboys

- Toronto FC

Key Milestones in North America Sports Team And Clubs Market Industry

- July 2023: U.S. Soccer and Coca-Cola North America's long-term partnership significantly boosts the U.S. soccer ecosystem's reach and marketing potential.

- June 2023: The merger of the PGA Tour and LIV Golf reshapes the golf landscape, potentially influencing sponsorship and media rights deals across other sports.

Strategic Outlook for North America Sports Team And Clubs Market Market

The North America Sports Team & Clubs Market possesses significant growth potential driven by consistent investment in infrastructure, technological innovation for enhanced fan engagement, and the expansion into new and diverse sports. Strategic partnerships, diversified revenue models, and a focus on sustainable practices will be key to unlocking this potential and ensuring long-term market leadership.

North America Sports Team And Clubs Market Segmentation

-

1. Type

- 1.1. Football

- 1.2. Basketball

- 1.3. Baseball

- 1.4. Hockey

- 1.5. Other Types

-

2. Revenue Source

- 2.1. Media Rights

- 2.2. Merchandising

- 2.3. Tickets

- 2.4. Sponsorship

North America Sports Team And Clubs Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Sports Team And Clubs Market Regional Market Share

Geographic Coverage of North America Sports Team And Clubs Market

North America Sports Team And Clubs Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. OTT and online streaming platforms driving the market; Rising Leisure time driving the sports entertainment market

- 3.3. Market Restrains

- 3.3.1. OTT and online streaming platforms driving the market; Rising Leisure time driving the sports entertainment market

- 3.4. Market Trends

- 3.4.1. Rising Digital Platforms Driving The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Sports Team And Clubs Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Football

- 5.1.2. Basketball

- 5.1.3. Baseball

- 5.1.4. Hockey

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Revenue Source

- 5.2.1. Media Rights

- 5.2.2. Merchandising

- 5.2.3. Tickets

- 5.2.4. Sponsorship

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Austin FC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Westwood Motorcycle Racing Club

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Great Lake Canadians

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Club America

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tennis Club Of Canada

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ESPN

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Fox Sports

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Coca Cola

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dallas Cowboys

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Toronto FC**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Austin FC

List of Figures

- Figure 1: North America Sports Team And Clubs Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Sports Team And Clubs Market Share (%) by Company 2025

List of Tables

- Table 1: North America Sports Team And Clubs Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Sports Team And Clubs Market Revenue billion Forecast, by Revenue Source 2020 & 2033

- Table 3: North America Sports Team And Clubs Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: North America Sports Team And Clubs Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: North America Sports Team And Clubs Market Revenue billion Forecast, by Revenue Source 2020 & 2033

- Table 6: North America Sports Team And Clubs Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States North America Sports Team And Clubs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Sports Team And Clubs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Sports Team And Clubs Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Sports Team And Clubs Market?

The projected CAGR is approximately 8.6%.

2. Which companies are prominent players in the North America Sports Team And Clubs Market?

Key companies in the market include Austin FC, Westwood Motorcycle Racing Club, Great Lake Canadians, Club America, Tennis Club Of Canada, ESPN, Fox Sports, Coca Cola, Dallas Cowboys, Toronto FC**List Not Exhaustive.

3. What are the main segments of the North America Sports Team And Clubs Market?

The market segments include Type, Revenue Source.

4. Can you provide details about the market size?

The market size is estimated to be USD 48.9 billion as of 2022.

5. What are some drivers contributing to market growth?

OTT and online streaming platforms driving the market; Rising Leisure time driving the sports entertainment market.

6. What are the notable trends driving market growth?

Rising Digital Platforms Driving The Market.

7. Are there any restraints impacting market growth?

OTT and online streaming platforms driving the market; Rising Leisure time driving the sports entertainment market.

8. Can you provide examples of recent developments in the market?

July 2023: U.S. Soccer and Coca-Cola North America entered into a long-term partnership, supporting the growth of the U.S. soccer ecosystem and leveraging Coca-Cola's iconic global reach to connect with fans around the world. The Coca-Cola Company exists as a beverage company with products sold in more than 200 countries and territories, and the U.S. Soccer Federation has been the official governing body of the sport in the United States for more than 100 years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Sports Team And Clubs Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Sports Team And Clubs Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Sports Team And Clubs Market?

To stay informed about further developments, trends, and reports in the North America Sports Team And Clubs Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence