Key Insights

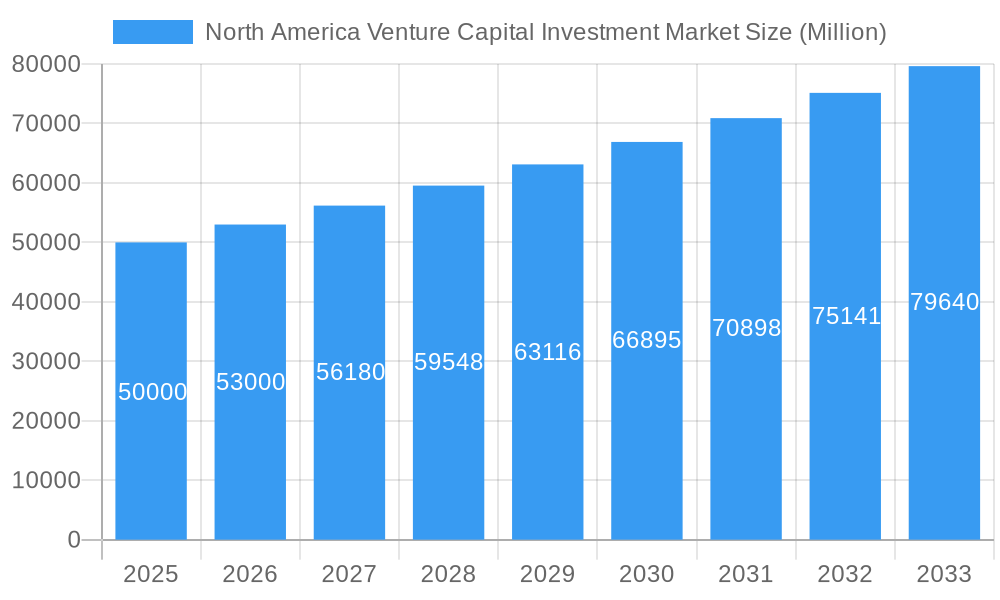

The North American venture capital (VC) investment market is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 6.00% from 2025 to 2033. Driven by a thriving entrepreneurial ecosystem, particularly in the technology sector, and abundant capital available from both established firms like Sequoia Capital and Greylock Partners and newer entrants, this market demonstrates significant potential. Key sectors attracting substantial VC funding include Fintech, Pharma and Biotech, and IT Hardware and Services, reflecting broader technological advancements and investor interest in high-growth potential industries. The US remains the dominant player, accounting for a significant majority of the market share within North America, with Canada and Mexico contributing steadily. Investment is distributed across various stages, from angel/seed funding nurturing early-stage startups to later-stage investments fueling expansion and scaling operations. While economic fluctuations and regulatory changes present potential restraints, the overall outlook remains positive, driven by ongoing technological innovation and a continuous flow of promising ventures seeking funding.

North America Venture Capital Investment Market Market Size (In Billion)

The market segmentation highlights the strategic focus of investors. Fintech's rapid innovation and potential for disruption attract substantial capital, while the Pharma and Biotech sectors' promise of groundbreaking treatments and advancements justifies significant investment. The distribution of investments across investment stages suggests a healthy and balanced market, catering to companies at all maturity levels. The geographical distribution underlines the importance of the US market, but growth in Canada and Mexico suggests an expanding opportunity across the region. The presence of prominent VC firms such as Sequoia Capital, Accel, and Tiger Global Management reflects the intense competition and significant interest in this lucrative market. Ongoing technological disruptions, such as the rise of Artificial Intelligence and its integration into various sectors, will likely continue to fuel further growth in the coming years. While challenges exist, the North American VC market is well-positioned for sustained expansion, offering significant returns for investors and fostering innovation across key industries.

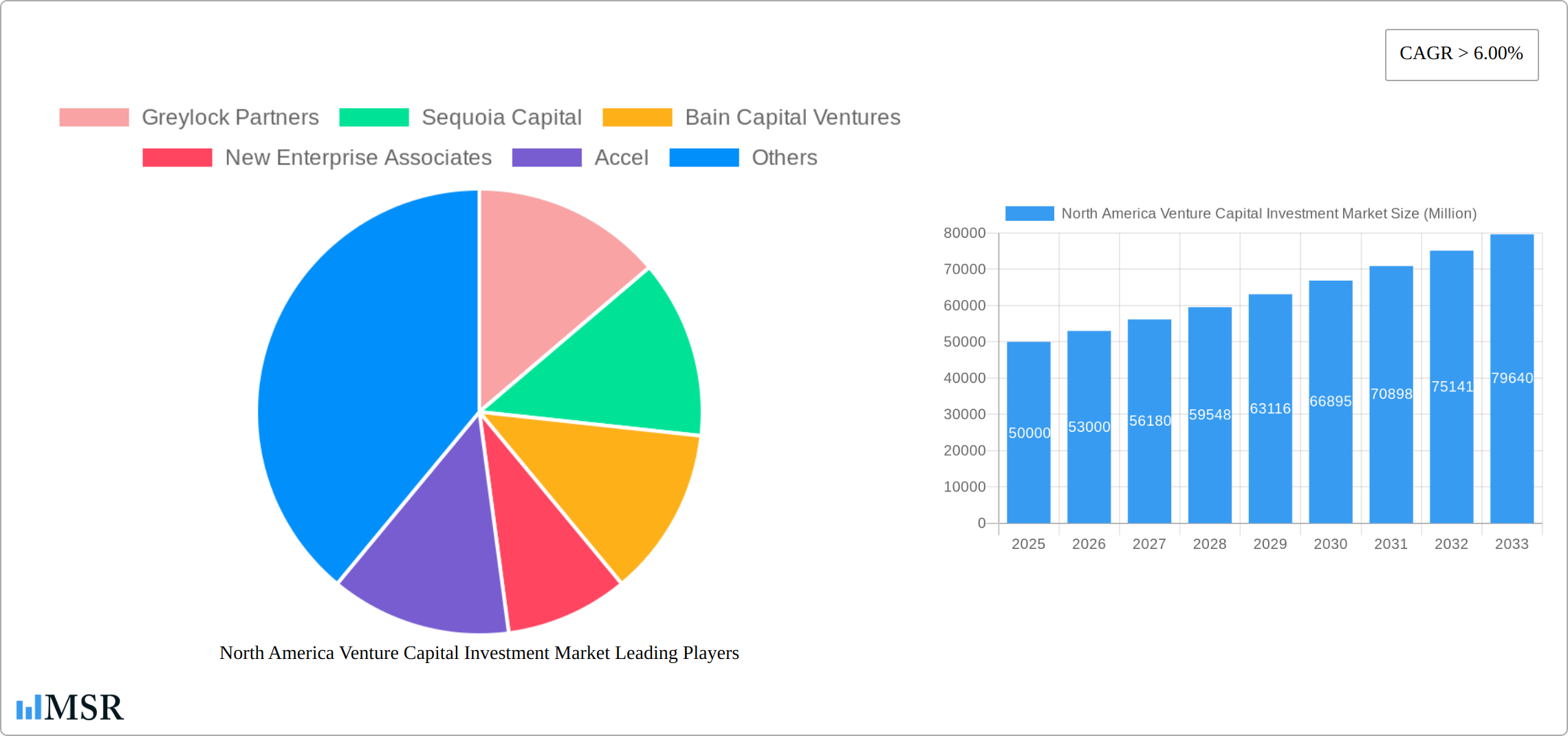

North America Venture Capital Investment Market Company Market Share

North America Venture Capital Investment Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America Venture Capital Investment Market, covering the period 2019-2033. With a focus on key segments, leading players, and emerging trends, this report offers invaluable insights for investors, entrepreneurs, and industry stakeholders seeking to navigate this dynamic landscape. The report utilizes a robust methodology, incorporating historical data (2019-2024), a base year of 2025, and forecasts extending to 2033. The market size is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

North America Venture Capital Investment Market Concentration & Dynamics

The North American venture capital market is characterized by a moderately concentrated landscape, with a few dominant players commanding significant market share. While precise market share figures for individual firms vary and are constantly evolving, leading firms like Sequoia Capital, Accel, and Andreessen Horowitz consistently secure prominent positions. The market is fiercely competitive, fueled by substantial capital inflows and a robust pipeline of innovative startups. The report details the market concentration through detailed analysis of top players and their strategic activities.

Market Dynamics:

- Innovation Ecosystems: Strong university-industry collaborations and a vibrant startup culture across major North American cities (Silicon Valley, Boston, New York, etc.) are driving innovation.

- Regulatory Frameworks: Regulations surrounding investment, data privacy, and intellectual property influence investor decisions and market growth. The report analyzes the impact of key regulatory changes.

- Substitute Products/Services: While direct substitutes are limited, alternative financing options like private equity and angel networks compete for investment dollars.

- End-User Trends: Growing demand for technology-driven solutions across diverse industries fuels venture capital investment. Specific industry trends are analyzed in detail within the report.

- M&A Activities: The report includes a comprehensive analysis of M&A activities, including deal counts and values, highlighting strategic shifts and consolidation within the market. The number of M&A deals in 2024 was estimated at xx, representing a xx% change from 2023.

North America Venture Capital Investment Market Industry Insights & Trends

The North American venture capital market is experiencing robust growth, driven by several key factors. Technological advancements, particularly in areas like Artificial Intelligence, Fintech, and Biotech, continue to attract significant investment. Furthermore, evolving consumer behaviors, such as increased adoption of digital services and a preference for sustainable products, are shaping investment strategies. The market exhibits significant heterogeneity across different investment stages and industries. Early-stage investments represent a substantial portion of the total investment, reflecting the abundance of innovative startups. Later-stage investments focus on high-growth, high-potential companies seeking expansion capital.

The report delves into specific market segments (Fintech, Pharma & Biotech, Consumer Goods, etc.) providing segment-specific CAGR projections and market size estimates for each. The analysis identifies key growth drivers including:

- Increased technological disruption: Leading to the emergence of new technologies and business models.

- Shifting consumer preferences towards digitalization and sustainability: Driving investment in relevant sectors.

- Government support and initiatives fostering innovation: Providing grants and incentives for startups.

- Abundant capital availability from institutional investors: Fueling a highly competitive investment landscape.

Key Markets & Segments Leading North America Venture Capital Investment Market

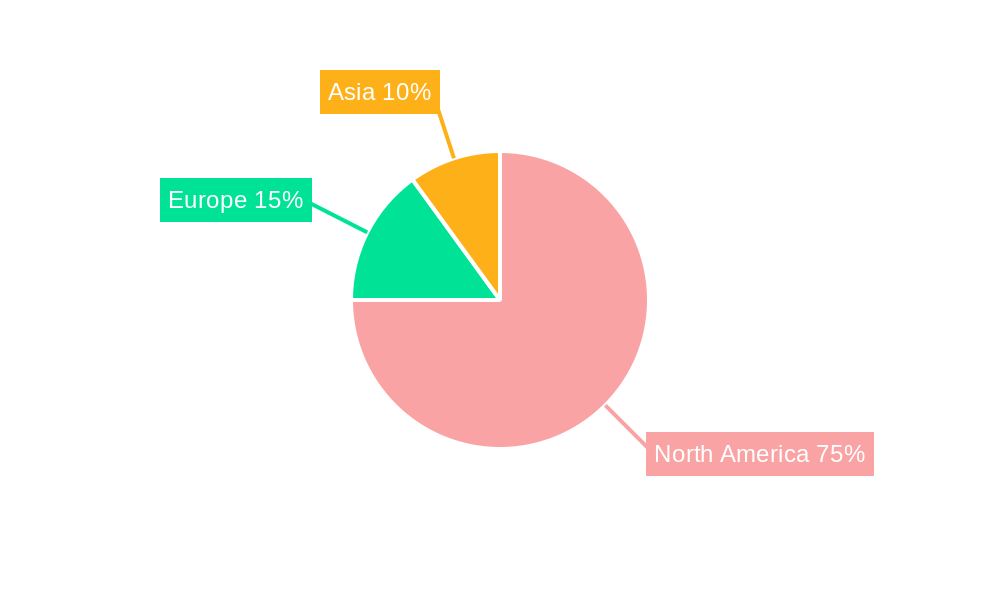

The USA remains the dominant market for venture capital investment in North America, owing to its established ecosystem, access to capital, and concentration of skilled talent. However, Canada and Mexico are experiencing growing investment activity, fueled by government initiatives and rising entrepreneurial activity.

By Stage of Investment:

- Early-stage investing: Continues to be a significant portion of the market, indicating a vibrant startup ecosystem.

- Later-stage investing: Attracts substantial capital, reflecting investor confidence in high-growth companies.

- Angel/Seed Investing: This segment displays strong growth potential, primarily fueled by growing interest from angel investors and crowdfunding platforms.

By Industry:

- Fintech: A leading sector attracting massive investment due to its disruptive potential and rapid growth.

- Pharma and Biotech: A consistent source of high-value investment owing to significant R&D expenditure and the potential for blockbuster drugs.

- IT Hardware and Services: This sector continues to generate investment activity fueled by increasing digitalization and cloud adoption.

- Consumer Goods: Attracts investment opportunities related to innovative products and digitally-driven consumer experiences.

Drivers:

- Economic growth: A strong economy leads to increased investor confidence and funding availability.

- Government incentives: Tax breaks and subsidies to encourage investments in specific sectors.

- Infrastructure development: Supporting the growth of high-growth industries.

North America Venture Capital Investment Market Product Developments

The North American venture capital market is a dynamic landscape of continuous innovation, driven by groundbreaking advancements across diverse sectors. Key areas fueling this innovation include: the rapid development and deployment of artificial intelligence (AI) and machine learning (ML) solutions across various industries; transformative breakthroughs in biotechnology, encompassing gene editing, personalized medicine, and novel therapeutic approaches; and the ongoing evolution of financial technology (FinTech), encompassing decentralized finance (DeFi), embedded finance, and innovative payment systems. These technological leaps provide startups with significant competitive advantages, attracting substantial investment and fostering a cycle of rapid growth and further innovation. Furthermore, the increasing focus on sustainable and environmentally conscious technologies is creating new opportunities and attracting significant capital.

Challenges in the North America Venture Capital Investment Market Market

The North American venture capital market faces challenges such as regulatory uncertainties surrounding data privacy and cybersecurity, increased competition among venture capital firms, and potential economic downturns that can impact funding availability. Supply chain disruptions can also impact startups, potentially impacting their growth and investment potential. These challenges can result in decreased investment activity and increased risk for investors.

Forces Driving North America Venture Capital Investment Market Growth

The growth of the North American venture capital market is fueled by a confluence of powerful factors. The continuous emergence of disruptive technologies, particularly AI, blockchain, and quantum computing, presents lucrative investment opportunities. The increasing involvement of institutional investors, including pension funds, sovereign wealth funds, and family offices, injects significant capital into the market. Supportive government policies, such as tax incentives for R&D and initiatives to foster entrepreneurship, create a favorable environment for innovation and growth. A robust ecosystem of experienced entrepreneurs, skilled talent pools, and specialized support services further enhances the market's attractiveness. Finally, the increasing focus on impact investing and ESG (Environmental, Social, and Governance) factors is attracting capital to companies focused on sustainable solutions and positive social impact.

Long-Term Growth Catalysts in the North America Venture Capital Investment Market

Long-term growth in this market will be driven by sustained innovation in sectors like AI, biotech, and clean energy. Strategic partnerships between corporations and startups will also accelerate growth. Expanding into new geographic markets within North America, especially in Canada and Mexico, will offer substantial opportunities.

Emerging Opportunities in North America Venture Capital Investment Market

Emerging opportunities lie in specialized sectors such as sustainable technology, space exploration, and advanced materials. The rise of Web3 and the metaverse presents new investment avenues. Furthermore, increased focus on diversity and inclusion within the venture capital ecosystem promises to unlock new opportunities and perspectives.

Leading Players in the North America Venture Capital Investment Market Sector

Key Milestones in North America Venture Capital Investment Market Industry

- June 2022: Fund Corporation for the Overseas Development of Japan's ICT and Postal Services Inc. invested in Sony Innovation Fund 3, targeting venture companies in high-growth sectors like health tech and fintech in the US, Canada, and other countries. This signifies increased global interest in North American startups.

- May 2023: AXA Venture Partners launched a EUR 1.5 Billion fund targeting late-stage tech companies in North America, indicating significant capital influx into the later-stage investment segment and a commitment to the North American market.

Strategic Outlook for North America Venture Capital Investment Market Market

The North American venture capital market is poised for continued strong growth. Strategic opportunities exist for investors to capitalize on emerging technologies, innovative business models, and expanding into underserved markets. A focus on sustainability, diversity, and technological advancements will be crucial for success in the coming years. The market's long-term potential is significant, driven by consistent innovation and a dynamic entrepreneurial environment.

North America Venture Capital Investment Market Segmentation

-

1. Stage of Investment

- 1.1. Angel/Seed Investing

- 1.2. Early-stage Investing

- 1.3. Later-stage Investing

-

2. Industry

- 2.1. Fintech

- 2.2. Pharma and Biotech

- 2.3. Consumer Goods

- 2.4. Industrial/Energy

- 2.5. IT Hardware and Services

- 2.6. Other Industries

North America Venture Capital Investment Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Venture Capital Investment Market Regional Market Share

Geographic Coverage of North America Venture Capital Investment Market

North America Venture Capital Investment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 20.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Investment in Fintech and Life Science Industry; Rising Number of Unicorns In North America

- 3.3. Market Restrains

- 3.3.1. Rising Risk in Market with Global Economic Uncertainity; Majority of Growth limited in ICT and Life Science segment

- 3.4. Market Trends

- 3.4.1. Canada Increasing Venture Capital Scenario is Fueling the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Venture Capital Investment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Stage of Investment

- 5.1.1. Angel/Seed Investing

- 5.1.2. Early-stage Investing

- 5.1.3. Later-stage Investing

- 5.2. Market Analysis, Insights and Forecast - by Industry

- 5.2.1. Fintech

- 5.2.2. Pharma and Biotech

- 5.2.3. Consumer Goods

- 5.2.4. Industrial/Energy

- 5.2.5. IT Hardware and Services

- 5.2.6. Other Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Stage of Investment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Greylock Partners

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sequoia Capital

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bain Capital Ventures

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 New Enterprise Associates

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Accel

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Khosla Ventures

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Real Ventures

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tiger Global Management

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Matrix Partners

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Index Ventures

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Greylock Partners

List of Figures

- Figure 1: North America Venture Capital Investment Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Venture Capital Investment Market Share (%) by Company 2025

List of Tables

- Table 1: North America Venture Capital Investment Market Revenue undefined Forecast, by Stage of Investment 2020 & 2033

- Table 2: North America Venture Capital Investment Market Revenue undefined Forecast, by Industry 2020 & 2033

- Table 3: North America Venture Capital Investment Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: North America Venture Capital Investment Market Revenue undefined Forecast, by Stage of Investment 2020 & 2033

- Table 5: North America Venture Capital Investment Market Revenue undefined Forecast, by Industry 2020 & 2033

- Table 6: North America Venture Capital Investment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States North America Venture Capital Investment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Venture Capital Investment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Venture Capital Investment Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Venture Capital Investment Market?

The projected CAGR is approximately 20.3%.

2. Which companies are prominent players in the North America Venture Capital Investment Market?

Key companies in the market include Greylock Partners, Sequoia Capital, Bain Capital Ventures, New Enterprise Associates, Accel, Khosla Ventures, Real Ventures, Tiger Global Management, Matrix Partners, Index Ventures.

3. What are the main segments of the North America Venture Capital Investment Market?

The market segments include Stage of Investment, Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Investment in Fintech and Life Science Industry; Rising Number of Unicorns In North America.

6. What are the notable trends driving market growth?

Canada Increasing Venture Capital Scenario is Fueling the Market.

7. Are there any restraints impacting market growth?

Rising Risk in Market with Global Economic Uncertainity; Majority of Growth limited in ICT and Life Science segment.

8. Can you provide examples of recent developments in the market?

June 2022: Fund Corporation for the Overseas Development of Japan's ICT and Postal Services Inc. announced an investment in Sony Innovation Fund 3, which was a new investment fund targeting venture companies in industry sectors with high growth potential, including ICT services such as health tech and fintech, as a limited partner. This fund was expected to support business growth and Investment in Startups in the United States, Canada, and other countries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Venture Capital Investment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Venture Capital Investment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Venture Capital Investment Market?

To stay informed about further developments, trends, and reports in the North America Venture Capital Investment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence