Key Insights

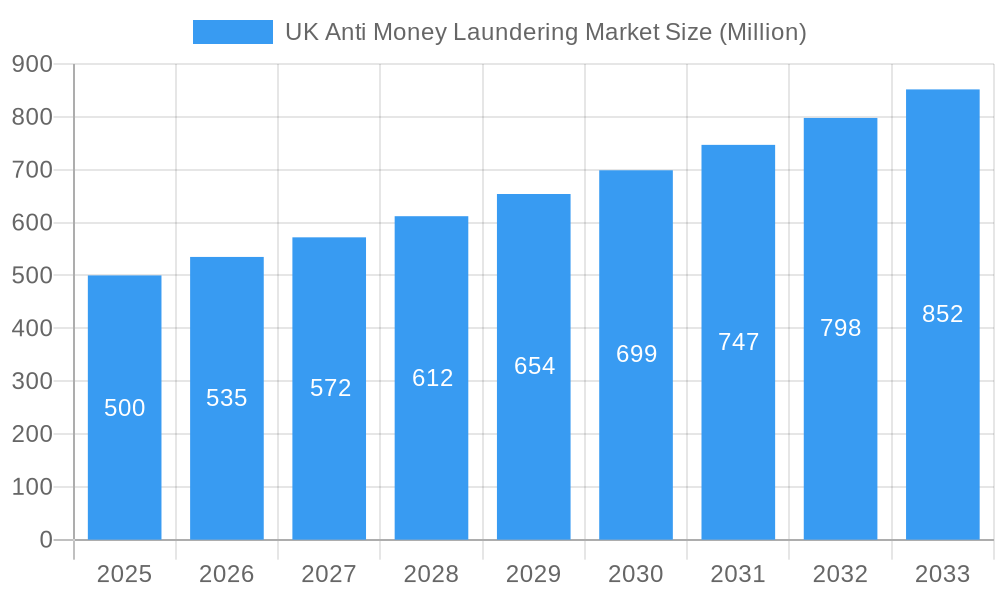

The UK Anti-Money Laundering (AML) market is poised for significant expansion, propelled by escalating financial crime sophistication and rigorous regulatory mandates. The market, projected to reach £4.13 billion by 2025, is anticipated to grow at a CAGR of 17.8% through 2033. Key growth drivers include the surge in online financial transactions, increasing AML solution adoption due to heightened regulatory enforcement and penalties, and the integration of AI and ML for enhanced detection capabilities. Growing institutional awareness of reputational and financial risks associated with AML non-compliance further fuels market growth.

UK Anti Money Laundering Market Market Size (In Billion)

The UK AML market is segmented by solution type (transaction monitoring, customer due diligence, sanctions screening), deployment mode (cloud-based, on-premise), and end-user industry (banking, insurance, etc.). While industry leaders like NICE Actimize, Trulioo, and LexisNexis Risk Solutions dominate, emerging Fintech firms are introducing specialized solutions, intensifying competition. Market challenges encompass high implementation and maintenance costs, the need for continuous system updates against evolving money laundering tactics, and a shortage of skilled AML professionals. Nevertheless, the UK AML market outlook remains robust, driven by persistent regulatory pressure and the continuous threat of financial crime.

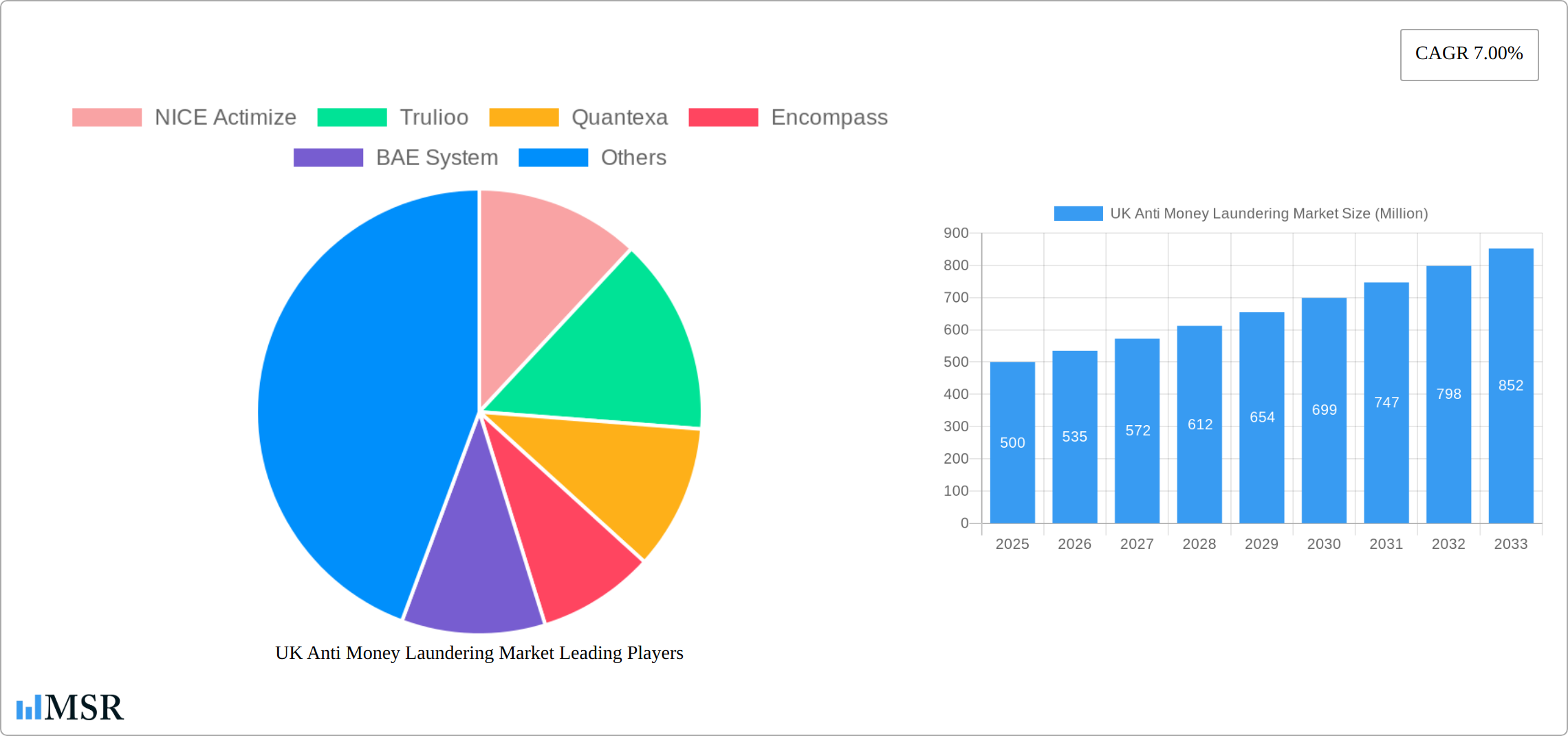

UK Anti Money Laundering Market Company Market Share

UK Anti-Money Laundering (AML) Market Report: 2019-2033

Uncover the Dynamics of the £XX Billion UK AML Market

This comprehensive report provides a detailed analysis of the UK Anti-Money Laundering market, offering invaluable insights for investors, businesses, and regulatory bodies. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market size, growth drivers, key players, and emerging trends, providing a robust foundation for strategic decision-making. The report leverages extensive data analysis from the historical period (2019-2024) to paint a clear picture of the current market landscape and project future growth. The market is estimated to be worth £XX Billion in 2025.

UK Anti Money Laundering Market Market Concentration & Dynamics

The UK AML market exhibits a moderately concentrated landscape, with several major players holding significant market share. However, the presence of numerous smaller, specialized firms fosters a dynamic and innovative ecosystem. Regulatory frameworks, including those from the Financial Conduct Authority (FCA) and the National Crime Agency (NCA), heavily influence market activity, driving adoption of sophisticated AML technologies. Substitute products, such as manual compliance processes, are gradually being replaced by automated solutions due to increased efficiency and regulatory pressures. End-user trends indicate a strong preference for integrated, scalable AML solutions that can adapt to evolving regulatory requirements. M&A activity has been relatively robust in recent years, with approximately XX deals recorded between 2019 and 2024, indicating a trend of consolidation within the sector. This consolidation further contributes to market concentration and the emergence of larger, more influential players.

- Market Share (2024): NICE Actimize (XX%), LexisNexis Risk Solutions (XX%), Quantexa (XX%), Others (XX%)

- M&A Deal Count (2019-2024): XX

UK Anti Money Laundering Market Industry Insights & Trends

The UK AML market is experiencing robust growth, driven by escalating regulatory scrutiny, increasing cross-border financial transactions, and the rise of sophisticated financial crimes. Technological disruptions, particularly the adoption of artificial intelligence (AI), machine learning (ML), and blockchain analytics, are fundamentally reshaping the AML landscape. These technologies enable faster, more accurate detection of suspicious activities and enhance overall compliance efficiency. Consumer behavior is also evolving, with a growing demand for user-friendly, intuitive AML solutions that seamlessly integrate into existing financial systems. The market size is projected to reach £XX billion by 2033, with a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033).

Key Markets & Segments Leading UK Anti Money Laundering Market

The UK's anti-money laundering (AML) market is a dynamic landscape shaped by evolving regulatory pressures and the increasing sophistication of financial crime. While the financial services sector remains a dominant force, significant growth is anticipated in several key segments.

Financial Services: This sector remains the largest segment, driven by:

- Stringent regulatory requirements from the Financial Conduct Authority (FCA) and other relevant bodies, including substantial penalties for non-compliance.

- High transaction volumes significantly increasing the risk of AML violations.

- Substantial investments in advanced AML technologies, including AI-powered solutions and RegTech platforms.

- The increasing complexity of financial products and services, demanding more robust AML controls.

Gaming and Gambling: This sector faces intensified scrutiny, necessitating robust AML measures:

- Increased regulatory focus on preventing money laundering and terrorist financing.

- Mandatory implementation of Know Your Customer (KYC) and Know Your Business (KYB) procedures.

- Growing adoption of AML technology to monitor transactions and identify suspicious activity.

Fintech and Cryptocurrency: Rapid growth in these sectors presents both opportunities and challenges:

- Increased regulatory attention and the development of specific AML guidelines for these innovative sectors.

- The need for specialized AML solutions to address the unique risks associated with digital assets and transactions.

- High potential for growth due to the expanding adoption of digital financial services.

UK Anti Money Laundering Market Product Developments

The market is witnessing significant innovation in AML technology, including the development of AI-powered solutions for transaction monitoring, enhanced KYC/KYB processes, and sophisticated sanctions screening tools. These advancements provide businesses with greater accuracy, efficiency, and scalability in their AML compliance efforts. The integration of these technologies into cloud-based platforms allows for greater flexibility and accessibility. These improvements offer a competitive edge to firms implementing these solutions, enhancing their compliance posture and reducing operational costs.

Challenges in the UK Anti Money Laundering Market Market

The UK AML market faces challenges, including the ever-evolving nature of financial crime, the complexity of regulatory requirements, and the ongoing "arms race" between criminals and AML technology providers. These factors contribute to substantial operational costs and require ongoing investments in technology and expertise to stay ahead of emerging threats. The high cost of implementing and maintaining AML systems can also present a barrier to entry for smaller firms. This creates a competitive landscape that favors larger companies with more significant resources. Further challenges include staying up-to-date with ever-changing regulations, the difficulty in integrating different AML tools, and a scarcity of skilled professionals.

Forces Driving UK Anti Money Laundering Market Growth

Despite the challenges, several factors are driving substantial growth in the UK AML market:

- Increased Regulatory Scrutiny and Penalties: Stringent enforcement and hefty fines for non-compliance incentivize organizations to invest heavily in robust AML solutions.

- Sophistication of Financial Crime: The increasingly complex nature of money laundering and terrorist financing necessitates advanced technological solutions to detect and prevent these activities.

- Technological Advancements: The adoption of artificial intelligence (AI), machine learning (ML), and blockchain analytics is revolutionizing AML capabilities.

- Rise in Cross-border Transactions: The globalization of finance increases the volume and complexity of cross-border transactions, significantly amplifying AML risks.

- Growing Awareness and Public Pressure: Increased public awareness of financial crime is driving demand for greater transparency and accountability.

Challenges in the UK Anti Money Laundering Market Market

Long-term growth is underpinned by continuous innovation in AML technology, strategic partnerships between technology providers and financial institutions, and expansion into new markets and sectors. Collaboration across the industry is crucial for sharing best practices and enhancing overall AML effectiveness.

Emerging Opportunities in UK Anti Money Laundering Market

The UK AML market presents numerous emerging opportunities for innovative solutions and service providers. Key areas of growth include:

- Specialized AML Solutions: Developing tailored AML solutions for specific sectors, such as fintech and cryptocurrency, addressing unique sector-specific risks.

- AI and Machine Learning: Leveraging AI and ML for predictive modeling, anomaly detection, and enhanced risk assessment.

- Blockchain Analytics: Utilizing blockchain technology to trace and analyze cryptocurrency transactions.

- Improved User Experience: Designing user-friendly and seamlessly integrated AML solutions to minimize disruption to business operations.

- Strategic Partnerships: Collaboration between technology providers and financial institutions to develop and deploy comprehensive AML solutions.

Leading Players in the UK Anti Money Laundering Market Sector

- NICE Actimize

- Trulioo

- Quantexa

- Encompass

- BAE Systems

- LexisNexis Risk Solutions

- PassFort

- Refinitiv

- Sanctionscanner

- FullCircle

Key Milestones in UK Anti Money Laundering Market Industry

- April 2022: NICE Actimize partners with Deutsche Telekom Global Business, expanding its reach across Europe. This significantly boosts NICE Actimize's market presence and customer base.

- January 2022: PassFort partners with Trulioo, streamlining KYC/KYB processes for regulated enterprises. This collaboration enhances the efficiency and effectiveness of AML compliance procedures for many businesses.

Strategic Outlook for UK Anti Money Laundering Market Market

The UK AML market holds significant potential for growth, driven by technological advancements, increasing regulatory stringency, and the persistent threat of financial crime. Strategic partnerships, investments in innovative technologies, and a focus on customer experience will be crucial for companies seeking to capitalize on this growth. The market's future is characterized by a dynamic interplay between technological innovation and regulatory evolution, presenting both challenges and immense opportunities for stakeholders.

UK Anti Money Laundering Market Segmentation

-

1. Solutions

- 1.1. Know Your Customer (KYC) Systems

- 1.2. Compliance Reporting

- 1.3. Transactions Monitoring

- 1.4. Auditing

-

2. Type

- 2.1. Softwares

- 2.2. Solutions

-

3. Deployment Model

- 3.1. On-Cloud

- 3.2. On-Premise

-

4. End-User

- 4.1. BFSI's

- 4.2. Government

- 4.3. IT & Telecom

- 4.4. Others

UK Anti Money Laundering Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Anti Money Laundering Market Regional Market Share

Geographic Coverage of UK Anti Money Laundering Market

UK Anti Money Laundering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. UK Ranks in Top for Global Money Laundering

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Anti Money Laundering Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Solutions

- 5.1.1. Know Your Customer (KYC) Systems

- 5.1.2. Compliance Reporting

- 5.1.3. Transactions Monitoring

- 5.1.4. Auditing

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Softwares

- 5.2.2. Solutions

- 5.3. Market Analysis, Insights and Forecast - by Deployment Model

- 5.3.1. On-Cloud

- 5.3.2. On-Premise

- 5.4. Market Analysis, Insights and Forecast - by End-User

- 5.4.1. BFSI's

- 5.4.2. Government

- 5.4.3. IT & Telecom

- 5.4.4. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Solutions

- 6. North America UK Anti Money Laundering Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Solutions

- 6.1.1. Know Your Customer (KYC) Systems

- 6.1.2. Compliance Reporting

- 6.1.3. Transactions Monitoring

- 6.1.4. Auditing

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Softwares

- 6.2.2. Solutions

- 6.3. Market Analysis, Insights and Forecast - by Deployment Model

- 6.3.1. On-Cloud

- 6.3.2. On-Premise

- 6.4. Market Analysis, Insights and Forecast - by End-User

- 6.4.1. BFSI's

- 6.4.2. Government

- 6.4.3. IT & Telecom

- 6.4.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Solutions

- 7. South America UK Anti Money Laundering Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Solutions

- 7.1.1. Know Your Customer (KYC) Systems

- 7.1.2. Compliance Reporting

- 7.1.3. Transactions Monitoring

- 7.1.4. Auditing

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Softwares

- 7.2.2. Solutions

- 7.3. Market Analysis, Insights and Forecast - by Deployment Model

- 7.3.1. On-Cloud

- 7.3.2. On-Premise

- 7.4. Market Analysis, Insights and Forecast - by End-User

- 7.4.1. BFSI's

- 7.4.2. Government

- 7.4.3. IT & Telecom

- 7.4.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Solutions

- 8. Europe UK Anti Money Laundering Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Solutions

- 8.1.1. Know Your Customer (KYC) Systems

- 8.1.2. Compliance Reporting

- 8.1.3. Transactions Monitoring

- 8.1.4. Auditing

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Softwares

- 8.2.2. Solutions

- 8.3. Market Analysis, Insights and Forecast - by Deployment Model

- 8.3.1. On-Cloud

- 8.3.2. On-Premise

- 8.4. Market Analysis, Insights and Forecast - by End-User

- 8.4.1. BFSI's

- 8.4.2. Government

- 8.4.3. IT & Telecom

- 8.4.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Solutions

- 9. Middle East & Africa UK Anti Money Laundering Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Solutions

- 9.1.1. Know Your Customer (KYC) Systems

- 9.1.2. Compliance Reporting

- 9.1.3. Transactions Monitoring

- 9.1.4. Auditing

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Softwares

- 9.2.2. Solutions

- 9.3. Market Analysis, Insights and Forecast - by Deployment Model

- 9.3.1. On-Cloud

- 9.3.2. On-Premise

- 9.4. Market Analysis, Insights and Forecast - by End-User

- 9.4.1. BFSI's

- 9.4.2. Government

- 9.4.3. IT & Telecom

- 9.4.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Solutions

- 10. Asia Pacific UK Anti Money Laundering Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Solutions

- 10.1.1. Know Your Customer (KYC) Systems

- 10.1.2. Compliance Reporting

- 10.1.3. Transactions Monitoring

- 10.1.4. Auditing

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Softwares

- 10.2.2. Solutions

- 10.3. Market Analysis, Insights and Forecast - by Deployment Model

- 10.3.1. On-Cloud

- 10.3.2. On-Premise

- 10.4. Market Analysis, Insights and Forecast - by End-User

- 10.4.1. BFSI's

- 10.4.2. Government

- 10.4.3. IT & Telecom

- 10.4.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Solutions

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 NICE Actimize

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Trulioo

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Quantexa

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Encompass

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BAE System

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 LexisNexis Risk Solutions

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Passfort

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Refinitive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sanctionscanner

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 FullCircl**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 NICE Actimize

List of Figures

- Figure 1: Global UK Anti Money Laundering Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America UK Anti Money Laundering Market Revenue (billion), by Solutions 2025 & 2033

- Figure 3: North America UK Anti Money Laundering Market Revenue Share (%), by Solutions 2025 & 2033

- Figure 4: North America UK Anti Money Laundering Market Revenue (billion), by Type 2025 & 2033

- Figure 5: North America UK Anti Money Laundering Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America UK Anti Money Laundering Market Revenue (billion), by Deployment Model 2025 & 2033

- Figure 7: North America UK Anti Money Laundering Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 8: North America UK Anti Money Laundering Market Revenue (billion), by End-User 2025 & 2033

- Figure 9: North America UK Anti Money Laundering Market Revenue Share (%), by End-User 2025 & 2033

- Figure 10: North America UK Anti Money Laundering Market Revenue (billion), by Country 2025 & 2033

- Figure 11: North America UK Anti Money Laundering Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America UK Anti Money Laundering Market Revenue (billion), by Solutions 2025 & 2033

- Figure 13: South America UK Anti Money Laundering Market Revenue Share (%), by Solutions 2025 & 2033

- Figure 14: South America UK Anti Money Laundering Market Revenue (billion), by Type 2025 & 2033

- Figure 15: South America UK Anti Money Laundering Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: South America UK Anti Money Laundering Market Revenue (billion), by Deployment Model 2025 & 2033

- Figure 17: South America UK Anti Money Laundering Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 18: South America UK Anti Money Laundering Market Revenue (billion), by End-User 2025 & 2033

- Figure 19: South America UK Anti Money Laundering Market Revenue Share (%), by End-User 2025 & 2033

- Figure 20: South America UK Anti Money Laundering Market Revenue (billion), by Country 2025 & 2033

- Figure 21: South America UK Anti Money Laundering Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe UK Anti Money Laundering Market Revenue (billion), by Solutions 2025 & 2033

- Figure 23: Europe UK Anti Money Laundering Market Revenue Share (%), by Solutions 2025 & 2033

- Figure 24: Europe UK Anti Money Laundering Market Revenue (billion), by Type 2025 & 2033

- Figure 25: Europe UK Anti Money Laundering Market Revenue Share (%), by Type 2025 & 2033

- Figure 26: Europe UK Anti Money Laundering Market Revenue (billion), by Deployment Model 2025 & 2033

- Figure 27: Europe UK Anti Money Laundering Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 28: Europe UK Anti Money Laundering Market Revenue (billion), by End-User 2025 & 2033

- Figure 29: Europe UK Anti Money Laundering Market Revenue Share (%), by End-User 2025 & 2033

- Figure 30: Europe UK Anti Money Laundering Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Europe UK Anti Money Laundering Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa UK Anti Money Laundering Market Revenue (billion), by Solutions 2025 & 2033

- Figure 33: Middle East & Africa UK Anti Money Laundering Market Revenue Share (%), by Solutions 2025 & 2033

- Figure 34: Middle East & Africa UK Anti Money Laundering Market Revenue (billion), by Type 2025 & 2033

- Figure 35: Middle East & Africa UK Anti Money Laundering Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East & Africa UK Anti Money Laundering Market Revenue (billion), by Deployment Model 2025 & 2033

- Figure 37: Middle East & Africa UK Anti Money Laundering Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 38: Middle East & Africa UK Anti Money Laundering Market Revenue (billion), by End-User 2025 & 2033

- Figure 39: Middle East & Africa UK Anti Money Laundering Market Revenue Share (%), by End-User 2025 & 2033

- Figure 40: Middle East & Africa UK Anti Money Laundering Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East & Africa UK Anti Money Laundering Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific UK Anti Money Laundering Market Revenue (billion), by Solutions 2025 & 2033

- Figure 43: Asia Pacific UK Anti Money Laundering Market Revenue Share (%), by Solutions 2025 & 2033

- Figure 44: Asia Pacific UK Anti Money Laundering Market Revenue (billion), by Type 2025 & 2033

- Figure 45: Asia Pacific UK Anti Money Laundering Market Revenue Share (%), by Type 2025 & 2033

- Figure 46: Asia Pacific UK Anti Money Laundering Market Revenue (billion), by Deployment Model 2025 & 2033

- Figure 47: Asia Pacific UK Anti Money Laundering Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 48: Asia Pacific UK Anti Money Laundering Market Revenue (billion), by End-User 2025 & 2033

- Figure 49: Asia Pacific UK Anti Money Laundering Market Revenue Share (%), by End-User 2025 & 2033

- Figure 50: Asia Pacific UK Anti Money Laundering Market Revenue (billion), by Country 2025 & 2033

- Figure 51: Asia Pacific UK Anti Money Laundering Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Anti Money Laundering Market Revenue billion Forecast, by Solutions 2020 & 2033

- Table 2: Global UK Anti Money Laundering Market Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Global UK Anti Money Laundering Market Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 4: Global UK Anti Money Laundering Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 5: Global UK Anti Money Laundering Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global UK Anti Money Laundering Market Revenue billion Forecast, by Solutions 2020 & 2033

- Table 7: Global UK Anti Money Laundering Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global UK Anti Money Laundering Market Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 9: Global UK Anti Money Laundering Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 10: Global UK Anti Money Laundering Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global UK Anti Money Laundering Market Revenue billion Forecast, by Solutions 2020 & 2033

- Table 15: Global UK Anti Money Laundering Market Revenue billion Forecast, by Type 2020 & 2033

- Table 16: Global UK Anti Money Laundering Market Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 17: Global UK Anti Money Laundering Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 18: Global UK Anti Money Laundering Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Brazil UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Argentina UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global UK Anti Money Laundering Market Revenue billion Forecast, by Solutions 2020 & 2033

- Table 23: Global UK Anti Money Laundering Market Revenue billion Forecast, by Type 2020 & 2033

- Table 24: Global UK Anti Money Laundering Market Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 25: Global UK Anti Money Laundering Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 26: Global UK Anti Money Laundering Market Revenue billion Forecast, by Country 2020 & 2033

- Table 27: United Kingdom UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Germany UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: France UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Italy UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Spain UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Russia UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Benelux UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Nordics UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Global UK Anti Money Laundering Market Revenue billion Forecast, by Solutions 2020 & 2033

- Table 37: Global UK Anti Money Laundering Market Revenue billion Forecast, by Type 2020 & 2033

- Table 38: Global UK Anti Money Laundering Market Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 39: Global UK Anti Money Laundering Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 40: Global UK Anti Money Laundering Market Revenue billion Forecast, by Country 2020 & 2033

- Table 41: Turkey UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Israel UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: GCC UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: North Africa UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: South Africa UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: Global UK Anti Money Laundering Market Revenue billion Forecast, by Solutions 2020 & 2033

- Table 48: Global UK Anti Money Laundering Market Revenue billion Forecast, by Type 2020 & 2033

- Table 49: Global UK Anti Money Laundering Market Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 50: Global UK Anti Money Laundering Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 51: Global UK Anti Money Laundering Market Revenue billion Forecast, by Country 2020 & 2033

- Table 52: China UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 53: India UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Japan UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 55: South Korea UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: ASEAN UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 57: Oceania UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Anti Money Laundering Market?

The projected CAGR is approximately 17.8%.

2. Which companies are prominent players in the UK Anti Money Laundering Market?

Key companies in the market include NICE Actimize, Trulioo, Quantexa, Encompass, BAE System, LexisNexis Risk Solutions, Passfort, Refinitive, Sanctionscanner, FullCircl**List Not Exhaustive.

3. What are the main segments of the UK Anti Money Laundering Market?

The market segments include Solutions, Type, Deployment Model, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.13 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

UK Ranks in Top for Global Money Laundering.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In April 2022, NICE established cooperation with Deutsche Telekom Global Business, a subsidiary of Deutsche Telekom that provides telecommunications and connectivity services to businesses of all kinds, including the government. Deutsche Telekom Global Business is now delivering the CXone portfolio of industry-leading digital and agent-assisted CX solutions across Europe as part of the partnership.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Anti Money Laundering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Anti Money Laundering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Anti Money Laundering Market?

To stay informed about further developments, trends, and reports in the UK Anti Money Laundering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence