Key Insights

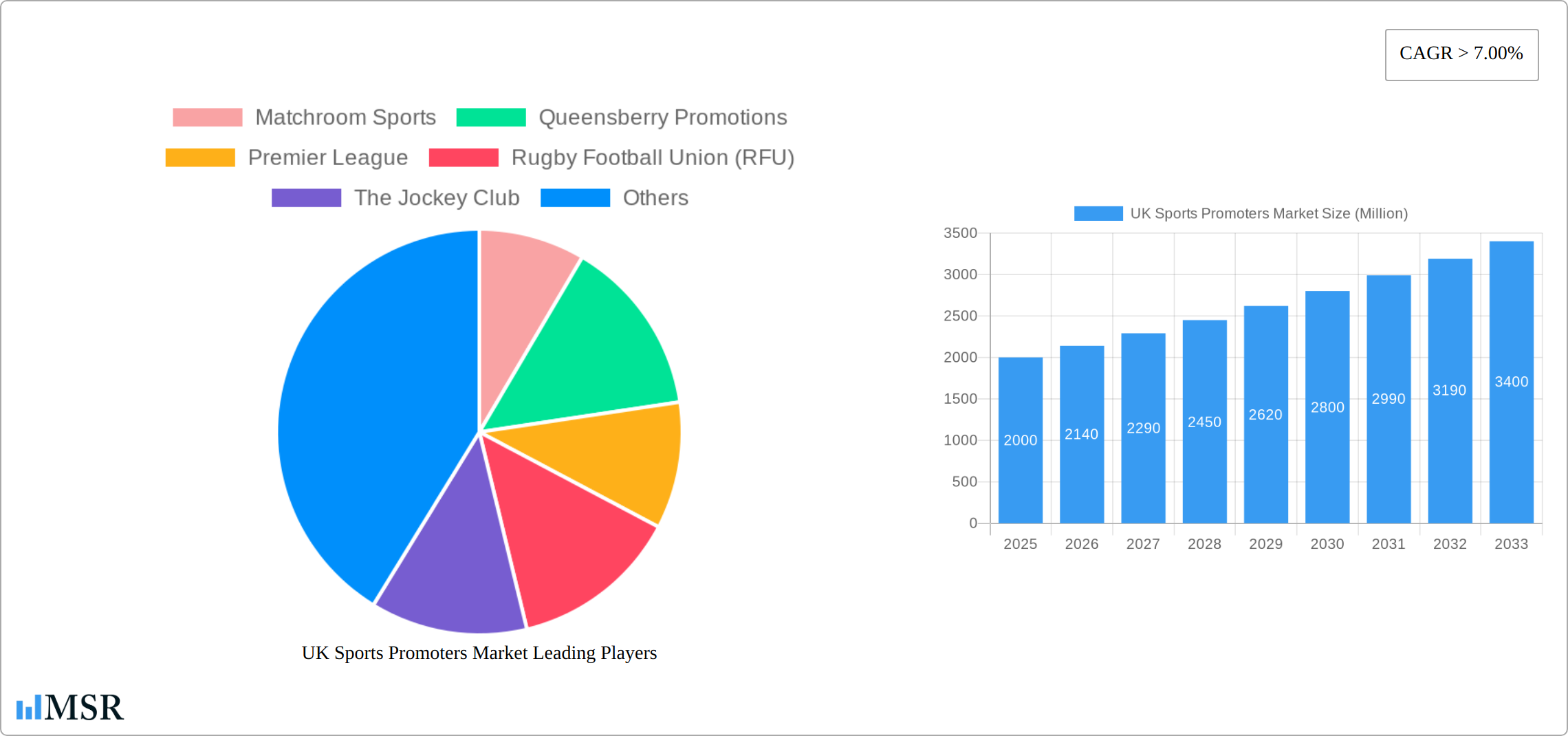

The UK Sports Promoters market is poised for significant expansion, with an estimated market size of 35.9 million in the base year 2024. This sector is projected to grow at a Compound Annual Growth Rate (CAGR) of 3.81%. Growth drivers include escalating sponsorship agreements, increasing media rights valuations, and heightened enthusiasm for diverse sporting events nationwide. The proliferation of digital channels and social media has also been a pivotal factor, creating novel pathways for fan interaction and brand visibility. Leading entities such as Matchroom Sports and Queensberry Promotions, alongside major organizations like the Premier League and RFU, are strategically leveraging these advancements. Nevertheless, the market faces headwinds from economic volatility impacting sponsorships and the dynamic nature of media rights negotiations.

UK Sports Promoters Market Market Size (In Million)

Market segmentation highlights varied revenue sources, spanning established sports such as football and rugby to burgeoning areas like esports and health-centric events. Premier sporting competitions, including the Premier League and Six Nations rugby, exert a substantial positive influence on the overall market. Enhanced investment in sporting event infrastructure further stimulates market development. Despite fierce competition, substantial opportunities exist for both established and emerging enterprises that can agilely respond to evolving consumer demands and capitalize on digital innovations. The upcoming period is expected to see increased market consolidation, with larger entities potentially acquiring smaller promoters to broaden their scope and diversify offerings.

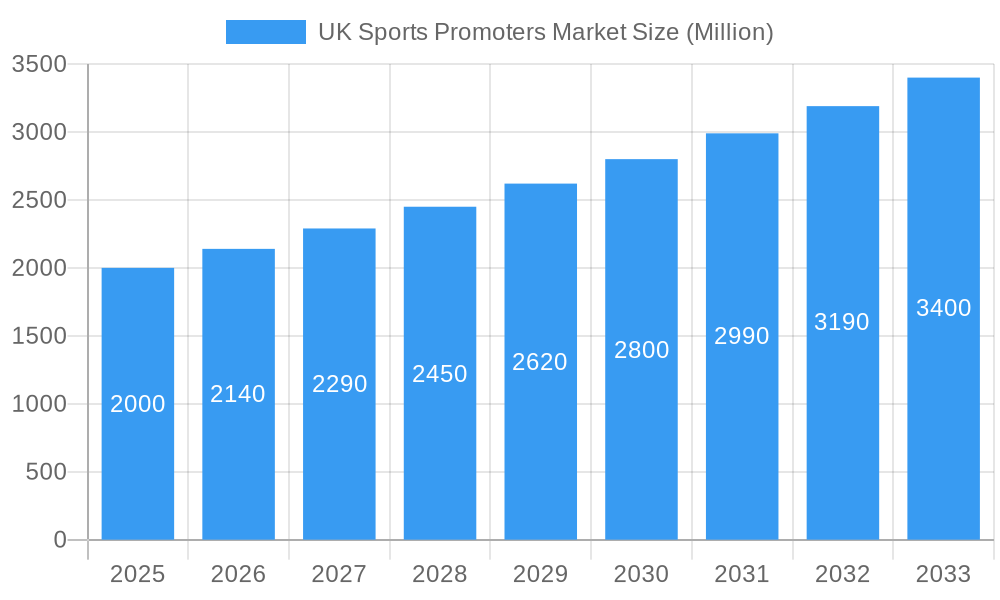

UK Sports Promoters Market Company Market Share

UK Sports Promoters Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the UK Sports Promoters Market, offering invaluable insights for industry stakeholders, investors, and strategic planners. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market dynamics, key players, emerging trends, and future growth opportunities. The market size in 2025 is estimated at £XX Million, exhibiting a CAGR of XX% during the forecast period. This report is essential for understanding the competitive landscape, identifying lucrative segments, and navigating the complexities of this dynamic market.

UK Sports Promoters Market Market Concentration & Dynamics

The UK sports promoters market displays a moderately concentrated structure, dominated by a few key players holding substantial market share. While precise figures remain elusive due to the private nature of some businesses' financials, prominent entities such as Matchroom Sport, Queensberry Promotions, and the Premier League are recognized as major forces. Industry estimates suggest that the top five promoters control approximately 60% of the market, highlighting the competitive landscape.

Market Dynamics:

- Innovation Ecosystems: Rapid technological advancements, particularly in data analytics and fan engagement, are driving significant innovation. The emergence of platforms like Sport-tech 50's Talent Pathway ID exemplifies this trend, providing promoters with powerful tools to enhance athlete development and event planning. The integration of AI and machine learning is also transforming talent scouting, marketing, and fan experience.

- Regulatory Frameworks: The market operates within a complex regulatory environment, encompassing broadcasting rights, athlete welfare, and financial transparency. Navigating these stringent regulations, and adapting to evolving legislation, is crucial for sustained success. Compliance and ethical conduct are paramount.

- Substitute Products & Services: While still relatively nascent, the rise of eSports and alternative entertainment options presents a growing competitive pressure. Promoters must adapt by exploring opportunities for diversification and leveraging their unique strengths in traditional sports.

- End-User Trends: Consumer demand for immersive and personalized experiences is reshaping the market. Fans increasingly seek interactive platforms, tailored content, and unique engagement opportunities. This drives investment in digital infrastructure and creative event formats.

- M&A Activities: The UK sports promotion sector has witnessed fluctuating M&A activity in recent years, with approximately XX deals concluded between 2019 and 2024. This signifies both consolidation within the industry and strategic expansion efforts by established players.

UK Sports Promoters Market Industry Insights & Trends

The UK sports promoters market is experiencing strong growth, propelled by several key factors. Rising disposable incomes, increased participation in various sports, and a significant surge in media consumption are contributing to market expansion. Technological advancements, particularly in digital platforms and data analytics (as seen with Sport-tech 50’s Talent Pathway ID), are enhancing fan engagement, creating new monetization streams and enabling more effective talent identification and development.

The market is projected to reach £XX Million by 2033, driven by:

- Increased sponsorship and media rights revenue, reflecting the growing value of sports broadcasting and brand partnerships.

- Growth in participation sports, leading to increased event attendance and demand for quality promotions.

- The continued evolution of broadcast media and digital engagement platforms, expanding reach and unlocking diverse revenue streams.

- Successful hosting of major sporting events, solidifying the UK's position as a premier sporting destination and attracting international investment.

Key Markets & Segments Leading UK Sports Promoters Market

The dominance within the UK Sports Promoters Market is dispersed across various segments. While specific market share figures remain unavailable for many sub-segments due to private business data, the following offers insights into key factors driving sector growth:

Key Market Drivers:

- Football: The Premier League's global reach and immense popularity dominate revenue generation, driving a significant portion of the market.

- Rugby: The Rugby Football Union (RFU) and associated competitions contribute substantially, particularly through its robust fanbase and impactful media deals.

- Horse Racing: The Jockey Club's prestigious events and strong media presence contributes heavily to the market size.

- Combat Sports: Companies like Matchroom Sports and Queensberry Promotions represent significant components of the market, driven by increasing global interest and media coverage.

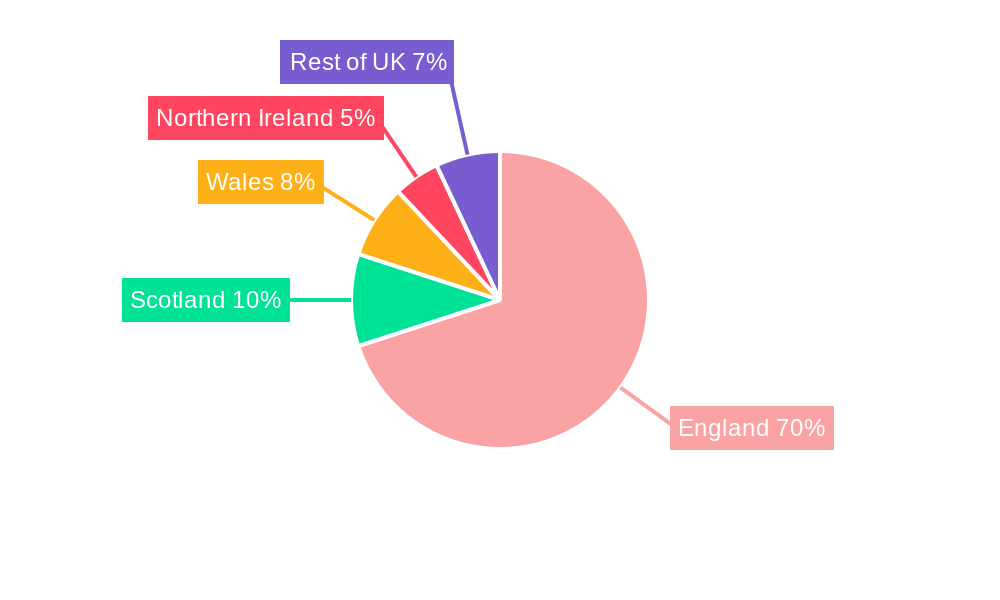

Regional Dominance Analysis:

London, as the capital, enjoys disproportionate representation in terms of events hosted and media coverage, influencing market value significantly. However, strong regional interest across the UK drives consistent market demand throughout the country. The impact of regional economic conditions and local government initiatives in various regions also influence specific market segments.

UK Sports Promoters Market Product Developments

Recent product innovations center around enhancing fan experience through immersive technologies, personalized content delivery, and data-driven insights. The integration of AI-powered performance analysis, as seen with the Talent Pathway ID, is significantly impacting athlete development and event strategy. This technology improves the quality of events and strengthens promotional marketing efforts, ensuring increased revenue streams. These innovations provide competitive advantages by delivering more engaging and optimized sporting events for spectators and participants.

Challenges in the UK Sports Promoters Market Market

The UK sports promoters market faces challenges such as intense competition, securing broadcast rights, and navigating stringent regulatory environments. The high cost of securing talent and venues, coupled with the economic instability impacting sponsorships, presents additional hurdles. A significant challenge is balancing the need for revenue generation with maintaining ethical practices and ensuring athlete welfare. These constraints cumulatively impact profitability, creating an environment where strategic planning and adaptability are crucial to thrive.

Forces Driving UK Sports Promoters Market Growth

Several factors fuel market growth, including increasing media rights revenues, rising participation rates in sports, and technological advancements enhancing fan engagement. Government initiatives promoting sports and tourism, coupled with the UK’s established infrastructure, and its status as a major sporting event host, all contribute to the market's expansion. The growing international interest in UK-based sporting events contributes significantly to this positive growth trend.

Long-Term Growth Catalysts in the UK Sports Promoters Market

Long-term growth hinges on fostering innovation in fan engagement, leveraging data analytics for strategic decision-making, and strategically partnering with technology companies. Exploring new revenue streams through interactive experiences, virtual reality, and global expansion plans will further accelerate growth. Continued investment in infrastructure and athlete development will significantly influence long-term sustainability and expansion within this market.

Emerging Opportunities in UK Sports Promoters Market

Emerging opportunities include leveraging eSports, integrating virtual and augmented reality technologies, and expanding into new geographical markets, particularly internationally. Personalized fan experiences, data-driven marketing, and sustainable event management practices present further avenues for growth. The market also presents untapped potential in niche sports and emerging athletic disciplines, providing a platform for innovative event creation and promotion.

Leading Players in the UK Sports Promoters Market Sector

- Matchroom Sports

- Queensberry Promotions

- Premier League

- Rugby Football Union (RFU)

- The Jockey Club

- SYL Sports And Wellness

- Reech Sports

- Strive Sports Management

- Sports Resource Group

- Metcalf Multisports

Key Milestones in UK Sports Promoters Market Industry

- June 2023: Sport-tech 50's launch of Talent Pathway ID, an AI-powered performance analysis tool, significantly impacts athlete development and event strategy, enhancing event quality and profitability. This innovation underscores the industry's embrace of technology.

- April 2023: Madison Square Garden Entertainment Corp.'s spin-off from Sphere Entertainment Co. signals increased market investment and potential shifts in future M&A activity within the broader entertainment and sports landscape, suggesting further consolidation and expansion opportunities.

Strategic Outlook for UK Sports Promoters Market Market

The UK sports promoters market exhibits strong potential for growth, driven by continuous technological advancements and evolving consumer preferences. Strategic partnerships, investment in data analytics, and expansion into new markets will be crucial to capturing future opportunities. The focus should be on delivering innovative and engaging experiences, maximizing revenue streams, and building long-term brand equity. Adapting to evolving regulatory landscapes and managing economic fluctuations remain paramount to ensuring sustained success.

UK Sports Promoters Market Segmentation

-

1. Type of Sports

- 1.1. Soccer

- 1.2. Formula 1

- 1.3. Basketball

- 1.4. Tennis

- 1.5. Other Types of Sports

-

2. Revenue Source

- 2.1. Media Rights

- 2.2. Merchandising

- 2.3. Ticket

- 2.4. Sponsoring

UK Sports Promoters Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Sports Promoters Market Regional Market Share

Geographic Coverage of UK Sports Promoters Market

UK Sports Promoters Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.81% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Number of Spectators Watching Sports

- 3.3. Market Restrains

- 3.3.1. Increase in Number of Spectators Watching Sports

- 3.4. Market Trends

- 3.4.1. Athletes Influencers is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Sports Promoters Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Sports

- 5.1.1. Soccer

- 5.1.2. Formula 1

- 5.1.3. Basketball

- 5.1.4. Tennis

- 5.1.5. Other Types of Sports

- 5.2. Market Analysis, Insights and Forecast - by Revenue Source

- 5.2.1. Media Rights

- 5.2.2. Merchandising

- 5.2.3. Ticket

- 5.2.4. Sponsoring

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type of Sports

- 6. North America UK Sports Promoters Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Sports

- 6.1.1. Soccer

- 6.1.2. Formula 1

- 6.1.3. Basketball

- 6.1.4. Tennis

- 6.1.5. Other Types of Sports

- 6.2. Market Analysis, Insights and Forecast - by Revenue Source

- 6.2.1. Media Rights

- 6.2.2. Merchandising

- 6.2.3. Ticket

- 6.2.4. Sponsoring

- 6.1. Market Analysis, Insights and Forecast - by Type of Sports

- 7. South America UK Sports Promoters Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Sports

- 7.1.1. Soccer

- 7.1.2. Formula 1

- 7.1.3. Basketball

- 7.1.4. Tennis

- 7.1.5. Other Types of Sports

- 7.2. Market Analysis, Insights and Forecast - by Revenue Source

- 7.2.1. Media Rights

- 7.2.2. Merchandising

- 7.2.3. Ticket

- 7.2.4. Sponsoring

- 7.1. Market Analysis, Insights and Forecast - by Type of Sports

- 8. Europe UK Sports Promoters Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Sports

- 8.1.1. Soccer

- 8.1.2. Formula 1

- 8.1.3. Basketball

- 8.1.4. Tennis

- 8.1.5. Other Types of Sports

- 8.2. Market Analysis, Insights and Forecast - by Revenue Source

- 8.2.1. Media Rights

- 8.2.2. Merchandising

- 8.2.3. Ticket

- 8.2.4. Sponsoring

- 8.1. Market Analysis, Insights and Forecast - by Type of Sports

- 9. Middle East & Africa UK Sports Promoters Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Sports

- 9.1.1. Soccer

- 9.1.2. Formula 1

- 9.1.3. Basketball

- 9.1.4. Tennis

- 9.1.5. Other Types of Sports

- 9.2. Market Analysis, Insights and Forecast - by Revenue Source

- 9.2.1. Media Rights

- 9.2.2. Merchandising

- 9.2.3. Ticket

- 9.2.4. Sponsoring

- 9.1. Market Analysis, Insights and Forecast - by Type of Sports

- 10. Asia Pacific UK Sports Promoters Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Sports

- 10.1.1. Soccer

- 10.1.2. Formula 1

- 10.1.3. Basketball

- 10.1.4. Tennis

- 10.1.5. Other Types of Sports

- 10.2. Market Analysis, Insights and Forecast - by Revenue Source

- 10.2.1. Media Rights

- 10.2.2. Merchandising

- 10.2.3. Ticket

- 10.2.4. Sponsoring

- 10.1. Market Analysis, Insights and Forecast - by Type of Sports

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Matchroom Sports

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Queensberry Promotions

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Premier League

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Rugby Football Union (RFU)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 The Jockey Club

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SYL Sports And Wellness

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Reech Sports

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Strive Sports Management

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sports Resource Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Metcalf Multisports**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Matchroom Sports

List of Figures

- Figure 1: Global UK Sports Promoters Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America UK Sports Promoters Market Revenue (million), by Type of Sports 2025 & 2033

- Figure 3: North America UK Sports Promoters Market Revenue Share (%), by Type of Sports 2025 & 2033

- Figure 4: North America UK Sports Promoters Market Revenue (million), by Revenue Source 2025 & 2033

- Figure 5: North America UK Sports Promoters Market Revenue Share (%), by Revenue Source 2025 & 2033

- Figure 6: North America UK Sports Promoters Market Revenue (million), by Country 2025 & 2033

- Figure 7: North America UK Sports Promoters Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America UK Sports Promoters Market Revenue (million), by Type of Sports 2025 & 2033

- Figure 9: South America UK Sports Promoters Market Revenue Share (%), by Type of Sports 2025 & 2033

- Figure 10: South America UK Sports Promoters Market Revenue (million), by Revenue Source 2025 & 2033

- Figure 11: South America UK Sports Promoters Market Revenue Share (%), by Revenue Source 2025 & 2033

- Figure 12: South America UK Sports Promoters Market Revenue (million), by Country 2025 & 2033

- Figure 13: South America UK Sports Promoters Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe UK Sports Promoters Market Revenue (million), by Type of Sports 2025 & 2033

- Figure 15: Europe UK Sports Promoters Market Revenue Share (%), by Type of Sports 2025 & 2033

- Figure 16: Europe UK Sports Promoters Market Revenue (million), by Revenue Source 2025 & 2033

- Figure 17: Europe UK Sports Promoters Market Revenue Share (%), by Revenue Source 2025 & 2033

- Figure 18: Europe UK Sports Promoters Market Revenue (million), by Country 2025 & 2033

- Figure 19: Europe UK Sports Promoters Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa UK Sports Promoters Market Revenue (million), by Type of Sports 2025 & 2033

- Figure 21: Middle East & Africa UK Sports Promoters Market Revenue Share (%), by Type of Sports 2025 & 2033

- Figure 22: Middle East & Africa UK Sports Promoters Market Revenue (million), by Revenue Source 2025 & 2033

- Figure 23: Middle East & Africa UK Sports Promoters Market Revenue Share (%), by Revenue Source 2025 & 2033

- Figure 24: Middle East & Africa UK Sports Promoters Market Revenue (million), by Country 2025 & 2033

- Figure 25: Middle East & Africa UK Sports Promoters Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific UK Sports Promoters Market Revenue (million), by Type of Sports 2025 & 2033

- Figure 27: Asia Pacific UK Sports Promoters Market Revenue Share (%), by Type of Sports 2025 & 2033

- Figure 28: Asia Pacific UK Sports Promoters Market Revenue (million), by Revenue Source 2025 & 2033

- Figure 29: Asia Pacific UK Sports Promoters Market Revenue Share (%), by Revenue Source 2025 & 2033

- Figure 30: Asia Pacific UK Sports Promoters Market Revenue (million), by Country 2025 & 2033

- Figure 31: Asia Pacific UK Sports Promoters Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Sports Promoters Market Revenue million Forecast, by Type of Sports 2020 & 2033

- Table 2: Global UK Sports Promoters Market Revenue million Forecast, by Revenue Source 2020 & 2033

- Table 3: Global UK Sports Promoters Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global UK Sports Promoters Market Revenue million Forecast, by Type of Sports 2020 & 2033

- Table 5: Global UK Sports Promoters Market Revenue million Forecast, by Revenue Source 2020 & 2033

- Table 6: Global UK Sports Promoters Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Global UK Sports Promoters Market Revenue million Forecast, by Type of Sports 2020 & 2033

- Table 11: Global UK Sports Promoters Market Revenue million Forecast, by Revenue Source 2020 & 2033

- Table 12: Global UK Sports Promoters Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: Brazil UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Argentina UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Global UK Sports Promoters Market Revenue million Forecast, by Type of Sports 2020 & 2033

- Table 17: Global UK Sports Promoters Market Revenue million Forecast, by Revenue Source 2020 & 2033

- Table 18: Global UK Sports Promoters Market Revenue million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Germany UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: France UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Italy UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Spain UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Russia UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Benelux UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Nordics UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Global UK Sports Promoters Market Revenue million Forecast, by Type of Sports 2020 & 2033

- Table 29: Global UK Sports Promoters Market Revenue million Forecast, by Revenue Source 2020 & 2033

- Table 30: Global UK Sports Promoters Market Revenue million Forecast, by Country 2020 & 2033

- Table 31: Turkey UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Israel UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: GCC UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: North Africa UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: South Africa UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Global UK Sports Promoters Market Revenue million Forecast, by Type of Sports 2020 & 2033

- Table 38: Global UK Sports Promoters Market Revenue million Forecast, by Revenue Source 2020 & 2033

- Table 39: Global UK Sports Promoters Market Revenue million Forecast, by Country 2020 & 2033

- Table 40: China UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: India UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Japan UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: South Korea UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 45: Oceania UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific UK Sports Promoters Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Sports Promoters Market?

The projected CAGR is approximately 3.81%.

2. Which companies are prominent players in the UK Sports Promoters Market?

Key companies in the market include Matchroom Sports, Queensberry Promotions, Premier League, Rugby Football Union (RFU), The Jockey Club, SYL Sports And Wellness, Reech Sports, Strive Sports Management, Sports Resource Group, Metcalf Multisports**List Not Exhaustive.

3. What are the main segments of the UK Sports Promoters Market?

The market segments include Type of Sports, Revenue Source.

4. Can you provide details about the market size?

The market size is estimated to be USD 35.9 million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Number of Spectators Watching Sports.

6. What are the notable trends driving market growth?

Athletes Influencers is Driving the Market.

7. Are there any restraints impacting market growth?

Increase in Number of Spectators Watching Sports.

8. Can you provide examples of recent developments in the market?

June 2023: Sport-tech 50 introduced Talent Pathway ID, a groundbreaking addition to its lineup, offering AI-powered performance analysis for both athletes and coaches.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Sports Promoters Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Sports Promoters Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Sports Promoters Market?

To stay informed about further developments, trends, and reports in the UK Sports Promoters Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence