Key Insights

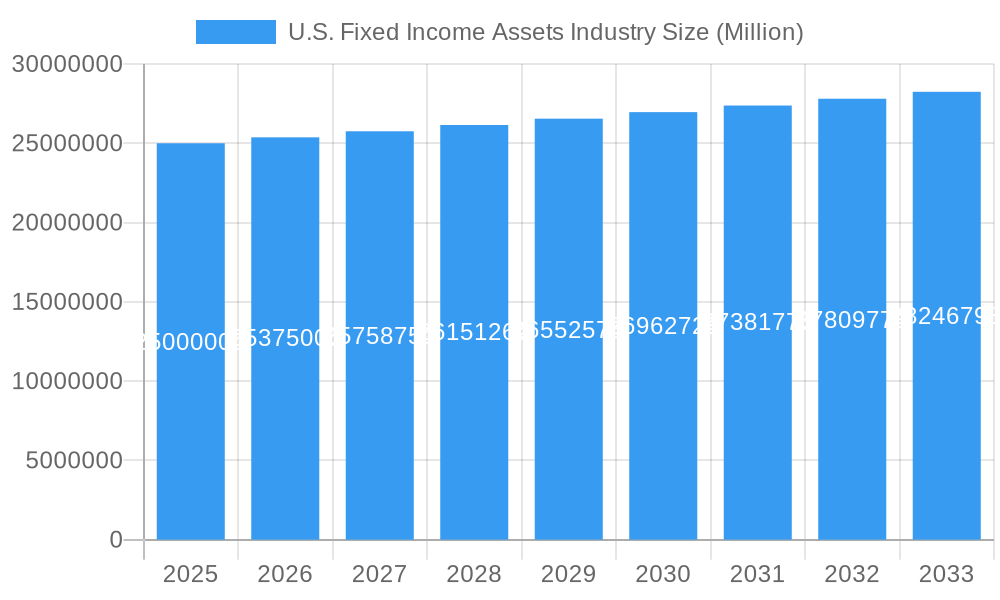

The U.S. fixed income asset market, a cornerstone of the global financial system, exhibits a stable growth trajectory. While a precise market size for 2025 is unavailable, considering a CAGR of 1.5% from a base year of 2025 and a forecast period to 2033, we can infer substantial market value. The market's expansion is driven by several factors. Firstly, increasing institutional investor participation, including pension funds, insurance companies, and endowments, continually fuels demand for fixed income securities. Secondly, persistent low interest rate environments in recent years have encouraged investors to seek higher yields, even within the relatively low-return fixed income space, leading to increased investment. Thirdly, the ongoing need for diversification within investment portfolios contributes to the market’s resilience. This is further strengthened by a continued search for safety and capital preservation, particularly during periods of economic uncertainty.

U.S. Fixed Income Assets Industry Market Size (In Million)

However, the market also faces headwinds. Inflationary pressures, though moderating, can negatively impact the value of fixed income assets. Rising interest rates, a countermeasure to inflation, can decrease the attractiveness of existing bonds. Furthermore, geopolitical instability and evolving regulatory landscapes introduce uncertainty, affecting investor sentiment and potentially impacting investment flows. Despite these challenges, the substantial size and established role of the fixed income market in the U.S. suggest continued, albeit moderate, growth. Key players such as BlackRock, Vanguard, and Fidelity Investments, along with other prominent firms listed, continue to dominate the landscape, vying for market share through innovative product offerings and sophisticated investment strategies. The market’s future will be shaped by navigating the delicate balance between interest rate movements, economic growth, and global uncertainty.

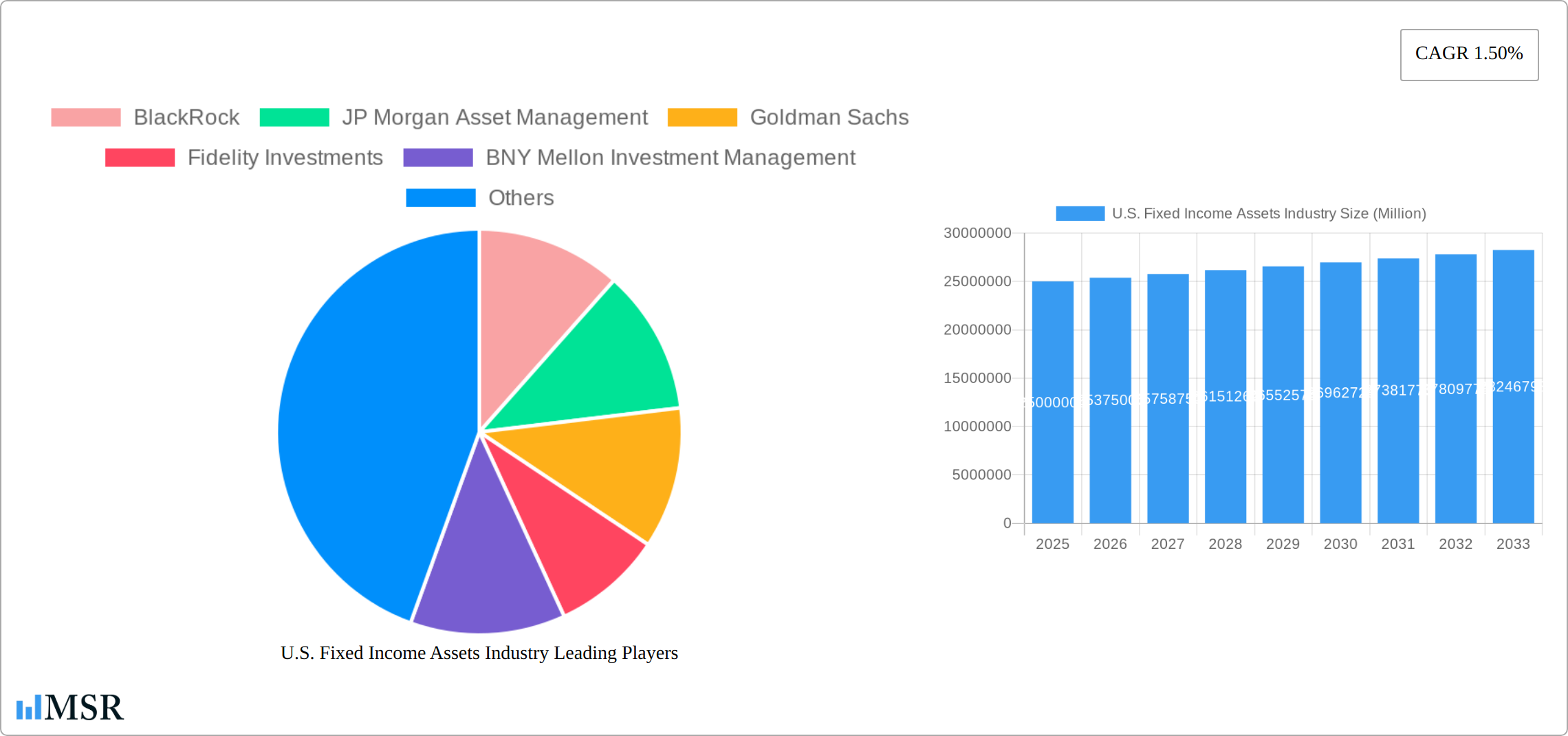

U.S. Fixed Income Assets Industry Company Market Share

U.S. Fixed Income Assets Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the U.S. Fixed Income Assets industry, offering crucial insights for investors, industry stakeholders, and market strategists. Covering the period from 2019 to 2033, with a base year of 2025, this report meticulously examines market dynamics, key players, emerging trends, and future growth prospects. The analysis incorporates data from the historical period (2019-2024) and projects the market's trajectory until 2033. Expect detailed breakdowns of market size (in Millions), CAGR, market share analysis, and impactful M&A activity.

U.S. Fixed Income Assets Industry Market Concentration & Dynamics

The U.S. fixed income asset market is highly concentrated, with a few dominant players controlling a substantial portion of the market share. BlackRock, Vanguard, Fidelity, and State Street Global Advisors consistently rank among the top asset managers, exerting significant influence on investment flows and market trends. Market dynamics are profoundly shaped by a robust innovation ecosystem driving technological advancements in portfolio management and trading platforms. Regulatory oversight, primarily from the SEC, plays a crucial role in ensuring market integrity and fostering investor confidence. Competitive pressures arise from substitute products, such as alternative investment strategies, which offer distinct risk-return profiles. Evolving end-user preferences, particularly the increasing demand for passively managed funds and ESG-conscious investments, are reshaping the market landscape. Mergers and acquisitions (M&A) activity remains a significant feature, with major players strategically acquiring companies to expand their reach and product offerings. Historically, deal counts averaged [Insert Average Deal Count] per year, projected to reach [Insert Projected Deal Count for 2025] in 2025. The projected market share of the top five players in 2025 is estimated at [Insert Market Share Percentage]%, reflecting a consolidated market structure.

- Market Concentration: A highly concentrated oligopoly, with leading firms possessing considerable market power.

- Innovation: A dynamic innovation ecosystem fuels continuous advancements in portfolio management technologies and trading infrastructure.

- Regulations: Robust regulatory frameworks, primarily overseen by the SEC, maintain market stability and investor protection.

- Substitute Products: Competition from alternative investment strategies creates diverse investment choices and influences market dynamics.

- End-User Trends: Growing demand for low-cost, passively managed funds and investments aligned with Environmental, Social, and Governance (ESG) criteria is reshaping investment strategies.

- M&A Activity: Strategic mergers and acquisitions drive market consolidation and expansion of product offerings among key players.

U.S. Fixed Income Assets Industry Industry Insights & Trends

The U.S. fixed income assets market is characterized by significant growth driven by several key factors. The market size reached an estimated xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%. Technological disruptions, such as the rise of fintech and algorithmic trading, are transforming market operations and efficiency. Evolving consumer behaviors, including a shift towards digital platforms and personalized investment solutions, are also reshaping the industry landscape. Low interest rates in recent years have pushed investors towards higher-yielding fixed-income products, contributing to the overall market expansion. However, increasing regulatory scrutiny and potential economic downturns present potential challenges to sustained growth. Increased focus on environmental, social, and governance (ESG) factors is impacting investment strategies and portfolio construction.

Key Markets & Segments Leading U.S. Fixed Income Assets Industry

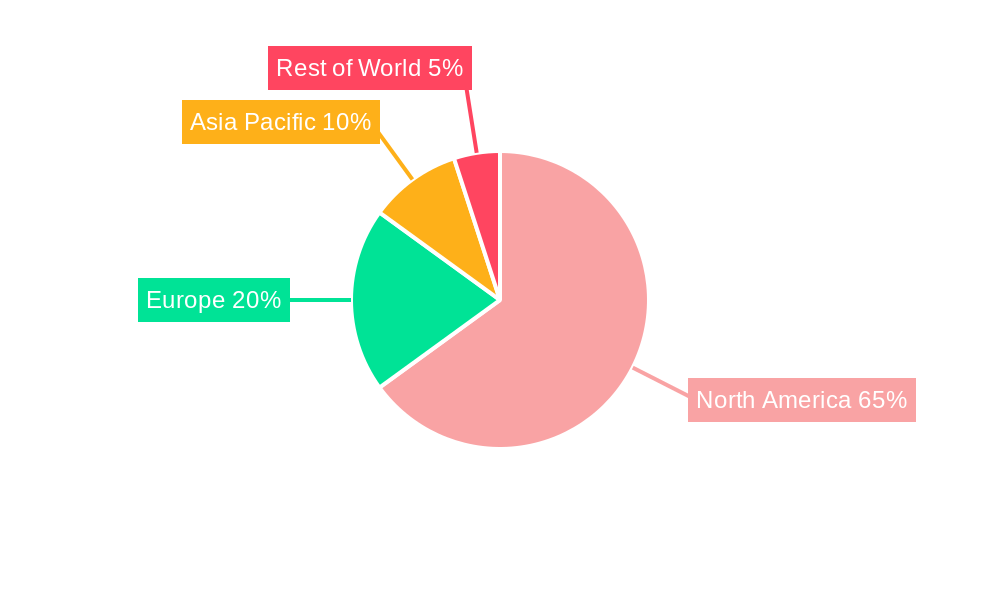

The U.S. dominates the North American fixed-income market due to its large, diversified economy and sophisticated financial infrastructure.

- Drivers of U.S. Market Dominance:

- A large and sophisticated investor base with diverse investment needs.

- A highly developed and efficient financial infrastructure supporting market liquidity and transaction efficiency.

- A robust and well-established regulatory framework ensuring market stability and investor protection.

- Significant economic activity generating a substantial supply of fixed-income securities.

The institutional investor segment (pension funds, insurance companies, etc.) remains a key driver of market growth, representing [Insert Percentage]% of the total market in 2025. Government bonds and corporate bonds constitute the largest segments, followed by mortgage-backed securities and municipal bonds. The continued borrowing needs of corporations and governments fuel the growth of these segments.

U.S. Fixed Income Assets Industry Product Developments

Recent product innovations include the development of sophisticated quantitative models for portfolio optimization, the integration of ESG factors into investment strategies, and the emergence of robo-advisors offering automated investment solutions. These innovations are enhancing portfolio management efficiency, improving risk management, and making investment more accessible to retail investors. The competition among providers is pushing innovation.

Challenges in the U.S. Fixed Income Assets Industry Market

The industry faces challenges including increasing regulatory scrutiny, potentially impacting profitability and operational efficiency. Cybersecurity threats also pose a significant risk, necessitating robust security measures. Supply chain disruptions, though less direct than in other sectors, can affect the timely settlement of transactions. Lastly, intense competition among established players and the emergence of new entrants creates pressure on margins. These factors combined could decrease overall industry profit by xx Million by 2030.

Forces Driving U.S. Fixed Income Assets Industry Growth

Key growth drivers include technological advancements enhancing efficiency and automation, increasing investor demand for ESG-compliant investments, the expansion of the retirement market driving demand for retirement-focused products, and the growth of the global economy creating new investment opportunities. The widespread adoption of low-cost index funds, coupled with the integration of machine learning and artificial intelligence, is optimizing portfolio management and trading processes.

Challenges in the U.S. Fixed Income Assets Industry Market

Long-term growth will depend on the industry's ability to adapt to evolving regulatory landscapes, embrace technological innovations, and cater to the changing needs of investors. Strategic partnerships and global market expansions will also play a key role.

Emerging Opportunities in U.S. Fixed Income Assets Industry

Emerging opportunities lie in the growing demand for alternative investments, the expansion of digital platforms, and the increasing adoption of sustainable investment strategies. The integration of blockchain technology is another emerging opportunity.

Leading Players in the U.S. Fixed Income Assets Industry Sector

- BlackRock

- JP Morgan Asset Management

- Goldman Sachs Asset Management

- Fidelity Investments

- BNY Mellon Investment Management

- The Vanguard Group

- State Street Global Advisors

- Pacific Investment Management Company LLC (PIMCO)

- Prudential Financial

- Capital Research & Management Company

- Franklin Templeton Investments

- Northern Trust Global Investments

Key Milestones in U.S. Fixed Income Assets Industry Industry

- January 2024: BlackRock finalizes the acquisition of Global Infrastructure Partners (GIP), significantly expanding its presence in infrastructure investments.

- October 2023: BlackRock partners with pvest, enhancing access to investing for millions of Europeans through a fintech collaboration.

Strategic Outlook for U.S. Fixed Income Assets Industry Market

The U.S. fixed income assets market is poised for continued growth, driven by technological advancements, evolving investor preferences, and a robust regulatory framework. Strategic opportunities exist for companies to leverage technological innovations to improve efficiency, enhance risk management, and deliver customized investment solutions. Expanding into emerging markets and offering innovative products tailored to ESG investing will be crucial for sustained success in this dynamic industry.

U.S. Fixed Income Assets Industry Segmentation

-

1. Client Type

- 1.1. Retail

- 1.2. Pension Funds

- 1.3. Insurance Companies

- 1.4. Banks

- 1.5. Other Client Types

-

2. Asset Class

- 2.1. Bonds

- 2.2. Money Market Instruments (includes Mutual Funds)

- 2.3. ETF

- 2.4. Other Asset Class

U.S. Fixed Income Assets Industry Segmentation By Geography

- 1. U.S.

U.S. Fixed Income Assets Industry Regional Market Share

Geographic Coverage of U.S. Fixed Income Assets Industry

U.S. Fixed Income Assets Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Distribution of US Fixed Income Assets - By Investment Style

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. U.S. Fixed Income Assets Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Client Type

- 5.1.1. Retail

- 5.1.2. Pension Funds

- 5.1.3. Insurance Companies

- 5.1.4. Banks

- 5.1.5. Other Client Types

- 5.2. Market Analysis, Insights and Forecast - by Asset Class

- 5.2.1. Bonds

- 5.2.2. Money Market Instruments (includes Mutual Funds)

- 5.2.3. ETF

- 5.2.4. Other Asset Class

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. U.S.

- 5.1. Market Analysis, Insights and Forecast - by Client Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BlackRock

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 JP Morgan Asset Management

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Goldman Sachs

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fidelity Investments

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BNY Mellon Investment Management

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 The Vanguard Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 State Street Global Advisors

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Pacific Investment Management Company LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Prudential Financial

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Capital Research & Management Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Franklin Templeton Investments

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Northern Trust Global Investments

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 BlackRock

List of Figures

- Figure 1: U.S. Fixed Income Assets Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: U.S. Fixed Income Assets Industry Share (%) by Company 2025

List of Tables

- Table 1: U.S. Fixed Income Assets Industry Revenue undefined Forecast, by Client Type 2020 & 2033

- Table 2: U.S. Fixed Income Assets Industry Revenue undefined Forecast, by Asset Class 2020 & 2033

- Table 3: U.S. Fixed Income Assets Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: U.S. Fixed Income Assets Industry Revenue undefined Forecast, by Client Type 2020 & 2033

- Table 5: U.S. Fixed Income Assets Industry Revenue undefined Forecast, by Asset Class 2020 & 2033

- Table 6: U.S. Fixed Income Assets Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the U.S. Fixed Income Assets Industry?

The projected CAGR is approximately 1.5%.

2. Which companies are prominent players in the U.S. Fixed Income Assets Industry?

Key companies in the market include BlackRock, JP Morgan Asset Management, Goldman Sachs, Fidelity Investments, BNY Mellon Investment Management, The Vanguard Group, State Street Global Advisors, Pacific Investment Management Company LLC, Prudential Financial, Capital Research & Management Company, Franklin Templeton Investments, Northern Trust Global Investments.

3. What are the main segments of the U.S. Fixed Income Assets Industry?

The market segments include Client Type, Asset Class.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Distribution of US Fixed Income Assets - By Investment Style.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2024, BlackRock has finalized an agreement to acquire Global Infrastructure Partners (GIP), a move that positions it as a dominant player in the global infrastructure private markets investment landscape.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "U.S. Fixed Income Assets Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the U.S. Fixed Income Assets Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the U.S. Fixed Income Assets Industry?

To stay informed about further developments, trends, and reports in the U.S. Fixed Income Assets Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence