Key Insights

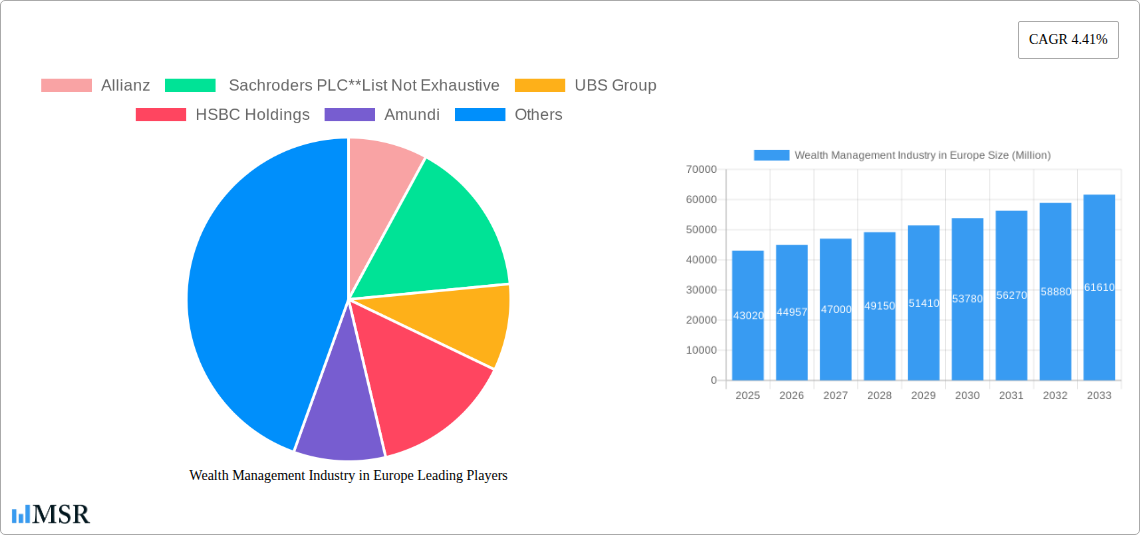

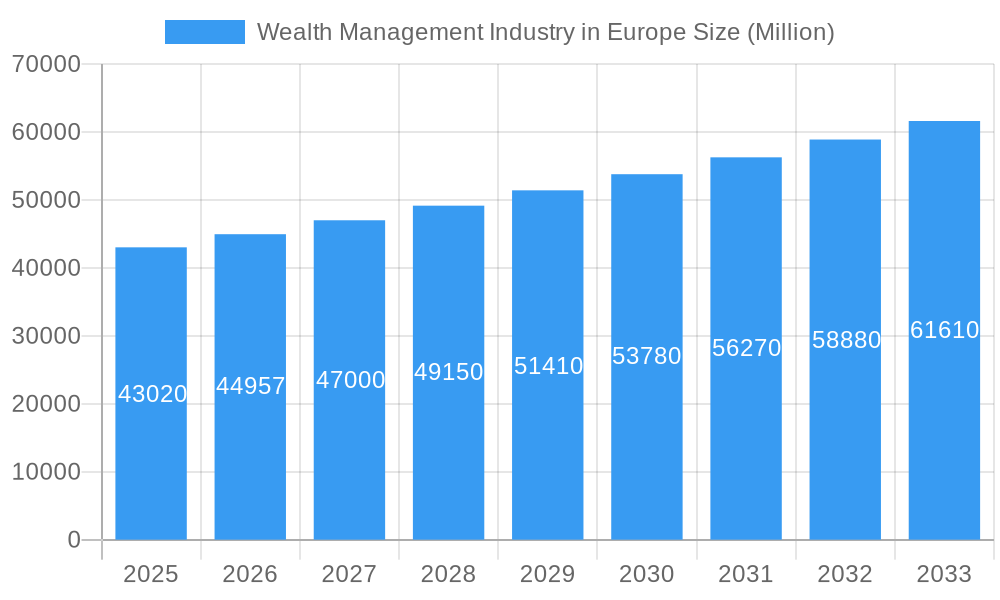

The European wealth management market, valued at €43.02 billion in 2025, is projected to experience robust growth, driven by several key factors. A rising high-net-worth individual (HNWI) population, coupled with increasing affluence among the mass affluent segment, fuels demand for sophisticated wealth management services. Technological advancements, including the rise of robo-advisors and fintech solutions, are streamlining operations and enhancing client experiences, further boosting market expansion. The preference for personalized and holistic wealth planning, encompassing investment management, retirement planning, and tax optimization, is also a significant driver. While regulatory changes and geopolitical uncertainties pose challenges, the market's resilience is underscored by the diverse range of services offered by established players like Allianz, Schroders, UBS, and HSBC, alongside the emergence of innovative fintech companies. The market is segmented by client type (HNWIs, retail/individuals, mass affluent) and wealth management firm (private bankers, family offices), offering diverse opportunities for growth. Competition is intense, with firms constantly innovating to attract and retain clients through superior service and investment strategies.

Wealth Management Industry in Europe Market Size (In Billion)

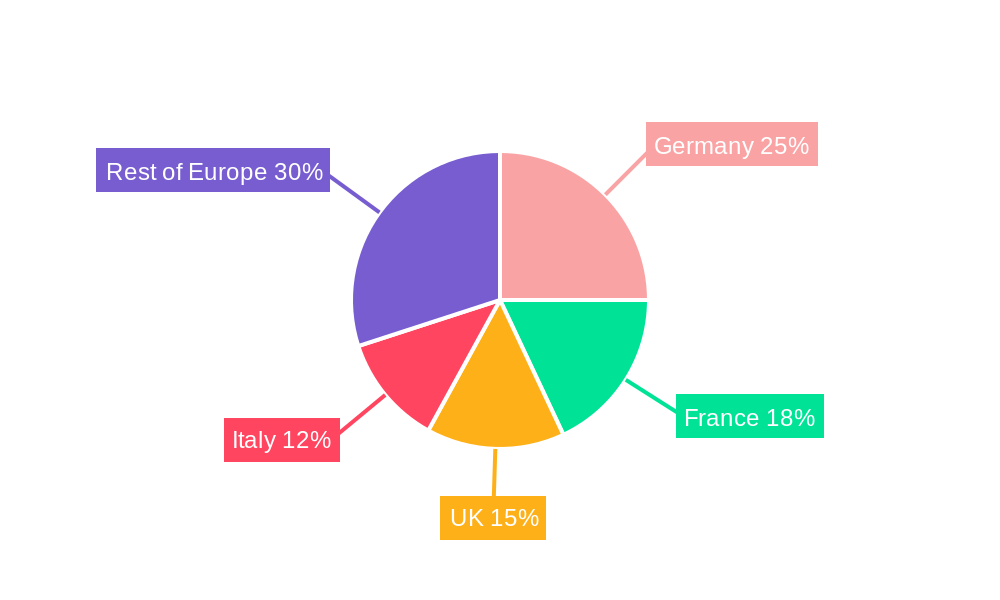

The projected Compound Annual Growth Rate (CAGR) of 4.41% from 2025 to 2033 signifies consistent market expansion. This growth is expected to be particularly strong in key European markets like Germany, France, the United Kingdom, and Italy, which collectively account for a significant share of the overall market. However, regional variations in economic growth and regulatory landscapes will influence growth trajectories within individual countries. The market's future hinges on adapting to evolving client needs, navigating regulatory hurdles, and leveraging technological advancements to enhance efficiency and deliver exceptional client experiences. The continued focus on sustainability and responsible investing will also shape the future landscape of the European wealth management industry.

Wealth Management Industry in Europe Company Market Share

Wealth Management Industry in Europe: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the European wealth management industry, covering market dynamics, key trends, leading players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry stakeholders, investors, and strategic decision-makers. The report analyzes the market across various segments, including by client type (HNWIs, retail/individuals, mass affluent, other) and wealth management firm (private bankers, family offices, other). Key players such as Allianz, Schroders PLC, UBS Group, HSBC Holdings, Amundi, AXA Group, BNP Paribas, Aegon N.V., Credit Suisse, and Legal & General are profiled, although the list is not exhaustive. The report uses real-world examples, including the failed UBS/Wealthfront acquisition and Legal & General's ONIX platform launch, to illustrate market developments. Expected market size and CAGR figures are included, providing a robust forecast for future growth. Download now to unlock crucial data and actionable intelligence for success in this dynamic market.

Wealth Management Industry in Europe Market Concentration & Dynamics

The European wealth management market is characterized by a **moderately concentrated structure**, with a discernible presence of large, established institutions alongside a vibrant ecosystem of specialized firms. While a select group of leading players commands a significant portion of the market value – with the top 10 firms estimated to hold approximately **[Insert Estimated Percentage]%** of the total market value by 2025 – the competitive landscape remains dynamic. This concentration is primarily attributable to the advantages of economies of scale, the enduring strength of brand recognition, and the extensive global reach of these dominant entities. Concurrently, a multitude of smaller, agile firms thrive by carving out expertise in niche segments, catering to specific client needs and investment preferences.

- Market Share Evolution: The top 5 players are estimated to hold around **[Insert Estimated Percentage]%** of the market share in 2025, indicating a continued concentration at the very top tier.

- M&A Activity & Consolidation: The period between 2019 and 2024 saw **[Insert Number]** significant mergers and acquisitions, underscoring a persistent trend of industry consolidation. The notable termination of the UBS/Wealthfront deal in 2022 serves as a salient example, illustrating the complex interplay of strategic objectives, technological integration challenges, and valuation considerations inherent in such transactions, while also highlighting the ongoing opportunities for strategic partnerships and acquisitions.

- Innovation Ecosystems & Digital Transformation: Rapid advancements in financial technology (Fintech) are a primary catalyst for innovation, birthing novel digital platforms and sophisticated wealth management solutions. While robust regulatory frameworks are in place to ensure client protection and market integrity, they also present a nuanced environment that can influence the pace of innovation and the ease of market entry for new participants.

- Rise of Substitute & Complementary Solutions: The burgeoning popularity of robo-advisors and other automated investment management solutions represents a significant competitive force, compelling traditional wealth management firms to adapt and integrate technology-driven offerings into their service models.

- Evolving End-User Demands: A growing emphasis on highly personalized financial advice, a strong and increasing demand for ESG (Environmental, Social, and Governance) compliant investment options, and a clear preference for seamless digital wealth management experiences are fundamentally reshaping market dynamics and client expectations.

Wealth Management Industry in Europe Industry Insights & Trends

The European wealth management sector is experiencing a period of robust expansion, propelled by a confluence of significant growth drivers. The total market size is projected to reach an impressive **€[Insert Estimated Market Size] Million** by 2025, forecasting a Compound Annual Growth Rate (CAGR) of **[Insert Estimated CAGR]%** between 2025 and 2033. This upward trajectory is primarily fueled by rising global affluence, particularly evident within the High Net Worth Individual (HNWI) and mass affluent segments, an increasing appetite for sophisticated and tailored financial products, and the pervasive influence of technological advancements. However, the industry must navigate potential headwinds stemming from geopolitical instability, economic volatility, and the ever-evolving regulatory landscape. Technological disruptions, including the strategic adoption of Artificial Intelligence (AI) and blockchain technology, are actively reshaping operational models and service delivery. Furthermore, consumer behavior is undergoing a marked transformation, with a pronounced shift towards digital engagement, a heightened expectation for bespoke advisory services, and a strong demand for transparent and understandable fee structures.

Key Markets & Segments Leading Wealth Management Industry in Europe

The UK and Germany represent the largest markets within Europe, while Switzerland and Luxembourg are significant wealth management hubs. Within client segments, HNWIs contribute the most to market revenue, followed by mass affluent individuals. Private banks currently dominate the market share, followed by other wealth management firms.

Key Drivers:

- HNWIs: High net-worth individuals drive market growth due to their significant investable assets and demand for personalized services.

- UK & Germany: Strong economies, established financial centers, and a large population of high-net-worth individuals contribute to market dominance.

- Technological advancements: AI-powered solutions and robo-advisors improve efficiency and access to wealth management services.

Dominance Analysis:

Private banks hold a larger market share due to their established client base, comprehensive service offerings, and experienced professionals. However, the emergence of family offices and other specialized firms is gradually challenging this dominance.

Wealth Management Industry in Europe Product Developments

Recent innovations include the development of sophisticated investment platforms, enhanced digital advisory tools, and the integration of ESG factors into investment strategies. These advancements enhance client experience, improve efficiency, and broaden market reach. The competitive edge lies in offering personalized, technology-driven services catering to evolving client needs and preferences.

Challenges in the Wealth Management Industry in Europe Market

The wealth management industry in Europe is navigating a complex terrain fraught with several critical challenges. These include the ever-increasing intensity of regulatory scrutiny, which necessitates substantial compliance efforts and can lead to higher operational costs. Intense competition from both established players and agile new entrants, including disruptive FinTech firms, is a constant pressure point. The imperative to adapt rapidly to transformative technological changes, such as the integration of AI and advanced data analytics, requires significant investment and strategic foresight. Moreover, the persistent threat of cybersecurity breaches and the stringent demands of data privacy regulations (like GDPR) present significant operational hurdles, potentially impacting profitability and client trust if not managed effectively.

Forces Driving Wealth Management Industry in Europe Growth

Technological advancements, particularly in AI and digitalization, are driving growth by improving efficiency, enhancing client experiences, and expanding market access. Favorable economic conditions in certain European countries also contribute to increased wealth accumulation and demand for wealth management services. Relaxed regulations in specific areas might further accelerate growth.

Long-Term Growth Catalysts in the Wealth Management Industry in Europe

Long-term growth will be fueled by innovations in wealth management technology, strategic partnerships with fintech companies, and expansion into new markets within and outside Europe. The focus on ESG investing and sustainable finance will also become a major growth driver in the coming years.

Emerging Opportunities in Wealth Management Industry in Europe

Emerging opportunities lie in tapping into the growing millennial and Gen Z wealth segments, developing personalized investment solutions incorporating ESG criteria, and leveraging blockchain technology for enhanced security and efficiency. Expansion into emerging markets within Europe, with potential in Southern and Eastern Europe, also presents significant opportunities.

Leading Players in the Wealth Management Industry in Europe Sector

Key Milestones in Wealth Management Industry in Europe Industry

- September 2022: The termination of the proposed acquisition deal between UBS and Wealthfront underscored the complexities involved in merging diverse business models, technological infrastructures, and client bases within the wealth management sphere, serving as a case study for future M&A considerations.

- 2021: Legal & General's successful launch of its next-generation ONIX platform exemplified a strategic commitment to digital transformation, aiming to enhance client experience through intuitive online services and streamlined digital interactions.

Strategic Outlook for Wealth Management Industry in Europe Market

The European wealth management industry is strategically positioned for sustained and significant growth. This optimistic outlook is underpinned by continued technological innovation, the persistent rise in global affluence, and the dynamic evolution of client preferences. Firms that can adeptly leverage cutting-edge technology, deliver highly personalized client experiences, and demonstrate agility in adapting to the evolving regulatory framework will be best placed for success. A strategic focus on expanding offerings in ESG investing and actively targeting underserved market segments are identified as crucial pillars for achieving enduring competitive advantage and long-term market leadership.

Wealth Management Industry in Europe Segmentation

-

1. Client Type

- 1.1. HNWIs

- 1.2. Retail/ Individuals

- 1.3. Mass Affluent

- 1.4. Other Client Types

-

2. Wealth Management Firm

- 2.1. Private Bankers

- 2.2. Family Offices

- 2.3. Other Wealth Management Firms

Wealth Management Industry in Europe Segmentation By Geography

- 1. Italy

- 2. Germany

- 3. France

- 4. United Kingdom

- 5. Rest of Europe

Wealth Management Industry in Europe Regional Market Share

Geographic Coverage of Wealth Management Industry in Europe

Wealth Management Industry in Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.41% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Guaranteed Protection Drives The Market

- 3.3. Market Restrains

- 3.3.1. Long and Costly Legal Procedures

- 3.4. Market Trends

- 3.4.1. Growth In Millionaire Wealth Leading to the European Wealth Management Market Uptrend

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Wealth Management Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Client Type

- 5.1.1. HNWIs

- 5.1.2. Retail/ Individuals

- 5.1.3. Mass Affluent

- 5.1.4. Other Client Types

- 5.2. Market Analysis, Insights and Forecast - by Wealth Management Firm

- 5.2.1. Private Bankers

- 5.2.2. Family Offices

- 5.2.3. Other Wealth Management Firms

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italy

- 5.3.2. Germany

- 5.3.3. France

- 5.3.4. United Kingdom

- 5.3.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Client Type

- 6. Italy Wealth Management Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Client Type

- 6.1.1. HNWIs

- 6.1.2. Retail/ Individuals

- 6.1.3. Mass Affluent

- 6.1.4. Other Client Types

- 6.2. Market Analysis, Insights and Forecast - by Wealth Management Firm

- 6.2.1. Private Bankers

- 6.2.2. Family Offices

- 6.2.3. Other Wealth Management Firms

- 6.1. Market Analysis, Insights and Forecast - by Client Type

- 7. Germany Wealth Management Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Client Type

- 7.1.1. HNWIs

- 7.1.2. Retail/ Individuals

- 7.1.3. Mass Affluent

- 7.1.4. Other Client Types

- 7.2. Market Analysis, Insights and Forecast - by Wealth Management Firm

- 7.2.1. Private Bankers

- 7.2.2. Family Offices

- 7.2.3. Other Wealth Management Firms

- 7.1. Market Analysis, Insights and Forecast - by Client Type

- 8. France Wealth Management Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Client Type

- 8.1.1. HNWIs

- 8.1.2. Retail/ Individuals

- 8.1.3. Mass Affluent

- 8.1.4. Other Client Types

- 8.2. Market Analysis, Insights and Forecast - by Wealth Management Firm

- 8.2.1. Private Bankers

- 8.2.2. Family Offices

- 8.2.3. Other Wealth Management Firms

- 8.1. Market Analysis, Insights and Forecast - by Client Type

- 9. United Kingdom Wealth Management Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Client Type

- 9.1.1. HNWIs

- 9.1.2. Retail/ Individuals

- 9.1.3. Mass Affluent

- 9.1.4. Other Client Types

- 9.2. Market Analysis, Insights and Forecast - by Wealth Management Firm

- 9.2.1. Private Bankers

- 9.2.2. Family Offices

- 9.2.3. Other Wealth Management Firms

- 9.1. Market Analysis, Insights and Forecast - by Client Type

- 10. Rest of Europe Wealth Management Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Client Type

- 10.1.1. HNWIs

- 10.1.2. Retail/ Individuals

- 10.1.3. Mass Affluent

- 10.1.4. Other Client Types

- 10.2. Market Analysis, Insights and Forecast - by Wealth Management Firm

- 10.2.1. Private Bankers

- 10.2.2. Family Offices

- 10.2.3. Other Wealth Management Firms

- 10.1. Market Analysis, Insights and Forecast - by Client Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Allianz

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sachroders PLC**List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 UBS Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 HSBC Holdings

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Amundi

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AXA Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BNP Paribas

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Aegon N V

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Credit Suisse

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Legal and General

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Allianz

List of Figures

- Figure 1: Wealth Management Industry in Europe Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Wealth Management Industry in Europe Share (%) by Company 2025

List of Tables

- Table 1: Wealth Management Industry in Europe Revenue Million Forecast, by Client Type 2020 & 2033

- Table 2: Wealth Management Industry in Europe Revenue Million Forecast, by Wealth Management Firm 2020 & 2033

- Table 3: Wealth Management Industry in Europe Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Wealth Management Industry in Europe Revenue Million Forecast, by Client Type 2020 & 2033

- Table 5: Wealth Management Industry in Europe Revenue Million Forecast, by Wealth Management Firm 2020 & 2033

- Table 6: Wealth Management Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Wealth Management Industry in Europe Revenue Million Forecast, by Client Type 2020 & 2033

- Table 8: Wealth Management Industry in Europe Revenue Million Forecast, by Wealth Management Firm 2020 & 2033

- Table 9: Wealth Management Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Wealth Management Industry in Europe Revenue Million Forecast, by Client Type 2020 & 2033

- Table 11: Wealth Management Industry in Europe Revenue Million Forecast, by Wealth Management Firm 2020 & 2033

- Table 12: Wealth Management Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Wealth Management Industry in Europe Revenue Million Forecast, by Client Type 2020 & 2033

- Table 14: Wealth Management Industry in Europe Revenue Million Forecast, by Wealth Management Firm 2020 & 2033

- Table 15: Wealth Management Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Wealth Management Industry in Europe Revenue Million Forecast, by Client Type 2020 & 2033

- Table 17: Wealth Management Industry in Europe Revenue Million Forecast, by Wealth Management Firm 2020 & 2033

- Table 18: Wealth Management Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wealth Management Industry in Europe?

The projected CAGR is approximately 4.41%.

2. Which companies are prominent players in the Wealth Management Industry in Europe?

Key companies in the market include Allianz, Sachroders PLC**List Not Exhaustive, UBS Group, HSBC Holdings, Amundi, AXA Group, BNP Paribas, Aegon N V, Credit Suisse, Legal and General.

3. What are the main segments of the Wealth Management Industry in Europe?

The market segments include Client Type, Wealth Management Firm.

4. Can you provide details about the market size?

The market size is estimated to be USD 43.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Guaranteed Protection Drives The Market.

6. What are the notable trends driving market growth?

Growth In Millionaire Wealth Leading to the European Wealth Management Market Uptrend.

7. Are there any restraints impacting market growth?

Long and Costly Legal Procedures.

8. Can you provide examples of recent developments in the market?

September 2022: UBS was set to acquire the Millennial and Gen Z-focused Wealthfront. UBS and wealth management platform Wealthfront have pulled out of a proposed acquisition deal.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wealth Management Industry in Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wealth Management Industry in Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wealth Management Industry in Europe?

To stay informed about further developments, trends, and reports in the Wealth Management Industry in Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence