Key Insights

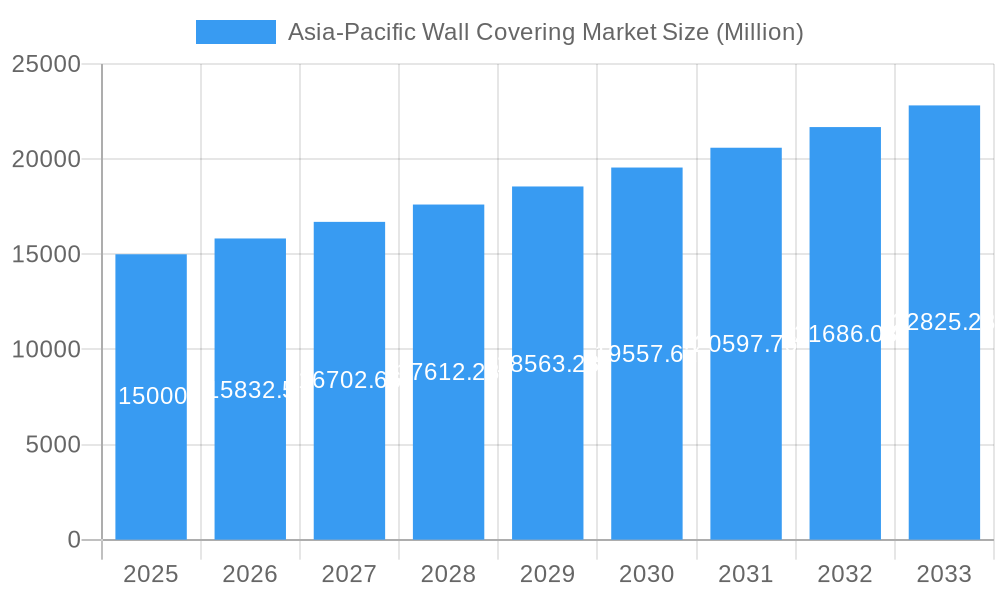

The Asia-Pacific wall covering market, comprising wallpaper, wall panels, metal wall coverings, and ceramic tiles, is poised for significant expansion. With a projected cagr: 5.2, the market is expected to reach market size: 6743 million by base year: 2025. This robust growth is propelled by increasing urbanization and rising disposable incomes across the region, particularly in developing economies. Consumers are increasingly prioritizing aesthetic appeal and durability in their home and commercial space renovations, driving demand for high-quality, innovative wall covering solutions. The burgeoning e-commerce sector further enhances market accessibility and product variety. Key market segments include product type, distribution channel (specialty stores, home centers, e-commerce), and application (residential and commercial). Major contributors to market growth include China, Japan, India, and South Korea, each influenced by distinct local preferences and economic dynamics.

Asia-Pacific Wall Covering Market Market Size (In Billion)

Despite challenges such as raw material price volatility and economic fluctuations, the market's long-term outlook remains positive. Growing construction sector activity, continued urbanization, and evolving consumer preferences for enhanced living and working space aesthetics are key drivers. Sustainability is also becoming a critical factor, encouraging manufacturers to adopt eco-friendly production methods. Intense competition necessitates continuous innovation and strategic marketing to secure market share. The dynamic construction landscape across Asia-Pacific nations will continue to shape demand, offering substantial opportunities for market participants.

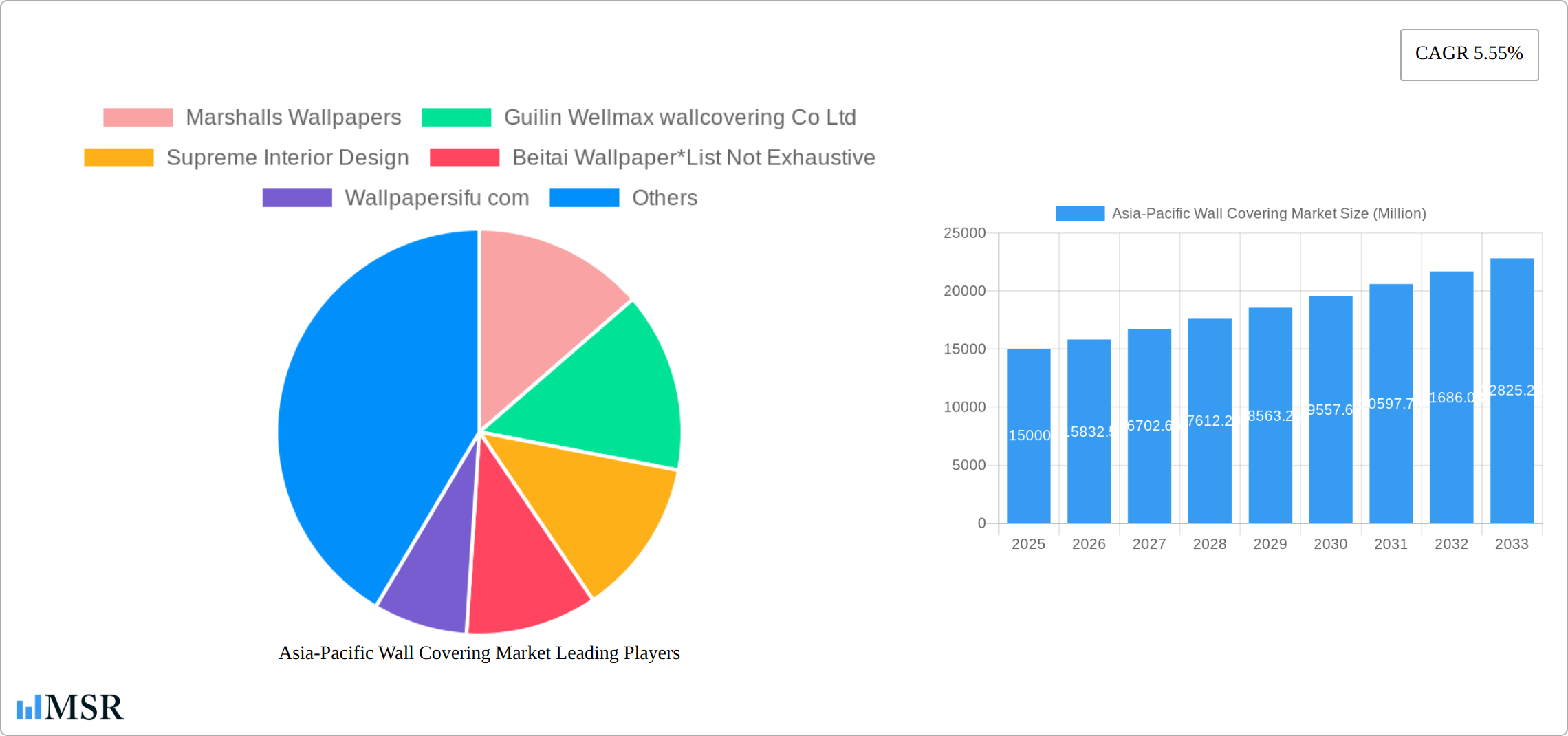

Asia-Pacific Wall Covering Market Company Market Share

Asia-Pacific Wall Covering Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia-Pacific wall covering market, encompassing market size, growth drivers, key players, and future trends. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. This report is essential for industry stakeholders, investors, and businesses seeking to understand and capitalize on the opportunities within this dynamic market. The market is segmented by product (wallpaper, wall panel, metal wall coverings, ceramic tile, other products), distribution channel (specialty store, home center, building material dealer, furniture store, mass merchandiser, e-commerce), application (residential, commercial), and country (China, Japan, India, Malaysia, South Korea, Rest of Asia Pacific). Key players analyzed include Marshalls Wallpapers, Guilin Wellmax wallcovering Co Ltd, Supreme Interior Design, Beitai Wallpaper, Wallpapersifu.com, Elegant Haus International, Sungreen Co Ltd, Ritz Wallcovering Sdn Bhd, JC Maison Malaysia, LAMEX Wall, Shinhan Wallcoverings Co Ltd, Guangdong Yulan Group Co Ltd, and A S Création (A S Création Tapeten AG). The report projects a market value of xx Million by 2033.

Asia-Pacific Wall Covering Market Market Concentration & Dynamics

The Asia-Pacific wall covering market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the presence of numerous smaller companies and the continuous entry of new players indicate a dynamic competitive environment. The market's innovation ecosystem is vibrant, with ongoing research and development focused on sustainable materials, advanced printing technologies, and innovative designs. Regulatory frameworks, varying across countries, influence material standards and environmental compliance. Substitute products, such as paint and textured plaster, exert competitive pressure. End-user trends reflect a growing preference for eco-friendly and customizable options. Mergers and acquisitions (M&A) activity is moderate, with approximately xx M&A deals recorded between 2019 and 2024.

- Market Share: Top 5 players hold approximately xx% of the market share (2024).

- M&A Activity: An average of xx M&A deals per year were observed during the historical period.

- Innovation: Focus on sustainable materials and digital printing technologies is driving innovation.

- Regulatory Landscape: Varies significantly across different Asia-Pacific countries impacting material standards.

Asia-Pacific Wall Covering Market Industry Insights & Trends

The Asia-Pacific wall covering market is experiencing robust growth, fueled by rising disposable incomes, rapid urbanization, and a surge in demand for home improvement and interior design. Market valuation reached xx Million in 2024 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%. This expansion is driven by several key factors: technological advancements such as digital printing and smart wall coverings; evolving consumer preferences for personalized and sustainable products; and the increasing accessibility of online retail channels. However, challenges remain, including fluctuating raw material prices and supply chain vulnerabilities. The market's trajectory is shaped by a dynamic interplay of these growth drivers and persistent headwinds.

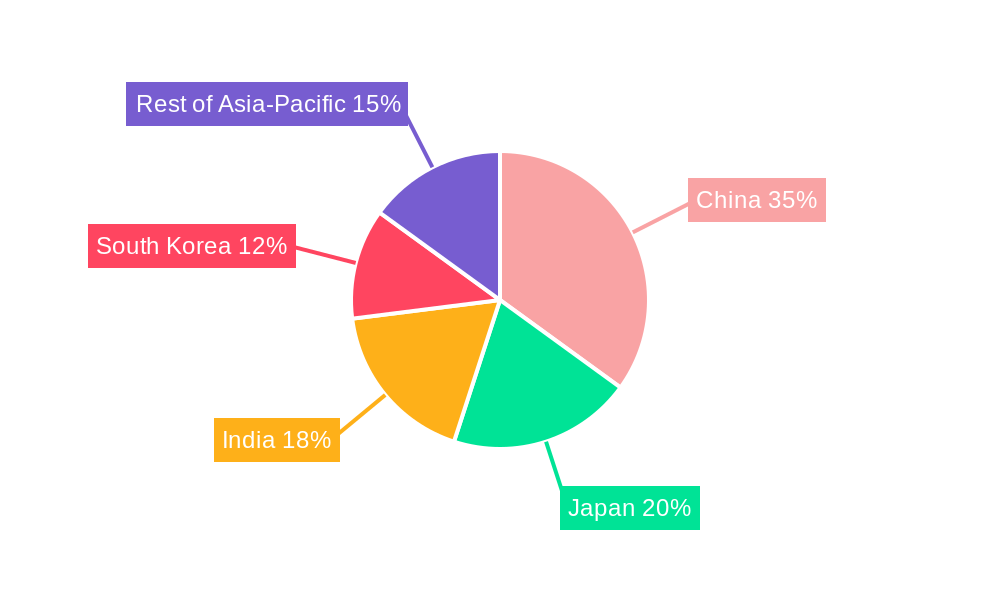

Key Markets & Segments Leading Asia-Pacific Wall Covering Market

China remains the dominant force in the Asia-Pacific wall covering market, benefiting from strong economic growth, extensive construction projects, and a burgeoning middle class with increased spending power. Japan and India represent substantial and rapidly developing markets, each with unique characteristics shaping their respective growth trajectories.

Key Geographic Regions:

- China: The largest market, fueled by high construction activity and a growing affluent consumer base.

- Japan: A mature market characterized by a preference for high-quality, aesthetically-driven wall coverings.

- India: Experiencing rapid expansion driven by urbanization, rising disposable incomes, and a burgeoning demand for home improvement.

- Other Notable Markets: Significant growth potential exists in other Southeast Asian nations, driven by factors such as increasing tourism and foreign investment.

Leading Product Segments:

- Wallpaper: Continues to dominate the market, benefiting from diverse design options and affordability.

- Wall Panels: Growing in popularity due to durability, ease of installation, and potential for unique aesthetic effects.

- Other Specialized Coverings: The market is witnessing the introduction of innovative materials and designs catering to specific needs and preferences.

Dominant Distribution Channels:

- Specialty Stores and Home Improvement Centers: Remain the primary channels, offering personalized consultations and product displays.

- E-commerce Platforms: Experiencing rapid growth, offering increased convenience and wider product selection.

Primary Applications:

- Residential: The largest segment, driven by increasing homeownership and renovation activity.

- Commercial: Growing demand from hotels, offices, and retail spaces, emphasizing durability and ease of maintenance.

Growth Catalysts:

- Sustained economic growth in key markets.

- Accelerated urbanization and infrastructure development.

- Increased disposable incomes and preference for home improvements.

- Rising popularity of customized and eco-friendly wall coverings.

- Government initiatives promoting sustainable construction practices.

Asia-Pacific Wall Covering Market Product Developments

Innovation is a key driver in the Asia-Pacific wall covering market. Recent advancements include sustainable materials like bamboo and recycled fibers, high-resolution digital printing techniques offering intricate designs, and smart functionalities such as sound absorption and temperature regulation. These innovations provide significant competitive advantages, catering to environmentally conscious consumers and enhancing product functionality. Furthermore, new applications are continuously emerging, particularly within the commercial sector, focusing on enhanced durability and simplified maintenance solutions. The integration of technology is rapidly changing the landscape, presenting numerous opportunities for growth and diversification.

Challenges in the Asia-Pacific Wall Covering Market Market

The Asia-Pacific wall covering market faces challenges including fluctuating raw material prices, supply chain disruptions impacting production timelines and costs, and intense competition among various players leading to price wars and reduced profit margins. Regulatory compliance requirements across diverse markets also add complexity and cost. These factors have resulted in a xx% decrease in profitability for some players in 2024.

Forces Driving Asia-Pacific Wall Covering Market Growth

The Asia-Pacific wall covering market's growth is driven by a confluence of factors: robust economic growth in several key nations, increased infrastructure development projects, and a growing consumer preference for home renovation and interior design. Government policies encouraging sustainable construction practices further bolster market expansion. These elements create a positive environment for continued growth, provided challenges related to sustainability and supply chain resilience are effectively managed.

Challenges in the Asia-Pacific Wall Covering Market Market

Long-term growth will depend on adapting to evolving consumer preferences, fostering innovation in sustainable materials and designs, and strategic partnerships to expand market reach. Investments in research and development are vital for developing advanced and environmentally friendly wall coverings.

Emerging Opportunities in Asia-Pacific Wall Covering Market

Emerging opportunities include the growing demand for eco-friendly and customizable wall coverings, expansion into the commercial sector particularly in healthcare and hospitality, and the development of smart wall coverings with integrated technology. Further penetration into untapped markets within the region offers significant growth potential.

Leading Players in the Asia-Pacific Wall Covering Market Sector

- Marshalls Wallpapers

- Guilin Wellmax wallcovering Co Ltd

- Supreme Interior Design

- Beitai Wallpaper

- Wallpapersifu.com

- Elegant Haus International

- Sungreen Co Ltd

- Ritz Wallcovering Sdn Bhd

- JC Maison Malaysia

- LAMEX Wall

- Shinhan Wallcoverings Co Ltd

- Guangdong Yulan Group Co Ltd

- A S Création (A S Création Tapeten AG)

Key Milestones in Asia-Pacific Wall Covering Market Industry

- 2020: Introduction of several eco-friendly wallpaper lines by major players.

- 2022: Significant investment in digital printing technology by a leading manufacturer.

- 2023: Acquisition of a smaller company specializing in metal wall coverings by a major player.

- 2024: Launch of a new line of smart wall coverings with integrated lighting by a major company.

Strategic Outlook for Asia-Pacific Wall Covering Market Market

The Asia-Pacific wall covering market holds significant long-term growth potential. Strategic opportunities lie in focusing on sustainable materials, incorporating smart features, expanding e-commerce channels, and targeting niche markets. Companies that adapt to evolving consumer preferences and invest in innovation will be best positioned to capitalize on future opportunities.

Asia-Pacific Wall Covering Market Segmentation

-

1. Product

- 1.1. Wallpaper

- 1.2. Wallpanel

- 1.3. Metal Wall Coverings

- 1.4. Ceramic Tile

- 1.5. Other Products

-

2. Distribution Channel

- 2.1. Specialty Store

- 2.2. Home Centre

- 2.3. Building Material Dealer

- 2.4. Furniture Store

- 2.5. Mass Merchandizer

- 2.6. e-Commerce

-

3. Application

- 3.1. Residential

- 3.2. Commercial

Asia-Pacific Wall Covering Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Wall Covering Market Regional Market Share

Geographic Coverage of Asia-Pacific Wall Covering Market

Asia-Pacific Wall Covering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand for Home Furnishing

- 3.3. Market Restrains

- 3.3.1. ; High Inventory Costs and Premium Pricing

- 3.4. Market Trends

- 3.4.1. Residential Sector is Expected to Register a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Wall Covering Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Wallpaper

- 5.1.2. Wallpanel

- 5.1.3. Metal Wall Coverings

- 5.1.4. Ceramic Tile

- 5.1.5. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Specialty Store

- 5.2.2. Home Centre

- 5.2.3. Building Material Dealer

- 5.2.4. Furniture Store

- 5.2.5. Mass Merchandizer

- 5.2.6. e-Commerce

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Marshalls Wallpapers

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Guilin Wellmax wallcovering Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Supreme Interior Design

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Beitai Wallpaper*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Wallpapersifu com

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Elegant Haus International

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sungreen Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ritz Wallcovering Sdn Bhd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 JC Maison Malaysia

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LAMEX Wall

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Shinhan Wallcoverings Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Guangdong Yulan Group Co Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 A S Création (A S Création Tapeten AG)

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Marshalls Wallpapers

List of Figures

- Figure 1: Asia-Pacific Wall Covering Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Wall Covering Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Wall Covering Market Revenue million Forecast, by Product 2020 & 2033

- Table 2: Asia-Pacific Wall Covering Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Asia-Pacific Wall Covering Market Revenue million Forecast, by Application 2020 & 2033

- Table 4: Asia-Pacific Wall Covering Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Wall Covering Market Revenue million Forecast, by Product 2020 & 2033

- Table 6: Asia-Pacific Wall Covering Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 7: Asia-Pacific Wall Covering Market Revenue million Forecast, by Application 2020 & 2033

- Table 8: Asia-Pacific Wall Covering Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: China Asia-Pacific Wall Covering Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia-Pacific Wall Covering Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia-Pacific Wall Covering Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: India Asia-Pacific Wall Covering Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia-Pacific Wall Covering Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: New Zealand Asia-Pacific Wall Covering Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Indonesia Asia-Pacific Wall Covering Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Malaysia Asia-Pacific Wall Covering Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Singapore Asia-Pacific Wall Covering Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Thailand Asia-Pacific Wall Covering Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Vietnam Asia-Pacific Wall Covering Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Philippines Asia-Pacific Wall Covering Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Wall Covering Market?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the Asia-Pacific Wall Covering Market?

Key companies in the market include Marshalls Wallpapers, Guilin Wellmax wallcovering Co Ltd, Supreme Interior Design, Beitai Wallpaper*List Not Exhaustive, Wallpapersifu com, Elegant Haus International, Sungreen Co Ltd, Ritz Wallcovering Sdn Bhd, JC Maison Malaysia, LAMEX Wall, Shinhan Wallcoverings Co Ltd, Guangdong Yulan Group Co Ltd, A S Création (A S Création Tapeten AG).

3. What are the main segments of the Asia-Pacific Wall Covering Market?

The market segments include Product, Distribution Channel, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 6743 million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand for Home Furnishing.

6. What are the notable trends driving market growth?

Residential Sector is Expected to Register a Significant Growth.

7. Are there any restraints impacting market growth?

; High Inventory Costs and Premium Pricing.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Wall Covering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Wall Covering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Wall Covering Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Wall Covering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence