Key Insights

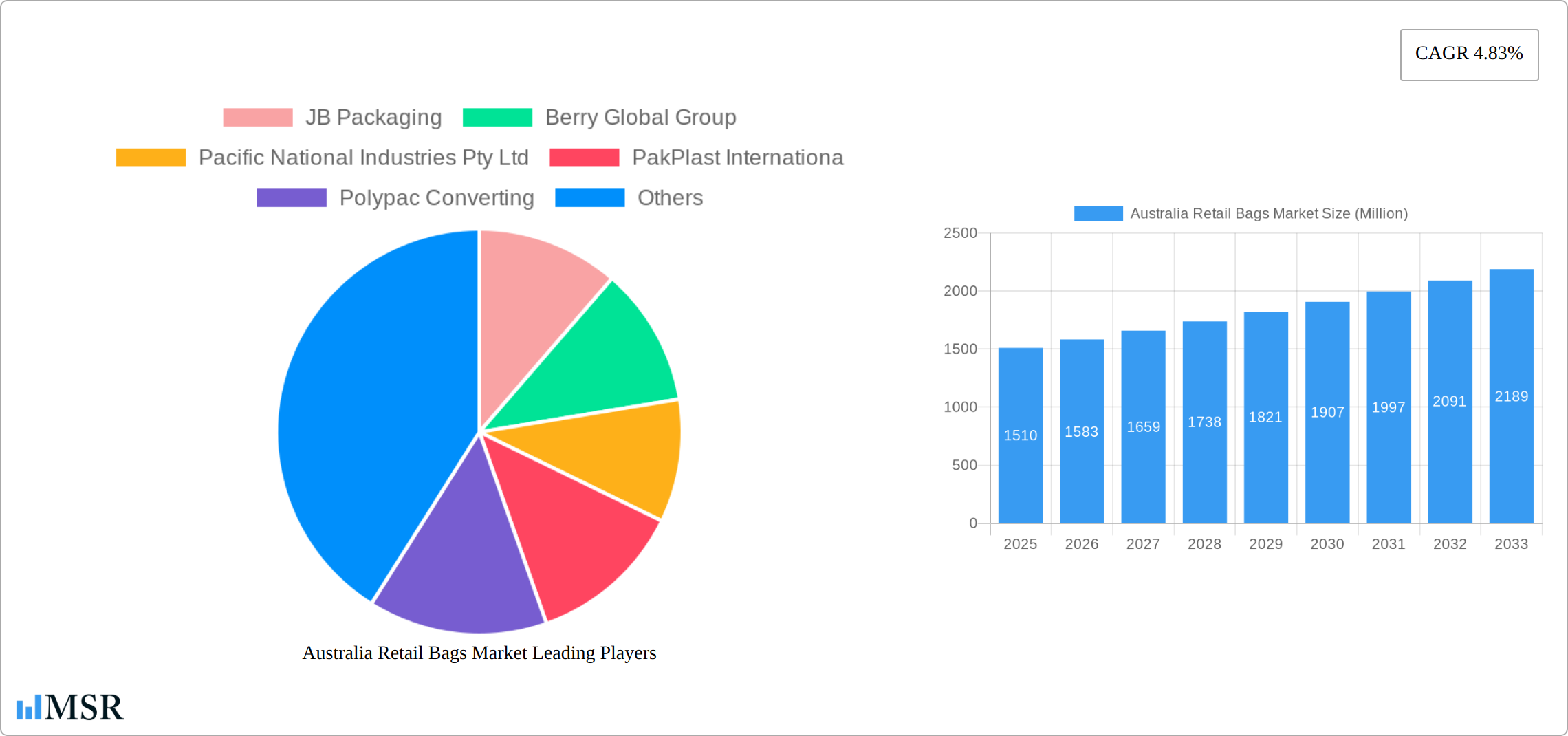

The Australian retail bags market, valued at approximately AU$1.51 billion in 2025, is projected to experience steady growth, driven by a rising e-commerce sector and increasing consumer demand for convenient and sustainable packaging solutions. A compound annual growth rate (CAGR) of 4.83% is anticipated from 2025 to 2033, indicating a substantial market expansion. Growth is fueled by the increasing popularity of online shopping, leading to a higher demand for delivery bags. Furthermore, the growing awareness of environmental concerns is pushing the adoption of eco-friendly alternatives, such as biodegradable paper and natural fabric bags, while simultaneously driving innovation in recyclable plastics like rPET. This shift towards sustainability is likely to reshape the market landscape, favoring companies that offer innovative and environmentally responsible solutions. However, fluctuations in raw material prices and stringent government regulations regarding plastic usage could pose challenges to market growth. The market segmentation reveals a significant share held by the foodservice and grocery sectors, with industrial and hospitality segments also contributing substantially. Leading players such as JB Packaging, Berry Global Group, and Pacific National Industries Pty Ltd are likely to continue dominating the market through strategic partnerships, product diversification, and expansion of their distribution networks.

Australia Retail Bags Market Market Size (In Billion)

The competitive landscape is characterized by both established players and emerging businesses vying for market share. Smaller companies focusing on niche markets, such as specialized reusable bags or custom-printed options, are finding success by catering to specific customer needs. The projected growth presents opportunities for both established and emerging players to innovate and capitalize on the increasing demand for sustainable and efficient retail packaging solutions, particularly catering to the growth in e-commerce and the heightened focus on environmentally friendly practices. The forecast period will see further refinement of product offerings, with a strong emphasis on recyclable and biodegradable materials.

Australia Retail Bags Market Company Market Share

Australia Retail Bags Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Australia retail bags market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market size, growth drivers, emerging trends, and competitive landscapes. The report leverages extensive primary and secondary research, incorporating data on key players like JB Packaging, Berry Global Group, Pacific National Industries Pty Ltd, PakPlast International, Polypac Converting, Detmold Group, Gispac, United Paper, PrimePac, and Bag People Australia, to deliver actionable strategic recommendations.

Australia Retail Bags Market Market Concentration & Dynamics

The Australian retail bags market exhibits a moderately concentrated structure, with a handful of major players controlling a significant market share. However, the presence of numerous smaller, specialized companies also contributes to a competitive landscape. Innovation is driven by sustainability concerns, leading to increased adoption of eco-friendly materials such as recycled paper and rPET. Stringent Australian regulations on plastic waste management are shaping market dynamics, pushing manufacturers to adopt more sustainable packaging solutions. Substitute products, such as reusable bags and online delivery systems, exert a degree of pressure, particularly within the grocery sector. End-user trends, including a growing emphasis on convenience and sustainability, influence material selection and packaging design.

- Market Share: Top 5 players hold approximately xx% of the market.

- M&A Activity: A total of xx M&A deals were recorded during the historical period (2019-2024).

- Innovation Ecosystem: Strong focus on sustainable and recyclable materials.

- Regulatory Framework: Increasingly stringent regulations on plastic waste.

- Substitute Products: Reusable bags and online delivery services pose some competitive pressure.

Australia Retail Bags Market Industry Insights & Trends

The Australian retail bags market is experiencing steady growth, fueled by a robust economy, expanding retail sector, and increasing consumer spending. The market size in 2025 is estimated at AU$ xx Million, exhibiting a CAGR of xx% during the forecast period (2025-2033). Technological advancements, particularly in material science and automation, are driving efficiency gains and creating new product possibilities. Consumer behavior shifts towards sustainability are significantly impacting the demand for eco-friendly bag options. E-commerce growth also plays a role, with increasing demand for packaging suitable for online delivery.

Key Markets & Segments Leading Australia Retail Bags Market

The Grocery end-user industry segment currently dominates the Australian retail bags market, accounting for approximately xx% of the total market value. The Plastic segment, particularly HDPE, LDPE, and PP, holds the largest share of the material segment, although the share of paper and natural fabrics is growing rapidly.

By Material:

- Plastic (HDPE, LDPE, PP, rPET, etc.): Dominates due to cost-effectiveness and versatility. Growth is challenged by sustainability concerns.

- Paper and Natural Fabric: Experiencing significant growth driven by consumer demand for sustainable options and regulatory pressure.

By End-user Industry:

- Grocery: Largest segment driven by high volume consumption and ongoing demand for efficient packaging.

- Foodservice: Steady growth fueled by the restaurant and takeaway industry.

- Industrial: Stable demand driven by a diversified range of packaging needs.

- Hospitality: Growth aligned with tourism and hotel industry trends.

Drivers:

- Strong economic growth.

- Expansion of the retail sector.

- Increasing consumer spending.

- Government initiatives promoting sustainability.

Australia Retail Bags Market Product Developments

Significant product innovations focus on enhanced sustainability and improved functionality. The introduction of recyclable paper bags by Visy (March 2024) exemplifies this trend. Manufacturers are actively incorporating recycled materials, biodegradable polymers, and compostable options. Technological advancements in printing and packaging machinery are also enhancing production efficiency and design capabilities, driving competitive differentiation.

Challenges in the Australia Retail Bags Market Market

The Australian retail bags market faces challenges from fluctuating raw material prices, increasing transportation costs, and the competitive pressure of substitute products. Stringent environmental regulations impose compliance costs, while supply chain disruptions can impact production and delivery schedules. This is also influenced by the availability of appropriate recycled materials and the need to balance cost with sustainability.

Forces Driving Australia Retail Bags Market Growth

Key growth drivers include increasing consumer demand for sustainable packaging, supportive government policies promoting recycling and waste reduction, and technological advancements in bag manufacturing. The expanding e-commerce sector also creates new market opportunities for specialized packaging solutions. Furthermore, the rise in consumer awareness of environmental issues further boosts the growth.

Long-Term Growth Catalysts in Australia Retail Bags Market

Long-term growth will be fuelled by continued innovation in sustainable materials, such as bioplastics and compostable polymers, and strategic partnerships between manufacturers and retailers to promote eco-friendly packaging options. Expansion into new market segments, such as specialized retail niches and the burgeoning online grocery market, will also drive long-term expansion.

Emerging Opportunities in Australia Retail Bags Market

Despite the challenges, the Australian retail bags market is ripe with emerging opportunities. The undeniable consumer and regulatory drive towards environmental responsibility fuels a robust demand for innovative, sustainable bag solutions. This includes significant growth potential in compostable and biodegradable alternatives made from plant-based materials, which cater to a conscious consumer base. Advancements in lightweighting technologies offer a dual benefit: reducing material usage, thereby lowering production and transportation costs, and enhancing the overall sustainability profile of the bags. The market also presents compelling avenues for expansion into niche markets requiring specialized packaging, such as premium retail, e-commerce fulfillment, or specific food service applications. Developing and promoting reusable bag solutions, particularly those with enhanced durability and aesthetic appeal, represents another key growth area as consumer habits shift. Furthermore, embracing circular economy principles, such as designing bags for easier recycling and promoting take-back schemes, can create unique market advantages.

Leading Players in the Australia Retail Bags Market Sector

- JB Packaging

- Berry Global Group

- Pacific National Industries Pty Ltd

- PakPlast International

- Polypac Converting

- Detmold Group

- Gispac

- United Paper

- PrimePac

- Bag People Australia

- Visy (growing presence with sustainable options)

- Other specialized and regional manufacturers

Key Milestones in Australia Retail Bags Market Industry

- March 2024: Visy launches a new range of fully recyclable paper bags in Australia, marking a significant step towards reducing reliance on single-use plastics and promoting a more circular economy for retail packaging.

- April 2024: W23 Global announces the establishment of a USD 125 Million venture capital fund dedicated to supporting innovative and sustainable grocery retail start-ups and scale-ups globally. This strategic investment has the potential to indirectly influence the Australian market by fostering innovation in companies that may develop advanced retail bag solutions or sustainable packaging technologies for Australian retailers.

- Ongoing: Increased adoption of reusable bag schemes and legislative action to phase out problematic single-use plastic bags across various Australian states and territories.

- Recent Developments: Growing investment in research and development for novel biodegradable and compostable materials suitable for Australian conditions.

Strategic Outlook for Australia Retail Bags Market Market

The future of the Australian retail bags market is promising, characterized by a strong emphasis on sustainability, innovation, and efficient supply chains. Companies that successfully integrate sustainable materials, optimize production processes, and adapt to evolving consumer preferences are poised for significant growth. Strategic partnerships and investment in research and development will be crucial for sustained success in this dynamic market.

Australia Retail Bags Market Segmentation

-

1. Material

- 1.1. Paper and Natural Fabric

- 1.2. Plastic (HDPE, LDPE, PP, rPET, etc.)

-

2. End-user Industry

- 2.1. Foodservice

- 2.2. Grocery

- 2.3. Industrial

- 2.4. Hospitality

- 2.5. Other End-user Industries

Australia Retail Bags Market Segmentation By Geography

- 1. Australia

Australia Retail Bags Market Regional Market Share

Geographic Coverage of Australia Retail Bags Market

Australia Retail Bags Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.83% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Growing Demand for Unit-sized Bags is Expected to Drive Growth; Legislative Changes will Propel the Growth of Paper-based Bags (State-wise Ban on Plastic Bags <35 microns)

- 3.3. Market Restrains

- 3.3.1. Near and Medium-term Dependence on Material Prices and the Dynamic Nature of the End-user Demand Expected to Pose Challenges; Anticipated Barriers to Entry for New Entrants Posed by Incumbents who have Established Partnerships with Retailers in the Country

- 3.4. Market Trends

- 3.4.1. Paper and Natural Fabric to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Retail Bags Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Paper and Natural Fabric

- 5.1.2. Plastic (HDPE, LDPE, PP, rPET, etc.)

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Foodservice

- 5.2.2. Grocery

- 5.2.3. Industrial

- 5.2.4. Hospitality

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 JB Packaging

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Berry Global Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pacific National Industries Pty Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PakPlast Internationa

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Polypac Converting

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Detmold Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gispac

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 United Paper

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PrimePac

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bag People Australia

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 JB Packaging

List of Figures

- Figure 1: Australia Retail Bags Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Retail Bags Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Retail Bags Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Australia Retail Bags Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Australia Retail Bags Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Australia Retail Bags Market Revenue Million Forecast, by Material 2020 & 2033

- Table 5: Australia Retail Bags Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Australia Retail Bags Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Retail Bags Market?

The projected CAGR is approximately 4.83%.

2. Which companies are prominent players in the Australia Retail Bags Market?

Key companies in the market include JB Packaging, Berry Global Group, Pacific National Industries Pty Ltd, PakPlast Internationa, Polypac Converting, Detmold Group, Gispac, United Paper, PrimePac, Bag People Australia.

3. What are the main segments of the Australia Retail Bags Market?

The market segments include Material, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.51 Million as of 2022.

5. What are some drivers contributing to market growth?

The Growing Demand for Unit-sized Bags is Expected to Drive Growth; Legislative Changes will Propel the Growth of Paper-based Bags (State-wise Ban on Plastic Bags <35 microns).

6. What are the notable trends driving market growth?

Paper and Natural Fabric to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Near and Medium-term Dependence on Material Prices and the Dynamic Nature of the End-user Demand Expected to Pose Challenges; Anticipated Barriers to Entry for New Entrants Posed by Incumbents who have Established Partnerships with Retailers in the Country.

8. Can you provide examples of recent developments in the market?

April 2024 - W23 Global unites five major players in the global grocery arena. Ahold Delhaize (operating in the US, Europe, and Indonesia), Tesco (based in the UK, ROI, and Europe), Woolworths Group (hailing from Australia and New Zealand), Empire Company Limited/Sobeys Inc. (representing Canada), and Shoprite Group (focused on Africa). This collaborative effort has birthed a new retail venture capital (VC) fund, aiming to invest USD125 million into the most innovative start-ups and scale-ups worldwide over the next five years. These investments are specifically targeted at revolutionizing the grocery retail landscape and tackling its sustainability challenges head-on.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Retail Bags Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Retail Bags Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Retail Bags Market?

To stay informed about further developments, trends, and reports in the Australia Retail Bags Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence