Key Insights

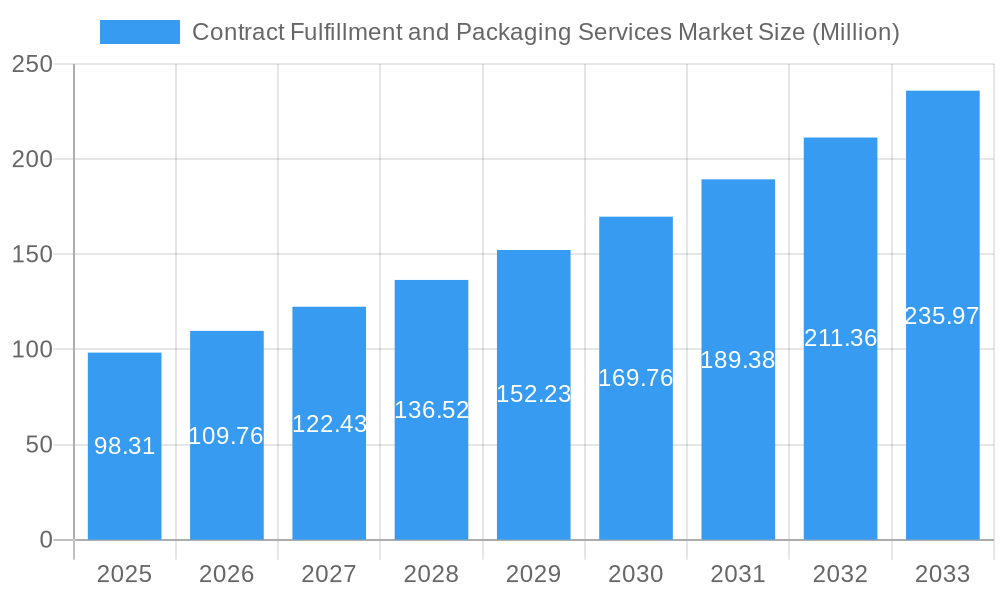

The Contract Fulfillment and Packaging Services market is experiencing robust growth, projected to reach a market size of $98.31 million in 2025 and expanding at a Compound Annual Growth Rate (CAGR) of 11.43%. This growth is fueled by several key factors. The increasing demand for e-commerce and faster delivery times necessitates efficient fulfillment solutions, driving the adoption of contract packaging and fulfillment services across various industries. Furthermore, the rising complexity of packaging requirements, particularly in sectors like pharmaceuticals and food, pushes companies to outsource specialized packaging design, prototyping, and testing. The trend towards sustainable and eco-friendly packaging materials also presents significant opportunities for providers offering innovative and compliant solutions. While potential restraints like fluctuating raw material costs and labor shortages exist, the overall market outlook remains positive, driven by the continuous growth of e-commerce and the increasing need for specialized packaging expertise.

Contract Fulfillment and Packaging Services Market Market Size (In Million)

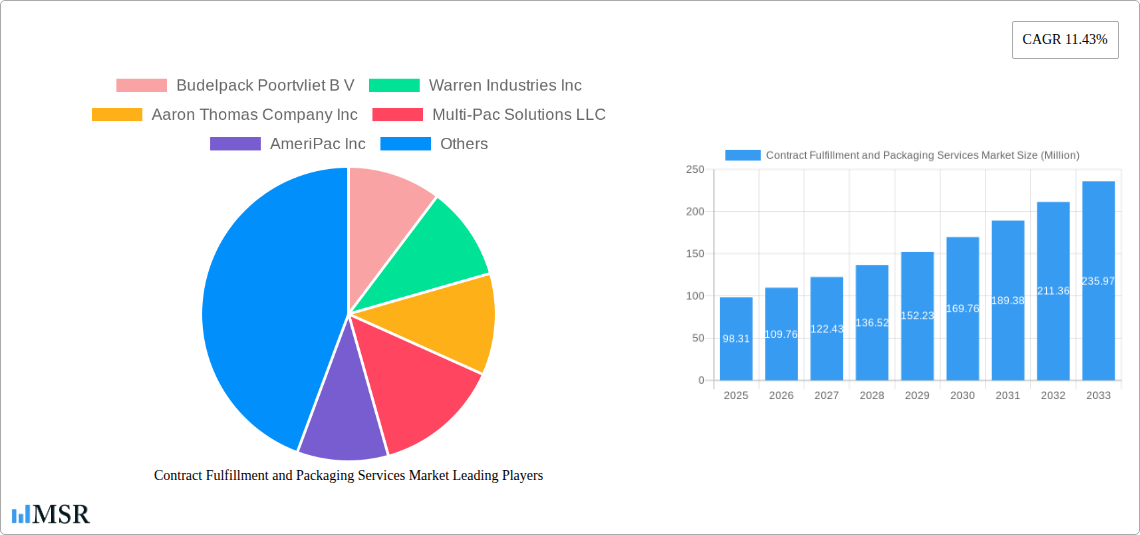

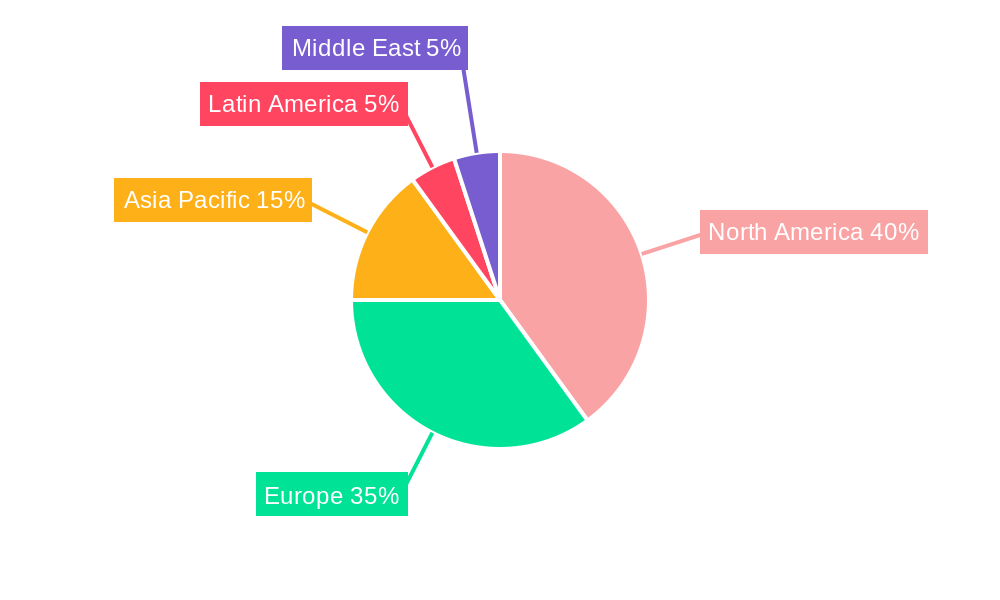

The market segmentation reveals a diverse landscape. Service types such as packaging design and prototyping, contract packing (encompassing bottling, filling, labeling, and wrapping), package testing, and warehousing/fulfillment dominate the market. End-user segments, including food, beverage, pharmaceutical, and household/personal care industries, represent key drivers, each with unique packaging and fulfillment requirements. Companies such as Budelpack Poortvliet B.V., Warren Industries Inc., and PAC Worldwide Inc. are key players, showcasing the competitive yet expanding nature of this sector. Geographical distribution likely favors North America and Europe initially, given established e-commerce infrastructure, but the Asia-Pacific region is expected to witness significant growth due to rising consumer spending and expanding e-commerce penetration. Future growth hinges on technological advancements in automation, increased focus on supply chain resilience, and continued evolution of consumer expectations regarding packaging and delivery.

Contract Fulfillment and Packaging Services Market Company Market Share

Contract Fulfillment and Packaging Services Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Contract Fulfillment and Packaging Services market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, key segments, leading players, and future growth opportunities. The study period spans the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033). The global market size in 2025 is estimated at xx Million.

Contract Fulfillment and Packaging Services Market Market Concentration & Dynamics

The Contract Fulfillment and Packaging Services market is characterized by a moderately consolidated landscape, with established large-scale providers holding substantial market share. This is balanced by a vibrant ecosystem of smaller, specialized firms that contribute to a dynamic competitive environment. Key influencers of market concentration include the realization of economies of scale, the adoption of advanced technological capabilities, and the extent of geographic reach. Strategic mergers and acquisitions (M&A) are a prevalent strategy for major players seeking to broaden their service portfolios and expand their market footprint. Between 2019 and 2024, an estimated [Insert Number] M&A deals were recorded, actively driving consolidation and shaping the market's trajectory. The regulatory environment, which varies significantly across different regions, plays a critical role in influencing compliance expenditures and operational efficiencies. Innovation remains a cornerstone of competitive advantage, with ongoing advancements in automation, the development of novel packaging materials, and sophisticated supply chain management practices propelling the industry forward. The increasing consumer and business demand for sustainable and eco-friendly packaging solutions is a significant trend that continues to reshape industry practices. Furthermore, the growing consumer expectation for personalized packaging experiences and highly efficient delivery systems presents fertile ground for innovative service providers.

- Market Share: In 2025, the top 5 players collectively commanded approximately [Insert Percentage]% of the market share.

- M&A Activity: An average of [Insert Number] M&A deals were observed annually between 2019 and 2024, indicating consistent consolidation efforts.

- Innovation Focus: Key areas driving innovation include advancements in automation, the development of sustainable packaging solutions, and the optimization of advanced logistics.

- Regulatory Landscape: Strict adherence to regulations pertaining to food safety, pharmaceutical standards, and environmental sustainability is paramount for operational success.

Contract Fulfillment and Packaging Services Market Industry Insights & Trends

The Contract Fulfillment and Packaging Services market is experiencing a period of significant and robust growth, largely propelled by the escalating demand for outsourced logistics and specialized packaging solutions across a diverse array of end-user industries. Projections indicate a Compound Annual Growth Rate (CAGR) of [Insert Percentage]% for the market from 2025 to 2033. This impressive growth trajectory is underpinned by a confluence of factors: the relentless expansion of e-commerce, the increasing intricacy of global supply chains, a heightened organizational focus on optimizing order fulfillment processes, and the critical need for sophisticated and tailored packaging solutions. Technological innovations, particularly in the realms of automation and robotics, are instrumental in enhancing operational efficiency and reducing associated costs. Evolving consumer preferences, such as a growing inclination towards personalized packaging and a strong commitment to sustainable practices, are also substantial contributors to market expansion. The market is forecasted to reach a valuation of [Insert Value] Million by 2033. Moreover, the continuous global expansion of the e-commerce sector is a primary catalyst, significantly amplifying the demand for efficient contract fulfillment and packaging services.

Key Markets & Segments Leading Contract Fulfillment and Packaging Services Market

The Pharmaceutical and Food & Beverage sectors stand out as the most dominant end-user segments within the Contract Fulfillment and Packaging Services market, collectively representing an estimated [Insert Percentage]% of the total market in 2025. Geographically, North America and Europe are currently at the forefront, driven by robust consumer demand, well-developed infrastructure, and advanced technological adoption. Within service types, Contract Packing, encompassing activities such as bottling/filling, packaging, labeling, and wrapping, emerges as the leading category, a reflection of the substantial volume of packaging requirements across various industries.

Drivers for Dominant Segments:

- Pharmaceutical: Stringent regulatory mandates and the unique, specialized packaging needs for pharmaceuticals significantly drive the outsourcing trend in this sector.

- Food & Beverage: The high demand for efficient packaging operations and robust cold chain logistics is a key driver for outsourcing in this segment.

- North America: A mature market characterized by established infrastructure, high consumer spending power, and a strong embrace of advanced technologies.

- Europe: Benefits from well-defined regulatory frameworks and a highly developed market for outsourced logistics solutions.

Dominance Analysis: The preeminence of the pharmaceutical and food & beverage sectors is largely attributable to the inherent complexity of their products and the critical need for specialized handling and packaging protocols. Similarly, the leading geographic regions leverage their established infrastructure and a high concentration of key end-user industries to maintain their market leadership.

Contract Fulfillment and Packaging Services Market Product Developments

Recent innovations include the development of sustainable packaging materials, automated packaging lines, and advanced warehouse management systems. These advancements improve efficiency, reduce costs, and enhance product protection. Companies are also focusing on developing customized packaging solutions to meet the specific needs of individual clients, strengthening their competitive position and driving market expansion. The integration of advanced technologies like AI and machine learning into packaging and fulfillment processes is further enhancing efficiency and optimizing logistics.

Challenges in the Contract Fulfillment and Packaging Services Market Market

The Contract Fulfillment and Packaging Services market faces challenges such as fluctuating raw material prices, increasing labor costs, and stringent regulatory requirements. Supply chain disruptions can significantly impact operational efficiency and profitability. Furthermore, intense competition from established players and new entrants creates pressure on pricing and margins. These factors can collectively reduce profit margins and hinder market growth. The overall impact of these challenges on market growth is estimated at approximately xx Million annually.

Forces Driving Contract Fulfillment and Packaging Services Market Growth

The growth of the Contract Fulfillment and Packaging Services market is propelled by a powerful combination of factors. The exponential rise of e-commerce necessitates highly efficient fulfillment operations and specialized packaging solutions tailored to direct-to-consumer delivery. Technological advancements, particularly in automation and robotics, are revolutionizing operational efficiency and driving down costs. The increasing global imperative for sustainable packaging materials and environmentally responsible practices is spurring innovation and opening new avenues for market expansion. Furthermore, the complex and ever-evolving landscape of regulatory compliance mandates a strategic reliance on specialized service providers, creating significant opportunities for companies adept at offering compliant and innovative solutions.

Long-Term Growth Catalysts in the Contract Fulfillment and Packaging Services Market

Long-term growth will be driven by continued innovation in packaging materials, automation technologies, and sustainable practices. Strategic partnerships between contract fulfillment providers and technology companies will enhance efficiency and expand service offerings. Expansion into emerging markets, especially in Asia-Pacific, presents significant growth potential. Furthermore, the increased demand for personalized packaging and omnichannel fulfillment strategies will further propel market expansion.

Emerging Opportunities in Contract Fulfillment and Packaging Services Market

Emerging opportunities lie in the growing demand for sustainable and eco-friendly packaging solutions. The integration of advanced technologies like AI and machine learning offers significant potential for process optimization and cost reduction. Expansion into niche markets, such as specialized healthcare or high-value goods packaging, presents lucrative growth prospects. Additionally, providing integrated fulfillment and logistics solutions catering to the omnichannel retail environment presents significant potential for market expansion.

Leading Players in the Contract Fulfillment and Packaging Services Market Sector

- Budelpack Poortvliet B V

- Warren Industries Inc

- Aaron Thomas Company Inc

- Multi-Pac Solutions LLC

- AmeriPac Inc

- FW Logistics

- Assemblies Unlimited Inc

- ActionPak Inc

- Boughey Distribution Ltd

- Kane Logistics

- Sharp (UDG Healthcare plc)

- PAC Worldwide Inc

- Sonoco Products Company

- Wasdell Packaging Group

- Swan Packaging Fulfillment Inc

Key Milestones in Contract Fulfillment and Packaging Services Market Industry

- 2020: Increased adoption of automated packaging systems due to labor shortages.

- 2021: Significant investments in sustainable packaging solutions driven by environmental concerns.

- 2022: Several mergers and acquisitions consolidating market share among leading players.

- 2023: Launch of innovative packaging designs focused on enhanced product protection and consumer experience.

- 2024: Growing adoption of AI-powered warehouse management systems for optimized logistics.

Strategic Outlook for Contract Fulfillment and Packaging Services Market Market

The Contract Fulfillment and Packaging Services market is poised for continued growth, driven by technological advancements, expanding e-commerce, and a growing emphasis on sustainable practices. Companies with a focus on innovation, strategic partnerships, and expansion into emerging markets are well-positioned to capture significant market share. The increasing demand for end-to-end fulfillment solutions creates substantial opportunities for companies offering integrated services. Strategic investments in automation, digitalization, and sustainable packaging technologies will be crucial for maintaining a competitive edge and ensuring long-term success.

Contract Fulfillment and Packaging Services Market Segmentation

-

1. Service Type

- 1.1. Packaging Design & Prototyping

- 1.2. Contract

- 1.3. Package Testing

- 1.4. Warehousing and Fulfilment

- 1.5. Other Service Types

-

2. End-user Type

- 2.1. Food

- 2.2. Beverage

- 2.3. Pharmaceutical

- 2.4. Household & Personal Care

- 2.5. Other End-user Segments

Contract Fulfillment and Packaging Services Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Contract Fulfillment and Packaging Services Market Regional Market Share

Geographic Coverage of Contract Fulfillment and Packaging Services Market

Contract Fulfillment and Packaging Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.43% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; Companies Looking to Gain Competitive Advantage by Outsourcing Non-core Operations; Steady Demand from Key Verticals

- 3.2.2 such as the Food and Beverage Sector; Entry of Key Warehousing Vendors in the Field of Contract Packaging Expected to Drive Innovation

- 3.3. Market Restrains

- 3.3.1. ; Stringent Government Regulations; Competition from In-house Packaging

- 3.4. Market Trends

- 3.4.1. Contract Packing is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Contract Fulfillment and Packaging Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Packaging Design & Prototyping

- 5.1.2. Contract

- 5.1.3. Package Testing

- 5.1.4. Warehousing and Fulfilment

- 5.1.5. Other Service Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Type

- 5.2.1. Food

- 5.2.2. Beverage

- 5.2.3. Pharmaceutical

- 5.2.4. Household & Personal Care

- 5.2.5. Other End-user Segments

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Contract Fulfillment and Packaging Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Packaging Design & Prototyping

- 6.1.2. Contract

- 6.1.3. Package Testing

- 6.1.4. Warehousing and Fulfilment

- 6.1.5. Other Service Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Type

- 6.2.1. Food

- 6.2.2. Beverage

- 6.2.3. Pharmaceutical

- 6.2.4. Household & Personal Care

- 6.2.5. Other End-user Segments

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Europe Contract Fulfillment and Packaging Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Packaging Design & Prototyping

- 7.1.2. Contract

- 7.1.3. Package Testing

- 7.1.4. Warehousing and Fulfilment

- 7.1.5. Other Service Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Type

- 7.2.1. Food

- 7.2.2. Beverage

- 7.2.3. Pharmaceutical

- 7.2.4. Household & Personal Care

- 7.2.5. Other End-user Segments

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Asia Pacific Contract Fulfillment and Packaging Services Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Packaging Design & Prototyping

- 8.1.2. Contract

- 8.1.3. Package Testing

- 8.1.4. Warehousing and Fulfilment

- 8.1.5. Other Service Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Type

- 8.2.1. Food

- 8.2.2. Beverage

- 8.2.3. Pharmaceutical

- 8.2.4. Household & Personal Care

- 8.2.5. Other End-user Segments

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Latin America Contract Fulfillment and Packaging Services Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Packaging Design & Prototyping

- 9.1.2. Contract

- 9.1.3. Package Testing

- 9.1.4. Warehousing and Fulfilment

- 9.1.5. Other Service Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Type

- 9.2.1. Food

- 9.2.2. Beverage

- 9.2.3. Pharmaceutical

- 9.2.4. Household & Personal Care

- 9.2.5. Other End-user Segments

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Middle East Contract Fulfillment and Packaging Services Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Packaging Design & Prototyping

- 10.1.2. Contract

- 10.1.3. Package Testing

- 10.1.4. Warehousing and Fulfilment

- 10.1.5. Other Service Types

- 10.2. Market Analysis, Insights and Forecast - by End-user Type

- 10.2.1. Food

- 10.2.2. Beverage

- 10.2.3. Pharmaceutical

- 10.2.4. Household & Personal Care

- 10.2.5. Other End-user Segments

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Budelpack Poortvliet B V

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Warren Industries Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Aaron Thomas Company Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Multi-Pac Solutions LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 AmeriPac Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 FW Logistics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Assemblies Unlimited Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ActionPak Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Boughey Distribution Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kane Logistics

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Sharp (UDG Healthcare plc)

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 PAC Worldwide Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Sonoco Products Company*List Not Exhaustive

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Wasdell Packaging Group

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Swan Packaging Fulfillment Inc

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Budelpack Poortvliet B V

List of Figures

- Figure 1: Global Contract Fulfillment and Packaging Services Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Contract Fulfillment and Packaging Services Market Revenue (Million), by Service Type 2025 & 2033

- Figure 3: North America Contract Fulfillment and Packaging Services Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: North America Contract Fulfillment and Packaging Services Market Revenue (Million), by End-user Type 2025 & 2033

- Figure 5: North America Contract Fulfillment and Packaging Services Market Revenue Share (%), by End-user Type 2025 & 2033

- Figure 6: North America Contract Fulfillment and Packaging Services Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Contract Fulfillment and Packaging Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Contract Fulfillment and Packaging Services Market Revenue (Million), by Service Type 2025 & 2033

- Figure 9: Europe Contract Fulfillment and Packaging Services Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 10: Europe Contract Fulfillment and Packaging Services Market Revenue (Million), by End-user Type 2025 & 2033

- Figure 11: Europe Contract Fulfillment and Packaging Services Market Revenue Share (%), by End-user Type 2025 & 2033

- Figure 12: Europe Contract Fulfillment and Packaging Services Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Contract Fulfillment and Packaging Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Contract Fulfillment and Packaging Services Market Revenue (Million), by Service Type 2025 & 2033

- Figure 15: Asia Pacific Contract Fulfillment and Packaging Services Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 16: Asia Pacific Contract Fulfillment and Packaging Services Market Revenue (Million), by End-user Type 2025 & 2033

- Figure 17: Asia Pacific Contract Fulfillment and Packaging Services Market Revenue Share (%), by End-user Type 2025 & 2033

- Figure 18: Asia Pacific Contract Fulfillment and Packaging Services Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Contract Fulfillment and Packaging Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Contract Fulfillment and Packaging Services Market Revenue (Million), by Service Type 2025 & 2033

- Figure 21: Latin America Contract Fulfillment and Packaging Services Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 22: Latin America Contract Fulfillment and Packaging Services Market Revenue (Million), by End-user Type 2025 & 2033

- Figure 23: Latin America Contract Fulfillment and Packaging Services Market Revenue Share (%), by End-user Type 2025 & 2033

- Figure 24: Latin America Contract Fulfillment and Packaging Services Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Contract Fulfillment and Packaging Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Contract Fulfillment and Packaging Services Market Revenue (Million), by Service Type 2025 & 2033

- Figure 27: Middle East Contract Fulfillment and Packaging Services Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 28: Middle East Contract Fulfillment and Packaging Services Market Revenue (Million), by End-user Type 2025 & 2033

- Figure 29: Middle East Contract Fulfillment and Packaging Services Market Revenue Share (%), by End-user Type 2025 & 2033

- Figure 30: Middle East Contract Fulfillment and Packaging Services Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East Contract Fulfillment and Packaging Services Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 3: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 5: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 6: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 8: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 9: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 11: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 12: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 14: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 15: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 17: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 18: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Contract Fulfillment and Packaging Services Market?

The projected CAGR is approximately 11.43%.

2. Which companies are prominent players in the Contract Fulfillment and Packaging Services Market?

Key companies in the market include Budelpack Poortvliet B V, Warren Industries Inc, Aaron Thomas Company Inc, Multi-Pac Solutions LLC, AmeriPac Inc, FW Logistics, Assemblies Unlimited Inc, ActionPak Inc, Boughey Distribution Ltd, Kane Logistics, Sharp (UDG Healthcare plc), PAC Worldwide Inc, Sonoco Products Company*List Not Exhaustive, Wasdell Packaging Group, Swan Packaging Fulfillment Inc.

3. What are the main segments of the Contract Fulfillment and Packaging Services Market?

The market segments include Service Type , End-user Type .

4. Can you provide details about the market size?

The market size is estimated to be USD 98.31 Million as of 2022.

5. What are some drivers contributing to market growth?

; Companies Looking to Gain Competitive Advantage by Outsourcing Non-core Operations; Steady Demand from Key Verticals. such as the Food and Beverage Sector; Entry of Key Warehousing Vendors in the Field of Contract Packaging Expected to Drive Innovation.

6. What are the notable trends driving market growth?

Contract Packing is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

; Stringent Government Regulations; Competition from In-house Packaging.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Contract Fulfillment and Packaging Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Contract Fulfillment and Packaging Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Contract Fulfillment and Packaging Services Market?

To stay informed about further developments, trends, and reports in the Contract Fulfillment and Packaging Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence