Key Insights

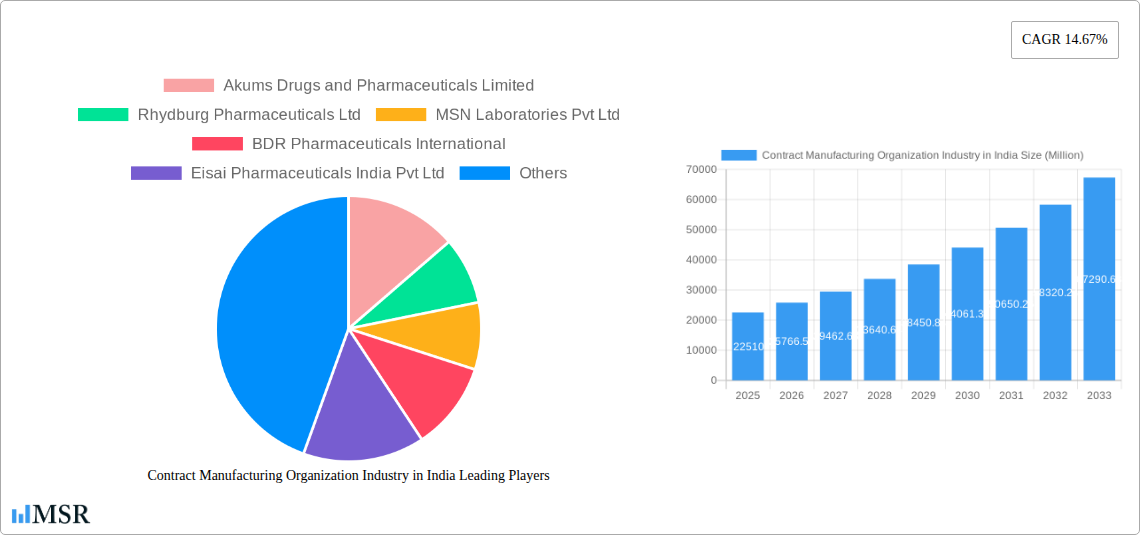

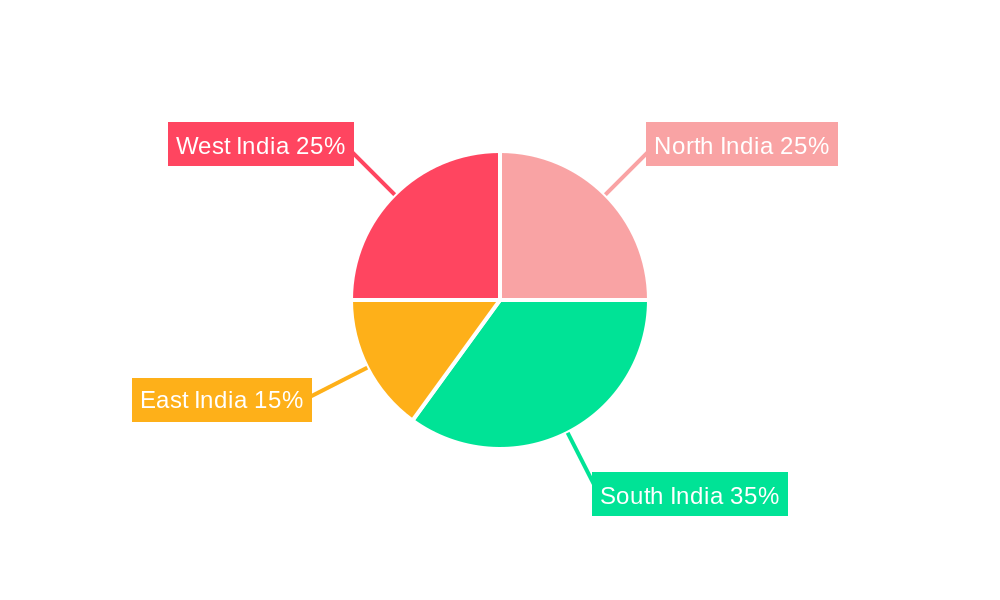

The Indian Contract Manufacturing Organization (CMO) industry is experiencing robust growth, projected to reach \$22.51 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 14.67% from 2025 to 2033. This expansion is driven by several factors. Firstly, the increasing demand for pharmaceutical products, both domestically and globally, necessitates efficient and cost-effective manufacturing solutions that CMOs readily provide. Secondly, the rising prevalence of chronic diseases in India fuels the need for larger-scale production of various medications, further boosting the CMO sector. Thirdly, the Indian government's initiatives to improve healthcare infrastructure and attract foreign investment in the pharmaceutical industry create a favorable environment for CMOs to flourish. The industry is segmented by service type, encompassing API and intermediates as well as finished dosage forms. Finished dosage manufacturing is expected to hold a larger market share, driven by increased demand for ready-to-use medications. The presence of numerous established players, including Akums Drugs, MSN Laboratories, and Dr. Reddy's Laboratories, along with several other prominent companies, indicates a competitive yet dynamic landscape. Regional variations exist, with potentially higher growth in regions like South India, known for its concentration of pharmaceutical manufacturing hubs.

Contract Manufacturing Organization Industry in India Market Size (In Billion)

The forecast period of 2025-2033 suggests continued strong growth for the Indian CMO industry, driven by ongoing investments in research and development, technological advancements, and a growing focus on quality control and regulatory compliance. However, challenges remain, such as the need for continuous improvement in infrastructure and skilled workforce development to meet the increasing production demands. Furthermore, maintaining stringent quality standards to meet global regulations will be critical for the continued success of Indian CMOs in the international market. The sector's ability to adapt to changing regulatory landscapes and technological advancements will be key determinants of its future trajectory. Companies are likely to focus on strategic partnerships and collaborations to expand their reach and capabilities.

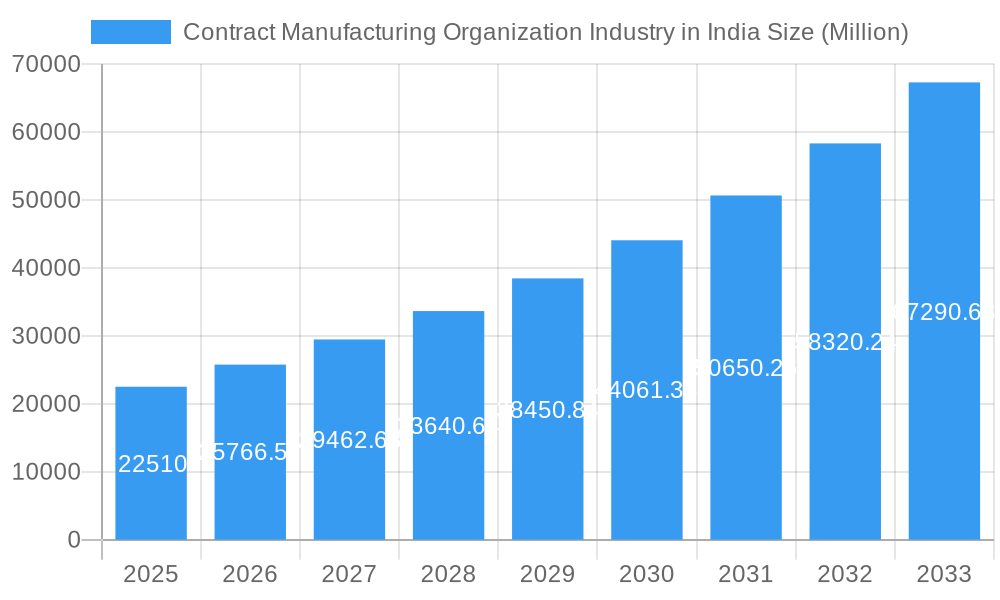

Contract Manufacturing Organization Industry in India Company Market Share

Contract Manufacturing Organization (CMO) Industry in India: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Contract Manufacturing Organization (CMO) industry in India, covering market dynamics, key players, emerging trends, and future growth prospects. The report covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period of 2025-2033. The Indian CMO sector, valued at xx Million in 2024, is poised for significant growth, driven by factors including increasing demand for pharmaceuticals, government initiatives, and technological advancements. This report is an essential resource for industry stakeholders, investors, and businesses seeking to understand and capitalize on opportunities within this dynamic market.

Contract Manufacturing Organization Industry in India Market Concentration & Dynamics

The Indian CMO market exhibits a moderately concentrated landscape, with a few large players holding significant market share. However, the presence of numerous smaller and specialized CMOs fosters competition and innovation. Market share data reveals that the top 5 players account for approximately xx% of the total market revenue in 2024, while the remaining share is distributed among numerous smaller companies. The industry's dynamics are shaped by several key factors:

- Innovation Ecosystems: A burgeoning network of research institutions, universities, and startups contribute to technological advancements within the industry, fostering the development of new drugs and manufacturing processes.

- Regulatory Frameworks: Stringent regulatory compliance requirements, primarily set by the Drug Controller General of India (DCGI), influence operational processes and standards. Navigating these regulations is a critical factor for CMO success.

- Substitute Products & Generics: The rise of generic drugs and biosimilars presents both challenges and opportunities for CMOs, necessitating flexibility and adaptability in their service offerings.

- End-User Trends: Growing demand for higher-quality, more affordable medications, particularly in the generic and over-the-counter segments, influences CMOs' production strategies.

- Mergers & Acquisitions (M&A) Activities: The CMO industry has witnessed a moderate number of M&A deals in recent years (xx deals in 2024), driven by strategic expansion, consolidation, and access to new technologies. This activity is expected to continue.

Contract Manufacturing Organization Industry in India Industry Insights & Trends

The Indian CMO market is experiencing robust growth, with a Compound Annual Growth Rate (CAGR) of xx% projected from 2025 to 2033. This growth is fueled by several key drivers:

- Expanding Pharmaceutical Market: The increasing prevalence of chronic diseases and rising healthcare expenditure in India are significantly boosting the demand for pharmaceuticals.

- Government Initiatives: Government support for the pharmaceutical industry, including initiatives to attract foreign investment and improve infrastructure, creates a favorable environment for CMOs.

- Technological Disruptions: Advancements in technologies like automation, artificial intelligence, and big data are transforming manufacturing processes, enhancing efficiency, and reducing costs.

- Evolving Consumer Behaviors: Consumers are increasingly demanding higher quality and more convenient drug delivery systems, leading to innovation in drug formulations and packaging.

- Increased focus on cost optimization CMOs are increasingly emphasizing cost optimization to support clients and remain competitive.

The market size, projected at xx Million in 2025, is anticipated to reach xx Million by 2033.

Key Markets & Segments Leading Contract Manufacturing Organization Industry in India

While the Indian CMO market is geographically diverse, several regions are driving growth. Dominance is characterized by robust infrastructure, skilled workforce, and proximity to key markets:

- Dominant Segment: The finished dosage forms segment is the largest, accounting for a significant portion (xx%) of the market share. This is primarily due to the rising demand for ready-to-use medications. The API and intermediates segment is also growing steadily.

Drivers for Segment Dominance:

- Economic Growth: Strong economic growth in India fuels increased healthcare spending, driving demand for pharmaceuticals.

- Infrastructure Development: Investments in infrastructure, including better transportation networks and improved manufacturing facilities, enhance operational efficiencies.

- Skilled Workforce: India has a large pool of skilled labor, enabling CMOs to access a skilled workforce at a competitive cost.

- Favorable Government Policies: Supportive government regulations and initiatives encourage investment and growth within the sector.

Contract Manufacturing Organization Industry in India Product Developments

The Indian CMO sector is witnessing significant product innovations, focusing on advanced drug delivery systems, including controlled-release formulations and novel drug conjugates. These innovations address unmet medical needs and enhance treatment efficacy. The adoption of advanced technologies such as continuous manufacturing is also driving efficiency and cost reduction. This competitive edge enables CMOs to offer superior services and attract clients seeking higher quality and efficiency.

Challenges in the Contract Manufacturing Organization Industry in India Market

The Indian CMO industry faces several challenges:

- Regulatory Hurdles: Strict regulatory compliance and approval processes can lead to delays and increased operational costs.

- Supply Chain Issues: Maintaining a stable and reliable supply chain for raw materials and packaging is crucial. Disruptions can significantly impact production.

- Intense Competition: The presence of both domestic and international CMOs creates intense competition, requiring CMOs to differentiate their offerings.

- Pricing Pressures: Cost pressures from clients seeking lower pricing can affect profitability.

Forces Driving Contract Manufacturing Organization Industry in India Growth

Several factors are driving growth in the Indian CMO industry:

- Technological advancements: Automation and AI are enhancing manufacturing efficiency and reducing costs.

- Favorable government policies: Initiatives to boost pharmaceutical manufacturing are creating a positive investment climate.

- Rising demand for generic drugs: The growing need for affordable medicines is fueling demand for CMO services.

- Strategic partnerships: Collaborations between Indian CMOs and global pharmaceutical companies are expanding market reach and expertise.

Challenges in the Contract Manufacturing Organization Industry in India Market

Long-term growth hinges on:

Continuous innovation in manufacturing processes and technologies is key to sustaining a competitive edge. Strategic partnerships and collaborations with global players will provide access to new markets and advanced technologies. Expanding into specialized therapeutic areas with high growth potential will also contribute to long-term success.

Emerging Opportunities in Contract Manufacturing Organization Industry in India

Emerging trends and opportunities include:

- Focus on niche therapeutic areas: Specialization in specific therapeutic segments like biologics or oncology can create unique market positioning.

- Adoption of advanced technologies: Early adoption of technologies like continuous manufacturing and AI-driven process optimization provides a significant competitive advantage.

- Expansion into new markets: Targeting emerging markets in Asia, Africa, and Latin America offers significant growth potential.

Leading Players in the Contract Manufacturing Organization Industry in India Sector

- Akums Drugs and Pharmaceuticals Limited

- Rhydburg Pharmaceuticals Ltd

- MSN Laboratories Pvt Ltd

- BDR Pharmaceuticals International

- Eisai Pharmaceuticals India Pvt Ltd

- Ciron Drugs & Pharmaceuticals Pvt Ltd

- Wockhardt Limited

- Cipla Ltd

- Delwis Healthcare Pvt Ltd

- Unichem Laboratories Ltd

- Dr Reddy's Laboratories

- Theon Pharmaceuticals Limited

- Viatris Inc (Mylan Laboratories Ltd)

- Maxheal Pharmaceuticals India Ltd

- Medipaams India Pvt Ltd

- AMRI India Pvt Ltd

- Cadila Healthcare Limited

Key Milestones in Contract Manufacturing Organization Industry in India Industry

- June 2022: Glenmark Pharmaceuticals launched Indamet, a fixed-dose combination medication for asthma, marking a significant product innovation.

- May 2022: Sun Pharma announced the launch of Brillo, a first-in-class oral drug for reducing LDL cholesterol.

- March 2022: Themis Medicare Ltd. received DCGI approval for their antiviral medication VIRALEX for Covid-19 treatment.

Strategic Outlook for Contract Manufacturing Organization Industry in India Market

The Indian CMO market is poised for substantial growth driven by factors such as increasing pharmaceutical demand, government support, and technological advancements. Strategic opportunities lie in focusing on specialized therapeutic areas, adopting advanced technologies, and expanding into new international markets. CMOs that successfully navigate regulatory complexities and leverage technological innovations will be well-positioned to capitalize on this growth potential.

Contract Manufacturing Organization Industry in India Segmentation

-

1. Service Type

- 1.1. API and Intermediates

-

1.2. Finished Dose

- 1.2.1. Solids

- 1.2.2. Liquids

- 1.2.3. Semi-Solids and Injectables

Contract Manufacturing Organization Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Contract Manufacturing Organization Industry in India Regional Market Share

Geographic Coverage of Contract Manufacturing Organization Industry in India

Contract Manufacturing Organization Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Availability of Skilled Labor at Relatively Lower Cost; Sustained increase in outsourcing volumes by big pharma companies; Geographical advantage in the form of access to large markets in the APAC region

- 3.3. Market Restrains

- 3.3.1. The existence of stringent government restrictions and a decrease in the approval of numerous small molecules and biologics in specific regions of the nation

- 3.4. Market Trends

- 3.4.1. Generic Medicine Under Solid Finished Dose Segment Holds Significant Share in The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Contract Manufacturing Organization Industry in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. API and Intermediates

- 5.1.2. Finished Dose

- 5.1.2.1. Solids

- 5.1.2.2. Liquids

- 5.1.2.3. Semi-Solids and Injectables

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Contract Manufacturing Organization Industry in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. API and Intermediates

- 6.1.2. Finished Dose

- 6.1.2.1. Solids

- 6.1.2.2. Liquids

- 6.1.2.3. Semi-Solids and Injectables

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. South America Contract Manufacturing Organization Industry in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. API and Intermediates

- 7.1.2. Finished Dose

- 7.1.2.1. Solids

- 7.1.2.2. Liquids

- 7.1.2.3. Semi-Solids and Injectables

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Europe Contract Manufacturing Organization Industry in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. API and Intermediates

- 8.1.2. Finished Dose

- 8.1.2.1. Solids

- 8.1.2.2. Liquids

- 8.1.2.3. Semi-Solids and Injectables

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Middle East & Africa Contract Manufacturing Organization Industry in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. API and Intermediates

- 9.1.2. Finished Dose

- 9.1.2.1. Solids

- 9.1.2.2. Liquids

- 9.1.2.3. Semi-Solids and Injectables

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Asia Pacific Contract Manufacturing Organization Industry in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. API and Intermediates

- 10.1.2. Finished Dose

- 10.1.2.1. Solids

- 10.1.2.2. Liquids

- 10.1.2.3. Semi-Solids and Injectables

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Akums Drugs and Pharmaceuticals Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Rhydburg Pharmaceuticals Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 MSN Laboratories Pvt Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BDR Pharmaceuticals International

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Eisai Pharmaceuticals India Pvt Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ciron Drugs & Pharmaceuticals Pvt Ltd*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Wockhardt Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cipla Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Delwis Healthcare Pvt Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Unichem Laboratories Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Dr Reddy's Laboratories

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Theon Pharmaceuticals Limited

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Viatris Inc (Mylan Laboratories Ltd)

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Maxheal Pharmaceuticals India Ltd

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Medipaams India Pvt Ltd

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 AMRI India Pvt Ltd

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Cadila Healthcare Limited

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Akums Drugs and Pharmaceuticals Limited

List of Figures

- Figure 1: Global Contract Manufacturing Organization Industry in India Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Contract Manufacturing Organization Industry in India Revenue (Million), by Service Type 2025 & 2033

- Figure 3: North America Contract Manufacturing Organization Industry in India Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: North America Contract Manufacturing Organization Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Contract Manufacturing Organization Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Contract Manufacturing Organization Industry in India Revenue (Million), by Service Type 2025 & 2033

- Figure 7: South America Contract Manufacturing Organization Industry in India Revenue Share (%), by Service Type 2025 & 2033

- Figure 8: South America Contract Manufacturing Organization Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 9: South America Contract Manufacturing Organization Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Contract Manufacturing Organization Industry in India Revenue (Million), by Service Type 2025 & 2033

- Figure 11: Europe Contract Manufacturing Organization Industry in India Revenue Share (%), by Service Type 2025 & 2033

- Figure 12: Europe Contract Manufacturing Organization Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Contract Manufacturing Organization Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Contract Manufacturing Organization Industry in India Revenue (Million), by Service Type 2025 & 2033

- Figure 15: Middle East & Africa Contract Manufacturing Organization Industry in India Revenue Share (%), by Service Type 2025 & 2033

- Figure 16: Middle East & Africa Contract Manufacturing Organization Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa Contract Manufacturing Organization Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Contract Manufacturing Organization Industry in India Revenue (Million), by Service Type 2025 & 2033

- Figure 19: Asia Pacific Contract Manufacturing Organization Industry in India Revenue Share (%), by Service Type 2025 & 2033

- Figure 20: Asia Pacific Contract Manufacturing Organization Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific Contract Manufacturing Organization Industry in India Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Service Type 2020 & 2033

- Table 4: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Service Type 2020 & 2033

- Table 9: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Service Type 2020 & 2033

- Table 14: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Service Type 2020 & 2033

- Table 25: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Service Type 2020 & 2033

- Table 33: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Contract Manufacturing Organization Industry in India?

The projected CAGR is approximately 14.67%.

2. Which companies are prominent players in the Contract Manufacturing Organization Industry in India?

Key companies in the market include Akums Drugs and Pharmaceuticals Limited, Rhydburg Pharmaceuticals Ltd, MSN Laboratories Pvt Ltd, BDR Pharmaceuticals International, Eisai Pharmaceuticals India Pvt Ltd, Ciron Drugs & Pharmaceuticals Pvt Ltd*List Not Exhaustive, Wockhardt Limited, Cipla Ltd, Delwis Healthcare Pvt Ltd, Unichem Laboratories Ltd, Dr Reddy's Laboratories, Theon Pharmaceuticals Limited, Viatris Inc (Mylan Laboratories Ltd), Maxheal Pharmaceuticals India Ltd, Medipaams India Pvt Ltd, AMRI India Pvt Ltd, Cadila Healthcare Limited.

3. What are the main segments of the Contract Manufacturing Organization Industry in India?

The market segments include Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 22.51 Million as of 2022.

5. What are some drivers contributing to market growth?

Availability of Skilled Labor at Relatively Lower Cost; Sustained increase in outsourcing volumes by big pharma companies; Geographical advantage in the form of access to large markets in the APAC region.

6. What are the notable trends driving market growth?

Generic Medicine Under Solid Finished Dose Segment Holds Significant Share in The Market.

7. Are there any restraints impacting market growth?

The existence of stringent government restrictions and a decrease in the approval of numerous small molecules and biologics in specific regions of the nation.

8. Can you provide examples of recent developments in the market?

In June of 2022: Glenmark Pharmaceuticals introduced the cutting-edge fixed-dose combination (FDC) medication Indacaterol + Mometasone for patients with uncontrolled asthma in India. The business introduced this FDC under the name Indamet. Glenmark is the first business in India to commercialize the ground-breaking FDC of Indacaterol, a long-acting beta-agonist, and Mometasone Furoate, an inhaled corticosteroid that has been authorized by the Drug Controller General of India (DCGI),

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Contract Manufacturing Organization Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Contract Manufacturing Organization Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Contract Manufacturing Organization Industry in India?

To stay informed about further developments, trends, and reports in the Contract Manufacturing Organization Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence