Key Insights

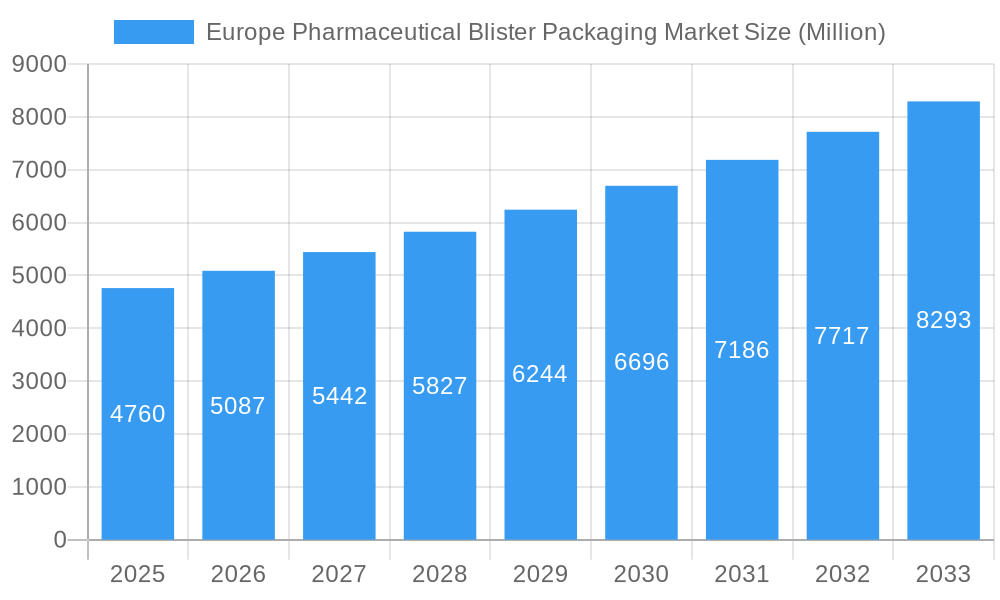

The European pharmaceutical blister packaging market, valued at €4.76 billion in 2025, is projected to experience robust growth, driven by several key factors. The increasing demand for pharmaceutical products, coupled with the rising preference for convenient and tamper-evident packaging solutions, fuels market expansion. Advancements in blister packaging technology, particularly in cold forming and thermoforming, are enabling the production of more sophisticated and protective packaging for sensitive medications. The growing focus on patient safety and medication adherence also contributes to the market's upward trajectory. Furthermore, stringent regulatory requirements concerning drug packaging within the European Union are stimulating innovation and adoption of advanced blister packaging solutions. The market is segmented by technology (cold forming, thermoforming), material (plastic, paper, aluminum), and country (with significant contributions from Germany, UK, France, Italy, and Spain). Key players, including Honeywell International Inc, Sonoco Products Company, and Amcor Limited, are actively involved in developing and supplying innovative blister packaging solutions to meet diverse pharmaceutical needs. Competition is expected to intensify as companies invest in research and development to enhance packaging performance and sustainability. The market's growth is anticipated to be sustained by increasing healthcare expenditure within the European region and the growing adoption of blister packs across various pharmaceutical segments.

Europe Pharmaceutical Blister Packaging Market Market Size (In Billion)

The forecast period of 2025-2033 anticipates a Compound Annual Growth Rate (CAGR) of 6.77%, indicating a steady expansion of the market. This growth is likely to be influenced by factors such as technological advancements, stringent regulatory compliance, and the increasing focus on patient convenience and medication safety. However, challenges such as fluctuating raw material prices and environmental concerns regarding plastic waste could potentially moderate growth. Nevertheless, the overall outlook remains positive, with significant opportunities for market players who can effectively cater to the evolving needs of pharmaceutical companies and patients alike. The market's segmentation across technology, material, and geography provides diverse avenues for growth, allowing companies to target specific niches and optimize their market strategies.

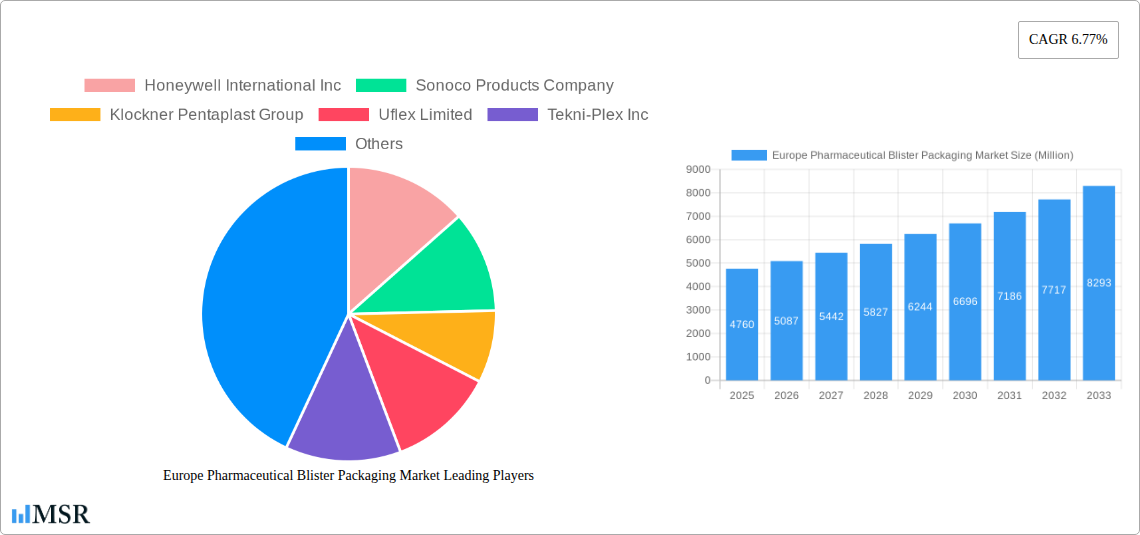

Europe Pharmaceutical Blister Packaging Market Company Market Share

Europe Pharmaceutical Blister Packaging Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Europe Pharmaceutical Blister Packaging Market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033 (base year 2025, forecast period 2025-2033), this report covers market size, segmentation, leading players, and future growth projections. The market is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Europe Pharmaceutical Blister Packaging Market Market Concentration & Dynamics

The European pharmaceutical blister packaging market exhibits a moderately concentrated landscape, with several major players holding significant market share. However, the presence of numerous smaller companies and regional players indicates a competitive environment. Market share data for 2024 reveals that Amcor Limited and Constantia Flexibles hold approximately xx% and xx% respectively, while other key players like Honeywell International Inc and Sonoco Products Company contribute significantly. The market dynamics are influenced by several factors:

- Innovation Ecosystems: Ongoing R&D efforts focus on sustainable materials (paper, fiber-based alternatives) and advanced manufacturing technologies (e.g., cold forming, thermoforming).

- Regulatory Frameworks: Stringent regulations concerning pharmaceutical packaging safety and sustainability (e.g., EU's plastic strategy) are driving innovation and market shifts.

- Substitute Products: While blister packs remain dominant, competition exists from alternative packaging formats like sachets and bottles, particularly for certain drug types.

- End-User Trends: Growing demand for convenience, child-resistance, and tamper-evident features shapes packaging preferences.

- M&A Activities: The market has witnessed xx mergers and acquisitions in the past five years (2019-2024), signaling consolidation and strategic expansion. These transactions primarily involved companies seeking to enhance their product portfolios, expand geographical reach, or gain access to new technologies.

Europe Pharmaceutical Blister Packaging Market Industry Insights & Trends

The European pharmaceutical blister packaging market is exhibiting substantial growth, propelled by a confluence of critical factors. The market size was valued at approximately **[Insert Current Market Size in Million] Million USD in 2024** and is forecasted to reach an impressive **[Insert Projected Market Size in Million] Million USD by 2033**, indicating a robust compound annual growth rate (CAGR) of **[Insert CAGR]%**. Several key drivers are fueling this upward trajectory:

- Escalating Pharmaceutical Consumption: The sustained rise in the aging population across Europe, coupled with the increasing prevalence of chronic diseases, is directly augmenting the demand for pharmaceutical products. This, in turn, is creating a sustained need for secure, convenient, and compliant blister packaging solutions.

- Pioneering Technological Advancements: Continuous innovation in blister packaging materials, such as the development of advanced barrier films and the increasing adoption of sustainable alternatives like paperboard and compostable plastics, is enhancing product shelf life and protecting sensitive medications. Furthermore, advancements in manufacturing processes are leading to improved patient convenience through features like easy-open designs and dosage adherence aids, while simultaneously bolstering the industry's commitment to sustainability. The significant trend towards recyclable and biodegradable packaging solutions is a testament to this progress.

- Upholding Stringent Regulatory Compliance: The European Union's rigorous regulatory framework concerning pharmaceutical packaging safety, tamper-evidence, and environmental impact is a significant catalyst for innovation. Manufacturers are increasingly driven to invest in and adopt more sustainable, compliant, and technologically advanced blister packaging solutions to meet these exacting standards.

- Growing Demand for Bespoke Packaging Solutions: Pharmaceutical companies are placing a greater emphasis on developing customized blister packs to precisely address specific product requirements, unique market demands, and enhance patient engagement. This includes the development of personalized medication packs for chronic condition management and specialized blister designs tailored for different drug delivery systems and therapeutic classes.

This pronounced growth trajectory is anticipated to persist and accelerate throughout the forecast period, largely influenced by evolving consumer preferences for sustainable and convenient healthcare solutions, alongside the dynamic landscape of the pharmaceutical market.

Key Markets & Segments Leading Europe Pharmaceutical Blister Packaging Market

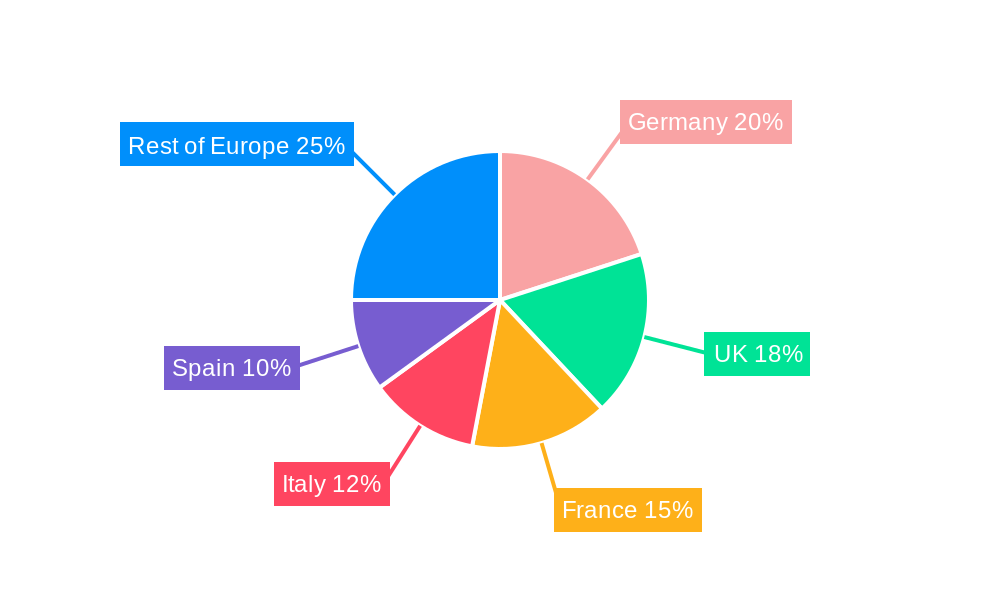

The European pharmaceutical blister packaging market is dominated by several key segments and regions:

By Technology:

- Cold Forming: This technology maintains a significant market share due to its cost-effectiveness and suitability for various pharmaceutical products.

- Thermoforming: This segment is experiencing growth due to its ability to create complex shapes and designs, catering to specialized packaging needs.

By Country:

- Germany: Germany represents a leading market due to its robust pharmaceutical industry and high healthcare expenditure. Strong economic growth and well-developed healthcare infrastructure contribute to this dominance.

- United Kingdom: The UK market is characterized by high pharmaceutical consumption and a focus on innovative packaging solutions.

- France, Italy, Spain: These countries represent significant markets with considerable growth potential, driven by factors such as rising healthcare spending and an aging population.

By Material:

- Plastic: While facing increasing scrutiny due to environmental concerns, plastic continues to be the most widely used material for blister packs due to its versatility, cost-effectiveness, and barrier properties.

- Paper: The adoption of paper-based blister packaging solutions is accelerating due to growing sustainability concerns and regulatory pressure to reduce plastic waste.

- Aluminum: Aluminum offers good barrier properties and is used in specialized applications where high protection is required.

Europe Pharmaceutical Blister Packaging Market Product Developments

Recent product developments in the European pharmaceutical blister packaging market center around sustainability and enhanced functionalities. Constantia Flexibles' REGULA CIRC cold-form foil, launched in July 2023, exemplifies the focus on circularity and compliance with upcoming regulations. The emergence of fiber-based blister packs, as highlighted by the Blister Pack Collective's initiative (February 2024), demonstrates a significant shift towards eco-friendly alternatives. These innovations improve sustainability and provide a competitive advantage to manufacturers embracing environmentally conscious packaging solutions.

Challenges in the Europe Pharmaceutical Blister Packaging Market Market

Despite the robust growth, the Europe pharmaceutical blister packaging market is not without its hurdles. Navigating the intricate landscape of stringent regulatory compliance requirements necessitates substantial and ongoing investments in research and development (R&D) and advanced manufacturing processes. Fluctuations in the prices of key raw materials, particularly plastics and specialty films, introduce significant cost pressures for manufacturers. Furthermore, the market is characterized by intense competition, both from well-established industry incumbents and emerging agile players, which compels continuous innovation, operational efficiency, and strategic pricing to maintain profitability and secure market share. Potential supply chain disruptions, stemming from geopolitical events, logistical complexities, or raw material availability, pose a risk to timely product delivery and can consequently impact overall market performance and customer satisfaction.

Forces Driving Europe Pharmaceutical Blister Packaging Market Growth

Several potent forces are acting as key growth drivers for the Europe pharmaceutical blister packaging market. The fundamental driver remains the escalating demand for pharmaceutical products, directly attributable to the region's aging demographic and the persistent rise in the incidence of chronic diseases. Concurrently, significant technological advancements are revolutionizing the industry, particularly in the development of sustainable, recyclable, and biodegradable packaging solutions that align with environmental consciousness. Supportive and often evolving regulatory policies that encourage the adoption of environmentally friendly packaging further contribute to this growth momentum. In addition, the increasing demand for customized and patient-centric packaging solutions, meticulously tailored to specific drug types, patient needs, and dosage regimens, is a significant impetus for market expansion.

Long-Term Growth Catalysts in the Europe Pharmaceutical Blister Packaging Market

Long-term growth will be driven by continued innovation in sustainable materials and manufacturing processes, focusing on recyclable and biodegradable options. Strategic collaborations among pharmaceutical companies, packaging manufacturers, and recycling firms will facilitate the adoption of greener packaging solutions. Expansion into new markets and regions with growing healthcare sectors will offer additional growth opportunities.

Emerging Opportunities in Europe Pharmaceutical Blister Packaging Market

Emerging opportunities reside in the development of advanced, sustainable packaging materials, such as bioplastics and compostable films. The growing demand for personalized medicine and customized packaging presents a significant opportunity. Exploring new markets within emerging economies and regions experiencing growth in healthcare spending also offers considerable potential. The integration of digital technologies, such as smart packaging, enhances traceability and product security, thus creating lucrative avenues.

Leading Players in the Europe Pharmaceutical Blister Packaging Market Sector

- Honeywell International Inc

- Sonoco Products Company

- Klockner Pentaplast Group

- Uflex Limited

- Tekni-Plex Inc

- Perlen Packaging AG

- Nelipak Corporation

- Dow Chemical Company

- Constantia Flexibles

- Amcor Limited

Key Milestones in Europe Pharmaceutical Blister Packaging Market Industry

- February 2024: Sanofi Consumer Healthcare's strategic decision to join the Blister Pack Collective marks a pivotal moment, actively accelerating the adoption and wider implementation of fiber-based, fully recyclable blister packs across its product lines. This significant milestone directly influences market dynamics by championing sustainable packaging alternatives and proactively reducing the reliance on traditional plastic materials.

- July 2023: Constantia Flexibles unveiled REGULA CIRC, an innovative and sustainable cold-form foil solution. This launch establishes a new benchmark for environmentally responsible blister packaging, showcasing the industry's proactive response to mounting sustainability concerns and the burgeoning consumer and regulatory demand for truly eco-friendly packaging alternatives.

Strategic Outlook for Europe Pharmaceutical Blister Packaging Market Market

The strategic outlook for the Europe pharmaceutical blister packaging market is overwhelmingly positive, underpinned by the sustained and growing demand for essential pharmaceutical products, an unwavering commitment to sustainability principles, and continuous waves of technological innovation. Companies that proactively embrace cutting-edge innovation, embed sustainability at the core of their operations, and cultivate robust, collaborative partnerships across the entire value chain are exceptionally well-positioned to capitalize on the market's substantial growth potential. Strategic and targeted investments in R&D, with a particular focus on pioneering sustainable material science and advanced, automated manufacturing technologies, will be absolutely critical for achieving enduring success and maintaining a competitive edge in this dynamic and evolving market.

Europe Pharmaceutical Blister Packaging Market Segmentation

-

1. Material

- 1.1. Plastic

- 1.2. Paper

- 1.3. Aluminum

-

2. Technology

- 2.1. Cold Forming

- 2.2. Thermoforming

Europe Pharmaceutical Blister Packaging Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Pharmaceutical Blister Packaging Market Regional Market Share

Geographic Coverage of Europe Pharmaceutical Blister Packaging Market

Europe Pharmaceutical Blister Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.77% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in the Rise of Diseases and Illness to Drive the Market Growth

- 3.3. Market Restrains

- 3.3.1. Dynamic Nature of Regulations Might Limit Market Growth

- 3.4. Market Trends

- 3.4.1. The Demand for Sustainable Packaging is Increasing

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Pharmaceutical Blister Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic

- 5.1.2. Paper

- 5.1.3. Aluminum

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Cold Forming

- 5.2.2. Thermoforming

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Honeywell International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sonoco Products Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Klockner Pentaplast Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Uflex Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tekni-Plex Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Perlen Packaging AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nelipak Corporatio

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Dow Chemical Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Constantia Flexibles

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Amcor Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Honeywell International Inc

List of Figures

- Figure 1: Europe Pharmaceutical Blister Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Pharmaceutical Blister Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Pharmaceutical Blister Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Europe Pharmaceutical Blister Packaging Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 3: Europe Pharmaceutical Blister Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Pharmaceutical Blister Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 5: Europe Pharmaceutical Blister Packaging Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 6: Europe Pharmaceutical Blister Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Pharmaceutical Blister Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Pharmaceutical Blister Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: France Europe Pharmaceutical Blister Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Pharmaceutical Blister Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Pharmaceutical Blister Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Pharmaceutical Blister Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Pharmaceutical Blister Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Pharmaceutical Blister Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Pharmaceutical Blister Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Pharmaceutical Blister Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Pharmaceutical Blister Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Pharmaceutical Blister Packaging Market?

The projected CAGR is approximately 6.77%.

2. Which companies are prominent players in the Europe Pharmaceutical Blister Packaging Market?

Key companies in the market include Honeywell International Inc, Sonoco Products Company, Klockner Pentaplast Group, Uflex Limited, Tekni-Plex Inc, Perlen Packaging AG, Nelipak Corporatio, Dow Chemical Company, Constantia Flexibles, Amcor Limited.

3. What are the main segments of the Europe Pharmaceutical Blister Packaging Market?

The market segments include Material, Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.76 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the Rise of Diseases and Illness to Drive the Market Growth.

6. What are the notable trends driving market growth?

The Demand for Sustainable Packaging is Increasing.

7. Are there any restraints impacting market growth?

Dynamic Nature of Regulations Might Limit Market Growth.

8. Can you provide examples of recent developments in the market?

February 2024: Sanofi Consumer Healthcare joined PA Consulting and Pulpac's Blister Pack Collective to deliver fiber-based blister packs that can be recycled in the paper waste stream and phase out problem plastics in pharmaceutical packaging. The Blister Pack Collective comprises companies in the pharma, consumer health, and FMCG industries and plans to create a tablet blister pack made of PulPac's Dry Molded Fiber.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Pharmaceutical Blister Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Pharmaceutical Blister Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Pharmaceutical Blister Packaging Market?

To stay informed about further developments, trends, and reports in the Europe Pharmaceutical Blister Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence