Key Insights

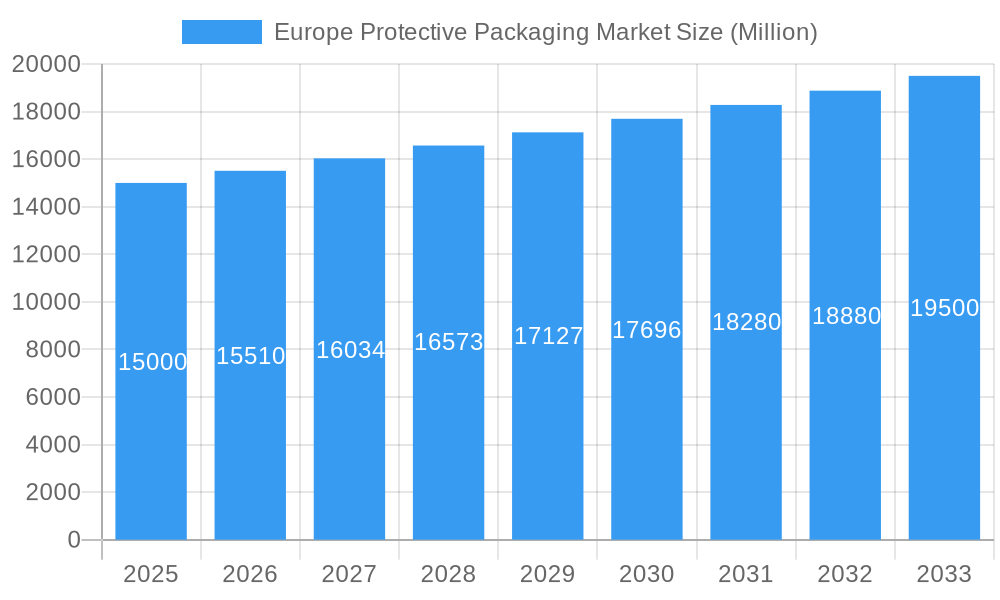

The European Protective Packaging Market is projected to reach $30.1 billion by 2033, expanding at a compound annual growth rate (CAGR) of 4.7% from a base year of 2025. This growth is primarily fueled by the rapid expansion of the e-commerce sector, which demands secure packaging for product protection during logistics. A significant driver is the rising consumer preference for sustainable and eco-friendly packaging, prompting innovation in biodegradable and recyclable materials such as paper and paperboard. The food and beverage industry, a key consumer vertical, contributes substantially to market expansion through its need for packaging that maintains product integrity and extends shelf life. Technological advancements in packaging design, focusing on enhanced protection and reduced material consumption, also bolster market growth.

Europe Protective Packaging Market Market Size (In Billion)

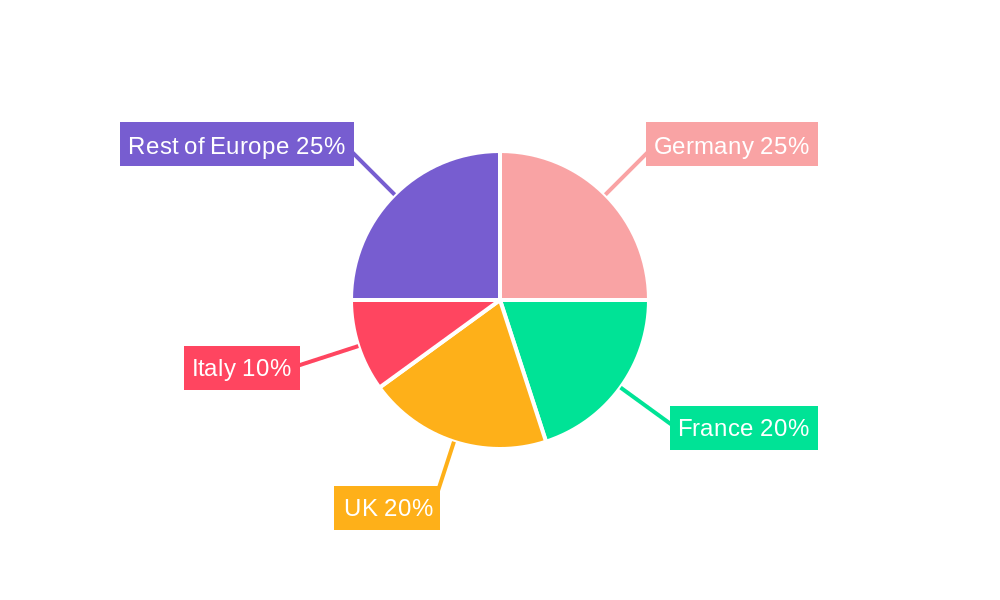

Conversely, the market confronts several challenges. Volatile raw material costs, especially for plastics, present a profitability concern. Stringent environmental regulations concerning packaging waste management necessitate investment in sustainable alternatives. The market experiences intense competition from established entities like Smurfit Kappa Group plc, Sonoco Products Company, and DS Smith plc, alongside emerging specialized solution providers. Regional growth disparities are expected, with Germany, France, and the United Kingdom anticipated to lead due to strong e-commerce penetration and developed manufacturing infrastructures. The increasing adoption of lightweight and cost-effective flexible packaging solutions, such as mailers and air pillows, is a key trend shaping market dynamics and future growth trajectories.

Europe Protective Packaging Market Company Market Share

Europe Protective Packaging Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe Protective Packaging Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report segments the market by end-user vertical (Food and Beverage, Pharmaceutical, Consumer Electronics, Beauty and Homecare, Other End-user Verticals), country (United Kingdom, Germany, France, Italy, Rest of Europe), material type (Plastics, Paper and Paperboard, Other Material Types), and product type (Rigid, Insulated Shipping Containers: Flexibles (Mailers, Paper Full, and Air Pillows), Bubble Wraps: Foam Based). Leading players like Smurfit Kappa Group plc, Sonoco Products Company, DS Smith plc, and Sealed Air Corporation are profiled, providing a complete picture of this dynamic market expected to reach xx Million by 2033.

Europe Protective Packaging Market Market Concentration & Dynamics

The Europe protective packaging market exhibits a moderately concentrated landscape, with the top five players holding approximately xx% of the market share in 2025. This concentration is driven by the significant investments made by major players in research and development, expanding their product portfolios, and pursuing strategic mergers and acquisitions (M&A).

- Market Share Concentration: The top 5 companies command xx% market share (2025 estimate).

- M&A Activity: The historical period (2019-2024) witnessed xx M&A deals, primarily focused on expanding geographic reach and product diversification. This trend is expected to continue during the forecast period, further consolidating the market.

- Innovation Ecosystems: A thriving ecosystem of startups and established players is driving innovation in sustainable packaging materials, such as biodegradable plastics and recycled paperboard.

- Regulatory Frameworks: The European Union's stringent regulations on plastic waste and sustainability are significantly influencing packaging choices, promoting the adoption of eco-friendly materials.

- Substitute Products: The market faces competition from alternative packaging solutions like reusable containers and innovative packaging designs aimed at reducing material usage.

- End-User Trends: The growing e-commerce sector fuels the demand for protective packaging, particularly for fragile goods. Increased consumer awareness of sustainability drives demand for eco-friendly packaging options.

Europe Protective Packaging Market Industry Insights & Trends

The Europe protective packaging market is experiencing robust growth, driven by the expanding e-commerce sector, rising consumer demand for convenient and safe product delivery, and a growing focus on sustainability. The market size was valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. Key factors contributing to this growth include:

- E-commerce Boom: The exponential rise in online shopping significantly boosts demand for efficient and protective packaging solutions.

- Technological Advancements: Innovations in material science, automation, and packaging design enhance product protection and reduce packaging waste.

- Sustainability Concerns: Growing environmental awareness among consumers and stricter regulations are pushing the adoption of eco-friendly materials and packaging designs.

- Supply Chain Optimization: Efficient packaging solutions contribute to streamlined logistics and reduced transportation costs.

Key Markets & Segments Leading Europe Protective Packaging Market

The United Kingdom, Germany, and France represent the largest national markets within Europe, collectively accounting for over xx% of the total market value in 2025. The Food and Beverage and Pharmaceutical sectors are the leading end-user verticals, due to their stringent requirements for product protection and safety. Paper and Paperboard remains the dominant material type, driven by its cost-effectiveness and recyclability.

- Dominant Regions/Countries: United Kingdom, Germany, France.

- Leading End-User Verticals: Food and Beverage, Pharmaceutical.

- Dominant Material Type: Paper and Paperboard.

- Growth Drivers:

- Economic Growth: Strong economic performance in key European markets fuels consumer spending and demand for goods.

- Improved Infrastructure: Efficient transportation networks and logistics support the seamless delivery of packaged goods.

- Government Initiatives: Government support for sustainable packaging and waste reduction promotes innovation and adoption of eco-friendly solutions.

Europe Protective Packaging Market Product Developments

Recent innovations focus on sustainable and efficient packaging solutions. This includes the development of biodegradable and compostable materials, lightweight packaging designs to reduce transportation costs, and smart packaging incorporating sensors for product tracking and condition monitoring. The introduction of Sealed Air's BUBBLE WRAP brand paper bubble mailer exemplifies this trend toward eco-friendly, recyclable alternatives.

Challenges in the Europe Protective Packaging Market Market

The Europe Protective Packaging Market is navigating a complex landscape marked by several key challenges. Fluctuations in the prices of essential raw materials, such as paper, plastics, and foam, directly impact production costs and require agile procurement strategies. Escalating transportation and logistics expenses, amplified by global supply chain disruptions and rising fuel prices, further squeeze profit margins for manufacturers and distributors. Concurrently, the market is under increasing pressure from stringent environmental regulations and ambitious sustainability mandates across various European nations. These regulations, focusing on recyclability, biodegradability, and reduced waste, necessitate significant investment in research and development for eco-friendly alternatives. Intense competition among a growing number of global and regional players intensifies pricing pressures, demanding operational efficiencies and innovative product offerings to maintain market share. Moreover, ensuring a resilient, secure, and reliable supply chain remains a persistent and critical challenge, especially in the face of geopolitical uncertainties and unforeseen disruptions.

Forces Driving Europe Protective Packaging Market Growth

Key growth drivers include the increasing demand for e-commerce packaging, the rising adoption of sustainable packaging materials, and ongoing technological advancements in packaging design and automation. Government regulations promoting eco-friendly packaging further accelerate market growth.

Long-Term Growth Catalysts in the Europe Protective Packaging Market

Long-term growth will be fueled by innovative packaging solutions that address sustainability concerns, enhance product protection, and optimize supply chain efficiency. Strategic partnerships and collaborations among packaging manufacturers, logistics providers, and retailers will also play a crucial role in shaping future market trends. Expansion into emerging markets within Europe and the development of specialized packaging for niche applications present significant opportunities.

Emerging Opportunities in Europe Protective Packaging Market

The Europe Protective Packaging Market is ripe with emerging opportunities, largely driven by evolving consumer demands and technological advancements. The burgeoning e-commerce sector continues to fuel a robust demand for customized packaging solutions tailored to specific product types, sizes, and shipping requirements, offering enhanced protection and reduced material usage. A significant growth area lies in the increasing adoption of smart packaging technologies, integrating features like RFID tags, QR codes, and sensors for enhanced tracking, inventory management, product authentication, and even temperature monitoring, thereby adding value beyond basic protection. Furthermore, the relentless pursuit of sustainability presents a prime opportunity for the development and adoption of innovative materials. This includes advanced bioplastics, compostable alternatives, recycled content integration, and lightweight yet durable designs that minimize environmental impact. The market also benefits from new packaging designs that prioritize not only robust product protection but also an enhanced consumer experience and improved product presentation, contributing to brand loyalty and market differentiation.

Leading Players in the Europe Protective Packaging Market Sector

- Smurfit Kappa Group plc

- Sonoco Products Company

- DS Smith plc

- Storopack Hans Reichenecker Gmbh

- Crown Holdings Inc

- Huhtamaki Group

- International Paper Company

- Intertape Polymer Group Inc

- Pregis Corporation

- Sealed Air Corporation

Key Milestones in Europe Protective Packaging Market Industry

- July 2022: Sealed Air introduced the BUBBLE WRAP brand paper bubble mailer, a recyclable, fiber-based padded mailer. This launch signifies a significant shift towards eco-friendly packaging solutions and strengthens Sealed Air's position in the sustainable packaging market, demonstrating a commitment to reducing plastic waste and meeting the growing demand for greener alternatives.

- November 2023: DS Smith announced its investment in a new state-of-the-art innovation centre focused on developing circular packaging solutions, further emphasizing the industry's drive towards resource efficiency and a circular economy.

- March 2024: Smurfit Kappa launched its sustainability-linked financing program, aligning its financial strategy with ambitious environmental targets and reinforcing its commitment to reducing its carbon footprint across its operations.

Strategic Outlook for Europe Protective Packaging Market Market

The strategic outlook for the Europe Protective Packaging Market remains exceptionally promising, poised for sustained and robust growth. This positive trajectory is predominantly fueled by the persistent and accelerating expansion of the e-commerce sector, which inherently demands sophisticated and reliable protective packaging for a vast array of goods. Simultaneously, there is an amplified and non-negotiable focus on sustainability across the entire value chain. This encompasses the demand for recyclable, biodegradable, compostable, and reusable packaging solutions, as well as the drive to reduce material usage and carbon emissions. Ongoing technological advancements are also playing a pivotal role, enabling the development of lighter, stronger, and smarter packaging solutions that offer enhanced functionality and efficiency. Companies that proactively prioritize innovation, invest heavily in sustainable material research and development, optimize their supply chain management for resilience and efficiency, and demonstrably align their operations with environmental objectives will be exceptionally well-positioned to not only navigate the existing challenges but also to capitalize on the significant and dynamic growth opportunities that define this evolving market.

Europe Protective Packaging Market Segmentation

-

1. Material Type

- 1.1. Plastics

- 1.2. Paper and Paperboard

- 1.3. Other Material Types

-

2. Product Type

-

2.1. Rigid

- 2.1.1. Molded Pulp

- 2.1.2. Paperboard-based Protectors

- 2.1.3. Insulated Shipping Containers

-

2.2. Flexibles (Mailers, Paper Full, and Air Pillows)

- 2.2.1. Bubble Wraps

- 2.3. Foam Based

-

2.1. Rigid

-

3. End-user Vertical

- 3.1. Food and Beverage

- 3.2. Pharmaceutical

- 3.3. Consumer Electronics

- 3.4. Beauty and Homecare

- 3.5. Other End-user Verticals

Europe Protective Packaging Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Protective Packaging Market Regional Market Share

Geographic Coverage of Europe Protective Packaging Market

Europe Protective Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Trend of E-commerce

- 3.3. Market Restrains

- 3.3.1. ; Alternative Forms of Packaging

- 3.4. Market Trends

- 3.4.1. Beauty and Homecare Industry to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Protective Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Plastics

- 5.1.2. Paper and Paperboard

- 5.1.3. Other Material Types

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Rigid

- 5.2.1.1. Molded Pulp

- 5.2.1.2. Paperboard-based Protectors

- 5.2.1.3. Insulated Shipping Containers

- 5.2.2. Flexibles (Mailers, Paper Full, and Air Pillows)

- 5.2.2.1. Bubble Wraps

- 5.2.3. Foam Based

- 5.2.1. Rigid

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Food and Beverage

- 5.3.2. Pharmaceutical

- 5.3.3. Consumer Electronics

- 5.3.4. Beauty and Homecare

- 5.3.5. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Smurfit Kappa Group plc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sonoco Products Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DS Smith plc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Storopack Hans Reichenecker Gmbh

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Crown Holdings Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Huhtamaki Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 International Paper Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Intertape Polymer Group Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Pregis Corporatio

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sealed Air Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Smurfit Kappa Group plc

List of Figures

- Figure 1: Europe Protective Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Protective Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Protective Packaging Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 2: Europe Protective Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: Europe Protective Packaging Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 4: Europe Protective Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Protective Packaging Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 6: Europe Protective Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: Europe Protective Packaging Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 8: Europe Protective Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Protective Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Protective Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: France Europe Protective Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Protective Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Protective Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Protective Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Protective Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Protective Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Protective Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Protective Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Protective Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Protective Packaging Market?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the Europe Protective Packaging Market?

Key companies in the market include Smurfit Kappa Group plc, Sonoco Products Company, DS Smith plc, Storopack Hans Reichenecker Gmbh, Crown Holdings Inc, Huhtamaki Group, International Paper Company, Intertape Polymer Group Inc, Pregis Corporatio, Sealed Air Corporation.

3. What are the main segments of the Europe Protective Packaging Market?

The market segments include Material Type, Product Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 30.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Trend of E-commerce.

6. What are the notable trends driving market growth?

Beauty and Homecare Industry to Drive the Market Growth.

7. Are there any restraints impacting market growth?

; Alternative Forms of Packaging.

8. Can you provide examples of recent developments in the market?

July 2022 - Sealedair has introduced the BUBBLE WRAP brand paper bubble mailer, a fiber-based padded mailer that can recycle in curbside bins. This product complements SEE's other paper mailer offerings, which include SEALED AIR brand return-ready mailers, padded mailers, and rigid mailers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Protective Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Protective Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Protective Packaging Market?

To stay informed about further developments, trends, and reports in the Europe Protective Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence