Key Insights

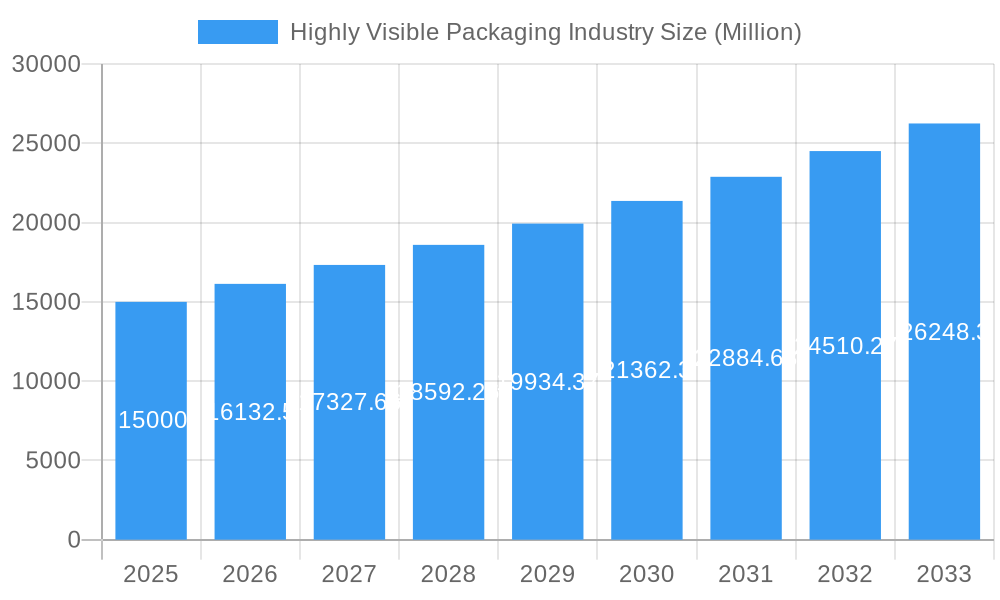

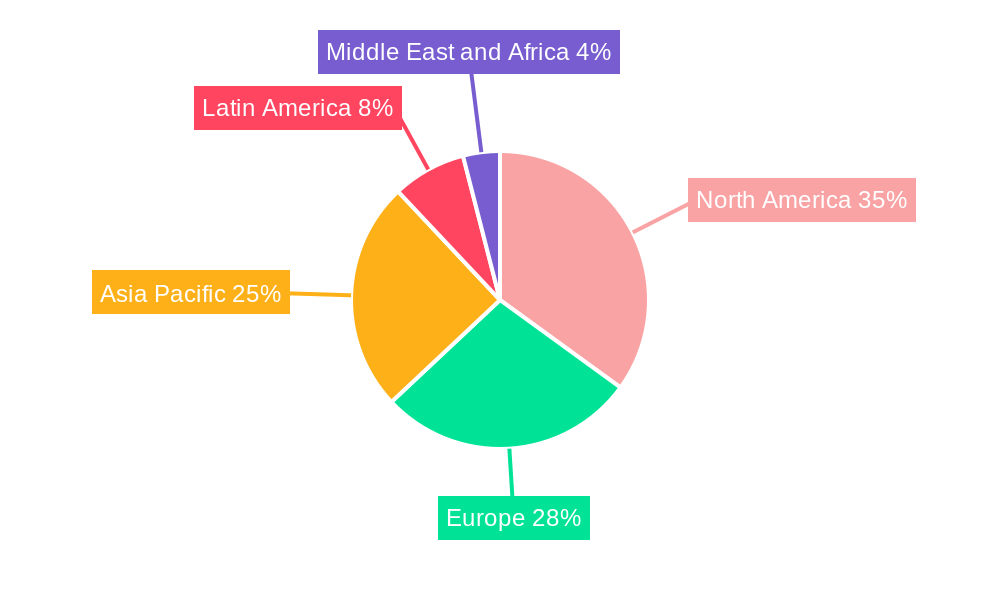

The global Highly Visible Packaging market is projected to reach 46.05 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 7.71% from a base year of 2024. This significant expansion is attributed to escalating consumer demand for aesthetically pleasing and informative packaging across key sectors such as food & beverage, healthcare, and electronics. Visually appealing packaging that clearly communicates product details is a primary driver, fostering innovation in design and material science. The surge in e-commerce further amplifies this trend, requiring packaging that ensures product protection during transit while enhancing the unboxing experience through durable and striking solutions. Growing consumer preference for sustainable and eco-friendly options is also a key influencer, prompting manufacturers to adopt biodegradable and recyclable materials. The market is segmented by end-user industry and packaging type, with clamshells, blister packs, and corrugated boxes being prominent segments. North America and Asia Pacific demonstrate robust growth, supported by high consumer spending and strong manufacturing bases. However, evolving regulations on material usage and disposal, alongside potential raw material price volatility, present market challenges.

Highly Visible Packaging Industry Market Size (In Billion)

The competitive arena features established global enterprises and niche specialized firms. Leading players like Amcor and Sonoco are actively investing in R&D to develop innovative and sustainable packaging solutions, fostering a competitive environment that drives cost efficiency and consumer benefits. The future outlook for the Highly Visible Packaging market is optimistic, with continued growth anticipated across various industries. Sustained success hinges on manufacturers' ability to adapt to evolving consumer expectations for sustainability and navigate regulatory landscapes effectively. Strategic collaborations and M&A activities are expected to reshape the market as companies seek to expand their reach and product portfolios.

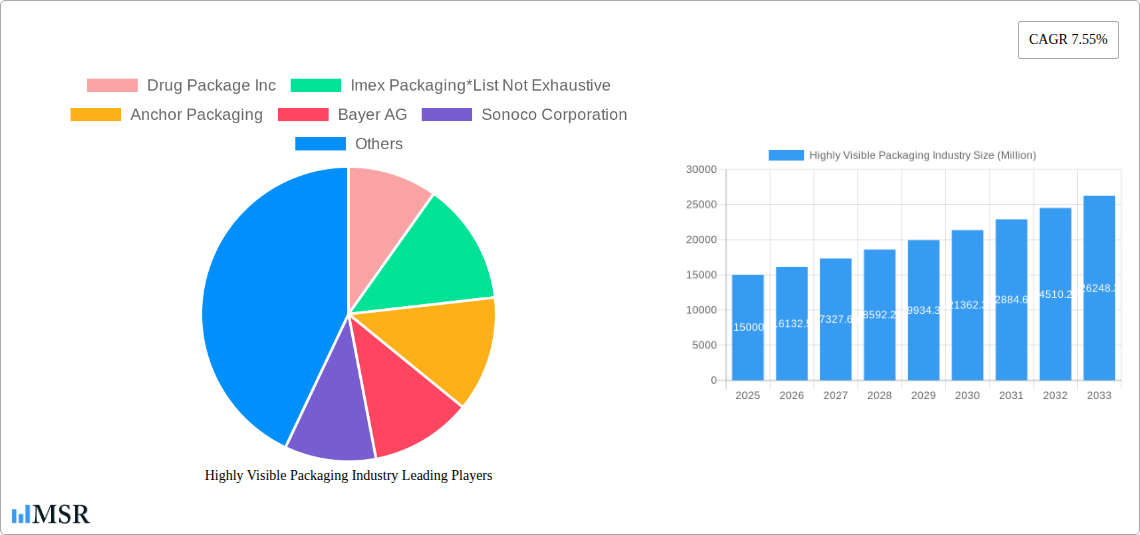

Highly Visible Packaging Industry Company Market Share

Highly Visible Packaging Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the highly visible packaging industry, encompassing market dynamics, key segments, leading players, and future growth prospects. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report is invaluable for industry stakeholders, investors, and businesses seeking to understand and capitalize on the evolving landscape of this multi-billion dollar market. The report's analysis covers a market exceeding $xx Million in 2025 and projects significant growth to $xx Million by 2033.

Highly Visible Packaging Industry Market Concentration & Dynamics

This section analyzes the competitive landscape, innovation, regulations, and market forces shaping the highly visible packaging industry. The market is moderately concentrated, with several major players holding significant market share. However, smaller niche players are also contributing significantly.

- Market Share: Amcor Limited and Sonoco Corporation hold a combined market share of approximately xx%, while other key players like Mondi Group and Reynolds Group Holdings Limited contribute substantial portions. Drug Package Inc and Imex Packaging account for approximately xx% combined. The remaining market share is dispersed among numerous smaller participants.

- M&A Activity: The industry witnessed xx M&A deals between 2019 and 2024, driven primarily by strategic acquisitions to expand product portfolios and geographic reach. This activity is projected to continue, particularly amongst larger players seeking consolidation.

- Innovation Ecosystem: Significant innovation is observed in sustainable packaging solutions, including recycled materials and biodegradable options. This is driven by increasing consumer demand for eco-friendly products and stringent environmental regulations.

- Regulatory Frameworks: Government regulations concerning material composition, recyclability, and labeling are constantly evolving, impacting product design and manufacturing processes. Compliance costs present a key challenge for many firms.

- Substitute Products: The industry faces competition from alternative packaging materials, although these substitutes often lack the visibility and functionality of highly visible packaging.

- End-User Trends: The growing preference for convenient, tamper-evident, and aesthetically appealing packaging is fueling demand for advanced packaging solutions across various end-user industries.

Highly Visible Packaging Industry Industry Insights & Trends

The highly visible packaging industry is experiencing dynamic and robust growth, fueled by a confluence of evolving consumer demands, technological breakthroughs, and a heightened focus on sustainability. The market is projected to reach an estimated **$XX Million in 2025**, with a significant Compound Annual Growth Rate (CAGR) of **XX%** anticipated during the forecast period. This upward trajectory is a testament to the sector's adaptability and its crucial role in modern commerce.

Several interconnected factors are propelling this substantial growth. Primarily, the escalating demand for consumer goods across a multitude of sectors, from fast-moving consumer goods (FMCG) to electronics and pharmaceuticals, necessitates increasingly sophisticated packaging solutions. Simultaneously, relentless advancements in materials science and innovative packaging design are continuously enhancing product appeal, extending shelf life, and crucially, improving the environmental footprint of packaging. Shifting consumer preferences, with a marked inclination towards premium, convenient, and aesthetically pleasing products, further stimulate the market. The meteoric rise of e-commerce has also played a pivotal role, driving the need for robust, protective, and eye-catching packaging that can withstand the rigors of online delivery while maintaining brand integrity. Finally, the industry's proactive embrace of sustainable and recyclable packaging materials is not only meeting regulatory requirements but also resonating deeply with environmentally conscious consumers, solidifying its growth potential.

Key Markets & Segments Leading Highly Visible Packaging Industry

This section details the dominant segments within the highly visible packaging market.

By End-user Industry:

- Food and Beverage: This remains the largest segment, accounting for approximately xx% of the market, driven by the rising demand for packaged food and beverages. Growth is fueled by factors such as population growth, urbanization, and changing dietary habits.

- Healthcare: This segment demonstrates substantial growth due to the increasing demand for pharmaceutical and medical device packaging. Stringent regulatory requirements and the need for tamper-evident packaging are notable drivers.

- Other Dominant Segments: Manufacturing, Agriculture, and Electronics and Appliances also contribute significantly to market growth, showcasing varying degrees of demand for specific packaging solutions.

By Type:

- Corrugated Boxes: This type enjoys significant market share due to its cost-effectiveness and versatility. Continuous innovation in corrugated board technology drives growth.

- Plastic Container Packaging: The versatility and cost-effectiveness of plastic containers contribute to significant market share. However, environmental concerns present challenges.

- Other Dominant Types: Clamshell packaging, blister packs, shrink wrap, and windowed packaging all have their own niche applications.

Highly Visible Packaging Industry Product Developments

Recent years have witnessed significant advancements in highly visible packaging, driven by the need for enhanced sustainability and functionality. These innovations include the integration of recycled materials, the development of biodegradable alternatives, and the incorporation of smart packaging technologies to enhance product traceability and shelf-life monitoring. Companies are focusing on developing unique and innovative packaging solutions that meet specific consumer and industry requirements. This competitive edge is gained through superior material selection, design, and manufacturing processes.

Challenges in the Highly Visible Packaging Industry Market

The industry faces several challenges, including volatile raw material prices, increasing environmental regulations, and intensifying competition. Supply chain disruptions can lead to production delays and increased costs, impacting profitability. Stringent regulations regarding material composition and recyclability require significant investments in R&D and manufacturing upgrades. The high cost of compliance can act as a significant barrier for smaller players.

Forces Driving Highly Visible Packaging Industry Growth

The expansion of the highly visible packaging industry is propelled by a potent combination of factors. Paramount among these is the ever-increasing consumer appetite for packaging that is not only functional but also aesthetically captivating and convenient for use. The digital revolution, with its exponential growth in e-commerce, demands packaging that can effectively protect products during transit while also serving as a powerful brand ambassador. Concurrently, significant strides in materials science and cutting-edge packaging design are continually expanding the possibilities for superior product protection, extending product freshness, and elevating the overall consumer unboxing experience. Furthermore, supportive government policies and a growing global impetus towards sustainable packaging solutions are providing a fertile ground for innovation and investment, accelerating the adoption of eco-friendly alternatives across the industry.

Long-Term Growth Catalysts in the Highly Visible Packaging Industry

Long-term growth hinges on the successful development and adoption of sustainable, eco-friendly packaging solutions. Strategic partnerships between packaging manufacturers and consumer goods companies are vital for accelerating the transition to sustainable practices. The expansion into emerging markets with growing consumer bases also offers significant opportunities. Furthermore, investment in advanced packaging technologies, such as smart packaging and active packaging, will be essential for future growth.

Emerging Opportunities in Highly Visible Packaging Industry

Emerging trends include the growing demand for personalized and customizable packaging, the increased use of augmented reality (AR) and virtual reality (VR) technologies to enhance the consumer experience, and the expanding adoption of packaging-as-a-service models. Opportunities also lie in the development of innovative packaging for specific applications, such as food preservation and medical device protection.

Leading Players in the Highly Visible Packaging Industry Sector

- Drug Package Inc

- Imex Packaging

- Anchor Packaging

- Bayer AG

- Sonoco Corporation

- Rohrer Corporation

- Bemis Corporation

- Mondi Group

- Reynolds Group Holdings Limited

- Amcor Limited

Key Milestones in Highly Visible Packaging Industry Industry

- September 2021: Celebration Packaging took a significant stride towards environmental responsibility with the launch of a new, fully recyclable range of packaging crafted from recycled PET. This move underscores the industry's commitment to embracing sustainable practices and reducing its ecological footprint.

- February 2022: Mondi Group demonstrated its innovative prowess by introducing a groundbreaking, fully recyclable packaging solution for Warmhaus. This development saw the replacement of traditional expanded polystyrene (EPS) inserts with 100% recyclable corrugated board, clearly illustrating the industry's proactive shift towards eco-friendly alternatives and circular economy principles.

Strategic Outlook for Highly Visible Packaging Industry Market

The highly visible packaging industry is strategically positioned for sustained and accelerated growth, driven by an unyielding commitment to innovation, the increasing demands of discerning consumers, and a profound and growing emphasis on environmental stewardship. To thrive in this rapidly evolving and competitive landscape, companies must prioritize strategic collaborations, substantial investments in research and development (R&D) to pioneer new materials and designs, and a proactive approach to navigating and anticipating evolving regulatory frameworks. The future success of the market hinges on the development of sophisticated, sustainable, and deeply consumer-centric packaging solutions that not only enhance product appeal and functionality but also champion environmental responsibility, ensuring a resilient and prosperous future for the industry.

Highly Visible Packaging Industry Segmentation

-

1. Type

- 1.1. Clamshell Packaging

- 1.2. Blister Pack

- 1.3. Shrink Wrap

- 1.4. Windowed Packaging

- 1.5. Plastic Container Packaging

- 1.6. Glass Container

- 1.7. Corrugated Box

-

2. End-user Industry

- 2.1. Food and Beverage

- 2.2. Healthcare

- 2.3. Manufacturing

- 2.4. Agriculture

- 2.5. Fashion and Apparels

- 2.6. Electronics and Appliances

- 2.7. Other End-user Industries

Highly Visible Packaging Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Singapore

- 3.5. Australia

- 3.6. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Argentina

- 4.4. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. Kuwait

- 5.4. Qatar

- 5.5. South Africa

- 5.6. Israel

- 5.7. Rest of Middle East and Africa

Highly Visible Packaging Industry Regional Market Share

Geographic Coverage of Highly Visible Packaging Industry

Highly Visible Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.71% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Facilitate Differentiation While Maintaining Security

- 3.3. Market Restrains

- 3.3.1. Addition of Sealing Process that Consumes Space and Resources

- 3.4. Market Trends

- 3.4.1. FMCG Holds a Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Highly Visible Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Clamshell Packaging

- 5.1.2. Blister Pack

- 5.1.3. Shrink Wrap

- 5.1.4. Windowed Packaging

- 5.1.5. Plastic Container Packaging

- 5.1.6. Glass Container

- 5.1.7. Corrugated Box

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food and Beverage

- 5.2.2. Healthcare

- 5.2.3. Manufacturing

- 5.2.4. Agriculture

- 5.2.5. Fashion and Apparels

- 5.2.6. Electronics and Appliances

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Highly Visible Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Clamshell Packaging

- 6.1.2. Blister Pack

- 6.1.3. Shrink Wrap

- 6.1.4. Windowed Packaging

- 6.1.5. Plastic Container Packaging

- 6.1.6. Glass Container

- 6.1.7. Corrugated Box

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Food and Beverage

- 6.2.2. Healthcare

- 6.2.3. Manufacturing

- 6.2.4. Agriculture

- 6.2.5. Fashion and Apparels

- 6.2.6. Electronics and Appliances

- 6.2.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Highly Visible Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Clamshell Packaging

- 7.1.2. Blister Pack

- 7.1.3. Shrink Wrap

- 7.1.4. Windowed Packaging

- 7.1.5. Plastic Container Packaging

- 7.1.6. Glass Container

- 7.1.7. Corrugated Box

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Food and Beverage

- 7.2.2. Healthcare

- 7.2.3. Manufacturing

- 7.2.4. Agriculture

- 7.2.5. Fashion and Apparels

- 7.2.6. Electronics and Appliances

- 7.2.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Highly Visible Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Clamshell Packaging

- 8.1.2. Blister Pack

- 8.1.3. Shrink Wrap

- 8.1.4. Windowed Packaging

- 8.1.5. Plastic Container Packaging

- 8.1.6. Glass Container

- 8.1.7. Corrugated Box

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Food and Beverage

- 8.2.2. Healthcare

- 8.2.3. Manufacturing

- 8.2.4. Agriculture

- 8.2.5. Fashion and Apparels

- 8.2.6. Electronics and Appliances

- 8.2.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Highly Visible Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Clamshell Packaging

- 9.1.2. Blister Pack

- 9.1.3. Shrink Wrap

- 9.1.4. Windowed Packaging

- 9.1.5. Plastic Container Packaging

- 9.1.6. Glass Container

- 9.1.7. Corrugated Box

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Food and Beverage

- 9.2.2. Healthcare

- 9.2.3. Manufacturing

- 9.2.4. Agriculture

- 9.2.5. Fashion and Apparels

- 9.2.6. Electronics and Appliances

- 9.2.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Highly Visible Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Clamshell Packaging

- 10.1.2. Blister Pack

- 10.1.3. Shrink Wrap

- 10.1.4. Windowed Packaging

- 10.1.5. Plastic Container Packaging

- 10.1.6. Glass Container

- 10.1.7. Corrugated Box

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Food and Beverage

- 10.2.2. Healthcare

- 10.2.3. Manufacturing

- 10.2.4. Agriculture

- 10.2.5. Fashion and Apparels

- 10.2.6. Electronics and Appliances

- 10.2.7. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Drug Package Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Imex Packaging*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Anchor Packaging

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bayer AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sonoco Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Rohrer Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bemis Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Mondi Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Reynolds Group Holdings Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Amcor Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Drug Package Inc

List of Figures

- Figure 1: Global Highly Visible Packaging Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Highly Visible Packaging Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Highly Visible Packaging Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Highly Visible Packaging Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 5: North America Highly Visible Packaging Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Highly Visible Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Highly Visible Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Highly Visible Packaging Industry Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Highly Visible Packaging Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Highly Visible Packaging Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 11: Europe Highly Visible Packaging Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Highly Visible Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Highly Visible Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Highly Visible Packaging Industry Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific Highly Visible Packaging Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Highly Visible Packaging Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Highly Visible Packaging Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Highly Visible Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Highly Visible Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Highly Visible Packaging Industry Revenue (billion), by Type 2025 & 2033

- Figure 21: Latin America Highly Visible Packaging Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Highly Visible Packaging Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: Latin America Highly Visible Packaging Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Latin America Highly Visible Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Highly Visible Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Highly Visible Packaging Industry Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East and Africa Highly Visible Packaging Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Highly Visible Packaging Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Highly Visible Packaging Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Highly Visible Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Highly Visible Packaging Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Highly Visible Packaging Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Highly Visible Packaging Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Highly Visible Packaging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Highly Visible Packaging Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Highly Visible Packaging Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Highly Visible Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Highly Visible Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Highly Visible Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Global Highly Visible Packaging Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Global Highly Visible Packaging Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Highly Visible Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Highly Visible Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Germany Highly Visible Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: France Highly Visible Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Spain Highly Visible Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Highly Visible Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Global Highly Visible Packaging Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Global Highly Visible Packaging Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 19: Global Highly Visible Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 20: China Highly Visible Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: India Highly Visible Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Japan Highly Visible Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Singapore Highly Visible Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Australia Highly Visible Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Highly Visible Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Global Highly Visible Packaging Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 27: Global Highly Visible Packaging Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Highly Visible Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 29: Brazil Highly Visible Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Mexico Highly Visible Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Argentina Highly Visible Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Rest of Latin America Highly Visible Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Global Highly Visible Packaging Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 34: Global Highly Visible Packaging Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 35: Global Highly Visible Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Saudi Arabia Highly Visible Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: United Arab Emirates Highly Visible Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Kuwait Highly Visible Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Qatar Highly Visible Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: South Africa Highly Visible Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Israel Highly Visible Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Rest of Middle East and Africa Highly Visible Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Highly Visible Packaging Industry?

The projected CAGR is approximately 7.71%.

2. Which companies are prominent players in the Highly Visible Packaging Industry?

Key companies in the market include Drug Package Inc, Imex Packaging*List Not Exhaustive, Anchor Packaging, Bayer AG, Sonoco Corporation, Rohrer Corporation, Bemis Corporation, Mondi Group, Reynolds Group Holdings Limited, Amcor Limited.

3. What are the main segments of the Highly Visible Packaging Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 46.05 billion as of 2022.

5. What are some drivers contributing to market growth?

Facilitate Differentiation While Maintaining Security.

6. What are the notable trends driving market growth?

FMCG Holds a Major Market Share.

7. Are there any restraints impacting market growth?

Addition of Sealing Process that Consumes Space and Resources.

8. Can you provide examples of recent developments in the market?

September 2021: The foodservice packaging supplier Celebration Packaging announced its new range of recycled PET packaging, which is made from recycled materials and is fully recyclable itself. The company added that its new range is available in multiple sizes to suit different applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Highly Visible Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Highly Visible Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Highly Visible Packaging Industry?

To stay informed about further developments, trends, and reports in the Highly Visible Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence