Key Insights

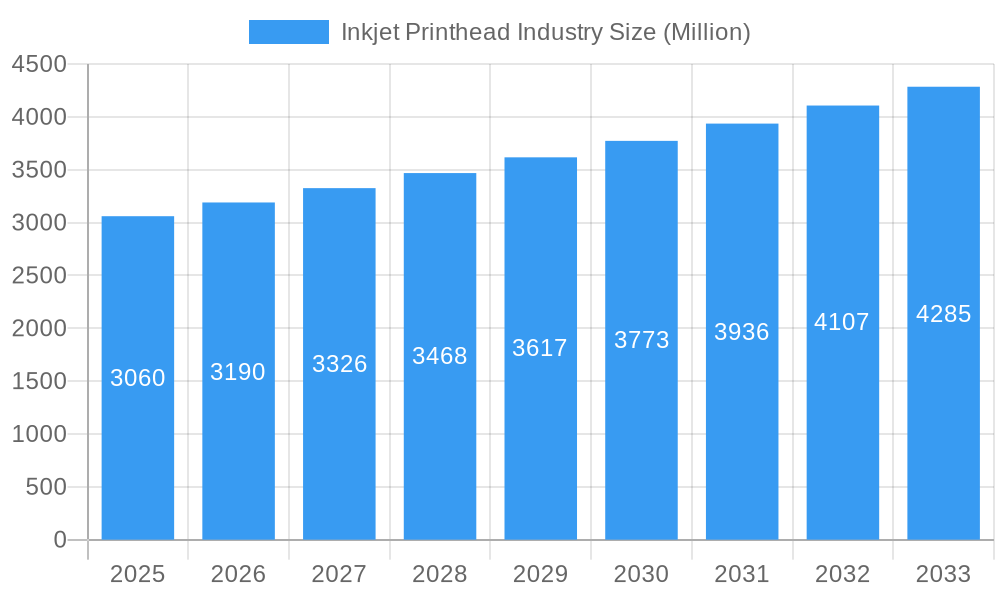

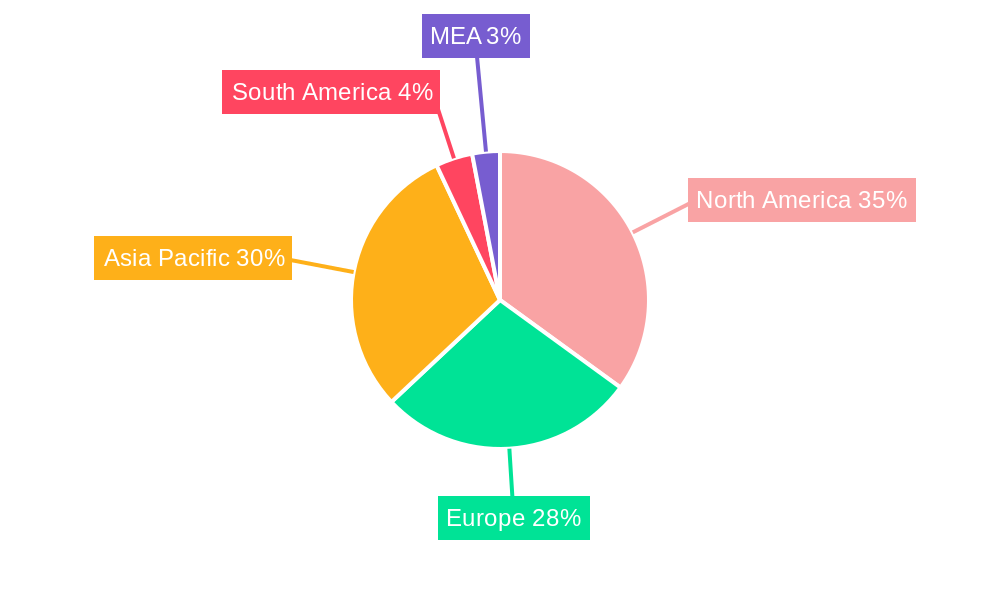

The inkjet printhead market, valued at $3.06 billion in 2025, is projected to experience robust growth, driven by increasing demand across diverse sectors. A compound annual growth rate (CAGR) of 4.28% from 2025 to 2033 indicates a significant expansion, fueled by several key factors. The rise of high-resolution printing in office and consumer applications, coupled with the growing adoption of inkjet technology in industrial and graphic printing, is a major catalyst. The continuous evolution of printhead technologies, particularly advancements in MEMS-based and piezo-based systems offering enhanced precision and speed, further contributes to market growth. The shift towards eco-friendly and cost-effective printing solutions is also bolstering the demand for inkjet printheads. While competitive pressures from alternative printing technologies might present some restraint, the ongoing innovation and development within the inkjet printhead sector are expected to offset these challenges and sustain the market's positive trajectory. Regional variations exist, with North America and Asia Pacific expected to be key contributors to market growth, reflecting strong industrial activity and consumer demand in these regions.

Inkjet Printhead Industry Market Size (In Billion)

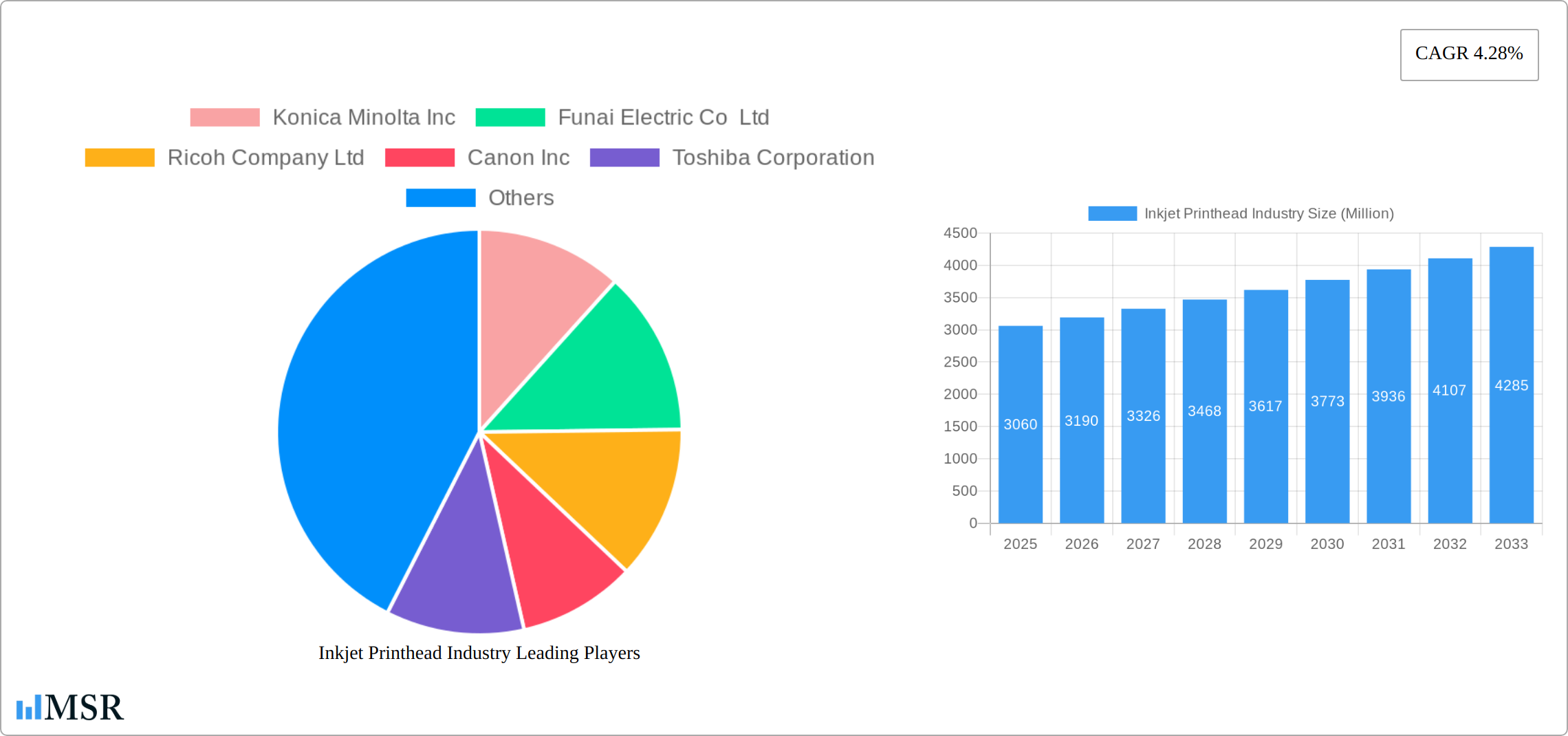

The competitive landscape is characterized by the presence of established players such as Canon, Epson, and Ricoh, alongside emerging companies specializing in innovative printhead technologies. These companies are engaged in continuous research and development to improve print quality, speed, and efficiency. The increasing demand for customized and specialized printheads for niche applications creates opportunities for both large and small players. The market is segmented by printhead type (piezo-based, MEMS-based, conventional), end-user (office/consumer, industrial, graphic printing), and technology (drop-on-demand). The ongoing development of advanced materials and manufacturing techniques is crucial in reducing production costs and enhancing the performance of inkjet printheads, which will ultimately impact the market's overall growth trajectory. Strategic alliances and mergers and acquisitions are also likely to reshape the market dynamics in the coming years.

Inkjet Printhead Industry Company Market Share

Inkjet Printhead Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the inkjet printhead industry, encompassing market dynamics, key players, technological advancements, and future growth prospects. The study period covers 2019-2033, with a focus on the forecast period of 2025-2033 and a base year of 2025. This report is essential for industry stakeholders, investors, and businesses seeking to understand and capitalize on opportunities within this dynamic market, projected to reach xx Million by 2033.

Inkjet Printhead Industry Market Concentration & Dynamics

The inkjet printhead market is characterized by a moderately concentrated landscape, with a few major players holding significant market share. Key players include Konica Minolta Inc., Funai Electric Co. Ltd., Ricoh Company Ltd., Canon Inc., Toshiba Corporation, Kyocera Corporation, Seiko Epson Corporation, Hewlett-Packard Development Company L.P., FUJIFILM Holdings Corporation, Xaar PLC, and Memjet Holdings Limited. While exact market share data varies depending on the segment and the specific year of analysis, these industry leaders collectively control a substantial portion of the global market. For instance, estimates suggest their combined market share hovered around 70% in 2025, highlighting their influence on market trends and pricing.

Innovation serves as a critical growth engine, with continuous advancements in printhead technology—such as higher droplet control, faster firing frequencies, and enhanced ink jettability—driving market expansion. Regulatory frameworks concerning environmental impact, ink composition, and material safety are increasingly shaping industry practices and product development. While substitute technologies like laser printing exist and cater to certain needs, inkjet technology maintains a competitive edge in specific applications due to its inherent versatility, cost-effectiveness for varying print volumes, and ability to handle a wider array of substrates and ink types. End-user trends are strongly favoring high-resolution, high-speed printing across diverse sectors, directly boosting demand for advanced inkjet printheads capable of meeting these evolving requirements. Mergers and acquisitions (M&A) activities, though not consistently frequent in recent years (with a limited number of significant deals recorded between 2019-2024), possess the potential to significantly reshape the competitive landscape. Such strategic moves enable companies to acquire cutting-edge technologies, expand their intellectual property portfolios, and broaden their market reach, ultimately impacting market dynamics.

Inkjet Printhead Industry Insights & Trends

The inkjet printhead market exhibits robust growth, driven by increasing demand across various end-user segments. The market size was valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. This growth is fueled by several factors: the rising adoption of inkjet printing in industrial applications, the increasing demand for high-quality printing in packaging and commercial printing, and the growing popularity of digital printing technologies. Technological advancements, such as the development of MEMS-based and piezo-based printheads with enhanced resolution and speed, further contribute to market expansion. Consumer preferences continue to shift towards personalized and customized printing solutions, creating new opportunities for inkjet technology.

Key Markets & Segments Leading Inkjet Printhead Industry

The industrial printing segment currently stands as the dominant force within the inkjet printhead market, accounting for approximately 45% of the total market share in 2025. This significant lead is largely attributed to the escalating adoption of inkjet technology in a wide array of industrial applications, including advanced packaging solutions, high-volume textile printing, decorative ceramics, and specialized labeling. The graphic printing segment also represents a substantial contributor, exhibiting steady and predictable growth, driven by the demand for high-quality commercial and marketing collateral.

- By Type: MEMS-based (Micro-Electro-Mechanical Systems) printheads are experiencing rapid growth due to their inherent advantages in terms of high precision, exceptional efficiency, and miniaturization capabilities. Concurrently, conventional printheads continue to hold significant market share, particularly in cost-sensitive applications and legacy systems.

- By End-user Type: Industrial printing commands the largest market share, followed closely by graphic printing. The office/consumer printing segment, while demonstrating consistent but moderate growth potential, remains a vital market for inkjet technology.

- By Technology Type: Drop-on-demand (DOD) technology remains the dominant technological underpinning, owing to its inherent versatility, precise ink control, and cost-effectiveness across a broad spectrum of printing applications.

- Regional Dominance: The Asia-Pacific region is projected to continue its dominance in the inkjet printhead market, both in terms of consumption and production, throughout the forecast period. This trend is propelled by robust economic expansion, increasing industrialization, and expanding consumer markets in key economies such as China, India, and Southeast Asian nations. North America and Europe also represent crucial markets, particularly for high-end, specialized applications and innovative research and development initiatives.

Key drivers fueling this market growth include:

- The rapid economic expansion in developing countries, leading to increased manufacturing and consumer spending.

- A heightened demand for high-quality, visually appealing printing across diverse industrial and commercial sectors.

- The expanding adoption of digital printing technologies across numerous applications, offering greater flexibility and customization.

- Technological advancements enabling inkjet printing to compete in previously inaccessible markets, such as direct-to-garment printing and industrial décor.

Inkjet Printhead Industry Product Developments

Recent years have witnessed transformative advancements in inkjet printhead technology, pushing the boundaries of performance and application. Key developments include the introduction of printheads boasting significantly increased resolutions for finer detail, dramatically faster print speeds to enhance productivity, and improved ink compatibility to support a wider range of specialized inks, including UV-curable and solvent-based formulations. Manufacturers are intensely focused on enhancing the long-term durability and operational reliability of their printheads while simultaneously working to reduce their overall manufacturing and integration costs. These innovations are pivotal in allowing inkjet printing to penetrate new and previously underserved markets and applications, thereby expanding the possibilities within digital printing. Notable examples of this trend towards improved performance and broadened application scope include the development of high-density, cost-effective MEMS printheads like Epson's I1600-A1 series and Kyocera's advanced KJ4B-EX1200-RC, which exemplify the industry's commitment to delivering superior print quality and efficiency.

Challenges in the Inkjet Printhead Industry Market

The inkjet printhead industry faces several challenges, including intense competition from established players, increasing raw material costs, and the need for continuous innovation to stay ahead of technological advancements. Regulatory compliance requirements for ink composition and environmental impact can also add complexities. Supply chain disruptions, particularly those observed in recent years, can significantly impact production and delivery timelines, affecting profitability. Furthermore, the entry of new players with disruptive technologies poses a competitive threat. These challenges, if not effectively addressed, could hinder the market's overall growth trajectory.

Forces Driving Inkjet Printhead Industry Growth

Several factors contribute to the growth of the inkjet printhead industry. Technological advancements, including the development of high-resolution, high-speed printheads, are key drivers. Growing demand for personalized and customized printing solutions across various applications fuels market expansion. The increasing adoption of inkjet printing in industrial applications, such as packaging and textile printing, further stimulates industry growth. Government initiatives promoting digital printing and environmentally friendly printing technologies contribute significantly, creating a more positive landscape for growth.

Long-Term Growth Catalysts in the Inkjet Printhead Industry

The long-term growth of the inkjet printhead industry hinges on continuous innovation and strategic partnerships. Developing next-generation printheads with enhanced features, such as improved resolution, increased durability, and wider ink compatibility, is crucial. Strategic collaborations between printhead manufacturers and ink suppliers can create synergy, resulting in optimized printing solutions. Expansion into new and emerging markets, particularly in developing economies, offers significant growth potential.

Emerging Opportunities in Inkjet Printhead Industry

Emerging opportunities within the inkjet printhead industry are largely concentrated in specialized and high-value application areas. The development of printheads specifically engineered for advanced manufacturing processes, such as high-resolution 3D printing and additive manufacturing, is gaining considerable momentum. Furthermore, the growing global demand for sustainable and environmentally responsible printing solutions is actively opening up new avenues for innovation in areas like low-VOC inks and energy-efficient printing processes. Exploring emerging markets such as flexible electronics printing, where inkjet technology can precisely deposit conductive inks onto flexible substrates, and advanced packaging technologies, offering new functionalities and aesthetic enhancements, present lucrative prospects for continued innovation and market growth. The increasing integration of artificial intelligence (AI) and machine learning algorithms for optimizing printhead performance, predicting maintenance needs, and enhancing print quality further supports significant development opportunities and competitive differentiation.

Leading Players in the Inkjet Printhead Industry Sector

- Konica Minolta Inc

- Funai Electric Co Ltd

- Ricoh Company Ltd

- Canon Inc

- Toshiba Corporation

- Kyocera Corporation

- Seiko Epson Corporation

- Hewlett-Packard Development Company LP

- FUJIFILM Holdings Corporation

- XAAR PLC

- Memjet Holdings Limited

Key Milestones in Inkjet Printhead Industry

- June 2023: Epson launches the I1600-A1, a cost-effective 1.33-inch-wide MEMS printhead with 600 DPI resolution, showcasing superior durability (10.6 billion piezo durability cycles).

- February 2024: Kyocera Corporation unveils the KJ4B-EX1200-RC, a new inkjet printhead with enhanced circulation technology, offering industry-leading performance across various applications.

Strategic Outlook for Inkjet Printhead Industry Market

The future of the inkjet printhead industry appears promising, driven by continuous technological advancements and expanding applications. Strategic investments in R&D, focusing on high-resolution, high-speed printheads and sustainable ink technologies, will be crucial for sustained growth. Collaborations and partnerships to develop innovative printing solutions will further strengthen market competitiveness. Focusing on emerging markets and specialized applications will unlock significant growth potential, shaping a positive outlook for the years to come.

Inkjet Printhead Industry Segmentation

-

1. Technology Type

-

1.1. Drop-on-demand

- 1.1.1. Thermal

- 1.1.2. Piezo-based

- 1.2. Continuous

-

1.1. Drop-on-demand

-

2. Type

- 2.1. MEMS-based

- 2.2. Conventional

-

3. End-user Type

- 3.1. Office and Consumer-Based

- 3.2. Industrial Printing

- 3.3. Graphic Printing

Inkjet Printhead Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Inkjet Printhead Industry Regional Market Share

Geographic Coverage of Inkjet Printhead Industry

Inkjet Printhead Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Piezo-Based Printheads Witnessing Higher Adoption in Industrial and Commercial Segments; Ongoing Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Cost Remains a Key Prohibitive Factor Compared to Other Technologies

- 3.4. Market Trends

- 3.4.1. Industrial Printing to Witness Major Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Inkjet Printhead Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology Type

- 5.1.1. Drop-on-demand

- 5.1.1.1. Thermal

- 5.1.1.2. Piezo-based

- 5.1.2. Continuous

- 5.1.1. Drop-on-demand

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. MEMS-based

- 5.2.2. Conventional

- 5.3. Market Analysis, Insights and Forecast - by End-user Type

- 5.3.1. Office and Consumer-Based

- 5.3.2. Industrial Printing

- 5.3.3. Graphic Printing

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology Type

- 6. North America Inkjet Printhead Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology Type

- 6.1.1. Drop-on-demand

- 6.1.1.1. Thermal

- 6.1.1.2. Piezo-based

- 6.1.2. Continuous

- 6.1.1. Drop-on-demand

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. MEMS-based

- 6.2.2. Conventional

- 6.3. Market Analysis, Insights and Forecast - by End-user Type

- 6.3.1. Office and Consumer-Based

- 6.3.2. Industrial Printing

- 6.3.3. Graphic Printing

- 6.1. Market Analysis, Insights and Forecast - by Technology Type

- 7. Europe Inkjet Printhead Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology Type

- 7.1.1. Drop-on-demand

- 7.1.1.1. Thermal

- 7.1.1.2. Piezo-based

- 7.1.2. Continuous

- 7.1.1. Drop-on-demand

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. MEMS-based

- 7.2.2. Conventional

- 7.3. Market Analysis, Insights and Forecast - by End-user Type

- 7.3.1. Office and Consumer-Based

- 7.3.2. Industrial Printing

- 7.3.3. Graphic Printing

- 7.1. Market Analysis, Insights and Forecast - by Technology Type

- 8. Asia Pacific Inkjet Printhead Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology Type

- 8.1.1. Drop-on-demand

- 8.1.1.1. Thermal

- 8.1.1.2. Piezo-based

- 8.1.2. Continuous

- 8.1.1. Drop-on-demand

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. MEMS-based

- 8.2.2. Conventional

- 8.3. Market Analysis, Insights and Forecast - by End-user Type

- 8.3.1. Office and Consumer-Based

- 8.3.2. Industrial Printing

- 8.3.3. Graphic Printing

- 8.1. Market Analysis, Insights and Forecast - by Technology Type

- 9. Latin America Inkjet Printhead Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology Type

- 9.1.1. Drop-on-demand

- 9.1.1.1. Thermal

- 9.1.1.2. Piezo-based

- 9.1.2. Continuous

- 9.1.1. Drop-on-demand

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. MEMS-based

- 9.2.2. Conventional

- 9.3. Market Analysis, Insights and Forecast - by End-user Type

- 9.3.1. Office and Consumer-Based

- 9.3.2. Industrial Printing

- 9.3.3. Graphic Printing

- 9.1. Market Analysis, Insights and Forecast - by Technology Type

- 10. Middle East and Africa Inkjet Printhead Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology Type

- 10.1.1. Drop-on-demand

- 10.1.1.1. Thermal

- 10.1.1.2. Piezo-based

- 10.1.2. Continuous

- 10.1.1. Drop-on-demand

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. MEMS-based

- 10.2.2. Conventional

- 10.3. Market Analysis, Insights and Forecast - by End-user Type

- 10.3.1. Office and Consumer-Based

- 10.3.2. Industrial Printing

- 10.3.3. Graphic Printing

- 10.1. Market Analysis, Insights and Forecast - by Technology Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Konica Minolta Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Funai Electric Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ricoh Company Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Canon Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Toshiba Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kyocera Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Seiko Epson Corporatio

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hewlett-Packard Development Company LP

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 FUJIFILM Holdings Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 XAAR PLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Memjet Holdings Limited

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Konica Minolta Inc

List of Figures

- Figure 1: Global Inkjet Printhead Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Inkjet Printhead Industry Revenue (Million), by Technology Type 2025 & 2033

- Figure 3: North America Inkjet Printhead Industry Revenue Share (%), by Technology Type 2025 & 2033

- Figure 4: North America Inkjet Printhead Industry Revenue (Million), by Type 2025 & 2033

- Figure 5: North America Inkjet Printhead Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Inkjet Printhead Industry Revenue (Million), by End-user Type 2025 & 2033

- Figure 7: North America Inkjet Printhead Industry Revenue Share (%), by End-user Type 2025 & 2033

- Figure 8: North America Inkjet Printhead Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Inkjet Printhead Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Inkjet Printhead Industry Revenue (Million), by Technology Type 2025 & 2033

- Figure 11: Europe Inkjet Printhead Industry Revenue Share (%), by Technology Type 2025 & 2033

- Figure 12: Europe Inkjet Printhead Industry Revenue (Million), by Type 2025 & 2033

- Figure 13: Europe Inkjet Printhead Industry Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Inkjet Printhead Industry Revenue (Million), by End-user Type 2025 & 2033

- Figure 15: Europe Inkjet Printhead Industry Revenue Share (%), by End-user Type 2025 & 2033

- Figure 16: Europe Inkjet Printhead Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Inkjet Printhead Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Inkjet Printhead Industry Revenue (Million), by Technology Type 2025 & 2033

- Figure 19: Asia Pacific Inkjet Printhead Industry Revenue Share (%), by Technology Type 2025 & 2033

- Figure 20: Asia Pacific Inkjet Printhead Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Asia Pacific Inkjet Printhead Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Asia Pacific Inkjet Printhead Industry Revenue (Million), by End-user Type 2025 & 2033

- Figure 23: Asia Pacific Inkjet Printhead Industry Revenue Share (%), by End-user Type 2025 & 2033

- Figure 24: Asia Pacific Inkjet Printhead Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Inkjet Printhead Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Inkjet Printhead Industry Revenue (Million), by Technology Type 2025 & 2033

- Figure 27: Latin America Inkjet Printhead Industry Revenue Share (%), by Technology Type 2025 & 2033

- Figure 28: Latin America Inkjet Printhead Industry Revenue (Million), by Type 2025 & 2033

- Figure 29: Latin America Inkjet Printhead Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: Latin America Inkjet Printhead Industry Revenue (Million), by End-user Type 2025 & 2033

- Figure 31: Latin America Inkjet Printhead Industry Revenue Share (%), by End-user Type 2025 & 2033

- Figure 32: Latin America Inkjet Printhead Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Inkjet Printhead Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Inkjet Printhead Industry Revenue (Million), by Technology Type 2025 & 2033

- Figure 35: Middle East and Africa Inkjet Printhead Industry Revenue Share (%), by Technology Type 2025 & 2033

- Figure 36: Middle East and Africa Inkjet Printhead Industry Revenue (Million), by Type 2025 & 2033

- Figure 37: Middle East and Africa Inkjet Printhead Industry Revenue Share (%), by Type 2025 & 2033

- Figure 38: Middle East and Africa Inkjet Printhead Industry Revenue (Million), by End-user Type 2025 & 2033

- Figure 39: Middle East and Africa Inkjet Printhead Industry Revenue Share (%), by End-user Type 2025 & 2033

- Figure 40: Middle East and Africa Inkjet Printhead Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Inkjet Printhead Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Inkjet Printhead Industry Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 2: Global Inkjet Printhead Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global Inkjet Printhead Industry Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 4: Global Inkjet Printhead Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Inkjet Printhead Industry Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 6: Global Inkjet Printhead Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 7: Global Inkjet Printhead Industry Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 8: Global Inkjet Printhead Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Inkjet Printhead Industry Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 10: Global Inkjet Printhead Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Inkjet Printhead Industry Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 12: Global Inkjet Printhead Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Inkjet Printhead Industry Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 14: Global Inkjet Printhead Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 15: Global Inkjet Printhead Industry Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 16: Global Inkjet Printhead Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Inkjet Printhead Industry Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 18: Global Inkjet Printhead Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 19: Global Inkjet Printhead Industry Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 20: Global Inkjet Printhead Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Inkjet Printhead Industry Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 22: Global Inkjet Printhead Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 23: Global Inkjet Printhead Industry Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 24: Global Inkjet Printhead Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Inkjet Printhead Industry?

The projected CAGR is approximately 4.28%.

2. Which companies are prominent players in the Inkjet Printhead Industry?

Key companies in the market include Konica Minolta Inc, Funai Electric Co Ltd, Ricoh Company Ltd, Canon Inc, Toshiba Corporation, Kyocera Corporation, Seiko Epson Corporatio, Hewlett-Packard Development Company LP, FUJIFILM Holdings Corporation, XAAR PLC, Memjet Holdings Limited.

3. What are the main segments of the Inkjet Printhead Industry?

The market segments include Technology Type, Type, End-user Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.06 Million as of 2022.

5. What are some drivers contributing to market growth?

Piezo-Based Printheads Witnessing Higher Adoption in Industrial and Commercial Segments; Ongoing Technological Advancements.

6. What are the notable trends driving market growth?

Industrial Printing to Witness Major Growth.

7. Are there any restraints impacting market growth?

Cost Remains a Key Prohibitive Factor Compared to Other Technologies.

8. Can you provide examples of recent developments in the market?

February 2024: A new inkjet printhead featuring increased circulation technology was developed by Kyocera Corporation. With compatibility with a wide range of inks, the new KJ4B-EX1200-RC offers industry-leading jetting performance across a wide range of printing applications, including package and commercial printing.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Inkjet Printhead Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Inkjet Printhead Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Inkjet Printhead Industry?

To stay informed about further developments, trends, and reports in the Inkjet Printhead Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence