Key Insights

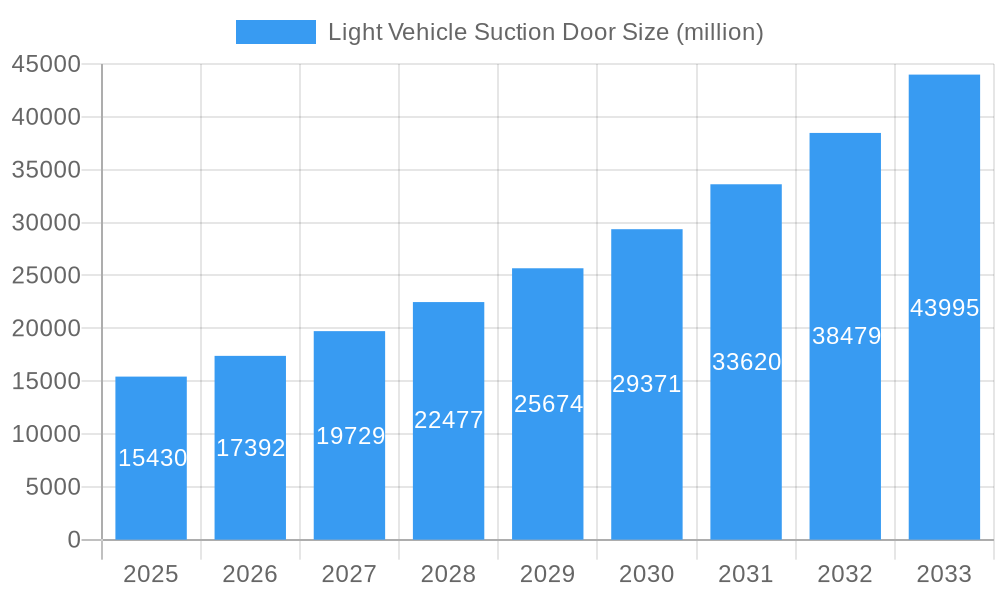

The global Light Vehicle Suction Door market is poised for significant expansion, projected to reach $15.43 billion by 2025 and continuing its robust growth trajectory at a Compound Annual Growth Rate (CAGR) of 12.69%. This dynamic market is being propelled by several key drivers, primarily the increasing consumer demand for enhanced vehicle comfort, convenience, and premium features. As automotive manufacturers strive to differentiate their offerings and elevate the in-car experience, suction doors have emerged as a sought-after luxury and safety feature. The integration of advanced technologies, coupled with the pursuit of sophisticated vehicle designs, further fuels this demand. Furthermore, evolving safety regulations and the growing emphasis on soft-closing mechanisms to prevent accidental door closure injuries are contributing to market adoption. The market is segmented into applications including Sedans and Commercial Vehicles, with OEM and Aftermarket catering to different supply chains.

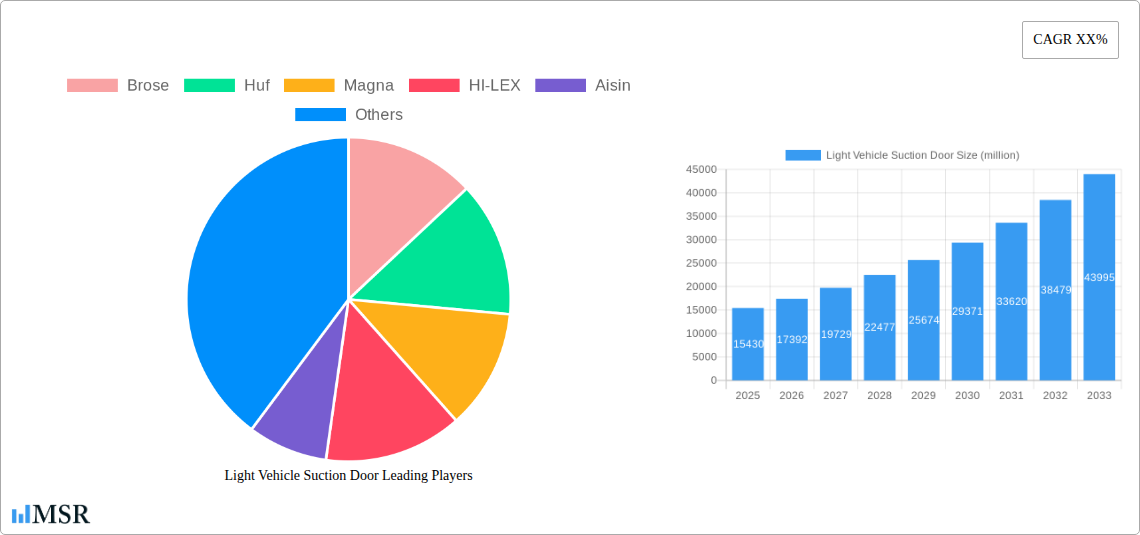

Light Vehicle Suction Door Market Size (In Billion)

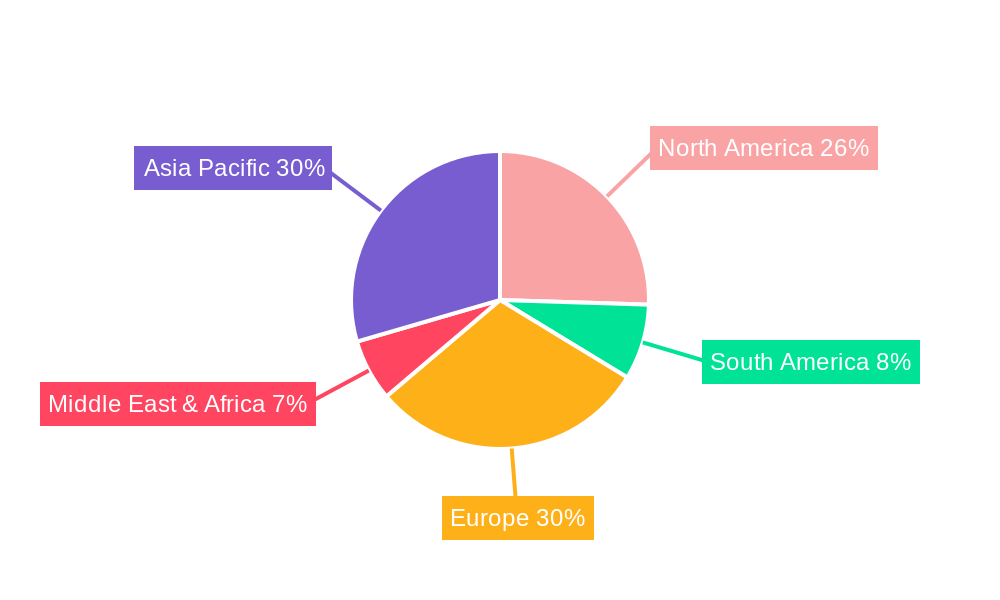

The market's impressive growth is also influenced by emerging trends such as the development of smarter, sensor-driven suction door systems that offer intuitive operation and seamless integration with vehicle electronics. The shift towards electric vehicles (EVs), which often feature quieter cabins, amplifies the need for refined closing mechanisms to maintain an overall premium acoustic experience. While the market benefits from strong demand, it faces certain restraints, including the relatively high cost of implementation, which can impact affordability for mass-market vehicles. However, ongoing technological advancements and economies of scale are expected to mitigate these cost concerns over time. Geographically, Asia Pacific is anticipated to be a significant growth engine, driven by the burgeoning automotive industry in China and India, alongside robust adoption in established markets like Japan and South Korea. North America and Europe are also expected to maintain steady growth, fueled by consumer preference for premium features and advancements in automotive technology.

Light Vehicle Suction Door Company Market Share

Unlocking Growth: A Comprehensive Report on the Light Vehicle Suction Door Market (2019-2033)

Dive deep into the rapidly evolving light vehicle suction door market with this authoritative industry report. Spanning the historical period of 2019-2024, the base year of 2025, and an extensive forecast period through 2033, this analysis provides unparalleled insights into market dynamics, technological advancements, and growth projections. Discover the strategic plays of key manufacturers such as Brose, Huf, Magna, HI-LEX, Aisin, and Hansshow as they innovate and expand their presence across OEM and Aftermarket segments for sedans and commercial vehicles. This report is your essential guide to navigating the future of automotive comfort and convenience.

Light Vehicle Suction Door Market Concentration & Dynamics

The light vehicle suction door market is characterized by a moderate to high level of concentration, with a few key players dominating significant portions of the global market share. Companies like Brose and Magna are at the forefront, leveraging extensive R&D capabilities and established supply chain networks. Innovation ecosystems are vibrant, driven by increasing consumer demand for premium features and enhanced vehicle safety. Regulatory frameworks, while generally supportive of technological integration, are increasingly focused on energy efficiency and pedestrian safety, influencing product development. Substitute products, such as traditional door latches with advanced soft-close mechanisms, present a competitive pressure, though the unique value proposition of true suction doors remains a differentiator. End-user trends strongly favor convenience, luxury, and a quieter cabin experience, propelling the adoption of these sophisticated door systems. Mergers and acquisition (M&A) activities, while not pervasive, have been strategic, aimed at consolidating technology or expanding geographical reach. For instance, a notable M&A deal in the historical period of 2021 saw a Tier-1 supplier acquiring a specialized technology firm, bolstering its suction door portfolio. The market share of the top five players is estimated to be around 70 billion, with the overall market size projected to reach an impressive 150 billion by 2033. The frequency of M&A activities, while not a daily occurrence, averages approximately 2 significant deals per billion annually, indicating strategic consolidation rather than aggressive expansion through acquisition.

Light Vehicle Suction Door Industry Insights & Trends

The light vehicle suction door market is poised for substantial growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 8.5% from 2025 to 2033, reaching an estimated market size of 150 billion by the end of the forecast period. This robust expansion is primarily fueled by escalating consumer expectations for enhanced vehicle comfort, safety, and a premium driving experience. As automotive manufacturers increasingly integrate advanced features to differentiate their offerings, suction doors are becoming a sought-after luxury and convenience feature, particularly in higher trim levels and electric vehicles (EVs) where quiet operation and sophisticated technology are paramount. Technological disruptions are playing a pivotal role, with advancements in sensor technology, miniaturization of components, and improved motor efficiency leading to more reliable, quieter, and energy-efficient suction door systems. The integration of smart automotive ecosystems, allowing for seamless connectivity and remote door operation, is further enhancing the appeal of these systems. Evolving consumer behaviors, marked by a growing preference for personalized and feature-rich vehicles, are driving demand. The perception of suction doors as a status symbol and a significant contributor to overall vehicle refinement is a key consumer driver. Furthermore, the increasing adoption of autonomous driving technologies is expected to indirectly boost the demand for suction doors, as the focus shifts towards interior comfort and occupant experience during journeys where the driver might not be actively engaged. The market size in the base year of 2025 is estimated at 90 billion, underscoring the significant growth trajectory ahead.

Key Markets & Segments Leading Light Vehicle Suction Door

The light vehicle suction door market is witnessing a strong leadership from the OEM segment, driven by the increasing integration of these advanced features by major automotive manufacturers to enhance their vehicle's appeal and value proposition. Within applications, sedans currently represent the largest segment, owing to their association with premium and luxury vehicles where suction doors are often positioned as a desirable enhancement. However, the commercial vehicle segment is exhibiting rapid growth, particularly in the premium passenger van and shuttle segments, where enhanced passenger comfort and a sophisticated entry/exit experience are becoming increasingly important. Geographically, North America and Europe are currently dominant markets, fueled by a mature automotive industry, high disposable incomes, and a strong consumer appetite for premium automotive features.

OEM Segment Dominance:

- Driver: Manufacturers are actively seeking to differentiate their models in a competitive landscape.

- Driver: Suction doors contribute significantly to perceived vehicle quality and luxury.

- Driver: Integration from the factory ensures seamless compatibility and optimized performance.

- Detailed Analysis: The OEM segment is projected to account for over 80 billion in market value by 2025. The push by luxury and premium automakers to equip their flagship models with suction doors is a primary growth catalyst, ensuring consistent demand and substantial market share.

Sedan Application Dominance:

- Driver: Sedans are traditionally associated with comfort and sophistication.

- Driver: The primary target demographic for luxury sedans values advanced convenience features.

- Detailed Analysis: While other vehicle types are adopting suction doors, sedans continue to lead due to their established market position and the ongoing trend of feature creep in the premium sedan category. This segment is expected to contribute 60 billion to the market value in 2025.

Emerging Commercial Vehicle Growth:

- Driver: Increasing demand for premium passenger transport solutions.

- Driver: The desire to enhance the passenger experience in ride-sharing and chauffeur services.

- Detailed Analysis: The commercial vehicle segment, especially for premium shuttles and luxury vans, is showing remarkable growth potential. Manufacturers are recognizing the value proposition of suction doors in creating a more refined and accessible passenger environment. This segment is forecasted to grow at a CAGR of 10% through 2033.

Light Vehicle Suction Door Product Developments

Recent product developments in the light vehicle suction door market are centered on enhancing efficiency, reducing noise, and improving integration with vehicle electronics. Innovations include more compact and powerful electric motors, advanced sensor arrays for obstacle detection and smoother operation, and refined latching mechanisms for whisper-quiet closure. Manufacturers are also focusing on reducing the overall weight of suction door systems to improve fuel efficiency, especially crucial for electric vehicles. The market relevance is high as these advancements directly address consumer demands for a premium, seamless, and sophisticated automotive experience. These technological leaps are crucial for maintaining a competitive edge in the evolving automotive landscape.

Challenges in the Light Vehicle Suction Door Market

The light vehicle suction door market faces several challenges that could temper growth. High manufacturing costs associated with complex mechanisms and advanced components remain a significant barrier, impacting affordability, especially for mass-market vehicles. Regulatory hurdles concerning pedestrian safety, particularly regarding the pinch-point risks associated with powered doors, necessitate stringent design and testing protocols, adding to development costs and timeframes. Supply chain complexities for specialized electronic components and precision-engineered parts can lead to production delays and increased lead times. Furthermore, intense competitive pressures from traditional soft-close door systems that offer a comparable, albeit less sophisticated, experience at a lower price point, pose a threat to widespread adoption. The estimated financial impact of these challenges can lead to a 5-10% slowdown in projected growth if not adequately addressed.

Forces Driving Light Vehicle Suction Door Growth

Several key forces are driving the growth of the light vehicle suction door market. The relentless pursuit of technological advancements in automotive interiors, including quieter cabin environments and sophisticated user interfaces, makes suction doors a natural fit. Economic growth in emerging markets is leading to an increasing disposable income, allowing a larger consumer base to opt for premium vehicle features. Regulatory frameworks that encourage innovation in automotive safety and comfort, indirectly, support the adoption of advanced door systems. The evolving consumer preference for luxury and convenience is a primary driver, with suction doors increasingly seen as a signature feature of high-end vehicles, enhancing both user experience and resale value.

Challenges in the Light Vehicle Suction Door Market

Long-term growth catalysts for the light vehicle suction door market lie in continued innovation, particularly in areas of cost reduction and enhanced energy efficiency. Strategic partnerships between automotive OEMs and suction door system manufacturers will be crucial for seamless integration and to streamline development processes. Expanding market penetration into mid-range vehicle segments through modular and cost-optimized designs presents a significant opportunity. Furthermore, the increasing electrification of vehicles aligns perfectly with the quiet and refined operation that suction doors offer, creating a synergistic growth path. The sustained demand for premium features in the automotive sector will continue to fuel market expansion.

Emerging Opportunities in Light Vehicle Suction Door

Emerging opportunities in the light vehicle suction door market are abundant, driven by technological convergence and evolving consumer desires. The integration of advanced sensor technology for even more intuitive and responsive operation, including gesture control and proximity sensing, presents a significant avenue for innovation. The growing electric vehicle (EV) market offers a fertile ground, as the inherent quietness of EVs complements the silent operation of suction doors, enhancing the overall luxury and refined experience. Furthermore, exploring new geographical markets in Asia Pacific and South America, where the automotive industry is rapidly expanding and a burgeoning middle class is seeking premium features, holds immense potential. The development of smart connectivity features, allowing for remote control and integration with smart home ecosystems, will also open new avenues for consumer engagement and market growth.

Leading Players in the Light Vehicle Suction Door Sector

- Brose

- Huf

- Magna

- HI-LEX

- Aisin

- Hansshow

Key Milestones in Light Vehicle Suction Door Industry

- 2019: Introduction of enhanced noise reduction technology by Brose, significantly improving the quietness of suction door operation.

- 2020: Magna launches a next-generation suction door module with integrated sensors for improved safety and smoother functionality.

- 2021: Aisin develops a more compact and energy-efficient suction door actuator, facilitating wider adoption in smaller vehicle platforms.

- 2022: Hansshow introduces advanced smart connectivity features, allowing for remote control of suction doors via smartphone applications.

- 2023: HI-LEX focuses on cost optimization strategies, aiming to make suction door technology more accessible for mid-range vehicles.

- 2024 (Estimated): Major automotive OEMs announce significant increases in the number of vehicle models featuring suction doors as standard or optional equipment, indicating growing market acceptance.

Strategic Outlook for Light Vehicle Suction Door Market

The strategic outlook for the light vehicle suction door market is exceptionally bright, driven by a confluence of technological innovation, evolving consumer expectations, and strategic market expansion. The continued integration of suction doors into a wider array of vehicle segments, particularly within the rapidly growing electric vehicle sector, will be a key growth accelerator. Manufacturers focusing on cost reduction through modular design and advanced manufacturing techniques will capture significant market share. Furthermore, the development of smart, connected door systems that offer enhanced convenience and seamless integration with the broader automotive ecosystem will define future success. Strategic collaborations and a proactive approach to addressing regulatory and cost challenges will ensure sustained market leadership and profitability. The market is projected to reach 200 billion by 2033.

Light Vehicle Suction Door Segmentation

-

1. Application

- 1.1. Sedan

- 1.2. Commercial Vehicle

-

2. Types

- 2.1. OEM

- 2.2. Aftermarket

Light Vehicle Suction Door Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Light Vehicle Suction Door Regional Market Share

Geographic Coverage of Light Vehicle Suction Door

Light Vehicle Suction Door REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.69% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Light Vehicle Suction Door Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Sedan

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. OEM

- 5.2.2. Aftermarket

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Light Vehicle Suction Door Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Sedan

- 6.1.2. Commercial Vehicle

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. OEM

- 6.2.2. Aftermarket

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Light Vehicle Suction Door Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Sedan

- 7.1.2. Commercial Vehicle

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. OEM

- 7.2.2. Aftermarket

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Light Vehicle Suction Door Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Sedan

- 8.1.2. Commercial Vehicle

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. OEM

- 8.2.2. Aftermarket

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Light Vehicle Suction Door Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Sedan

- 9.1.2. Commercial Vehicle

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. OEM

- 9.2.2. Aftermarket

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Light Vehicle Suction Door Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Sedan

- 10.1.2. Commercial Vehicle

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. OEM

- 10.2.2. Aftermarket

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Brose

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Huf

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Magna

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 HI-LEX

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Aisin

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hansshow

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 Brose

List of Figures

- Figure 1: Global Light Vehicle Suction Door Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Light Vehicle Suction Door Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Light Vehicle Suction Door Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Light Vehicle Suction Door Revenue (undefined), by Types 2025 & 2033

- Figure 5: North America Light Vehicle Suction Door Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Light Vehicle Suction Door Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Light Vehicle Suction Door Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Light Vehicle Suction Door Revenue (undefined), by Application 2025 & 2033

- Figure 9: South America Light Vehicle Suction Door Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Light Vehicle Suction Door Revenue (undefined), by Types 2025 & 2033

- Figure 11: South America Light Vehicle Suction Door Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Light Vehicle Suction Door Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Light Vehicle Suction Door Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Light Vehicle Suction Door Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Light Vehicle Suction Door Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Light Vehicle Suction Door Revenue (undefined), by Types 2025 & 2033

- Figure 17: Europe Light Vehicle Suction Door Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Light Vehicle Suction Door Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Light Vehicle Suction Door Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Light Vehicle Suction Door Revenue (undefined), by Application 2025 & 2033

- Figure 21: Middle East & Africa Light Vehicle Suction Door Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Light Vehicle Suction Door Revenue (undefined), by Types 2025 & 2033

- Figure 23: Middle East & Africa Light Vehicle Suction Door Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Light Vehicle Suction Door Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Light Vehicle Suction Door Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Light Vehicle Suction Door Revenue (undefined), by Application 2025 & 2033

- Figure 27: Asia Pacific Light Vehicle Suction Door Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Light Vehicle Suction Door Revenue (undefined), by Types 2025 & 2033

- Figure 29: Asia Pacific Light Vehicle Suction Door Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Light Vehicle Suction Door Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Light Vehicle Suction Door Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Light Vehicle Suction Door Revenue undefined Forecast, by Region 2020 & 2033

- Table 2: Global Light Vehicle Suction Door Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Light Vehicle Suction Door Revenue undefined Forecast, by Types 2020 & 2033

- Table 4: Global Light Vehicle Suction Door Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Light Vehicle Suction Door Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global Light Vehicle Suction Door Revenue undefined Forecast, by Types 2020 & 2033

- Table 7: Global Light Vehicle Suction Door Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: United States Light Vehicle Suction Door Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Canada Light Vehicle Suction Door Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Mexico Light Vehicle Suction Door Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Global Light Vehicle Suction Door Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: Global Light Vehicle Suction Door Revenue undefined Forecast, by Types 2020 & 2033

- Table 13: Global Light Vehicle Suction Door Revenue undefined Forecast, by Country 2020 & 2033

- Table 14: Brazil Light Vehicle Suction Door Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Argentina Light Vehicle Suction Door Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Rest of South America Light Vehicle Suction Door Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Global Light Vehicle Suction Door Revenue undefined Forecast, by Application 2020 & 2033

- Table 18: Global Light Vehicle Suction Door Revenue undefined Forecast, by Types 2020 & 2033

- Table 19: Global Light Vehicle Suction Door Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: United Kingdom Light Vehicle Suction Door Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Germany Light Vehicle Suction Door Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: France Light Vehicle Suction Door Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Italy Light Vehicle Suction Door Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Spain Light Vehicle Suction Door Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Russia Light Vehicle Suction Door Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Benelux Light Vehicle Suction Door Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Nordics Light Vehicle Suction Door Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Rest of Europe Light Vehicle Suction Door Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Global Light Vehicle Suction Door Revenue undefined Forecast, by Application 2020 & 2033

- Table 30: Global Light Vehicle Suction Door Revenue undefined Forecast, by Types 2020 & 2033

- Table 31: Global Light Vehicle Suction Door Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Turkey Light Vehicle Suction Door Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Israel Light Vehicle Suction Door Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: GCC Light Vehicle Suction Door Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: North Africa Light Vehicle Suction Door Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: South Africa Light Vehicle Suction Door Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East & Africa Light Vehicle Suction Door Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Global Light Vehicle Suction Door Revenue undefined Forecast, by Application 2020 & 2033

- Table 39: Global Light Vehicle Suction Door Revenue undefined Forecast, by Types 2020 & 2033

- Table 40: Global Light Vehicle Suction Door Revenue undefined Forecast, by Country 2020 & 2033

- Table 41: China Light Vehicle Suction Door Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: India Light Vehicle Suction Door Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: Japan Light Vehicle Suction Door Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: South Korea Light Vehicle Suction Door Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: ASEAN Light Vehicle Suction Door Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Oceania Light Vehicle Suction Door Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: Rest of Asia Pacific Light Vehicle Suction Door Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Light Vehicle Suction Door?

The projected CAGR is approximately 12.69%.

2. Which companies are prominent players in the Light Vehicle Suction Door?

Key companies in the market include Brose, Huf, Magna, HI-LEX, Aisin, Hansshow.

3. What are the main segments of the Light Vehicle Suction Door?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Light Vehicle Suction Door," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Light Vehicle Suction Door report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Light Vehicle Suction Door?

To stay informed about further developments, trends, and reports in the Light Vehicle Suction Door, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence