Key Insights

The Middle East and Africa frozen food packaging market is projected to expand significantly, driven by increasing disposable incomes, urbanization, and a growing preference for convenient, ready-to-eat meals. The expanding food service sector across key urban centers like Dubai, Johannesburg, and Cairo is a major growth catalyst. Consumers are embracing frozen foods for their convenience and efficiency in managing busy lifestyles, which in turn elevates the demand for robust and secure packaging. Innovations in packaging technology, including a surge in demand for sustainable and eco-friendly materials such as biodegradable plastics and recyclable paper, are further accelerating market growth. Key product segments demonstrating strong growth include ready-made meals, fruits and vegetables, and seafood. The rising popularity of convenient packaging formats like pouches and trays also contributes to market expansion. Intense competition among industry leaders is fostering innovation in packaging design and material science, leading to improved shelf life and product preservation.

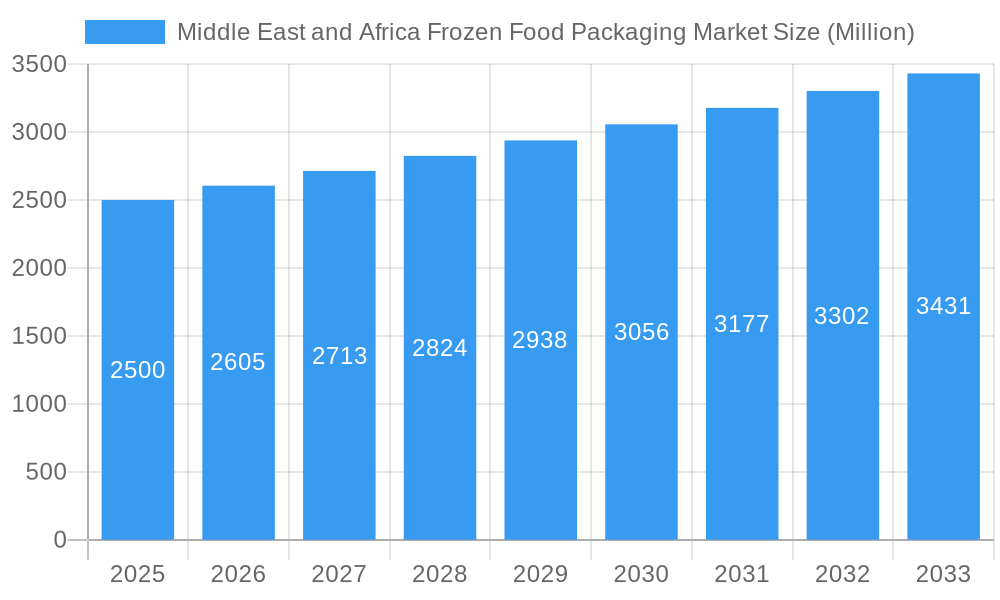

Middle East and Africa Frozen Food Packaging Market Market Size (In Billion)

Despite positive growth trends, the market faces challenges including price volatility of raw materials like plastics and metals, which impacts packaging costs and profitability. Inadequate cold chain logistics infrastructure in certain African regions presents an obstacle for the broader frozen food industry. Furthermore, evolving regulatory landscapes concerning food safety and environmental sustainability necessitate continuous adaptation by packaging manufacturers. Nevertheless, the Middle East and Africa frozen food packaging market outlook remains optimistic, fueled by persistent demographic shifts and evolving consumer preferences, offering considerable opportunities for both established and emerging businesses. The market is expected to reach $11.95 billion by 2025, with a compound annual growth rate (CAGR) of 5.34% from the base year of 2025.

Middle East and Africa Frozen Food Packaging Market Company Market Share

Middle East and Africa Frozen Food Packaging Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Middle East and Africa Frozen Food Packaging Market, offering invaluable insights for industry stakeholders. Covering the period 2019-2033, with a base year of 2025, this study unravels market dynamics, growth drivers, key segments, leading players, and emerging opportunities. The report uses a combination of historical data (2019-2024), estimated figures for 2025, and forecasts for 2025-2033, presenting a holistic view of the market's evolution and future potential. All financial values are expressed in Millions.

Middle East and Africa Frozen Food Packaging Market Market Concentration & Dynamics

The Middle East and Africa frozen food packaging market is characterized by a moderately concentrated landscape, with a few major players holding significant market share. However, the market also presents opportunities for smaller, specialized companies to thrive by focusing on niche segments or innovative packaging solutions. The market's dynamics are shaped by several factors, including technological advancements, evolving consumer preferences, stringent regulatory frameworks, the emergence of substitute products, and ongoing mergers and acquisitions (M&A) activity. The historical period (2019-2024) witnessed a steady rise in M&A activity, with an estimated xx deals concluded, signifying industry consolidation and strategic expansion. Market share analysis reveals that the top 5 players collectively hold approximately xx% of the market, leaving considerable room for growth and competition amongst the remaining players. Innovation within the ecosystem is driven by the need for sustainable and convenient packaging solutions, fostering the development of eco-friendly materials and advanced packaging technologies. Regulatory frameworks, varying across different countries within the region, play a significant role in shaping material choices and labeling requirements. The presence of substitute products, like modified atmosphere packaging (MAP) for some food segments, adds another layer of complexity to the market’s dynamics. Finally, end-user trends, reflecting a growing demand for convenient and ready-to-eat frozen meals, are significantly influencing packaging design and functionality.

Middle East and Africa Frozen Food Packaging Market Industry Insights & Trends

The Middle East and Africa frozen food packaging market exhibits robust growth, driven by factors such as the rising popularity of ready-to-eat meals, increasing urbanization, and the expanding middle class. The market size is estimated at USD xx Million in 2025, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors, including the increasing demand for convenient food options, rapid expansion of the retail sector, and the growing adoption of frozen food among consumers seeking convenience and long shelf life. Technological disruptions, such as the introduction of advanced packaging materials like biodegradable plastics and smart packaging solutions, are further stimulating market growth. Evolving consumer behaviors, including increased health consciousness and a preference for sustainable products, are also impacting packaging choices. Consumers are increasingly seeking packaging that is not only functional and protective but also environmentally friendly and ethically sourced. This trend is pushing manufacturers to adopt sustainable packaging materials and technologies, while also focusing on clear and concise labeling that meets consumer demand for transparency.

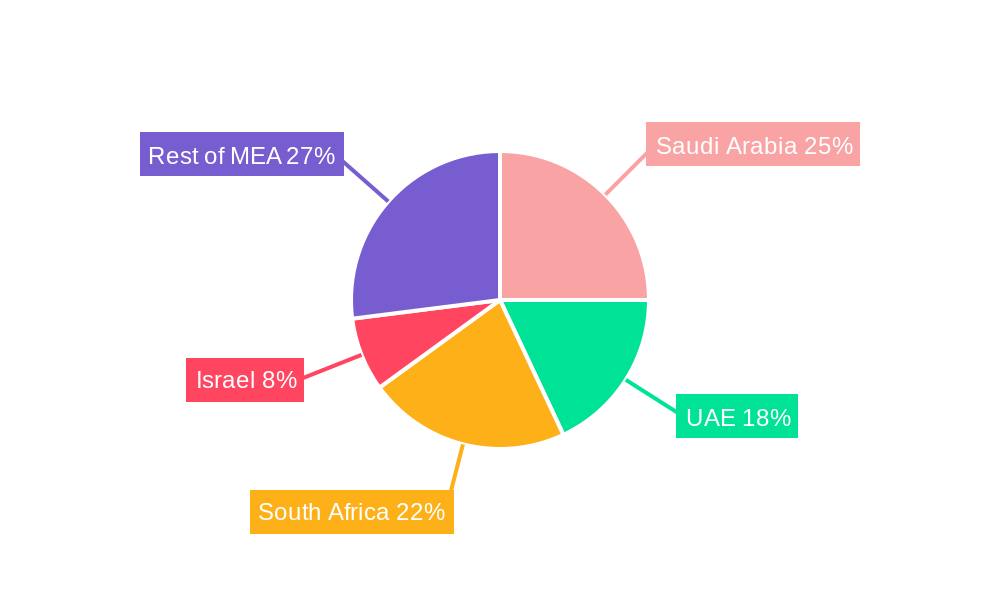

Key Markets & Segments Leading Middle East and Africa Frozen Food Packaging Market

The Middle East and Africa frozen food packaging market is segmented by primary material (glass, paper, metal, plastic, others), type of packaging product (bags, boxes, tubs and cups, trays, wrappers, pouches, other types), type of food product (readymade meals, fruits and vegetables, meat, seafood, baked goods, others), and country (Saudi Arabia, United Arab Emirates, South Africa, Israel, Rest of Middle East and Africa).

Dominant Regions/Countries: Saudi Arabia and the UAE are leading the market due to their high per capita income, growing food processing industries, and robust retail infrastructure. South Africa also represents a significant market, driven by its large population and expanding frozen food sector.

Dominant Segments:

- By Primary Material: Plastic dominates due to its cost-effectiveness, versatility, and ease of use. However, the growing demand for eco-friendly options is driving increased adoption of paper and other sustainable materials.

- By Type of Packaging Product: Bags and boxes remain the most widely used packaging types, driven by their suitability for various frozen food products and cost-effectiveness.

- By Type of Food Product: Readymade meals and fruits & vegetables are the leading segments, reflecting the growing consumer preference for convenience and health-conscious options.

Growth Drivers:

- Economic Growth: Expanding economies in several countries within the region are driving increased disposable incomes, leading to higher spending on convenient food options like frozen foods.

- Retail Infrastructure Development: The significant investments in modern retail channels, such as supermarkets and hypermarkets, are providing greater access to frozen food products.

- Technological Advancements: Innovations in packaging materials and technologies are enhancing product shelf life and convenience.

Middle East and Africa Frozen Food Packaging Market Product Developments

Recent product innovations have centered around sustainable and functional packaging solutions. Manufacturers are actively developing biodegradable and compostable packaging materials to cater to environmentally conscious consumers. Smart packaging technologies, incorporating features like temperature indicators and tamper-evident seals, are gaining traction to ensure food safety and enhance consumer trust. These advancements are driving competitiveness within the market, with companies differentiating themselves through unique packaging features and materials. The development of customizable and flexible packaging solutions, adaptable to various frozen food types and sizes, is another major trend, further enhancing product appeal and reducing waste.

Challenges in the Middle East and Africa Frozen Food Packaging Market Market

The market faces challenges including stringent regulatory compliance requirements related to food safety and environmental sustainability, fluctuating raw material prices impacting production costs, and the intense competition from both domestic and international players. Supply chain disruptions, particularly concerning transportation and logistics within the region, pose another significant obstacle. The impact of these challenges can be seen in reduced profit margins for some businesses and slower market growth in certain segments.

Forces Driving Middle East and Africa Frozen Food Packaging Market Growth

Several factors contribute to market expansion. The increasing urbanization and the rise of the middle class, creating higher demand for convenient food options, are key drivers. Furthermore, government initiatives promoting food safety and quality standards stimulate investment in advanced packaging technologies. Finally, technological advancements, particularly in sustainable materials and smart packaging, enhance market attractiveness.

Challenges in the Middle East and Africa Frozen Food Packaging Market Market

Long-term growth will be fueled by ongoing innovations in sustainable materials and smart packaging technologies, strategic collaborations and partnerships between packaging manufacturers and food producers, and market expansion into new regions within the Middle East and Africa.

Emerging Opportunities in Middle East and Africa Frozen Food Packaging Market

Opportunities exist in developing eco-friendly packaging solutions, catering to increasing consumer demand for sustainable products. The growing demand for customized and personalized packaging also presents a significant market niche. Expansion into underserved regions within the Middle East and Africa holds further potential. Investment in advanced packaging technologies and strategic partnerships with food companies are crucial for capturing these opportunities.

Leading Players in the Middle East and Africa Frozen Food Packaging Market Sector

- WestRock Company

- Owens-Illinois

- Rexam Company

- Tetra Pak International

- Alcoa Corporation

- Nuconic Packaging

- The Scoular Company

- Toyo Seikan Group Holdings Ltd

- Graham Packaging Company Inc

- Ball Corporation Inc

- Crown Holdings

- Placon Corporation

- Genpak LLC

- Pactiv Evergreen

- Amcor Ltd

Key Milestones in Middle East and Africa Frozen Food Packaging Market Industry

- August 2022: GEA Food Solutions signed a USD 4 Million contract with Wafrah for Industry and Development Co. in Saudi Arabia for automated frozen and cooked meat processing and packaging lines. This signifies increased investment in advanced packaging technology within the region.

- June 2022: Siwar Foods launched a new line of ready-to-eat frozen meals and sweets in Saudi Arabia, expanding the convenience food market and driving demand for related packaging solutions.

Strategic Outlook for Middle East and Africa Frozen Food Packaging Market Market

The Middle East and Africa frozen food packaging market is poised for significant growth, driven by several key factors. The increasing demand for convenient and healthy frozen food products, combined with technological advancements in sustainable and innovative packaging solutions, presents considerable opportunities for players in the market. Strategic partnerships and investments in research and development will be crucial for companies aiming to capture a significant market share and capitalize on this growth trajectory. The focus on sustainability and customization will further shape market dynamics in the coming years.

Middle East and Africa Frozen Food Packaging Market Segmentation

-

1. Primary Material

- 1.1. Glass

- 1.2. Paper

- 1.3. Metal

- 1.4. Plastic

- 1.5. Others

-

2. Type of Packaging Product

- 2.1. Bags

- 2.2. Boxes

- 2.3. Tubs and Cups

- 2.4. Trays

- 2.5. Wrappers

- 2.6. Pouches

- 2.7. Other Types of Packaging

-

3. Type of Food Product

- 3.1. Readymade Meals

- 3.2. Fruits and Vegetables

- 3.3. Meat

- 3.4. Sea Food

- 3.5. Baked Goods

- 3.6. Others

Middle East and Africa Frozen Food Packaging Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Frozen Food Packaging Market Regional Market Share

Geographic Coverage of Middle East and Africa Frozen Food Packaging Market

Middle East and Africa Frozen Food Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.34% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Convenience by Consumers; Increase in Disposable Income and Changing Consumer Behavior

- 3.3. Market Restrains

- 3.3.1. Government Regulations and Interventions

- 3.4. Market Trends

- 3.4.1. Plastic Packaging to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Frozen Food Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Primary Material

- 5.1.1. Glass

- 5.1.2. Paper

- 5.1.3. Metal

- 5.1.4. Plastic

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Type of Packaging Product

- 5.2.1. Bags

- 5.2.2. Boxes

- 5.2.3. Tubs and Cups

- 5.2.4. Trays

- 5.2.5. Wrappers

- 5.2.6. Pouches

- 5.2.7. Other Types of Packaging

- 5.3. Market Analysis, Insights and Forecast - by Type of Food Product

- 5.3.1. Readymade Meals

- 5.3.2. Fruits and Vegetables

- 5.3.3. Meat

- 5.3.4. Sea Food

- 5.3.5. Baked Goods

- 5.3.6. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Primary Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 WestRock Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Owens-Illinois

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Rexam Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tetra Pak International

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Alcoa Corporatio

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nuconic Packaging

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 The Scoular Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Toyo Seikan Group Holdings Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Graham Packaging Company Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ball Corporation Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Crown Holdings

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Placon Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Genpak LLC

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Pactiv Evergreen

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Amcor Ltd

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 WestRock Company

List of Figures

- Figure 1: Middle East and Africa Frozen Food Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Frozen Food Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Frozen Food Packaging Market Revenue billion Forecast, by Primary Material 2020 & 2033

- Table 2: Middle East and Africa Frozen Food Packaging Market Revenue billion Forecast, by Type of Packaging Product 2020 & 2033

- Table 3: Middle East and Africa Frozen Food Packaging Market Revenue billion Forecast, by Type of Food Product 2020 & 2033

- Table 4: Middle East and Africa Frozen Food Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Middle East and Africa Frozen Food Packaging Market Revenue billion Forecast, by Primary Material 2020 & 2033

- Table 6: Middle East and Africa Frozen Food Packaging Market Revenue billion Forecast, by Type of Packaging Product 2020 & 2033

- Table 7: Middle East and Africa Frozen Food Packaging Market Revenue billion Forecast, by Type of Food Product 2020 & 2033

- Table 8: Middle East and Africa Frozen Food Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Saudi Arabia Middle East and Africa Frozen Food Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: United Arab Emirates Middle East and Africa Frozen Food Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Israel Middle East and Africa Frozen Food Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Qatar Middle East and Africa Frozen Food Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Kuwait Middle East and Africa Frozen Food Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Oman Middle East and Africa Frozen Food Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Bahrain Middle East and Africa Frozen Food Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Jordan Middle East and Africa Frozen Food Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Lebanon Middle East and Africa Frozen Food Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Frozen Food Packaging Market?

The projected CAGR is approximately 5.34%.

2. Which companies are prominent players in the Middle East and Africa Frozen Food Packaging Market?

Key companies in the market include WestRock Company, Owens-Illinois, Rexam Company, Tetra Pak International, Alcoa Corporatio, Nuconic Packaging, The Scoular Company, Toyo Seikan Group Holdings Ltd, Graham Packaging Company Inc, Ball Corporation Inc, Crown Holdings, Placon Corporation, Genpak LLC, Pactiv Evergreen, Amcor Ltd.

3. What are the main segments of the Middle East and Africa Frozen Food Packaging Market?

The market segments include Primary Material, Type of Packaging Product, Type of Food Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.95 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Convenience by Consumers; Increase in Disposable Income and Changing Consumer Behavior.

6. What are the notable trends driving market growth?

Plastic Packaging to Dominate the Market.

7. Are there any restraints impacting market growth?

Government Regulations and Interventions.

8. Can you provide examples of recent developments in the market?

August 2022: One of the biggest producers of food lines and plants worldwide, German GEA Food Solutions, inked a contract with the Saudi food company Wafrah for Industry and Development Co. GEA Food Solutions would produce and provide Wafrah with highly automated lines for processing and packaging frozen and cooked meats under the USD 4 million deal.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Frozen Food Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Frozen Food Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Frozen Food Packaging Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Frozen Food Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence