Key Insights

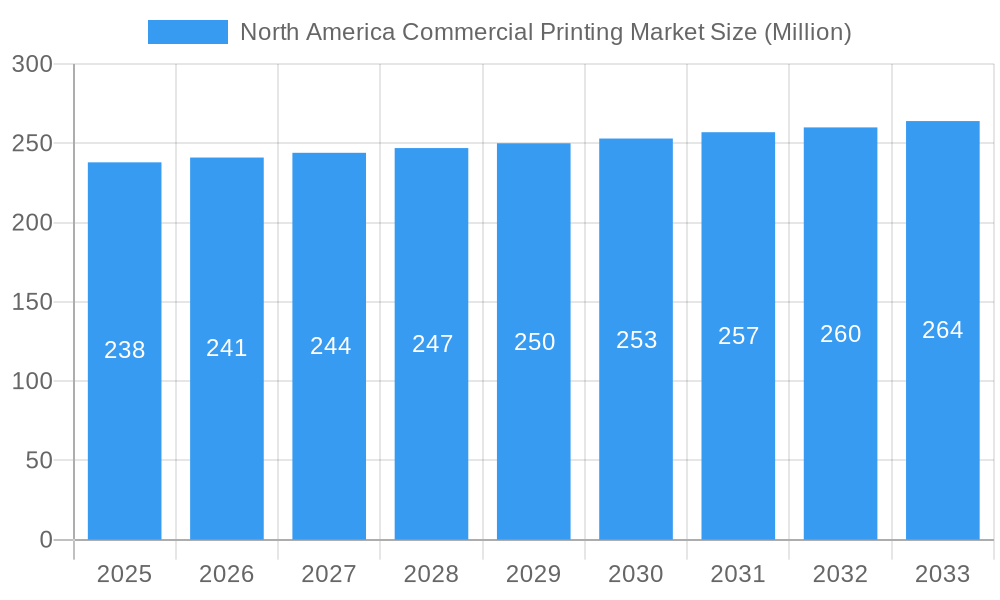

The North American commercial printing market, valued at $238 million in 2025, is projected to experience modest growth, driven primarily by the increasing demand for personalized marketing materials and specialized packaging solutions. While a CAGR of 1.27% might seem low, it reflects a mature market adapting to digital transformation. Key drivers include the growing adoption of digital printing technologies offering faster turnaround times and cost-effectiveness for short-run printing jobs, the increasing demand for sustainable and eco-friendly printing solutions, and the continued need for high-quality print materials in sectors like packaging and direct mail marketing. However, the market faces challenges from the persistent shift towards digital marketing and the ongoing pressure on print prices due to increased competition. Segments such as packaging printing are anticipated to experience relatively higher growth compared to traditional print media like brochures and flyers, reflecting evolving consumer preferences and brand strategies. Furthermore, the industry's sustainability focus will likely drive investment in greener printing processes and materials, creating opportunities for companies that offer such solutions. Consolidation within the industry, as evidenced by the presence of large players like Amcor Group and Graphic Packaging International, is expected to continue, influencing market dynamics and pricing strategies.

North America Commercial Printing Market Market Size (In Million)

The forecast period (2025-2033) will likely see a gradual increase in market value, with growth potentially being accelerated by specific industry innovations. Companies will need to focus on differentiation through specialized services, technology adoption, and sustainability initiatives to maintain competitiveness. The resilience of certain segments, like packaging and label printing, suggests continued demand despite the digital shift. This points to a future where commercial printing is less about mass-produced materials and more about targeted, high-quality, and sustainably produced print solutions catering to niche markets and specific customer needs. The competitive landscape, though dominated by established players, remains dynamic, with opportunities for smaller, specialized firms offering unique value propositions.

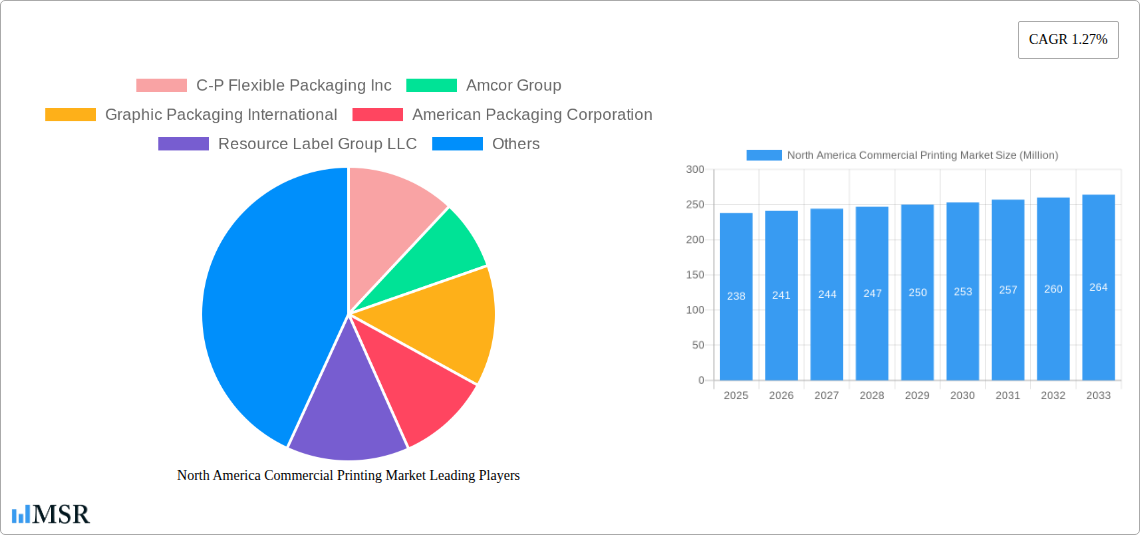

North America Commercial Printing Market Company Market Share

North America Commercial Printing Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America commercial printing market, covering market size, growth drivers, key segments, leading players, and future opportunities. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is crucial for industry stakeholders, investors, and businesses seeking to understand and navigate this dynamic market.

North America Commercial Printing Market Concentration & Dynamics

The North American commercial printing market exhibits a moderately consolidated structure, with a few large players holding significant market share. However, a large number of smaller, specialized printers also contribute significantly to the overall market volume. The market is characterized by intense competition, driven by factors such as pricing pressures, technological advancements, and evolving consumer preferences. Innovation ecosystems are vibrant, with companies constantly investing in new technologies like digital printing and sustainable materials. Regulatory frameworks, including environmental regulations and labeling requirements, significantly impact operational costs and strategies. Substitute products, such as digital marketing and online communication channels, pose a continuous challenge. End-user trends, particularly towards personalization and shorter print runs, are reshaping market dynamics. M&A activity has been relatively frequent, reflecting a strategy of consolidation and expansion among major players.

- Market Share: Top 5 players hold approximately xx% of the market share (2025 Estimate).

- M&A Deal Count: An estimated xx M&A deals occurred between 2019 and 2024.

- Innovation Focus: Significant investments in digital printing, sustainable inks, and automation technologies.

- Regulatory Landscape: Stringent environmental regulations impacting ink usage and waste management.

North America Commercial Printing Market Industry Insights & Trends

The North American commercial printing market is projected to experience significant growth during the forecast period (2025-2033). Driven by factors like increasing demand from e-commerce and packaging industries, the market is expected to reach a value of xx Million by 2033, exhibiting a CAGR of xx% from 2025. Technological advancements, particularly in digital printing and personalized marketing materials, are major catalysts. Evolving consumer behaviors, a preference for on-demand printing, and customized products, fuel market expansion. However, challenges remain due to the increasing adoption of digital marketing alternatives and rising operational costs. The overall growth trajectory is positive, driven by the adaptability of the printing industry to meet evolving market demands. The market size in 2025 is estimated at xx Million.

Key Markets & Segments Leading North America Commercial Packaging Market

The packaging segment dominates the North American commercial printing market, driven primarily by the robust growth of the e-commerce sector and increased demand for customized packaging solutions. Specific regional dominance is observed in the Eastern and Western regions of the US, attributed to higher population density and thriving industrial activities.

- Dominant Segment: Packaging (labels, cartons, flexible packaging)

- Drivers for Packaging Segment:

- Growth of e-commerce and online retail.

- Demand for customized and sustainable packaging.

- Increasing consumer preference for branded packaging.

- Regional Dominance: Eastern and Western US regions.

- Higher population density, concentrated industries.

- Well-established infrastructure and logistics.

North America Commercial Printing Market Product Developments

Recent product developments focus on incorporating sustainable materials, advanced digital printing technologies, and enhanced personalization capabilities. Innovations in variable data printing allow for mass customization, increasing market competitiveness. The integration of smart packaging technologies offers brand owners opportunities for interactive engagement and enhanced product tracking, adding value to printed materials. These advancements cater to the rising consumer demand for eco-friendly and personalized products.

Challenges in the North America Commercial Printing Market

The North American commercial printing market faces several challenges including increasing competition from digital marketing alternatives, rising raw material costs, and stringent environmental regulations. These factors contribute to shrinking profit margins and necessitate continuous adaptation and innovation. Supply chain disruptions, exacerbated by global events, also pose a significant hurdle. The industry must proactively address these challenges through strategic partnerships, efficient operations, and sustainable practices to maintain long-term profitability. The combined impact of these challenges has led to a xx% reduction in overall profit margins (2024 estimate).

Forces Driving North America Commercial Printing Market Growth

Technological advancements such as digital printing, personalized packaging, and sustainable materials are key drivers for market expansion. The growth of e-commerce and the associated demand for customized packaging solutions also play a vital role. Favorable economic conditions and increased consumer spending further fuel market growth. Government initiatives supporting sustainable printing practices contribute to market expansion.

Long-Term Growth Catalysts in the North America Commercial Printing Market

Long-term growth will be driven by the ongoing development of sustainable printing solutions, advanced personalization capabilities, and integration with smart packaging technologies. Strategic partnerships and collaborations among printers, material suppliers, and brand owners are crucial for driving innovation and market expansion. Exploring new market segments, such as personalized healthcare packaging, will also contribute to long-term growth.

Emerging Opportunities in North America Commercial Printing Market

Emerging opportunities lie in specialized packaging solutions, personalized healthcare and pharmaceutical labeling, and the growing demand for sustainable and eco-friendly printing materials. New technologies like augmented reality (AR) and 3D printing offer avenues for innovative product development. Expanding into niche markets, such as high-end packaging for luxury goods, provides significant growth potential.

Leading Players in the North America Commercial Printing Market Sector

- C-P Flexible Packaging Inc

- Amcor Group

- Graphic Packaging International

- American Packaging Corporation

- Resource Label Group LLC

- Weber Packaging Solution

- Advanced Labelworx Inc

- Multi-colour Corporation

- OMNI Systems Inc

- Quad (formerly known as Quad/Graphics)

- Vistaprint (Cimpress PLC)

- R R Donnelley & Sons Company

- Deluxe Corporation

- Taylor Corporation

- LSC Communications LLC

- 4over LLC

- JPS Books + Logistics

- Cober Solutions

- CJ Graphics Inc

- Hemlock Printers Ltd

- *List Not Exhaustive

Key Milestones in North America Commercial Printing Market Industry

- May 2024: American Packaging Corporation expands operations with a new digital printing unit for flexible packaging, enhancing its rapid response capabilities.

- February 2024: Resource Label Group LLC launches RLG Healthcare, a new division focusing on pharmaceutical and healthcare packaging solutions.

Strategic Outlook for North America Commercial Printing Market

The North American commercial printing market presents significant growth potential driven by technological advancements, increasing demand for customized and sustainable packaging solutions, and the ongoing expansion of the e-commerce sector. Strategic opportunities include investing in cutting-edge printing technologies, developing sustainable product lines, and forging strategic partnerships to expand market reach and enhance operational efficiency. The future of the market hinges on the industry's ability to adapt to changing consumer demands and leverage innovation to create value for its customers.

North America Commercial Printing Market Segmentation

-

1. Technology

- 1.1. Offset Lithography

- 1.2. Inkjet

- 1.3. Flexographic

- 1.4. Screen

- 1.5. Gravure

- 1.6. Others (Electrophotography and Letterpress)

-

2. Application

- 2.1. Direct Mail

- 2.2. Books & Stationery

- 2.3. Business Forms & Cards

- 2.4. Tickets (Lottery, others)

- 2.5. Advertis

- 2.6. Transactional Print

- 2.7. Security

- 2.8. Labels

- 2.9. Packaging (Paper & Other Packaging)

- 2.10. Other Applications

-

3. North America Commercial Printing Growth Analysis

- 3.1. Factors Responsible for Growth Projections

- 3.2. Key Segm

- 3.3. Labels I

-

4. Printing Industry Supply Landscape

- 4.1. Printing

- 4.2. Inks & Toners

- 4.3. Printing Equipment

- 4.4. Print Components - Printheads, etc.

- 4.5. Printing Services in North America

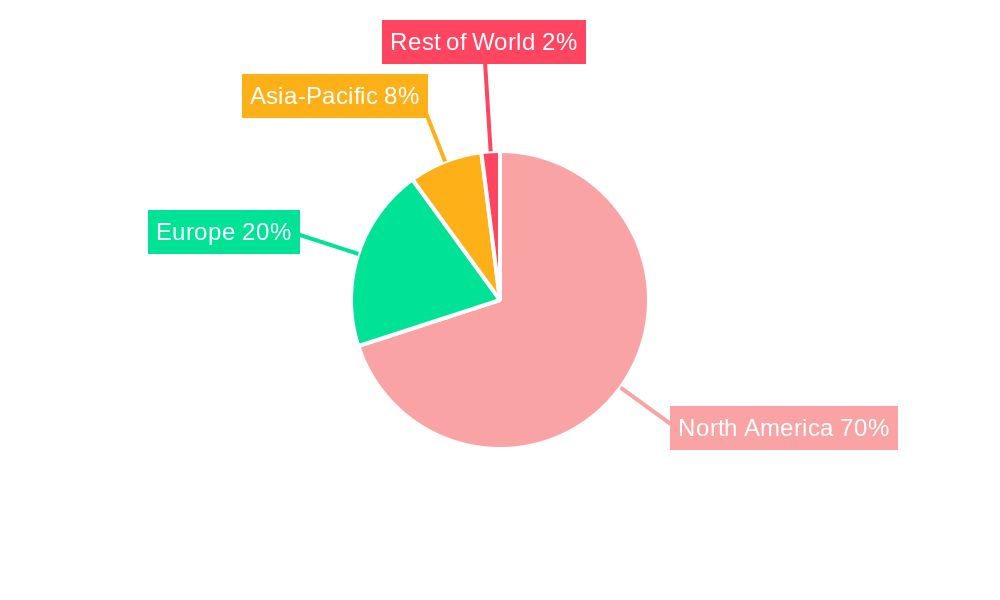

North America Commercial Printing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Commercial Printing Market Regional Market Share

Geographic Coverage of North America Commercial Printing Market

North America Commercial Printing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.27% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Economic Growth & Industrialization; Rising Demand for Flexible and E-commerce Packaging; Advertising Printing & Branding Growth

- 3.3. Market Restrains

- 3.3.1. Economic Growth & Industrialization; Rising Demand for Flexible and E-commerce Packaging; Advertising Printing & Branding Growth

- 3.4. Market Trends

- 3.4.1. Packaging Application Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Commercial Printing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Offset Lithography

- 5.1.2. Inkjet

- 5.1.3. Flexographic

- 5.1.4. Screen

- 5.1.5. Gravure

- 5.1.6. Others (Electrophotography and Letterpress)

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Direct Mail

- 5.2.2. Books & Stationery

- 5.2.3. Business Forms & Cards

- 5.2.4. Tickets (Lottery, others)

- 5.2.5. Advertis

- 5.2.6. Transactional Print

- 5.2.7. Security

- 5.2.8. Labels

- 5.2.9. Packaging (Paper & Other Packaging)

- 5.2.10. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by North America Commercial Printing Growth Analysis

- 5.3.1. Factors Responsible for Growth Projections

- 5.3.2. Key Segm

- 5.3.3. Labels I

- 5.4. Market Analysis, Insights and Forecast - by Printing Industry Supply Landscape

- 5.4.1. Printing

- 5.4.2. Inks & Toners

- 5.4.3. Printing Equipment

- 5.4.4. Print Components - Printheads, etc.

- 5.4.5. Printing Services in North America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 C-P Flexible Packaging Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Amcor Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Graphic Packaging International

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 American Packaging Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Resource Label Group LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Weber Packaging Solution

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Advanced Labelworx Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Multi-colour Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 OMNI Systems Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Quad (formerly known as Quad/Graphics)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Vistaprint (Cimpress PLC)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 R R Donnelley & Sons Company

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Deluxe Corporation

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Taylor Corporation

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 LSC Communications LLC

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 4over LLC

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 JPS Books + Logistics

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Cober Solutions

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 CJ Graphics Inc

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 Hemlock Printers Ltd*List Not Exhaustive 7 2 Sustainability Trends in the North American Printing Industr

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.1 C-P Flexible Packaging Inc

List of Figures

- Figure 1: North America Commercial Printing Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Commercial Printing Market Share (%) by Company 2025

List of Tables

- Table 1: North America Commercial Printing Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: North America Commercial Printing Market Volume Billion Forecast, by Technology 2020 & 2033

- Table 3: North America Commercial Printing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: North America Commercial Printing Market Volume Billion Forecast, by Application 2020 & 2033

- Table 5: North America Commercial Printing Market Revenue Million Forecast, by North America Commercial Printing Growth Analysis 2020 & 2033

- Table 6: North America Commercial Printing Market Volume Billion Forecast, by North America Commercial Printing Growth Analysis 2020 & 2033

- Table 7: North America Commercial Printing Market Revenue Million Forecast, by Printing Industry Supply Landscape 2020 & 2033

- Table 8: North America Commercial Printing Market Volume Billion Forecast, by Printing Industry Supply Landscape 2020 & 2033

- Table 9: North America Commercial Printing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: North America Commercial Printing Market Volume Billion Forecast, by Region 2020 & 2033

- Table 11: North America Commercial Printing Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 12: North America Commercial Printing Market Volume Billion Forecast, by Technology 2020 & 2033

- Table 13: North America Commercial Printing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: North America Commercial Printing Market Volume Billion Forecast, by Application 2020 & 2033

- Table 15: North America Commercial Printing Market Revenue Million Forecast, by North America Commercial Printing Growth Analysis 2020 & 2033

- Table 16: North America Commercial Printing Market Volume Billion Forecast, by North America Commercial Printing Growth Analysis 2020 & 2033

- Table 17: North America Commercial Printing Market Revenue Million Forecast, by Printing Industry Supply Landscape 2020 & 2033

- Table 18: North America Commercial Printing Market Volume Billion Forecast, by Printing Industry Supply Landscape 2020 & 2033

- Table 19: North America Commercial Printing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: North America Commercial Printing Market Volume Billion Forecast, by Country 2020 & 2033

- Table 21: United States North America Commercial Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United States North America Commercial Printing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Canada North America Commercial Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Canada North America Commercial Printing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Mexico North America Commercial Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Mexico North America Commercial Printing Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Commercial Printing Market?

The projected CAGR is approximately 1.27%.

2. Which companies are prominent players in the North America Commercial Printing Market?

Key companies in the market include C-P Flexible Packaging Inc, Amcor Group, Graphic Packaging International, American Packaging Corporation, Resource Label Group LLC, Weber Packaging Solution, Advanced Labelworx Inc, Multi-colour Corporation, OMNI Systems Inc, Quad (formerly known as Quad/Graphics), Vistaprint (Cimpress PLC), R R Donnelley & Sons Company, Deluxe Corporation, Taylor Corporation, LSC Communications LLC, 4over LLC, JPS Books + Logistics, Cober Solutions, CJ Graphics Inc, Hemlock Printers Ltd*List Not Exhaustive 7 2 Sustainability Trends in the North American Printing Industr.

3. What are the main segments of the North America Commercial Printing Market?

The market segments include Technology, Application, North America Commercial Printing Growth Analysis, Printing Industry Supply Landscape.

4. Can you provide details about the market size?

The market size is estimated to be USD 238 Million as of 2022.

5. What are some drivers contributing to market growth?

Economic Growth & Industrialization; Rising Demand for Flexible and E-commerce Packaging; Advertising Printing & Branding Growth.

6. What are the notable trends driving market growth?

Packaging Application Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Economic Growth & Industrialization; Rising Demand for Flexible and E-commerce Packaging; Advertising Printing & Branding Growth.

8. Can you provide examples of recent developments in the market?

May 2024: The American Packaging Corporation expanded its operations by opening a second production unit for digitally printed flexible packaging at its Wisconsin Center of Excellence. The company invested in this new unit's packaging equipment and service capabilities, including digital printing, laminating, registered coating, and pouch-making machinery. APC established a rapid response library of stocked packaging materials designed to fulfill orders within 15 days or less.February 2024: Resource Label Group LLC (RLG) announced the formation of a specialty pharmaceutical and healthcare packaging division named RLG Healthcare. The formation of RLG Healthcare is expected to help the company offer packaging solutions such as labels, inserts, cartons, and others for the pharmaceutical and healthcare sector in the region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Commercial Printing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Commercial Printing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Commercial Printing Market?

To stay informed about further developments, trends, and reports in the North America Commercial Printing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence