Key Insights

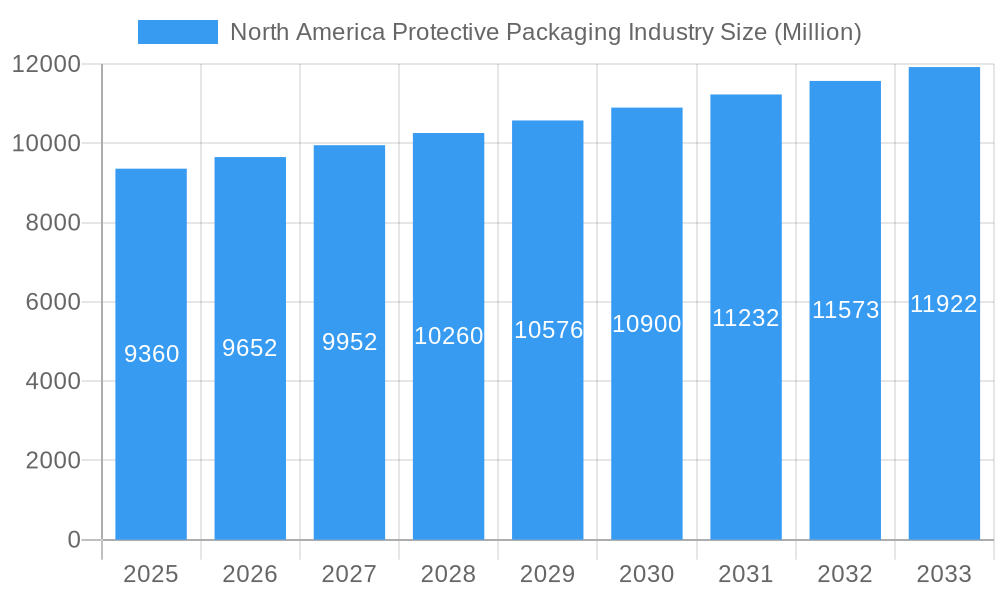

The North American protective packaging market, valued at $9.36 billion in 2025, is projected to experience steady growth, driven by several key factors. The increasing e-commerce sector necessitates robust packaging solutions to ensure product safety during transit, fueling demand for both rigid and flexible protective packaging materials. Growth within the food and beverage, pharmaceuticals, and consumer electronics industries, all heavily reliant on protective packaging to maintain product integrity and shelf life, further contributes to market expansion. While specific driver details are unavailable, considerations like the rising focus on sustainable packaging alternatives and the increasing adoption of automation in packaging processes likely contribute to this growth. Furthermore, the market's segmentation across product types (rigid and flexible) and end-user verticals provides diverse opportunities for market players. The prevalence of companies like Sonoco Products Company, Smurfit Kappa Group, and Pregis LLC indicates a competitive landscape, yet opportunities for innovation and expansion remain. The projected CAGR of 3.05% suggests a relatively stable, consistent growth trajectory through 2033. Growth may be slightly moderated by potential restraints such as fluctuating raw material prices and evolving regulatory requirements related to sustainable and eco-friendly packaging.

North America Protective Packaging Industry Market Size (In Billion)

The North American market’s dominance within the broader protective packaging landscape is largely attributable to its established e-commerce infrastructure and the presence of major players with significant manufacturing and distribution capabilities. Growth within specific segments, such as insulated shipping containers for temperature-sensitive goods (pharmaceuticals, food), will likely outpace overall market growth. Expansion into innovative materials and solutions, such as biodegradable and compostable options, will likely be a focal point for growth in the coming years as companies strive to meet increasing environmental concerns. This evolution will also drive innovation within the manufacturing processes, potentially leading to increased efficiency and reduced costs. The established presence of key players, coupled with continued investment in research and development within the sector, reinforces the market's positive outlook.

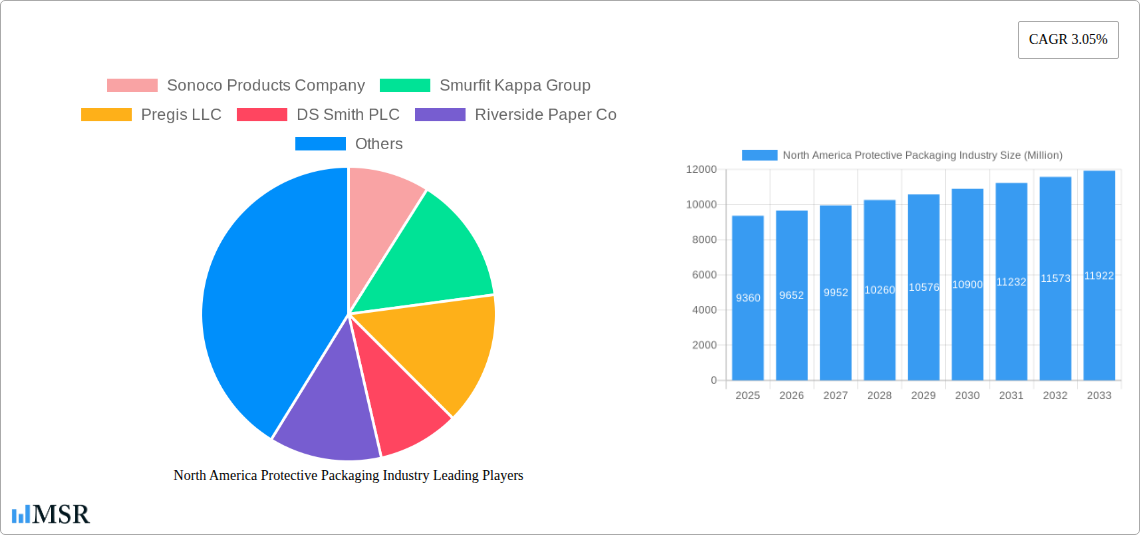

North America Protective Packaging Industry Company Market Share

North America Protective Packaging Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America protective packaging industry, offering valuable insights for stakeholders, investors, and industry professionals. With a focus on market dynamics, key segments, leading players, and future growth prospects, this report is an essential resource for understanding this dynamic market. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period extends from 2025 to 2033, and the historical period encompasses 2019-2024. The market value is presented in Millions.

North America Protective Packaging Industry Market Concentration & Dynamics

The North American protective packaging market is characterized by a moderately consolidated structure, with several large multinational corporations and smaller regional players competing for market share. Key players like Sonoco Products Company, Smurfit Kappa Group, Pregis LLC, DS Smith PLC, and Sealed Air Corporation hold significant portions of the market. However, the market also exhibits a high degree of fragmentation, particularly within specialized segments.

Market Concentration Metrics (2024 Estimates):

- Top 5 players’ combined market share: xx%

- Average market share of top 10 players: xx%

- Number of M&A deals (2019-2024): xx

Innovation Ecosystems and Regulatory Frameworks: The industry is witnessing continuous innovation driven by the need for sustainable, lightweight, and efficient packaging solutions. Stringent environmental regulations, particularly concerning recyclability and reduced carbon footprint, are shaping industry trends and driving investments in eco-friendly materials and technologies.

Substitute Products and End-User Trends: Competition from alternative packaging materials and the increasing demand for e-commerce packaging are impacting the market. End-user trends, including the growing popularity of online shopping and the demand for customized packaging solutions, are also playing a significant role in shaping industry dynamics.

M&A Activities: The protective packaging sector has seen a moderate level of mergers and acquisitions activity over the past few years, mainly driven by strategic expansion, consolidation, and the pursuit of technological advancements. This activity is expected to continue as companies strive for greater market share and operational efficiencies.

North America Protective Packaging Industry Industry Insights & Trends

The North American protective packaging market is experiencing robust growth, driven by factors such as the expansion of e-commerce, the increasing demand for fragile goods protection, and the growing focus on sustainability. The market is expected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). The market size in 2025 is estimated at $xx Million, and it is projected to reach $xx Million by 2033.

Technological advancements, including the development of lightweight, customizable, and eco-friendly packaging materials, are significantly influencing the market. Evolving consumer preferences, including the growing demand for sustainable and convenient packaging solutions, are also shaping industry trends. The increasing focus on supply chain efficiency and reduced packaging waste is further driving innovation in the sector. This growth is propelled by an expanding e-commerce sector, increasing consumer demand for durable and eco-conscious packaging options, and technological advancements contributing to heightened efficiency and sustainability.

Key Markets & Segments Leading North America Protective Packaging Industry

The North American protective packaging market is segmented by product type (rigid, flexible, insulated shipping containers), end-user vertical (food and beverage, industrial, pharmaceuticals, consumer electronics, beauty and home care, other end-user verticals), and other flexible products (foam).

Dominant Segments:

- End-user Vertical: The food and beverage and e-commerce sectors are the largest end-users of protective packaging in North America, driven by the need for safe and efficient transportation of perishable goods and the growth of online retail. Pharmaceuticals represent a rapidly growing segment due to the strict regulations and sensitivity of the products.

- Product Type: Flexible packaging (including foam) holds a significant share of the market, owing to its versatility, cost-effectiveness, and suitability for diverse applications. Rigid packaging solutions maintain a substantial market presence, driven by their robust protection capabilities for high-value products.

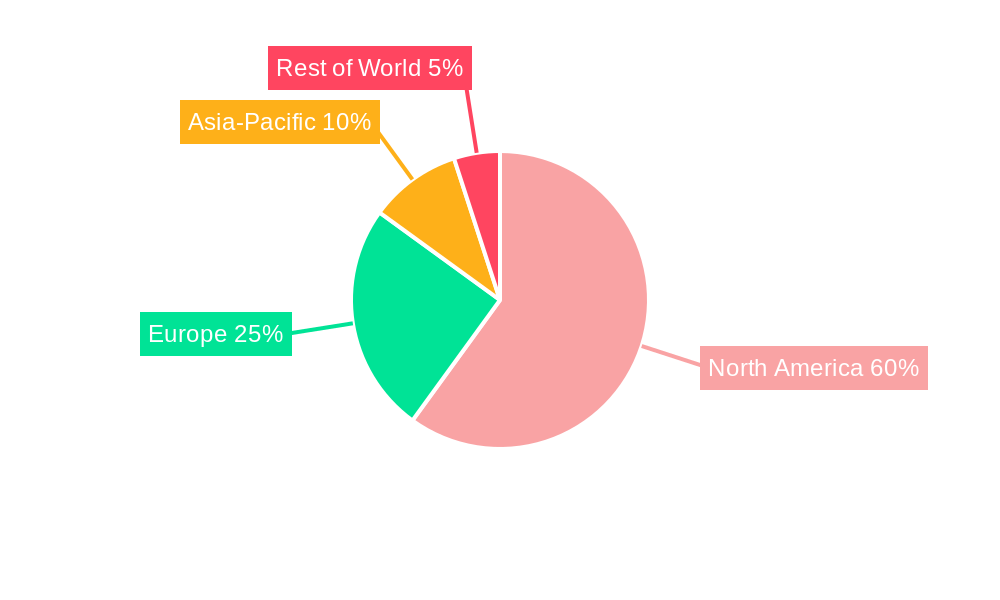

- Geographic Dominance: The United States holds the largest market share within North America due to its large and diverse economy, substantial e-commerce sector, and established manufacturing base. Canada and Mexico are also significant markets, exhibiting steady growth.

Growth Drivers:

- Economic growth and expansion of the manufacturing sector.

- Growth of e-commerce and online retail.

- Stringent regulations concerning product safety and sustainability.

- Increased consumer demand for convenient and eco-friendly packaging solutions.

North America Protective Packaging Industry Product Developments

Recent years have witnessed significant advancements in protective packaging, focusing on sustainability and enhanced performance. Key developments include the introduction of lightweight, recyclable materials, improved cushioning technologies, and innovative designs optimized for automated packaging lines. These advancements offer manufacturers a competitive edge through cost savings, enhanced efficiency, and a reduced environmental impact. The integration of smart packaging features such as RFID tags and tamper-evident seals is also gaining traction, further enhancing supply chain visibility and security.

Challenges in the North America Protective Packaging Industry Market

The North American protective packaging market faces several challenges, including rising raw material costs, fluctuating oil prices (impact on plastic-based materials), increased competition from substitute products, and stringent environmental regulations. Supply chain disruptions and labor shortages can also impact production and delivery timelines, while navigating varying regulatory requirements across different regions can add complexity for manufacturers. These challenges necessitate strategic adaptation and investment in innovation to ensure long-term sustainability and competitiveness. The estimated quantifiable impact of these challenges on market growth is a reduction of xx% in projected CAGR.

Forces Driving North America Protective Packaging Industry Growth

Several factors are driving growth in the North American protective packaging market. The expansion of e-commerce is a key driver, demanding efficient and secure packaging for online deliveries. Advances in sustainable packaging materials, such as recycled content and biodegradable options, are also spurring growth as companies and consumers prioritize environmental responsibility. Furthermore, technological advancements leading to automation in packaging processes are boosting efficiency and reducing operational costs, contributing positively to the market expansion.

Long-Term Growth Catalysts in the North America Protective Packaging Industry

Long-term growth in the North American protective packaging industry will be driven by continued innovation in materials and design, fostering lighter, more sustainable, and customizable packaging solutions. Strategic partnerships between material providers and packaging manufacturers will accelerate the adoption of eco-friendly options. Expansion into new markets, particularly in emerging sectors like personalized medicine and advanced electronics, will also contribute to long-term growth.

Emerging Opportunities in North America Protective Packaging Industry

Emerging opportunities exist in developing advanced protective packaging solutions for specialized products such as temperature-sensitive pharmaceuticals, high-value electronics, and delicate artwork. Growing demand for customized and personalized packaging, alongside the increasing use of recycled and compostable materials, presents significant potential for innovative solutions. The integration of smart technologies, including sensors and RFID, further presents significant growth opportunities for enhanced tracking and monitoring of goods throughout the supply chain.

Leading Players in the North America Protective Packaging Industry Sector

- Sonoco Products Company

- Smurfit Kappa Group

- Pregis LLC

- DS Smith PLC

- Riverside Paper Co

- International Paper Company

- Intertape Polymer Group Inc

- Pro-pac Packaging Limited

- Sealed Air Corporation

Key Milestones in North America Protective Packaging Industry Industry

- September 2021: Henkel and Pregis partnered to develop sustainable protective packaging solutions, launching a lightweight, recyclable paper cushion mailer. This collaboration highlights the industry's focus on eco-friendly alternatives.

- November 2021: DS Smith launched a quickly erectable, 100% recyclable corrugated cardboard tray, improving logistics efficiency. This innovation demonstrates the ongoing drive for optimized packaging solutions.

- January 2022: Klockner Pentaplast announced plans to significantly increase post-consumer recycled PET capacity in North America, expanding sustainable offerings in consumer health, pharmaceutical, and food packaging. This investment underscores the growing emphasis on sustainability within the industry.

- May 2022: Storopack introduced AIRplus Void Recycle, a polyethylene air pillow film containing at least 50% post-consumer recycled material. This product launch reflects the increasing use of recycled content in protective packaging.

Strategic Outlook for North America Protective Packaging Industry Market

The future of the North American protective packaging market is bright, driven by a confluence of factors including sustained e-commerce growth, increasing focus on sustainability, and ongoing technological innovation. Companies that prioritize eco-friendly materials, efficient production processes, and customized packaging solutions will be best positioned to capture market share. Strategic partnerships and investments in research and development will play a crucial role in unlocking the substantial growth potential within this dynamic market. The market's strategic outlook points towards a continued upward trajectory, emphasizing the importance of agility and adaptation to changing consumer and regulatory landscapes.

North America Protective Packaging Industry Segmentation

-

1. Product Type

-

1.1. Rigid

- 1.1.1. Corrugated Paperboard Protectors

- 1.1.2. Molded Pulp

- 1.1.3. Insulated Shipping Containers

-

1.2. Flexible

- 1.2.1. Protective Mailers

- 1.2.2. Bubble Wraps

- 1.2.3. Air Pillows/Air Bags

- 1.2.4. Paper Fill

- 1.2.5. Other Flexible Products

-

1.3. Foam

- 1.3.1. Molded Foam

- 1.3.2. Foam in Place (FIP)

- 1.3.3. Loose Fill

- 1.3.4. Foam Rolls/Sheets

- 1.3.5. Other Foam Products

-

1.1. Rigid

-

2. End-user Vertical

- 2.1. Food and Beverage

- 2.2. Industrial

- 2.3. Pharmaceuticals

- 2.4. Consumer Electronics

- 2.5. Beauty and Home Care

- 2.6. Other End-user Verticals

-

3. Geography

- 3.1. United States

- 3.2. Canada

North America Protective Packaging Industry Segmentation By Geography

- 1. United States

- 2. Canada

North America Protective Packaging Industry Regional Market Share

Geographic Coverage of North America Protective Packaging Industry

North America Protective Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.05% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for E-commerce-based Products; Demand for Flexible Protective Packaging Products

- 3.3. Market Restrains

- 3.3.1. ; Alternative Forms of Packaging

- 3.4. Market Trends

- 3.4.1. Increasing Trend of E-commerce to Augment the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Protective Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Rigid

- 5.1.1.1. Corrugated Paperboard Protectors

- 5.1.1.2. Molded Pulp

- 5.1.1.3. Insulated Shipping Containers

- 5.1.2. Flexible

- 5.1.2.1. Protective Mailers

- 5.1.2.2. Bubble Wraps

- 5.1.2.3. Air Pillows/Air Bags

- 5.1.2.4. Paper Fill

- 5.1.2.5. Other Flexible Products

- 5.1.3. Foam

- 5.1.3.1. Molded Foam

- 5.1.3.2. Foam in Place (FIP)

- 5.1.3.3. Loose Fill

- 5.1.3.4. Foam Rolls/Sheets

- 5.1.3.5. Other Foam Products

- 5.1.1. Rigid

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Food and Beverage

- 5.2.2. Industrial

- 5.2.3. Pharmaceuticals

- 5.2.4. Consumer Electronics

- 5.2.5. Beauty and Home Care

- 5.2.6. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Protective Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Rigid

- 6.1.1.1. Corrugated Paperboard Protectors

- 6.1.1.2. Molded Pulp

- 6.1.1.3. Insulated Shipping Containers

- 6.1.2. Flexible

- 6.1.2.1. Protective Mailers

- 6.1.2.2. Bubble Wraps

- 6.1.2.3. Air Pillows/Air Bags

- 6.1.2.4. Paper Fill

- 6.1.2.5. Other Flexible Products

- 6.1.3. Foam

- 6.1.3.1. Molded Foam

- 6.1.3.2. Foam in Place (FIP)

- 6.1.3.3. Loose Fill

- 6.1.3.4. Foam Rolls/Sheets

- 6.1.3.5. Other Foam Products

- 6.1.1. Rigid

- 6.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.2.1. Food and Beverage

- 6.2.2. Industrial

- 6.2.3. Pharmaceuticals

- 6.2.4. Consumer Electronics

- 6.2.5. Beauty and Home Care

- 6.2.6. Other End-user Verticals

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America Protective Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Rigid

- 7.1.1.1. Corrugated Paperboard Protectors

- 7.1.1.2. Molded Pulp

- 7.1.1.3. Insulated Shipping Containers

- 7.1.2. Flexible

- 7.1.2.1. Protective Mailers

- 7.1.2.2. Bubble Wraps

- 7.1.2.3. Air Pillows/Air Bags

- 7.1.2.4. Paper Fill

- 7.1.2.5. Other Flexible Products

- 7.1.3. Foam

- 7.1.3.1. Molded Foam

- 7.1.3.2. Foam in Place (FIP)

- 7.1.3.3. Loose Fill

- 7.1.3.4. Foam Rolls/Sheets

- 7.1.3.5. Other Foam Products

- 7.1.1. Rigid

- 7.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.2.1. Food and Beverage

- 7.2.2. Industrial

- 7.2.3. Pharmaceuticals

- 7.2.4. Consumer Electronics

- 7.2.5. Beauty and Home Care

- 7.2.6. Other End-user Verticals

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Competitive Analysis

- 8.1. Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 Sonoco Products Company

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Smurfit Kappa Group

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 Pregis LLC

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 DS Smith PLC

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 Riverside Paper Co

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 International Paper Company

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Intertape Polymer Group Inc

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 Pro-pac Packaging Limited*List Not Exhaustive

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 Sealed Air Corporation

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.1 Sonoco Products Company

List of Figures

- Figure 1: North America Protective Packaging Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Protective Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Protective Packaging Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: North America Protective Packaging Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 3: North America Protective Packaging Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: North America Protective Packaging Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Protective Packaging Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: North America Protective Packaging Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 7: North America Protective Packaging Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: North America Protective Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: North America Protective Packaging Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: North America Protective Packaging Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 11: North America Protective Packaging Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: North America Protective Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Protective Packaging Industry?

The projected CAGR is approximately 3.05%.

2. Which companies are prominent players in the North America Protective Packaging Industry?

Key companies in the market include Sonoco Products Company, Smurfit Kappa Group, Pregis LLC, DS Smith PLC, Riverside Paper Co, International Paper Company, Intertape Polymer Group Inc, Pro-pac Packaging Limited*List Not Exhaustive, Sealed Air Corporation.

3. What are the main segments of the North America Protective Packaging Industry?

The market segments include Product Type, End-user Vertical, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.36 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for E-commerce-based Products; Demand for Flexible Protective Packaging Products.

6. What are the notable trends driving market growth?

Increasing Trend of E-commerce to Augment the Market Growth.

7. Are there any restraints impacting market growth?

; Alternative Forms of Packaging.

8. Can you provide examples of recent developments in the market?

May 2022 - Protective packaging company Storopack added AIRplus Void Recycle as a new product to the company line-up. The company claims that this polyethylene (PE) air pillow film contains at least 50% post-consumer recycled material while still maintaining the sturdy and durable characteristics of PE and contributing to resource conservation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Protective Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Protective Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Protective Packaging Industry?

To stay informed about further developments, trends, and reports in the North America Protective Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence