Key Insights

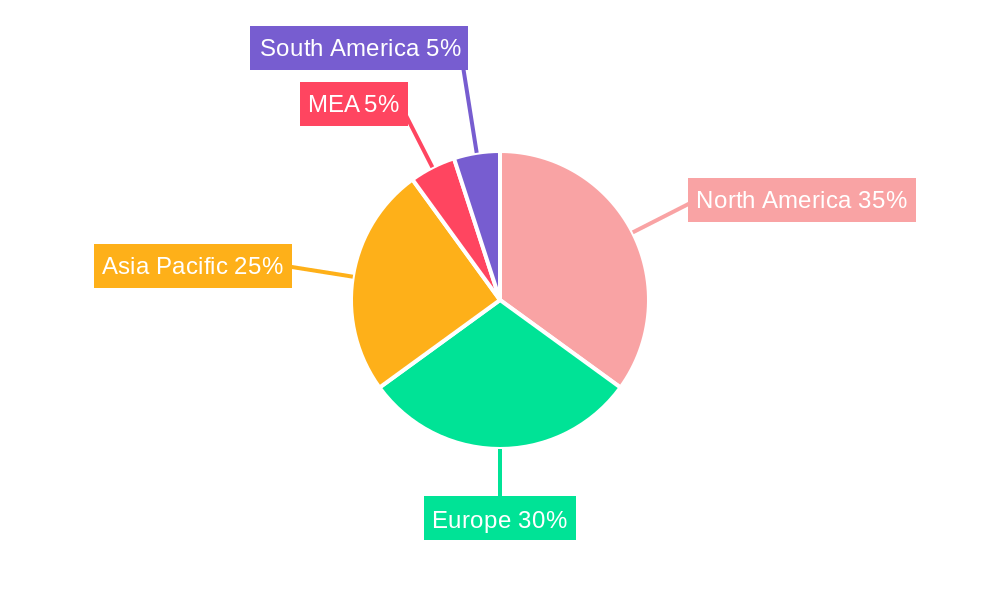

The global personal care contract manufacturing market is experiencing robust growth, driven by increasing demand for personalized and customized beauty products, a surge in e-commerce and direct-to-consumer brands, and the rising preference for outsourcing manufacturing processes among smaller and medium-sized personal care companies. The market's expansion is fueled by several key factors, including the growing popularity of natural and organic personal care products, the increasing adoption of innovative packaging solutions, and the need for efficient and cost-effective manufacturing processes. The market is segmented by service type (R&D and formulation, manufacturing, packaging & allied services) and product type (skincare, haircare, makeup & cosmetics, other). Skincare and haircare currently dominate, although makeup and cosmetics are experiencing significant growth driven by evolving beauty trends and increasing consumer spending. North America and Europe currently hold substantial market share, benefiting from established infrastructure and consumer demand, but the Asia-Pacific region is anticipated to witness the fastest growth in the coming years due to rising disposable incomes and expanding middle classes. Competition within the market is intense, with numerous established players and new entrants vying for market share. Strategic partnerships, acquisitions, and technological advancements are key strategies employed by leading companies such as PLZ Corp, McBride PLC, and Intercos SPA to maintain a competitive edge.

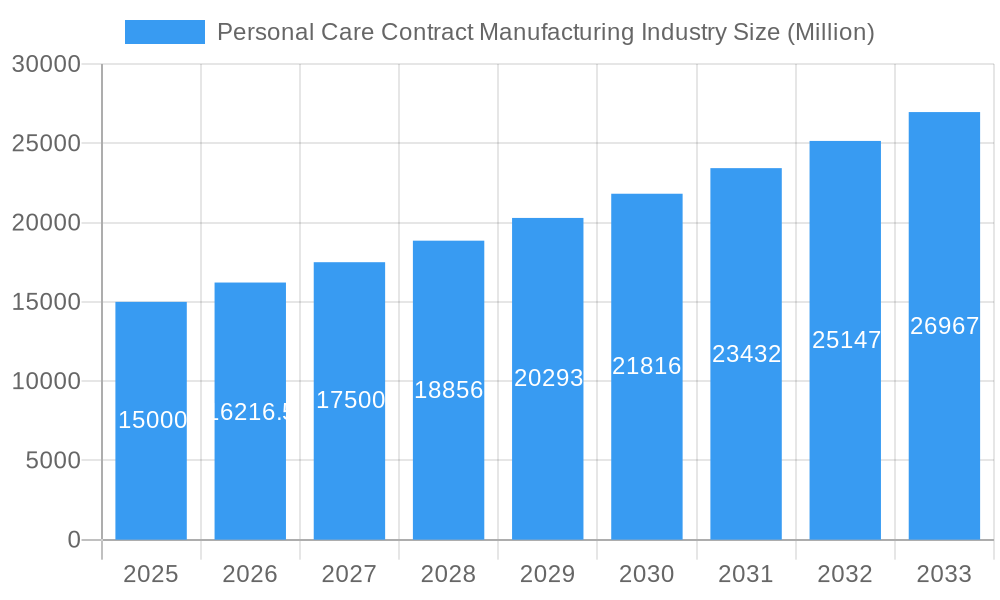

Personal Care Contract Manufacturing Industry Market Size (In Billion)

The projected Compound Annual Growth Rate (CAGR) of 8.11% from 2019 to 2033 indicates a substantial increase in market value. While precise figures for market size in 2025 are unavailable, a reasonable estimate can be derived from the given data and market trends. Considering the CAGR and the base year of 2025, we can project significant growth for the remainder of the forecast period. Key restraints include regulatory hurdles in various regions, fluctuations in raw material prices, and the need for stringent quality control measures. The market is adapting through sustainable manufacturing practices, embracing digitalization for efficiency improvements, and focusing on providing personalized solutions to cater to evolving consumer needs.

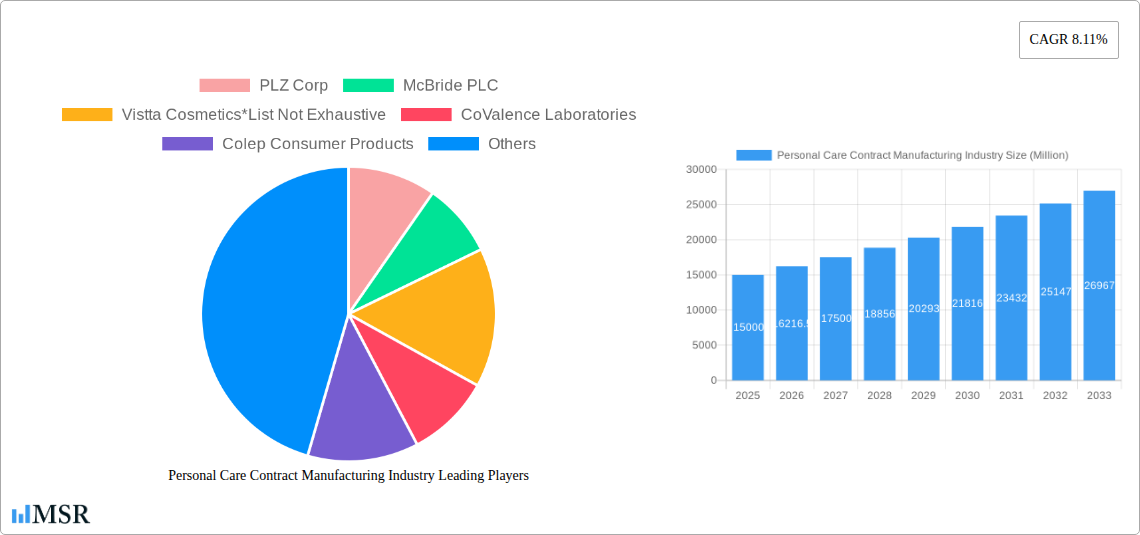

Personal Care Contract Manufacturing Industry Company Market Share

This in-depth report provides a comprehensive analysis of the global Personal Care Contract Manufacturing industry, offering valuable insights for stakeholders, investors, and industry professionals. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to project future market trends and opportunities. The market is valued at $xx Million in 2025 and is projected to reach $xx Million by 2033, exhibiting a CAGR of xx%.

Personal Care Contract Manufacturing Industry Market Concentration & Dynamics

The personal care contract manufacturing market is moderately concentrated, with several large players holding significant market share. Key players like PLZ Corp, McBride PLC, and ALBEA SA compete alongside numerous smaller, specialized firms. Market share analysis reveals that the top five players collectively hold approximately xx% of the market, indicating room for both consolidation and the emergence of niche players. Innovation ecosystems are dynamic, driven by advancements in formulation, packaging, and sustainability. Regulatory frameworks, varying by region, significantly impact production costs and product compliance. Substitute products, such as homemade cosmetics and ethically sourced alternatives, present a growing challenge. End-user trends towards natural, sustainable, and personalized products shape the demand for specialized contract manufacturing services. M&A activity, as exemplified by TruArcPartners' investment in Trademark Cosmetics in April 2023, reflects the industry's consolidation and pursuit of expansion. The average annual number of M&A deals over the historical period was xx, indicating a healthy level of industry restructuring.

- Market Concentration: Top 5 players hold approximately xx% market share.

- Innovation: Focus on sustainable, natural, and personalized products.

- Regulatory Landscape: Varies significantly by region, impacting compliance and costs.

- M&A Activity: Average xx deals annually during the historical period (2019-2024).

Personal Care Contract Manufacturing Industry Industry Insights & Trends

The personal care contract manufacturing market is experiencing robust growth, fueled by several key factors. The rising demand for personal care products globally, driven by increasing disposable incomes and changing lifestyles, is a major driver. Technological advancements in formulation, packaging, and automation are enhancing efficiency and product quality. Evolving consumer behaviors, including a heightened focus on sustainability and natural ingredients, are shaping product development and manufacturing practices. The market's growth is further fueled by the increasing prevalence of e-commerce, which expands distribution channels and allows for direct-to-consumer (DTC) brands to flourish. Contract manufacturers play a pivotal role in enabling the growth of these DTC brands by providing flexible and scalable manufacturing solutions. The market size in 2025 is estimated at $xx Million and is projected to reach $xx Million by 2033.

Key Markets & Segments Leading Personal Care Contract Manufacturing Industry

The North American and European regions currently dominate the personal care contract manufacturing market, driven by strong economic growth, well-established infrastructure, and a high concentration of both established brands and emerging players. However, Asia-Pacific is experiencing rapid expansion, fueled by rising disposable incomes and increasing demand for personal care products.

By Service Type:

- Manufacturing: Holds the largest market share, driven by high demand for diverse product types.

- Packaging & Allied Services: Experiencing rapid growth due to increasing focus on sustainable and innovative packaging solutions.

- R&D and Formulation: Growing steadily as brands increasingly outsource formulation expertise.

By Product Type:

- Skincare: Remains the largest segment, driven by the growing awareness of skincare benefits and diverse product offerings.

- Haircare: Shows significant growth potential due to increasing focus on hair health and styling.

- Make-up & Cosmetics: A dynamic segment shaped by trends and innovations in color cosmetics and makeup artistry.

Drivers:

- Strong economic growth in key regions.

- Well-developed infrastructure and logistics networks.

- High concentration of established brands and emerging players.

- Increasing consumer demand for diverse product categories.

Personal Care Contract Manufacturing Industry Product Developments

Recent product innovations focus on sustainable and ethically sourced ingredients, personalized formulations, and advanced packaging technologies. Advancements in formulation techniques allow for creating highly effective and customized products, catering to diverse consumer needs. The development of eco-friendly packaging materials and improved recycling processes contribute to a more sustainable industry. These technological advancements enable contract manufacturers to offer a competitive edge, attracting clients seeking innovative and responsible solutions.

Challenges in the Personal Care Contract Manufacturing Industry Market

The personal care contract manufacturing industry faces several challenges, including increasing regulatory compliance costs, fluctuations in raw material prices, supply chain disruptions, and intense competition. Regulatory hurdles, varying by region, can significantly impact production and increase costs. Supply chain vulnerabilities, particularly related to sourcing raw materials and packaging, lead to production delays and cost increases. The intensifying competition among contract manufacturers necessitates continuous innovation and the pursuit of operational excellence to maintain profitability. The overall impact of these factors on the market is estimated to reduce the annual growth rate by approximately xx%.

Forces Driving Personal Care Contract Manufacturing Industry Growth

Several factors drive the growth of the personal care contract manufacturing industry. The increasing demand for personal care products, driven by rising disposable incomes and changing consumer preferences, is a major growth catalyst. Technological advancements in formulation, packaging, and manufacturing processes boost efficiency and product quality. Favorable regulatory environments in certain regions promote market expansion. For instance, supportive government policies towards sustainable manufacturing practices encourage investment and growth in this sector.

Long-Term Growth Catalysts in the Personal Care Contract Manufacturing Industry

Long-term growth is driven by ongoing innovation in product formulation and packaging, strategic partnerships among contract manufacturers and brand owners, and expansion into new and emerging markets. The integration of advanced technologies like AI and machine learning will further optimize manufacturing processes. Collaborations focused on sustainable practices and product development will also play a significant role in driving future growth.

Emerging Opportunities in Personal Care Contract Manufacturing Industry

Emerging opportunities lie in the growing demand for customized and personalized products, the increasing popularity of natural and organic ingredients, and the expansion into new geographic markets. The focus on sustainability and ethical sourcing creates opportunities for manufacturers who can offer eco-friendly solutions. Moreover, the rise of direct-to-consumer (DTC) brands presents significant growth potential for contract manufacturers who can provide flexible and scalable manufacturing services.

Leading Players in the Personal Care Contract Manufacturing Industry Sector

- PLZ Corp

- McBride PLC

- Vistta Cosmetics

- CoValence Laboratories

- Colep Consumer Products

- ALBEA SA

- Fareva Group

- Powerpack Cosmetics

- Intercos SPA

- Voyant Beauty

- Hair Styling Applications SpA

- FORMULA CORP

- Clarion Cosmetics

- HCT Group

Key Milestones in Personal Care Contract Manufacturing Industry Industry

- April 2023: TruArcPartners invests in Trademark Cosmetics (TCI), driving expansion through organic initiatives and M&A.

- February 2023: BASF showcases innovative personal care solutions at PCHi, emphasizing sustainable technology and healthy beauty.

Strategic Outlook for Personal Care Contract Manufacturing Industry Market

The personal care contract manufacturing market presents substantial growth potential. Strategic opportunities include investing in advanced technologies, focusing on sustainable practices, and forging strong partnerships with brand owners. Expansion into new and emerging markets, coupled with product diversification, will be crucial for maintaining a competitive edge and capturing market share in this dynamic and evolving industry.

Personal Care Contract Manufacturing Industry Segmentation

-

1. Service Type

- 1.1. R&D & Formulation

- 1.2. Manufacturing

- 1.3. Packaging & Allied Services

-

2. Product Type

- 2.1. Skin Care

- 2.2. Hair Care

- 2.3. Make-up & Cosmetics

- 2.4. Other Product Types

Personal Care Contract Manufacturing Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Italy

-

3. Asia

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 4. Australia and New Zealand

- 5. Rest of the World

Personal Care Contract Manufacturing Industry Regional Market Share

Geographic Coverage of Personal Care Contract Manufacturing Industry

Personal Care Contract Manufacturing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Evolution of Service Offerings has Enabled Organizations to Increasingly Rely on Contract Manufacturers for their Production Needs While they Focus on R&D and Promotion; Localization of Contract Manufacturing in Personal Care Helps in Gaining Lead Time & Cost Advantages

- 3.3. Market Restrains

- 3.3.1. Stringent Government Rules and Regulations

- 3.4. Market Trends

- 3.4.1. Skin Care Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Personal Care Contract Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. R&D & Formulation

- 5.1.2. Manufacturing

- 5.1.3. Packaging & Allied Services

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Skin Care

- 5.2.2. Hair Care

- 5.2.3. Make-up & Cosmetics

- 5.2.4. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Personal Care Contract Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. R&D & Formulation

- 6.1.2. Manufacturing

- 6.1.3. Packaging & Allied Services

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Skin Care

- 6.2.2. Hair Care

- 6.2.3. Make-up & Cosmetics

- 6.2.4. Other Product Types

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Europe Personal Care Contract Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. R&D & Formulation

- 7.1.2. Manufacturing

- 7.1.3. Packaging & Allied Services

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Skin Care

- 7.2.2. Hair Care

- 7.2.3. Make-up & Cosmetics

- 7.2.4. Other Product Types

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Asia Personal Care Contract Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. R&D & Formulation

- 8.1.2. Manufacturing

- 8.1.3. Packaging & Allied Services

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Skin Care

- 8.2.2. Hair Care

- 8.2.3. Make-up & Cosmetics

- 8.2.4. Other Product Types

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Australia and New Zealand Personal Care Contract Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. R&D & Formulation

- 9.1.2. Manufacturing

- 9.1.3. Packaging & Allied Services

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Skin Care

- 9.2.2. Hair Care

- 9.2.3. Make-up & Cosmetics

- 9.2.4. Other Product Types

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Rest of the World Personal Care Contract Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. R&D & Formulation

- 10.1.2. Manufacturing

- 10.1.3. Packaging & Allied Services

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Skin Care

- 10.2.2. Hair Care

- 10.2.3. Make-up & Cosmetics

- 10.2.4. Other Product Types

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 PLZ Corp

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 McBride PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Vistta Cosmetics*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CoValence Laboratories

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Colep Consumer Products

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ALBEA SA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Fareva Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Powerpack Cosmetics

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Intercos SPA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Voyant Beauty

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Hair Styling Applications SpA

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 FORMULA CORP

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Clarion Cosmetics

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 HCT Group

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 PLZ Corp

List of Figures

- Figure 1: Global Personal Care Contract Manufacturing Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Personal Care Contract Manufacturing Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 3: North America Personal Care Contract Manufacturing Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: North America Personal Care Contract Manufacturing Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 5: North America Personal Care Contract Manufacturing Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Personal Care Contract Manufacturing Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Personal Care Contract Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Personal Care Contract Manufacturing Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 9: Europe Personal Care Contract Manufacturing Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 10: Europe Personal Care Contract Manufacturing Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 11: Europe Personal Care Contract Manufacturing Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Personal Care Contract Manufacturing Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Personal Care Contract Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Personal Care Contract Manufacturing Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 15: Asia Personal Care Contract Manufacturing Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 16: Asia Personal Care Contract Manufacturing Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 17: Asia Personal Care Contract Manufacturing Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: Asia Personal Care Contract Manufacturing Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Personal Care Contract Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand Personal Care Contract Manufacturing Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 21: Australia and New Zealand Personal Care Contract Manufacturing Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 22: Australia and New Zealand Personal Care Contract Manufacturing Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 23: Australia and New Zealand Personal Care Contract Manufacturing Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 24: Australia and New Zealand Personal Care Contract Manufacturing Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Australia and New Zealand Personal Care Contract Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Personal Care Contract Manufacturing Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 27: Rest of the World Personal Care Contract Manufacturing Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 28: Rest of the World Personal Care Contract Manufacturing Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 29: Rest of the World Personal Care Contract Manufacturing Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Rest of the World Personal Care Contract Manufacturing Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Rest of the World Personal Care Contract Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 5: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Personal Care Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Personal Care Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 10: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 11: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Personal Care Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: France Personal Care Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Italy Personal Care Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 16: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: China Personal Care Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: India Personal Care Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Personal Care Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: South Korea Personal Care Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 23: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 24: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 26: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 27: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Personal Care Contract Manufacturing Industry?

The projected CAGR is approximately 8.11%.

2. Which companies are prominent players in the Personal Care Contract Manufacturing Industry?

Key companies in the market include PLZ Corp, McBride PLC, Vistta Cosmetics*List Not Exhaustive, CoValence Laboratories, Colep Consumer Products, ALBEA SA, Fareva Group, Powerpack Cosmetics, Intercos SPA, Voyant Beauty, Hair Styling Applications SpA, FORMULA CORP, Clarion Cosmetics, HCT Group.

3. What are the main segments of the Personal Care Contract Manufacturing Industry?

The market segments include Service Type, Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX Million as of 2022.

5. What are some drivers contributing to market growth?

Evolution of Service Offerings has Enabled Organizations to Increasingly Rely on Contract Manufacturers for their Production Needs While they Focus on R&D and Promotion; Localization of Contract Manufacturing in Personal Care Helps in Gaining Lead Time & Cost Advantages.

6. What are the notable trends driving market growth?

Skin Care Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Stringent Government Rules and Regulations.

8. Can you provide examples of recent developments in the market?

April 2023: TruArcPartners, a private equity fund, invested in Trademark Cosmetics (TCI) to pursue continuous expansion and support brand partner success through organic initiatives and strategic mergers and acquisitions (M&A). TCI's formulation and production capabilities and strong customer-service focus proved important in its growth and will be the primary driver for future progress and expansion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Personal Care Contract Manufacturing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Personal Care Contract Manufacturing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Personal Care Contract Manufacturing Industry?

To stay informed about further developments, trends, and reports in the Personal Care Contract Manufacturing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence