Key Insights

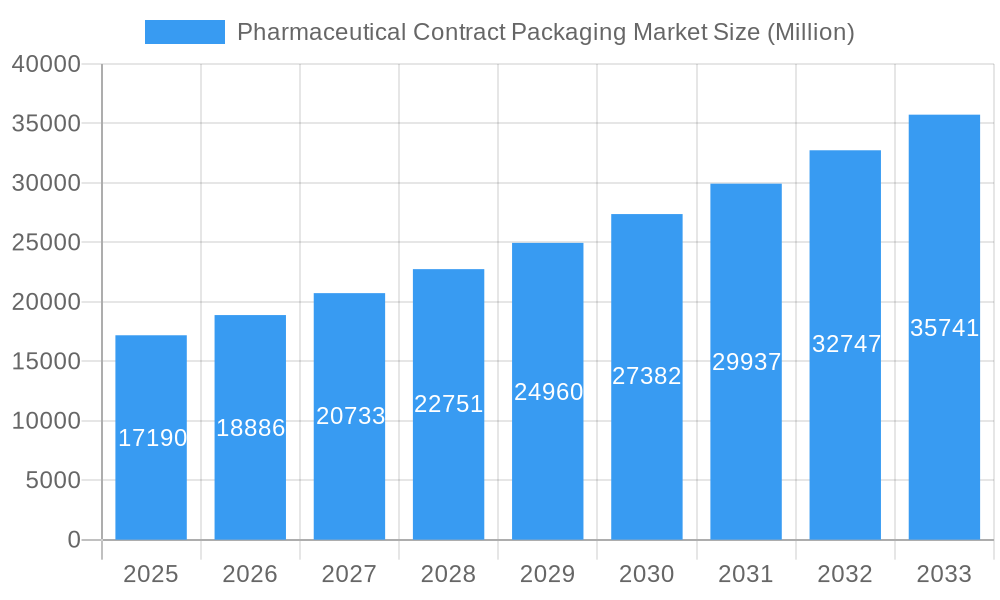

The pharmaceutical contract packaging market, valued at $17.19 billion in 2025, is experiencing robust growth, projected to expand at a CAGR of 9.82% from 2025 to 2033. This expansion is driven by several key factors. The increasing complexity of pharmaceutical products, coupled with stringent regulatory requirements, necessitates specialized packaging solutions that many pharmaceutical companies outsource to contract packaging organizations (CPOs). This allows pharmaceutical companies to focus on core competencies like research and development while leveraging the expertise and economies of scale offered by CPOs. Furthermore, the rising demand for innovative packaging formats, such as blister packs, pouches, and pre-filled syringes, fuels market growth. The growth is also being propelled by the increasing adoption of advanced technologies, including automation and robotics, in contract packaging to enhance efficiency and reduce costs. Growing outsourcing trends within the pharmaceutical industry, driven by cost optimization and a focus on core competencies, will further stimulate market expansion. Geographic expansion, especially in emerging markets with growing pharmaceutical industries, presents significant opportunities for growth.

Pharmaceutical Contract Packaging Market Market Size (In Billion)

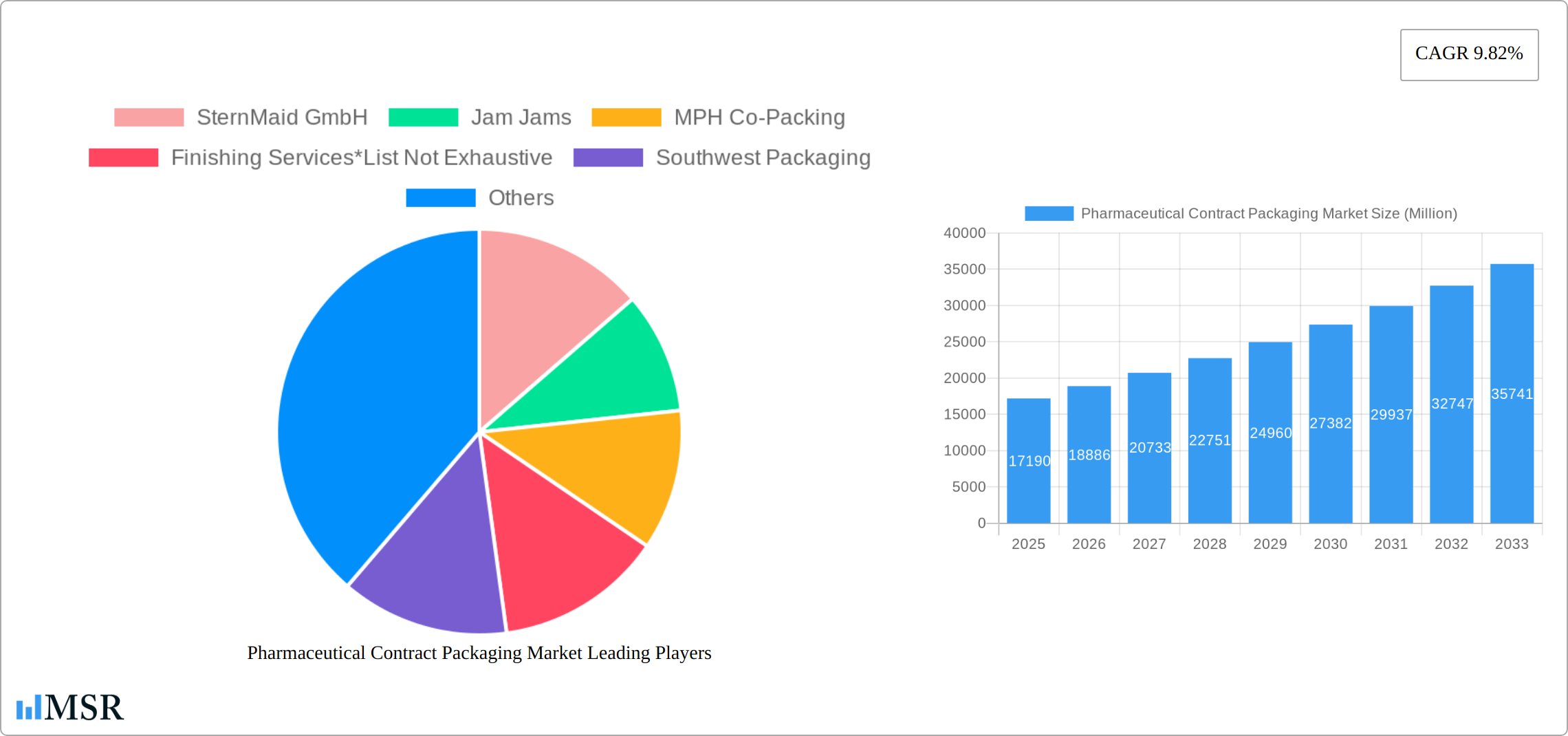

Segmentation analysis reveals a significant portion of the market dominated by primary service types, reflecting the high demand for core packaging functions. However, the secondary and tertiary segments are also exhibiting considerable growth, suggesting a shift towards more comprehensive and specialized packaging services. The competitive landscape is fragmented, with numerous players ranging from large multinational corporations to smaller specialized firms. Companies such as SternMaid GmbH, Almac Group, and PCI Pharma Services are leading the market, but many smaller, regional players contribute significantly to the overall market dynamism. The geographical distribution shows strong presence in North America and Europe, but the Asia-Pacific region demonstrates significant growth potential, driven by expanding pharmaceutical manufacturing bases and increasing consumer demand. The overall market outlook for pharmaceutical contract packaging remains extremely positive, with continued expansion anticipated throughout the forecast period.

Pharmaceutical Contract Packaging Market Company Market Share

Pharmaceutical Contract Packaging Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Pharmaceutical Contract Packaging Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report delves into market dynamics, trends, leading players, and future growth prospects. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Pharmaceutical Contract Packaging Market Market Concentration & Dynamics

The Pharmaceutical Contract Packaging market demonstrates a moderately concentrated landscape, with several large players holding significant market share. However, a significant number of smaller, specialized contract packagers also contribute to the overall market volume. Innovation within the sector is driven by advancements in packaging materials (e.g., sustainable and tamper-evident options), automation technologies, and serialization solutions to meet stringent regulatory requirements. The regulatory environment is highly complex and varies across different geographical regions, influencing packaging standards and compliance procedures. Substitute products are limited, mainly focusing on in-house packaging by pharmaceutical companies, which is often less cost-effective for smaller manufacturers. End-user trends towards personalized medicine and increased demand for specialized packaging solutions are shaping market demand. M&A activities have been moderate in recent years, with xx major deals recorded between 2019 and 2024, reflecting a trend toward consolidation within the industry. Market share data indicates that the top 5 players account for approximately xx% of the global market, leaving ample opportunity for smaller players to carve out niches through specialization and innovation.

Pharmaceutical Contract Packaging Market Industry Insights & Trends

The Pharmaceutical Contract Packaging market is experiencing robust growth fueled by several key factors. The increasing outsourcing of packaging activities by pharmaceutical companies, driven by cost optimization and specialization, is a significant market driver. Technological advancements, such as automation and robotics, are enhancing efficiency and reducing production costs. The rise of personalized medicine and the need for complex packaging solutions further fuel market expansion. Evolving consumer behaviors, including a growing preference for convenience and sustainable packaging options, are creating new opportunities. The global market size was valued at xx Million in 2024 and is expected to reach xx Million by 2025. The market is projected to witness considerable expansion, reaching xx Million by 2033, indicating strong long-term growth potential.

Key Markets & Segments Leading Pharmaceutical Contract Packaging Market

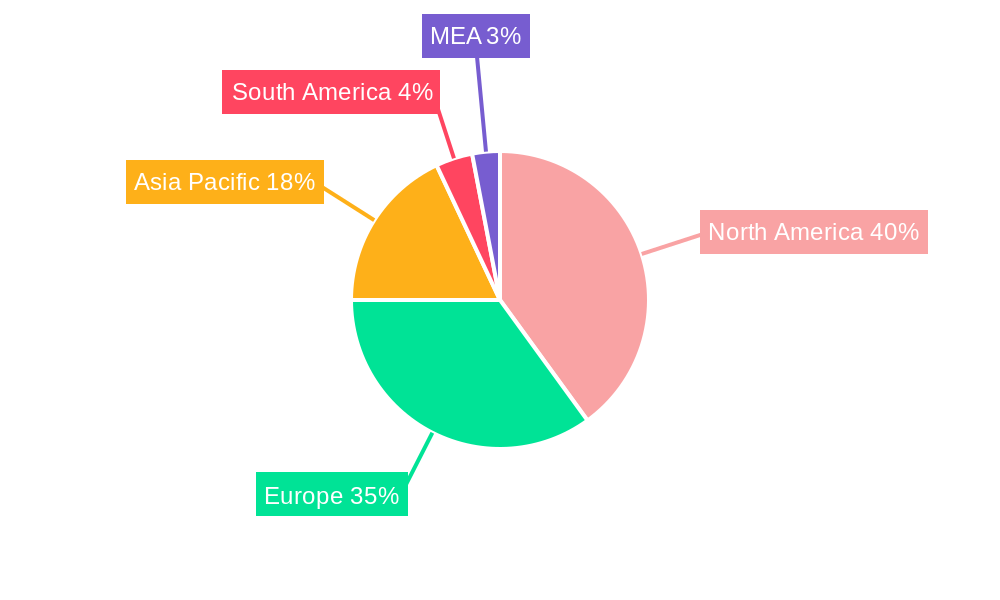

The pharmaceutical contract packaging market is experiencing robust growth, driven by a confluence of factors. North America currently holds the largest market share, fueled by extensive pharmaceutical manufacturing, stringent regulatory environments promoting outsourcing, and high technological adoption rates. Europe follows closely, benefiting from a mature pharmaceutical sector and increasing demand for specialized packaging solutions. The Asia-Pacific region is emerging as a key growth area, exhibiting significant potential due to rising healthcare expenditure and government support for pharmaceutical manufacturing. This dynamic landscape is further shaped by the evolving needs of pharmaceutical companies and increasing global demand for safe, efficient, and sustainable packaging solutions.

Market Segmentation:

- Primary Packaging: This segment commands the largest market share, reflecting the substantial volume of primary packaging required across diverse pharmaceutical products, from tablets and capsules to injectables and vials. Innovation in materials and technologies within this area continues to drive growth.

- Secondary & Tertiary Packaging: These segments are exhibiting strong growth, propelled by the increasing demand for sophisticated and specialized packaging solutions. This includes blister packs, cartons, and other forms of secondary and tertiary containment designed to enhance product protection, security, and patient convenience. The focus here is on customization, branding, and logistics optimization.

- By Drug Type: The market also shows significant variation based on the type of pharmaceutical product. Packaging solutions for biologics, for example, have unique requirements compared to those for solid oral dosage forms. This necessitates specialized expertise and technologies within the contract packaging sector.

Key Growth Drivers:

- Increased Outsourcing: Pharmaceutical companies increasingly outsource packaging activities to reduce operational costs, improve efficiency, and focus on core competencies. This trend is a major catalyst for market expansion.

- Stringent Regulatory Compliance: Meeting stringent global regulatory requirements, including serialization and track-and-trace mandates, necessitates collaboration with specialized contract packaging providers possessing the necessary expertise and technologies.

- Technological Advancements: Automation, robotics, and advanced packaging technologies are significantly enhancing efficiency, precision, and overall quality in pharmaceutical packaging processes, leading to improved productivity and reduced error rates.

- Sustainability Concerns: The growing emphasis on environmental sustainability is driving the adoption of eco-friendly packaging materials, such as biodegradable polymers and recycled plastics, presenting significant opportunities for innovative contract packaging solutions.

- Demand for Customization: The increasing need for customized packaging solutions tailored to specific product characteristics and branding requirements fuels market growth and encourages specialized service offerings.

Pharmaceutical Contract Packaging Market Product Developments

Recent product innovations include the introduction of sustainable packaging materials, such as biodegradable polymers and recycled plastics, to meet growing environmental concerns. Advancements in automation and robotics have led to increased efficiency and precision in packaging processes. The development of sophisticated serialization technologies ensures product traceability and combats counterfeiting, adding significant value to the market. These advancements provide contract packagers with a competitive edge, enabling them to meet the evolving needs of pharmaceutical companies.

Challenges in the Pharmaceutical Contract Packaging Market Market

The Pharmaceutical Contract Packaging market faces challenges including stringent regulatory compliance requirements that necessitate significant investments in quality control and validation processes. Supply chain disruptions, exacerbated by geopolitical events and pandemics, impact the availability of raw materials and timely delivery of finished products. Intense competition among contract packaging providers necessitates continuous innovation and cost optimization to maintain profitability and market share. These factors can collectively impact overall market growth.

Forces Driving Pharmaceutical Contract Packaging Market Growth

The market's growth is driven by increasing outsourcing by pharmaceutical companies to reduce operational costs, enhancing efficiency through automation and technological advancements, stringent regulatory requirements emphasizing safety and compliance, and the burgeoning demand for customized and sustainable packaging. The growing global pharmaceutical industry and expanding healthcare spending also contribute significantly to the market's trajectory.

Long-Term Growth Catalysts in the Pharmaceutical Contract Packaging Market

Long-term growth is fueled by continuous innovation in packaging materials and technologies, strategic partnerships and mergers & acquisitions increasing market share, and expansion into emerging markets presenting substantial growth potential. The rising adoption of advanced serialization and track-and-trace technologies will continue driving market expansion in the long term.

Emerging Opportunities in Pharmaceutical Contract Packaging Market

Emerging opportunities lie in the growing demand for sustainable and eco-friendly packaging solutions, the increasing adoption of advanced technologies such as AI and machine learning for automation and quality control, and the expansion into emerging markets with significant growth potential in pharmaceutical manufacturing. Customized packaging solutions tailored to specific drug types and patient needs represent another major growth opportunity.

Leading Players in the Pharmaceutical Contract Packaging Sector

- SternMaid GmbH

- Jam Jams

- MPH Co-Packing

- Finishing Services

- Southwest Packaging

- AmeriPac

- Variopack Lohnfertigungen GmbH

- DaklaPack Filling

- Ropack Inc

- Wasdell Group

- LABO Phytophar

- Delobris Pharmaceuticals Limited

- CentralPharma

- Almac Group

- Aphena Pharma Solutions Inc

- UNICEP Packaging LLC

- Assemblies Unlimited Inc

- Pharma Packaging Solutions

- Reed-Lane Inc

- Nelipak BV

- Asiapack Limited (Elanders Group)

- Jones Packaging Inc

- Sepha Limited

- Sharp (UDG Healthcare)

- AbbVie Contract Manufacturing

- Tripak Pharmaceuticals

- PCI Pharma Services

- Tjaopak

- MJS Packaging

Key Milestones in Pharmaceutical Contract Packaging Market Industry

- December 2020: Tjoapack announced a EUR 10 Million investment in its facility, expanding capacity for primary packaging of oral solids to over four billion tablets per year and enhancing its warehousing and cold chain capabilities.

- January 2021: PCI Pharma Services announced the expansion of its Biotech Packaging Center of Excellence in Philadelphia and significant investments in its Irish facilities, enhancing global biotech packaging capabilities.

Strategic Outlook for Pharmaceutical Contract Packaging Market Market

The future of the Pharmaceutical Contract Packaging market looks promising, with strong growth expected driven by technological innovations, increasing outsourcing, and expansion into new geographical markets. Strategic partnerships and collaborations will play a crucial role in shaping the market's landscape. Companies focusing on sustainability, advanced automation, and specialized packaging solutions are poised to capture significant market share and drive long-term growth.

Pharmaceutical Contract Packaging Market Segmentation

-

1. Service Type

-

1.1. Primary

- 1.1.1. Bottles

- 1.1.2. Vials

- 1.1.3. Ampoules

- 1.1.4. Blister Packs

- 1.2. Secondary

- 1.3. Tertiary

-

1.1. Primary

Pharmaceutical Contract Packaging Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Pharmaceutical Contract Packaging Market Regional Market Share

Geographic Coverage of Pharmaceutical Contract Packaging Market

Pharmaceutical Contract Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.82% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Ongoing efforts towards serialization to aid market growth; Recent capacity expansions & investments in expanding bottling and filling services

- 3.3. Market Restrains

- 3.3.1. ; High Initial Cost

- 3.4. Market Trends

- 3.4.1. Bottles Pharmaceutical Packaging is Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pharmaceutical Contract Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Primary

- 5.1.1.1. Bottles

- 5.1.1.2. Vials

- 5.1.1.3. Ampoules

- 5.1.1.4. Blister Packs

- 5.1.2. Secondary

- 5.1.3. Tertiary

- 5.1.1. Primary

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Pharmaceutical Contract Packaging Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Primary

- 6.1.1.1. Bottles

- 6.1.1.2. Vials

- 6.1.1.3. Ampoules

- 6.1.1.4. Blister Packs

- 6.1.2. Secondary

- 6.1.3. Tertiary

- 6.1.1. Primary

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Europe Pharmaceutical Contract Packaging Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Primary

- 7.1.1.1. Bottles

- 7.1.1.2. Vials

- 7.1.1.3. Ampoules

- 7.1.1.4. Blister Packs

- 7.1.2. Secondary

- 7.1.3. Tertiary

- 7.1.1. Primary

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Asia Pacific Pharmaceutical Contract Packaging Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Primary

- 8.1.1.1. Bottles

- 8.1.1.2. Vials

- 8.1.1.3. Ampoules

- 8.1.1.4. Blister Packs

- 8.1.2. Secondary

- 8.1.3. Tertiary

- 8.1.1. Primary

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Latin America Pharmaceutical Contract Packaging Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Primary

- 9.1.1.1. Bottles

- 9.1.1.2. Vials

- 9.1.1.3. Ampoules

- 9.1.1.4. Blister Packs

- 9.1.2. Secondary

- 9.1.3. Tertiary

- 9.1.1. Primary

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Middle East and Africa Pharmaceutical Contract Packaging Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Primary

- 10.1.1.1. Bottles

- 10.1.1.2. Vials

- 10.1.1.3. Ampoules

- 10.1.1.4. Blister Packs

- 10.1.2. Secondary

- 10.1.3. Tertiary

- 10.1.1. Primary

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 SternMaid GmbH

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Jam Jams

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 MPH Co-Packing

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Finishing Services*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Southwest Packaging

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AmeriPac

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Variopack Lohnfertigungen GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 DaklaPack Filling

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ropack Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Wasdell Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 LABO Phytophar

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 DelobrisPharmaceuticals Limited

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 CentralPharma

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Almac Group

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Aphena Pharma Solutions Inc

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 UNICEP Packaging LLC

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Assemblies Unlimited Inc

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Pharma Packaging Solutions

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Reed-Lane Inc

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Nelipak BV

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 AsiapackLimited (Elanders Group)

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Jones Packaging Inc

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Sepha Limited

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Sharp (UDG Healthcare)

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 AbbVie Contract Manufacturing

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 Tripak Pharmaceuticals

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 PCI Pharma Services

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.28 Tjaopak

- 11.2.28.1. Overview

- 11.2.28.2. Products

- 11.2.28.3. SWOT Analysis

- 11.2.28.4. Recent Developments

- 11.2.28.5. Financials (Based on Availability)

- 11.2.29 MJS Packaging

- 11.2.29.1. Overview

- 11.2.29.2. Products

- 11.2.29.3. SWOT Analysis

- 11.2.29.4. Recent Developments

- 11.2.29.5. Financials (Based on Availability)

- 11.2.1 SternMaid GmbH

List of Figures

- Figure 1: Global Pharmaceutical Contract Packaging Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Pharmaceutical Contract Packaging Market Revenue (Million), by Service Type 2025 & 2033

- Figure 3: North America Pharmaceutical Contract Packaging Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: North America Pharmaceutical Contract Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Pharmaceutical Contract Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Pharmaceutical Contract Packaging Market Revenue (Million), by Service Type 2025 & 2033

- Figure 7: Europe Pharmaceutical Contract Packaging Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 8: Europe Pharmaceutical Contract Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Pharmaceutical Contract Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Pharmaceutical Contract Packaging Market Revenue (Million), by Service Type 2025 & 2033

- Figure 11: Asia Pacific Pharmaceutical Contract Packaging Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 12: Asia Pacific Pharmaceutical Contract Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Pharmaceutical Contract Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Pharmaceutical Contract Packaging Market Revenue (Million), by Service Type 2025 & 2033

- Figure 15: Latin America Pharmaceutical Contract Packaging Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 16: Latin America Pharmaceutical Contract Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Pharmaceutical Contract Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Pharmaceutical Contract Packaging Market Revenue (Million), by Service Type 2025 & 2033

- Figure 19: Middle East and Africa Pharmaceutical Contract Packaging Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 20: Middle East and Africa Pharmaceutical Contract Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Pharmaceutical Contract Packaging Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Pharmaceutical Contract Packaging Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global Pharmaceutical Contract Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Pharmaceutical Contract Packaging Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 4: Global Pharmaceutical Contract Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Pharmaceutical Contract Packaging Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 6: Global Pharmaceutical Contract Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Pharmaceutical Contract Packaging Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 8: Global Pharmaceutical Contract Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Pharmaceutical Contract Packaging Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 10: Global Pharmaceutical Contract Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Pharmaceutical Contract Packaging Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 12: Global Pharmaceutical Contract Packaging Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pharmaceutical Contract Packaging Market?

The projected CAGR is approximately 9.82%.

2. Which companies are prominent players in the Pharmaceutical Contract Packaging Market?

Key companies in the market include SternMaid GmbH, Jam Jams, MPH Co-Packing, Finishing Services*List Not Exhaustive, Southwest Packaging, AmeriPac, Variopack Lohnfertigungen GmbH, DaklaPack Filling, Ropack Inc, Wasdell Group, LABO Phytophar, DelobrisPharmaceuticals Limited, CentralPharma, Almac Group, Aphena Pharma Solutions Inc, UNICEP Packaging LLC, Assemblies Unlimited Inc, Pharma Packaging Solutions, Reed-Lane Inc, Nelipak BV, AsiapackLimited (Elanders Group), Jones Packaging Inc, Sepha Limited, Sharp (UDG Healthcare), AbbVie Contract Manufacturing, Tripak Pharmaceuticals, PCI Pharma Services, Tjaopak, MJS Packaging.

3. What are the main segments of the Pharmaceutical Contract Packaging Market?

The market segments include Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.19 Million as of 2022.

5. What are some drivers contributing to market growth?

Ongoing efforts towards serialization to aid market growth; Recent capacity expansions & investments in expanding bottling and filling services.

6. What are the notable trends driving market growth?

Bottles Pharmaceutical Packaging is Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

; High Initial Cost.

8. Can you provide examples of recent developments in the market?

January 2021 - PCI Pharma has announced the expansion of its new Biotech Packaging Center of Excellence in Philadelphia, Pennsylvania, alongside significant new investments to expand its global biotech packaging capabilities in Ireland.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pharmaceutical Contract Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pharmaceutical Contract Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pharmaceutical Contract Packaging Market?

To stay informed about further developments, trends, and reports in the Pharmaceutical Contract Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence