Key Insights

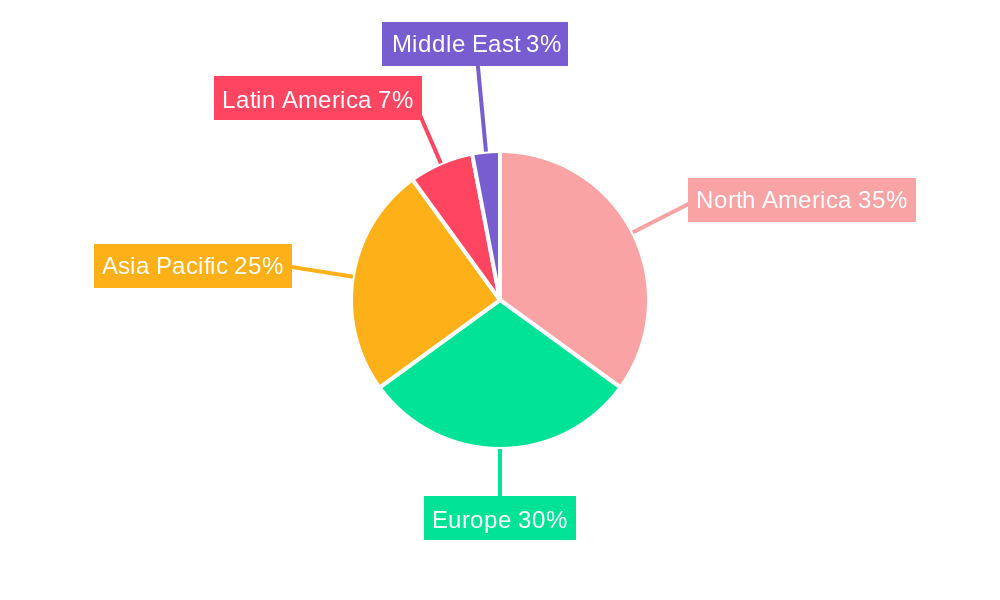

The primary packaging labels market is experiencing robust growth, projected to reach a substantial size driven by several key factors. The rising demand for packaged goods across diverse sectors like food and beverages, pharmaceuticals, and personal care fuels this expansion. Consumers increasingly prioritize product information and branding, leading to sophisticated label designs and functionalities. The shift towards e-commerce further enhances label importance, with labels playing a crucial role in product identification, tracking, and security throughout the supply chain. Technological advancements, including the adoption of pressure-sensitive, heat shrink, and in-mold labels, contribute to market dynamism. Pressure-sensitive labels, owing to their ease of application and cost-effectiveness, remain dominant. However, heat shrink and in-mold labels are witnessing rapid growth due to their enhanced durability and aesthetic appeal. The market is segmented by application method (pressure-sensitive, heat shrink, glue applied, in-mold, others) and end-user industry (food, beverage, pharmaceutical, personal care, others). Companies like Avery Dennison, CCL Industries, and Amcor are major players, continually innovating to meet evolving market demands. Regional variations exist, with North America and Europe currently holding significant market shares, while Asia-Pacific exhibits high growth potential due to its burgeoning consumer base and manufacturing activities. Despite economic fluctuations, the market's long-term outlook remains positive, supported by continuous innovation and the ever-growing need for effective product packaging.

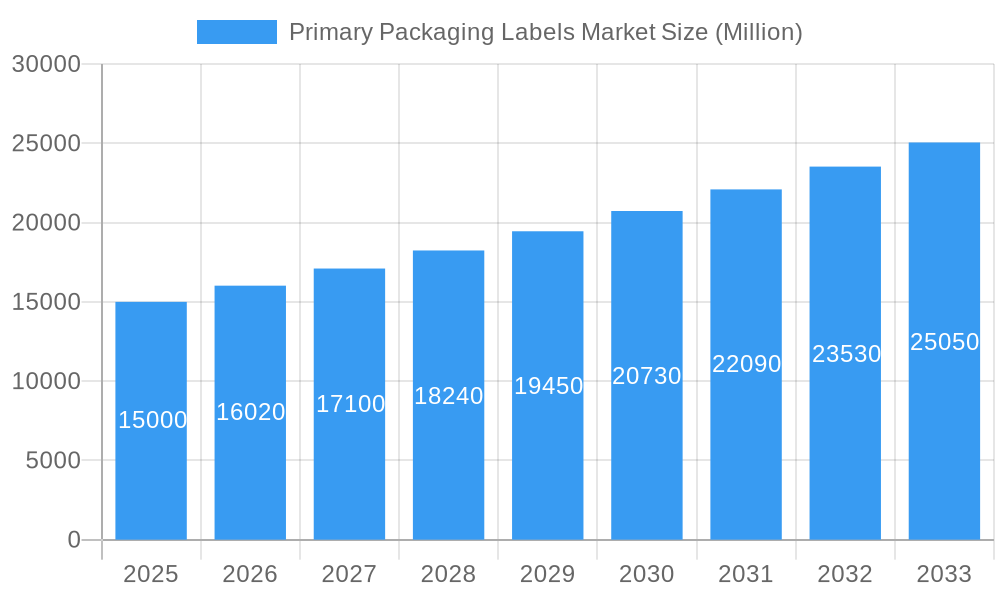

Primary Packaging Labels Market Market Size (In Billion)

The market's Compound Annual Growth Rate (CAGR) of 6.80% from 2019-2033 indicates a steady expansion. This growth is expected to accelerate in the forecast period (2025-2033) as emerging economies witness increased consumption and as the demand for sustainable and innovative labeling solutions gains traction. Competitive pressures necessitate continuous improvements in label technology, material efficiency, and supply chain optimization. Companies are investing in research and development to introduce eco-friendly labels made from recycled or biodegradable materials. The market is characterized by both organic growth through increased packaging consumption and inorganic growth via mergers and acquisitions among existing players. This competitive landscape is likely to intensify further, potentially resulting in market consolidation.

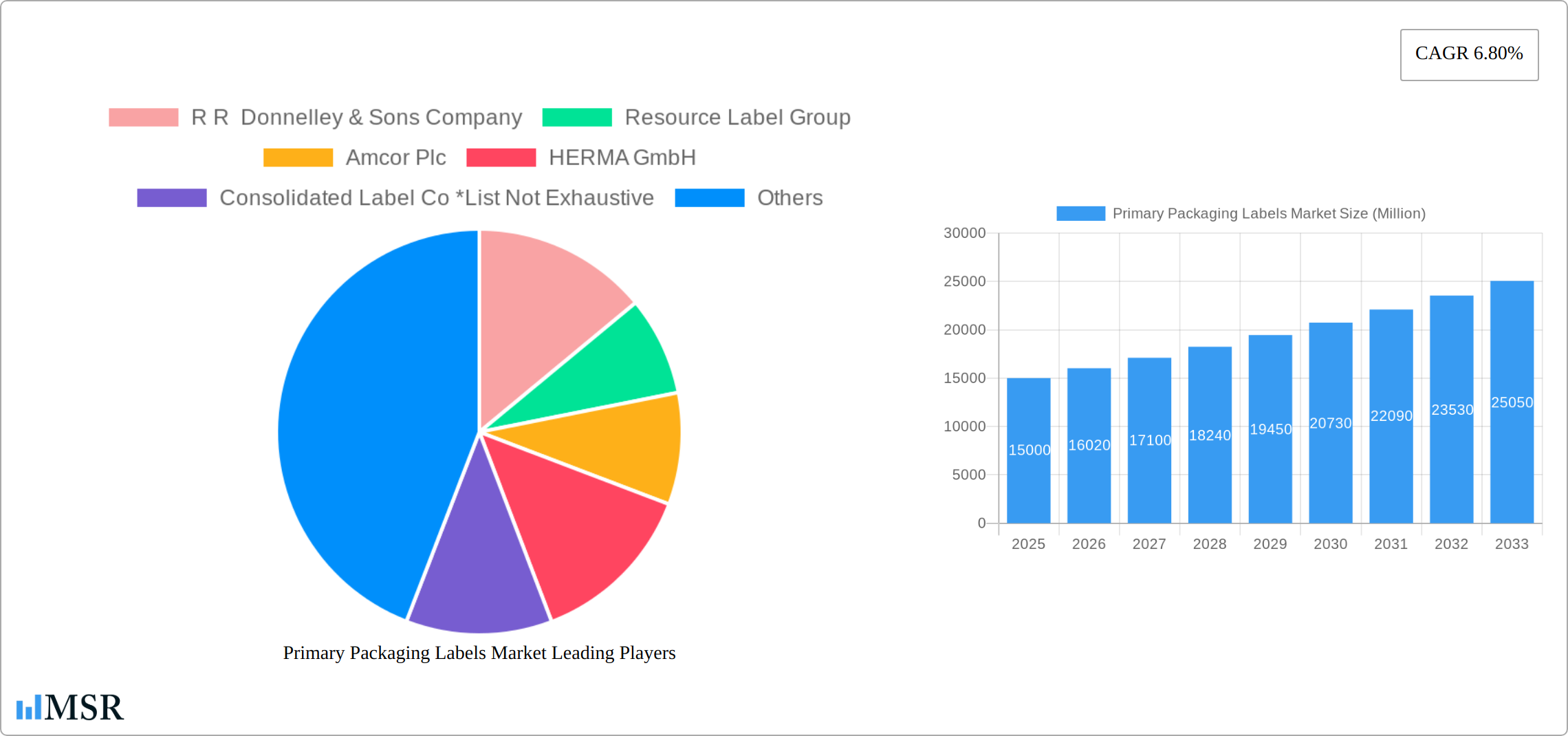

Primary Packaging Labels Market Company Market Share

Primary Packaging Labels Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global Primary Packaging Labels Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025, this report delves into market dynamics, trends, key segments, leading players, and future growth prospects. The market is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Primary Packaging Labels Market Market Concentration & Dynamics

The Primary Packaging Labels Market is characterized by a moderately concentrated landscape, with several key players holding significant market share. However, the presence of numerous smaller, specialized label manufacturers contributes to a dynamic competitive environment. The market is driven by innovation in label materials, printing technologies, and application methods. Stringent regulatory frameworks regarding food safety and product labeling influence manufacturing processes and material selection. Substitute products, such as digital printing technologies, are continuously evolving, challenging the traditional label market. Consumer trends towards sustainable packaging and personalized products significantly impact label design and material choices. Mergers and acquisitions (M&A) are common, with companies seeking to expand their market reach and product portfolios.

- Market Share: The top 5 players account for approximately xx% of the global market share in 2025.

- M&A Activity: Over the historical period (2019-2024), an estimated xx M&A deals occurred, reflecting consolidation and expansion within the industry. Examples include the 2022 merger of All American Label & Packaging and Western Shield Label & Packaging.

Primary Packaging Labels Market Industry Insights & Trends

The global Primary Packaging Labels Market is on a trajectory of robust expansion, propelled by the ever-growing demand for packaged goods across various consumer sectors and the increasing sophistication of the global supply chain. Technological innovations, including the widespread adoption of digital printing for shorter runs and enhanced customization, alongside the integration of RFID and NFC technologies for improved traceability and smart packaging solutions, are fundamentally reshaping label production and functionality. Furthermore, a significant paradigm shift is occurring due to evolving consumer preferences that increasingly favor eco-friendly, sustainable packaging options and the demand for convenience. This is spurring considerable innovation in the development of novel label materials derived from recycled, biodegradable, and compostable sources, as well as the design of labels that facilitate easier opening and disposal. The market size reached XX Million in 2024 and is projected to witness substantial growth, reaching an estimated XX Million by 2025. Key growth drivers include the insatiable demand for food and beverage products, the expanding pharmaceutical industry with its stringent regulatory requirements for labeling, and the burgeoning personal care sector where aesthetic appeal and product differentiation are paramount. The accelerated shift toward e-commerce is also a pivotal factor, driving the imperative for labels with enhanced security features, tamper-evidence, and improved supply chain traceability to combat counterfeiting and ensure product integrity.

Key Markets & Segments Leading Primary Packaging Labels Market

Within the dynamic Primary Packaging Labels Market, pressure-sensitive labels continue to command the largest market share due to their inherent ease of application, versatility, and cost-effectiveness across a wide array of substrates. Following closely are heat shrink and stretch sleeve labels, which are gaining significant traction due to their ability to provide high-quality, tamper-evident seals and a premium aesthetic, particularly for beverages and personal care products. By end-user industry, the food and beverage sector remains the dominant force, consistently driven by the sheer volume of packaged food and beverage products consumed globally and the ongoing need for clear, informative, and regulatory-compliant labeling. Geographically, North America and Europe currently represent the leading regional markets, benefiting from established economies and mature consumer bases. However, the Asia-Pacific region is exhibiting the most significant growth potential, fueled by rapid industrialization, a burgeoning middle class, and increasing disposable incomes leading to higher consumption of packaged goods.

- By Application Method:

- Pressure Sensitive Labels: Retains its dominant market share owing to its unparalleled ease of application, broad range of adhesive options, and remarkable versatility for diverse packaging formats. Advancements in adhesive technologies, such as high-performance and specialty adhesives, alongside sophisticated printing techniques, continue to bolster its position.

- Heat Shrink and Stretch Sleeve Labels: This segment is experiencing robust growth, propelled by the escalating demand for high-quality, visually appealing, and tamper-evident packaging solutions that enhance product security and brand presentation.

- Glue Applied Labels: A mature segment exhibiting steady demand, primarily utilized in industrial applications where cost-effectiveness and durability are key considerations.

- In-Mold Labels: A rapidly expanding niche market, offering superior durability, excellent aesthetic appeal, and seamless integration directly into the packaging during the manufacturing process.

- By End-user Industry:

- Food and Beverage: The largest and most significant segment, driven by consistent global demand for packaged food and beverage products, alongside increasingly stringent regulatory labeling requirements pertaining to nutrition, ingredients, and safety.

- Pharmaceutical: Experiencing strong and consistent growth, necessitated by the critical need for tamper-evident seals, serialization for track-and-trace capabilities, and strict adherence to pharmaceutical labeling regulations for patient safety and product integrity.

- Personal Care: A substantial and dynamic market segment, heavily influenced by consumer preferences for attractive, premium, and informative packaging that contributes to brand perception and product differentiation.

Key Growth Drivers:

- Robust economic growth and rising disposable incomes in emerging markets, leading to increased consumption of packaged goods.

- Continuous expansion and diversification of the food and beverage industries, requiring a constant supply of innovative packaging labels.

- Growing global demand for pharmaceutical products, driven by aging populations, increasing healthcare access, and the development of new therapeutics.

- Significant advancements in label technology, including digital printing, smart labeling solutions, and the development of sustainable and functional materials.

Primary Packaging Labels Market Product Developments

Recent years have witnessed significant advancements in label printing technologies, including the increased adoption of digital printing for short-run label production and customization. Innovations in materials, such as sustainable and recyclable substrates, are gaining traction, aligning with environmentally conscious consumer preferences. The integration of RFID and NFC technologies enables enhanced product tracking and consumer engagement. These developments are enhancing label functionality and providing competitive advantages to manufacturers.

Challenges in the Primary Packaging Labels Market Market

The Primary Packaging Labels Market faces challenges from fluctuating raw material prices, stringent regulatory compliance requirements, and intense competition. Supply chain disruptions can significantly impact production and delivery timelines, affecting profitability. The rise of substitute products and the pressure to adopt sustainable practices add to the challenges faced by industry players. The total impact of these challenges is estimated to reduce market growth by approximately xx% during the forecast period.

Forces Driving Primary Packaging Labels Market Growth

The overarching growth of the Primary Packaging Labels Market is primarily propelled by the escalating demand emanating from a diverse array of end-user industries, with the food & beverage and pharmaceutical sectors standing out as significant contributors. Crucial enablers of this growth include relentless technological advancements in printing technologies, leading to greater efficiency and customization, and significant strides in material science, offering enhanced functionality and sustainability. The burgeoning adoption of sustainable packaging solutions, driven by both consumer demand and corporate responsibility, plays a pivotal role. Additionally, favorable regulatory policies in specific regions that mandate clear and comprehensive labeling are also acting as significant catalysts for market expansion.

Challenges in the Primary Packaging Labels Market Market

Long-term growth hinges on continued innovation in sustainable materials and printing technologies, strategic partnerships to enhance supply chains, and expansion into new and emerging markets. Companies will need to prioritize adaptation to changing consumer demands and evolving regulations.

Emerging Opportunities in Primary Packaging Labels Market

Emerging opportunities include the growth of personalized labels, increasing demand for security features and traceability solutions, and the expansion into new applications like electronics and industrial goods. The adoption of smart labels with integrated sensors and the development of biodegradable and compostable materials present significant growth potential.

Leading Players in the Primary Packaging Labels Market Sector

- R R Donnelley & Sons Company

- Resource Label Group

- Amcor Plc

- HERMA GmbH

- Consolidated Label Co

- CCL Industries Inc

- Multi-Color Corporation

- Avery Dennison Corporation

- Fuji Seal International Inc

- Huhtamaki Oyj

Key Milestones in Primary Packaging Labels Market Industry

- March 2022: Heartwood Partners announced the merger of All American Label & Packaging and Western Shield Label & Packaging, expanding the market's capacity for pressure-sensitive labels within key sectors.

- January 2022: Resource Label Group's acquisition of QSX Labels strengthened its New England presence and overall market position.

Strategic Outlook for Primary Packaging Labels Market Market

The Primary Packaging Labels Market presents substantial growth potential over the next decade. Companies that invest in innovation, sustainability, and strategic partnerships will be well-positioned to capitalize on the market's opportunities. Focus on developing advanced label technologies, expanding into high-growth segments, and providing value-added services will be key for success.

Primary Packaging Labels Market Segmentation

-

1. Application Method

- 1.1. Pressure Sensitive Labels

- 1.2. Heat Shrink and Stretch Sleeve Labels

- 1.3. Glue Applied Labels

- 1.4. In-Mold Labels

- 1.5. Other Labels

-

2. End-user Industry

- 2.1. Food

- 2.2. Beverage

- 2.3. Pharmaceutical

- 2.4. Personalcare

- 2.5. Other End-user Industries

Primary Packaging Labels Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Primary Packaging Labels Market Regional Market Share

Geographic Coverage of Primary Packaging Labels Market

Primary Packaging Labels Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Focus on Manufacturing in Developing Economies; Growing Demand from Food and Beverage Industry

- 3.3. Market Restrains

- 3.3.1. Changing Government Regulations and Standards

- 3.4. Market Trends

- 3.4.1. Growing Demand for Beverages

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Primary Packaging Labels Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Method

- 5.1.1. Pressure Sensitive Labels

- 5.1.2. Heat Shrink and Stretch Sleeve Labels

- 5.1.3. Glue Applied Labels

- 5.1.4. In-Mold Labels

- 5.1.5. Other Labels

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food

- 5.2.2. Beverage

- 5.2.3. Pharmaceutical

- 5.2.4. Personalcare

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Application Method

- 6. North America Primary Packaging Labels Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application Method

- 6.1.1. Pressure Sensitive Labels

- 6.1.2. Heat Shrink and Stretch Sleeve Labels

- 6.1.3. Glue Applied Labels

- 6.1.4. In-Mold Labels

- 6.1.5. Other Labels

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Food

- 6.2.2. Beverage

- 6.2.3. Pharmaceutical

- 6.2.4. Personalcare

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Application Method

- 7. Europe Primary Packaging Labels Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application Method

- 7.1.1. Pressure Sensitive Labels

- 7.1.2. Heat Shrink and Stretch Sleeve Labels

- 7.1.3. Glue Applied Labels

- 7.1.4. In-Mold Labels

- 7.1.5. Other Labels

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Food

- 7.2.2. Beverage

- 7.2.3. Pharmaceutical

- 7.2.4. Personalcare

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Application Method

- 8. Asia Pacific Primary Packaging Labels Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application Method

- 8.1.1. Pressure Sensitive Labels

- 8.1.2. Heat Shrink and Stretch Sleeve Labels

- 8.1.3. Glue Applied Labels

- 8.1.4. In-Mold Labels

- 8.1.5. Other Labels

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Food

- 8.2.2. Beverage

- 8.2.3. Pharmaceutical

- 8.2.4. Personalcare

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Application Method

- 9. Latin America Primary Packaging Labels Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application Method

- 9.1.1. Pressure Sensitive Labels

- 9.1.2. Heat Shrink and Stretch Sleeve Labels

- 9.1.3. Glue Applied Labels

- 9.1.4. In-Mold Labels

- 9.1.5. Other Labels

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Food

- 9.2.2. Beverage

- 9.2.3. Pharmaceutical

- 9.2.4. Personalcare

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Application Method

- 10. Middle East Primary Packaging Labels Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application Method

- 10.1.1. Pressure Sensitive Labels

- 10.1.2. Heat Shrink and Stretch Sleeve Labels

- 10.1.3. Glue Applied Labels

- 10.1.4. In-Mold Labels

- 10.1.5. Other Labels

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Food

- 10.2.2. Beverage

- 10.2.3. Pharmaceutical

- 10.2.4. Personalcare

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Application Method

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 R R Donnelley & Sons Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Resource Label Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Amcor Plc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 HERMA GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Consolidated Label Co *List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CCL Industries Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Multi-Color Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Avery Dennison Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Fuji Seal International Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Huhtamaki Oyj

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 R R Donnelley & Sons Company

List of Figures

- Figure 1: Global Primary Packaging Labels Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Primary Packaging Labels Market Revenue (Million), by Application Method 2025 & 2033

- Figure 3: North America Primary Packaging Labels Market Revenue Share (%), by Application Method 2025 & 2033

- Figure 4: North America Primary Packaging Labels Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: North America Primary Packaging Labels Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Primary Packaging Labels Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Primary Packaging Labels Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Primary Packaging Labels Market Revenue (Million), by Application Method 2025 & 2033

- Figure 9: Europe Primary Packaging Labels Market Revenue Share (%), by Application Method 2025 & 2033

- Figure 10: Europe Primary Packaging Labels Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Europe Primary Packaging Labels Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Primary Packaging Labels Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Primary Packaging Labels Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Primary Packaging Labels Market Revenue (Million), by Application Method 2025 & 2033

- Figure 15: Asia Pacific Primary Packaging Labels Market Revenue Share (%), by Application Method 2025 & 2033

- Figure 16: Asia Pacific Primary Packaging Labels Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Primary Packaging Labels Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Primary Packaging Labels Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Primary Packaging Labels Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Primary Packaging Labels Market Revenue (Million), by Application Method 2025 & 2033

- Figure 21: Latin America Primary Packaging Labels Market Revenue Share (%), by Application Method 2025 & 2033

- Figure 22: Latin America Primary Packaging Labels Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Latin America Primary Packaging Labels Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Latin America Primary Packaging Labels Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Primary Packaging Labels Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Primary Packaging Labels Market Revenue (Million), by Application Method 2025 & 2033

- Figure 27: Middle East Primary Packaging Labels Market Revenue Share (%), by Application Method 2025 & 2033

- Figure 28: Middle East Primary Packaging Labels Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Middle East Primary Packaging Labels Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East Primary Packaging Labels Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East Primary Packaging Labels Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Primary Packaging Labels Market Revenue Million Forecast, by Application Method 2020 & 2033

- Table 2: Global Primary Packaging Labels Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Primary Packaging Labels Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Primary Packaging Labels Market Revenue Million Forecast, by Application Method 2020 & 2033

- Table 5: Global Primary Packaging Labels Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Primary Packaging Labels Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Primary Packaging Labels Market Revenue Million Forecast, by Application Method 2020 & 2033

- Table 8: Global Primary Packaging Labels Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Primary Packaging Labels Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Primary Packaging Labels Market Revenue Million Forecast, by Application Method 2020 & 2033

- Table 11: Global Primary Packaging Labels Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Primary Packaging Labels Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Primary Packaging Labels Market Revenue Million Forecast, by Application Method 2020 & 2033

- Table 14: Global Primary Packaging Labels Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Primary Packaging Labels Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Primary Packaging Labels Market Revenue Million Forecast, by Application Method 2020 & 2033

- Table 17: Global Primary Packaging Labels Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Primary Packaging Labels Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Primary Packaging Labels Market?

The projected CAGR is approximately 6.80%.

2. Which companies are prominent players in the Primary Packaging Labels Market?

Key companies in the market include R R Donnelley & Sons Company, Resource Label Group, Amcor Plc, HERMA GmbH, Consolidated Label Co *List Not Exhaustive, CCL Industries Inc, Multi-Color Corporation, Avery Dennison Corporation, Fuji Seal International Inc, Huhtamaki Oyj.

3. What are the main segments of the Primary Packaging Labels Market?

The market segments include Application Method, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Focus on Manufacturing in Developing Economies; Growing Demand from Food and Beverage Industry.

6. What are the notable trends driving market growth?

Growing Demand for Beverages.

7. Are there any restraints impacting market growth?

Changing Government Regulations and Standards.

8. Can you provide examples of recent developments in the market?

March 2022: Heartwood Partners announced the merger of All American Label & Packaging and Western Shield Label & Packaging, a significant supplier of pressure-sensitive prime labels and packaging solutions to the food & beverage, health & beauty, and industrials sectors. Western Shield and AALP's highest quality standards and advanced operations across California, Texas, Ohio, and Tennessee are ideally positioned to service customers nationwide.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Primary Packaging Labels Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Primary Packaging Labels Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Primary Packaging Labels Market?

To stay informed about further developments, trends, and reports in the Primary Packaging Labels Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence