Key Insights

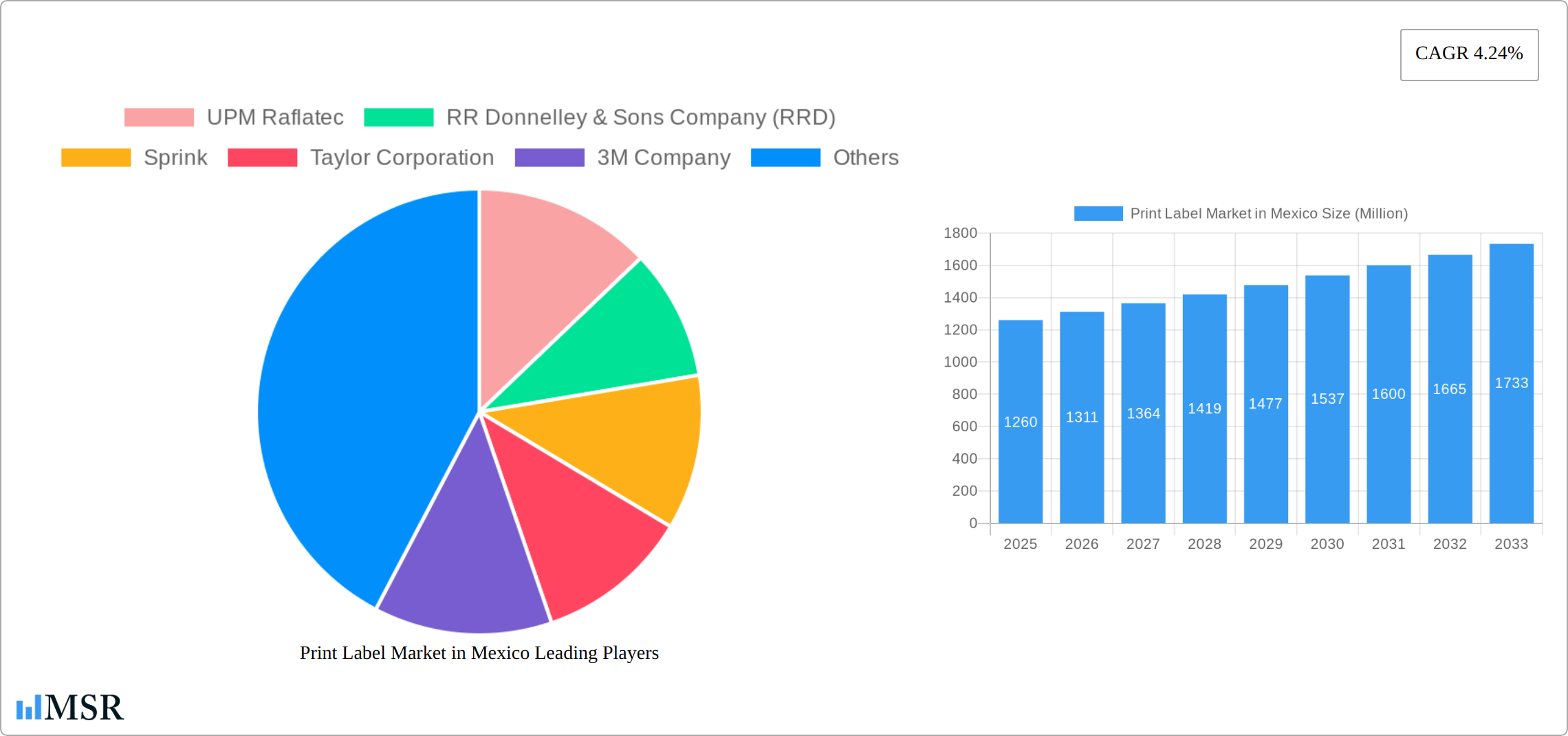

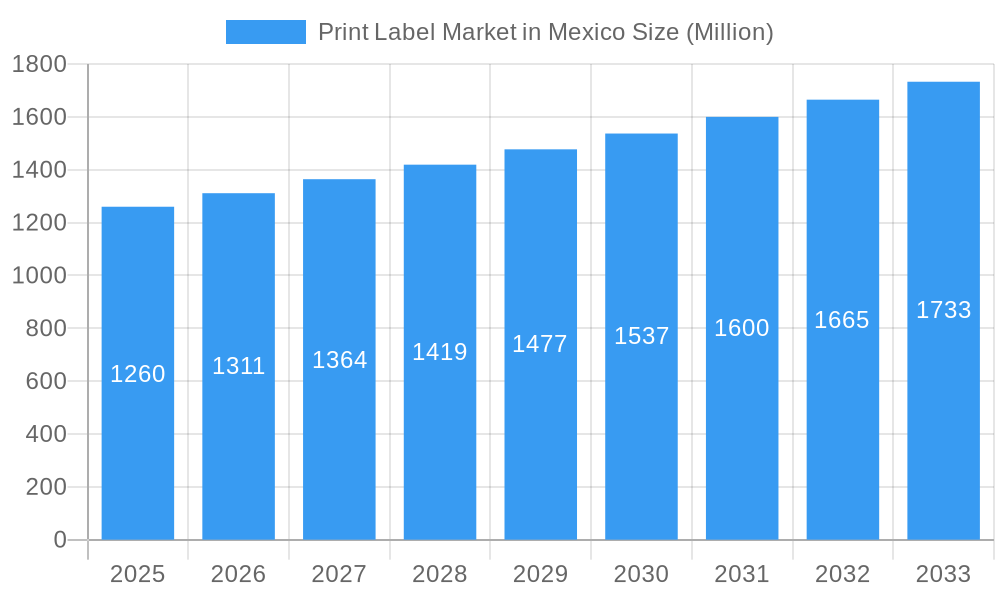

The Mexican print label market, valued at $1.26 billion in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 4.24% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning food and beverage sector, coupled with a rising demand for enhanced product packaging and branding, significantly drives label consumption. The increasing adoption of pressure-sensitive labels (PSL) over traditional wet-glued labels reflects a trend toward improved convenience and application efficiency. Furthermore, growth within the healthcare and pharmaceutical industries, demanding tamper-evident and informative labels, contributes to market expansion. The rise of e-commerce further stimulates demand for high-quality labels, particularly those suited for efficient automated handling and shipping. While competition among established players like UPM Raflatec, Avery Dennison, and CCL Industries remains intense, opportunities exist for specialized label manufacturers catering to niche market segments, such as sustainable and eco-friendly label solutions.

Print Label Market in Mexico Market Size (In Billion)

However, the market also faces challenges. Fluctuations in raw material prices, particularly paper and adhesives, can impact profitability. The emergence of digital printing technologies, while offering advantages in customization and short-run printing, also presents a competitive landscape for traditional printing methods. Economic volatility within Mexico and shifting consumer preferences require continuous adaptation and innovation from market players. Successful players will need to focus on technological advancements, strategic partnerships, and a deep understanding of evolving consumer demands to maintain a competitive edge and capitalize on the growth opportunities within the Mexican print label market. Maintaining robust supply chains and effectively navigating regulatory changes will be crucial for sustained success in this dynamic market.

Print Label Market in Mexico Company Market Share

Mexico's Print Label Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the dynamic Print Label Market in Mexico, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this lucrative sector. Covering the period 2019-2033, with a focus on 2025, this report unveils the market's current state, future trajectory, and key players shaping its evolution. The Mexican print label market, valued at xx Million USD in 2025, is poised for substantial growth, driven by technological advancements, expanding end-user industries, and strategic investments.

Print Label Market in Mexico Market Concentration & Dynamics

The Mexican print label market is characterized by a moderately concentrated structure, featuring a dynamic interplay between established multinational corporations and prominent domestic enterprises vying for significant market share. While specific market share data for individual companies is proprietary, industry assessments indicate a highly competitive environment where the leading five entities are collectively estimated to command approximately XX% of the total market. This competitive landscape is shaped by a confluence of factors, including:

- Robust Innovation Ecosystems: Mexico's print label sector thrives on a continually evolving innovation ecosystem. This growth is propelled by strategic investments in Research & Development (R&D) and the progressive adoption of cutting-edge printing technologies, most notably digital printing solutions.

- Impactful Regulatory Frameworks: The prevailing regulatory environment plays a crucial role, with strict adherence to labeling regulations across a spectrum of end-user industries significantly influencing market expansion and the trajectory of product development. Currently, these regulations do not represent a substantial impediment to market growth.

- Evolving Substitute Products: While the rise of digital printing and alternative labeling solutions introduces an element of substitution, traditional printing methods continue to maintain a strong presence and dominance in the market.

- Shifting End-User Trends: A primary growth catalyst is the escalating demand for highly customized and premium-quality labels from a diverse array of end-user industries, including the food & beverage, pharmaceutical, and cosmetics sectors.

- Strategic M&A Activities: The frequency of mergers and acquisitions within the Mexican print label market has been relatively subdued in recent years, averaging approximately XX transactions annually. This suggests a market landscape where organic growth strategies are the preferred approach for expansion.

Print Label Market in Mexico Industry Insights & Trends

The print label market in Mexico is experiencing a period of substantial and sustained growth. Projections indicate a Compound Annual Growth Rate (CAGR) of approximately XX% between 2025 and 2033, underscoring the sector's upward trajectory. Several key drivers are contributing to this expansion:

The estimated market size for 2025 is valued at approximately XX Million USD, reflecting the robust and consistent demand originating from a wide array of end-user segments. Core drivers fueling this growth include an increase in consumer spending, a trend towards greater product diversification, and a heightened emphasis on the critical role of effective product branding and packaging in consumer purchasing decisions. Technological advancements, particularly the accelerated adoption of digital printing technologies, are fundamentally reshaping the production landscape. These innovations are enabling greater flexibility, shorter lead times, and more efficient production cycles. Concurrently, consumer preferences are increasingly leaning towards sustainable and environmentally friendly labeling solutions, spurring significant innovation in materials science and printing processes. These evolving trends present both significant challenges and lucrative opportunities for all stakeholders within the market.

Key Markets & Segments Leading Print Label Market in Mexico

The Mexican print label market is geographically diverse, with strong presence across major urban centers and industrial hubs. Pressure-sensitive labels (PSL) represent the dominant segment in terms of volume and revenue, driven by their versatility and ease of application.

Leading Segments:

- Label Type: Pressure-Sensitive Labels (PSL) hold the largest market share, followed by wet-glued labels and shrink sleeve labels.

- Print Technology: Flexography remains the dominant print technology, accounting for the largest share, but digital printing is gaining traction due to its cost-effectiveness for shorter runs and customized labels.

- End-user Industry: The Food & Beverage, Healthcare & Pharmaceutical, and Cosmetics sectors are the major consumers of print labels, driving substantial market growth.

Key Growth Drivers:

- Economic Growth: Mexico's steady economic growth fuels increased consumer spending, driving demand for packaged goods and thus for labels.

- Infrastructure Development: Investments in infrastructure improve logistics and supply chain efficiency, positively impacting the market.

- Government Initiatives: Supportive government policies and initiatives aimed at promoting the manufacturing sector also play a role.

Print Label Market in Mexico Product Developments

Recent product innovations have focused on enhancing label performance, sustainability, and cost-effectiveness. This includes the introduction of new adhesive technologies, improved printing inks, and the adoption of sustainable materials like recycled paper and biodegradable films. These developments are aimed at providing label solutions that meet the evolving needs of diverse end-user industries. Companies are also increasingly leveraging digital printing technologies to offer greater customization options and reduced production lead times, enhancing their competitive advantage.

Challenges in the Print Label Market in Mexico Market

The print label market in Mexico navigates several significant challenges, including:

- Supply Chain Vulnerabilities: Global supply chain disruptions continue to pose a threat, impacting the consistent availability and cost of essential raw materials. This can directly influence production costs and ultimately affect profit margins. Historically, this impact has been estimated to account for approximately XX% of total production costs in recent years.

- Intense Competitive Pressures: The market is characterized by fierce competition, stemming from both domestic players and aggressive international entrants. This necessitates a continuous commitment to innovation and the implementation of stringent cost optimization strategies to maintain a competitive edge.

- Price Volatility of Raw Materials: Fluctuations in the market prices of key raw materials, such as paper and adhesives, have a direct and immediate impact on the profitability of print label manufacturers.

Forces Driving Print Label Market in Mexico Growth

Several key factors are driving growth in Mexico's print label market:

- Technological Advancements: The adoption of advanced printing technologies like digital and flexography is improving efficiency and customization options.

- Expanding End-User Industries: Growth in sectors such as food & beverage and cosmetics fuels demand for labels.

- Favorable Economic Conditions: Mexico’s stable economic conditions provide a supportive backdrop for market expansion.

Long-Term Growth Catalysts in Print Label Market in Mexico

The long-term growth prospects for the Mexican print label market are positive, fueled by several factors. Continuous innovation in materials and printing technologies will be crucial. Strategic partnerships and collaborations between label manufacturers, adhesive suppliers, and technology providers will further enhance efficiency and expand market reach. Expansion into new markets and product segments, such as specialized labels for the industrial sector, offer significant opportunities for growth.

Emerging Opportunities in Print Label Market in Mexico

The Mexican print label market is ripe with emerging opportunities. A notable area of growth is the increasing demand for sustainable and eco-friendly label solutions. Furthermore, the integration of smart labels with advanced technologies like RFID presents significant potential. Expansion into specialized niche markets, such as personalized and variable data labels, also offers promising avenues for growth. The widespread adoption of digital printing technology is a particularly significant opportunity, enabling unprecedented levels of customization for small and medium-sized enterprises (SMEs) and unlocking new segments of market growth.

Leading Players in the Print Label Market in Mexico Sector

- UPM Raflatec

- RR Donnelley & Sons Company (RRD)

- Sprink

- Taylor Corporation

- 3M Company

- STICKER'S PACK SA de CV

- CCL Industries Inc

- Clondalkin Group

- Avery Dennison Corporation

- Fuji Seal International Inc

- Multi-Color Mexico Corporation

- Papers and Conversions of Mexico

- Eximpro

- Brady Worldwide Inc

Key Milestones in Print Label Market in Mexico Industry

- October 2023: All4Labels' significant expansion in Mexico, tripling its production capacity with a USD 4.32 Million investment in new printing lines and technology upgrades. This significantly boosts the market's capacity for pressure-sensitive and shrink sleeve labels.

- June 2022: Henkel's opening of a new hot melt adhesive plant in Mexico substantially increases the supply of crucial materials for pressure-sensitive label production, supporting market growth.

Strategic Outlook for Print Label Market in Mexico Market

The future of the Mexican print label market appears bright. Continued investment in advanced technologies, expansion into new market segments, and a focus on sustainability will drive growth. Companies that leverage digital printing capabilities, offer customized solutions, and prioritize environmentally friendly materials will be well-positioned to capture significant market share in the years to come. The market’s dynamic nature presents substantial opportunities for both established players and new entrants.

Print Label Market in Mexico Segmentation

-

1. Print Technology

- 1.1. Offset

- 1.2. Flexography

- 1.3. Rotogravure

- 1.4. Screen

- 1.5. Letterpress

- 1.6. Digital Printing

-

2. Label Type

- 2.1. Wet-glued Labels

- 2.2. Pressure Sensitive Labels (PSL)

- 2.3. Liner less Labels

- 2.4. In-mold Labels

- 2.5. Shrink Sleeve Labels

- 2.6. Multi-part Tracking Label

-

3. End-user Industry

- 3.1. Food

- 3.2. Beverage

- 3.3. Healthcare and Pharmaceutical

- 3.4. Cosmetics

- 3.5. Household

- 3.6. Industrial

- 3.7. Other End-user Industries

Print Label Market in Mexico Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Print Label Market in Mexico Regional Market Share

Geographic Coverage of Print Label Market in Mexico

Print Label Market in Mexico REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Evolution of Digital Print Technology; Technological Advancements Leading to Reduction in Cost and Run Length

- 3.3. Market Restrains

- 3.3.1. Lack of Products with Ability to Withstand Harsh Climatic Conditions

- 3.4. Market Trends

- 3.4.1. Flexographic Printing to Hold the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Print Label Market in Mexico Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Print Technology

- 5.1.1. Offset

- 5.1.2. Flexography

- 5.1.3. Rotogravure

- 5.1.4. Screen

- 5.1.5. Letterpress

- 5.1.6. Digital Printing

- 5.2. Market Analysis, Insights and Forecast - by Label Type

- 5.2.1. Wet-glued Labels

- 5.2.2. Pressure Sensitive Labels (PSL)

- 5.2.3. Liner less Labels

- 5.2.4. In-mold Labels

- 5.2.5. Shrink Sleeve Labels

- 5.2.6. Multi-part Tracking Label

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food

- 5.3.2. Beverage

- 5.3.3. Healthcare and Pharmaceutical

- 5.3.4. Cosmetics

- 5.3.5. Household

- 5.3.6. Industrial

- 5.3.7. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Print Technology

- 6. North America Print Label Market in Mexico Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Print Technology

- 6.1.1. Offset

- 6.1.2. Flexography

- 6.1.3. Rotogravure

- 6.1.4. Screen

- 6.1.5. Letterpress

- 6.1.6. Digital Printing

- 6.2. Market Analysis, Insights and Forecast - by Label Type

- 6.2.1. Wet-glued Labels

- 6.2.2. Pressure Sensitive Labels (PSL)

- 6.2.3. Liner less Labels

- 6.2.4. In-mold Labels

- 6.2.5. Shrink Sleeve Labels

- 6.2.6. Multi-part Tracking Label

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Food

- 6.3.2. Beverage

- 6.3.3. Healthcare and Pharmaceutical

- 6.3.4. Cosmetics

- 6.3.5. Household

- 6.3.6. Industrial

- 6.3.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Print Technology

- 7. South America Print Label Market in Mexico Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Print Technology

- 7.1.1. Offset

- 7.1.2. Flexography

- 7.1.3. Rotogravure

- 7.1.4. Screen

- 7.1.5. Letterpress

- 7.1.6. Digital Printing

- 7.2. Market Analysis, Insights and Forecast - by Label Type

- 7.2.1. Wet-glued Labels

- 7.2.2. Pressure Sensitive Labels (PSL)

- 7.2.3. Liner less Labels

- 7.2.4. In-mold Labels

- 7.2.5. Shrink Sleeve Labels

- 7.2.6. Multi-part Tracking Label

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Food

- 7.3.2. Beverage

- 7.3.3. Healthcare and Pharmaceutical

- 7.3.4. Cosmetics

- 7.3.5. Household

- 7.3.6. Industrial

- 7.3.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Print Technology

- 8. Europe Print Label Market in Mexico Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Print Technology

- 8.1.1. Offset

- 8.1.2. Flexography

- 8.1.3. Rotogravure

- 8.1.4. Screen

- 8.1.5. Letterpress

- 8.1.6. Digital Printing

- 8.2. Market Analysis, Insights and Forecast - by Label Type

- 8.2.1. Wet-glued Labels

- 8.2.2. Pressure Sensitive Labels (PSL)

- 8.2.3. Liner less Labels

- 8.2.4. In-mold Labels

- 8.2.5. Shrink Sleeve Labels

- 8.2.6. Multi-part Tracking Label

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Food

- 8.3.2. Beverage

- 8.3.3. Healthcare and Pharmaceutical

- 8.3.4. Cosmetics

- 8.3.5. Household

- 8.3.6. Industrial

- 8.3.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Print Technology

- 9. Middle East & Africa Print Label Market in Mexico Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Print Technology

- 9.1.1. Offset

- 9.1.2. Flexography

- 9.1.3. Rotogravure

- 9.1.4. Screen

- 9.1.5. Letterpress

- 9.1.6. Digital Printing

- 9.2. Market Analysis, Insights and Forecast - by Label Type

- 9.2.1. Wet-glued Labels

- 9.2.2. Pressure Sensitive Labels (PSL)

- 9.2.3. Liner less Labels

- 9.2.4. In-mold Labels

- 9.2.5. Shrink Sleeve Labels

- 9.2.6. Multi-part Tracking Label

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Food

- 9.3.2. Beverage

- 9.3.3. Healthcare and Pharmaceutical

- 9.3.4. Cosmetics

- 9.3.5. Household

- 9.3.6. Industrial

- 9.3.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Print Technology

- 10. Asia Pacific Print Label Market in Mexico Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Print Technology

- 10.1.1. Offset

- 10.1.2. Flexography

- 10.1.3. Rotogravure

- 10.1.4. Screen

- 10.1.5. Letterpress

- 10.1.6. Digital Printing

- 10.2. Market Analysis, Insights and Forecast - by Label Type

- 10.2.1. Wet-glued Labels

- 10.2.2. Pressure Sensitive Labels (PSL)

- 10.2.3. Liner less Labels

- 10.2.4. In-mold Labels

- 10.2.5. Shrink Sleeve Labels

- 10.2.6. Multi-part Tracking Label

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Food

- 10.3.2. Beverage

- 10.3.3. Healthcare and Pharmaceutical

- 10.3.4. Cosmetics

- 10.3.5. Household

- 10.3.6. Industrial

- 10.3.7. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Print Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 UPM Raflatec

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 RR Donnelley & Sons Company (RRD)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sprink

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Taylor Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 3M Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 STICKER'S PACK SA de CV

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CCL Industries Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Clondalkin Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Avery Dennison Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Fuji Seal International Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Multi-Color Mexico Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Papers and Conversions of Mexico*List Not Exhaustive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Eximpro

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Brady Worldwide Inc

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 UPM Raflatec

List of Figures

- Figure 1: Global Print Label Market in Mexico Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Print Label Market in Mexico Revenue (Million), by Print Technology 2025 & 2033

- Figure 3: North America Print Label Market in Mexico Revenue Share (%), by Print Technology 2025 & 2033

- Figure 4: North America Print Label Market in Mexico Revenue (Million), by Label Type 2025 & 2033

- Figure 5: North America Print Label Market in Mexico Revenue Share (%), by Label Type 2025 & 2033

- Figure 6: North America Print Label Market in Mexico Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: North America Print Label Market in Mexico Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Print Label Market in Mexico Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Print Label Market in Mexico Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Print Label Market in Mexico Revenue (Million), by Print Technology 2025 & 2033

- Figure 11: South America Print Label Market in Mexico Revenue Share (%), by Print Technology 2025 & 2033

- Figure 12: South America Print Label Market in Mexico Revenue (Million), by Label Type 2025 & 2033

- Figure 13: South America Print Label Market in Mexico Revenue Share (%), by Label Type 2025 & 2033

- Figure 14: South America Print Label Market in Mexico Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: South America Print Label Market in Mexico Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: South America Print Label Market in Mexico Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Print Label Market in Mexico Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Print Label Market in Mexico Revenue (Million), by Print Technology 2025 & 2033

- Figure 19: Europe Print Label Market in Mexico Revenue Share (%), by Print Technology 2025 & 2033

- Figure 20: Europe Print Label Market in Mexico Revenue (Million), by Label Type 2025 & 2033

- Figure 21: Europe Print Label Market in Mexico Revenue Share (%), by Label Type 2025 & 2033

- Figure 22: Europe Print Label Market in Mexico Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Europe Print Label Market in Mexico Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Europe Print Label Market in Mexico Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Print Label Market in Mexico Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Print Label Market in Mexico Revenue (Million), by Print Technology 2025 & 2033

- Figure 27: Middle East & Africa Print Label Market in Mexico Revenue Share (%), by Print Technology 2025 & 2033

- Figure 28: Middle East & Africa Print Label Market in Mexico Revenue (Million), by Label Type 2025 & 2033

- Figure 29: Middle East & Africa Print Label Market in Mexico Revenue Share (%), by Label Type 2025 & 2033

- Figure 30: Middle East & Africa Print Label Market in Mexico Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: Middle East & Africa Print Label Market in Mexico Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Middle East & Africa Print Label Market in Mexico Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Print Label Market in Mexico Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Print Label Market in Mexico Revenue (Million), by Print Technology 2025 & 2033

- Figure 35: Asia Pacific Print Label Market in Mexico Revenue Share (%), by Print Technology 2025 & 2033

- Figure 36: Asia Pacific Print Label Market in Mexico Revenue (Million), by Label Type 2025 & 2033

- Figure 37: Asia Pacific Print Label Market in Mexico Revenue Share (%), by Label Type 2025 & 2033

- Figure 38: Asia Pacific Print Label Market in Mexico Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Asia Pacific Print Label Market in Mexico Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Asia Pacific Print Label Market in Mexico Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific Print Label Market in Mexico Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Print Label Market in Mexico Revenue Million Forecast, by Print Technology 2020 & 2033

- Table 2: Global Print Label Market in Mexico Revenue Million Forecast, by Label Type 2020 & 2033

- Table 3: Global Print Label Market in Mexico Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Print Label Market in Mexico Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Print Label Market in Mexico Revenue Million Forecast, by Print Technology 2020 & 2033

- Table 6: Global Print Label Market in Mexico Revenue Million Forecast, by Label Type 2020 & 2033

- Table 7: Global Print Label Market in Mexico Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Print Label Market in Mexico Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Print Label Market in Mexico Revenue Million Forecast, by Print Technology 2020 & 2033

- Table 13: Global Print Label Market in Mexico Revenue Million Forecast, by Label Type 2020 & 2033

- Table 14: Global Print Label Market in Mexico Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Print Label Market in Mexico Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Print Label Market in Mexico Revenue Million Forecast, by Print Technology 2020 & 2033

- Table 20: Global Print Label Market in Mexico Revenue Million Forecast, by Label Type 2020 & 2033

- Table 21: Global Print Label Market in Mexico Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 22: Global Print Label Market in Mexico Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Print Label Market in Mexico Revenue Million Forecast, by Print Technology 2020 & 2033

- Table 33: Global Print Label Market in Mexico Revenue Million Forecast, by Label Type 2020 & 2033

- Table 34: Global Print Label Market in Mexico Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 35: Global Print Label Market in Mexico Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global Print Label Market in Mexico Revenue Million Forecast, by Print Technology 2020 & 2033

- Table 43: Global Print Label Market in Mexico Revenue Million Forecast, by Label Type 2020 & 2033

- Table 44: Global Print Label Market in Mexico Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 45: Global Print Label Market in Mexico Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Print Label Market in Mexico?

The projected CAGR is approximately 4.24%.

2. Which companies are prominent players in the Print Label Market in Mexico?

Key companies in the market include UPM Raflatec, RR Donnelley & Sons Company (RRD), Sprink, Taylor Corporation, 3M Company, STICKER'S PACK SA de CV, CCL Industries Inc, Clondalkin Group, Avery Dennison Corporation, Fuji Seal International Inc, Multi-Color Mexico Corporation, Papers and Conversions of Mexico*List Not Exhaustive, Eximpro, Brady Worldwide Inc.

3. What are the main segments of the Print Label Market in Mexico?

The market segments include Print Technology, Label Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.26 Million as of 2022.

5. What are some drivers contributing to market growth?

Evolution of Digital Print Technology; Technological Advancements Leading to Reduction in Cost and Run Length.

6. What are the notable trends driving market growth?

Flexographic Printing to Hold the Largest Market Share.

7. Are there any restraints impacting market growth?

Lack of Products with Ability to Withstand Harsh Climatic Conditions.

8. Can you provide examples of recent developments in the market?

October 2023 - All4Labels relocated to a larger facility spanning over 12,000 square meters in Mexico. It is implementing various new technologies to enhance its nationwide footprint as part of its expansion strategy. The addition of five new printing lines, emphasizing pressure-sensitive labels and shrink sleeves, is set to triple production capacity at the site. In phase two, the company is investing EUR 4 million (USD 4.32 million) in equipment, encompassing digital, flexo, and gravure presses, along with a comprehensive upgrade of its pre-press capabilities. This strategic expansion, coupled with the integration of advanced technologies, solidifies its presence and plays a pivotal role in fueling the growth of the flourishing label market in Mexico.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Print Label Market in Mexico," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Print Label Market in Mexico report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Print Label Market in Mexico?

To stay informed about further developments, trends, and reports in the Print Label Market in Mexico, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence