Key Insights

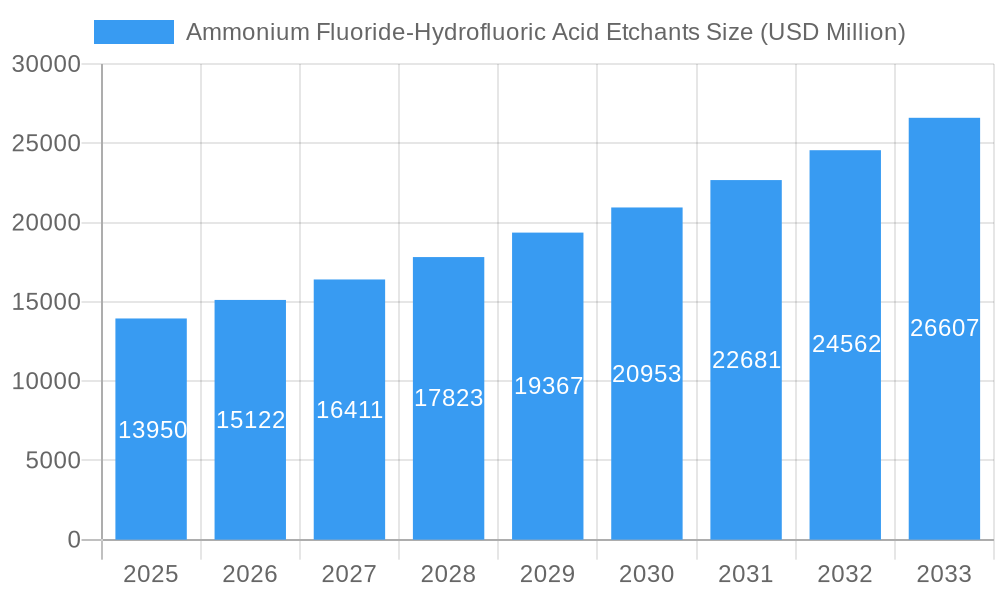

The Ammonium Fluoride-Hydrofluoric Acid Etchants market is projected to reach a substantial $13.95 billion in 2025, driven by an impressive CAGR of 8.66% throughout the forecast period ending in 2033. This robust growth is primarily fueled by the escalating demand for advanced semiconductor devices, which require precise and efficient etching processes for microchip fabrication. The burgeoning solar energy sector also presents a significant growth avenue, as these etchants are crucial for preparing photovoltaic cells. Furthermore, the expanding production of sophisticated flat panel displays for consumer electronics and industrial applications directly contributes to the market's expansion. Emerging economies with a growing manufacturing base are also expected to play a pivotal role in this upward trajectory, creating new opportunities for market players.

Ammonium Fluoride-Hydrofluoric Acid Etchants Market Size (In Billion)

The market is characterized by a dynamic landscape of innovation and strategic partnerships, with key players actively investing in research and development to enhance product purity and performance. While the market demonstrates strong upward momentum, certain factors could present challenges. Stringent environmental regulations regarding the handling and disposal of hydrofluoric acid, coupled with the high capital investment required for advanced manufacturing facilities, might act as restraining forces. Nevertheless, the continuous advancements in etching technologies and the increasing adoption of these etchants in niche applications are expected to outweigh these restraints. The market is segmented into various types, including 6:1 and 7:1 mixtures, catering to specific application requirements across the semiconductor, flat panel display, and solar energy industries, ensuring a diverse and adaptable market offering.

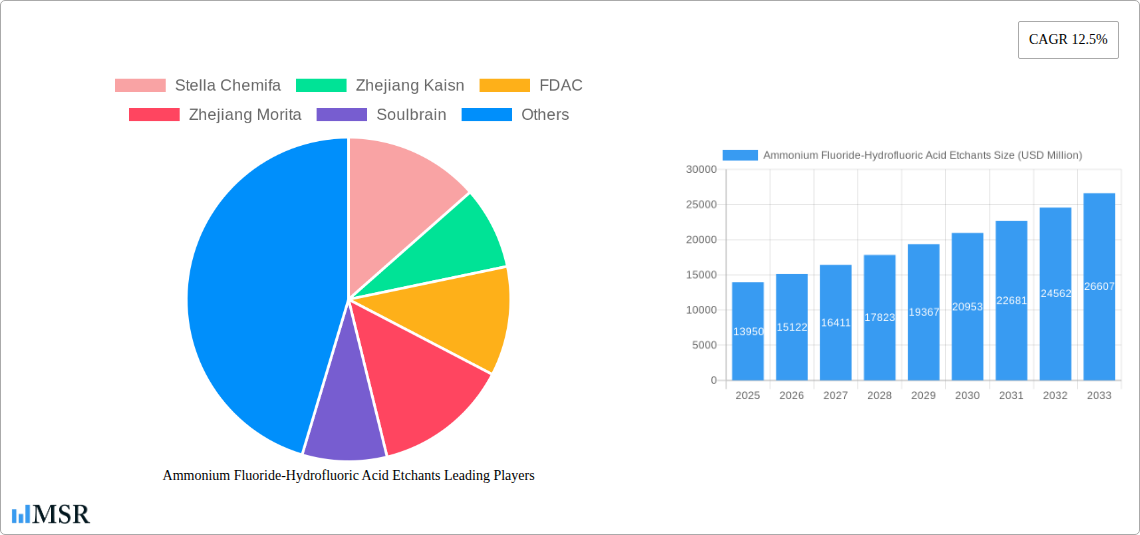

Ammonium Fluoride-Hydrofluoric Acid Etchants Company Market Share

Ammonium Fluoride-Hydrofluoric Acid Etchants Market Report: Comprehensive Analysis & Future Outlook (2019-2033)

This in-depth report offers a definitive analysis of the global Ammonium Fluoride-Hydrofluoric Acid Etchants market, a critical component in advanced manufacturing processes. Spanning the historical period from 2019 to 2024, the base year of 2025, and a robust forecast period extending to 2033, this study provides unparalleled insights for industry stakeholders. We meticulously examine market concentration, dynamics, key growth drivers, leading applications, evolving product landscapes, and emerging opportunities within this vital sector. With a projected market size of approximately $3.5 billion in the base year 2025 and a Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period, this report is essential for strategic decision-making.

Ammonium Fluoride-Hydrofluoric Acid Etchants Market Concentration & Dynamics

The global Ammonium Fluoride-Hydrofluoric Acid Etchants market exhibits a moderately consolidated structure, with key players investing heavily in research and development to maintain a competitive edge. The innovation ecosystem is driven by the demand for ultra-high purity chemicals in cutting-edge semiconductor fabrication and advanced display technologies. Regulatory frameworks, particularly concerning environmental impact and safety standards for hydrofluoric acid derivatives, are becoming increasingly stringent, influencing production processes and market entry barriers. Substitute products, while existing, often lack the specific performance characteristics and cost-effectiveness of ammonium fluoride-hydrofluoric acid mixtures for critical etching applications. End-user trends are dominated by the burgeoning demand from the semiconductor industry, fueled by the proliferation of advanced electronics, AI, and 5G technologies. M&A activities are on the rise as larger entities seek to expand their product portfolios and secure market share. Recent M&A deal counts are estimated at 15 between 2022-2024, with significant consolidation expected. Market share analysis reveals that the top 5 players collectively hold approximately 60% of the market.

Ammonium Fluoride-Hydrofluoric Acid Etchants Industry Insights & Trends

The Ammonium Fluoride-Hydrofluoric Acid Etchants market is poised for substantial expansion, driven by persistent demand from high-growth sectors. The projected market size in 2025 is estimated to be around $3.5 billion, with a projected CAGR of 5.8% through 2033. This growth is intrinsically linked to the relentless advancement in semiconductor technology, including the development of smaller, more powerful microchips, and the increasing complexity of wafer fabrication processes. The flat panel display industry, encompassing OLED and advanced LCD technologies, also represents a significant demand driver, requiring precise etching solutions for pixel formation and circuitry. Furthermore, the burgeoning solar energy sector, with its focus on high-efficiency photovoltaic cells, necessitates specialized etchants for silicon wafer processing. Emerging applications in micro-electromechanical systems (MEMS) and advanced packaging are also contributing to market diversification. Technological disruptions, such as the development of new etching chemistries with improved selectivity and reduced environmental impact, are shaping the competitive landscape. Evolving consumer behaviors, characterized by an insatiable appetite for sophisticated electronic devices and renewable energy solutions, indirectly fuel the demand for these essential industrial chemicals. The ongoing miniaturization trend in electronics, coupled with the demand for higher performance, necessitates etchants with tighter control over etching rates and profiles. The increasing complexity of chip architectures, including 3D NAND and FinFET transistors, requires highly specialized and reliable etching processes. Additionally, the push for more sustainable manufacturing practices is driving innovation towards etchants with lower waste generation and improved recyclability. The global market for Ammonium Fluoride-Hydrofluoric Acid Etchants is projected to reach approximately $5.5 billion by 2033.

Key Markets & Segments Leading Ammonium Fluoride-Hydrofluoric Acid Etchants

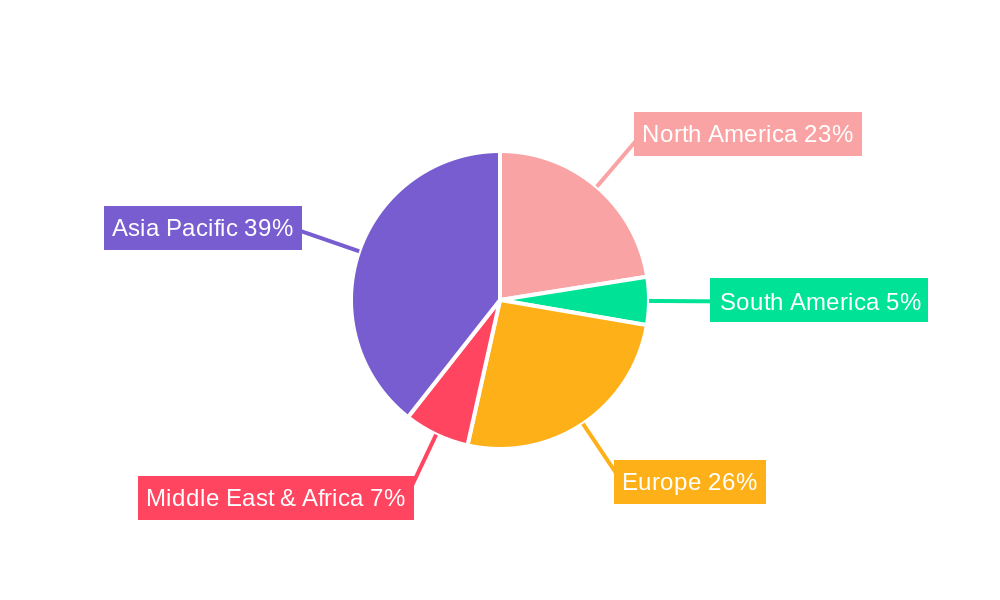

The global Ammonium Fluoride-Hydrofluoric Acid Etchants market is significantly influenced by its dominance in specific regions and application segments. Asia Pacific, particularly East Asia (including China, South Korea, and Taiwan), stands out as the leading market.

Dominant Region: Asia Pacific

- Drivers: Robust manufacturing infrastructure for semiconductors and flat panel displays, substantial government investments in advanced technology sectors, a large and growing consumer base for electronics, and established supply chains.

Dominant Application Segment: Semiconductor

- Drivers: The insatiable global demand for semiconductors, driven by the proliferation of artificial intelligence, 5G technology, the Internet of Things (IoT), and data centers. The continuous push for smaller, more powerful, and energy-efficient microprocessors and memory chips necessitates increasingly sophisticated etching processes.

- Detailed Dominance Analysis: The semiconductor industry's stringent requirements for ultra-high purity, precise etch rates, and minimal contamination make ammonium fluoride-hydrofluoric acid etchants indispensable. These etchants are crucial for silicon wafer cleaning, etching dielectric layers, and creating intricate patterns on the wafer surface during photolithography. The development of advanced nodes and novel transistor architectures continuously demands enhanced etching capabilities.

Key Type Segment: 6:1 Mixture & 7:1 Mixture

- Drivers: These specific volumetric ratios of Ammonium Fluoride to Hydrofluoric Acid offer optimized performance for a wide range of critical etching applications in both semiconductor and display manufacturing. They provide a balance of etching speed and selectivity that is ideal for many established and emerging fabrication processes.

- Detailed Dominance Analysis: The 6:1 and 7:1 mixtures are the workhorses of the industry due to their proven efficacy and adaptability across various wafer and substrate types. Their well-understood chemical properties allow for predictable and repeatable etching results, which are paramount in high-volume, precision manufacturing environments. While "Others" may encompass custom formulations, these standard ratios cater to the vast majority of current industrial needs.

Emerging Application Segment: Solar Energy

- Drivers: The global imperative to transition to renewable energy sources, coupled with government incentives and declining manufacturing costs, is driving significant growth in the solar energy sector. High-efficiency solar cells require precise surface texturing and etching for optimal light absorption, directly boosting demand for specialized etchants.

Ammonium Fluoride-Hydrofluoric Acid Etchants Product Developments

Product developments in the Ammonium Fluoride-Hydrofluoric Acid Etchants market are largely focused on enhancing purity, improving etch selectivity, and minimizing environmental impact. Innovations in formulation and manufacturing processes are leading to etchants with reduced trace metal impurities, critical for advanced semiconductor nodes. Companies are also developing tailored mixtures for specific applications, such as advanced lithography techniques and novel photovoltaic cell designs. The market relevance of these developments lies in their ability to enable next-generation electronic devices and renewable energy technologies, offering manufacturers a competitive edge through enhanced yield and reduced process complexity.

Challenges in the Ammonium Fluoride-Hydrofluoric Acid Etchants Market

The Ammonium Fluoride-Hydrofluoric Acid Etchants market faces several significant challenges. Stringent environmental regulations and the hazardous nature of hydrofluoric acid pose considerable compliance and safety hurdles for manufacturers and end-users. Supply chain disruptions, particularly for raw materials and specialized handling equipment, can impact production volumes and pricing. Furthermore, intense competition among established players and emerging regional manufacturers can lead to price pressures and reduced profit margins. The significant upfront investment required for high-purity chemical production facilities also acts as a barrier to entry.

Forces Driving Ammonium Fluoride-Hydrofluoric Acid Etchants Growth

Several powerful forces are propelling the growth of the Ammonium Fluoride-Hydrofluoric Acid Etchants market. The relentless demand for advanced semiconductors, fueled by AI, 5G, and the IoT, is a primary driver. Continuous innovation in the flat panel display industry, with the adoption of OLED and other advanced screen technologies, creates sustained demand. The expanding solar energy sector, driven by global decarbonization efforts, requires specialized etching solutions for efficient photovoltaic cell manufacturing. Moreover, government initiatives and investments in high-tech manufacturing and renewable energy infrastructure globally are creating a favorable market environment.

Challenges in the Ammonium Fluoride-Hydrofluoric Acid Etchants Market

Long-term growth catalysts for the Ammonium Fluoride-Hydrofluoric Acid Etchants market are rooted in continuous technological advancements and strategic market expansion. The ongoing miniaturization of electronic components and the development of novel materials will necessitate the creation of even more sophisticated and precise etching chemistries. Partnerships between etchant suppliers and semiconductor/display manufacturers will be crucial for co-developing solutions tailored to future fabrication processes. Furthermore, the expansion of manufacturing capabilities in emerging economies and the increasing demand for electronic devices in developing regions present significant growth opportunities.

Emerging Opportunities in Ammonium Fluoride-Hydrofluoric Acid Etchants

Emerging opportunities within the Ammonium Fluoride-Hydrofluoric Acid Etchants market are diverse and promising. The growing demand for advanced packaging solutions in semiconductors presents a new frontier for specialized etching applications. The increasing adoption of micro-electromechanical systems (MEMS) in various industries, from automotive to medical devices, will drive demand for etchants with high precision and control. Furthermore, the development of novel semiconductor materials, such as gallium nitride (GaN) and silicon carbide (SiC), will require the formulation of new, compatible etching chemistries. The growing focus on sustainability is also creating opportunities for etchant manufacturers who can offer eco-friendly formulations and closed-loop recycling solutions.

Leading Players in the Ammonium Fluoride-Hydrofluoric Acid Etchants Sector

- Stella Chemifa

- Zhejiang Kaisn

- FDAC

- Zhejiang Morita

- Soulbrain

- KMG Chemicals

- Jiangyin Jianghua

- Suzhou Crystal Clear Chemical

- Fujian Shaowu Yongfei

- Suzhou Boyang Chemical

- Jiangyin Runma

- Puritan Products (Avantor)

- Columbus Chemical Industries

- Transene Company

Key Milestones in Ammonium Fluoride-Hydrofluoric Acid Etchants Industry

- 2019: Increased global investment in 5G infrastructure spurs demand for advanced semiconductor manufacturing, directly impacting etchant requirements.

- 2020: Major semiconductor manufacturers announce significant capital expenditures for new fabrication plants, signaling future demand growth.

- 2021: Advancements in OLED display technology lead to increased adoption and refined etching processes for display manufacturers.

- 2022: Growing emphasis on renewable energy leads to higher production volumes in the solar energy sector, requiring specialized etchants.

- 2023: Several key players in the market announce significant R&D investments in ultra-high purity chemical development.

- 2024: Emerging trends in advanced chip packaging drive research into new etchant formulations for complex 3D structures.

Strategic Outlook for Ammonium Fluoride-Hydrofluoric Acid Etchants Market

The strategic outlook for the Ammonium Fluoride-Hydrofluoric Acid Etchants market is exceptionally positive, driven by a confluence of technological advancements and escalating global demand for sophisticated electronic devices and clean energy solutions. Growth accelerators include the ongoing innovation in semiconductor fabrication, particularly the transition to sub-10nm nodes and the development of new transistor architectures. The rapid expansion of the electric vehicle market and the continuous push for renewable energy will further bolster demand from the solar sector. Strategic opportunities lie in forming deeper collaborations with end-users to develop customized etching solutions that meet the precise requirements of next-generation technologies, alongside investments in sustainable production methods to address evolving regulatory and societal expectations.

Ammonium Fluoride-Hydrofluoric Acid Etchants Segmentation

-

1. Application

- 1.1. Semiconductor

- 1.2. Flat Panel Display

- 1.3. Solar Energy

- 1.4. Others

-

2. Types

- 2.1. 6:1 Mixture

- 2.2. 7:1 Mixture

- 2.3. Others

Ammonium Fluoride-Hydrofluoric Acid Etchants Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Ammonium Fluoride-Hydrofluoric Acid Etchants Regional Market Share

Geographic Coverage of Ammonium Fluoride-Hydrofluoric Acid Etchants

Ammonium Fluoride-Hydrofluoric Acid Etchants REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.66% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ammonium Fluoride-Hydrofluoric Acid Etchants Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Semiconductor

- 5.1.2. Flat Panel Display

- 5.1.3. Solar Energy

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. 6:1 Mixture

- 5.2.2. 7:1 Mixture

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Ammonium Fluoride-Hydrofluoric Acid Etchants Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Semiconductor

- 6.1.2. Flat Panel Display

- 6.1.3. Solar Energy

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. 6:1 Mixture

- 6.2.2. 7:1 Mixture

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Ammonium Fluoride-Hydrofluoric Acid Etchants Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Semiconductor

- 7.1.2. Flat Panel Display

- 7.1.3. Solar Energy

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. 6:1 Mixture

- 7.2.2. 7:1 Mixture

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Ammonium Fluoride-Hydrofluoric Acid Etchants Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Semiconductor

- 8.1.2. Flat Panel Display

- 8.1.3. Solar Energy

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. 6:1 Mixture

- 8.2.2. 7:1 Mixture

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Ammonium Fluoride-Hydrofluoric Acid Etchants Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Semiconductor

- 9.1.2. Flat Panel Display

- 9.1.3. Solar Energy

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. 6:1 Mixture

- 9.2.2. 7:1 Mixture

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Ammonium Fluoride-Hydrofluoric Acid Etchants Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Semiconductor

- 10.1.2. Flat Panel Display

- 10.1.3. Solar Energy

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. 6:1 Mixture

- 10.2.2. 7:1 Mixture

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Stella Chemifa

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Zhejiang Kaisn

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 FDAC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Zhejiang Morita

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Soulbrain

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 KMG Chemicals

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Jiangyin Jianghua

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Suzhou Crystal Clear Chemical

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Fujian Shaowu Yongfei

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Suzhou Boyang Chemical

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Jiangyin Runma

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Puritan Products(Avantor)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Columbus Chemical Industries

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Transene Company

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Stella Chemifa

List of Figures

- Figure 1: Global Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Ammonium Fluoride-Hydrofluoric Acid Etchants Volume Breakdown (K, %) by Region 2025 & 2033

- Figure 3: North America Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined), by Application 2025 & 2033

- Figure 4: North America Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K), by Application 2025 & 2033

- Figure 5: North America Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Ammonium Fluoride-Hydrofluoric Acid Etchants Volume Share (%), by Application 2025 & 2033

- Figure 7: North America Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined), by Types 2025 & 2033

- Figure 8: North America Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K), by Types 2025 & 2033

- Figure 9: North America Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue Share (%), by Types 2025 & 2033

- Figure 10: North America Ammonium Fluoride-Hydrofluoric Acid Etchants Volume Share (%), by Types 2025 & 2033

- Figure 11: North America Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined), by Country 2025 & 2033

- Figure 12: North America Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K), by Country 2025 & 2033

- Figure 13: North America Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Ammonium Fluoride-Hydrofluoric Acid Etchants Volume Share (%), by Country 2025 & 2033

- Figure 15: South America Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined), by Application 2025 & 2033

- Figure 16: South America Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K), by Application 2025 & 2033

- Figure 17: South America Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue Share (%), by Application 2025 & 2033

- Figure 18: South America Ammonium Fluoride-Hydrofluoric Acid Etchants Volume Share (%), by Application 2025 & 2033

- Figure 19: South America Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined), by Types 2025 & 2033

- Figure 20: South America Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K), by Types 2025 & 2033

- Figure 21: South America Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue Share (%), by Types 2025 & 2033

- Figure 22: South America Ammonium Fluoride-Hydrofluoric Acid Etchants Volume Share (%), by Types 2025 & 2033

- Figure 23: South America Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined), by Country 2025 & 2033

- Figure 24: South America Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K), by Country 2025 & 2033

- Figure 25: South America Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Ammonium Fluoride-Hydrofluoric Acid Etchants Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined), by Application 2025 & 2033

- Figure 28: Europe Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K), by Application 2025 & 2033

- Figure 29: Europe Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue Share (%), by Application 2025 & 2033

- Figure 30: Europe Ammonium Fluoride-Hydrofluoric Acid Etchants Volume Share (%), by Application 2025 & 2033

- Figure 31: Europe Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined), by Types 2025 & 2033

- Figure 32: Europe Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K), by Types 2025 & 2033

- Figure 33: Europe Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue Share (%), by Types 2025 & 2033

- Figure 34: Europe Ammonium Fluoride-Hydrofluoric Acid Etchants Volume Share (%), by Types 2025 & 2033

- Figure 35: Europe Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined), by Country 2025 & 2033

- Figure 36: Europe Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K), by Country 2025 & 2033

- Figure 37: Europe Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Ammonium Fluoride-Hydrofluoric Acid Etchants Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined), by Application 2025 & 2033

- Figure 40: Middle East & Africa Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K), by Application 2025 & 2033

- Figure 41: Middle East & Africa Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue Share (%), by Application 2025 & 2033

- Figure 42: Middle East & Africa Ammonium Fluoride-Hydrofluoric Acid Etchants Volume Share (%), by Application 2025 & 2033

- Figure 43: Middle East & Africa Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined), by Types 2025 & 2033

- Figure 44: Middle East & Africa Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K), by Types 2025 & 2033

- Figure 45: Middle East & Africa Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue Share (%), by Types 2025 & 2033

- Figure 46: Middle East & Africa Ammonium Fluoride-Hydrofluoric Acid Etchants Volume Share (%), by Types 2025 & 2033

- Figure 47: Middle East & Africa Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined), by Country 2025 & 2033

- Figure 48: Middle East & Africa Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K), by Country 2025 & 2033

- Figure 49: Middle East & Africa Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa Ammonium Fluoride-Hydrofluoric Acid Etchants Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined), by Application 2025 & 2033

- Figure 52: Asia Pacific Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K), by Application 2025 & 2033

- Figure 53: Asia Pacific Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue Share (%), by Application 2025 & 2033

- Figure 54: Asia Pacific Ammonium Fluoride-Hydrofluoric Acid Etchants Volume Share (%), by Application 2025 & 2033

- Figure 55: Asia Pacific Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined), by Types 2025 & 2033

- Figure 56: Asia Pacific Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K), by Types 2025 & 2033

- Figure 57: Asia Pacific Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue Share (%), by Types 2025 & 2033

- Figure 58: Asia Pacific Ammonium Fluoride-Hydrofluoric Acid Etchants Volume Share (%), by Types 2025 & 2033

- Figure 59: Asia Pacific Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined), by Country 2025 & 2033

- Figure 60: Asia Pacific Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K), by Country 2025 & 2033

- Figure 61: Asia Pacific Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Ammonium Fluoride-Hydrofluoric Acid Etchants Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue undefined Forecast, by Region 2020 & 2033

- Table 2: Global Ammonium Fluoride-Hydrofluoric Acid Etchants Volume K Forecast, by Region 2020 & 2033

- Table 3: Global Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Global Ammonium Fluoride-Hydrofluoric Acid Etchants Volume K Forecast, by Application 2020 & 2033

- Table 5: Global Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue undefined Forecast, by Types 2020 & 2033

- Table 6: Global Ammonium Fluoride-Hydrofluoric Acid Etchants Volume K Forecast, by Types 2020 & 2033

- Table 7: Global Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Global Ammonium Fluoride-Hydrofluoric Acid Etchants Volume K Forecast, by Region 2020 & 2033

- Table 9: Global Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue undefined Forecast, by Application 2020 & 2033

- Table 10: Global Ammonium Fluoride-Hydrofluoric Acid Etchants Volume K Forecast, by Application 2020 & 2033

- Table 11: Global Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue undefined Forecast, by Types 2020 & 2033

- Table 12: Global Ammonium Fluoride-Hydrofluoric Acid Etchants Volume K Forecast, by Types 2020 & 2033

- Table 13: Global Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue undefined Forecast, by Country 2020 & 2033

- Table 14: Global Ammonium Fluoride-Hydrofluoric Acid Etchants Volume K Forecast, by Country 2020 & 2033

- Table 15: United States Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: United States Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K) Forecast, by Application 2020 & 2033

- Table 17: Canada Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Canada Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K) Forecast, by Application 2020 & 2033

- Table 19: Mexico Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Mexico Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K) Forecast, by Application 2020 & 2033

- Table 21: Global Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue undefined Forecast, by Application 2020 & 2033

- Table 22: Global Ammonium Fluoride-Hydrofluoric Acid Etchants Volume K Forecast, by Application 2020 & 2033

- Table 23: Global Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue undefined Forecast, by Types 2020 & 2033

- Table 24: Global Ammonium Fluoride-Hydrofluoric Acid Etchants Volume K Forecast, by Types 2020 & 2033

- Table 25: Global Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: Global Ammonium Fluoride-Hydrofluoric Acid Etchants Volume K Forecast, by Country 2020 & 2033

- Table 27: Brazil Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Brazil Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K) Forecast, by Application 2020 & 2033

- Table 29: Argentina Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Argentina Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Rest of South America Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K) Forecast, by Application 2020 & 2033

- Table 33: Global Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue undefined Forecast, by Application 2020 & 2033

- Table 34: Global Ammonium Fluoride-Hydrofluoric Acid Etchants Volume K Forecast, by Application 2020 & 2033

- Table 35: Global Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue undefined Forecast, by Types 2020 & 2033

- Table 36: Global Ammonium Fluoride-Hydrofluoric Acid Etchants Volume K Forecast, by Types 2020 & 2033

- Table 37: Global Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue undefined Forecast, by Country 2020 & 2033

- Table 38: Global Ammonium Fluoride-Hydrofluoric Acid Etchants Volume K Forecast, by Country 2020 & 2033

- Table 39: United Kingdom Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: United Kingdom Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K) Forecast, by Application 2020 & 2033

- Table 41: Germany Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Germany Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K) Forecast, by Application 2020 & 2033

- Table 43: France Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: France Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K) Forecast, by Application 2020 & 2033

- Table 45: Italy Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Italy Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K) Forecast, by Application 2020 & 2033

- Table 47: Spain Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Spain Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K) Forecast, by Application 2020 & 2033

- Table 49: Russia Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: Russia Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K) Forecast, by Application 2020 & 2033

- Table 51: Benelux Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Benelux Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K) Forecast, by Application 2020 & 2033

- Table 53: Nordics Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Nordics Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K) Forecast, by Application 2020 & 2033

- Table 55: Rest of Europe Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 56: Rest of Europe Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K) Forecast, by Application 2020 & 2033

- Table 57: Global Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue undefined Forecast, by Application 2020 & 2033

- Table 58: Global Ammonium Fluoride-Hydrofluoric Acid Etchants Volume K Forecast, by Application 2020 & 2033

- Table 59: Global Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue undefined Forecast, by Types 2020 & 2033

- Table 60: Global Ammonium Fluoride-Hydrofluoric Acid Etchants Volume K Forecast, by Types 2020 & 2033

- Table 61: Global Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue undefined Forecast, by Country 2020 & 2033

- Table 62: Global Ammonium Fluoride-Hydrofluoric Acid Etchants Volume K Forecast, by Country 2020 & 2033

- Table 63: Turkey Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: Turkey Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K) Forecast, by Application 2020 & 2033

- Table 65: Israel Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 66: Israel Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K) Forecast, by Application 2020 & 2033

- Table 67: GCC Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 68: GCC Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K) Forecast, by Application 2020 & 2033

- Table 69: North Africa Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 70: North Africa Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K) Forecast, by Application 2020 & 2033

- Table 71: South Africa Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 72: South Africa Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K) Forecast, by Application 2020 & 2033

- Table 73: Rest of Middle East & Africa Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 74: Rest of Middle East & Africa Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K) Forecast, by Application 2020 & 2033

- Table 75: Global Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue undefined Forecast, by Application 2020 & 2033

- Table 76: Global Ammonium Fluoride-Hydrofluoric Acid Etchants Volume K Forecast, by Application 2020 & 2033

- Table 77: Global Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue undefined Forecast, by Types 2020 & 2033

- Table 78: Global Ammonium Fluoride-Hydrofluoric Acid Etchants Volume K Forecast, by Types 2020 & 2033

- Table 79: Global Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue undefined Forecast, by Country 2020 & 2033

- Table 80: Global Ammonium Fluoride-Hydrofluoric Acid Etchants Volume K Forecast, by Country 2020 & 2033

- Table 81: China Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 82: China Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K) Forecast, by Application 2020 & 2033

- Table 83: India Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 84: India Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K) Forecast, by Application 2020 & 2033

- Table 85: Japan Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 86: Japan Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K) Forecast, by Application 2020 & 2033

- Table 87: South Korea Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 88: South Korea Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K) Forecast, by Application 2020 & 2033

- Table 89: ASEAN Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 90: ASEAN Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K) Forecast, by Application 2020 & 2033

- Table 91: Oceania Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 92: Oceania Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K) Forecast, by Application 2020 & 2033

- Table 93: Rest of Asia Pacific Ammonium Fluoride-Hydrofluoric Acid Etchants Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 94: Rest of Asia Pacific Ammonium Fluoride-Hydrofluoric Acid Etchants Volume (K) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ammonium Fluoride-Hydrofluoric Acid Etchants?

The projected CAGR is approximately 8.66%.

2. Which companies are prominent players in the Ammonium Fluoride-Hydrofluoric Acid Etchants?

Key companies in the market include Stella Chemifa, Zhejiang Kaisn, FDAC, Zhejiang Morita, Soulbrain, KMG Chemicals, Jiangyin Jianghua, Suzhou Crystal Clear Chemical, Fujian Shaowu Yongfei, Suzhou Boyang Chemical, Jiangyin Runma, Puritan Products(Avantor), Columbus Chemical Industries, Transene Company.

3. What are the main segments of the Ammonium Fluoride-Hydrofluoric Acid Etchants?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ammonium Fluoride-Hydrofluoric Acid Etchants," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ammonium Fluoride-Hydrofluoric Acid Etchants report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ammonium Fluoride-Hydrofluoric Acid Etchants?

To stay informed about further developments, trends, and reports in the Ammonium Fluoride-Hydrofluoric Acid Etchants, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence