Key Insights

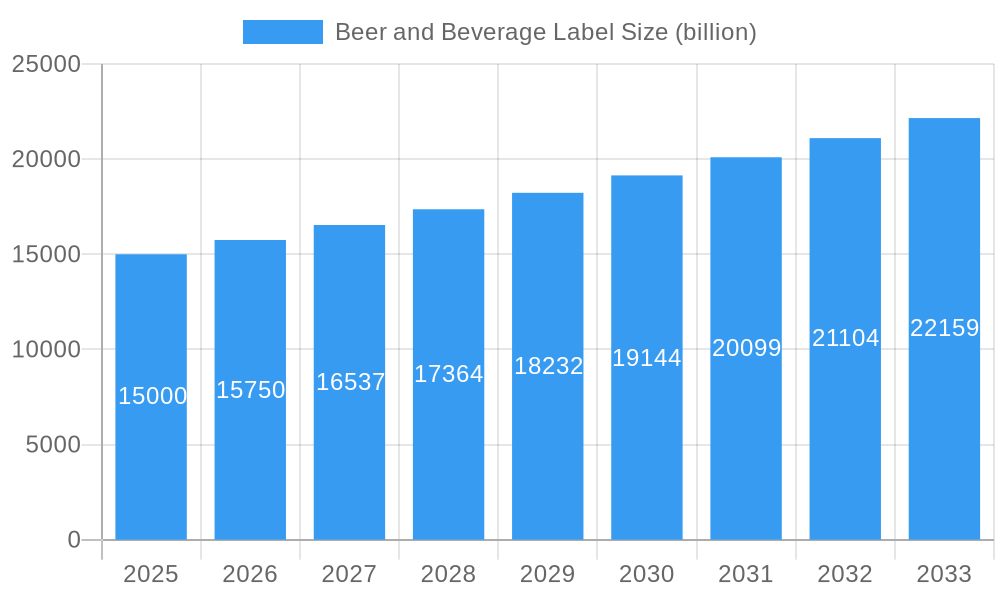

The global Beer and Beverage Label market is poised for robust growth, with an estimated market size of $15 billion in 2025 and a projected Compound Annual Growth Rate (CAGR) of 5% through 2033. This expansion is primarily driven by escalating consumer demand for premium and craft beverages, which necessitates eye-catching and informative labeling to convey brand identity and product differentiation. The increasing popularity of packaged beverages across various consumption occasions, from casual gatherings to formal events, further fuels the demand for sophisticated labeling solutions. Advancements in printing technologies, including digital printing, are enabling greater customization, faster turnaround times, and the creation of intricate designs, directly supporting the growth trajectory of the market. Furthermore, the growing emphasis on sustainability is pushing manufacturers towards eco-friendly labeling materials and production processes, presenting a significant opportunity for innovation and market leadership.

Beer and Beverage Label Market Size (In Billion)

The market is segmented into diverse applications, with Juice, Beer, Wine, and Spirits representing key segments, each with unique labeling requirements and growth potentials. Paper labels continue to hold a significant share due to their cost-effectiveness, while Pressure-Sensitive Labels (PSL) are gaining traction for their ease of application and versatility. Shrink sleeve labels are becoming increasingly prevalent for their ability to provide 360-degree branding and tamper-evident features, particularly in the spirits and wine categories. However, the market also faces certain restraints, including fluctuating raw material costs, particularly for paper and adhesives, and the increasing regulatory scrutiny surrounding food and beverage packaging. Despite these challenges, the ongoing innovation in label materials, printing techniques, and the persistent consumer preference for visually appealing and informative packaging are expected to sustain the market's upward momentum.

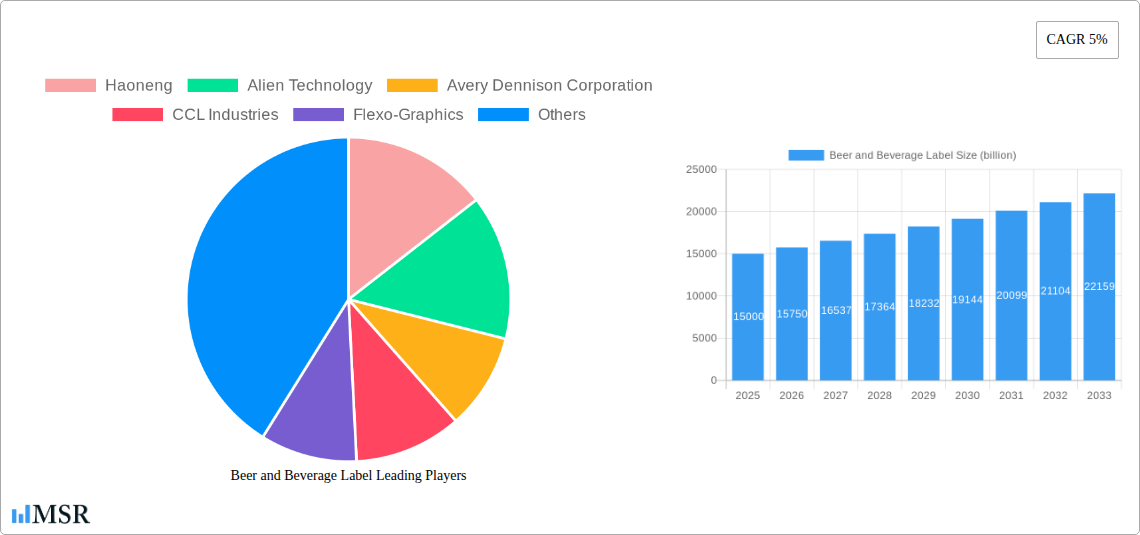

Beer and Beverage Label Company Market Share

Beer and Beverage Label Market Report Description

Unlock critical insights into the global beer and beverage label market, a rapidly evolving sector projected to reach over a billion by 2033. This comprehensive report, spanning 2019–2033 with a base year of 2025, delivers unparalleled analysis for industry stakeholders, from label manufacturers and converters to brand owners and ingredient suppliers. Dive deep into market concentration, innovation, and growth drivers, powered by an in-depth understanding of segments including Juice, Beer, Wine, Spirits, and Paper Label, PSL Label, Shrink Sleeve Label. With data up to 2024 and forecasts extending to 2033, equip your business with the strategic intelligence to navigate this dynamic landscape.

Beer and Beverage Label Market Concentration & Dynamics

The global beer and beverage label market exhibits a moderate level of concentration, with a significant presence of both large, established players and agile, specialized manufacturers. Companies like Avery Dennison Corporation, CCL Industries, and UPM Raflatac hold substantial market share due to their extensive product portfolios, global manufacturing footprints, and strong R&D capabilities. The innovation ecosystem is robust, driven by the continuous demand for enhanced brand visibility, sustainability, and functional labeling solutions. Haoneng, Alien Technology, and Sato Holding Corporation are key contributors to technological advancements in areas such as smart labels and track-and-trace solutions. Regulatory frameworks, primarily concerning food safety, environmental impact, and material compliance, play a crucial role in shaping market entry and product development. The threat of substitute products, while present in the form of direct printing or alternative packaging formats, remains limited for premium and specialty beverages where elaborate labeling is a key brand differentiator. End-user trends are heavily influenced by consumer preferences for visually appealing, informative, and eco-friendly packaging, driving demand for innovative label materials and printing technologies. Mergers and acquisitions (M&A) activities are a common strategy for consolidating market share, expanding geographical reach, and acquiring new technologies. Notable M&A deals within the historical period (2019-2024) have significantly reshaped the competitive landscape, with an estimated hundreds of billions in total deal value and numerous transactions involving companies like MPI Label, Mepco Label, and Brook + Whittle.

Beer and Beverage Label Industry Insights & Trends

The beer and beverage label market is experiencing robust growth, driven by a confluence of escalating consumption of alcoholic and non-alcoholic beverages globally and the increasing importance of branding and product differentiation. The market size, estimated to be in the hundreds of billions in the base year of 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) of over xx% during the forecast period of 2025–2033. Market growth drivers are multifaceted, stemming from rising disposable incomes in emerging economies, the booming craft beer and artisanal spirits segments, and the growing demand for functional beverages like enhanced juices and functional waters. Technological disruptions are a key theme, with advancements in digital printing enabling shorter runs, greater customization, and faster turnaround times, catering to the increasing need for personalized and limited-edition offerings. Furthermore, the integration of smart technologies, such as NFC and QR codes, is enhancing consumer engagement and providing valuable supply chain traceability. Evolving consumer behaviors are also significantly shaping the industry. There is a pronounced shift towards sustainability, with consumers actively seeking products with eco-friendly packaging. This translates into a higher demand for recycled materials, biodegradable options, and label constructions that facilitate easier recycling of the entire packaging. The premiumization trend in the beverage sector also fuels demand for high-impact, visually sophisticated labels that convey quality and exclusivity.

Key Markets & Segments Leading Beer and Beverage Label

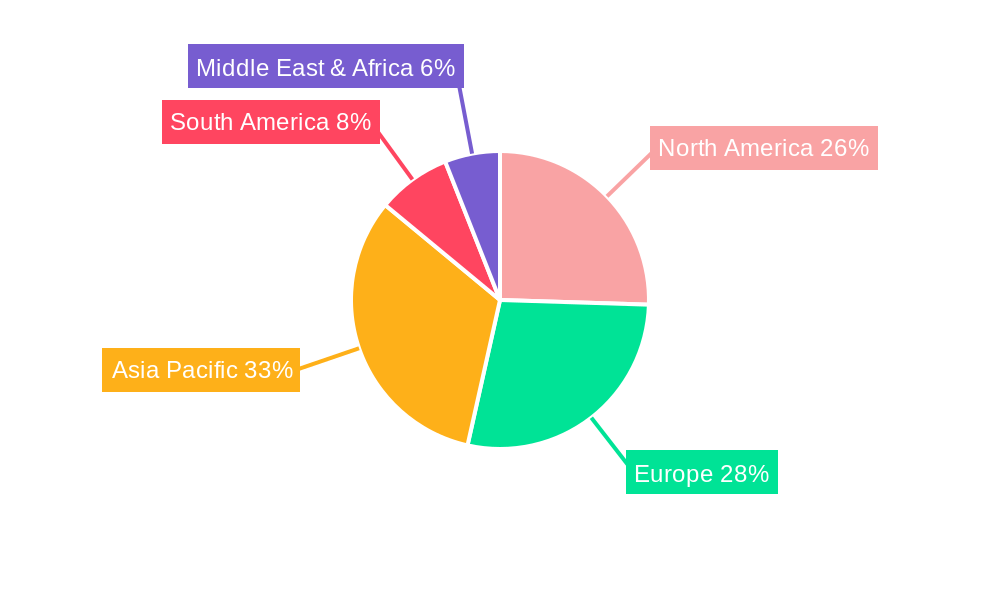

The beer and beverage label market is characterized by regional dominance and segment-specific growth. North America and Europe currently lead in market value and adoption of advanced labeling technologies, driven by established beverage industries and high consumer spending power. However, the Asia-Pacific region is emerging as the fastest-growing market due to rapid industrialization, a burgeoning middle class, and increasing per capita consumption of beverages.

Within the application segments:

- Beer: This segment is a significant contributor, fueled by the massive global beer market and the strong trend towards craft and specialty beers, demanding unique and eye-catching labels. Economic growth and increased social gatherings are key drivers here.

- Wine: The wine industry relies heavily on sophisticated labeling to convey heritage, origin, and premium quality. Growing global wine consumption, particularly in emerging markets, directly benefits this segment.

- Spirits: Similar to wine, spirits labels are crucial for brand positioning and perceived value. The premiumization trend in spirits, coupled with the popularity of ready-to-drink (RTD) cocktails, is a major growth accelerator.

- Juice: While often a high-volume segment, the juice market is seeing growth in functional and premium offerings, requiring innovative and informative labeling. Increasing health consciousness is a primary driver.

- Others: This encompasses a broad range of beverages, including water, dairy drinks, and non-alcoholic alternatives, each with its own labeling demands.

In terms of label types:

- PSL Label (Pressure Sensitive Label): This remains the dominant type due to its versatility, ease of application, and cost-effectiveness across various beverage categories. Its widespread adoption is linked to the mature beverage packaging infrastructure.

- Shrink Sleeve Label: Experiencing rapid growth, shrink sleeves offer 360-degree branding opportunities and can conform to complex bottle shapes, making them ideal for specialty beers, spirits, and premium juices. Technological advancements in materials and printing have made them more accessible and attractive.

- Paper Label: A traditional and cost-effective option, paper labels continue to hold a significant share, especially in high-volume, lower-margin beverage segments.

- Aluminum Foil Label: Primarily used for premium products and as tamper-evident seals, these labels convey a sense of quality and security.

- Aluminum Lid: Often integrated with other labeling solutions, aluminum lids provide sealing and branding in one.

The dominance of these segments is underpinned by factors such as the sheer volume of production, the marketing imperative for brand differentiation, and the evolving aesthetic preferences of consumers. Infrastructure development, particularly in developing economies, is also crucial for the adoption of advanced labeling solutions in these key segments.

Beer and Beverage Label Product Developments

Product innovations in the beer and beverage label market are primarily focused on enhancing sustainability, enabling smart functionalities, and improving aesthetic appeal. Manufacturers are developing eco-friendly materials such as compostable films and recycled content paper to meet growing consumer and regulatory demands for sustainable packaging. Advancements in digital printing technologies are allowing for highly customized and personalized labels, including variable data printing for promotional campaigns and limited editions. The integration of near-field communication (NFC) tags and QR codes into labels is creating interactive experiences, offering consumers access to product information, recipes, or brand stories, thereby increasing consumer engagement and brand loyalty. Furthermore, the development of specialized adhesives and barrier coatings is ensuring label durability and performance in challenging environments, such as refrigeration or humid conditions. These innovations provide competitive edges by offering unique value propositions to beverage brands seeking to stand out in a crowded marketplace.

Challenges in the Beer and Beverage Label Market

The beer and beverage label market faces several significant challenges that can impact growth and profitability. Regulatory hurdles, particularly concerning food-grade materials, ink migration, and evolving environmental legislation (e.g., single-use plastic bans), require constant adaptation and investment in compliance. Supply chain disruptions, including raw material shortages and price volatility for key inputs like paper pulp and adhesives, can affect production schedules and cost structures, with estimated impacts of tens of billions on market stability. Competitive pressures are intense, with a crowded marketplace leading to price wars and the need for continuous innovation to maintain market share. The increasing demand for sustainable solutions also presents a challenge, as adopting new, eco-friendly materials and production processes can incur substantial upfront costs and require significant R&D investment.

Forces Driving Beer and Beverage Label Growth

Several powerful forces are driving the expansion of the beer and beverage label market. The continuous global demand for alcoholic and non-alcoholic beverages, fueled by population growth and changing consumer lifestyles, forms the foundational growth engine. Technological advancements, particularly in digital printing and smart labeling solutions, are enabling greater customization, efficiency, and interactivity, directly influencing brand strategies. Economic factors, such as rising disposable incomes in emerging markets, translate into increased spending on premium and diverse beverage options, which in turn requires more sophisticated and appealing labeling. Furthermore, the growing emphasis on brand storytelling and consumer engagement is compelling beverage companies to invest in high-impact labels that communicate brand values and product differentiation effectively.

Challenges in the Beer and Beverage Label Market

Long-term growth in the beer and beverage label market is propelled by several catalysts, primarily centered around innovation and market expansion. The increasing consumer demand for transparency and traceability regarding product origin and ingredients is driving the adoption of smart labels with advanced track-and-trace capabilities, creating new revenue streams. The ongoing global push towards sustainability is another major catalyst, spurring the development and adoption of biodegradable, compostable, and easily recyclable label materials, which aligns with corporate social responsibility goals and consumer preferences. Market expansion into untapped or underserved geographical regions, coupled with the growing popularity of niche beverage categories like hard seltzers and functional drinks, presents significant opportunities for label manufacturers to innovate and tailor their offerings to specific market needs and evolving consumer tastes. Partnerships and collaborations between label suppliers, beverage brands, and technology providers are also crucial for driving innovation and market penetration.

Emerging Opportunities in Beer and Beverage Label

The beer and beverage label market is ripe with emerging opportunities. The burgeoning e-commerce and direct-to-consumer (DTC) sales channels for beverages are creating a demand for specialized labeling solutions that can withstand the rigors of shipping and enhance unboxing experiences. The growing market for functional and health-oriented beverages, such as probiotic drinks and adaptogenic beverages, presents opportunities for labels that can effectively communicate complex health benefits and premium ingredients. Furthermore, the increasing adoption of smart packaging across the food and beverage industry, extending beyond basic QR codes to include interactive features and supply chain monitoring, is a significant growth area. Exploring novel materials, such as those derived from agricultural waste or offering enhanced protective properties, also represents a promising avenue for differentiation and market leadership.

Leading Players in the Beer and Beverage Label Sector

- Haoneng

- Alien Technology

- Avery Dennison Corporation

- CCL Industries

- Flexo-Graphics

- Star Label

- UPM Raflatac

- Pixelle

- Mepco Label

- MPI Label

- Columbine Label

- The Label Factory

- FOCUSales

- Bristol Labels

- Consolidated Label

- Brook + Whittle

- dcraft Labels

- TLF Graphics

- PLCTX

- HB Fuller

- Hally Labels

- Milabels

- Fantastick Label

- Crown Labels

- Sato Holding Corporation

- Advantage Label & Packaging

- Capital Label

Key Milestones in Beer and Beverage Label Industry

- 2019: Increased adoption of digital printing technologies for short-run, customized beverage labels.

- 2020: Heightened focus on sustainable labeling solutions in response to growing environmental awareness and regulations.

- 2021: Significant M&A activity as larger players consolidated to expand their portfolios and market reach.

- 2022: Advancements in smart labeling, with greater integration of NFC and QR codes for enhanced consumer engagement and traceability.

- 2023: Introduction of new compostable and biodegradable label materials to meet eco-friendly packaging demands.

- 2024: Continued growth in the shrink sleeve label segment, driven by its versatility and aesthetic appeal for various beverage containers.

Strategic Outlook for Beer and Beverage Label Market

The strategic outlook for the beer and beverage label market is exceptionally positive, projecting sustained growth driven by innovation and market expansion. The increasing demand for personalized and interactive labeling, particularly through smart technologies, will continue to be a key growth accelerator, fostering deeper consumer engagement and brand loyalty. The paramount importance of sustainability will drive further investment in eco-friendly materials and circular economy solutions, presenting opportunities for companies that can lead in this domain. Expanding into emerging economies with rapidly growing beverage consumption will also be a critical strategic imperative. Furthermore, the continuous evolution of beverage categories, such as the rise of hard seltzers and functional drinks, will necessitate agile and adaptable labeling solutions, creating a fertile ground for niche specialization and targeted product development. Strategic partnerships and technological collaborations will be vital for navigating this dynamic landscape and securing long-term competitive advantage.

Beer and Beverage Label Segmentation

-

1. Application

- 1.1. Juice

- 1.2. Beer

- 1.3. Wine

- 1.4. Spirits

- 1.5. Others

-

2. Types

- 2.1. Paper Label

- 2.2. PSL Label

- 2.3. Aluminum Foil Label

- 2.4. Shrink Sleeve Label

- 2.5. Aluminum Lid

- 2.6. Others

Beer and Beverage Label Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Beer and Beverage Label Regional Market Share

Geographic Coverage of Beer and Beverage Label

Beer and Beverage Label REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Beer and Beverage Label Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Juice

- 5.1.2. Beer

- 5.1.3. Wine

- 5.1.4. Spirits

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Paper Label

- 5.2.2. PSL Label

- 5.2.3. Aluminum Foil Label

- 5.2.4. Shrink Sleeve Label

- 5.2.5. Aluminum Lid

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Beer and Beverage Label Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Juice

- 6.1.2. Beer

- 6.1.3. Wine

- 6.1.4. Spirits

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Paper Label

- 6.2.2. PSL Label

- 6.2.3. Aluminum Foil Label

- 6.2.4. Shrink Sleeve Label

- 6.2.5. Aluminum Lid

- 6.2.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Beer and Beverage Label Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Juice

- 7.1.2. Beer

- 7.1.3. Wine

- 7.1.4. Spirits

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Paper Label

- 7.2.2. PSL Label

- 7.2.3. Aluminum Foil Label

- 7.2.4. Shrink Sleeve Label

- 7.2.5. Aluminum Lid

- 7.2.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Beer and Beverage Label Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Juice

- 8.1.2. Beer

- 8.1.3. Wine

- 8.1.4. Spirits

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Paper Label

- 8.2.2. PSL Label

- 8.2.3. Aluminum Foil Label

- 8.2.4. Shrink Sleeve Label

- 8.2.5. Aluminum Lid

- 8.2.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Beer and Beverage Label Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Juice

- 9.1.2. Beer

- 9.1.3. Wine

- 9.1.4. Spirits

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Paper Label

- 9.2.2. PSL Label

- 9.2.3. Aluminum Foil Label

- 9.2.4. Shrink Sleeve Label

- 9.2.5. Aluminum Lid

- 9.2.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Beer and Beverage Label Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Juice

- 10.1.2. Beer

- 10.1.3. Wine

- 10.1.4. Spirits

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Paper Label

- 10.2.2. PSL Label

- 10.2.3. Aluminum Foil Label

- 10.2.4. Shrink Sleeve Label

- 10.2.5. Aluminum Lid

- 10.2.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Haoneng

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Alien Technology

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Avery Dennison Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CCL Industries

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Flexo-Graphics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Star Label

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 UPM Raflatac

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Pixelle

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mepco Label

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 MPI Label

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Columbine Label

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 The Label Factory

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 FOCUSales

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Bristol Labels

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Consolidated Label

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Brook + Whittle

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 dcraft Labels

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 TLF Graphics

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 PLCTX

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 HB Fuller

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Hally Labels

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Milabels

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Fantastick Label

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Crown Labels

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Sato Holding Corporation

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 Advantage Label & Packaging

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 Capital Label

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.1 Haoneng

List of Figures

- Figure 1: Global Beer and Beverage Label Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Beer and Beverage Label Revenue (billion), by Application 2025 & 2033

- Figure 3: North America Beer and Beverage Label Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Beer and Beverage Label Revenue (billion), by Types 2025 & 2033

- Figure 5: North America Beer and Beverage Label Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Beer and Beverage Label Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Beer and Beverage Label Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Beer and Beverage Label Revenue (billion), by Application 2025 & 2033

- Figure 9: South America Beer and Beverage Label Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Beer and Beverage Label Revenue (billion), by Types 2025 & 2033

- Figure 11: South America Beer and Beverage Label Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Beer and Beverage Label Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Beer and Beverage Label Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Beer and Beverage Label Revenue (billion), by Application 2025 & 2033

- Figure 15: Europe Beer and Beverage Label Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Beer and Beverage Label Revenue (billion), by Types 2025 & 2033

- Figure 17: Europe Beer and Beverage Label Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Beer and Beverage Label Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Beer and Beverage Label Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Beer and Beverage Label Revenue (billion), by Application 2025 & 2033

- Figure 21: Middle East & Africa Beer and Beverage Label Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Beer and Beverage Label Revenue (billion), by Types 2025 & 2033

- Figure 23: Middle East & Africa Beer and Beverage Label Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Beer and Beverage Label Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Beer and Beverage Label Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Beer and Beverage Label Revenue (billion), by Application 2025 & 2033

- Figure 27: Asia Pacific Beer and Beverage Label Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Beer and Beverage Label Revenue (billion), by Types 2025 & 2033

- Figure 29: Asia Pacific Beer and Beverage Label Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Beer and Beverage Label Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Beer and Beverage Label Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Beer and Beverage Label Revenue billion Forecast, by Region 2020 & 2033

- Table 2: Global Beer and Beverage Label Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Beer and Beverage Label Revenue billion Forecast, by Types 2020 & 2033

- Table 4: Global Beer and Beverage Label Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Beer and Beverage Label Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Beer and Beverage Label Revenue billion Forecast, by Types 2020 & 2033

- Table 7: Global Beer and Beverage Label Revenue billion Forecast, by Country 2020 & 2033

- Table 8: United States Beer and Beverage Label Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Canada Beer and Beverage Label Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Mexico Beer and Beverage Label Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Beer and Beverage Label Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Global Beer and Beverage Label Revenue billion Forecast, by Types 2020 & 2033

- Table 13: Global Beer and Beverage Label Revenue billion Forecast, by Country 2020 & 2033

- Table 14: Brazil Beer and Beverage Label Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Argentina Beer and Beverage Label Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Rest of South America Beer and Beverage Label Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Global Beer and Beverage Label Revenue billion Forecast, by Application 2020 & 2033

- Table 18: Global Beer and Beverage Label Revenue billion Forecast, by Types 2020 & 2033

- Table 19: Global Beer and Beverage Label Revenue billion Forecast, by Country 2020 & 2033

- Table 20: United Kingdom Beer and Beverage Label Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Germany Beer and Beverage Label Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: France Beer and Beverage Label Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Italy Beer and Beverage Label Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Spain Beer and Beverage Label Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Russia Beer and Beverage Label Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Benelux Beer and Beverage Label Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Nordics Beer and Beverage Label Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Rest of Europe Beer and Beverage Label Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Beer and Beverage Label Revenue billion Forecast, by Application 2020 & 2033

- Table 30: Global Beer and Beverage Label Revenue billion Forecast, by Types 2020 & 2033

- Table 31: Global Beer and Beverage Label Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Turkey Beer and Beverage Label Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Israel Beer and Beverage Label Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: GCC Beer and Beverage Label Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: North Africa Beer and Beverage Label Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: South Africa Beer and Beverage Label Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East & Africa Beer and Beverage Label Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Global Beer and Beverage Label Revenue billion Forecast, by Application 2020 & 2033

- Table 39: Global Beer and Beverage Label Revenue billion Forecast, by Types 2020 & 2033

- Table 40: Global Beer and Beverage Label Revenue billion Forecast, by Country 2020 & 2033

- Table 41: China Beer and Beverage Label Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: India Beer and Beverage Label Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: Japan Beer and Beverage Label Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: South Korea Beer and Beverage Label Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: ASEAN Beer and Beverage Label Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Oceania Beer and Beverage Label Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: Rest of Asia Pacific Beer and Beverage Label Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Beer and Beverage Label?

The projected CAGR is approximately 5%.

2. Which companies are prominent players in the Beer and Beverage Label?

Key companies in the market include Haoneng, Alien Technology, Avery Dennison Corporation, CCL Industries, Flexo-Graphics, Star Label, UPM Raflatac, Pixelle, Mepco Label, MPI Label, Columbine Label, The Label Factory, FOCUSales, Bristol Labels, Consolidated Label, Brook + Whittle, dcraft Labels, TLF Graphics, PLCTX, HB Fuller, Hally Labels, Milabels, Fantastick Label, Crown Labels, Sato Holding Corporation, Advantage Label & Packaging, Capital Label.

3. What are the main segments of the Beer and Beverage Label?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 15 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Beer and Beverage Label," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Beer and Beverage Label report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Beer and Beverage Label?

To stay informed about further developments, trends, and reports in the Beer and Beverage Label, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence