Key Insights

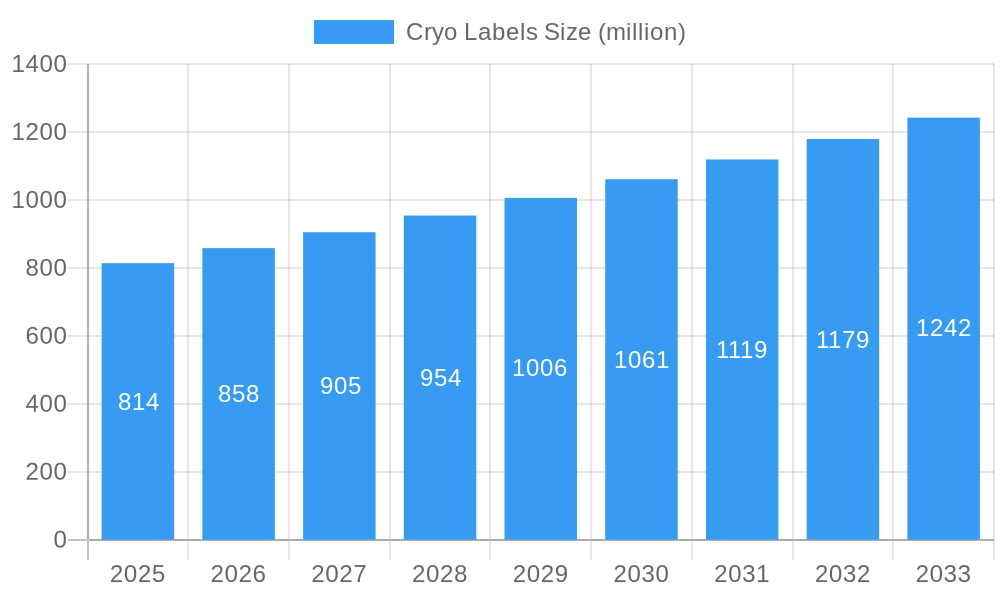

The global Cryo Labels market is poised for significant expansion, projected to reach $814 million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 5.4% anticipated from 2025 to 2033. This robust growth is primarily fueled by the escalating demand across critical sectors such as cold chain transportation and frozen food industries, where maintaining product integrity at extremely low temperatures is paramount. The pharmaceutical and biotechnology sectors are also major contributors, driven by the need for reliable, durable labels for storing sensitive biological samples, vaccines, and medicines in cryogenic conditions. Furthermore, the increasing stringency of regulatory requirements for sample tracking and traceability in laboratories and chemical industries further bolsters the market. Innovations in material science, leading to the development of labels with enhanced adhesion, printability, and resistance to extreme temperatures and chemicals, are also acting as key growth drivers, enabling broader adoption across diverse applications.

Cryo Labels Market Size (In Million)

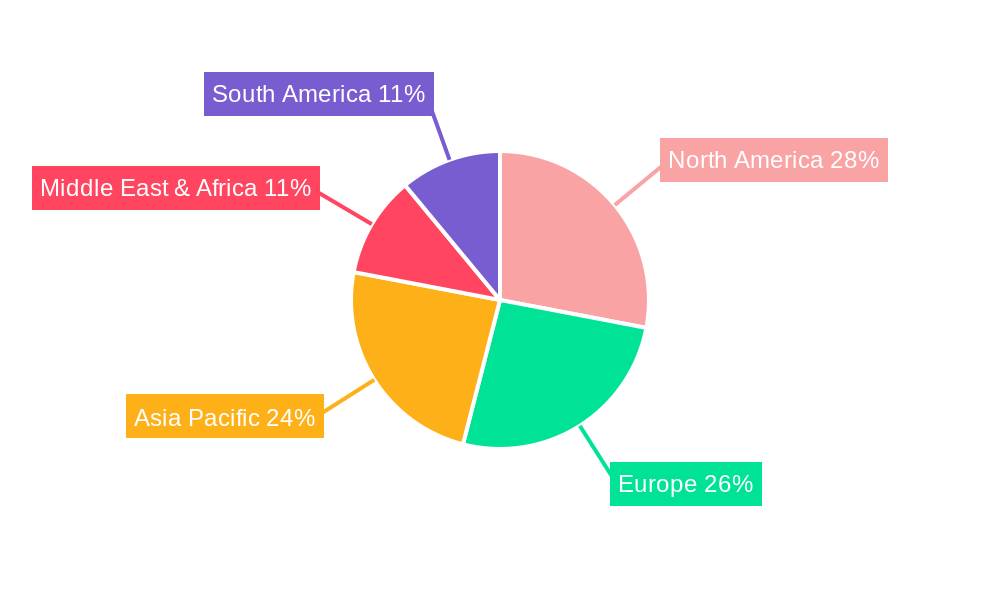

The market's trajectory is further shaped by emerging trends such as the integration of smart labeling technologies, including RFID and QR codes, to facilitate real-time inventory management and supply chain visibility in ultra-low temperature environments. While the market benefits from these drivers, certain factors present challenges. High initial investment costs for specialized printing equipment and materials, coupled with the environmental concerns associated with certain label materials, could pose restraints. However, the continuous development of eco-friendly and cost-effective labeling solutions is expected to mitigate these concerns. Geographically, the Asia Pacific region is emerging as a dynamic market, driven by rapid industrialization and a growing focus on cold chain infrastructure. North America and Europe continue to hold substantial market share due to established pharmaceutical and research sectors. The market is characterized by a competitive landscape with key players like 3M, Avery Dennison, and GA International focusing on product innovation and strategic partnerships to capture market share.

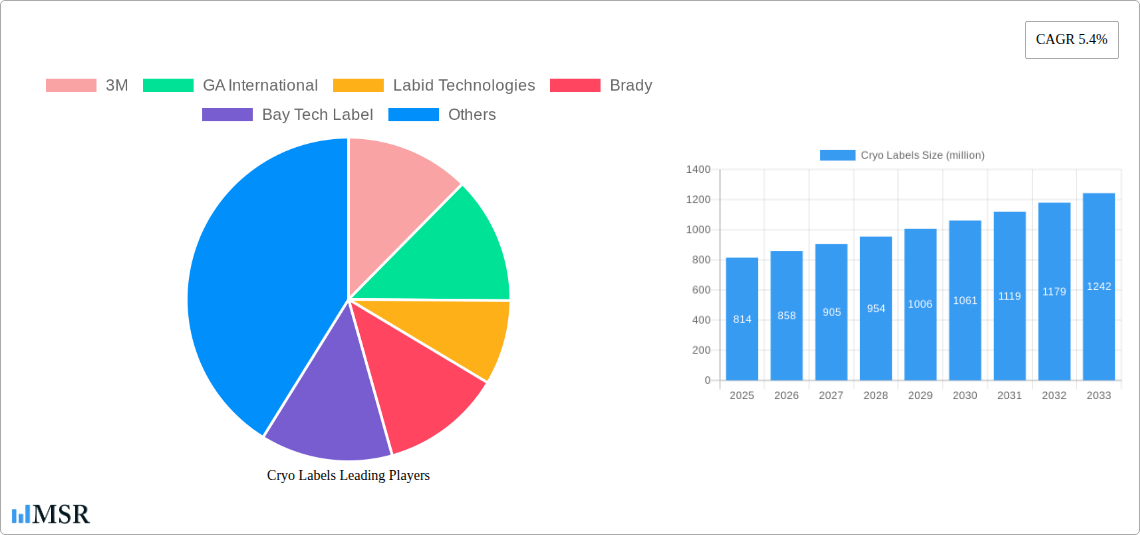

Cryo Labels Company Market Share

This comprehensive report, "Cryo Labels Market: Global Analysis, Trends, and Forecast (2019-2033)," offers an in-depth examination of the global cryo labels industry. Spanning a detailed study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period from 2025 to 2033, this report provides critical insights into market dynamics, key segments, and future growth trajectories. The historical period of 2019–2024 lays the foundation for understanding past performance and emerging patterns. This report is an indispensable resource for stakeholders seeking to navigate the evolving landscape of cold chain labeling solutions, identifying lucrative opportunities and mitigating potential challenges.

Cryo Labels Market Concentration & Dynamics

The global cryo labels market exhibits a moderate to high concentration, with a significant portion of market share held by a few leading players. Innovation ecosystems are robust, driven by continuous research and development in material science and printing technologies to meet stringent application requirements for extreme temperatures. Regulatory frameworks, particularly in the pharmaceutical and chemical sectors, play a pivotal role in shaping product development and market access. The prevalence of substitute products, such as direct printing on containers or alternative identification methods, presents a competitive challenge, although specialized cryo labels offer superior performance and durability in harsh environments. End-user trends are increasingly focused on enhanced traceability, data integrity, and compliance with global supply chain regulations. Mergers and acquisitions (M&A) activities are observed, albeit at a measured pace, as companies seek to expand their product portfolios, geographic reach, and technological capabilities. The number of M&A deals in the last five years is approximately 15, contributing to a market share redistribution among key competitors.

Cryo Labels Industry Insights & Trends

The cryo labels industry is poised for significant expansion, driven by the escalating demand for reliable and durable labeling solutions across a multitude of sectors. The global cryo labels market size is estimated to reach USD 750 million by 2025 and is projected to grow at a robust Compound Annual Growth Rate (CAGR) of 8.5% during the forecast period of 2025–2033. This growth is underpinned by several key factors. Firstly, the increasing globalization of supply chains, particularly in the frozen food and pharmaceutical industries, necessitates advanced labeling technologies that can withstand extreme temperatures encountered during cold chain transportation. The stringent regulatory requirements for tracking and tracing sensitive products, such as vaccines and biologics, further fuel the adoption of high-performance cryo labels.

Technological disruptions are continuously reshaping the market. Innovations in adhesive formulations have led to the development of labels that maintain their integrity and legibility even at temperatures as low as -196°C (-320°F). Advancements in printing technologies, including digital printing, allow for greater customization and faster turnaround times, catering to the diverse needs of end-users. The development of smart labels with embedded RFID or QR codes enhances traceability and enables real-time data capture, a trend gaining significant traction.

Evolving consumer behaviors, particularly a heightened awareness regarding food safety and product provenance, also contribute to market growth. Consumers are demanding greater transparency in the supply chain, which translates to a need for robust labeling solutions that can provide accurate and verifiable product information. The expansion of e-commerce for frozen goods and pharmaceuticals further amplifies the requirement for dependable cold chain logistics, and consequently, cryo labels. The laboratory segment, with its critical need for accurate sample identification and preservation, also represents a substantial and growing market for cryo labels. The chemical industry also relies heavily on cryo labels for the safe storage and transportation of temperature-sensitive chemicals and reagents.

Key Markets & Segments Leading Cryo Labels

The North America region is a dominant force in the global cryo labels market, driven by its advanced healthcare infrastructure, extensive cold chain logistics network, and stringent regulatory environment. Within North America, the United States leads in market penetration, fueled by its large pharmaceutical industry and a significant presence in frozen food production and distribution. Economic growth in this region, coupled with substantial investments in cold chain infrastructure, directly translates to a higher demand for sophisticated labeling solutions.

Dominant Segments:

Application:

- Medicine: This segment is the primary driver of cryo label demand. The global increase in vaccine production, biopharmaceutical research, and the transport of temperature-sensitive drugs necessitates highly reliable cryo labels to ensure product integrity and patient safety. The estimated market share for this application is approximately 40%.

- Cold Chain Transportation: Encompassing the entire cold chain from production to consumption, this segment is crucial. The growth of e-commerce for frozen foods and temperature-sensitive medical supplies directly impacts cryo label usage. This segment accounts for roughly 30% of the market.

- Laboratory: Laboratories worldwide, conducting critical research and diagnostics, depend on cryo labels for sample identification, cryogenic storage, and ultra-low temperature preservation. The growing R&D investments globally contribute to this segment's expansion, representing about 20% of the market.

- Frozen Food: The expanding global market for frozen foods, including premium and specialty items, requires labels that can withstand deep freezing and thawing cycles without degradation. This segment holds an estimated 7% market share.

- Chemical Industry: The safe storage and transportation of volatile and temperature-sensitive chemicals, reagents, and biological samples in the chemical industry create a consistent demand for specialized cryo labels. This segment represents approximately 3% of the market.

Type:

- Polyester: Polyester cryo labels are highly favored due to their excellent durability, resistance to moisture, chemicals, and extreme temperatures, making them ideal for long-term cryogenic storage. This type dominates the market, holding an estimated 55% share.

- Polypropylene: Polypropylene labels offer good performance in cold environments and are a cost-effective alternative for less demanding applications. They represent approximately 25% of the market.

- Vinyl: Vinyl labels provide good flexibility and adhesion in cold temperatures, suitable for various applications within the cryo labeling spectrum. This type accounts for about 15% of the market.

- Others: This category includes specialized materials designed for specific ultra-low temperature applications or unique environmental conditions, comprising the remaining 5% of the market.

Application:

- Medicine: This segment is the primary driver of cryo label demand. The global increase in vaccine production, biopharmaceutical research, and the transport of temperature-sensitive drugs necessitates highly reliable cryo labels to ensure product integrity and patient safety. The estimated market share for this application is approximately 40%.

- Cold Chain Transportation: Encompassing the entire cold chain from production to consumption, this segment is crucial. The growth of e-commerce for frozen foods and temperature-sensitive medical supplies directly impacts cryo label usage. This segment accounts for roughly 30% of the market.

- Laboratory: Laboratories worldwide, conducting critical research and diagnostics, depend on cryo labels for sample identification, cryogenic storage, and ultra-low temperature preservation. The growing R&D investments globally contribute to this segment's expansion, representing about 20% of the market.

- Frozen Food: The expanding global market for frozen foods, including premium and specialty items, requires labels that can withstand deep freezing and thawing cycles without degradation. This segment holds an estimated 7% market share.

- Chemical Industry: The safe storage and transportation of volatile and temperature-sensitive chemicals, reagents, and biological samples in the chemical industry create a consistent demand for specialized cryo labels. This segment represents approximately 3% of the market.

Type:

- Polyester: Polyester cryo labels are highly favored due to their excellent durability, resistance to moisture, chemicals, and extreme temperatures, making them ideal for long-term cryogenic storage. This type dominates the market, holding an estimated 55% share.

- Polypropylene: Polypropylene labels offer good performance in cold environments and are a cost-effective alternative for less demanding applications. They represent approximately 25% of the market.

- Vinyl: Vinyl labels provide good flexibility and adhesion in cold temperatures, suitable for various applications within the cryo labeling spectrum. This type accounts for about 15% of the market.

- Others: This category includes specialized materials designed for specific ultra-low temperature applications or unique environmental conditions, comprising the remaining 5% of the market.

Cryo Labels Product Developments

Recent product developments in the cryo labels sector focus on enhanced adhesion, extreme temperature resistance, and improved printability. Innovations include advanced adhesive formulations capable of maintaining a strong bond at temperatures below -100°C (-148°F), essential for long-term cryogenic storage of biological samples and pharmaceuticals. Furthermore, advancements in durable film materials ensure legibility and integrity against moisture, frost, and chemical exposure. The integration of serial numbering, barcodes, and QR codes on these labels is becoming standard, facilitating accurate tracking and data management throughout the cold chain. The market relevance of these developments is significant, directly addressing the growing need for reliable identification and traceability in critical cold chain applications.

Challenges in the Cryo Labels Market

The cryo labels market faces several inherent challenges that can impact growth and adoption. Stringent regulatory compliance for applications in the pharmaceutical and medical sectors requires extensive testing and validation, adding to product development costs and timelines. Supply chain disruptions, exacerbated by geopolitical events and global logistics complexities, can affect the availability and cost of raw materials, impacting production output and delivery schedules. Furthermore, intense competition from established players and emerging manufacturers drives price pressures, potentially squeezing profit margins for smaller enterprises. The development of innovative, yet cost-effective, solutions that meet the extreme performance demands of cryogenic environments remains a continuous hurdle.

Forces Driving Cryo Labels Growth

Several powerful forces are propelling the growth of the cryo labels market. The burgeoning global pharmaceutical and biotechnology sectors, with their increasing reliance on temperature-sensitive biologics and vaccines, are major catalysts. Advancements in medical research and diagnostics, particularly in fields requiring long-term sample preservation at ultra-low temperatures, further amplify demand. The expansion of the global cold chain logistics network, driven by the growth of frozen food e-commerce and the need for reliable transportation of perishable goods, is another significant growth driver. Additionally, evolving international regulations mandating enhanced product traceability and serialization are compelling businesses to adopt robust labeling solutions like cryo labels.

Challenges in the Cryo Labels Market

Looking ahead, the long-term growth of the cryo labels market will be shaped by continued innovation and strategic market expansion. The development of "smart" cryo labels, incorporating advanced functionalities like temperature monitoring sensors or RFID tags, represents a significant long-term growth catalyst. Partnerships between cryo label manufacturers and cold chain logistics providers can foster integrated solutions, enhancing efficiency and traceability. Exploring emerging markets with developing cold chain infrastructures and increasing healthcare investments offers substantial potential for market expansion. The continuous refinement of materials science to achieve even greater performance at extreme temperatures will also be a key factor in sustained growth.

Emerging Opportunities in Cryo Labels

Emerging opportunities in the cryo labels market are being shaped by technological advancements and evolving industry needs. The growing demand for personalized medicine and the increasing complexity of cell and gene therapies necessitate highly specialized, ultra-low temperature labeling solutions for precise sample identification and tracking. The expansion of the plant-based and alternative protein industries, requiring sophisticated cold chain management, presents a new avenue for cryo label adoption. Furthermore, the development of sustainable and eco-friendly cryo label materials, aligning with global environmental initiatives, represents a significant emerging opportunity for manufacturers. The increasing adoption of IoT (Internet of Things) in cold chain management also opens doors for smart cryo labels with integrated data capabilities.

Leading Players in the Cryo Labels Sector

- 3M

- GA International

- Labid Technologies

- Brady

- Bay Tech Label

- Clarion Safety Systems

- CILS International

- Robos-labels

- Avery Dennison

- Expert Labels

- Peak Technologies

- Electronic Imaging Materials

- Nev's Ink

- Roll Labels

- Duralabel

- Windmill

- Triridev Labelss

- Matform

- EKS-Etiketten

- IVYSUN

- Shenzhen Kaisheng Printing Products

Key Milestones in Cryo Labels Industry

- 2019: Increased regulatory focus on pharmaceutical traceability, leading to enhanced demand for high-performance cryo labels.

- 2020: Global pandemic accelerates the need for robust cold chain logistics for vaccines and medical supplies, boosting cryo label market.

- 2021: Advancements in adhesive technology enable cryo labels to perform reliably at even lower temperatures.

- 2022: Growth in e-commerce for frozen foods and specialized perishables drives demand for durable cryo labels.

- 2023: Emergence of "smart" cryo labels with integrated data-logging capabilities begins to gain traction.

- 2024: Increased investment in biopharmaceutical research and development continues to fuel demand for reliable sample labeling.

- 2025: Forecasted market expansion driven by ongoing technological innovation and increasing global cold chain infrastructure.

Strategic Outlook for Cryo Labels Market

The strategic outlook for the cryo labels market is highly positive, characterized by sustained growth and evolving opportunities. Key growth accelerators include the continuous expansion of the biopharmaceutical and vaccine industries, the increasing adoption of advanced cold chain logistics solutions, and the persistent demand for stringent regulatory compliance. Manufacturers focusing on product innovation, particularly in developing labels with enhanced durability, superior adhesion at extreme temperatures, and integrated smart functionalities, will be well-positioned for success. Strategic partnerships and collaborations with stakeholders across the cold chain value proposition will be crucial for market penetration and creating comprehensive solutions. Exploring niche applications and emerging geographical markets will also contribute to long-term market dominance.

Cryo Labels Segmentation

-

1. Application

- 1.1. Cold Chain Transportation

- 1.2. Frozen Food

- 1.3. Medicine

- 1.4. Laboratory

- 1.5. Chemical Industry

- 1.6. Others

-

2. Type

- 2.1. Polyester

- 2.2. Polypropylene

- 2.3. Vinyl

- 2.4. Others

Cryo Labels Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Cryo Labels Regional Market Share

Geographic Coverage of Cryo Labels

Cryo Labels REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cryo Labels Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Cold Chain Transportation

- 5.1.2. Frozen Food

- 5.1.3. Medicine

- 5.1.4. Laboratory

- 5.1.5. Chemical Industry

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Polyester

- 5.2.2. Polypropylene

- 5.2.3. Vinyl

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Cryo Labels Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Cold Chain Transportation

- 6.1.2. Frozen Food

- 6.1.3. Medicine

- 6.1.4. Laboratory

- 6.1.5. Chemical Industry

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Polyester

- 6.2.2. Polypropylene

- 6.2.3. Vinyl

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Cryo Labels Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Cold Chain Transportation

- 7.1.2. Frozen Food

- 7.1.3. Medicine

- 7.1.4. Laboratory

- 7.1.5. Chemical Industry

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Polyester

- 7.2.2. Polypropylene

- 7.2.3. Vinyl

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Cryo Labels Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Cold Chain Transportation

- 8.1.2. Frozen Food

- 8.1.3. Medicine

- 8.1.4. Laboratory

- 8.1.5. Chemical Industry

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Polyester

- 8.2.2. Polypropylene

- 8.2.3. Vinyl

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Cryo Labels Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Cold Chain Transportation

- 9.1.2. Frozen Food

- 9.1.3. Medicine

- 9.1.4. Laboratory

- 9.1.5. Chemical Industry

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Polyester

- 9.2.2. Polypropylene

- 9.2.3. Vinyl

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Cryo Labels Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Cold Chain Transportation

- 10.1.2. Frozen Food

- 10.1.3. Medicine

- 10.1.4. Laboratory

- 10.1.5. Chemical Industry

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Polyester

- 10.2.2. Polypropylene

- 10.2.3. Vinyl

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 3M

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 GA International

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Labid Technologies

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Brady

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bay Tech Label

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Clarion Safety Systems

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CILS International

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Robos-labels

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Avery Dennison

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Expert Labels

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Peak Technologies

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Electronic Imaging Materials

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Nev's Ink

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Roll Labels

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Duralabel

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Windmill

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Triridev Labelss

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Matform

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 EKS-Etiketten

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 IVYSUN

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Shenzhen Kaisheng Printing Products

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.1 3M

List of Figures

- Figure 1: Global Cryo Labels Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Cryo Labels Revenue (million), by Application 2025 & 2033

- Figure 3: North America Cryo Labels Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Cryo Labels Revenue (million), by Type 2025 & 2033

- Figure 5: North America Cryo Labels Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Cryo Labels Revenue (million), by Country 2025 & 2033

- Figure 7: North America Cryo Labels Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Cryo Labels Revenue (million), by Application 2025 & 2033

- Figure 9: South America Cryo Labels Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Cryo Labels Revenue (million), by Type 2025 & 2033

- Figure 11: South America Cryo Labels Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America Cryo Labels Revenue (million), by Country 2025 & 2033

- Figure 13: South America Cryo Labels Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Cryo Labels Revenue (million), by Application 2025 & 2033

- Figure 15: Europe Cryo Labels Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Cryo Labels Revenue (million), by Type 2025 & 2033

- Figure 17: Europe Cryo Labels Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Cryo Labels Revenue (million), by Country 2025 & 2033

- Figure 19: Europe Cryo Labels Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Cryo Labels Revenue (million), by Application 2025 & 2033

- Figure 21: Middle East & Africa Cryo Labels Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Cryo Labels Revenue (million), by Type 2025 & 2033

- Figure 23: Middle East & Africa Cryo Labels Revenue Share (%), by Type 2025 & 2033

- Figure 24: Middle East & Africa Cryo Labels Revenue (million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Cryo Labels Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Cryo Labels Revenue (million), by Application 2025 & 2033

- Figure 27: Asia Pacific Cryo Labels Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Cryo Labels Revenue (million), by Type 2025 & 2033

- Figure 29: Asia Pacific Cryo Labels Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific Cryo Labels Revenue (million), by Country 2025 & 2033

- Figure 31: Asia Pacific Cryo Labels Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cryo Labels Revenue million Forecast, by Region 2020 & 2033

- Table 2: Global Cryo Labels Revenue million Forecast, by Application 2020 & 2033

- Table 3: Global Cryo Labels Revenue million Forecast, by Type 2020 & 2033

- Table 4: Global Cryo Labels Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Cryo Labels Revenue million Forecast, by Application 2020 & 2033

- Table 6: Global Cryo Labels Revenue million Forecast, by Type 2020 & 2033

- Table 7: Global Cryo Labels Revenue million Forecast, by Country 2020 & 2033

- Table 8: United States Cryo Labels Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Canada Cryo Labels Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Mexico Cryo Labels Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Global Cryo Labels Revenue million Forecast, by Application 2020 & 2033

- Table 12: Global Cryo Labels Revenue million Forecast, by Type 2020 & 2033

- Table 13: Global Cryo Labels Revenue million Forecast, by Country 2020 & 2033

- Table 14: Brazil Cryo Labels Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Argentina Cryo Labels Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Rest of South America Cryo Labels Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Global Cryo Labels Revenue million Forecast, by Application 2020 & 2033

- Table 18: Global Cryo Labels Revenue million Forecast, by Type 2020 & 2033

- Table 19: Global Cryo Labels Revenue million Forecast, by Country 2020 & 2033

- Table 20: United Kingdom Cryo Labels Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Germany Cryo Labels Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: France Cryo Labels Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Italy Cryo Labels Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Spain Cryo Labels Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Russia Cryo Labels Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Benelux Cryo Labels Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Nordics Cryo Labels Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Europe Cryo Labels Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Global Cryo Labels Revenue million Forecast, by Application 2020 & 2033

- Table 30: Global Cryo Labels Revenue million Forecast, by Type 2020 & 2033

- Table 31: Global Cryo Labels Revenue million Forecast, by Country 2020 & 2033

- Table 32: Turkey Cryo Labels Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: Israel Cryo Labels Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: GCC Cryo Labels Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: North Africa Cryo Labels Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: South Africa Cryo Labels Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East & Africa Cryo Labels Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: Global Cryo Labels Revenue million Forecast, by Application 2020 & 2033

- Table 39: Global Cryo Labels Revenue million Forecast, by Type 2020 & 2033

- Table 40: Global Cryo Labels Revenue million Forecast, by Country 2020 & 2033

- Table 41: China Cryo Labels Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: India Cryo Labels Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: Japan Cryo Labels Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: South Korea Cryo Labels Revenue (million) Forecast, by Application 2020 & 2033

- Table 45: ASEAN Cryo Labels Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Oceania Cryo Labels Revenue (million) Forecast, by Application 2020 & 2033

- Table 47: Rest of Asia Pacific Cryo Labels Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cryo Labels?

The projected CAGR is approximately 5.4%.

2. Which companies are prominent players in the Cryo Labels?

Key companies in the market include 3M, GA International, Labid Technologies, Brady, Bay Tech Label, Clarion Safety Systems, CILS International, Robos-labels, Avery Dennison, Expert Labels, Peak Technologies, Electronic Imaging Materials, Nev's Ink, Roll Labels, Duralabel, Windmill, Triridev Labelss, Matform, EKS-Etiketten, IVYSUN, Shenzhen Kaisheng Printing Products.

3. What are the main segments of the Cryo Labels?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 814 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cryo Labels," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cryo Labels report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cryo Labels?

To stay informed about further developments, trends, and reports in the Cryo Labels, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence