Key Insights

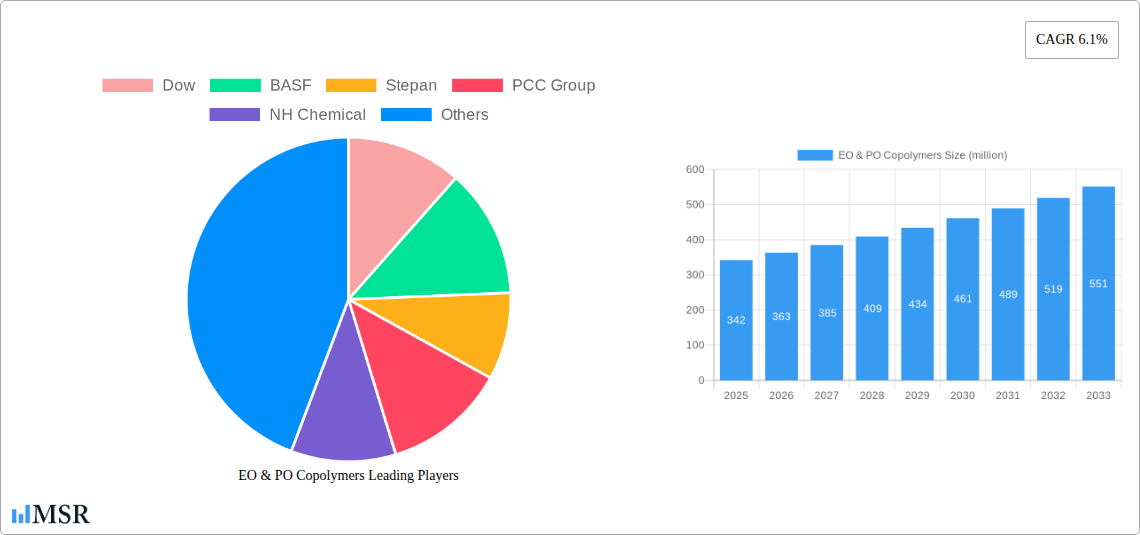

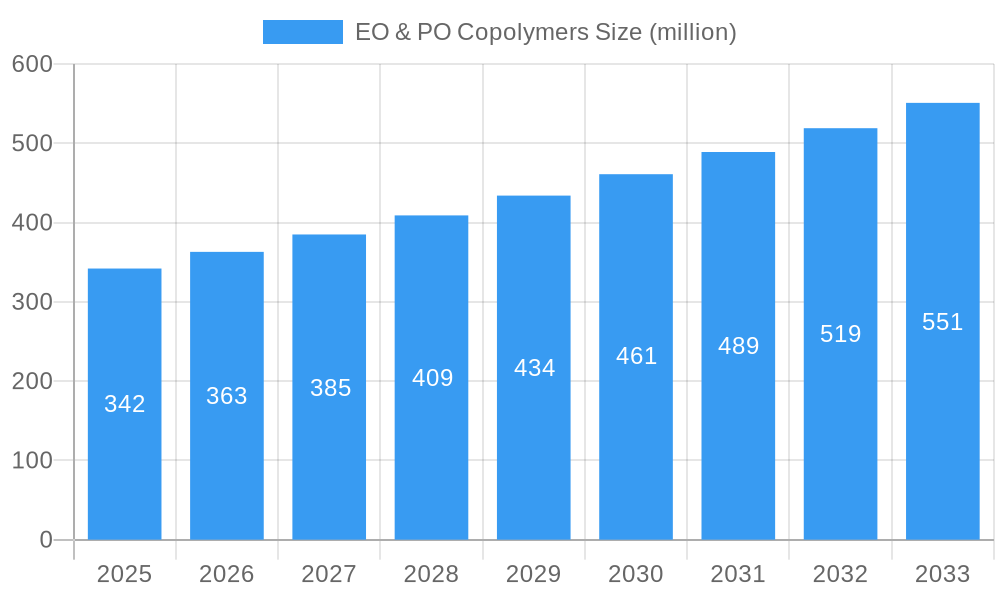

The global market for EO & PO Copolymers is poised for substantial growth, driven by their versatile applications across numerous industries. The market is estimated to be $342 million in 2025, with a projected Compound Annual Growth Rate (CAGR) of 6.1% through 2033. This robust expansion is primarily fueled by the increasing demand for emulsifiers in the food and beverage sector, dispersants in paints and coatings, and defoamers in water treatment and industrial processes. These copolymers offer unique functionalities such as solubility control, viscosity modification, and surfactant properties, making them indispensable in formulations aimed at enhancing product performance and sustainability. The growing emphasis on eco-friendly and high-performance chemical solutions further bolsters market demand.

EO & PO Copolymers Market Size (In Million)

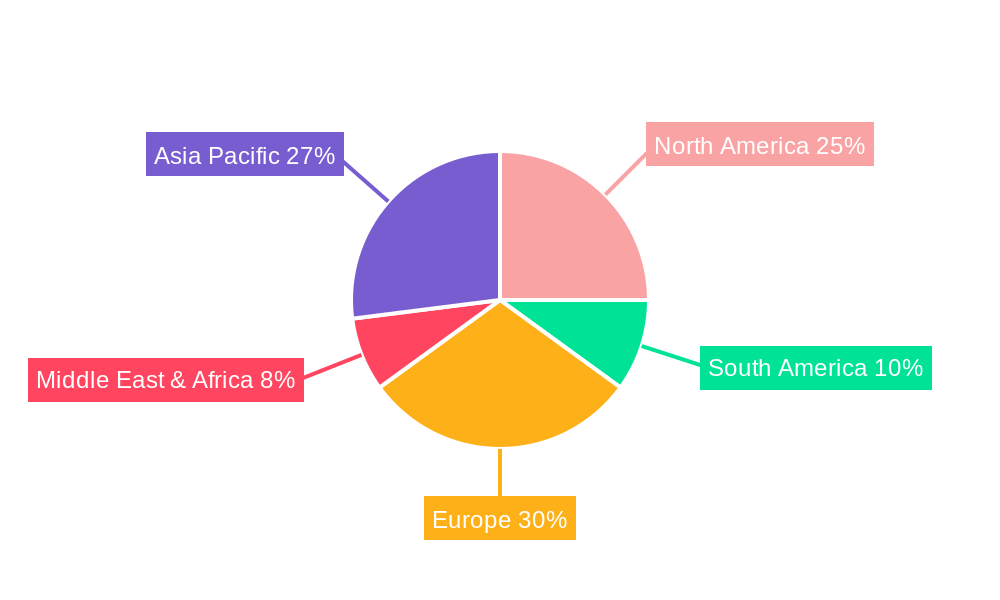

Further dissecting the market, key growth drivers include the expanding construction industry, which necessitates advanced coatings and adhesives utilizing these copolymers, and the burgeoning personal care and cosmetics sector, where they act as solubilizers and emulsifiers. Innovations in polymer science, leading to the development of novel EO & PO copolymer grades with tailored properties, are also contributing to market dynamism. The 10% EO and 20% EO segments are expected to witness significant traction due to their cost-effectiveness and suitability for a wide range of applications. While emerging economies in Asia Pacific, particularly China and India, are anticipated to lead regional growth, North America and Europe will remain significant markets due to established industrial bases and a focus on specialty chemical applications. The market is characterized by a competitive landscape with major players like Dow, BASF, and Stepan investing in research and development to introduce innovative products and expand their global presence.

EO & PO Copolymers Company Market Share

This in-depth report provides an exhaustive analysis of the global Ethylene Oxide (EO) and Propylene Oxide (PO) copolymers market, a critical segment within the specialty chemicals industry. Spanning the historical period of 2019-2024, the base year of 2025, and a forecast period extending to 2033, this study offers invaluable insights for chemical manufacturers, formulators, investors, and end-users. With a projected market size of over xx million in 2025 and a robust CAGR of xx% during the forecast period, the EO & PO copolymers market is poised for significant expansion. Our research delves into market concentration, innovation, key applications such as emulsifiers, dispersants, and defoamers, diverse product types ranging from 10% EO to 80% EO, and critical industry developments. This report is essential for understanding market dynamics, identifying growth opportunities, and navigating the competitive landscape of this dynamic sector.

EO & PO Copolymers Market Concentration & Dynamics

The global EO & PO copolymers market exhibits a moderately concentrated landscape, characterized by the presence of several large, established players alongside a growing number of niche manufacturers. Key industry participants including Dow, BASF, Stepan, PCC Group, NH Chemical, CPS Performance Materials, Golden Chemical Sdn Bhd, Oriental Union Chemical Corporation, and Shree Vallabh Chemicals are actively shaping market dynamics through continuous innovation and strategic expansions. The innovation ecosystem is vibrant, with a strong emphasis on developing novel EO & PO copolymer formulations tailored to specific end-use requirements, particularly in advanced surfactant applications. Regulatory frameworks, while evolving to address environmental sustainability concerns, are generally supportive of the growth of high-performance chemical solutions. Substitute products, such as fatty alcohol ethoxylates and other nonionic surfactants, present a competitive challenge, but the unique performance attributes of EO & PO copolymers in demanding applications continue to drive their adoption. End-user trends are shifting towards greener, more efficient, and bio-based alternatives, compelling manufacturers to invest in sustainable production processes and product development. Mergers and acquisitions (M&A) activities, although not consistently high, have been instrumental in consolidating market share and expanding geographical reach. For instance, recent M&A deals in the past yy years have involved acquisitions valued at over zz million, indicating a strategic consolidation trend among leading entities.

EO & PO Copolymers Industry Insights & Trends

The EO & PO copolymers market is experiencing robust growth, driven by an ever-increasing demand across a multitude of industrial sectors. The global market size was estimated at over xx million in 2024 and is projected to reach an impressive xx million by 2033, growing at a compound annual growth rate (CAGR) of xx% during the forecast period (2025-2033). This expansion is underpinned by several key market growth drivers. The escalating demand for high-performance surfactants in personal care products, detergents, and industrial cleaning formulations is a significant contributor. EO & PO copolymers offer superior emulsifying, dispersing, and wetting properties, making them indispensable in these applications. Furthermore, the burgeoning oil and gas industry, particularly in exploration and production activities, necessitates the use of specialized chemicals like EO & PO copolymers as demulsifiers, corrosion inhibitors, and drilling fluid additives. The agricultural sector's increasing reliance on advanced crop protection chemicals, where these copolymers act as effective adjuvants and dispersants, also fuels market growth.

Technological disruptions are playing a pivotal role in shaping the industry. Advancements in polymerization techniques are enabling the production of tailor-made EO & PO copolymers with precise molecular weights, architectures, and functionalities. This allows for the development of products with enhanced efficacy, reduced environmental impact, and improved cost-effectiveness. The focus on sustainability is leading to the development of bio-based EO & PO copolymers derived from renewable feedstocks, catering to the growing consumer preference for eco-friendly products. Evolving consumer behaviors are also indirectly influencing the market. The demand for more effective and gentler personal care products, energy-efficient cleaning solutions, and sustainable agricultural practices are all translating into a higher demand for advanced specialty chemicals like EO & PO copolymers. The trend towards urbanization and a rising middle class in emerging economies is further augmenting the consumption of goods that utilize these copolymers, from detergents to paints and coatings. The ability of EO & PO copolymers to offer customized solutions for complex industrial challenges positions them favorably to capitalize on these diverse and dynamic market trends, projecting a sustained upward trajectory for the foreseeable future. The market size in 2025 is estimated to be xx million and is expected to grow to xx million by 2033.

Key Markets & Segments Leading EO & PO Copolymers

The global EO & PO copolymers market demonstrates strong regional and segmental dominance, driven by a confluence of economic, industrial, and technological factors. Asia Pacific currently stands as the leading regional market, accounting for over xx% of the global market share. This dominance is fueled by rapid industrialization, a burgeoning manufacturing base, and a growing middle class in countries like China and India, which are major consumers of downstream products utilizing EO & PO copolymers. The region's robust agricultural sector and significant investments in infrastructure development further bolster demand.

Within the application segments, Emulsifier remains the largest and most dynamic segment, contributing over xx% to the overall market revenue. This is attributed to the widespread use of EO & PO copolymers as highly effective emulsifying agents in a vast array of applications, including personal care products (lotions, creams), food processing, pharmaceuticals, and industrial formulations like paints and coatings. The demand for stable and efficient emulsions across these sectors consistently drives the growth of this segment.

The Dispersant segment also holds a significant market share, estimated at over xx%, driven by its critical role in preventing the aggregation of solid particles in liquid media. Applications span from pigment dispersion in inks and coatings to pesticide formulations in agriculture and the stabilization of slurries in the ceramic and construction industries. The performance benefits of EO & PO copolymers in achieving fine particle size distribution and long-term stability are highly valued.

The Defoamer segment, while smaller in comparison, exhibits steady growth, accounting for approximately xx% of the market. These copolymers are essential for controlling foam formation in industrial processes such as paper manufacturing, wastewater treatment, and fermentation. Their efficacy in reducing surface tension and disrupting foam lamellae makes them indispensable in improving process efficiency and product quality.

The "Others" application segment, encompassing niche applications like wetting agents, solubilizers, and intermediates, contributes the remaining xx% and is expected to witness considerable growth due to ongoing R&D efforts exploring new functionalities.

In terms of product types, the 50% EO and 70% EO variants are currently the most dominant, collectively representing over xx% of the market volume. These specific EO/PO ratios offer a balanced range of hydrophilic and lipophilic properties, making them versatile for a wide spectrum of emulsifying and dispersing applications. The 40% EO and 30% EO types also hold significant market positions, catering to specific formulation needs requiring different hydrophilic-lipophilic balance (HLB) values. The 10% EO, 20% EO, and 80% EO segments, while smaller, are crucial for specialized applications demanding extreme polarity or non-polarity. The "Others" type, representing custom-synthesized copolymers, is an emerging segment with high growth potential as industries seek highly specialized solutions.

Drivers for dominance in the Asia Pacific region include substantial economic growth, increasing disposable incomes driving demand for consumer goods, and extensive government initiatives promoting manufacturing and industrial development. In the application segments, the widespread adoption of EO & PO copolymers in mature industries like personal care and detergents, coupled with their expanding use in emerging applications like agrochemicals and construction, underpins their leadership. The dominance of specific EO percentages is largely dictated by their established efficacy and cost-effectiveness in the most prevalent applications, with ongoing innovation gradually expanding the utility of other variants.

EO & PO Copolymers Product Developments

Product innovation in the EO & PO copolymers market is intensely focused on enhancing performance, sustainability, and application versatility. Manufacturers are actively developing novel copolymer architectures and molecular weight distributions to achieve superior emulsification, dispersion, and wetting properties for demanding applications. There is a discernible trend towards creating bio-based and biodegradable EO & PO copolymers derived from renewable feedstocks, addressing the growing demand for eco-friendly chemical solutions. Furthermore, advancements in synthesis methodologies are enabling the production of copolymers with tailored functionalities, such as improved thermal stability, lower foaming tendencies, and enhanced compatibility with specific solvent systems. These developments are expanding the market relevance of EO & PO copolymers into new frontiers, including advanced drug delivery systems, sustainable agricultural inputs, and high-performance industrial lubricants, thereby solidifying their competitive edge in a rapidly evolving chemical landscape.

Challenges in the EO & PO Copolymers Market

The EO & PO copolymers market, despite its strong growth prospects, faces several critical challenges that can impact its trajectory. Raw material price volatility for ethylene oxide and propylene oxide, driven by fluctuations in crude oil and natural gas prices, poses a significant threat to profit margins and necessitates robust supply chain management strategies. Stringent environmental regulations concerning the production and disposal of chemical products, particularly in developed regions, can increase compliance costs and necessitate investments in cleaner production technologies. The presence of established substitute products, such as fatty alcohol ethoxylates and other nonionic surfactants, often offers a lower price point, creating competitive pressure, especially in cost-sensitive applications. Supply chain disruptions, exacerbated by geopolitical events and logistical complexities, can lead to production delays and impact the availability of key intermediates, further challenging market stability. The overall impact of these challenges on market growth is estimated to be a potential reduction of xx% in projected revenue over the forecast period if not effectively mitigated.

Forces Driving EO & PO Copolymers Growth

Several powerful forces are propelling the growth of the EO & PO copolymers market. Technological advancements in polymerization processes allow for the creation of highly specialized copolymers with enhanced performance characteristics, opening up new application areas and driving demand for customized solutions. The ever-increasing demand for high-performance surfactants across diverse industries, including personal care, detergents, agriculture, and oil & gas, is a fundamental growth catalyst. Furthermore, the growing global emphasis on sustainability and green chemistry is creating opportunities for bio-based and biodegradable EO & PO copolymers, aligning with evolving consumer preferences and regulatory mandates. Economic growth in emerging economies is also a significant driver, as increased industrial activity and rising disposable incomes lead to higher consumption of products that utilize these essential chemical components. The ability of EO & PO copolymers to deliver superior functionality, efficiency, and performance in critical applications ensures their continued relevance and market expansion.

Challenges in the EO & PO Copolymers Market

Looking beyond the immediate, long-term growth catalysts for the EO & PO copolymers market are deeply rooted in innovation and strategic market positioning. Continued investment in research and development to create next-generation copolymers with novel functionalities and improved sustainability profiles will be crucial for maintaining a competitive edge. Strategic partnerships and collaborations between raw material suppliers, copolymer manufacturers, and end-users can accelerate product development cycles and unlock new market opportunities. Furthermore, expanding market reach into developing economies by establishing local production facilities and distribution networks will tap into nascent demand and diversify revenue streams. The focus on developing circular economy solutions and bio-based alternatives will also be a key differentiator, aligning with global sustainability goals and appealing to environmentally conscious consumers and businesses. These long-term catalysts are essential for ensuring sustained and robust growth in the evolving chemical landscape.

Emerging Opportunities in EO & PO Copolymers

The EO & PO copolymers market is ripe with emerging opportunities driven by evolving market demands and technological breakthroughs. The growing consciousness around environmental sustainability is creating significant opportunities for the development and adoption of bio-based and biodegradable EO & PO copolymers derived from renewable feedstocks, catering to the increasing consumer preference for eco-friendly products. Advancements in specialty chemical applications, particularly in niche areas like advanced drug delivery systems, enhanced oil recovery (EOR), and high-performance coatings, present lucrative avenues for growth. Furthermore, the increasing industrialization and infrastructure development in emerging economies, especially in Asia and Africa, will translate into substantial demand for a wide range of EO & PO copolymer-based products. The trend towards miniaturization and enhanced efficiency in various industrial processes also opens doors for the development of highly concentrated and specialized copolymer formulations. Identifying and capitalizing on these emerging trends will be key to unlocking future market potential and securing a competitive advantage.

Leading Players in the EO & PO Copolymers Sector

- Dow

- BASF

- Stepan

- PCC Group

- NH Chemical

- CPS Performance Materials

- Golden Chemical Sdn Bhd

- Oriental Union Chemical Corporation

- Shree Vallabh Chemicals

Key Milestones in EO & PO Copolymers Industry

- 2019: Increased focus on developing bio-based EO & PO copolymers as sustainability concerns rise.

- 2020: Introduction of novel EO & PO copolymer formulations with enhanced biodegradability by leading manufacturers.

- 2021: Significant investment in R&D for specialty EO & PO copolymers for advanced agricultural applications.

- 2022: M&A activities aimed at consolidating market share and expanding product portfolios in specialty surfactants.

- 2023: Growing demand for EO & PO copolymers in the oil and gas sector for enhanced oil recovery (EOR) operations.

- 2024: Advancements in polymerization techniques enabling the production of EO & PO copolymers with highly tailored molecular structures.

- 2025 (Estimated): Projected surge in demand for EO & PO copolymers in personal care and home care sectors due to rising consumer spending.

- 2026-2033 (Forecast): Continued innovation in sustainable EO & PO copolymer solutions and expansion into new geographical markets.

Strategic Outlook for EO & PO Copolymers Market

The strategic outlook for the EO & PO copolymers market is overwhelmingly positive, characterized by sustained growth fueled by innovation and expanding applications. Key growth accelerators include the continued development of high-performance, sustainable, and bio-based copolymer formulations that align with global environmental mandates and consumer preferences. Strategic investments in expanding production capacities, particularly in emerging markets with high growth potential, will be crucial for meeting escalating demand. Furthermore, fostering collaborative research and development initiatives with end-users to co-create customized solutions for niche applications will unlock significant market opportunities. The ability to navigate evolving regulatory landscapes and capitalize on the increasing demand for specialty chemicals across diverse sectors, from personal care to industrial applications, positions the EO & PO copolymers market for a robust and dynamic future, with an estimated market value of xx million by 2033.

EO & PO Copolymers Segmentation

-

1. Application

- 1.1. Emulsifier

- 1.2. Dispersant

- 1.3. Defoamer

- 1.4. Others

-

2. Types

- 2.1. 10%EO

- 2.2. 20%EO

- 2.3. 30%EO

- 2.4. 40%EO

- 2.5. 50%EO

- 2.6. 70%EO

- 2.7. 80%EO

- 2.8. Others

EO & PO Copolymers Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

EO & PO Copolymers Regional Market Share

Geographic Coverage of EO & PO Copolymers

EO & PO Copolymers REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global EO & PO Copolymers Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Emulsifier

- 5.1.2. Dispersant

- 5.1.3. Defoamer

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. 10%EO

- 5.2.2. 20%EO

- 5.2.3. 30%EO

- 5.2.4. 40%EO

- 5.2.5. 50%EO

- 5.2.6. 70%EO

- 5.2.7. 80%EO

- 5.2.8. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America EO & PO Copolymers Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Emulsifier

- 6.1.2. Dispersant

- 6.1.3. Defoamer

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. 10%EO

- 6.2.2. 20%EO

- 6.2.3. 30%EO

- 6.2.4. 40%EO

- 6.2.5. 50%EO

- 6.2.6. 70%EO

- 6.2.7. 80%EO

- 6.2.8. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America EO & PO Copolymers Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Emulsifier

- 7.1.2. Dispersant

- 7.1.3. Defoamer

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. 10%EO

- 7.2.2. 20%EO

- 7.2.3. 30%EO

- 7.2.4. 40%EO

- 7.2.5. 50%EO

- 7.2.6. 70%EO

- 7.2.7. 80%EO

- 7.2.8. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe EO & PO Copolymers Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Emulsifier

- 8.1.2. Dispersant

- 8.1.3. Defoamer

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. 10%EO

- 8.2.2. 20%EO

- 8.2.3. 30%EO

- 8.2.4. 40%EO

- 8.2.5. 50%EO

- 8.2.6. 70%EO

- 8.2.7. 80%EO

- 8.2.8. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa EO & PO Copolymers Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Emulsifier

- 9.1.2. Dispersant

- 9.1.3. Defoamer

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. 10%EO

- 9.2.2. 20%EO

- 9.2.3. 30%EO

- 9.2.4. 40%EO

- 9.2.5. 50%EO

- 9.2.6. 70%EO

- 9.2.7. 80%EO

- 9.2.8. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific EO & PO Copolymers Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Emulsifier

- 10.1.2. Dispersant

- 10.1.3. Defoamer

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. 10%EO

- 10.2.2. 20%EO

- 10.2.3. 30%EO

- 10.2.4. 40%EO

- 10.2.5. 50%EO

- 10.2.6. 70%EO

- 10.2.7. 80%EO

- 10.2.8. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Dow

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BASF

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Stepan

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 PCC Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 NH Chemical

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CPS Performance Materials

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Golden Chemical Sdn Bhd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Oriental Union Chemical Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Shree Vallabh Chemicals

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Dow

List of Figures

- Figure 1: Global EO & PO Copolymers Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America EO & PO Copolymers Revenue (million), by Application 2025 & 2033

- Figure 3: North America EO & PO Copolymers Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America EO & PO Copolymers Revenue (million), by Types 2025 & 2033

- Figure 5: North America EO & PO Copolymers Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America EO & PO Copolymers Revenue (million), by Country 2025 & 2033

- Figure 7: North America EO & PO Copolymers Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America EO & PO Copolymers Revenue (million), by Application 2025 & 2033

- Figure 9: South America EO & PO Copolymers Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America EO & PO Copolymers Revenue (million), by Types 2025 & 2033

- Figure 11: South America EO & PO Copolymers Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America EO & PO Copolymers Revenue (million), by Country 2025 & 2033

- Figure 13: South America EO & PO Copolymers Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe EO & PO Copolymers Revenue (million), by Application 2025 & 2033

- Figure 15: Europe EO & PO Copolymers Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe EO & PO Copolymers Revenue (million), by Types 2025 & 2033

- Figure 17: Europe EO & PO Copolymers Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe EO & PO Copolymers Revenue (million), by Country 2025 & 2033

- Figure 19: Europe EO & PO Copolymers Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa EO & PO Copolymers Revenue (million), by Application 2025 & 2033

- Figure 21: Middle East & Africa EO & PO Copolymers Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa EO & PO Copolymers Revenue (million), by Types 2025 & 2033

- Figure 23: Middle East & Africa EO & PO Copolymers Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa EO & PO Copolymers Revenue (million), by Country 2025 & 2033

- Figure 25: Middle East & Africa EO & PO Copolymers Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific EO & PO Copolymers Revenue (million), by Application 2025 & 2033

- Figure 27: Asia Pacific EO & PO Copolymers Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific EO & PO Copolymers Revenue (million), by Types 2025 & 2033

- Figure 29: Asia Pacific EO & PO Copolymers Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific EO & PO Copolymers Revenue (million), by Country 2025 & 2033

- Figure 31: Asia Pacific EO & PO Copolymers Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global EO & PO Copolymers Revenue million Forecast, by Region 2020 & 2033

- Table 2: Global EO & PO Copolymers Revenue million Forecast, by Application 2020 & 2033

- Table 3: Global EO & PO Copolymers Revenue million Forecast, by Types 2020 & 2033

- Table 4: Global EO & PO Copolymers Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global EO & PO Copolymers Revenue million Forecast, by Application 2020 & 2033

- Table 6: Global EO & PO Copolymers Revenue million Forecast, by Types 2020 & 2033

- Table 7: Global EO & PO Copolymers Revenue million Forecast, by Country 2020 & 2033

- Table 8: United States EO & PO Copolymers Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Canada EO & PO Copolymers Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Mexico EO & PO Copolymers Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Global EO & PO Copolymers Revenue million Forecast, by Application 2020 & 2033

- Table 12: Global EO & PO Copolymers Revenue million Forecast, by Types 2020 & 2033

- Table 13: Global EO & PO Copolymers Revenue million Forecast, by Country 2020 & 2033

- Table 14: Brazil EO & PO Copolymers Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Argentina EO & PO Copolymers Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Rest of South America EO & PO Copolymers Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Global EO & PO Copolymers Revenue million Forecast, by Application 2020 & 2033

- Table 18: Global EO & PO Copolymers Revenue million Forecast, by Types 2020 & 2033

- Table 19: Global EO & PO Copolymers Revenue million Forecast, by Country 2020 & 2033

- Table 20: United Kingdom EO & PO Copolymers Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Germany EO & PO Copolymers Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: France EO & PO Copolymers Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Italy EO & PO Copolymers Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Spain EO & PO Copolymers Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Russia EO & PO Copolymers Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Benelux EO & PO Copolymers Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Nordics EO & PO Copolymers Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Europe EO & PO Copolymers Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Global EO & PO Copolymers Revenue million Forecast, by Application 2020 & 2033

- Table 30: Global EO & PO Copolymers Revenue million Forecast, by Types 2020 & 2033

- Table 31: Global EO & PO Copolymers Revenue million Forecast, by Country 2020 & 2033

- Table 32: Turkey EO & PO Copolymers Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: Israel EO & PO Copolymers Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: GCC EO & PO Copolymers Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: North Africa EO & PO Copolymers Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: South Africa EO & PO Copolymers Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East & Africa EO & PO Copolymers Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: Global EO & PO Copolymers Revenue million Forecast, by Application 2020 & 2033

- Table 39: Global EO & PO Copolymers Revenue million Forecast, by Types 2020 & 2033

- Table 40: Global EO & PO Copolymers Revenue million Forecast, by Country 2020 & 2033

- Table 41: China EO & PO Copolymers Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: India EO & PO Copolymers Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: Japan EO & PO Copolymers Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: South Korea EO & PO Copolymers Revenue (million) Forecast, by Application 2020 & 2033

- Table 45: ASEAN EO & PO Copolymers Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Oceania EO & PO Copolymers Revenue (million) Forecast, by Application 2020 & 2033

- Table 47: Rest of Asia Pacific EO & PO Copolymers Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the EO & PO Copolymers?

The projected CAGR is approximately 6.1%.

2. Which companies are prominent players in the EO & PO Copolymers?

Key companies in the market include Dow, BASF, Stepan, PCC Group, NH Chemical, CPS Performance Materials, Golden Chemical Sdn Bhd, Oriental Union Chemical Corporation, Shree Vallabh Chemicals.

3. What are the main segments of the EO & PO Copolymers?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 342 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "EO & PO Copolymers," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the EO & PO Copolymers report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the EO & PO Copolymers?

To stay informed about further developments, trends, and reports in the EO & PO Copolymers, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence