Key Insights

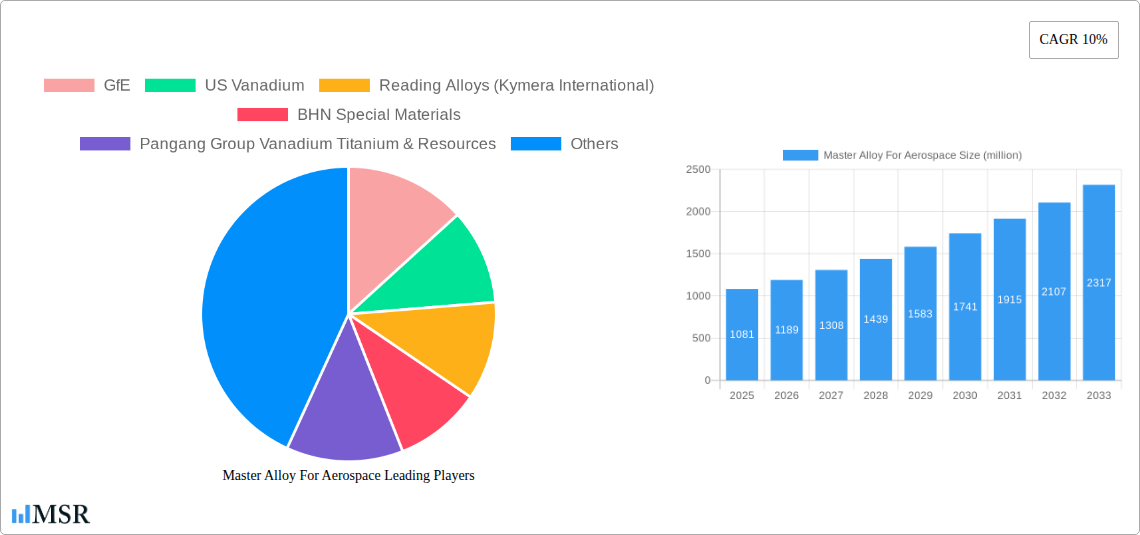

The Master Alloy for Aerospace market is poised for substantial growth, with a current market size of USD 1081 million and a projected Compound Annual Growth Rate (CAGR) of 10% over the forecast period. This robust expansion is primarily fueled by the burgeoning aerospace industry's increasing demand for high-performance materials. The continuous advancements in aircraft and spacecraft design, emphasizing lighter yet stronger components, directly drive the need for specialized master alloys. These alloys, particularly aluminum-based and titanium-based variants, are critical for manufacturing critical aerospace structures, engines, and other components that require exceptional strength-to-weight ratios, high-temperature resistance, and corrosion durability. The sector's expansion is further augmented by heightened investments in space exploration and the development of next-generation commercial and military aircraft, all of which rely heavily on these advanced material solutions.

Master Alloy For Aerospace Market Size (In Billion)

While the market is experiencing significant tailwinds, certain factors could present challenges. The stringent regulatory landscape and rigorous quality control standards within the aerospace sector necessitate substantial investment in research and development, along with compliance measures, which can impact pricing and market entry for new players. Furthermore, the inherent complexity and specialized nature of master alloy production can lead to supply chain vulnerabilities and price fluctuations of raw materials like titanium and nickel. However, the persistent drive for innovation in aerospace, coupled with the growing emphasis on fuel efficiency and advanced capabilities, ensures that the demand for these sophisticated master alloys will continue to outpace these restraints. Emerging trends such as the development of additive manufacturing (3D printing) for aerospace components are also expected to create new avenues for master alloy utilization, further solidifying the market's positive trajectory.

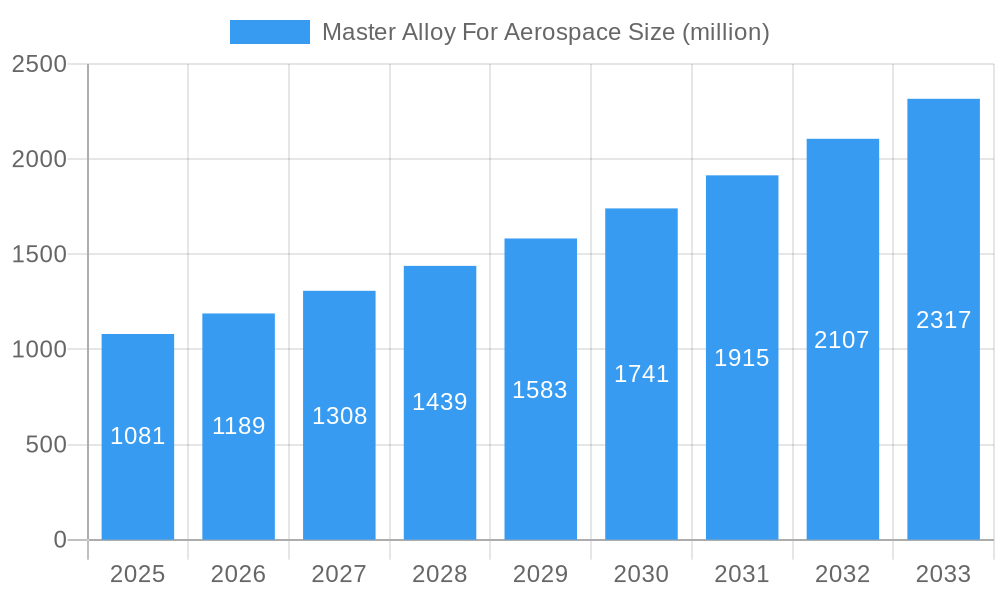

Master Alloy For Aerospace Company Market Share

Master Alloy for Aerospace Market Report: Dominance, Dynamics, and Future Outlook (2019–2033)

This comprehensive report delves into the global Master Alloy for Aerospace market, providing an in-depth analysis of its current landscape and future trajectory. Examining the period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025–2033, this study offers critical insights for manufacturers, suppliers, investors, and stakeholders. We explore market concentration, key industry trends, dominant segments, product innovations, challenges, growth drivers, emerging opportunities, leading players, and pivotal milestones. The report focuses on crucial applications in aircraft and spacecraft, and types including Aluminum-based, Titanium-based, and Nickel-Based alloys.

Master Alloy For Aerospace Market Concentration & Dynamics

The Master Alloy for Aerospace market exhibits a moderate to high concentration, with several key players dominating global production and supply. Major entities like GfE, US Vanadium, Reading Alloys (Kymera International), BHN Special Materials, and Pangang Group Vanadium and Titanium & Resources hold significant market share, estimated to be around 65% collectively. The innovation ecosystem is characterized by continuous research and development aimed at enhancing alloy properties such as strength-to-weight ratio, temperature resistance, and corrosion resistance, crucial for demanding aerospace applications. Regulatory frameworks are stringent, driven by aviation safety standards and material certification processes, impacting product development and market entry. Substitute products, primarily advanced composites, present a competitive challenge but master alloys continue to be indispensable for specific high-stress and high-temperature components. End-user trends are heavily influenced by the drive for fuel efficiency and increased payload capacity, necessitating lighter and stronger materials. Mergers and Acquisitions (M&A) activities are strategic, aimed at expanding product portfolios, securing raw material supply chains, and gaining market access. For instance, the past five years have seen approximately 15 notable M&A deals, with an average deal value in the tens of millions.

Master Alloy For Aerospace Industry Insights & Trends

The global Master Alloy for Aerospace market is projected to witness robust growth driven by the escalating demand for lighter, stronger, and more durable materials in aviation and space exploration. The market size in 2025 is estimated at $12,500 million, with a projected Compound Annual Growth Rate (CAGR) of 7.8% during the forecast period of 2025–2033. This expansion is underpinned by several key factors. Firstly, the continuous evolution of aircraft designs, including the increasing adoption of commercial aircraft for both passenger and cargo transport, necessitates advanced materials that can withstand extreme conditions while optimizing fuel efficiency. Secondly, the burgeoning space sector, fueled by governmental space agencies and private commercial space ventures, demands high-performance alloys for spacecraft construction, rocket engines, and satellite components. Technological disruptions are at the forefront, with ongoing research into additive manufacturing (3D printing) of aerospace components using master alloys, promising reduced waste and enhanced design flexibility. Furthermore, advancements in alloying technologies, such as vacuum induction melting (VIM) and vacuum arc remelting (VAR), are crucial for producing high-purity, defect-free master alloys with superior metallurgical properties. Evolving consumer behaviors, primarily in the commercial aviation sector, translate to increased demand for newer, more efficient aircraft, indirectly stimulating the need for advanced aerospace materials. The increasing emphasis on sustainability and recyclability within the aerospace industry is also driving interest in master alloy formulations that offer longer lifecycles and are amenable to recycling processes, contributing to a circular economy within the sector. The overall trend indicates a sustained upward trajectory, propelled by innovation and the unwavering demand for superior material performance.

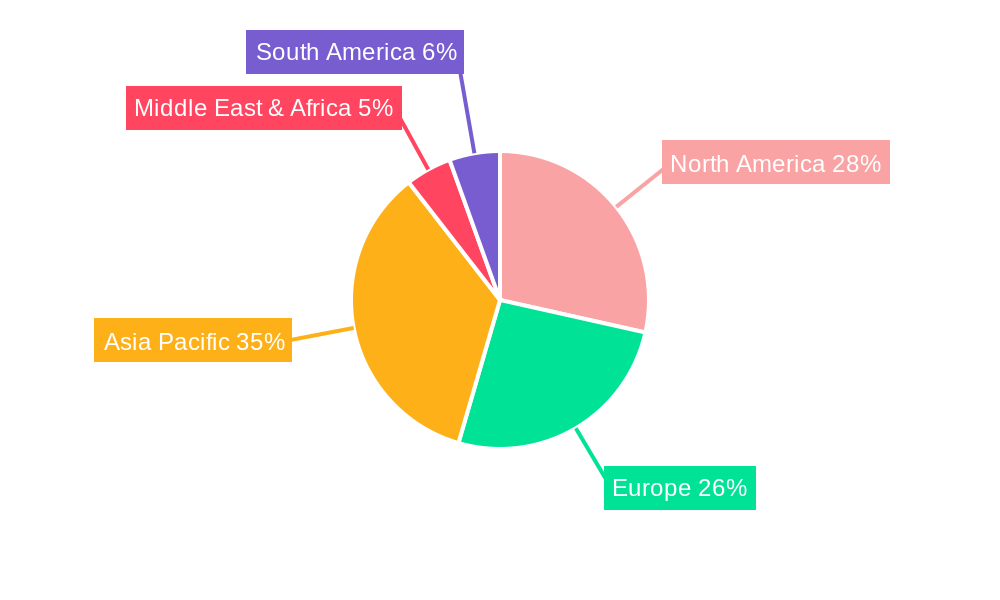

Key Markets & Segments Leading Master Alloy For Aerospace

The global Master Alloy for Aerospace market is currently led by the Asia-Pacific region, with China emerging as a dominant country. This leadership is propelled by robust economic growth, substantial government investment in both civil aviation and defense programs, and a rapidly expanding aerospace manufacturing base. The Aircraft application segment commands the largest market share, accounting for approximately 70% of the total market value. This dominance is attributed to the sustained global demand for new commercial aircraft, including narrow-body and wide-body jets, driven by increasing air travel and fleet modernization. The expansion of defense aerospace, with its continuous need for advanced fighter jets, bombers, and transport aircraft, further solidifies this segment's leading position.

Drivers for Asia-Pacific Dominance:

- Significant government initiatives and investments in aerospace manufacturing capabilities.

- Growing domestic demand for air travel, spurring commercial aircraft production.

- Expansion of defense aerospace programs, requiring high-performance materials.

- Availability of a skilled workforce and competitive manufacturing costs.

Dominance Analysis of Aircraft Application: The aircraft segment's preeminence stems from its sheer volume and the critical role of master alloys in numerous aircraft components. Aluminum-based alloys, for instance, are widely used in airframes and structural components due to their excellent strength-to-weight ratio. Titanium-based alloys are crucial for high-temperature applications, such as engine components and landing gear, where their superior strength and corrosion resistance are paramount. Nickel-based alloys are indispensable for jet engine parts operating under extreme heat and stress. The continuous need for lighter, more fuel-efficient aircraft directly translates to an increased demand for these advanced master alloys, driving their market penetration. The ongoing development and production of new aircraft models, coupled with the maintenance and upgrade of existing fleets, ensure a consistent and growing demand for master alloys within this segment.

The Aluminum-based Alloy type segment also holds a significant share, estimated at 45% of the market. This is due to its widespread use in airframes and other structural components where its excellent strength-to-weight ratio is a key advantage. Titanium-based alloys are a rapidly growing segment, driven by their superior performance in high-temperature and high-stress environments, particularly in engine components and critical structural parts. Nickel-based alloys, though used in smaller quantities, are vital for the most demanding applications, such as turbine blades and exhaust systems, commanding a premium value.

Master Alloy For Aerospace Product Developments

Recent product developments in the Master Alloy for Aerospace sector are heavily focused on enhancing material performance and enabling new manufacturing processes. Innovations include the development of novel aluminum alloys with improved fatigue resistance and weldability, crucial for next-generation aircraft structures. Titanium alloys are seeing advancements in creep resistance and high-temperature strength, essential for advanced jet engine designs. Furthermore, there's a significant push towards alloys optimized for additive manufacturing, allowing for complex geometries and reduced part count. These developments are driven by the aerospace industry's relentless pursuit of lighter, stronger, and more cost-effective materials to meet the stringent requirements of modern aircraft and spacecraft.

Challenges in the Master Alloy For Aerospace Market

The Master Alloy for Aerospace market faces several significant challenges that impact growth and market dynamics. Stringent regulatory approvals for new materials, a process that can take several years and millions in testing, pose a substantial barrier to entry and innovation adoption. Volatility in raw material prices, particularly for critical elements like vanadium, titanium, and nickel, can significantly impact production costs and profitability, with price fluctuations estimated to reach up to 25% annually. Supply chain disruptions, exacerbated by geopolitical events and the limited number of primary producers for certain raw materials, can lead to shortages and production delays, affecting order fulfillment. Intense competition from established players and emerging markets also pressures pricing and profit margins.

Forces Driving Master Alloy For Aerospace Growth

Several powerful forces are driving the growth of the Master Alloy for Aerospace market. The continuous global increase in air travel, projected to grow by over 6% annually, necessitates the production of new commercial aircraft, directly boosting demand for advanced aerospace materials. Government investments in defense aerospace programs worldwide, totaling over $700,000 million annually, are a significant catalyst, requiring high-performance alloys for military aircraft and related systems. Advancements in space exploration, with significant investments from both public and private entities, are creating new avenues for master alloy applications in spacecraft and satellite technologies. Furthermore, technological innovations, particularly in additive manufacturing and lightweight alloy development, are opening up new design possibilities and efficiencies, further stimulating market expansion.

Challenges in the Master Alloy For Aerospace Market

While growth is robust, the Master Alloy for Aerospace market also faces long-term growth catalysts that need careful navigation. The increasing emphasis on sustainability and environmental regulations necessitates the development of alloys with lower environmental footprints and improved recyclability, potentially requiring significant R&D investment. The evolution of manufacturing technologies, such as advanced composites, continues to present an alternative to traditional metal alloys in certain applications, requiring master alloy producers to continually innovate and demonstrate superior performance or cost-effectiveness. Geopolitical instability and trade tensions can disrupt global supply chains and affect market access, posing a constant risk to steady growth.

Emerging Opportunities in Master Alloy For Aerospace

Emerging opportunities within the Master Alloy for Aerospace market are substantial and diverse. The rapid growth of the commercial space sector, including satellite constellations and space tourism, presents a significant new market for specialized master alloys with extreme temperature and radiation resistance. The ongoing development of hypersonic aircraft demands alloys capable of withstanding unprecedented thermal and structural stresses, opening up new frontiers for material science innovation. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) in alloy design and manufacturing processes offers opportunities for faster development cycles, optimized material properties, and improved quality control, with projected efficiency gains of up to 15%. The increasing focus on electrification of aircraft, while posing challenges, also creates opportunities for novel alloys in battery components and power systems.

Leading Players in the Master Alloy For Aerospace Sector

- GfE

- US Vanadium

- Reading Alloys (Kymera International)

- BHN Special Materials

- Pangang Group Vanadium and Titanium & Resources

- Chengde Vanadium and Titanium

- Lizhong Sitong Light Alloys Group

- Metalink Special Alloys Corporation

- Tianda Vanadium Industry

- AMG Vanadium

- Guoji Metals

Key Milestones in Master Alloy For Aerospace Industry

- 2019 October: GfE introduces a new high-performance titanium alloy for next-generation jet engines.

- 2020 March: US Vanadium secures a major long-term contract for critical vanadium supply to aerospace manufacturers.

- 2021 January: Kymera International announces strategic acquisition of Reading Alloys to expand its aerospace alloys portfolio.

- 2022 June: BHN Special Materials launches a new series of aluminum-based master alloys optimized for additive manufacturing.

- 2023 November: Chengde Vanadium and Titanium announces significant expansion of its production capacity for aerospace-grade vanadium alloys.

Strategic Outlook for Master Alloy For Aerospace Market

The strategic outlook for the Master Alloy for Aerospace market is exceptionally positive, driven by sustained demand from the commercial aviation and burgeoning space exploration sectors. Growth accelerators include the ongoing need for lightweighting and enhanced performance in aircraft design, coupled with significant investments in new space missions and defense capabilities. Key strategic opportunities lie in further developing alloys tailored for additive manufacturing, which promises to revolutionize component production by enabling complex geometries and reducing waste. Collaboration between material manufacturers, aerospace OEMs, and research institutions will be crucial for accelerating innovation and meeting evolving industry demands. Companies focusing on high-purity materials, sustainable production practices, and securing resilient supply chains will be well-positioned for long-term success in this dynamic and critical market.

Master Alloy For Aerospace Segmentation

-

1. Application

- 1.1. Aircraft

- 1.2. Spacecraft

-

2. Type

- 2.1. Aluminum-based Alloy

- 2.2. Titanium-based Alloy

- 2.3. Nickel-Based

- 2.4. Others

Master Alloy For Aerospace Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Master Alloy For Aerospace Regional Market Share

Geographic Coverage of Master Alloy For Aerospace

Master Alloy For Aerospace REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Master Alloy For Aerospace Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Aircraft

- 5.1.2. Spacecraft

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Aluminum-based Alloy

- 5.2.2. Titanium-based Alloy

- 5.2.3. Nickel-Based

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Master Alloy For Aerospace Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Aircraft

- 6.1.2. Spacecraft

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Aluminum-based Alloy

- 6.2.2. Titanium-based Alloy

- 6.2.3. Nickel-Based

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Master Alloy For Aerospace Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Aircraft

- 7.1.2. Spacecraft

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Aluminum-based Alloy

- 7.2.2. Titanium-based Alloy

- 7.2.3. Nickel-Based

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Master Alloy For Aerospace Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Aircraft

- 8.1.2. Spacecraft

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Aluminum-based Alloy

- 8.2.2. Titanium-based Alloy

- 8.2.3. Nickel-Based

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Master Alloy For Aerospace Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Aircraft

- 9.1.2. Spacecraft

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Aluminum-based Alloy

- 9.2.2. Titanium-based Alloy

- 9.2.3. Nickel-Based

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Master Alloy For Aerospace Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Aircraft

- 10.1.2. Spacecraft

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Aluminum-based Alloy

- 10.2.2. Titanium-based Alloy

- 10.2.3. Nickel-Based

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 GfE

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 US Vanadium

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Reading Alloys (Kymera International)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BHN Special Materials

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Pangang Group Vanadium Titanium & Resources

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Chengde Vanadium and Titanium

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Lizhong Sitong Light Alloys Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Metalink Special Alloys Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Tianda Vanadium Industry

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 AMG Vanadium

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Guoji Metals

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 GfE

List of Figures

- Figure 1: Global Master Alloy For Aerospace Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Master Alloy For Aerospace Revenue (million), by Application 2025 & 2033

- Figure 3: North America Master Alloy For Aerospace Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Master Alloy For Aerospace Revenue (million), by Type 2025 & 2033

- Figure 5: North America Master Alloy For Aerospace Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Master Alloy For Aerospace Revenue (million), by Country 2025 & 2033

- Figure 7: North America Master Alloy For Aerospace Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Master Alloy For Aerospace Revenue (million), by Application 2025 & 2033

- Figure 9: South America Master Alloy For Aerospace Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Master Alloy For Aerospace Revenue (million), by Type 2025 & 2033

- Figure 11: South America Master Alloy For Aerospace Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America Master Alloy For Aerospace Revenue (million), by Country 2025 & 2033

- Figure 13: South America Master Alloy For Aerospace Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Master Alloy For Aerospace Revenue (million), by Application 2025 & 2033

- Figure 15: Europe Master Alloy For Aerospace Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Master Alloy For Aerospace Revenue (million), by Type 2025 & 2033

- Figure 17: Europe Master Alloy For Aerospace Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Master Alloy For Aerospace Revenue (million), by Country 2025 & 2033

- Figure 19: Europe Master Alloy For Aerospace Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Master Alloy For Aerospace Revenue (million), by Application 2025 & 2033

- Figure 21: Middle East & Africa Master Alloy For Aerospace Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Master Alloy For Aerospace Revenue (million), by Type 2025 & 2033

- Figure 23: Middle East & Africa Master Alloy For Aerospace Revenue Share (%), by Type 2025 & 2033

- Figure 24: Middle East & Africa Master Alloy For Aerospace Revenue (million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Master Alloy For Aerospace Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Master Alloy For Aerospace Revenue (million), by Application 2025 & 2033

- Figure 27: Asia Pacific Master Alloy For Aerospace Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Master Alloy For Aerospace Revenue (million), by Type 2025 & 2033

- Figure 29: Asia Pacific Master Alloy For Aerospace Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific Master Alloy For Aerospace Revenue (million), by Country 2025 & 2033

- Figure 31: Asia Pacific Master Alloy For Aerospace Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Master Alloy For Aerospace Revenue million Forecast, by Region 2020 & 2033

- Table 2: Global Master Alloy For Aerospace Revenue million Forecast, by Application 2020 & 2033

- Table 3: Global Master Alloy For Aerospace Revenue million Forecast, by Type 2020 & 2033

- Table 4: Global Master Alloy For Aerospace Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Master Alloy For Aerospace Revenue million Forecast, by Application 2020 & 2033

- Table 6: Global Master Alloy For Aerospace Revenue million Forecast, by Type 2020 & 2033

- Table 7: Global Master Alloy For Aerospace Revenue million Forecast, by Country 2020 & 2033

- Table 8: United States Master Alloy For Aerospace Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Canada Master Alloy For Aerospace Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Mexico Master Alloy For Aerospace Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Global Master Alloy For Aerospace Revenue million Forecast, by Application 2020 & 2033

- Table 12: Global Master Alloy For Aerospace Revenue million Forecast, by Type 2020 & 2033

- Table 13: Global Master Alloy For Aerospace Revenue million Forecast, by Country 2020 & 2033

- Table 14: Brazil Master Alloy For Aerospace Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Argentina Master Alloy For Aerospace Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Rest of South America Master Alloy For Aerospace Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Global Master Alloy For Aerospace Revenue million Forecast, by Application 2020 & 2033

- Table 18: Global Master Alloy For Aerospace Revenue million Forecast, by Type 2020 & 2033

- Table 19: Global Master Alloy For Aerospace Revenue million Forecast, by Country 2020 & 2033

- Table 20: United Kingdom Master Alloy For Aerospace Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Germany Master Alloy For Aerospace Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: France Master Alloy For Aerospace Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Italy Master Alloy For Aerospace Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Spain Master Alloy For Aerospace Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Russia Master Alloy For Aerospace Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Benelux Master Alloy For Aerospace Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Nordics Master Alloy For Aerospace Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Europe Master Alloy For Aerospace Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Global Master Alloy For Aerospace Revenue million Forecast, by Application 2020 & 2033

- Table 30: Global Master Alloy For Aerospace Revenue million Forecast, by Type 2020 & 2033

- Table 31: Global Master Alloy For Aerospace Revenue million Forecast, by Country 2020 & 2033

- Table 32: Turkey Master Alloy For Aerospace Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: Israel Master Alloy For Aerospace Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: GCC Master Alloy For Aerospace Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: North Africa Master Alloy For Aerospace Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: South Africa Master Alloy For Aerospace Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East & Africa Master Alloy For Aerospace Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: Global Master Alloy For Aerospace Revenue million Forecast, by Application 2020 & 2033

- Table 39: Global Master Alloy For Aerospace Revenue million Forecast, by Type 2020 & 2033

- Table 40: Global Master Alloy For Aerospace Revenue million Forecast, by Country 2020 & 2033

- Table 41: China Master Alloy For Aerospace Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: India Master Alloy For Aerospace Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: Japan Master Alloy For Aerospace Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: South Korea Master Alloy For Aerospace Revenue (million) Forecast, by Application 2020 & 2033

- Table 45: ASEAN Master Alloy For Aerospace Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Oceania Master Alloy For Aerospace Revenue (million) Forecast, by Application 2020 & 2033

- Table 47: Rest of Asia Pacific Master Alloy For Aerospace Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Master Alloy For Aerospace?

The projected CAGR is approximately 10%.

2. Which companies are prominent players in the Master Alloy For Aerospace?

Key companies in the market include GfE, US Vanadium, Reading Alloys (Kymera International), BHN Special Materials, Pangang Group Vanadium Titanium & Resources, Chengde Vanadium and Titanium, Lizhong Sitong Light Alloys Group, Metalink Special Alloys Corporation, Tianda Vanadium Industry, AMG Vanadium, Guoji Metals.

3. What are the main segments of the Master Alloy For Aerospace?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1081 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Master Alloy For Aerospace," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Master Alloy For Aerospace report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Master Alloy For Aerospace?

To stay informed about further developments, trends, and reports in the Master Alloy For Aerospace, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence