Key Insights

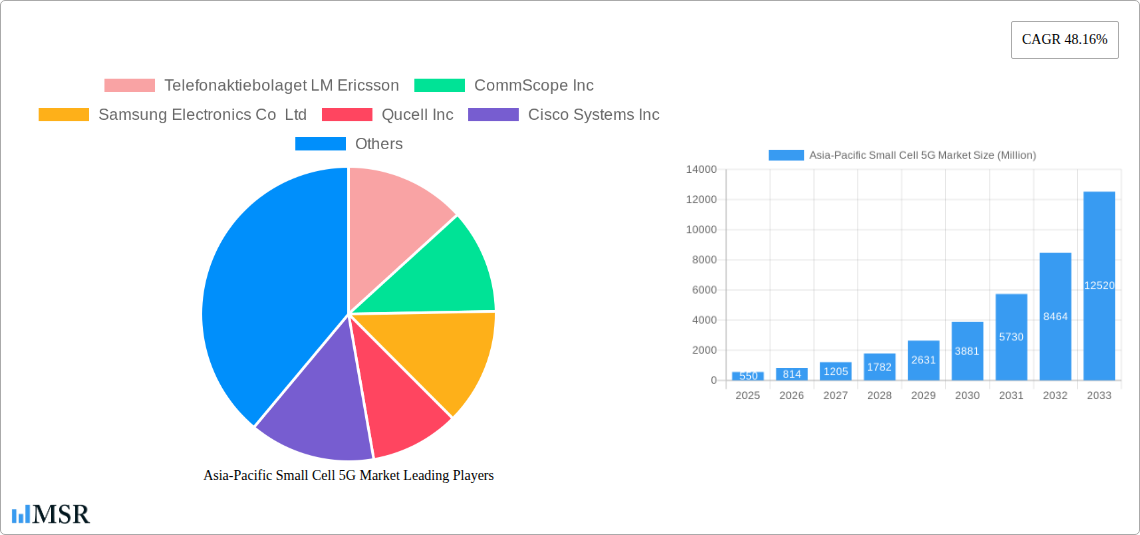

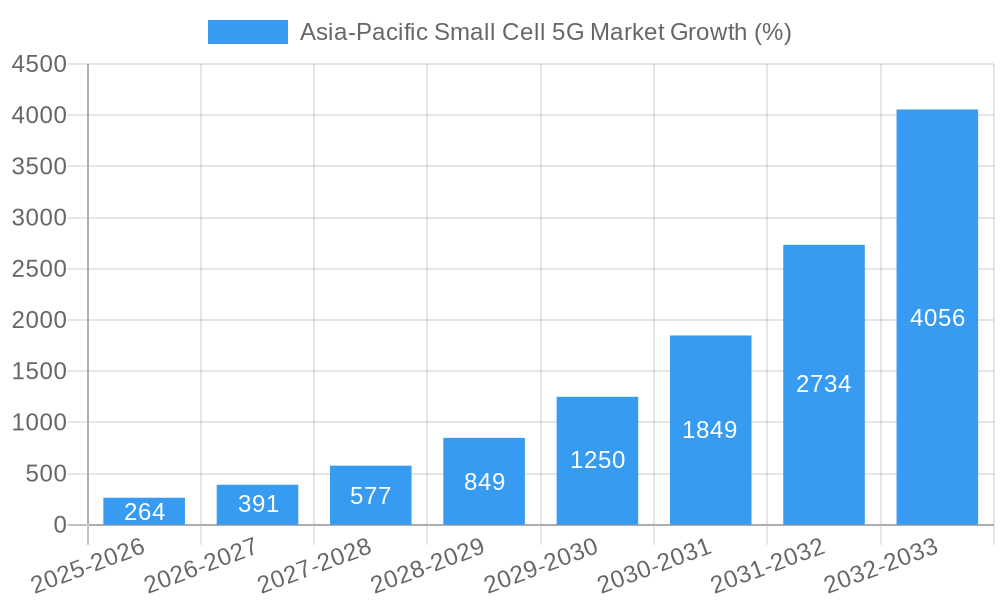

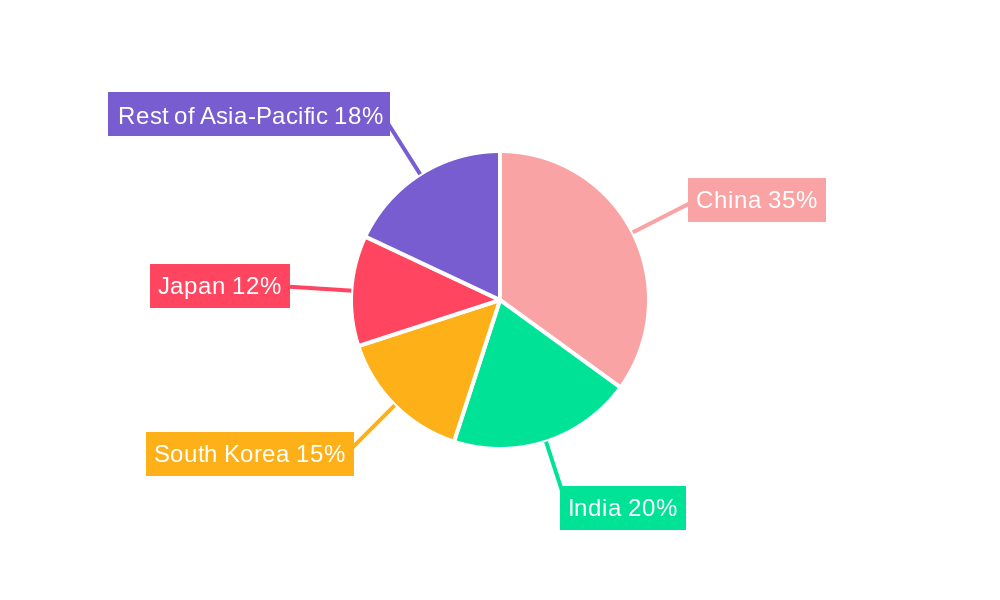

The Asia-Pacific small cell 5G market is experiencing explosive growth, projected to reach a substantial size driven by the increasing demand for high-speed, low-latency connectivity. The region's burgeoning population, rapid urbanization, and the proliferation of smart devices are key catalysts. A compound annual growth rate (CAGR) of 48.16% from 2019 to 2024 indicates a significant market expansion, exceeding the global average. This robust growth is fueled by significant investments in 5G infrastructure by telecom operators and enterprises aiming to enhance network capacity and improve service quality, particularly in densely populated urban areas. China, India, South Korea, and Japan are leading the market, with significant deployment of small cell networks to support the rapidly expanding 5G user base. However, challenges remain, including the high initial investment costs associated with small cell deployment and the need for effective spectrum management. Regulatory hurdles and the complexity of integrating small cells into existing network infrastructure could also pose challenges to market growth. Despite these hurdles, the long-term growth prospects for the Asia-Pacific small cell 5G market remain extremely positive, driven by sustained technological advancements, rising data consumption, and expanding 5G coverage.

The segment breakdown reveals the dominance of telecom operators as the primary end-user, followed by enterprises and residential users. Outdoor deployments currently hold a larger market share compared to indoor deployments, although the latter is expected to witness significant growth in the coming years driven by the increasing demand for high-bandwidth connectivity in indoor environments such as offices, stadiums, and shopping malls. The competitive landscape is dynamic, featuring both established players like Ericsson, CommScope, Samsung, and Huawei, as well as emerging companies specializing in small cell technology. This competition fosters innovation and drives down costs, ultimately benefitting consumers and businesses alike. The market is also characterized by strategic partnerships and collaborations, accelerating the pace of 5G deployment and adoption across the region. Ongoing technological advancements in areas such as software-defined networking and virtualization are also poised to further fuel the growth of this dynamic market.

Asia-Pacific Small Cell 5G Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific small cell 5G market, covering market dynamics, industry trends, key players, and future growth prospects. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report offers actionable insights for industry stakeholders, investors, and businesses seeking to navigate this rapidly evolving landscape. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Asia-Pacific Small Cell 5G Market Market Concentration & Dynamics

The Asia-Pacific small cell 5G market exhibits a moderately concentrated landscape, with key players like Telefonaktiebolaget LM Ericsson, CommScope Inc, Samsung Electronics Co Ltd, and Huawei Technologies Co Ltd holding significant market share. However, the market is also witnessing increased participation from smaller players and startups, fostering innovation and competition.

Market Concentration Metrics (2025 Estimates):

- Top 5 players: xx% market share

- Top 10 players: xx% market share

Market Dynamics:

- Innovation Ecosystems: The region is characterized by a dynamic ecosystem of research institutions, technology providers, and telecom operators driving innovation in small cell 5G technologies. This includes advancements in areas like MIMO, distributed antenna systems (DAS), and software-defined networking (SDN).

- Regulatory Frameworks: Government initiatives promoting 5G infrastructure development and digitalization across the region significantly impact market growth. However, regulatory complexities and varying spectrum allocation policies across different countries pose challenges.

- Substitute Products: While small cells are crucial for 5G deployment, technologies like Wi-Fi 6E and other fixed wireless access (FWA) solutions may pose competitive challenges in specific use cases.

- End-User Trends: Growing demand for high-bandwidth applications, including streaming, cloud gaming, and IoT, is a significant driver of small cell 5G adoption across various verticals. The increasing penetration of smartphones and smart devices further fuels market expansion.

- M&A Activities: The number of M&A deals in the small cell 5G sector has been steadily increasing in recent years, as larger players seek to expand their market reach and acquire specialized technologies. An estimated xx M&A deals were recorded in 2024.

Asia-Pacific Small Cell 5G Market Industry Insights & Trends

The Asia-Pacific small cell 5G market is experiencing robust growth, propelled by increasing 5G network deployments, surging demand for enhanced mobile broadband, and the expanding adoption of IoT devices. The market size reached xx Million in 2024 and is projected to witness significant expansion in the coming years. The key drivers behind this growth include:

- Rapid 5G Network Rollouts: Governments and telecom operators across the region are investing heavily in deploying 5G infrastructure, creating a strong demand for small cells to improve coverage and capacity.

- Increasing Smartphone Penetration: The rising adoption of 5G-enabled smartphones is driving user demand for high-speed mobile data services, fueling the need for improved network infrastructure.

- Growth of IoT Applications: The proliferation of IoT devices necessitates wider and denser network coverage, creating a significant opportunity for small cell deployments.

- Technological Advancements: Continuous innovations in small cell technology, such as improved energy efficiency, smaller form factors, and advanced antenna designs, are driving wider adoption.

The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Key Markets & Segments Leading Asia-Pacific Small Cell 5G Market

China and India represent the largest markets within the Asia-Pacific region, driven by their large populations and substantial investments in 5G infrastructure development. South Korea and Japan also hold significant market share due to their advanced technological infrastructure and high mobile data consumption.

Dominant Segments:

- Operating Environment: The outdoor small cell segment currently dominates the market due to its broader applicability in various environments. However, the indoor segment is experiencing rapid growth, driven by the increasing demand for reliable high-speed connectivity within buildings.

- End-User Vertical: Telecom operators remain the largest segment in terms of revenue generation. However, the enterprise and residential segments are witnessing substantial growth, driven by the expanding adoption of 5G-powered services and applications.

Drivers by Country:

- China: Massive 5G network deployments, government support, and a large pool of telecom operators.

- India: Government initiatives like Digital India, growing smartphone penetration, and expanding 5G infrastructure.

- South Korea: High mobile data consumption, advanced technological infrastructure, and a strong presence of leading technology companies.

- Japan: High mobile data consumption, advanced technological infrastructure, and a focus on smart cities development.

- Rest of Asia Pacific: Growing economies, rising smartphone adoption, and ongoing 5G infrastructure development.

Asia-Pacific Small Cell 5G Market Product Developments

Recent product innovations highlight significant advancements in small cell technology. Ericsson's launch of the Fusion Unit 5G solution and IRU 8850 caters to diverse indoor deployment needs, emphasizing efficiency and cost savings. Nokia's airscale indoor radio (ASiR) solution focuses on improved indoor coverage and enhanced user experience. Huawei's 5G CPE Pro enhances broadband speeds for SMEs and residential users, showcasing the broadening applications of small cell 5G technology. These advancements demonstrate the ongoing efforts to improve network performance, expand coverage, and enhance user experience.

Challenges in the Asia-Pacific Small Cell 5G Market Market

The Asia-Pacific small cell 5G market faces challenges like regulatory hurdles in some countries slowing down spectrum allocation and licensing processes. Supply chain disruptions, particularly concerning semiconductor components, can impact production and deployment timelines. Intense competition among established players and new entrants adds pressure on pricing and margins. These factors create uncertainty and require strategic adaptability from market participants.

Forces Driving Asia-Pacific Small Cell 5G Market Growth

Key growth drivers include: increasing demand for high-speed mobile data, government initiatives supporting 5G deployment, expansion of IoT applications, and continuous technological advancements leading to smaller, more efficient, and cost-effective small cell solutions. These factors collectively ensure sustained market expansion.

Challenges in the Asia-Pacific Small Cell 5G Market Market

Long-term growth hinges on addressing persistent challenges. Overcoming regulatory complexities, securing stable supply chains, and fostering collaboration within the ecosystem are critical for sustained growth. Strategic partnerships and technological innovations can mitigate risks and drive continued expansion.

Emerging Opportunities in Asia-Pacific Small Cell 5G Market

Emerging opportunities exist in the private 5G network space for enterprises, particularly in sectors like manufacturing, healthcare, and logistics. The development and deployment of private 5G networks offering high reliability, low latency, and enhanced security are major opportunities. Furthermore, the expansion of 5G into rural and underserved areas presents significant growth potential.

Leading Players in the Asia-Pacific Small Cell 5G Market Sector

- Telefonaktiebolaget LM Ericsson

- CommScope Inc

- Samsung Electronics Co Ltd

- Qucell Inc

- Cisco Systems Inc

- Qualcomm Technologies Inc

- NEC Corporation

- Huawei Technologies Co Ltd

- ZTE Corporation

- Nokia Corporation

- Airspan Networks Inc

- Baicells Technologies Co Ltd

Key Milestones in Asia-Pacific Small Cell 5G Market Industry

- January 2023: Huawei launched 5G CPE Pro, boosting broadband speeds for SMEs and residential users. This broadened the reach of 5G connectivity and stimulated market demand.

- February 2023: Ericsson launched Fusion Unit 5G and IRU 8850, enhancing indoor 5G coverage and efficiency. This significantly improved the cost-effectiveness of small cell deployments.

- February 2023: The Antina alliance (M1 and StarHub in Singapore) partnered with Nokia to expand 5G coverage using Nokia's small cell solution. This demonstrated the growing collaboration within the industry to improve network coverage and user experience.

Strategic Outlook for Asia-Pacific Small Cell 5G Market Market

The Asia-Pacific small cell 5G market is poised for significant growth, driven by continuous technological innovations, increased investments in 5G infrastructure, and the growing demand for high-speed connectivity across various sectors. Strategic partnerships, expansion into new markets, and focusing on specialized applications will further fuel market expansion and create significant opportunities for market participants.

Asia-Pacific Small Cell 5G Market Segmentation

-

1. Operating Environment

- 1.1. Indoor

- 1.2. Outdoor

-

2. End-User Vertical

- 2.1. Telecom Operators

- 2.2. Enterprises

- 2.3. Residential

Asia-Pacific Small Cell 5G Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Small Cell 5G Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 48.16% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Mobile Data Traffic; Evolution of Network Technology and Connectivity Devices

- 3.3. Market Restrains

- 3.3.1. Poor Backhaul Connectivity

- 3.4. Market Trends

- 3.4.1. Telecom Operators are expected to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Small Cell 5G Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Operating Environment

- 5.1.1. Indoor

- 5.1.2. Outdoor

- 5.2. Market Analysis, Insights and Forecast - by End-User Vertical

- 5.2.1. Telecom Operators

- 5.2.2. Enterprises

- 5.2.3. Residential

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Operating Environment

- 6. China Asia-Pacific Small Cell 5G Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Small Cell 5G Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Small Cell 5G Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Small Cell 5G Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific Small Cell 5G Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Small Cell 5G Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Small Cell 5G Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Telefonaktiebolaget LM Ericsson

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 CommScope Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Samsung Electronics Co Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Qucell Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Cisco Systems Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Qualcomm Technologies Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 NEC Corporation

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Huawei Technologies Co Ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 ZTE Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Nokia Corporation

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Airspan Networks Inc

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Baicells Technologies Co Ltd *List Not Exhaustive

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Telefonaktiebolaget LM Ericsson

List of Figures

- Figure 1: Asia-Pacific Small Cell 5G Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Small Cell 5G Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Small Cell 5G Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Small Cell 5G Market Revenue Million Forecast, by Operating Environment 2019 & 2032

- Table 3: Asia-Pacific Small Cell 5G Market Revenue Million Forecast, by End-User Vertical 2019 & 2032

- Table 4: Asia-Pacific Small Cell 5G Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia-Pacific Small Cell 5G Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia-Pacific Small Cell 5G Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia-Pacific Small Cell 5G Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia-Pacific Small Cell 5G Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia-Pacific Small Cell 5G Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia-Pacific Small Cell 5G Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia-Pacific Small Cell 5G Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia-Pacific Small Cell 5G Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia-Pacific Small Cell 5G Market Revenue Million Forecast, by Operating Environment 2019 & 2032

- Table 14: Asia-Pacific Small Cell 5G Market Revenue Million Forecast, by End-User Vertical 2019 & 2032

- Table 15: Asia-Pacific Small Cell 5G Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Asia-Pacific Small Cell 5G Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Asia-Pacific Small Cell 5G Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Asia-Pacific Small Cell 5G Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Asia-Pacific Small Cell 5G Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Asia-Pacific Small Cell 5G Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: New Zealand Asia-Pacific Small Cell 5G Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Indonesia Asia-Pacific Small Cell 5G Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Malaysia Asia-Pacific Small Cell 5G Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Singapore Asia-Pacific Small Cell 5G Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Thailand Asia-Pacific Small Cell 5G Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Vietnam Asia-Pacific Small Cell 5G Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Philippines Asia-Pacific Small Cell 5G Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Small Cell 5G Market?

The projected CAGR is approximately 48.16%.

2. Which companies are prominent players in the Asia-Pacific Small Cell 5G Market?

Key companies in the market include Telefonaktiebolaget LM Ericsson, CommScope Inc, Samsung Electronics Co Ltd, Qucell Inc, Cisco Systems Inc, Qualcomm Technologies Inc, NEC Corporation, Huawei Technologies Co Ltd, ZTE Corporation, Nokia Corporation, Airspan Networks Inc, Baicells Technologies Co Ltd *List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Small Cell 5G Market?

The market segments include Operating Environment, End-User Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.55 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Mobile Data Traffic; Evolution of Network Technology and Connectivity Devices.

6. What are the notable trends driving market growth?

Telecom Operators are expected to Hold Significant Share.

7. Are there any restraints impacting market growth?

Poor Backhaul Connectivity.

8. Can you provide examples of recent developments in the market?

February 2023: Ericsson launched Fusion Unit 5G solution for indoor coverage to cater to small and medium-sized building requirements like movie theaters, restaurants, chain stores, etc. The solution is proficient in technologies like distributed antenna systems (DAS) and small cells. In addition, Ericsson also introduced an indoor radio unit (IRU) 8850 for single or multi-operator deployments in medium to large spaces, which can serve up to eight venues from one centralized location, with a 10 km fiber reach. The clients adopting these new products will be able to save time, as it will boost signal strength and even cost as the same infrastructure will be used for its deployment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Small Cell 5G Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Small Cell 5G Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Small Cell 5G Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Small Cell 5G Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence