Key Insights

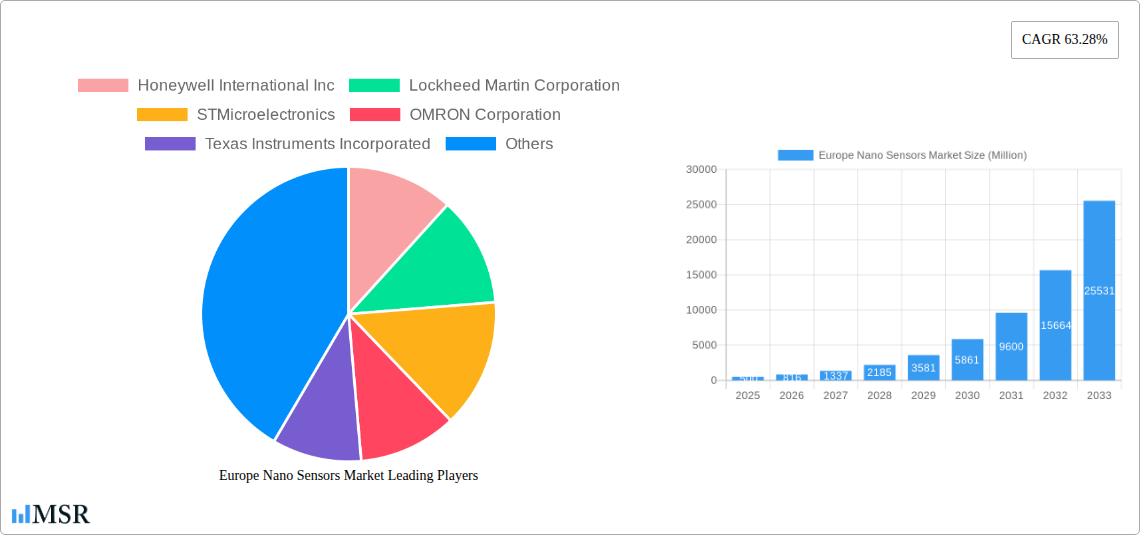

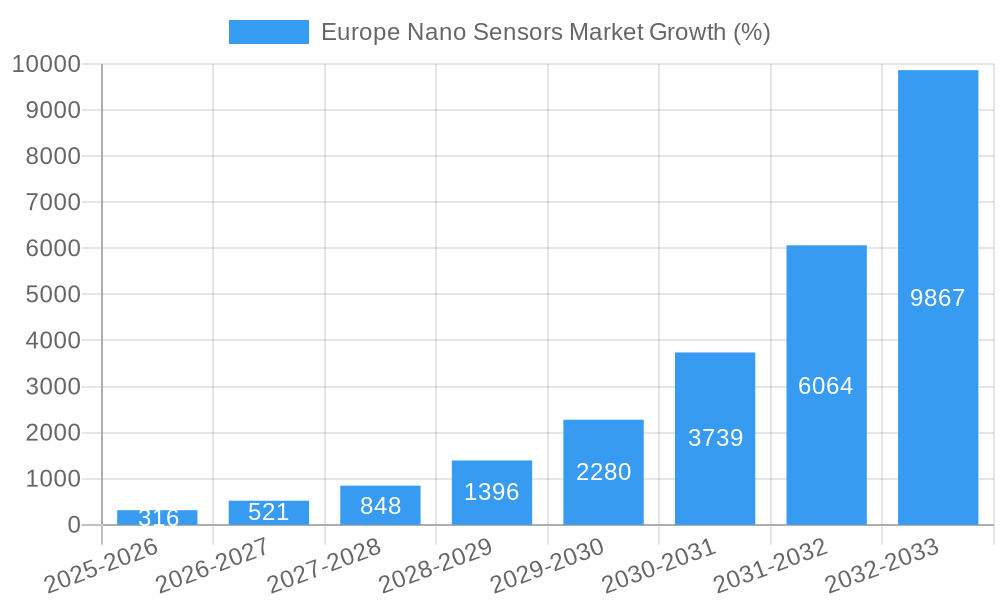

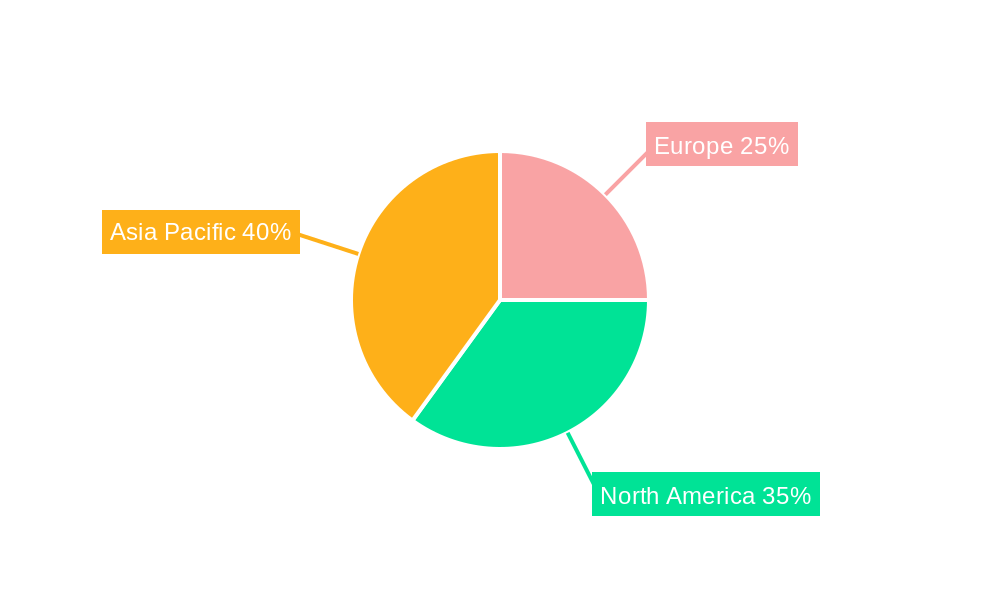

The European nano sensors market is experiencing robust growth, fueled by a compound annual growth rate (CAGR) of 63.28% from 2019 to 2024. This surge is primarily driven by the increasing adoption of nano sensors across diverse sectors, including consumer electronics (driven by miniaturization and improved functionality in smartphones and wearables), automotive (for advanced driver-assistance systems and enhanced safety features), and healthcare (for early disease detection and personalized medicine). Technological advancements leading to higher sensitivity, improved accuracy, and reduced production costs are further accelerating market expansion. The market is segmented by sensor type (optical, electrochemical, electromechanical) and end-user industry, with consumer electronics and automotive currently dominating, followed by healthcare and industrial applications demonstrating significant growth potential. Germany, France, and the UK represent the largest national markets within Europe, benefiting from robust R&D investments and a strong presence of established sensor manufacturers and technology integrators. However, regulatory hurdles related to data privacy and safety standards, as well as the high initial investment costs associated with nano sensor technology, pose challenges to market growth. The forecast period (2025-2033) anticipates continued strong expansion, driven by ongoing technological innovation and increasing demand across various application areas, particularly in emerging fields such as the Internet of Things (IoT) and smart cities.

The projected market value for 2025, based on the provided CAGR and assuming a reasonable starting point, will serve as a foundational figure for estimating subsequent years' values. Using this base, a logical extrapolation across the forecast period (2025-2033) can be generated by applying the provided CAGR. This process accounts for the anticipated market dynamism, including further technological advancements and expanded application possibilities, providing a reliable projection of market growth. Continued expansion in specific industry verticals, like healthcare and industrial automation, is anticipated to drive substantial growth within the European market. This growth will likely be unevenly distributed across European nations, with countries possessing advanced technological infrastructures and strong regulatory frameworks experiencing more rapid growth than others. Competitive dynamics, including mergers, acquisitions, and the entry of new players, will also influence the overall market trajectory.

Europe Nano Sensors Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe nano sensors market, offering invaluable insights for stakeholders across the industry. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, key players, emerging trends, and future growth potential. The market is segmented by type (Optical Sensor, Electrochemical Sensor, Electromechanical Sensor) and end-user industry (Consumer Electronics, Power Generation, Automotive, Aerospace and Defense, Healthcare, Industrial, Other End-User Industries), providing a granular understanding of this rapidly evolving sector. Key players analyzed include Honeywell International Inc, Lockheed Martin Corporation, STMicroelectronics, OMRON Corporation, Texas Instruments Incorporated, Agilent Technologies, Analog Devices Inc, Teledyne Technologies, and Samsung Electronics co Limited. The report's value surpasses xx Million.

Europe Nano Sensors Market Market Concentration & Dynamics

The European nano sensors market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the presence of numerous smaller, specialized firms fosters a dynamic competitive environment. Innovation ecosystems are flourishing, particularly in countries like Germany and the UK, driven by substantial R&D investments and collaborations between academia and industry. Stringent regulatory frameworks, particularly concerning health and safety standards for nano-materials, significantly influence market growth. Substitute products, such as conventional sensors with less advanced technology, present a degree of competition, although the superior sensitivity and accuracy of nano sensors are driving market adoption. End-user trends favor miniaturization and increased functionality, pushing demand for advanced nano sensor technologies. Mergers and acquisitions (M&A) activity has been relatively moderate in recent years, with xx M&A deals recorded between 2019 and 2024. Market share data indicates that Honeywell International Inc. and STMicroelectronics currently hold the largest shares, each accounting for approximately xx% of the market.

- Market Concentration: Moderately concentrated, with a few dominant players and numerous smaller firms.

- Innovation Ecosystems: Strong in Germany and the UK, fueled by R&D investment and collaborations.

- Regulatory Frameworks: Stringent, impacting market growth and product development.

- Substitute Products: Conventional sensors offer some competition, but the advantages of nano sensors are driving market expansion.

- End-User Trends: Demand for miniaturization and advanced functionality.

- M&A Activity: Moderate, with xx deals recorded between 2019-2024.

Europe Nano Sensors Market Industry Insights & Trends

The Europe nano sensors market is experiencing robust growth, with a Compound Annual Growth Rate (CAGR) of xx% projected from 2025 to 2033. The market size is estimated to reach xx Million by 2025. This growth is primarily driven by the increasing demand for advanced sensing capabilities across various end-user industries. Technological disruptions, such as the development of highly sensitive and selective nano sensors, are fueling innovation and expanding market applications. Evolving consumer behaviors, particularly a growing preference for smart and connected devices, are also significantly influencing market expansion. The automotive sector's growing adoption of advanced driver-assistance systems (ADAS) and the burgeoning Internet of Things (IoT) are major contributors to market growth. Furthermore, increasing investments in research and development of nanotechnology applications across diverse fields, and government initiatives promoting the development of advanced sensor technologies are key growth catalysts.

Key Markets & Segments Leading Europe Nano Sensors Market

The automotive sector currently dominates the Europe nano sensors market, followed by the healthcare and consumer electronics sectors. Germany and the UK are the leading countries in terms of market size and adoption of nano sensor technology. Within sensor types, optical sensors hold the largest market share due to their versatility and high precision, although electrochemical sensors are witnessing rapid growth owing to their suitability for a wide range of applications including environmental monitoring and biomedical diagnostics.

Key Drivers by Segment:

- Automotive: Growing demand for ADAS, improved safety features, and increased vehicle automation.

- Healthcare: Advancements in medical diagnostics, drug delivery systems, and personalized medicine.

- Consumer Electronics: Rising adoption of smart devices, wearables, and IoT applications.

- Optical Sensors: Versatility, high precision, and suitability for diverse applications.

- Electrochemical Sensors: Growing use in environmental monitoring and biomedical diagnostics.

The dominance of the automotive and healthcare sectors is expected to continue throughout the forecast period, fueled by sustained investments in technological advancements and regulatory support. The German and UK markets will likely maintain their leading positions, driven by a strong industrial base and supportive governmental policies.

Europe Nano Sensors Market Product Developments

Recent years have witnessed significant advancements in nano sensor technology, including the development of more sensitive, selective, and miniaturized sensors with improved signal processing and data analysis capabilities. These improvements have expanded the range of applications for nano sensors, leading to increased market penetration across various industries. Key advancements include the integration of nanomaterials such as graphene and carbon nanotubes, which enhance sensor performance and durability. Furthermore, the development of wireless and integrated sensor systems is simplifying implementation and increasing market appeal. This ongoing innovation fuels strong competitive pressures and drives continual product enhancements.

Challenges in the Europe Nano Sensors Market Market

The Europe nano sensors market faces several challenges, including stringent regulatory requirements, which increase the cost and complexity of bringing new products to market. Supply chain disruptions, particularly in the procurement of specialized nanomaterials, pose another significant hurdle, leading to production delays and price fluctuations. Furthermore, intense competition among established players and new entrants requires ongoing innovation and strategic investments to maintain market share. These factors collectively impact market growth and profitability. The estimated impact of these challenges on overall market growth is approximately xx%.

Forces Driving Europe Nano Sensors Market Growth

Technological advancements in nanomaterials and sensor design are primary drivers of market growth. The increasing demand for miniaturization and integration of sensors into various products fuels market expansion. Economic factors, including rising disposable incomes and increased investment in R&D, also contribute significantly. Supportive government regulations and policies aimed at promoting the development and adoption of advanced sensor technologies further drive market growth. The increasing prevalence of IoT devices and smart technologies presents a vast opportunity for the growth of nano sensors market.

Long-Term Growth Catalysts in Europe Nano Sensors Market

Long-term growth in the Europe nano sensors market is driven by continuous innovation in sensor design and materials. Strategic partnerships between research institutions, technology providers, and end-users accelerate product development and market penetration. Expansion into new markets, such as environmental monitoring and industrial automation, along with exploration of emerging technologies like biosensors, will play an important role in sustainable long-term growth. The substantial amount of funding allocated to nanotechnology research, alongside various government support schemes, are key to maintaining momentum.

Emerging Opportunities in Europe Nano Sensors Market

Emerging opportunities include the integration of nano sensors into wearable health monitoring devices, the development of advanced environmental monitoring systems, and the expansion into the burgeoning field of precision agriculture. The utilization of nano sensors in industrial automation for predictive maintenance and process optimization also presents significant potential. Finally, the development of low-cost, high-performance nano sensors will broaden market accessibility. These opportunities are expected to significantly expand the market throughout the forecast period.

Leading Players in the Europe Nano Sensors Market Sector

- Honeywell International Inc

- Lockheed Martin Corporation

- STMicroelectronics

- OMRON Corporation

- Texas Instruments Incorporated

- Agilent Technologies

- Analog Devices Inc

- Teledyne Technologies

- Samsung Electronics co Limited

Key Milestones in Europe Nano Sensors Market Industry

- September 2021: The EPSRC awarded GBP 853,000 to a university for the creation of the Multiscale Metrology Suite (MMS) for Next-Generation Health Nanotechnologies, signifying a significant investment in the advancement of health-related nano sensor technologies. This funding highlights the growing importance and potential of nano sensors in the healthcare sector.

Strategic Outlook for Europe Nano Sensors Market Market

The future of the Europe nano sensors market is exceptionally promising, driven by ongoing technological advancements, increasing demand across diverse sectors, and supportive government initiatives. Strategic opportunities include collaborations between technology providers and end-users to accelerate product development and market penetration, particularly in emerging application areas. Companies focusing on innovation and strategic partnerships are well-positioned to capitalize on the significant growth potential that lies ahead. The market is poised for considerable expansion, with continued growth fueled by both established applications and the emergence of new ones.

Europe Nano Sensors Market Segmentation

-

1. Type

- 1.1. Optical Sensor

- 1.2. Electrochemical Sensor

- 1.3. Electromechanical Sensor

-

2. End-User Industry

- 2.1. Consumer Electronics

- 2.2. Power Generation

- 2.3. Automotive

- 2.4. Aerospace and Defense

- 2.5. Healthcare

- 2.6. Industrial

- 2.7. Other End-User Industries

Europe Nano Sensors Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Nano Sensors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 63.28% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing adoption of technology in healthcare industry; Increasing research and development in innovative materials

- 3.3. Market Restrains

- 3.3.1. Complexity in Manufacturing Nanosensors

- 3.4. Market Trends

- 3.4.1. Electrochemical biological nano sensors and photometric biological nano sensors find significant demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Nano Sensors Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Optical Sensor

- 5.1.2. Electrochemical Sensor

- 5.1.3. Electromechanical Sensor

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Consumer Electronics

- 5.2.2. Power Generation

- 5.2.3. Automotive

- 5.2.4. Aerospace and Defense

- 5.2.5. Healthcare

- 5.2.6. Industrial

- 5.2.7. Other End-User Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Nano Sensors Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Nano Sensors Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Nano Sensors Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Nano Sensors Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Nano Sensors Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Nano Sensors Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Nano Sensors Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Honeywell International Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Lockheed Martin Corporation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 STMicroelectronics

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 OMRON Corporation

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Texas Instruments Incorporated

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Agilent Technologies

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Analog Devices Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Teledyne Technologies

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Samsung Electronics co Limited

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 Honeywell International Inc

List of Figures

- Figure 1: Europe Nano Sensors Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Nano Sensors Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Nano Sensors Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Nano Sensors Market Volume cubic micrometers Forecast, by Region 2019 & 2032

- Table 3: Europe Nano Sensors Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Europe Nano Sensors Market Volume cubic micrometers Forecast, by Type 2019 & 2032

- Table 5: Europe Nano Sensors Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 6: Europe Nano Sensors Market Volume cubic micrometers Forecast, by End-User Industry 2019 & 2032

- Table 7: Europe Nano Sensors Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Europe Nano Sensors Market Volume cubic micrometers Forecast, by Region 2019 & 2032

- Table 9: Europe Nano Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Europe Nano Sensors Market Volume cubic micrometers Forecast, by Country 2019 & 2032

- Table 11: Germany Europe Nano Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Germany Europe Nano Sensors Market Volume (cubic micrometers) Forecast, by Application 2019 & 2032

- Table 13: France Europe Nano Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France Europe Nano Sensors Market Volume (cubic micrometers) Forecast, by Application 2019 & 2032

- Table 15: Italy Europe Nano Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Italy Europe Nano Sensors Market Volume (cubic micrometers) Forecast, by Application 2019 & 2032

- Table 17: United Kingdom Europe Nano Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United Kingdom Europe Nano Sensors Market Volume (cubic micrometers) Forecast, by Application 2019 & 2032

- Table 19: Netherlands Europe Nano Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Netherlands Europe Nano Sensors Market Volume (cubic micrometers) Forecast, by Application 2019 & 2032

- Table 21: Sweden Europe Nano Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Sweden Europe Nano Sensors Market Volume (cubic micrometers) Forecast, by Application 2019 & 2032

- Table 23: Rest of Europe Europe Nano Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Europe Europe Nano Sensors Market Volume (cubic micrometers) Forecast, by Application 2019 & 2032

- Table 25: Europe Nano Sensors Market Revenue Million Forecast, by Type 2019 & 2032

- Table 26: Europe Nano Sensors Market Volume cubic micrometers Forecast, by Type 2019 & 2032

- Table 27: Europe Nano Sensors Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 28: Europe Nano Sensors Market Volume cubic micrometers Forecast, by End-User Industry 2019 & 2032

- Table 29: Europe Nano Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Europe Nano Sensors Market Volume cubic micrometers Forecast, by Country 2019 & 2032

- Table 31: United Kingdom Europe Nano Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: United Kingdom Europe Nano Sensors Market Volume (cubic micrometers) Forecast, by Application 2019 & 2032

- Table 33: Germany Europe Nano Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Germany Europe Nano Sensors Market Volume (cubic micrometers) Forecast, by Application 2019 & 2032

- Table 35: France Europe Nano Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: France Europe Nano Sensors Market Volume (cubic micrometers) Forecast, by Application 2019 & 2032

- Table 37: Italy Europe Nano Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Italy Europe Nano Sensors Market Volume (cubic micrometers) Forecast, by Application 2019 & 2032

- Table 39: Spain Europe Nano Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Spain Europe Nano Sensors Market Volume (cubic micrometers) Forecast, by Application 2019 & 2032

- Table 41: Netherlands Europe Nano Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Netherlands Europe Nano Sensors Market Volume (cubic micrometers) Forecast, by Application 2019 & 2032

- Table 43: Belgium Europe Nano Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Belgium Europe Nano Sensors Market Volume (cubic micrometers) Forecast, by Application 2019 & 2032

- Table 45: Sweden Europe Nano Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Sweden Europe Nano Sensors Market Volume (cubic micrometers) Forecast, by Application 2019 & 2032

- Table 47: Norway Europe Nano Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Norway Europe Nano Sensors Market Volume (cubic micrometers) Forecast, by Application 2019 & 2032

- Table 49: Poland Europe Nano Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Poland Europe Nano Sensors Market Volume (cubic micrometers) Forecast, by Application 2019 & 2032

- Table 51: Denmark Europe Nano Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Denmark Europe Nano Sensors Market Volume (cubic micrometers) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Nano Sensors Market?

The projected CAGR is approximately 63.28%.

2. Which companies are prominent players in the Europe Nano Sensors Market?

Key companies in the market include Honeywell International Inc, Lockheed Martin Corporation, STMicroelectronics, OMRON Corporation, Texas Instruments Incorporated, Agilent Technologies, Analog Devices Inc, Teledyne Technologies, Samsung Electronics co Limited.

3. What are the main segments of the Europe Nano Sensors Market?

The market segments include Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing adoption of technology in healthcare industry; Increasing research and development in innovative materials.

6. What are the notable trends driving market growth?

Electrochemical biological nano sensors and photometric biological nano sensors find significant demand.

7. Are there any restraints impacting market growth?

Complexity in Manufacturing Nanosensors.

8. Can you provide examples of recent developments in the market?

September 2021 - The EPSRC (Engineering and Physical Sciences Research Council) has awarded GBP 853,000 to the University to create the Multiscale Metrology Suite (MMS) for Next-Generation Health Nanotechnologies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in cubic micrometers.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Nano Sensors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Nano Sensors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Nano Sensors Market?

To stay informed about further developments, trends, and reports in the Europe Nano Sensors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence