Key Insights

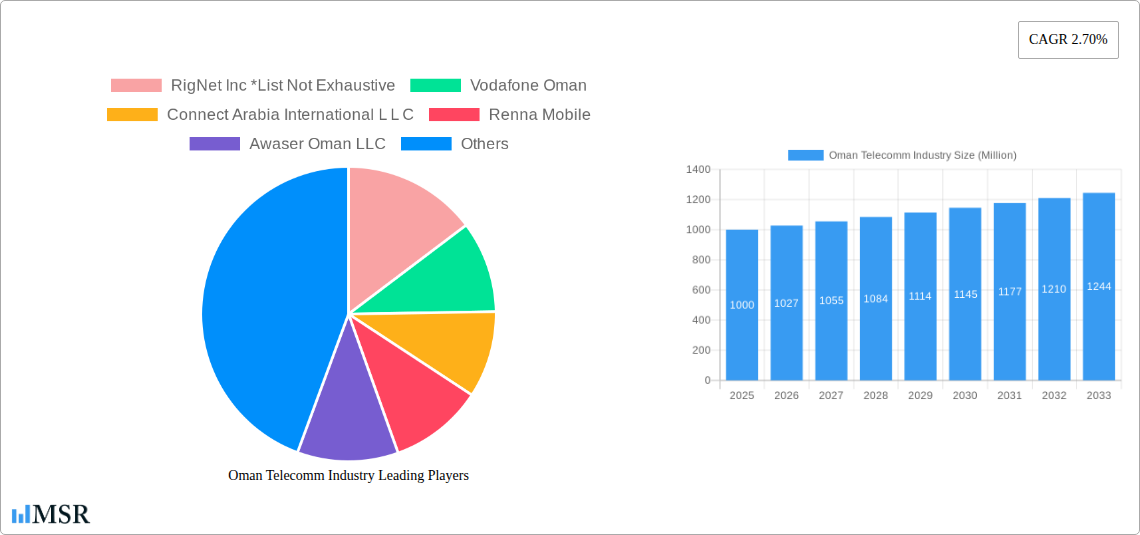

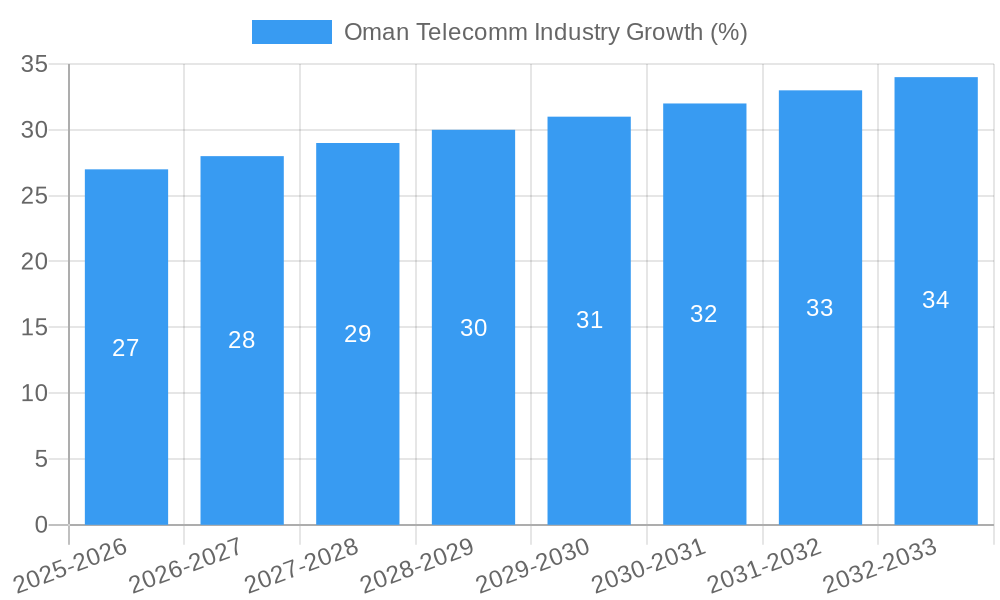

The Oman telecommunications industry, valued at approximately $XX million in 2025 (assuming a logical extrapolation based on the provided CAGR of 2.70% and market size XX), is characterized by a moderate growth trajectory. Drivers for this growth include increasing smartphone penetration, rising data consumption fueled by the popularity of OTT and PayTV services, and government initiatives promoting digital transformation within the country. The market is segmented into Voice Services, Wireless Data and Messaging Services (including increasingly popular internet and handset data packages often bundled with discounts), and rapidly expanding OTT and PayTV Services. Competition is fierce amongst key players like Oman Telecommunications Company, Ooredoo Oman, and Vodafone Oman, amongst others, leading to innovative pricing strategies and service offerings. While the market exhibits healthy growth, challenges exist, including infrastructure limitations in certain regions and potential regulatory hurdles. The average revenue per user (ARPU) for the overall services segment is likely influenced by competitive pressures and evolving consumption patterns, requiring strategic adjustments by providers to maintain profitability. The forecast period (2025-2033) suggests continued growth, though the exact pace will depend on factors such as economic conditions, technological advancements, and regulatory frameworks. The historical period (2019-2024) likely showcased a similar growth pattern, providing a strong baseline for the current forecast. Analyzing this historical data alongside current market trends will be critical to making accurate long-term predictions.

The future of the Omani telecommunications sector hinges on adapting to the shifting consumer landscape. The increasing demand for high-speed data, driven by the proliferation of streaming services and mobile gaming, necessitates substantial investments in network infrastructure upgrades. Operators are also challenged to balance ARPU with the need for competitive pricing, particularly concerning data packages. Strategic partnerships and mergers & acquisitions may play a role in consolidating market share and driving efficiencies. Focus on digital service innovation, tailored to the specific needs of the Omani market, will be key for sustained growth and profitability. The projected growth over the forecast period presents both opportunities and challenges for existing players, requiring a blend of aggressive investment, strategic partnerships, and innovative service offerings.

Oman Telecomm Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Oman telecommunications industry, covering market dynamics, key players, technological advancements, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry stakeholders, investors, and strategists. The report analyzes a market valued at xx Million in 2025 and projects significant growth over the forecast period, driven by factors such as increasing smartphone penetration, rising data consumption, and government initiatives to boost digitalization. The report uses data from the historical period (2019-2024) to provide a robust foundation for future projections. Key segments analyzed include Voice Services, Wireless Data & Messaging, and OTT & PayTV Services, with detailed analysis of Average Revenue Per User (ARPU) and market size estimates for each segment from 2020-2027.

Oman Telecomm Industry Market Concentration & Dynamics

The Oman telecommunications market exhibits moderate concentration, with several major players vying for market share. Omantel and Ooredoo hold significant positions, while other operators like Vodafone Oman and FRiENDi Mobile contribute to the competitive landscape. The market exhibits a dynamic interplay of innovation, regulation, and consumer behavior. The regulatory framework, overseen by the Telecommunications Regulatory Authority (TRA), plays a crucial role in shaping market competition and infrastructure development. The industry is witnessing a surge in the adoption of 5G technology and the expansion of fiber optic networks, driving innovation and enhancing service offerings. Several mergers and acquisitions (M&A) have taken place recently, further consolidating the market and shaping the competitive landscape.

- Market Share: Omantel and Ooredoo hold approximately xx% and xx% market share, respectively, in 2025 (estimated).

- M&A Activity: Over the period 2019-2024, there were approximately xx M&A deals in the Oman telecomm sector. This trend is expected to continue, driven by the need for consolidation and expansion.

- Substitute Products: Over-the-top (OTT) communication services pose a growing challenge to traditional telecom providers, impacting revenue streams from voice and messaging services.

- End-User Trends: Rising smartphone penetration and increasing data consumption are key drivers of market growth, pushing demand for high-speed internet and data-centric packages.

Oman Telecomm Industry Industry Insights & Trends

The Oman telecommunications industry is experiencing robust growth, driven by several factors. The rising adoption of smartphones and mobile internet access among the Omani population has fueled a significant increase in data consumption, creating substantial demand for higher bandwidth services. Technological advancements, such as the deployment of 5G networks and the expansion of fiber optic infrastructure, are enhancing network capacity and speed. Government initiatives aimed at promoting digitalization and the development of the digital economy further support market growth. These factors have led to a Compound Annual Growth Rate (CAGR) of xx% for the overall market during the period 2019-2024. The market size is projected to reach xx Million by 2033. Evolving consumer preferences, such as the increasing demand for bundled services and customized data packages, also influence market dynamics. The industry also witnesses continuous innovation in areas like IoT (Internet of Things) and cloud computing, generating new revenue streams.

Key Markets & Segments Leading Oman Telecomm Industry

The Oman telecommunications market is primarily driven by the urban areas, which exhibit higher smartphone penetration and internet usage. The Wireless: Data and Messaging Services segment is the most significant revenue contributor, accounting for an estimated xx% of the total market revenue in 2025. The growth of this segment is underpinned by the explosive demand for mobile internet access and data-intensive applications.

- Key Drivers:

- Economic growth and rising disposable incomes.

- Government investment in digital infrastructure.

- Increasing smartphone penetration.

- Growing demand for high-speed internet access.

- Segment Analysis:

- Voice Services: The market for voice services is gradually declining, with ARPU for this segment estimated to be xx per user in 2025. Market size in 2025 is estimated at xx Million.

- Wireless Data & Messaging: This segment is experiencing the highest growth, with a projected market size of xx Million in 2025, and an estimated ARPU of xx per user.

- OTT and PayTV Services: This segment is growing steadily and offering exciting growth opportunities, projected to reach xx Million in 2025.

Oman Telecomm Industry Product Developments

Recent product innovations in the Oman telecom sector include the introduction of advanced data center interconnect (DCI) solutions by Omantel, enhancing network capacity and speed. Vodafone Oman's enhancement of its network capabilities through its partnership with Netcracker improves service quality and customer experience. These developments highlight the industry's focus on technological advancements to improve services and maintain a competitive edge.

Challenges in the Oman Telecomm Industry Market

The Oman telecomm industry faces several challenges, including regulatory hurdles related to licensing and spectrum allocation that can constrain market expansion and innovation. Supply chain disruptions and the global chip shortage can impact the deployment of new infrastructure and equipment. Intense competition among established players and the emergence of new entrants intensify the pressure to maintain profitability and market share. These factors collectively impact the industry's ability to deliver cost-effective, high-quality services and achieve projected growth targets.

Forces Driving Oman Telecomm Industry Growth

Several factors drive the growth of Oman's telecommunications industry. Technological advancements such as the rollout of 5G and fiber-optic networks are crucial. Government support for digital transformation through infrastructure investment and regulatory reforms also fosters growth. The rising adoption of smartphones and increased data consumption among the population significantly contribute to market expansion. These factors collectively create favorable conditions for significant and sustained industry growth.

Long-Term Growth Catalysts in Oman Telecomm Industry

Long-term growth will be fueled by innovations in areas like IoT and cloud computing. Strategic partnerships between telecom operators and technology providers are also key to introducing new technologies and services. The expansion of broadband access into underserved regions will further contribute to market expansion.

Emerging Opportunities in Oman Telecomm Industry

The Oman telecomm industry presents significant opportunities, including the expansion of 5G services. The growing demand for cloud-based services and the potential of IoT applications create lucrative avenues for growth. Addressing the digital divide through the expansion of broadband access to underserved areas provides immense potential.

Leading Players in the Oman Telecomm Industry Sector

- RigNet Inc

- Vodafone Oman

- Connect Arabia International L L C

- Renna Mobile

- Awaser Oman LLC

- Oman Telecommunications Company

- Ooredoo Oman

- Zajel Communications LLC

- FRiENDi Mobile

- TeO Telecom

Key Milestones in Oman Telecomm Industry Industry

- November 2022: Omantel introduces 400GbE DCI assistance using Ciena's solution, enhancing its data center interconnect capabilities and improving customer experience for wholesale, cloud, and content provider clients.

- October 2022: Vodafone Oman strengthens its partnership with Netcracker, adding new capabilities to expand operations and improve customer experience.

Strategic Outlook for Oman Telecomm Industry Market

The Oman telecommunications market shows significant growth potential over the forecast period. Strategic investments in infrastructure, particularly 5G deployment and fiber optic networks, will be vital. Innovation in service offerings, focusing on data-centric packages and bundled services tailored to customer needs, will be essential for sustained growth and competitive advantage. Collaborations and partnerships to leverage technological advancements and explore emerging opportunities in areas such as IoT and cloud services will play a key role in shaping the future of the industry.

Oman Telecomm Industry Segmentation

-

1. Segmenta

-

1.1. Voice Services

- 1.1.1. Wired

- 1.1.2. Wireless

- 1.2. Data and

- 1.3. OTT and PayTV Services

-

1.1. Voice Services

Oman Telecomm Industry Segmentation By Geography

- 1. Oman

Oman Telecomm Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Internet Coverage5.1.2 5G Taking Pace

- 3.3. Market Restrains

- 3.3.1. Lack of Good Lighting Conditions

- 3.4. Market Trends

- 3.4.1. Growth in OTT Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Oman Telecomm Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Segmenta

- 5.1.1. Voice Services

- 5.1.1.1. Wired

- 5.1.1.2. Wireless

- 5.1.2. Data and

- 5.1.3. OTT and PayTV Services

- 5.1.1. Voice Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Oman

- 5.1. Market Analysis, Insights and Forecast - by Segmenta

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 RigNet Inc *List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Vodafone Oman

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Connect Arabia International L L C

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Renna Mobile

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Awaser Oman LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Oman Telecommunications Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ooredoo Oman

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Zajel Communications LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 FRiENDi Mobile

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 TeO Telecom

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 RigNet Inc *List Not Exhaustive

List of Figures

- Figure 1: Oman Telecomm Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Oman Telecomm Industry Share (%) by Company 2024

List of Tables

- Table 1: Oman Telecomm Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Oman Telecomm Industry Revenue Million Forecast, by Segmenta 2019 & 2032

- Table 3: Oman Telecomm Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Oman Telecomm Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Oman Telecomm Industry Revenue Million Forecast, by Segmenta 2019 & 2032

- Table 6: Oman Telecomm Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oman Telecomm Industry?

The projected CAGR is approximately 2.70%.

2. Which companies are prominent players in the Oman Telecomm Industry?

Key companies in the market include RigNet Inc *List Not Exhaustive, Vodafone Oman, Connect Arabia International L L C, Renna Mobile, Awaser Oman LLC, Oman Telecommunications Company, Ooredoo Oman, Zajel Communications LLC, FRiENDi Mobile, TeO Telecom.

3. What are the main segments of the Oman Telecomm Industry?

The market segments include Segmenta.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Wide Internet Coverage5.1.2 5G Taking Pace.

6. What are the notable trends driving market growth?

Growth in OTT Services.

7. Are there any restraints impacting market growth?

Lack of Good Lighting Conditions.

8. Can you provide examples of recent developments in the market?

November 2022: The first and foremost supplier of comprehensive telecommunications services in Oman, Omantel, disclosed the introduction of 400GbE DCI assistance employing Ciena's solution for Data Centre Interconnect. The service is made to provide a superior customer experience while meeting the constantly increasing connection needs of Omantel's wholesale, cloud, and content provider clients.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oman Telecomm Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oman Telecomm Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oman Telecomm Industry?

To stay informed about further developments, trends, and reports in the Oman Telecomm Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence