Key Insights

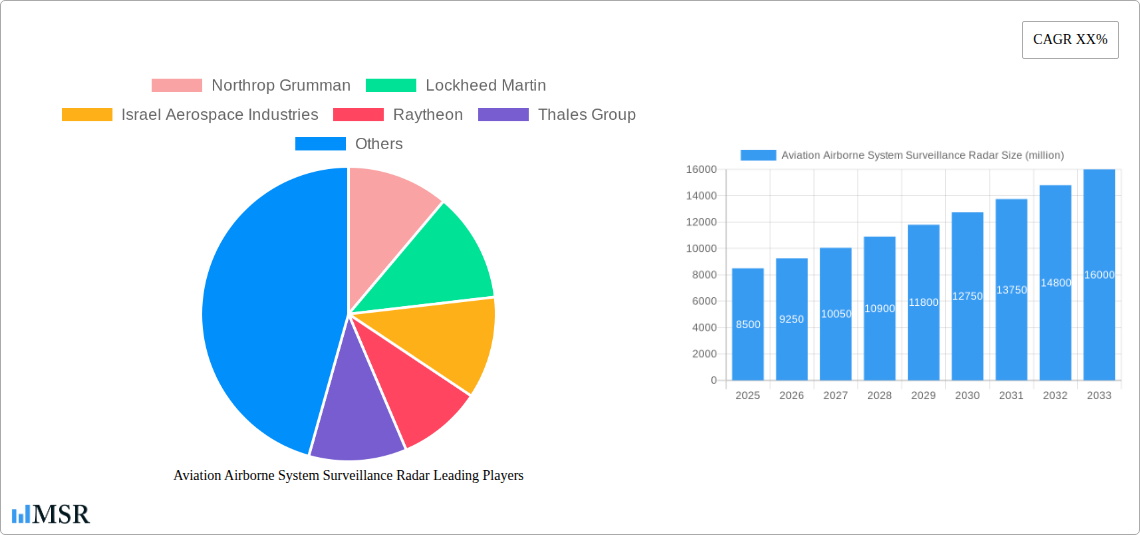

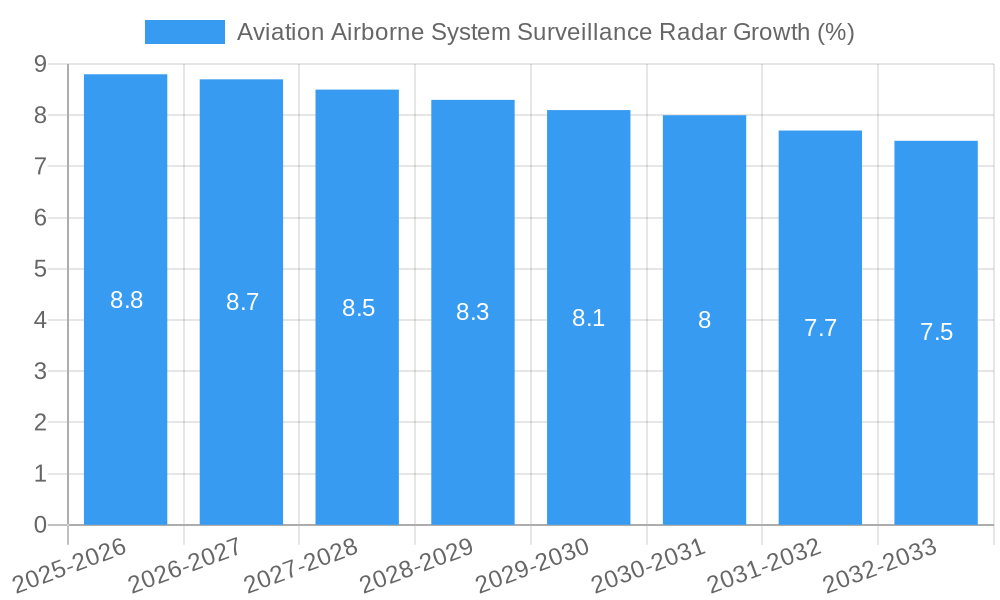

The Aviation Airborne System Surveillance Radar market is poised for robust expansion, projected to reach an estimated market size of approximately USD 8,500 million by 2025, with a compound annual growth rate (CAGR) of around 8.5% during the forecast period of 2025-2033. This significant growth is primarily fueled by escalating defense budgets worldwide and the increasing demand for advanced surveillance capabilities in both military and civilian aviation sectors. The continuous evolution of aerial threats and the need for enhanced situational awareness for fighter jets, transport aircraft, and unmanned aerial vehicles (UAVs) are key drivers. Furthermore, advancements in radar technology, including miniaturization, improved resolution, and multi-functionality, are creating new opportunities and expanding the application scope of these systems. The rising adoption of airborne surveillance radars in unmanned aircraft for persistent monitoring, intelligence gathering, and border patrol further underscores the market's upward trajectory.

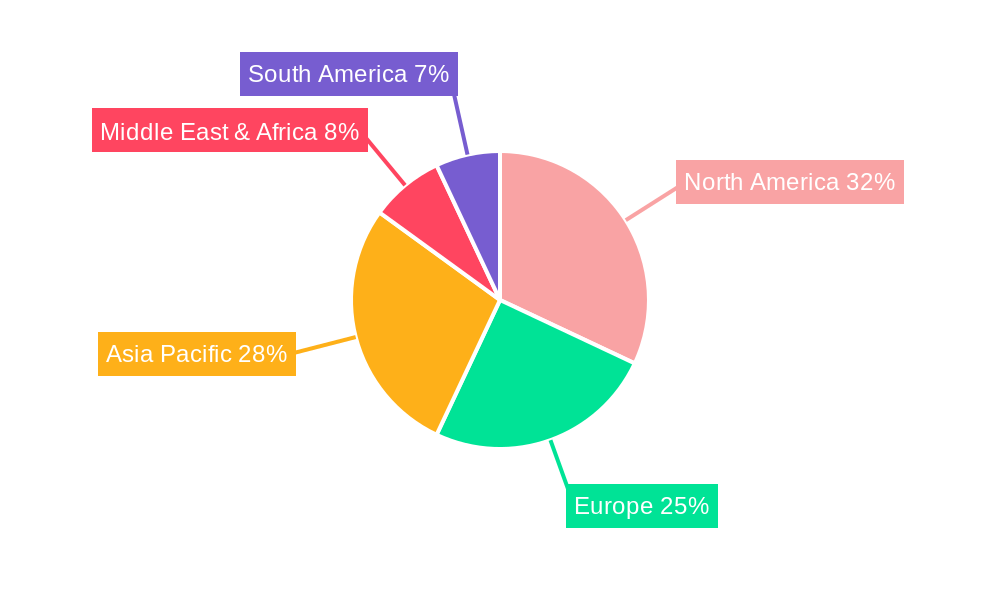

The market is segmented by application into Military Aircraft and Civilian Aircraft, with Military Aircraft currently dominating due to substantial defense investments. Within the types, Manned Aircraft Mounted Surveillance Radars hold a significant share, but Unmanned Aircraft Mounted Surveillance Radars are exhibiting a faster growth rate, reflecting the burgeoning drone industry and its increasing reliance on sophisticated sensor technology. Key industry players like Northrop Grumman, Lockheed Martin, and Raytheon are at the forefront of innovation, driving technological advancements and expanding their market presence. Restraints such as the high cost of development and integration, coupled with stringent regulatory approvals, present challenges. However, ongoing technological innovations, particularly in areas like AI-powered radar data processing and all-weather operational capabilities, are expected to overcome these hurdles and propel the market forward, especially in regions like North America and Asia Pacific, which represent substantial market shares.

Aviation Airborne System Surveillance Radar Market Analysis Report

Unlock critical insights into the global Aviation Airborne System Surveillance Radar market with this comprehensive report. Spanning from 2019 to 2033, this analysis provides an in-depth look at market dynamics, key trends, technological advancements, and strategic outlook for industry stakeholders. Featuring an estimated market size of over xx million by 2025, this report is essential for understanding the competitive landscape and identifying future growth avenues.

Aviation Airborne System Surveillance Radar Market Concentration & Dynamics

The Aviation Airborne System Surveillance Radar market exhibits a moderate to high concentration, driven by the presence of several large, established aerospace and defense conglomerates. Key players such as Northrop Grumman, Lockheed Martin, Israel Aerospace Industries, Raytheon, Thales Group, SAAB AB, Finmeccanica SPA, BAE Systems, Telephonics, CASIC, and Harris significantly influence market dynamics through their extensive research and development capabilities, established supply chains, and strong government contracts. Innovation ecosystems are thriving, with continuous advancements in sensor technology, signal processing, and data fusion. Regulatory frameworks, primarily driven by defense procurement policies and aviation safety standards, play a crucial role in shaping market access and product development. While direct substitute products for comprehensive airborne surveillance radar are limited, advancements in alternative sensing technologies (e.g., electro-optical/infrared systems) can exert indirect competitive pressure. End-user trends are increasingly favoring multi-mission capabilities, miniaturization for unmanned platforms, and enhanced data analytics for improved situational awareness. Mergers and acquisition (M&A) activities, while not overly frequent, can signal strategic shifts and consolidation within niche segments, with an estimated xx M&A deals observed during the study period. Understanding these dynamics is crucial for navigating the competitive terrain and capitalizing on emerging opportunities within this vital sector.

Aviation Airborne System Surveillance Radar Industry Insights & Trends

The Aviation Airborne System Surveillance Radar industry is poised for robust growth, driven by escalating global security concerns, increasing adoption of advanced surveillance technologies in both military and civilian aviation, and continuous technological innovation. The global market size is projected to reach an impressive xx million by the base year 2025 and is expected to expand at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025–2033. This growth is underpinned by several key factors. Geopolitical tensions worldwide are necessitating enhanced border control, maritime surveillance, and tactical reconnaissance capabilities, directly fueling demand for sophisticated airborne radar systems. Furthermore, the burgeoning aviation sector, encompassing both commercial airliners and the rapidly expanding unmanned aerial vehicle (UAV) market, presents significant opportunities for airborne surveillance radar adoption. These systems are critical for air traffic management, collision avoidance, weather monitoring, and search and rescue operations.

Technological disruptions are at the forefront of market evolution. The integration of Artificial Intelligence (AI) and Machine Learning (ML) into radar systems is enabling real-time data analysis, automated target recognition, and improved threat detection with unprecedented accuracy. Advancements in gallium nitride (GaN) semiconductor technology are facilitating the development of more powerful, efficient, and compact radar systems, particularly crucial for integration into smaller platforms like drones. The transition towards software-defined radar architectures offers greater flexibility, adaptability, and upgradability, allowing systems to be reconfigured for different missions and operational environments.

Evolving consumer behaviors, though less direct in the defense sector, are influencing civilian applications. Increased demand for safer skies, efficient air traffic management, and improved search and rescue capabilities are driving investments in advanced surveillance technologies for commercial aircraft. In the unmanned segment, the desire for extended flight durations and enhanced operational capabilities necessitates lighter and more energy-efficient radar solutions. The increasing focus on comprehensive battlefield awareness and the need for persistent surveillance in complex operational theaters are further propelling the demand for multi-function radar systems capable of performing a range of tasks, from ground surveillance to electronic warfare. The report forecasts a significant increase in the adoption of synthetic aperture radar (SAR) and other advanced imaging radar technologies for their superior resolution and all-weather capabilities.

Key Markets & Segments Leading Aviation Airborne System Surveillance Radar

The Aviation Airborne System Surveillance Radar market is characterized by strong regional and segmental leadership, driven by a confluence of economic, geopolitical, and technological factors.

Military Aircraft Segment Dominance

The Military Aircraft segment is the undisputed leader in the Aviation Airborne System Surveillance Radar market. This dominance is attributed to:

- Escalating Global Security Concerns: Increased geopolitical tensions, the rise of asymmetric warfare, and the need for persistent surveillance in contested regions are driving substantial investments in advanced military radar systems. Nations are prioritizing platforms equipped with sophisticated airborne surveillance radars for reconnaissance, intelligence gathering, target acquisition, and electronic warfare capabilities.

- Defense Modernization Programs: Many countries are undergoing extensive military modernization programs, with a significant focus on enhancing air force capabilities. This includes upgrading existing fighter jets, bombers, and reconnaissance aircraft with state-of-the-art radar systems, as well as procuring new platforms designed with integrated advanced surveillance technologies.

- Operational Requirements for ISR: Intelligence, Surveillance, and Reconnaissance (ISR) missions are paramount for modern military operations. Airborne surveillance radars are indispensable for providing real-time battlefield awareness, tracking enemy movements, and identifying threats in diverse operational environments, from arid deserts to dense jungle terrains.

- Technological Advancements in Military Radar: Innovations such as Active Electronically Scanned Array (AESA) radar, which offers superior performance, multi-functionality, and resistance to jamming, are primarily being adopted in military aircraft, further solidifying this segment's lead.

Unmanned Aircraft Mounted Surveillance Radar Segment Growth

While the Military Aircraft segment leads, the Unmanned Aircraft Mounted Surveillance Radar segment is experiencing the most rapid growth and is poised to significantly influence future market dynamics. This surge is propelled by:

- Cost-Effectiveness and Reduced Risk: UAVs offer a more cost-effective and less risky alternative to manned aircraft for many surveillance missions, especially those in hazardous environments. This makes them an attractive option for nations with constrained defense budgets or those seeking to minimize crew exposure.

- Miniaturization and Power Efficiency: Advancements in radar technology, particularly the development of smaller, lighter, and more power-efficient radar systems, are enabling their integration into increasingly smaller and longer-endurance UAV platforms.

- Expanding Applications: Beyond traditional military reconnaissance, UAV-mounted radars are finding applications in border patrol, maritime surveillance, disaster management, infrastructure inspection, and precision agriculture, broadening their market appeal.

- Advancements in AI and Data Processing for UAVs: The integration of AI and advanced data processing capabilities allows UAVs equipped with surveillance radars to autonomously identify targets, analyze data, and transmit actionable intelligence, enhancing their operational effectiveness.

Regional Dominance: North America and Asia-Pacific

- North America: This region, particularly the United States, leads due to its substantial defense spending, ongoing military modernization initiatives, and a strong presence of leading aerospace and defense manufacturers like Northrop Grumman, Lockheed Martin, and Raytheon. The emphasis on advanced ISR capabilities and the development of next-generation combat aircraft and unmanned systems drives high demand.

- Asia-Pacific: This region is emerging as a significant growth hub, driven by increasing defense budgets, rising geopolitical tensions, and a growing interest in modernizing military and civilian aviation fleets. Countries like China, India, and South Korea are investing heavily in indigenous defense capabilities, including advanced radar systems, and are also key markets for international suppliers. The rapid expansion of the commercial aviation sector and the increasing adoption of UAVs for various applications also contribute to this region's prominence.

Aviation Airborne System Surveillance Radar Product Developments

Recent product developments in Aviation Airborne System Surveillance Radar are focused on enhancing multi-functionality, miniaturization, and data processing capabilities. Companies are integrating Artificial Intelligence (AI) and Machine Learning (ML) for superior target recognition and threat assessment. For instance, advancements in AESA radar technology allow for simultaneous operation of multiple modes, such as air-to-air combat, air-to-ground mapping, and electronic warfare. The development of compact, lightweight radar systems is enabling their integration into a wider range of platforms, including small unmanned aerial vehicles (UAVs), expanding surveillance capabilities for diverse applications, from reconnaissance to infrastructure monitoring. These innovations are crucial for maintaining a competitive edge and addressing the evolving demands of both military and civilian aviation sectors.

Challenges in the Aviation Airborne System Surveillance Radar Market

The Aviation Airborne System Surveillance Radar market faces several significant challenges that can impact growth and adoption. Regulatory hurdles, particularly concerning export controls for advanced defense technologies and spectrum allocation for radar operations, can slow down deployment and international market access. Supply chain disruptions, exacerbated by global events and the specialized nature of components, can lead to production delays and increased costs. Competitive pressures from both established players and emerging niche technology providers necessitate continuous innovation and cost optimization. Furthermore, the high research and development costs associated with cutting-edge radar technology can be a barrier, especially for smaller companies.

Forces Driving Aviation Airborne System Surveillance Radar Growth

Several key forces are driving the growth of the Aviation Airborne System Surveillance Radar market. The escalating global security landscape and the persistent need for enhanced intelligence, surveillance, and reconnaissance (ISR) capabilities in military operations are primary drivers. The rapid expansion of the unmanned aerial vehicle (UAV) market, fueled by cost-effectiveness and versatility, is creating a substantial demand for miniaturized and efficient airborne radar systems. Advancements in sensor technology, including the adoption of Gallium Nitride (GaN) and the development of sophisticated signal processing algorithms, are leading to more capable and compact radar solutions. Furthermore, increasing investments in air traffic management modernization and civilian surveillance applications, driven by the need for enhanced safety and efficiency in air travel, are also significant growth catalysts.

Challenges in the Aviation Airborne System Surveillance Radar Market

Long-term growth catalysts for the Aviation Airborne System Surveillance Radar market are deeply intertwined with ongoing technological advancements and evolving operational demands. The continuous pursuit of higher resolution, all-weather sensing capabilities, and the integration of advanced data fusion techniques to provide commanders with comprehensive situational awareness will fuel sustained development. The increasing reliance on AI and machine learning for automated target recognition and real-time threat analysis will drive innovation in software-defined radar architectures. Partnerships and collaborations between prime contractors and specialized component manufacturers are crucial for driving down costs and accelerating the adoption of next-generation technologies across a broader range of platforms, including commercial and unmanned applications. Market expansion into emerging economies with growing defense and aviation sectors also presents significant long-term growth potential.

Emerging Opportunities in Aviation Airborne System Surveillance Radar

Emerging opportunities in the Aviation Airborne System Surveillance Radar market are abundant and span across various sectors. The burgeoning demand for advanced surveillance solutions in homeland security and border patrol applications presents a significant untapped market. The rapid growth of the commercial drone industry for applications like package delivery, infrastructure inspection, and aerial mapping is creating a new segment for compact, affordable airborne radar systems. Furthermore, the integration of airborne radar with other sensor modalities, such as electro-optical/infrared (EO/IR) and electronic intelligence (ELINT), offers enhanced multi-sensor fusion capabilities for improved threat detection and situational awareness. The increasing focus on maritime surveillance, driven by concerns over illegal fishing, piracy, and smuggling, is also a key area for radar system deployment on both manned and unmanned platforms.

Leading Players in the Aviation Airborne System Surveillance Radar Sector

- Northrop Grumman

- Lockheed Martin

- Israel Aerospace Industries

- Raytheon

- Thales Group

- SAAB AB

- Finmeccanica SPA

- BAE Systems

- Telephonics

- CASIC

- Harris

Key Milestones in Aviation Airborne System Surveillance Radar Industry

- 2019: Launch of advanced AESA radar variants for next-generation fighter aircraft, enhancing multi-role capabilities.

- 2020: Significant advancements in GaN technology leading to smaller and more power-efficient radar modules for UAV integration.

- 2021: Increased focus on AI-driven target recognition algorithms for airborne surveillance radars, improving accuracy and reducing operator workload.

- 2022: Several major defense contractors announce strategic partnerships to develop integrated ISR solutions for manned and unmanned platforms.

- 2023: Growing adoption of software-defined radar architectures, offering greater flexibility and upgradability for diverse mission requirements.

- 2024: Emergence of compact surveillance radar solutions specifically designed for small and medium-sized unmanned aerial vehicles.

Strategic Outlook for Aviation Airborne System Surveillance Radar Market

The strategic outlook for the Aviation Airborne System Surveillance Radar market is one of sustained growth and continuous innovation. Key growth accelerators include the increasing demand for enhanced ISR capabilities, the rapid proliferation of unmanned aerial systems, and ongoing advancements in sensor and processing technologies. Strategic opportunities lie in developing multi-function, AI-enabled radar systems that can cater to both military and expanding civilian applications. Partnerships aimed at reducing production costs and improving system integration will be critical for market penetration. Furthermore, focusing on emerging markets and catering to the specific surveillance needs of developing nations will unlock significant future growth potential, ensuring the market remains dynamic and responsive to global security and aviation needs.

Aviation Airborne System Surveillance Radar Segmentation

-

1. Application

- 1.1. Military Aircraft

- 1.2. Civilian Aircraft

-

2. Types

- 2.1. Manned Aircraft Mounted Surveillance Radar

- 2.2. Unmanned Aircraft Mounted Surveillance Radar

Aviation Airborne System Surveillance Radar Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Aviation Airborne System Surveillance Radar REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aviation Airborne System Surveillance Radar Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Military Aircraft

- 5.1.2. Civilian Aircraft

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Manned Aircraft Mounted Surveillance Radar

- 5.2.2. Unmanned Aircraft Mounted Surveillance Radar

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Aviation Airborne System Surveillance Radar Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Military Aircraft

- 6.1.2. Civilian Aircraft

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Manned Aircraft Mounted Surveillance Radar

- 6.2.2. Unmanned Aircraft Mounted Surveillance Radar

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Aviation Airborne System Surveillance Radar Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Military Aircraft

- 7.1.2. Civilian Aircraft

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Manned Aircraft Mounted Surveillance Radar

- 7.2.2. Unmanned Aircraft Mounted Surveillance Radar

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Aviation Airborne System Surveillance Radar Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Military Aircraft

- 8.1.2. Civilian Aircraft

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Manned Aircraft Mounted Surveillance Radar

- 8.2.2. Unmanned Aircraft Mounted Surveillance Radar

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Aviation Airborne System Surveillance Radar Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Military Aircraft

- 9.1.2. Civilian Aircraft

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Manned Aircraft Mounted Surveillance Radar

- 9.2.2. Unmanned Aircraft Mounted Surveillance Radar

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Aviation Airborne System Surveillance Radar Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Military Aircraft

- 10.1.2. Civilian Aircraft

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Manned Aircraft Mounted Surveillance Radar

- 10.2.2. Unmanned Aircraft Mounted Surveillance Radar

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Northrop Grumman

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Lockheed Martin

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 lsrael Aerospace Industries

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Raytheon

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Thales Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SAAB AB

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Finmeccanica SPA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 BAE Systems

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Telephonics

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 CASIC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Harris

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Northrop Grumman

List of Figures

- Figure 1: Global Aviation Airborne System Surveillance Radar Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Aviation Airborne System Surveillance Radar Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Aviation Airborne System Surveillance Radar Revenue (million), by Application 2024 & 2032

- Figure 4: North America Aviation Airborne System Surveillance Radar Volume (K), by Application 2024 & 2032

- Figure 5: North America Aviation Airborne System Surveillance Radar Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Aviation Airborne System Surveillance Radar Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Aviation Airborne System Surveillance Radar Revenue (million), by Types 2024 & 2032

- Figure 8: North America Aviation Airborne System Surveillance Radar Volume (K), by Types 2024 & 2032

- Figure 9: North America Aviation Airborne System Surveillance Radar Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Aviation Airborne System Surveillance Radar Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Aviation Airborne System Surveillance Radar Revenue (million), by Country 2024 & 2032

- Figure 12: North America Aviation Airborne System Surveillance Radar Volume (K), by Country 2024 & 2032

- Figure 13: North America Aviation Airborne System Surveillance Radar Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Aviation Airborne System Surveillance Radar Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Aviation Airborne System Surveillance Radar Revenue (million), by Application 2024 & 2032

- Figure 16: South America Aviation Airborne System Surveillance Radar Volume (K), by Application 2024 & 2032

- Figure 17: South America Aviation Airborne System Surveillance Radar Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Aviation Airborne System Surveillance Radar Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Aviation Airborne System Surveillance Radar Revenue (million), by Types 2024 & 2032

- Figure 20: South America Aviation Airborne System Surveillance Radar Volume (K), by Types 2024 & 2032

- Figure 21: South America Aviation Airborne System Surveillance Radar Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Aviation Airborne System Surveillance Radar Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Aviation Airborne System Surveillance Radar Revenue (million), by Country 2024 & 2032

- Figure 24: South America Aviation Airborne System Surveillance Radar Volume (K), by Country 2024 & 2032

- Figure 25: South America Aviation Airborne System Surveillance Radar Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Aviation Airborne System Surveillance Radar Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Aviation Airborne System Surveillance Radar Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Aviation Airborne System Surveillance Radar Volume (K), by Application 2024 & 2032

- Figure 29: Europe Aviation Airborne System Surveillance Radar Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Aviation Airborne System Surveillance Radar Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Aviation Airborne System Surveillance Radar Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Aviation Airborne System Surveillance Radar Volume (K), by Types 2024 & 2032

- Figure 33: Europe Aviation Airborne System Surveillance Radar Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Aviation Airborne System Surveillance Radar Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Aviation Airborne System Surveillance Radar Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Aviation Airborne System Surveillance Radar Volume (K), by Country 2024 & 2032

- Figure 37: Europe Aviation Airborne System Surveillance Radar Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Aviation Airborne System Surveillance Radar Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Aviation Airborne System Surveillance Radar Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Aviation Airborne System Surveillance Radar Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Aviation Airborne System Surveillance Radar Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Aviation Airborne System Surveillance Radar Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Aviation Airborne System Surveillance Radar Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Aviation Airborne System Surveillance Radar Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Aviation Airborne System Surveillance Radar Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Aviation Airborne System Surveillance Radar Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Aviation Airborne System Surveillance Radar Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Aviation Airborne System Surveillance Radar Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Aviation Airborne System Surveillance Radar Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Aviation Airborne System Surveillance Radar Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Aviation Airborne System Surveillance Radar Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Aviation Airborne System Surveillance Radar Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Aviation Airborne System Surveillance Radar Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Aviation Airborne System Surveillance Radar Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Aviation Airborne System Surveillance Radar Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Aviation Airborne System Surveillance Radar Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Aviation Airborne System Surveillance Radar Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Aviation Airborne System Surveillance Radar Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Aviation Airborne System Surveillance Radar Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Aviation Airborne System Surveillance Radar Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Aviation Airborne System Surveillance Radar Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Aviation Airborne System Surveillance Radar Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Aviation Airborne System Surveillance Radar Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Aviation Airborne System Surveillance Radar Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Aviation Airborne System Surveillance Radar Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Aviation Airborne System Surveillance Radar Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Aviation Airborne System Surveillance Radar Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Aviation Airborne System Surveillance Radar Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Aviation Airborne System Surveillance Radar Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Aviation Airborne System Surveillance Radar Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Aviation Airborne System Surveillance Radar Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Aviation Airborne System Surveillance Radar Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Aviation Airborne System Surveillance Radar Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Aviation Airborne System Surveillance Radar Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Aviation Airborne System Surveillance Radar Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Aviation Airborne System Surveillance Radar Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Aviation Airborne System Surveillance Radar Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Aviation Airborne System Surveillance Radar Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Aviation Airborne System Surveillance Radar Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Aviation Airborne System Surveillance Radar Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Aviation Airborne System Surveillance Radar Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Aviation Airborne System Surveillance Radar Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Aviation Airborne System Surveillance Radar Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Aviation Airborne System Surveillance Radar Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Aviation Airborne System Surveillance Radar Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Aviation Airborne System Surveillance Radar Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Aviation Airborne System Surveillance Radar Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Aviation Airborne System Surveillance Radar Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Aviation Airborne System Surveillance Radar Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Aviation Airborne System Surveillance Radar Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Aviation Airborne System Surveillance Radar Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Aviation Airborne System Surveillance Radar Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Aviation Airborne System Surveillance Radar Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Aviation Airborne System Surveillance Radar Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Aviation Airborne System Surveillance Radar Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Aviation Airborne System Surveillance Radar Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Aviation Airborne System Surveillance Radar Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Aviation Airborne System Surveillance Radar Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Aviation Airborne System Surveillance Radar Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Aviation Airborne System Surveillance Radar Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Aviation Airborne System Surveillance Radar Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Aviation Airborne System Surveillance Radar Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Aviation Airborne System Surveillance Radar Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Aviation Airborne System Surveillance Radar Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Aviation Airborne System Surveillance Radar Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Aviation Airborne System Surveillance Radar Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Aviation Airborne System Surveillance Radar Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Aviation Airborne System Surveillance Radar Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Aviation Airborne System Surveillance Radar Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Aviation Airborne System Surveillance Radar Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Aviation Airborne System Surveillance Radar Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Aviation Airborne System Surveillance Radar Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Aviation Airborne System Surveillance Radar Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Aviation Airborne System Surveillance Radar Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Aviation Airborne System Surveillance Radar Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Aviation Airborne System Surveillance Radar Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Aviation Airborne System Surveillance Radar Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Aviation Airborne System Surveillance Radar Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Aviation Airborne System Surveillance Radar Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Aviation Airborne System Surveillance Radar Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Aviation Airborne System Surveillance Radar Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Aviation Airborne System Surveillance Radar Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Aviation Airborne System Surveillance Radar Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Aviation Airborne System Surveillance Radar Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Aviation Airborne System Surveillance Radar Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Aviation Airborne System Surveillance Radar Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Aviation Airborne System Surveillance Radar Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Aviation Airborne System Surveillance Radar Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Aviation Airborne System Surveillance Radar Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Aviation Airborne System Surveillance Radar Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Aviation Airborne System Surveillance Radar Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Aviation Airborne System Surveillance Radar Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Aviation Airborne System Surveillance Radar Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Aviation Airborne System Surveillance Radar Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Aviation Airborne System Surveillance Radar Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Aviation Airborne System Surveillance Radar Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Aviation Airborne System Surveillance Radar Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Aviation Airborne System Surveillance Radar Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Aviation Airborne System Surveillance Radar Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Aviation Airborne System Surveillance Radar Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Aviation Airborne System Surveillance Radar Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Aviation Airborne System Surveillance Radar Volume K Forecast, by Country 2019 & 2032

- Table 81: China Aviation Airborne System Surveillance Radar Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Aviation Airborne System Surveillance Radar Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Aviation Airborne System Surveillance Radar Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Aviation Airborne System Surveillance Radar Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Aviation Airborne System Surveillance Radar Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Aviation Airborne System Surveillance Radar Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Aviation Airborne System Surveillance Radar Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Aviation Airborne System Surveillance Radar Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Aviation Airborne System Surveillance Radar Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Aviation Airborne System Surveillance Radar Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Aviation Airborne System Surveillance Radar Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Aviation Airborne System Surveillance Radar Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Aviation Airborne System Surveillance Radar Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Aviation Airborne System Surveillance Radar Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aviation Airborne System Surveillance Radar?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Aviation Airborne System Surveillance Radar?

Key companies in the market include Northrop Grumman, Lockheed Martin, lsrael Aerospace Industries, Raytheon, Thales Group, SAAB AB, Finmeccanica SPA, BAE Systems, Telephonics, CASIC, Harris.

3. What are the main segments of the Aviation Airborne System Surveillance Radar?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aviation Airborne System Surveillance Radar," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aviation Airborne System Surveillance Radar report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aviation Airborne System Surveillance Radar?

To stay informed about further developments, trends, and reports in the Aviation Airborne System Surveillance Radar, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence