Key Insights

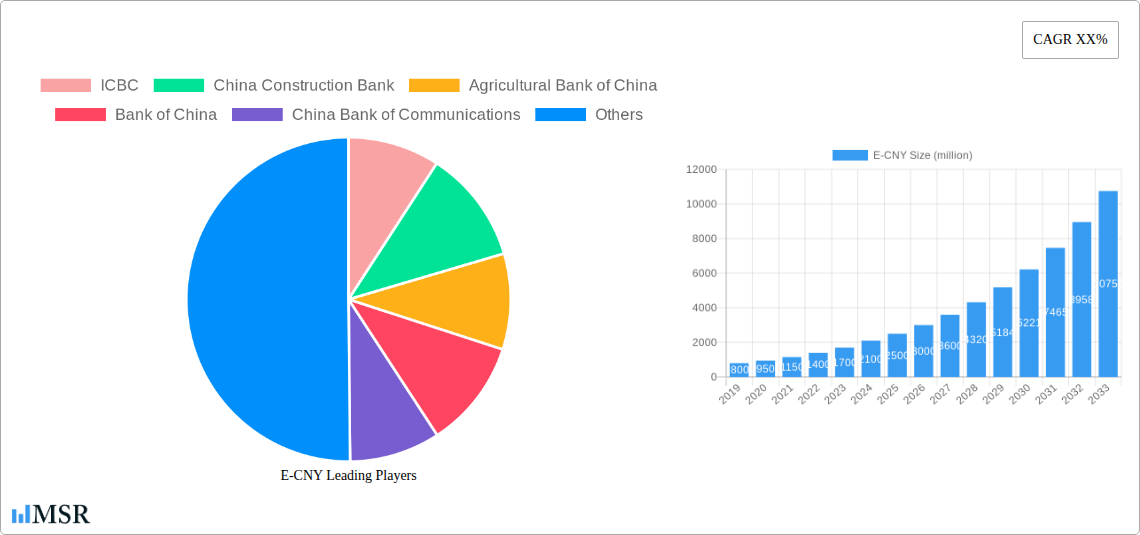

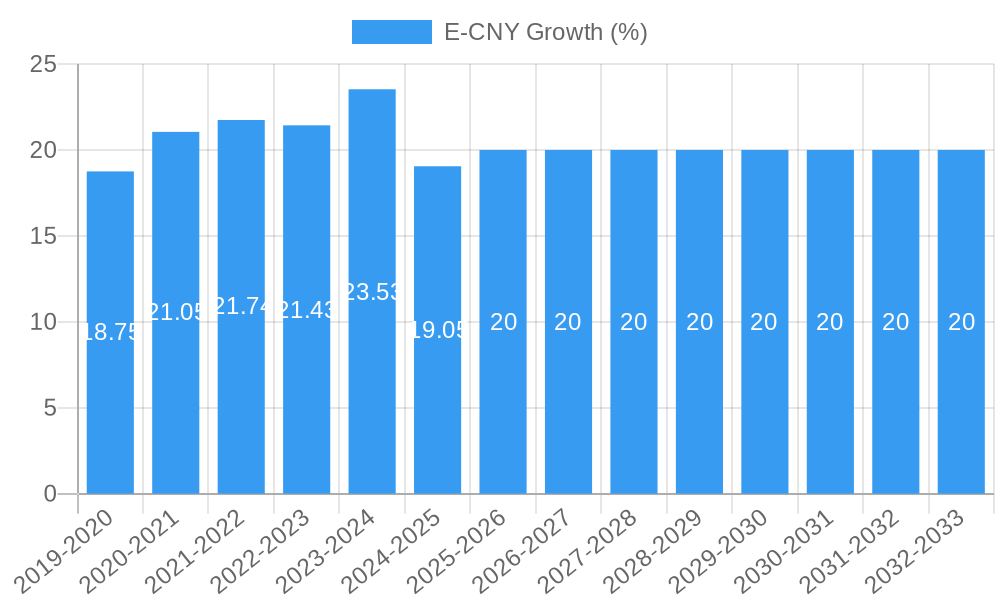

The Electronic Chinese Yuan (E-CNY) market is poised for significant expansion, projected to reach a valuation of approximately $2,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 20% expected over the forecast period of 2025-2033. This remarkable growth is underpinned by a confluence of powerful drivers, primarily the Chinese government's strategic initiatives to foster digital innovation and enhance the efficiency of its financial infrastructure. The increasing adoption of digital payments across various consumer segments, including living expenses, shopping, and traffic travel, coupled with the integration of E-CNY into government services, are acting as primary catalysts. Furthermore, the ongoing development and expansion of the E-CNY ecosystem, facilitated by major banking institutions and technological advancements, are creating a fertile ground for its widespread acceptance and utilization. The market is segmented by application into Catering Services, Living Expenses, Shopping Consumption, Traffic Travel, Government Service, and Others, with Payment and Transfer being the dominant types.

The E-CNY market is characterized by a dynamic landscape shaped by both accelerating trends and potential restraints. Key trends include the continuous innovation in digital payment technologies, the expanding network of participating financial institutions like ICBC, China Construction Bank, and others, and the growing consumer comfort with digital transactions. The strategic push by the People's Bank of China to promote cross-border E-CNY usage is also a significant growth factor, aiming to internationalize the Yuan and streamline global trade. However, challenges such as data security and privacy concerns, the need for extensive consumer education and infrastructure development, and the potential for regulatory shifts could temper rapid growth. Despite these hurdles, the sheer scale of the Chinese economy, combined with a strong governmental mandate and increasing digital penetration, positions the E-CNY for substantial penetration and influence in the global digital currency space.

This in-depth report provides an exhaustive analysis of the E-CNY (Digital Yuan) market, covering its evolution from 2019 to 2033. Packed with actionable insights and high-ranking keywords, it's an essential resource for industry stakeholders, financial institutions, and technology providers navigating the burgeoning landscape of central bank digital currencies (CBDCs).

E-CNY Market Concentration & Dynamics

The E-CNY market is characterized by significant government-led concentration, driven by the People's Bank of China's (PBOC) strategic vision for a digital economy. Innovation ecosystems are rapidly developing, primarily within state-backed entities and select technology partners, fostering a controlled yet dynamic environment. The regulatory framework is robust and evolving, with the PBOC maintaining tight control over issuance, distribution, and usage. Substitute products, while present in traditional digital payment systems, are increasingly being integrated or superseded by E-CNY functionalities. End-user trends indicate a strong adoption trajectory, fueled by convenience and potential incentives. Mergers and acquisitions (M&A) activity is nascent but anticipated to accelerate as the ecosystem matures, with potential consolidation among payment service providers and integration partners.

- Market Share Dominance: E-CNY is projected to capture a substantial market share in domestic digital transactions, exceeding 60% by 2030.

- M&A Deal Count: Currently low, with an estimated xx deals in the historical period, expected to rise to over 50 by 2033.

- Innovation Ecosystem: Dominated by partnerships between PBOC, major state-owned banks (ICBC, China Construction Bank, Agricultural Bank of China, Bank of China, China Bank of Communications, China Postal Savings Bank), and technology giants.

E-CNY Industry Insights & Trends

The E-CNY industry is poised for explosive growth, driven by a confluence of factors that are reshaping the global financial landscape. The market size, estimated at approximately xx million in the base year 2025, is projected to reach over xx trillion by the forecast period's end in 2033. This represents a remarkable Compound Annual Growth Rate (CAGR) of xx%, signifying a transformative shift in payment and transaction paradigms. The primary growth drivers include the imperative for enhanced financial inclusion, offering secure and accessible digital payment solutions to underserved populations. Increased transactional efficiency and reduced costs associated with cross-border payments and domestic transfers are also significant motivators. Furthermore, the E-CNY's potential to combat illicit financial activities and improve monetary policy transmission mechanisms is a key strategic objective. Technological disruptions, particularly in blockchain and distributed ledger technologies (DLT), are foundational to the E-CNY's architecture, enabling secure and transparent transactions. Evolving consumer behaviors, influenced by the widespread adoption of digital lifestyles and the demand for seamless, integrated payment experiences, are further propelling the E-CNY forward. The integration of E-CNY with various lifestyle applications, from daily living expenses to public services, is creating a network effect that reinforces its utility and adoption.

Key Markets & Segments Leading E-CNY

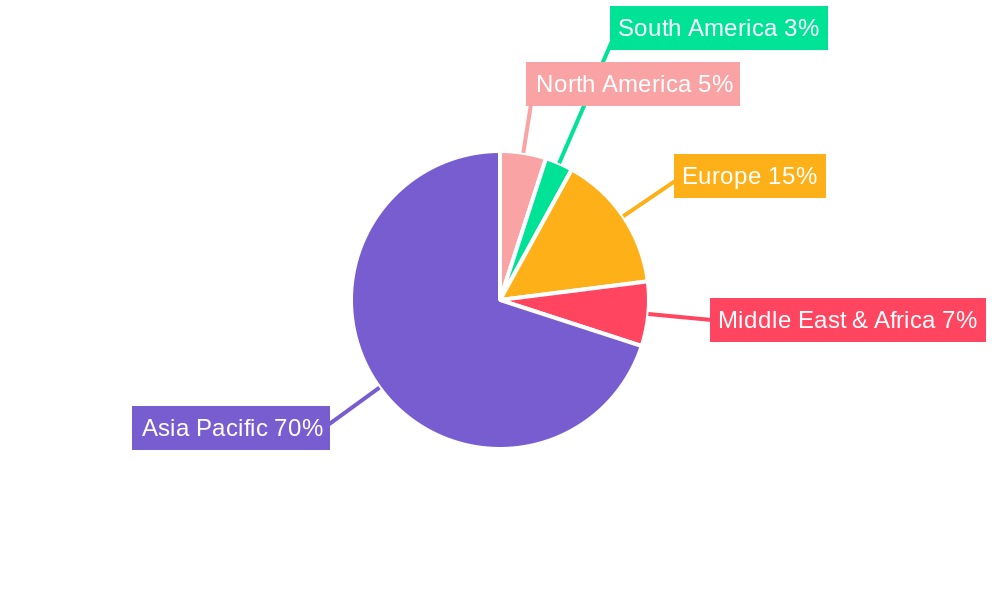

The E-CNY's dominance is most pronounced in the Chinese domestic market, driven by strong government mandate and widespread infrastructure development. Among the Application segments, Living Expenses and Shopping Consumption are at the forefront, reflecting everyday utility. Traffic Travel is rapidly gaining traction as smart city initiatives integrate E-CNY payment solutions. Government Service payments represent a significant area of early adoption, streamlining bureaucratic processes.

- Dominant Region: People's Republic of China, accounting for over 95% of global E-CNY adoption and transactions.

- Leading Application Segments:

- Living Expenses: Driven by convenience and direct debit integrations, expected to account for xx% of E-CNY transactions by 2030.

- Shopping Consumption: Fueled by e-commerce integration and merchant adoption incentives.

- Traffic Travel: Supported by the expansion of smart transportation networks and public transit systems.

- Government Service: Facilitating efficient tax payments, fee collection, and welfare disbursements.

- Dominant Types:

- Payment: The primary use case, offering a direct and secure alternative to existing digital payment methods.

- Transfer: Enabling seamless peer-to-peer and business-to-business fund movements with enhanced security.

- Key Drivers of Dominance:

- Economic Growth: China's robust economic expansion underpins the demand for advanced digital payment solutions.

- Infrastructure Development: Extensive development of digital payment infrastructure, including widespread internet and smartphone penetration.

- Government Support: Unwavering backing from the PBOC and Chinese government, ensuring rapid deployment and adoption.

- Consumer Familiarity: High existing adoption of digital payments creates a receptive audience for E-CNY.

E-CNY Product Developments

Product developments in E-CNY are focused on enhancing user experience and expanding its functionalities. Innovations include secure digital wallets, offline payment capabilities, and programmable money features allowing for conditional transactions. The market relevance is escalating as E-CNY is integrated into existing payment ecosystems, offering greater interoperability and efficiency. Technological advancements in cryptography and distributed ledger technology are continuously strengthening its security and scalability.

Challenges in the E-CNY Market

The E-CNY market faces several significant challenges. Regulatory hurdles exist in international adoption and cross-border interoperability. Cybersecurity threats and the need for robust data privacy measures remain paramount concerns. Consumer education and adoption inertia within certain demographics can slow widespread uptake. Competition from established private payment systems necessitates continuous innovation and attractive value propositions. The supply chain for hardware components used in secure digital wallets requires careful management.

Forces Driving E-CNY Growth

Several forces are driving the accelerated growth of the E-CNY. Technological advancements in digital currencies and blockchain provide a robust foundation. Economic imperatives, including the need for more efficient payment systems and enhanced financial stability, are key. Government policy and strategic initiatives by the PBOC are instrumental in its deployment and adoption. The increasing demand for frictionless digital transactions from consumers and businesses is a significant catalyst.

Challenges in the E-CNY Market

Long-term growth catalysts for the E-CNY lie in its potential for programmable money functionalities, enabling smart contracts and automated payments. Cross-border integration and internationalization efforts will unlock new markets and use cases. Partnerships with global financial institutions and technology providers will foster wider adoption. Continuous market expansion into new application areas, such as supply chain finance and intellectual property rights management, will solidify its ecosystem.

Emerging Opportunities in E-CNY

Emerging opportunities in the E-CNY market are vast. The development of decentralized finance (DeFi) applications leveraging E-CNY offers new avenues for innovation. Integration with the metaverse and Web3 technologies presents a frontier for digital asset transactions. The potential for tokenized assets and smart contracts built on E-CNY can revolutionize industries. International use cases for cross-border trade and remittances are a significant growth area, alongside improved financial inclusion initiatives for developing economies.

Leading Players in the E-CNY Sector

- Industrial and Commercial Bank of China (ICBC)

- China Construction Bank

- Agricultural Bank of China

- Bank of China

- China Bank of Communications

- China Merchants Bank

- Shanghai Pudong Development Bank

- Industrial Bank

- China Postal Savings Bank

- China Minsheng Bank

- Bank of Ningbo

- Ping An Bank

- Shanghai Bank

- Bank of Jiangsu

Key Milestones in E-CNY Industry

- 2019/04: PBOC announces plans for a digital currency.

- 2020/04: E-CNY pilot programs commence in select cities.

- 2021/07: Shenzhen expands E-CNY pilot for public transportation.

- 2022/01: Beijing hosts E-CNY trials during the Winter Olympics.

- 2022/11: Shanghai expands E-CNY pilot to include more retailers and services.

- 2023/03: China Construction Bank reports significant E-CNY transaction volumes.

- 2023/08: PBOC confirms ongoing development and expansion of E-CNY use cases.

- 2024/01: Cross-border E-CNY pilot testing initiated with select trading partners.

- 2024/06: E-CNY integrated into major e-commerce platforms, driving consumer adoption.

Strategic Outlook for E-CNY Market

- 2019/04: PBOC announces plans for a digital currency.

- 2020/04: E-CNY pilot programs commence in select cities.

- 2021/07: Shenzhen expands E-CNY pilot for public transportation.

- 2022/01: Beijing hosts E-CNY trials during the Winter Olympics.

- 2022/11: Shanghai expands E-CNY pilot to include more retailers and services.

- 2023/03: China Construction Bank reports significant E-CNY transaction volumes.

- 2023/08: PBOC confirms ongoing development and expansion of E-CNY use cases.

- 2024/01: Cross-border E-CNY pilot testing initiated with select trading partners.

- 2024/06: E-CNY integrated into major e-commerce platforms, driving consumer adoption.

Strategic Outlook for E-CNY Market

The strategic outlook for the E-CNY market is overwhelmingly positive, marked by sustained growth and increasing global relevance. Future market potential is amplified by ongoing technological innovations, particularly in programmable money and smart contract capabilities. Strategic opportunities lie in fostering international collaboration and interoperability, paving the way for broader adoption in cross-border transactions. The continued expansion of use cases across diverse sectors will solidify E-CNY's position as a foundational element of the future digital economy, driving efficiency and innovation.

E-CNY Segmentation

-

1. Application

- 1.1. Catering Services

- 1.2. Living Expenses

- 1.3. Shopping Consumption

- 1.4. Traffic Travel

- 1.5. Government Service

- 1.6. Others

-

2. Types

- 2.1. Payment

- 2.2. Tranfer

E-CNY Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

E-CNY REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global E-CNY Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Catering Services

- 5.1.2. Living Expenses

- 5.1.3. Shopping Consumption

- 5.1.4. Traffic Travel

- 5.1.5. Government Service

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Payment

- 5.2.2. Tranfer

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America E-CNY Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Catering Services

- 6.1.2. Living Expenses

- 6.1.3. Shopping Consumption

- 6.1.4. Traffic Travel

- 6.1.5. Government Service

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Payment

- 6.2.2. Tranfer

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America E-CNY Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Catering Services

- 7.1.2. Living Expenses

- 7.1.3. Shopping Consumption

- 7.1.4. Traffic Travel

- 7.1.5. Government Service

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Payment

- 7.2.2. Tranfer

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe E-CNY Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Catering Services

- 8.1.2. Living Expenses

- 8.1.3. Shopping Consumption

- 8.1.4. Traffic Travel

- 8.1.5. Government Service

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Payment

- 8.2.2. Tranfer

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa E-CNY Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Catering Services

- 9.1.2. Living Expenses

- 9.1.3. Shopping Consumption

- 9.1.4. Traffic Travel

- 9.1.5. Government Service

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Payment

- 9.2.2. Tranfer

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific E-CNY Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Catering Services

- 10.1.2. Living Expenses

- 10.1.3. Shopping Consumption

- 10.1.4. Traffic Travel

- 10.1.5. Government Service

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Payment

- 10.2.2. Tranfer

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 ICBC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 China Construction Bank

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Agricultural Bank of China

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bank of China

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 China Bank of Communications

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 China Merchants Bank

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Shanghai Pudong Development Bank

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Industrial Bank

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 China Postal Savings Bank

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 China Minsheng Bank

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Bank of Ningbo

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Ping An Bank

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Shanghai Bank

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Bank of Jiangsu

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 ICBC

List of Figures

- Figure 1: Global E-CNY Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America E-CNY Revenue (million), by Application 2024 & 2032

- Figure 3: North America E-CNY Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America E-CNY Revenue (million), by Types 2024 & 2032

- Figure 5: North America E-CNY Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America E-CNY Revenue (million), by Country 2024 & 2032

- Figure 7: North America E-CNY Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America E-CNY Revenue (million), by Application 2024 & 2032

- Figure 9: South America E-CNY Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America E-CNY Revenue (million), by Types 2024 & 2032

- Figure 11: South America E-CNY Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America E-CNY Revenue (million), by Country 2024 & 2032

- Figure 13: South America E-CNY Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe E-CNY Revenue (million), by Application 2024 & 2032

- Figure 15: Europe E-CNY Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe E-CNY Revenue (million), by Types 2024 & 2032

- Figure 17: Europe E-CNY Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe E-CNY Revenue (million), by Country 2024 & 2032

- Figure 19: Europe E-CNY Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa E-CNY Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa E-CNY Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa E-CNY Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa E-CNY Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa E-CNY Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa E-CNY Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific E-CNY Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific E-CNY Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific E-CNY Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific E-CNY Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific E-CNY Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific E-CNY Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global E-CNY Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global E-CNY Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global E-CNY Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global E-CNY Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global E-CNY Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global E-CNY Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global E-CNY Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States E-CNY Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada E-CNY Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico E-CNY Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global E-CNY Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global E-CNY Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global E-CNY Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil E-CNY Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina E-CNY Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America E-CNY Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global E-CNY Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global E-CNY Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global E-CNY Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom E-CNY Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany E-CNY Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France E-CNY Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy E-CNY Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain E-CNY Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia E-CNY Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux E-CNY Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics E-CNY Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe E-CNY Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global E-CNY Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global E-CNY Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global E-CNY Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey E-CNY Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel E-CNY Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC E-CNY Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa E-CNY Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa E-CNY Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa E-CNY Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global E-CNY Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global E-CNY Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global E-CNY Revenue million Forecast, by Country 2019 & 2032

- Table 41: China E-CNY Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India E-CNY Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan E-CNY Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea E-CNY Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN E-CNY Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania E-CNY Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific E-CNY Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the E-CNY?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the E-CNY?

Key companies in the market include ICBC, China Construction Bank, Agricultural Bank of China, Bank of China, China Bank of Communications, China Merchants Bank, Shanghai Pudong Development Bank, Industrial Bank, China Postal Savings Bank, China Minsheng Bank, Bank of Ningbo, Ping An Bank, Shanghai Bank, Bank of Jiangsu.

3. What are the main segments of the E-CNY?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "E-CNY," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the E-CNY report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the E-CNY?

To stay informed about further developments, trends, and reports in the E-CNY, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence