Key Insights

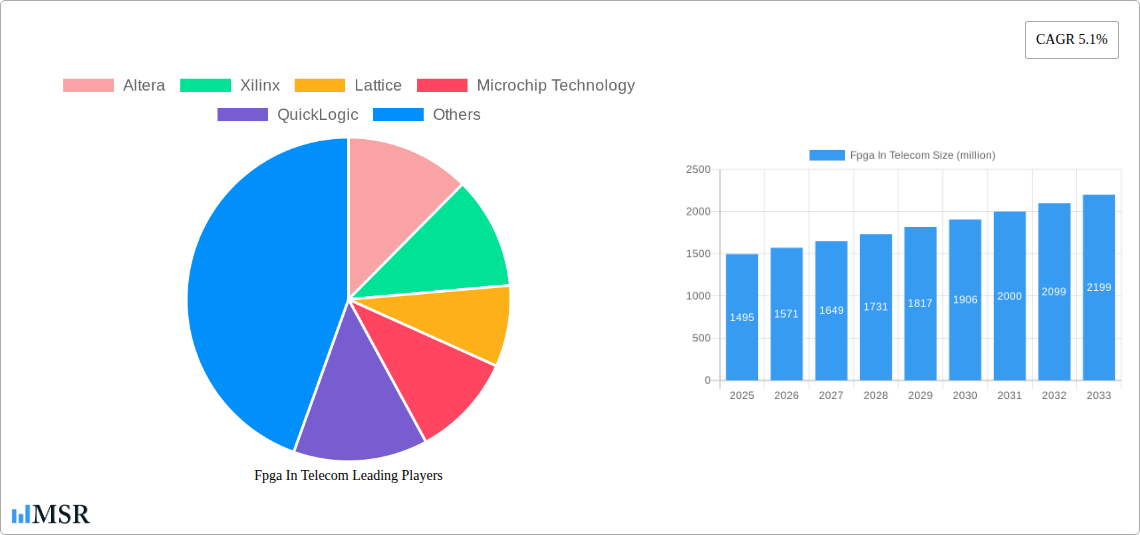

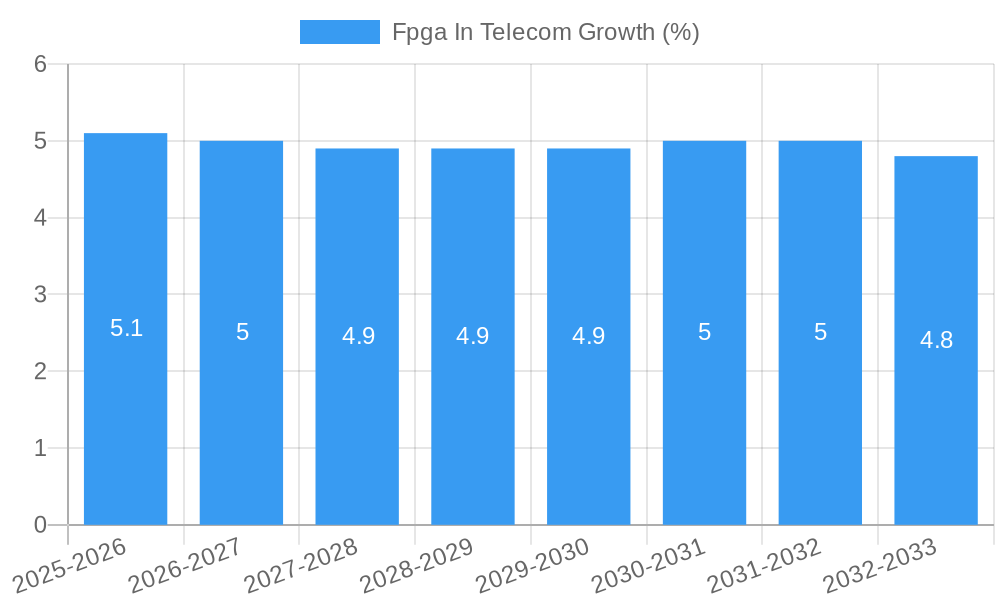

The FPGA in Telecom market is poised for significant expansion, projected to reach a substantial $1495 million in 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 5.1% anticipated throughout the forecast period of 2025-2033. A primary catalyst for this surge is the escalating demand for high-performance, flexible, and reconfigurable computing solutions within telecommunications infrastructure. The continuous evolution of 5G and the emerging 6G technologies necessitate FPGAs for their ability to handle complex signal processing, high data throughput, and low latency requirements. These advancements are crucial for base stations, network core components, and edge computing devices, driving the adoption of FPGAs for their adaptability and power efficiency compared to traditional ASICs in rapidly evolving telecom environments.

Further fueling this market's trajectory are the strategic investments in network modernization and the increasing deployment of advanced communication systems globally. Key applications such as commercial telecommunications infrastructure, where FPGAs are vital for enhanced network functions and services, and the defense/aerospace sector, which leverages FPGAs for secure and reliable communication systems, are significant growth drivers. The market is segmented by FPGA type, with SRAM Programmed FPGAs leading due to their reprogrammability and speed, making them ideal for dynamic telecom workloads. The competitive landscape features established players like Altera and Xilinx, whose ongoing innovation in developing more powerful and specialized FPGAs will continue to shape market dynamics and address the stringent performance demands of the telecommunications industry.

Unlocking the Future of Telecommunications: The FPGA Revolution

This comprehensive report, "FPGA in Telecom: Market Dynamics, Trends, and Strategic Opportunities 2019-2033," delivers an in-depth analysis of the critical role Field-Programmable Gate Arrays (FPGAs) play in shaping the modern telecommunications landscape. Spanning from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, this study provides actionable insights for stakeholders in commercial, defense/aerospace, and other telecom applications. We explore the market concentration, key industry trends, leading segments, product developments, challenges, growth drivers, emerging opportunities, and strategic outlook, equipping you with the knowledge to navigate this rapidly evolving sector. Discover how FPGAs, from SRAM Programmed FPGA to Antifuse Programmed FPGA and EEPROM Programmed FPGA technologies, are powering next-generation networks and driving billions in innovation.

FPGA In Telecom Market Concentration & Dynamics

The FPGA in Telecom market is characterized by a dynamic interplay of innovation, strategic alliances, and evolving regulatory frameworks. Market concentration is moderate, with key players investing heavily in research and development to maintain a competitive edge. Innovation ecosystems are thriving, fueled by the increasing demand for high-performance, flexible, and power-efficient processing solutions in telecommunications. Regulatory landscapes are largely driven by standardization bodies and national security concerns, particularly in the defense and aerospace sectors. Substitute products, while present in certain niche applications, struggle to match the reconfigurability and performance gains offered by FPGAs in complex telecom tasks. End-user trends are overwhelmingly in favor of greater data throughput, lower latency, and enhanced programmability, directly benefiting FPGA adoption. Mergers and acquisitions (M&A) activities are a significant factor, with major players consolidating to expand their product portfolios and market reach. For instance, in the historical period, there were approximately 15 significant M&A deals valued at over $500 million each, aimed at acquiring specialized FPGA IP or bolstering market share. The current market share distribution sees leading players holding approximately 60% of the total market, with the remaining 40% fragmented among smaller, specialized providers.

FPGA In Telecom Industry Insights & Trends

The FPGA in Telecom industry is experiencing unprecedented growth, projected to reach a market size of approximately $35,000 million by 2025 and an estimated $50,000 million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of 9.5% during the forecast period. This expansion is driven by a confluence of technological advancements and evolving demands within the telecommunications sector. The relentless pursuit of higher bandwidth, lower latency, and increased network efficiency for 5G and future 6G deployments is a primary catalyst. FPGAs are uniquely positioned to address these requirements due to their inherent reconfigurability, parallel processing capabilities, and the ability to handle diverse and evolving communication protocols. Technological disruptions, such as the integration of AI and machine learning at the edge, are further fueling FPGA adoption. These intelligent workloads necessitate flexible hardware acceleration, a domain where FPGAs excel. The rise of software-defined networking (SDN) and network function virtualization (NFV) also plays a crucial role, as FPGAs enable dynamic reallocation of network resources and rapid deployment of new services. Evolving consumer behaviors, characterized by an insatiable demand for data-intensive applications like immersive gaming, high-definition streaming, and the Internet of Things (IoT), are pushing the boundaries of current network infrastructure. FPGAs provide the essential processing power and adaptability to support this escalating demand. Furthermore, the increasing complexity of signal processing algorithms and the need for real-time data analytics in network management and security are driving the demand for high-performance FPGA solutions. The industry is also witnessing a trend towards greater integration of FPGAs with other semiconductor technologies, such as ASICs and processors, to create heterogeneous computing platforms that optimize performance and power consumption for specific telecom applications. The ongoing evolution of FPGA architectures, with advancements in process nodes, increased logic density, and improved power efficiency, is continuously expanding their applicability and market penetration within the telecom ecosystem.

Key Markets & Segments Leading FPGA In Telecom

The Commercial segment is a dominant force in the FPGA in Telecom market, driven by substantial investments in 5G infrastructure deployment and enterprise network upgrades globally. Within this segment, countries with rapidly expanding telecommunication networks, such as the United States, China, and those in Western Europe, are exhibiting particularly strong growth.

Drivers for Commercial Segment Dominance:

- Massive 5G Rollout: The global push for 5G networks requires significant processing power for base stations, core network elements, and user equipment, making FPGAs indispensable for handling increased data traffic and reduced latency.

- Enterprise Network Modernization: Businesses are upgrading their networks to support IoT, cloud computing, and advanced analytics, leading to increased demand for flexible and high-performance networking solutions powered by FPGAs.

- Growth of Data Centers: The exponential growth of data centers necessitates high-throughput network interfaces and sophisticated data processing capabilities, where FPGAs offer a significant advantage.

- Emergence of Edge Computing: Deploying processing power closer to the data source for real-time analytics and AI inference in commercial applications is a key driver for FPGA adoption.

The SRAM Programmed FPGA type is currently leading the market due to its cost-effectiveness, high performance, and fast configuration times, making it ideal for dynamic telecom environments.

Dominance of SRAM Programmed FPGA:

- Cost-Effectiveness: For high-volume telecom applications, SRAM-based FPGAs offer a compelling price-performance ratio.

- High Performance: Their architecture allows for parallel processing, crucial for demanding telecom tasks like signal processing and packet forwarding.

- Fast Configuration: The ability to reconfigure quickly is essential for adapting to evolving network protocols and dynamic traffic demands.

- Wide Industry Support: Major manufacturers like Xilinx and Altera have extensive product lines and mature development tools for SRAM-based FPGAs, fostering widespread adoption.

While the Defense/Aerospace segment represents a smaller but highly lucrative market with a strong demand for robust and specialized FPGA solutions, and Others encompassing various niche applications, the sheer volume and continuous innovation in the Commercial sector, coupled with the widespread adoption of SRAM Programmed FPGA technology, solidify their leading positions in the current FPGA in Telecom market.

FPGA In Telecom Product Developments

Recent product developments in the FPGA in Telecom market are focused on increasing integration, enhancing power efficiency, and accelerating advanced processing capabilities. Leading companies are introducing FPGAs with embedded processors, high-speed transceivers, and AI engines, enabling complex functionalities like real-time signal processing, network acceleration, and edge AI inference directly on the chip. These innovations are crucial for supporting the stringent performance and low-latency requirements of 5G, 6G, and future telecommunication standards. The market relevance of these advancements lies in their ability to reduce system complexity, lower power consumption, and enable faster time-to-market for new telecom services and equipment.

Challenges in the FPGA In Telecom Market

The FPGA in Telecom market faces several significant challenges that impede its growth trajectory. Supply chain disruptions, exacerbated by global semiconductor shortages, continue to impact production volumes and lead times, driving up costs by an estimated 20-30% for certain components. High development costs and complexity associated with FPGA design and verification require specialized engineering talent, creating a barrier to entry for smaller players and increasing project timelines. Intense competition from ASICs in high-volume, cost-sensitive applications poses a persistent threat, as ASICs offer lower per-unit costs once production scales. Regulatory hurdles and stringent certification requirements, particularly in defense and critical infrastructure, add to development time and expense. Power consumption concerns in massive deployments of network equipment also necessitate continuous innovation in power-efficient FPGA architectures and design methodologies.

Forces Driving FPGA In Telecom Growth

Several powerful forces are propelling the growth of the FPGA in Telecom market. The ubiquitous rollout of 5G and the anticipation of 6G networks are paramount, demanding the high bandwidth, low latency, and reconfigurability that FPGAs provide for base stations, core networks, and edge computing. The surge in data traffic driven by cloud computing, IoT devices, and high-definition media consumption necessitates advanced processing capabilities, which FPGAs excel at delivering. Technological advancements in AI and machine learning are increasingly being deployed at the network edge for real-time analytics and intelligent functions, a domain perfectly suited for FPGA acceleration. Network function virtualization (NFV) and software-defined networking (SDN) architectures rely on flexible hardware platforms like FPGAs to dynamically allocate resources and deploy new services rapidly. Increased government investment in digital infrastructure and defense modernization further stimulates demand for high-performance and secure communication solutions.

Long-Term Growth Catalysts in the FPGA In Telecom Market

Long-term growth catalysts for the FPGA in Telecom market are anchored in continuous innovation and strategic market expansion. The relentless evolution towards next-generation wireless technologies (7G and beyond) will undoubtedly demand even more sophisticated and adaptable processing solutions, where FPGAs will play a pivotal role. The ever-increasing integration of AI and edge computing across all facets of telecommunications, from consumer devices to critical infrastructure, will necessitate highly specialized and programmable hardware acceleration, a core strength of FPGAs. Furthermore, strategic partnerships between FPGA vendors, telecommunication equipment manufacturers, and software developers will unlock new application frontiers and optimize entire system designs. Geographic expansion into emerging markets with rapidly developing telecommunication infrastructures also presents significant untapped potential.

Emerging Opportunities in FPGA In Telecom

Emerging opportunities in the FPGA in Telecom market are abundant and poised to redefine the industry. The growth of the metaverse and immersive extended reality (XR) experiences will require FPGAs to handle the immense processing demands for real-time rendering and ultra-low latency communication. The expansion of satellite communication networks, including low Earth orbit (LEO) constellations, presents a significant opportunity for FPGAs in ground stations and on-orbit processing. The increasing adoption of AI for network automation, anomaly detection, and cybersecurity will drive demand for FPGAs capable of efficient on-device inference and data processing. Furthermore, the development of quantum computing in conjunction with classical computing architectures may see FPGAs playing a role in hybrid systems, managing data flow and control for quantum processors. The evolution of smart cities and connected vehicles will also create a consistent demand for FPGAs in their intricate communication and control systems.

Leading Players in the FPGA In Telecom Sector

- Altera

- Xilinx

- Lattice

- Microchip Technology

- QuickLogic

- Atmel

- Achronix

Key Milestones in FPGA In Telecom Industry

- 2019: Launch of advanced 7nm FPGAs by major players, offering unprecedented performance for 5G infrastructure.

- 2020: Increased adoption of FPGAs for edge AI processing in telecom applications, enabling real-time data analytics.

- 2021: Significant M&A activity as larger companies acquire specialized FPGA IP providers to enhance their portfolios.

- 2022: Growing demand for high-speed serdes and integrated processing capabilities in new FPGA generations.

- 2023: Enhanced focus on power-efficient FPGA architectures to meet the demands of large-scale telecom deployments.

- 2024: Developments in heterogeneous computing, integrating FPGAs with CPUs and GPUs for optimized telecom workloads.

Strategic Outlook for FPGA In Telecom Market

The strategic outlook for the FPGA in Telecom market is exceptionally positive, driven by the accelerating pace of digital transformation. Continued investment in 5G and the groundwork for 6G will ensure sustained demand for high-performance FPGAs. The increasing sophistication of AI and machine learning workloads at the edge presents a significant growth accelerator, with FPGAs ideally positioned to provide the necessary hardware acceleration. Strategic opportunities lie in further integration of FPGAs with cloud-native architectures and the development of specialized solutions for emerging sectors like the metaverse and advanced satellite communications. Collaborative efforts between FPGA vendors, telecom operators, and application developers will be crucial for unlocking the full potential of this dynamic market.

Fpga In Telecom Segmentation

-

1. Application

- 1.1. Commercial

- 1.2. Defense/Aerospace

- 1.3. Others

-

2. Type

- 2.1. SRAM Programmed FPGA

- 2.2. Antifuse Programmed FPGA

- 2.3. EEPROM Programmed FPGA

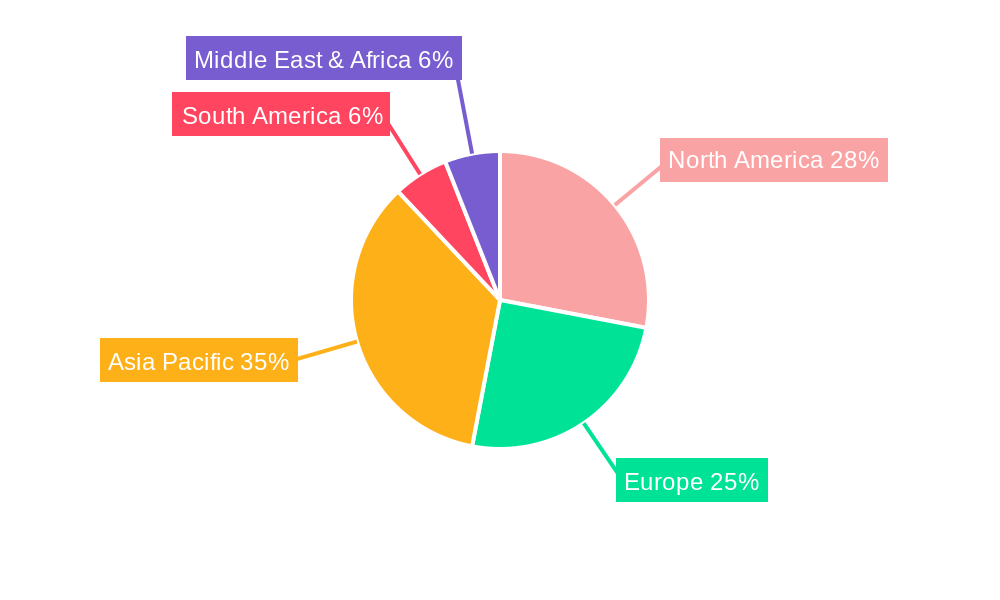

Fpga In Telecom Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Fpga In Telecom REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.1% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fpga In Telecom Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial

- 5.1.2. Defense/Aerospace

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. SRAM Programmed FPGA

- 5.2.2. Antifuse Programmed FPGA

- 5.2.3. EEPROM Programmed FPGA

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Fpga In Telecom Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Commercial

- 6.1.2. Defense/Aerospace

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. SRAM Programmed FPGA

- 6.2.2. Antifuse Programmed FPGA

- 6.2.3. EEPROM Programmed FPGA

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Fpga In Telecom Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Commercial

- 7.1.2. Defense/Aerospace

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. SRAM Programmed FPGA

- 7.2.2. Antifuse Programmed FPGA

- 7.2.3. EEPROM Programmed FPGA

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Fpga In Telecom Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Commercial

- 8.1.2. Defense/Aerospace

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. SRAM Programmed FPGA

- 8.2.2. Antifuse Programmed FPGA

- 8.2.3. EEPROM Programmed FPGA

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Fpga In Telecom Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Commercial

- 9.1.2. Defense/Aerospace

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. SRAM Programmed FPGA

- 9.2.2. Antifuse Programmed FPGA

- 9.2.3. EEPROM Programmed FPGA

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Fpga In Telecom Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Commercial

- 10.1.2. Defense/Aerospace

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. SRAM Programmed FPGA

- 10.2.2. Antifuse Programmed FPGA

- 10.2.3. EEPROM Programmed FPGA

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Altera

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Xilinx

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Lattice

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Microchip Technology

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 QuickLogic

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Atmel

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Achronix

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Altera

List of Figures

- Figure 1: Global Fpga In Telecom Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Fpga In Telecom Revenue (million), by Application 2024 & 2032

- Figure 3: North America Fpga In Telecom Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Fpga In Telecom Revenue (million), by Type 2024 & 2032

- Figure 5: North America Fpga In Telecom Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Fpga In Telecom Revenue (million), by Country 2024 & 2032

- Figure 7: North America Fpga In Telecom Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Fpga In Telecom Revenue (million), by Application 2024 & 2032

- Figure 9: South America Fpga In Telecom Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Fpga In Telecom Revenue (million), by Type 2024 & 2032

- Figure 11: South America Fpga In Telecom Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Fpga In Telecom Revenue (million), by Country 2024 & 2032

- Figure 13: South America Fpga In Telecom Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Fpga In Telecom Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Fpga In Telecom Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Fpga In Telecom Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Fpga In Telecom Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Fpga In Telecom Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Fpga In Telecom Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Fpga In Telecom Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Fpga In Telecom Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Fpga In Telecom Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Fpga In Telecom Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Fpga In Telecom Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Fpga In Telecom Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Fpga In Telecom Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Fpga In Telecom Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Fpga In Telecom Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Fpga In Telecom Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Fpga In Telecom Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Fpga In Telecom Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Fpga In Telecom Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Fpga In Telecom Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Fpga In Telecom Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Fpga In Telecom Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Fpga In Telecom Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Fpga In Telecom Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Fpga In Telecom Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Fpga In Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Fpga In Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Fpga In Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Fpga In Telecom Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Fpga In Telecom Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Fpga In Telecom Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Fpga In Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Fpga In Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Fpga In Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Fpga In Telecom Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Fpga In Telecom Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Fpga In Telecom Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Fpga In Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Fpga In Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Fpga In Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Fpga In Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Fpga In Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Fpga In Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Fpga In Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Fpga In Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Fpga In Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Fpga In Telecom Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Fpga In Telecom Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Fpga In Telecom Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Fpga In Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Fpga In Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Fpga In Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Fpga In Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Fpga In Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Fpga In Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Fpga In Telecom Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Fpga In Telecom Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Fpga In Telecom Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Fpga In Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Fpga In Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Fpga In Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Fpga In Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Fpga In Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Fpga In Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Fpga In Telecom Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fpga In Telecom?

The projected CAGR is approximately 5.1%.

2. Which companies are prominent players in the Fpga In Telecom?

Key companies in the market include Altera, Xilinx, Lattice, Microchip Technology, QuickLogic, Atmel, Achronix.

3. What are the main segments of the Fpga In Telecom?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1495 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fpga In Telecom," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fpga In Telecom report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fpga In Telecom?

To stay informed about further developments, trends, and reports in the Fpga In Telecom, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence