Key Insights

The India wireless audio market is experiencing robust growth, driven by increasing smartphone penetration, rising disposable incomes, and a burgeoning young population eager to adopt the latest technology. The market, while showing significant expansion in recent years (2019-2024), is poised for even more substantial growth during the forecast period (2025-2033). The preference for convenience and superior audio quality offered by wireless earphones and headphones, compared to wired alternatives, is a key factor fueling this expansion. Furthermore, the increasing availability of affordable, feature-rich wireless audio devices from both established brands and emerging players is democratizing access to this technology, broadening the market's consumer base. The rising popularity of online music streaming services and podcasts also significantly contributes to market growth, as consumers seek enhanced listening experiences. While precise market size figures for 2019-2024 are not provided, a logical estimation based on the stated study period and the projected growth indicates a considerable expansion over the past few years.

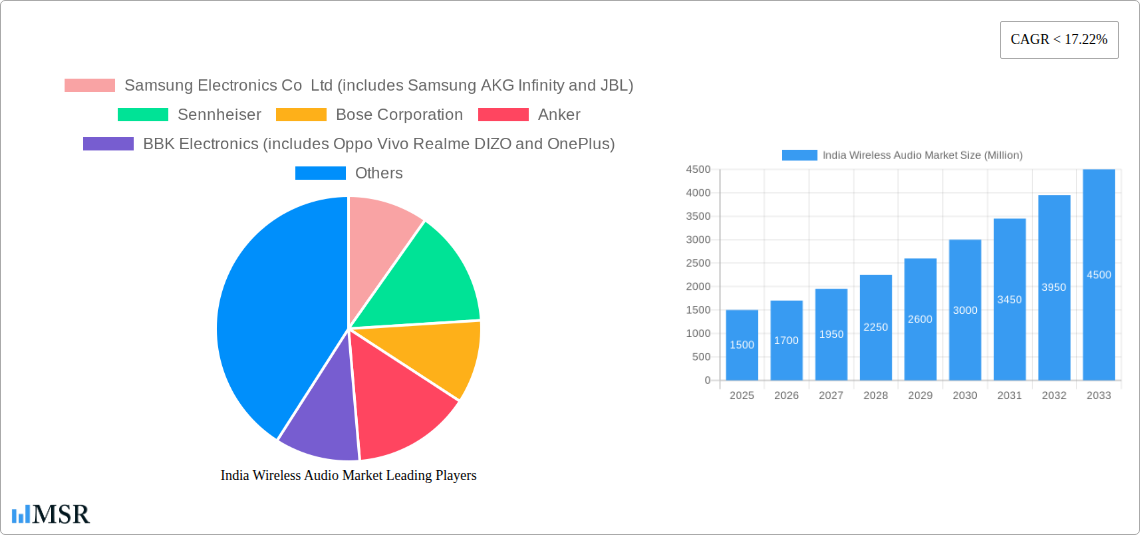

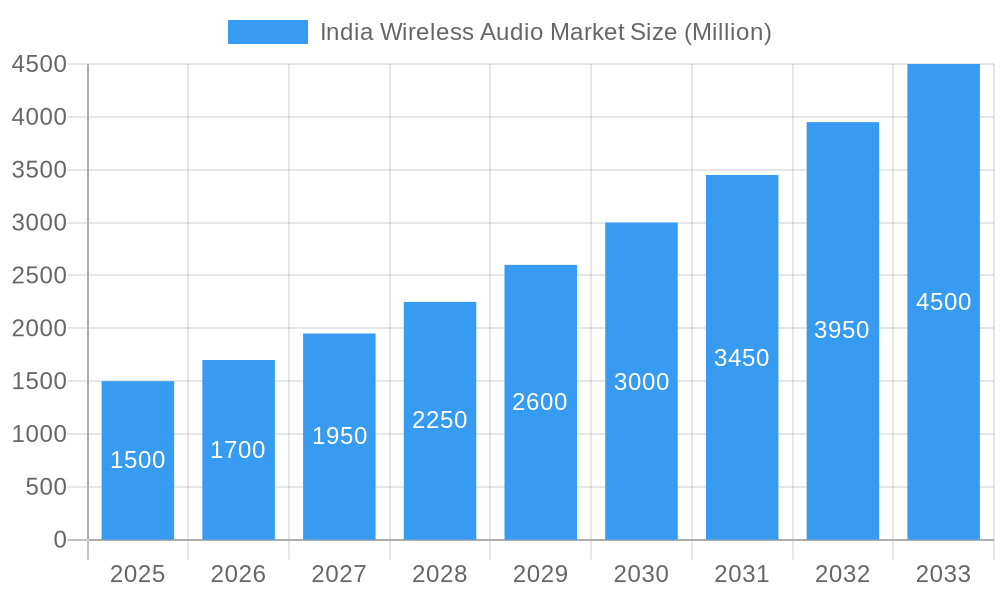

India Wireless Audio Market Market Size (In Billion)

The forecast period (2025-2033) presents substantial opportunities for growth. Continued technological advancements, such as improved battery life, noise cancellation, and enhanced connectivity features, will further stimulate demand. The increasing integration of smart features, such as voice assistants and health tracking capabilities, in wireless audio devices, will also attract a broader range of users. Competitive pricing strategies and innovative marketing campaigns by manufacturers are likely to maintain the high growth trajectory. However, factors such as fluctuating raw material prices and potential disruptions in the global supply chain could pose challenges. Nonetheless, the long-term outlook for the India wireless audio market remains highly positive, projecting sustained growth throughout the forecast period, driven by a combination of technological advancements, evolving consumer preferences, and favorable economic conditions.

India Wireless Audio Market Company Market Share

India Wireless Audio Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the burgeoning India wireless audio market, offering invaluable insights for industry stakeholders. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, key players, emerging trends, and future growth prospects. The study unveils the market size, CAGR, and dominant segments, empowering businesses to make informed strategic decisions.

India Wireless Audio Market Market Concentration & Dynamics

The India wireless audio market exhibits a moderately concentrated landscape, dominated by several major global and domestic players. Market share is largely influenced by brand recognition, product innovation, pricing strategies, and distribution networks. The ecosystem is characterized by intense competition, fueled by continuous product launches and technological advancements. Regulatory frameworks, while largely supportive of market growth, play a role in influencing product compliance and import/export regulations. Substitute products, such as wired headphones and integrated device audio, exert minimal pressure due to the growing consumer preference for wireless convenience.

End-user trends showcase a clear shift towards premium features, such as noise cancellation and superior sound quality, especially among younger demographics. The market also witnesses significant M&A activity, with several larger companies acquiring smaller innovative players to expand their portfolios and enhance their market presence. For the period 2020-2024, approximately xx M&A deals occurred in this sector. The largest players hold approximately xx% of the market share collectively. The remaining share is distributed amongst numerous smaller players, creating a dynamic competitive environment.

India Wireless Audio Market Industry Insights & Trends

The India wireless audio market experienced significant growth during the historical period (2019-2024), driven primarily by increasing smartphone penetration, rising disposable incomes, and a growing preference for wireless audio devices. The market size in 2024 was estimated at xx Million, exhibiting a CAGR of xx% during the historical period. This growth is further fueled by the increasing adoption of truly wireless earbuds (TWS), which have gained immense popularity among consumers. Technological advancements, such as improved battery life, enhanced audio quality, and the integration of smart features, continue to drive market expansion. Consumer behavior is also shifting towards personalized audio experiences, resulting in greater demand for noise-cancellation and customizable sound profiles. The forecast period (2025-2033) is projected to witness even stronger growth, reaching xx Million by 2033, with a CAGR of xx%. This projected growth is driven by factors such as increasing urbanization, the rise of the online retail sector, and continued technological innovation within the wireless audio space.

Key Markets & Segments Leading India Wireless Audio Market

- Dominant Segment: Truly Wireless Earbuds (TWS) are the fastest-growing segment, holding the largest market share in 2024. Wireless earphones hold a significant share as well, driven by affordability and broad availability.

- Distribution Channels: Online channels are experiencing rapid growth, due to the convenience and competitive pricing offered by e-commerce platforms. Offline channels, encompassing retail stores and electronics dealers, continue to hold a significant share, particularly for consumers preferring to physically examine and try products before purchase.

- Online Drivers: Increased internet and smartphone penetration, attractive online promotions, and convenient home delivery.

- Offline Drivers: Established retail presence, opportunity for hands-on product experience, trust in physical stores.

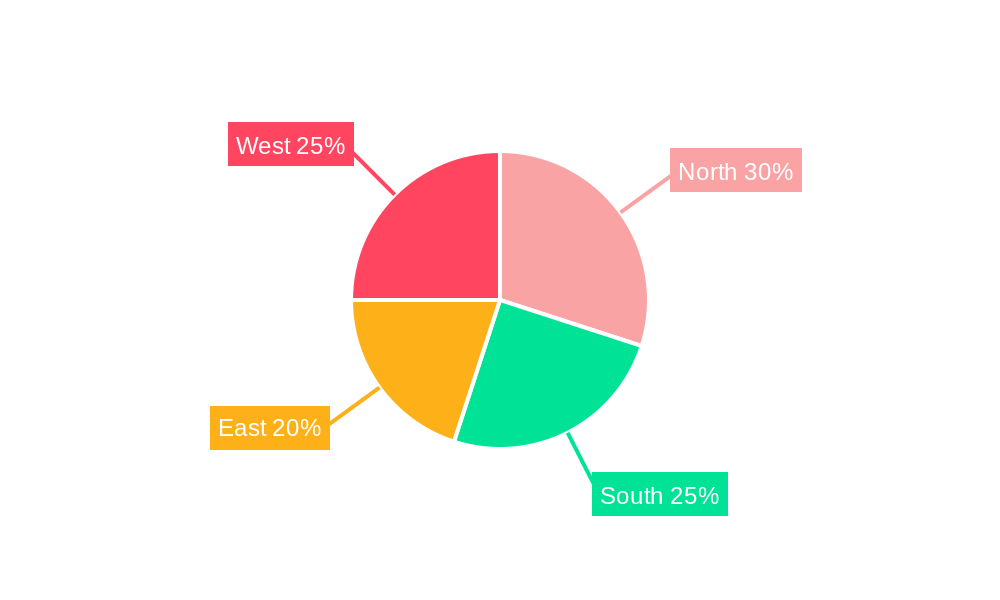

- Regional Dominance: Urban areas, particularly in major metropolitan cities, demonstrate higher consumption levels due to increased disposable incomes and access to technology. However, growth is also observed in tier-2 and tier-3 cities.

India Wireless Audio Market Product Developments

Recent product innovations have focused on enhancing audio quality, battery life, noise cancellation technology, and the integration of smart features. Companies are constantly striving to provide superior user experiences by introducing features like seamless connectivity, water resistance, and health-monitoring capabilities. These advancements are designed to improve user comfort and create a stronger competitive edge in the market. The release of products like Sony's WF-LS900N and Sennheiser's Momentum 4 wireless headphones exemplify this trend towards more sophisticated and feature-rich wireless audio products.

Challenges in the India Wireless Audio Market Market

The India wireless audio market faces challenges such as intense competition, fluctuating raw material prices impacting production costs, and the potential for counterfeiting, impacting brand reputation and profitability. Supply chain disruptions could lead to delays and increased costs, and navigating complex import regulations adds another layer of difficulty. The combined impact of these challenges could negatively affect market growth by approximately xx% in certain years if not properly addressed.

Forces Driving India Wireless Audio Market Growth

Several factors contribute to the market's robust growth. These include:

- Technological Advancements: Continued innovation in areas like noise cancellation, battery technology, and audio codecs.

- Rising Disposable Incomes: Increased purchasing power, particularly among younger consumers, fuels demand for premium audio products.

- Smartphone Penetration: High smartphone adoption increases demand for complementary wireless audio devices.

Long-Term Growth Catalysts in India Wireless Audio Market

Long-term growth will be propelled by the ongoing development of new audio technologies, the expansion of partnerships between audio companies and technology providers, and an increased focus on integrating wireless audio into smart home ecosystems. Further market expansion into less penetrated regions will also contribute to long-term growth.

Emerging Opportunities in India Wireless Audio Market

Emerging opportunities include the growing adoption of personalized audio experiences, the expansion of the market into rural areas, and the integration of wireless audio devices with fitness and health applications. The development of sustainable and eco-friendly wireless audio products also presents a substantial opportunity for market expansion.

Leading Players in the India Wireless Audio Market Sector

- Samsung Electronics Co Ltd (includes Samsung AKG Infinity and JBL)

- Sennheiser

- Bose Corporation

- Anker

- BBK Electronics (includes Oppo Vivo Realme DIZO and OnePlus)

- Sony India

- Xiaomi Corporation

- Imagine Marketing Limited (boat LIFESTYLE)

- Skullcandy

- Apple Inc

Key Milestones in India Wireless Audio Market Industry

- September 2022: Sennheiser launched the Momentum 4 wireless headphones.

- September 2022: JBL introduced the JBL Quantum 350 wireless headphones.

- November 2022: Sony released the WF-LS900N noise-canceling earphones.

Strategic Outlook for India Wireless Audio Market Market

The future of the India wireless audio market looks promising, with substantial growth potential driven by technological advancements, changing consumer preferences, and expanding distribution networks. Companies that strategically invest in research and development, expand their product portfolios, and adapt to evolving consumer demands are poised to capture significant market share and drive sustained growth in the years to come.

India Wireless Audio Market Segmentation

-

1. Product Type

- 1.1. Wireless Earphones

- 1.2. Wireless Headphones

- 1.3. Truly Wireless Earbuds

-

2. Distribution Channel

- 2.1. Online

- 2.2. Offline

India Wireless Audio Market Segmentation By Geography

- 1. India

India Wireless Audio Market Regional Market Share

Geographic Coverage of India Wireless Audio Market

India Wireless Audio Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 25.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing E-Commerce Industry Will Boost Market Growth

- 3.3. Market Restrains

- 3.3.1. Health Problems Caused by Continuous Usage of Audio Devices

- 3.4. Market Trends

- 3.4.1. Growing E-Commerce Industry Will Boost Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Wireless Audio Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Wireless Earphones

- 5.1.2. Wireless Headphones

- 5.1.3. Truly Wireless Earbuds

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Samsung Electronics Co Ltd (includes Samsung AKG Infinity and JBL)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sennheiser

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bose Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Anker

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BBK Electronics (includes Oppo Vivo Realme DIZO and OnePlus)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sony India

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Xiaomi Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Imagine Marketing Limited (boat LIFESTYLE)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Skullcandy*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Apple Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Samsung Electronics Co Ltd (includes Samsung AKG Infinity and JBL)

List of Figures

- Figure 1: India Wireless Audio Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: India Wireless Audio Market Share (%) by Company 2025

List of Tables

- Table 1: India Wireless Audio Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: India Wireless Audio Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 3: India Wireless Audio Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: India Wireless Audio Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 5: India Wireless Audio Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 6: India Wireless Audio Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Wireless Audio Market?

The projected CAGR is approximately 25.8%.

2. Which companies are prominent players in the India Wireless Audio Market?

Key companies in the market include Samsung Electronics Co Ltd (includes Samsung AKG Infinity and JBL), Sennheiser, Bose Corporation, Anker, BBK Electronics (includes Oppo Vivo Realme DIZO and OnePlus), Sony India, Xiaomi Corporation, Imagine Marketing Limited (boat LIFESTYLE), Skullcandy*List Not Exhaustive, Apple Inc.

3. What are the main segments of the India Wireless Audio Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing E-Commerce Industry Will Boost Market Growth.

6. What are the notable trends driving market growth?

Growing E-Commerce Industry Will Boost Market Growth.

7. Are there any restraints impacting market growth?

Health Problems Caused by Continuous Usage of Audio Devices.

8. Can you provide examples of recent developments in the market?

November 2022: Sony's TWS product selection in India was enhanced with the release of the WF-LS900N noise-canceling earphones. Sony's newest TWS earbuds aim to give consumers an entirely new audio experience. These earphones provide realistic sound in AR gaming by utilizing an assortment of sensors and multidimensional sound technologies. The WF-LS900N is also ideal for the continuous streaming of material.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Wireless Audio Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Wireless Audio Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Wireless Audio Market?

To stay informed about further developments, trends, and reports in the India Wireless Audio Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence