Key Insights

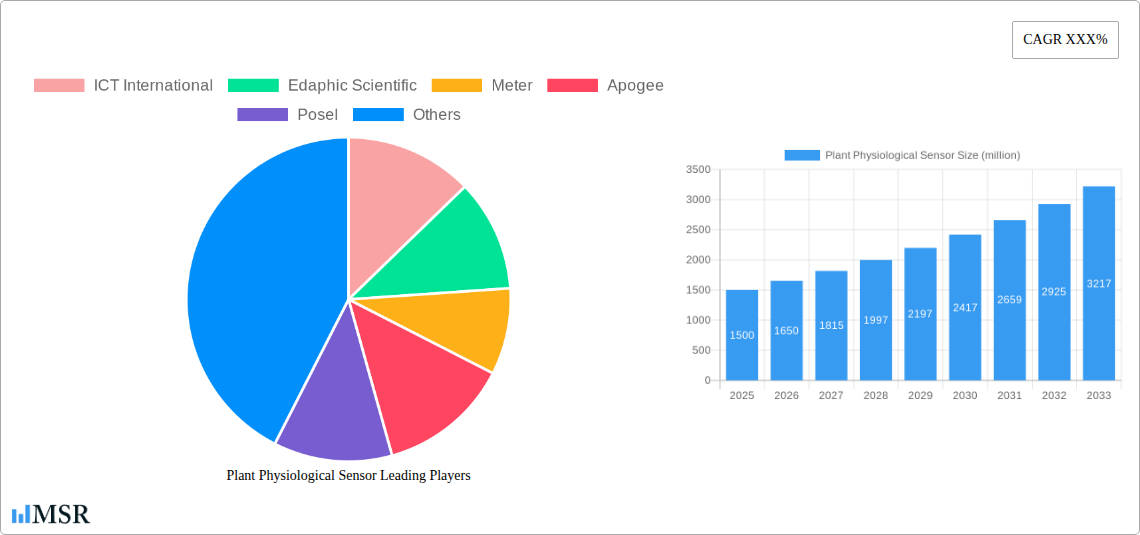

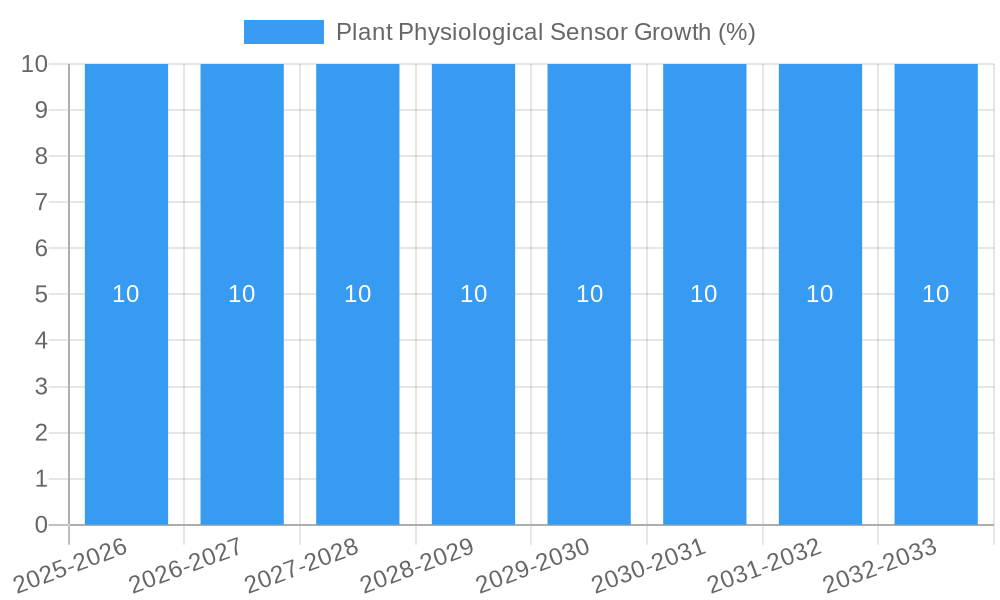

The global Plant Physiological Sensor market is poised for significant expansion, projected to reach an estimated $XXX million by 2025, with a robust Compound Annual Growth Rate (CAGR) of XXX% projected throughout the forecast period of 2025-2033. This growth is primarily propelled by the escalating demand for precision agriculture and the increasing adoption of advanced technologies to optimize crop yields and resource management. Environmental monitoring applications are a key driver, as industries and researchers increasingly rely on these sensors to understand plant responses to environmental stressors like climate change, pollution, and altered weather patterns. Furthermore, the burgeoning field of scientific research, particularly in plant biology and climate resilience, is creating a substantial need for sophisticated physiological data, further fueling market expansion. The agricultural production management segment is also experiencing accelerated adoption as farmers seek to enhance efficiency, reduce input costs (water, fertilizers), and mitigate risks associated with unpredictable environmental conditions.

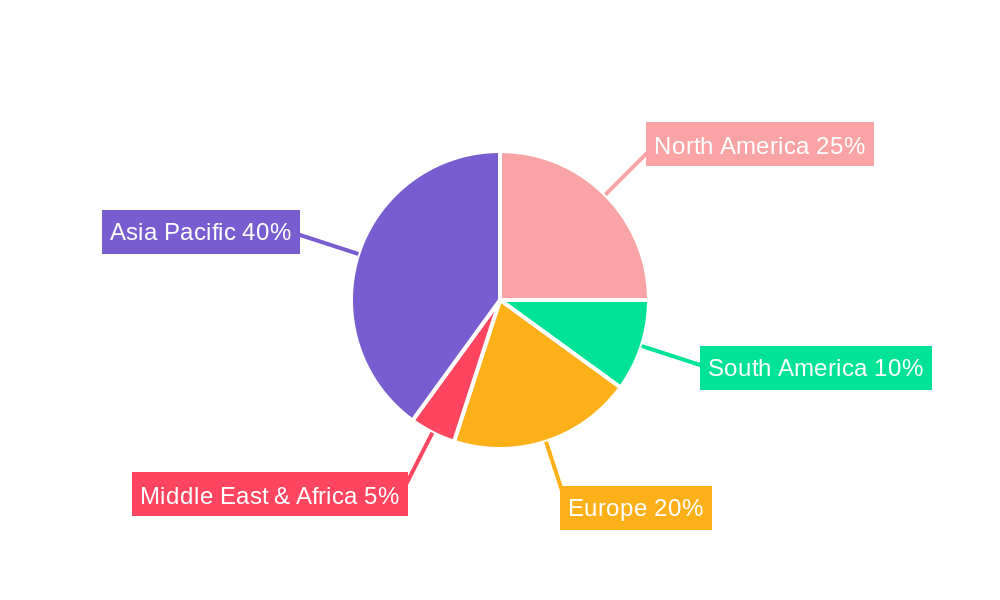

The market is segmented by type into Internal Environmental Sensors and External Environmental Sensors. While both segments are expected to witness growth, the increasing sophistication and miniaturization of internal sensors, offering more direct and granular insights into plant health, are likely to drive higher growth in that category. Conversely, external sensors will continue to be vital for broader environmental monitoring. Key market restraints include the initial high cost of some advanced sensor technologies and the need for specialized expertise for data interpretation. However, technological advancements are continuously addressing cost barriers, and educational initiatives are helping to bridge the knowledge gap. Geographically, the Asia Pacific region, led by China and India, is anticipated to emerge as a dominant market due to its vast agricultural land, increasing adoption of smart farming technologies, and supportive government initiatives. North America and Europe, with their established agricultural sectors and high technological penetration, will also remain significant contributors to the market's overall growth.

Plant Physiological Sensor Market: Comprehensive Analysis & Forecast (2019-2033)

Unlock critical insights into the burgeoning Plant Physiological Sensor market with this in-depth report. Covering a study period from 2019 to 2033, this analysis provides a definitive roadmap for industry stakeholders, investors, and researchers seeking to capitalize on advancements in environmental monitoring, scientific research, and precision agriculture. Discover market concentration, growth drivers, key trends, leading players, and emerging opportunities shaping the future of plant health and crop management. With a base year of 2025 and a forecast period extending to 2033, this report offers actionable intelligence and data-driven forecasts, vital for strategic decision-making in this dynamic sector.

Plant Physiological Sensor Market Concentration & Dynamics

The global Plant Physiological Sensor market exhibits a dynamic concentration, characterized by the presence of both established giants and agile innovators. Leading companies such as LI-COR Biosciences, Decagon Devices, and Apogee maintain significant market share through their comprehensive product portfolios and strong brand recognition. However, the market is increasingly energized by specialized players like ICT International, Edaphic Scientific, and Posel, who are driving innovation in niche applications and advanced sensor technologies. The innovation ecosystem is robust, fueled by continuous research and development in areas like IoT integration, AI-powered analytics, and miniaturized sensor designs. Regulatory frameworks, particularly concerning environmental data accuracy and agricultural practices, are gradually shaping market entry and product development, favoring solutions that offer verifiable precision. While substitute products like manual testing kits exist, their limitations in real-time data acquisition and scalability render them less competitive against sophisticated sensor solutions. End-user trends are overwhelmingly leaning towards precision agriculture, demanding granular data for optimizing resource allocation, disease detection, and yield prediction. Mergers and acquisitions (M&A) activities are anticipated to increase as larger players seek to acquire innovative technologies and expand their market reach. For instance, we predict approximately 5-10 M&A deals annually within the forecast period, with an estimated average deal value of xx million. The market share distribution indicates that the top 5 players hold around 60% of the market revenue, with the remaining 40% fragmented among smaller and emerging companies.

Plant Physiological Sensor Industry Insights & Trends

The Plant Physiological Sensor market is poised for substantial growth, projected to reach an estimated market size of over xx million by 2025 and expand to over xx million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of approximately 12-15% during the forecast period (2025-2033). This expansion is primarily propelled by the escalating global demand for food security, driven by a burgeoning population and the imperative to optimize agricultural productivity amidst climate change and resource scarcity. Technological advancements are at the forefront of this growth trajectory. The integration of Internet of Things (IoT) connectivity into plant physiological sensors is revolutionizing data collection, enabling real-time monitoring, remote access, and seamless data transfer to cloud platforms. This facilitates predictive analytics and informed decision-making for farmers, researchers, and environmental scientists. The development of advanced sensor technologies, including non-invasive sensors that measure parameters like leaf temperature, stomatal conductance, and chlorophyll fluorescence without damaging plant tissues, is gaining significant traction. Furthermore, the increasing adoption of Artificial Intelligence (AI) and Machine Learning (ML) algorithms for analyzing the vast datasets generated by these sensors is unlocking deeper insights into plant health, stress detection, and yield forecasting. Evolving consumer behaviors, particularly the growing consumer preference for sustainably grown produce, is also a significant market driver. Farmers are increasingly adopting precision agriculture techniques, facilitated by plant physiological sensors, to minimize water and fertilizer usage, reduce pesticide application, and enhance crop quality, thereby aligning with consumer demand for eco-friendly products. The scientific research segment is also a key contributor, with researchers utilizing these sensors to gain a deeper understanding of plant physiology, crop responses to environmental stressors, and the impact of climate change on vegetation. The "Others" segment, encompassing applications like horticulture, urban farming, and smart landscaping, is also witnessing steady growth as technology becomes more accessible and its benefits are recognized across a broader spectrum of plant management. The global market size in the historical period (2019-2024) reached approximately xx million in 2024, indicating a steady upward trend.

Key Markets & Segments Leading Plant Physiological Sensor

The Plant Physiological Sensor market is dominated by Agriculture Production Management as the leading application segment, reflecting the global drive towards precision agriculture and enhanced crop yields. This dominance is underpinned by several key drivers.

- Economic Growth and Food Security Imperative: Growing global populations necessitate increased food production, making efficient and sustainable agricultural practices paramount. Plant physiological sensors are instrumental in optimizing every stage of the crop lifecycle, from planting to harvest.

- Technological Adoption in Agriculture: The increasing accessibility and affordability of sensor technology, coupled with the rise of smart farming initiatives, are accelerating adoption rates among farmers of all scales.

- Data-Driven Decision Making: The ability of these sensors to provide granular, real-time data empowers farmers to make informed decisions regarding irrigation, fertilization, pest control, and disease management, leading to significant cost savings and yield improvements.

- Climate Change Adaptation: As agricultural regions face increasingly unpredictable weather patterns and environmental stressors, plant physiological sensors help in monitoring plant stress and adapting management strategies accordingly.

Within Agriculture Production Management, the sub-segment of Internal Environmental Sensors is experiencing strong growth, particularly for measuring parameters like stem diameter, sap flow, and root zone moisture, offering deep insights into plant water status and nutrient uptake. Concurrently, External Environmental Sensors are vital for monitoring ambient conditions such as temperature, humidity, light intensity, and CO2 levels, providing a holistic view of the growing environment.

Regionally, North America and Europe are currently leading markets, driven by their well-established agricultural infrastructure, high adoption rates of advanced technologies, and significant investments in agricultural research and development. However, the Asia-Pacific region is emerging as a rapid growth market, fueled by substantial investments in modernizing agriculture, a growing focus on food security, and the increasing adoption of smart farming solutions in countries like China, India, and Southeast Asian nations. The government initiatives promoting agricultural technology and sustainability further bolster this growth.

The Scientific Research segment also plays a crucial role, providing invaluable data for academic institutions and research bodies studying plant biology, climate change impacts, and developing new crop varieties. Environmental Monitoring applications are also expanding, with sensors being deployed to assess vegetation health in forests, natural reserves, and urban green spaces.

The Type segment is further broken down:

- Internal Environmental Sensor: Dominates due to the direct measurement of plant physiological responses, offering precise insights into internal plant health and stress.

- External Environmental Sensor: Crucial for contextualizing internal plant data by providing ambient environmental parameters, enabling a comprehensive understanding of plant-environment interactions.

The combination of these segments and their underlying drivers highlights the multifaceted growth of the Plant Physiological Sensor market, with agriculture at its core.

Plant Physiological Sensor Product Developments

Recent product developments in the Plant Physiological Sensor market are characterized by enhanced precision, miniaturization, and seamless integration with IoT platforms. Companies are focusing on developing non-invasive sensors that accurately measure critical physiological parameters such as leaf wetness, stem water potential, and chlorophyll fluorescence without causing any damage to the plant. Innovations in sensor materials and manufacturing techniques are leading to more robust, durable, and cost-effective devices. Furthermore, the integration of AI and machine learning algorithms directly into sensor hardware or associated software is enabling real-time data analysis and predictive insights for growers. Examples include sensors that can autonomously detect early signs of disease or nutrient deficiency, allowing for timely interventions. The market relevance of these advancements is significant, enabling precision agriculture practices that optimize resource utilization, minimize environmental impact, and maximize crop yields. Companies like Meter and SpectrumTech are at the forefront of these technological leaps, offering solutions that provide a competitive edge to users.

Challenges in the Plant Physiological Sensor Market

The Plant Physiological Sensor market, while robust, faces several challenges that could impede its growth trajectory. Regulatory hurdles related to data privacy and agricultural technology integration can slow down adoption in certain regions. Supply chain disruptions, particularly for specialized electronic components, can lead to increased lead times and costs for manufacturers, impacting product availability and pricing. For instance, a shortage of microprocessors has been estimated to increase production costs by approximately 10-15%. Intense competitive pressures among established players and emerging startups also create a challenging pricing environment, potentially impacting profit margins. Furthermore, the initial investment cost for advanced sensor systems can be a significant barrier for smallholder farmers in developing economies, requiring innovative financing models or government subsidies to overcome. The complexity of integrating and interpreting data from multiple sensor types can also pose a challenge for less tech-savvy users, necessitating user-friendly interfaces and comprehensive support services.

Forces Driving Plant Physiological Sensor Growth

Several powerful forces are propelling the growth of the Plant Physiological Sensor market. Technological innovation is a primary driver, with ongoing advancements in sensor accuracy, miniaturization, and wireless connectivity enabling more sophisticated and user-friendly solutions. The increasing adoption of precision agriculture worldwide is a significant economic factor, as farmers seek to optimize resource management and improve crop yields to meet the demands of a growing global population. Government initiatives and subsidies promoting sustainable farming practices and smart agriculture further bolster this trend. The growing awareness of climate change and its impact on agriculture is also a key catalyst, driving demand for tools that help monitor and adapt to environmental stressors. For example, sensors that measure soil moisture and plant transpiration are critical for efficient water management in drought-prone regions. The expanding research into plant biology and crop science also fuels demand for high-precision physiological data, contributing to market expansion.

Challenges in the Plant Physiological Sensor Market

Long-term growth catalysts for the Plant Physiological Sensor market are deeply rooted in continuous innovation and strategic market expansion. The ongoing miniaturization of sensors and the development of low-power consumption technologies are making these devices more accessible and versatile, opening up new application areas. The increasing integration of AI and machine learning into sensor data analysis is a significant catalyst, transforming raw data into actionable insights for improved decision-making in agriculture, research, and environmental management. Partnerships between sensor manufacturers, software developers, and agricultural service providers are crucial for creating integrated solutions that offer end-to-end value. Market expansion into emerging economies, where agricultural modernization is a key focus, presents substantial growth opportunities. Furthermore, the development of standardized data protocols and interoperability between different sensor systems will foster wider adoption and facilitate cross-platform data analysis.

Emerging Opportunities in Plant Physiological Sensor

The Plant Physiological Sensor market is rife with emerging opportunities driven by evolving technologies and market demands. The expansion of smart farming and vertical agriculture presents a significant avenue for growth, particularly for indoor environmental sensors that monitor light, humidity, CO2, and nutrient levels. The increasing use of drones and satellite imagery for agricultural monitoring is creating opportunities for integrating ground-based physiological sensors to provide ground-truth data and enhance the accuracy of remote sensing analyses. The growing demand for hyper-local weather data and its impact on crop health is also creating a niche for localized sensor networks. Furthermore, the development of biodegradable sensors and sustainable sensor materials aligns with the growing global focus on environmental sustainability, offering a unique selling proposition. The use of plant physiological sensors in urban green spaces and landscape management, for optimizing irrigation and plant health in cities, is another burgeoning area. The predictive analytics capabilities enabled by these sensors are also opening doors for insurance companies and financial institutions to develop new risk assessment models for agriculture.

Leading Players in the Plant Physiological Sensor Sector

- ICT International

- Edaphic Scientific

- Meter

- Apogee

- Posel

- SpectrumTech

- LI-COR Biosciences

- Decagon Devices

- Gro Water

- EasyBloom

- Dynamax

- Aozuo

Key Milestones in Plant Physiological Sensor Industry

- 2019: Introduction of advanced AI-powered anomaly detection algorithms for physiological data analysis.

- 2020: Significant advancements in non-invasive sensor technology, enabling real-time sap flow measurements.

- 2021: Increased investment in R&D for IoT-enabled plant monitoring systems, leading to more connected solutions.

- 2022: Development of highly miniaturized and energy-efficient sensors for long-term deployments.

- 2023: Growing adoption of cloud-based data platforms for integrated plant physiological data management and analysis.

- 2024: Emergence of biodegradable sensor materials, aligning with sustainability trends.

- 2025 (Estimated): Expected wider integration of predictive analytics for disease and stress forecasting, reaching over xx million market value.

- 2026-2030 (Forecast): Continued growth driven by precision agriculture adoption and expansion into new geographical markets, projected CAGR of 12-15%.

- 2031-2033 (Forecast): Further integration with robotics and autonomous farming systems, market size projected to exceed xx million by 2033.

Strategic Outlook for Plant Physiological Sensor Market

The strategic outlook for the Plant Physiological Sensor market is exceptionally positive, driven by a confluence of technological innovation, growing global agricultural demands, and an increasing emphasis on sustainable practices. Growth accelerators include the continued miniaturization and cost reduction of sensor technology, making it more accessible to a wider range of users. The seamless integration of these sensors with AI and machine learning platforms will unlock sophisticated predictive analytics, enabling proactive crop management and optimized resource allocation. Expansion into emerging markets in Asia, Africa, and Latin America presents significant untapped potential. Strategic partnerships between sensor manufacturers, agritech companies, and research institutions will foster the development of comprehensive, end-to-end solutions. The increasing demand for data-driven insights across environmental monitoring and scientific research will further solidify the market's growth trajectory, positioning the Plant Physiological Sensor market for sustained expansion in the coming decade.

Plant Physiological Sensor Segmentation

-

1. Application

- 1.1. Environmental Monitoring

- 1.2. Scientific Research

- 1.3. Agriculture Production Management

- 1.4. Others

-

2. Type

- 2.1. Internal Environmental Sensor

- 2.2. External Environmental Sensor

Plant Physiological Sensor Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Plant Physiological Sensor REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Plant Physiological Sensor Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Environmental Monitoring

- 5.1.2. Scientific Research

- 5.1.3. Agriculture Production Management

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Internal Environmental Sensor

- 5.2.2. External Environmental Sensor

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Plant Physiological Sensor Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Environmental Monitoring

- 6.1.2. Scientific Research

- 6.1.3. Agriculture Production Management

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Internal Environmental Sensor

- 6.2.2. External Environmental Sensor

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Plant Physiological Sensor Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Environmental Monitoring

- 7.1.2. Scientific Research

- 7.1.3. Agriculture Production Management

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Internal Environmental Sensor

- 7.2.2. External Environmental Sensor

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Plant Physiological Sensor Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Environmental Monitoring

- 8.1.2. Scientific Research

- 8.1.3. Agriculture Production Management

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Internal Environmental Sensor

- 8.2.2. External Environmental Sensor

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Plant Physiological Sensor Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Environmental Monitoring

- 9.1.2. Scientific Research

- 9.1.3. Agriculture Production Management

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Internal Environmental Sensor

- 9.2.2. External Environmental Sensor

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Plant Physiological Sensor Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Environmental Monitoring

- 10.1.2. Scientific Research

- 10.1.3. Agriculture Production Management

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Internal Environmental Sensor

- 10.2.2. External Environmental Sensor

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 ICT International

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Edaphic Scientific

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Meter

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Apogee

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Posel

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SpectrumTech

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 LI-COR Biosciences

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Decagon Devices

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Gro Water

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 EasyBloom

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Dynamax

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Aozuo

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 ICT International

List of Figures

- Figure 1: Global Plant Physiological Sensor Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Plant Physiological Sensor Revenue (million), by Application 2024 & 2032

- Figure 3: North America Plant Physiological Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Plant Physiological Sensor Revenue (million), by Type 2024 & 2032

- Figure 5: North America Plant Physiological Sensor Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Plant Physiological Sensor Revenue (million), by Country 2024 & 2032

- Figure 7: North America Plant Physiological Sensor Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Plant Physiological Sensor Revenue (million), by Application 2024 & 2032

- Figure 9: South America Plant Physiological Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Plant Physiological Sensor Revenue (million), by Type 2024 & 2032

- Figure 11: South America Plant Physiological Sensor Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Plant Physiological Sensor Revenue (million), by Country 2024 & 2032

- Figure 13: South America Plant Physiological Sensor Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Plant Physiological Sensor Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Plant Physiological Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Plant Physiological Sensor Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Plant Physiological Sensor Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Plant Physiological Sensor Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Plant Physiological Sensor Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Plant Physiological Sensor Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Plant Physiological Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Plant Physiological Sensor Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Plant Physiological Sensor Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Plant Physiological Sensor Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Plant Physiological Sensor Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Plant Physiological Sensor Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Plant Physiological Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Plant Physiological Sensor Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Plant Physiological Sensor Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Plant Physiological Sensor Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Plant Physiological Sensor Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Plant Physiological Sensor Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Plant Physiological Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Plant Physiological Sensor Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Plant Physiological Sensor Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Plant Physiological Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Plant Physiological Sensor Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Plant Physiological Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Plant Physiological Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Plant Physiological Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Plant Physiological Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Plant Physiological Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Plant Physiological Sensor Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Plant Physiological Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Plant Physiological Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Plant Physiological Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Plant Physiological Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Plant Physiological Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Plant Physiological Sensor Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Plant Physiological Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Plant Physiological Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Plant Physiological Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Plant Physiological Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Plant Physiological Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Plant Physiological Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Plant Physiological Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Plant Physiological Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Plant Physiological Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Plant Physiological Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Plant Physiological Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Plant Physiological Sensor Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Plant Physiological Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Plant Physiological Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Plant Physiological Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Plant Physiological Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Plant Physiological Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Plant Physiological Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Plant Physiological Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Plant Physiological Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Plant Physiological Sensor Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Plant Physiological Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Plant Physiological Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Plant Physiological Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Plant Physiological Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Plant Physiological Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Plant Physiological Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Plant Physiological Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Plant Physiological Sensor Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Plant Physiological Sensor?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Plant Physiological Sensor?

Key companies in the market include ICT International, Edaphic Scientific, Meter, Apogee, Posel, SpectrumTech, LI-COR Biosciences, Decagon Devices, Gro Water, EasyBloom, Dynamax, Aozuo.

3. What are the main segments of the Plant Physiological Sensor?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Plant Physiological Sensor," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Plant Physiological Sensor report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Plant Physiological Sensor?

To stay informed about further developments, trends, and reports in the Plant Physiological Sensor, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence