Key Insights

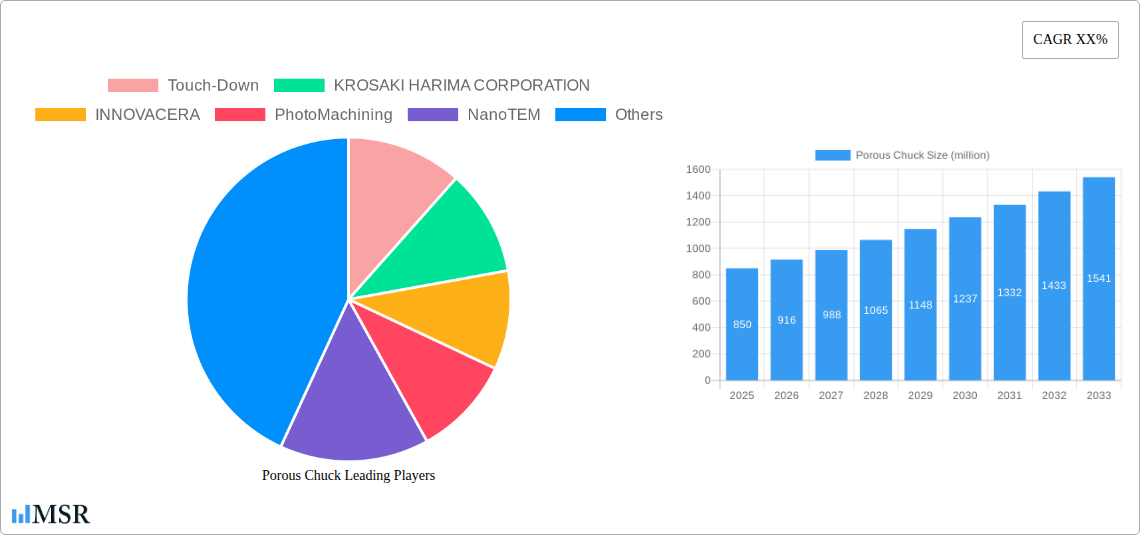

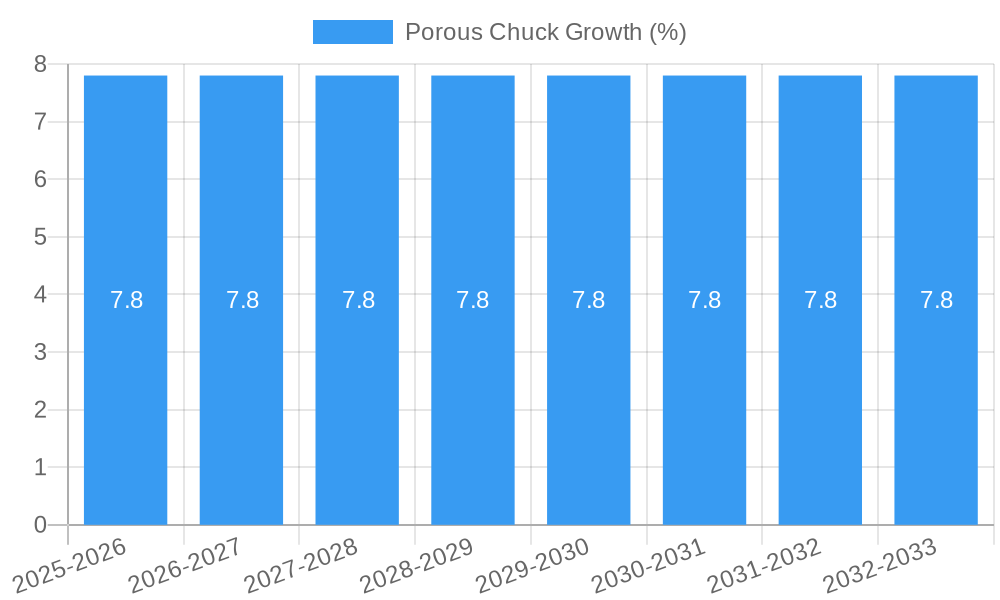

The global Porous Chuck market is poised for significant expansion, projected to reach an estimated market size of approximately $850 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 7.8% through 2033. This growth is primarily fueled by the escalating demand from the Semiconductor Industry, driven by the continuous innovation and miniaturization of electronic components, requiring ever-more precise handling and processing solutions. The Photovoltaic Industry also presents a substantial growth avenue, as advancements in solar cell manufacturing necessitate advanced materials for efficient wafer handling and processing, thereby contributing to the overall market buoyancy. Alumina Porous Chucks, known for their thermal stability and electrostatic properties, are expected to dominate the market share within the types segment, owing to their widespread adoption in high-precision semiconductor fabrication processes.

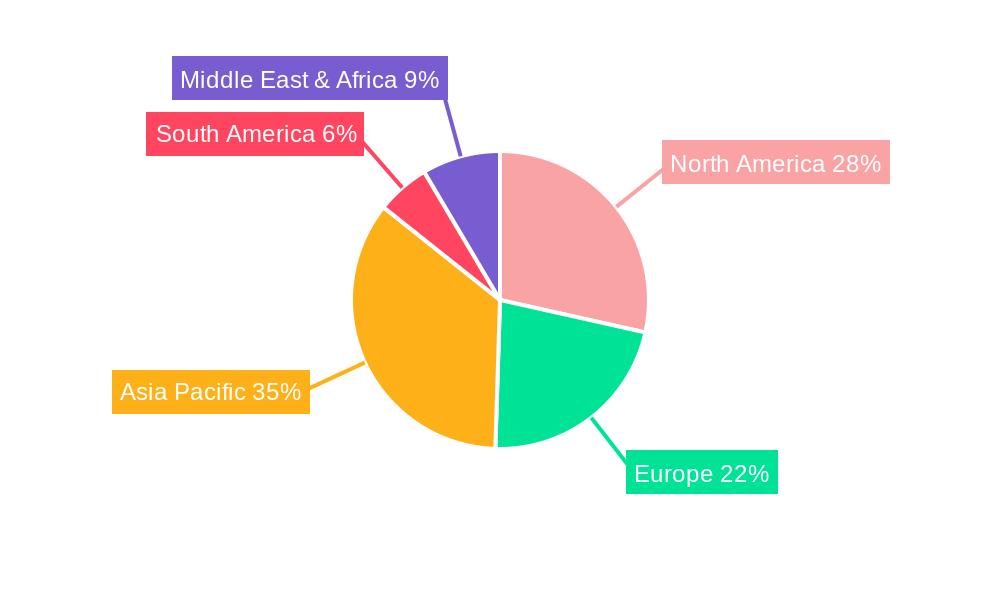

While the market exhibits strong growth potential, certain factors may act as restraints. The high cost of advanced manufacturing processes and raw materials, coupled with the need for specialized expertise in producing and maintaining these sophisticated chucks, could pose challenges to broader market penetration, especially in emerging economies. However, ongoing technological advancements aimed at improving manufacturing efficiency and reducing costs are likely to mitigate these restraints over the forecast period. The market is characterized by a competitive landscape with key players like Touch-Down, KROSAKI HARIMA CORPORATION, and INNOVACERA actively involved in product development and strategic collaborations to capture market share. North America and Asia Pacific are anticipated to be the leading regions, owing to the concentration of semiconductor and photovoltaic manufacturing hubs in these areas.

Porous Chuck Market: Comprehensive Analysis and Future Projections (2019–2033)

Embark on a deep dive into the global porous chuck market with this exhaustive report, meticulously crafted for industry stakeholders seeking actionable insights and strategic advantages. Spanning the historical period of 2019–2024, with a robust base year of 2025 and an extensive forecast period extending to 2033, this analysis provides unparalleled visibility into market dynamics, technological advancements, and future growth trajectories. Discover critical market intelligence on porous chuck applications in the semiconductor and photovoltaic industries, along with emerging trends in ‘Other’ segments. Delve into the competitive landscape featuring key players like Touch-Down, KROSAKI HARIMA CORPORATION, INNOVACERA, PhotoMachining, NanoTEM, LONGYI Precision Technology, Emitech Resources, SemiXicon, Advanced Research Corporation (ARC), CERMAX CO.,LTD., SIO CO.,LTD, Martini Tech, Hans advanced ceramics, Zhengzhou Hongtuo Superabrasive Products Co.,Ltd., NTK CERATEC, and navigate the dominance of Alumina Porous Chucks, Silicon Carbide Porous Chucks, and ‘Other’ types.

Porous Chuck Market Concentration & Dynamics

The global porous chuck market is characterized by a moderate to high concentration, with a discernible trend towards strategic alliances and technological collaborations to enhance market share and innovation capabilities. The innovation ecosystem is particularly vibrant within the semiconductor and photovoltaic sectors, driven by an insatiable demand for precision and efficiency in wafer handling and processing. Regulatory frameworks, while generally supportive of technological advancements, can introduce complexities, particularly concerning environmental standards and material sourcing. Substitute products, though present, often fall short in offering the unique vacuum hold-down and uniform cooling capabilities that define porous chucks, limiting their direct competitive impact. End-user trends are firmly anchored in the pursuit of higher yields, reduced contamination, and improved throughput in advanced manufacturing processes. Mergers and acquisitions (M&A) activities, though not at an extremely high volume, are strategic, often involving technology acquisition or market consolidation, aiming to bolster competitive positions. For instance, recent M&A activities indicate a push for integrated solutions, with deal counts estimated in the range of 5-10 significant transactions over the historical period. The market share distribution among leading players is estimated to range from 10% for the top contender to xx% for mid-tier players, reflecting a dynamic competitive environment.

Porous Chuck Industry Insights & Trends

The porous chuck industry is poised for substantial growth, driven by several interconnected factors that are reshaping advanced manufacturing landscapes. The estimated market size for porous chucks in 2025 is projected to be in the range of $500 million to $700 million, with a compelling Compound Annual Growth Rate (CAGR) of 8-10% anticipated throughout the forecast period (2025–2033). This robust growth is primarily fueled by the insatiable demand from the semiconductor industry, which is experiencing an unprecedented surge in chip production driven by the proliferation of AI, 5G, and the Internet of Things (IoT). Advanced semiconductor fabrication processes, demanding ultra-high precision, ultra-low particle generation, and superior thermal management, are creating a fertile ground for sophisticated porous chuck solutions. Similarly, the burgeoning photovoltaic industry, with its ambitious global expansion targets and a relentless pursuit of higher solar cell efficiency, represents another significant growth pillar. Innovations in solar panel manufacturing, including larger wafer sizes and more complex cell architectures, necessitate advanced handling and holding solutions, a niche where porous chucks excel.

Technological disruptions are playing a pivotal role in shaping market trends. The development of novel ceramic materials with enhanced thermal conductivity, improved vacuum integrity, and superior chemical resistance is a key area of innovation. Companies are investing heavily in R&D to create porous chucks that can withstand extreme processing temperatures, minimize wafer-induced contamination, and offer superior non-contact handling. Furthermore, advancements in additive manufacturing (3D printing) for porous structures are opening up possibilities for customized chuck designs tailored to specific application requirements, potentially reducing lead times and manufacturing costs. Evolving consumer behaviors, though indirect, influence the demand for porous chucks. The increasing global demand for sophisticated electronic devices, renewable energy solutions, and advanced medical equipment translates into higher production volumes for the underlying components, thereby boosting the demand for precision manufacturing equipment, including porous chucks. The need for higher precision, greater yield, and reduced operational costs are persistent drivers, pushing manufacturers to adopt cutting-edge porous chuck technology. The market is also witnessing a trend towards integrated solutions, where porous chucks are designed to work seamlessly with other components in a manufacturing line, offering enhanced system performance and efficiency. The total addressable market is projected to reach $1.2 billion to $1.5 billion by 2033.

Key Markets & Segments Leading Porous Chuck

The global porous chuck market's leadership is predominantly dictated by the Semiconductor Industry, followed closely by the Photovoltaic Industry, with ‘Other’ applications exhibiting steady growth.

Dominance of the Semiconductor Industry:

- Economic Growth: The robust global economic growth, especially in technology-driven regions, directly fuels the expansion of the semiconductor manufacturing sector. Increased consumer demand for advanced electronics, coupled with massive investments in AI infrastructure and 5G deployment, creates an insatiable appetite for semiconductors. This surge in demand necessitates a corresponding increase in wafer fabrication capacity, directly translating into a higher requirement for high-performance porous chucks.

- Technological Advancements: The relentless pace of innovation in semiconductor technology, characterized by shrinking transistor sizes and the development of novel materials and architectures, demands increasingly sophisticated manufacturing processes. Porous chucks are critical for enabling these advancements by providing precise wafer holding, uniform temperature control, and contamination-free handling, which are paramount for achieving high yields in sub-micron lithography and advanced packaging.

- Infrastructure Development: Significant investments in new semiconductor fabrication plants (fabs) and the expansion of existing facilities worldwide are a primary driver for porous chuck demand. These large-scale infrastructure projects require substantial quantities of precision manufacturing equipment, with porous chucks being a vital component in wafer processing equipment.

The Photovoltaic Industry's Ascendance:

- Renewable Energy Push: Global initiatives and government policies aimed at combating climate change and transitioning to renewable energy sources are significantly boosting the photovoltaic industry. Ambitious solar energy targets worldwide are driving unprecedented investment in solar panel manufacturing.

- Efficiency Gains: The continuous drive for higher solar cell efficiency and the increasing adoption of larger wafer formats necessitate improved manufacturing precision. Porous chucks play a crucial role in ensuring uniform handling and processing of these larger and more delicate wafers, contributing to higher production yields and reduced manufacturing defects.

- Cost Reduction: As the solar industry strives for cost competitiveness, efficient and high-throughput manufacturing processes are essential. Porous chucks contribute to this by enabling faster processing cycles and minimizing material waste through precise wafer handling.

Types of Porous Chucks: Alumina Porous Chucks Leading the Charge:

- Alumina Porous Chucks: These dominate the market due to their excellent thermal conductivity, high stiffness, and resistance to chemical attack, making them ideal for a wide range of semiconductor and photovoltaic processing applications, particularly at elevated temperatures. Their cost-effectiveness compared to advanced materials further bolsters their market position.

- Silicon Carbide Porous Chucks: Gaining traction for their superior thermal shock resistance and even higher thermal conductivity, Silicon Carbide (SiC) porous chucks are increasingly used in demanding applications requiring rapid cooling and heating cycles. Their high hardness also contributes to improved wear resistance.

- Other Porous Chucks: This category encompasses chucks made from specialized materials like ceramics and composites, offering tailored properties for niche applications. Innovations in this segment are often driven by specific performance requirements, such as ultra-low particle generation or extreme temperature resistance.

Porous Chuck Product Developments

The porous chuck market is witnessing continuous product development focused on enhancing precision, thermal management, and material purity. Innovations include the development of chucks with micro-pore structures for ultra-fine vacuum control, advanced ceramic composites for improved thermal conductivity exceeding 300 W/mK, and enhanced surface treatments to minimize particle generation below 10 particles per cubic foot. These advancements are critical for enabling next-generation semiconductor fabrication and high-efficiency photovoltaic cell manufacturing. The market relevance is underscored by their indispensable role in wafer handling, etching, deposition, and annealing processes, providing a competitive edge through improved process stability and reduced defect rates.

Challenges in the Porous Chuck Market

The porous chuck market faces several challenges that impact its growth trajectory. High manufacturing costs associated with precision ceramic machining and quality control contribute significantly to the overall price point, with per-unit costs potentially ranging from $5,000 to $20,000 for advanced units. Supply chain disruptions, particularly for specialized ceramic raw materials, can lead to extended lead times, estimated at 8-12 weeks. Furthermore, stringent quality control requirements in the semiconductor industry necessitate rigorous testing and certification, adding to operational complexities. The high initial investment for advanced porous chuck systems can also be a barrier for smaller manufacturers. The competitive landscape, while offering innovation, also presents challenges in terms of price pressures and the need for continuous R&D to maintain market leadership.

Forces Driving Porous Chuck Growth

The porous chuck market is propelled by a confluence of powerful growth forces. The unprecedented demand from the semiconductor industry, fueled by AI, 5G, and the expanding IoT ecosystem, is a primary catalyst. Significant investments in new fab construction worldwide, projected to exceed $200 billion annually, directly translate into a surge in demand for precision manufacturing equipment, including porous chucks. Technological advancements in wafer handling, such as the adoption of larger wafer diameters (e.g., 300mm and beyond), necessitate superior chuck performance. Furthermore, the global push towards renewable energy is significantly augmenting the growth of the photovoltaic industry, creating substantial opportunities for porous chuck manufacturers. Emerging applications in advanced packaging and MEMS manufacturing are also contributing to market expansion.

Challenges in the Porous Chuck Market

The long-term growth of the porous chuck market hinges on overcoming inherent challenges and capitalizing on emerging trends. Continuous innovation in material science and manufacturing techniques is crucial to meet the ever-increasing demands for precision and performance in next-generation semiconductor nodes and solar cell technologies. Strategic partnerships and collaborations between porous chuck manufacturers and equipment OEMs will be vital for developing integrated solutions and accelerating market penetration. Expanding into new geographic markets, particularly those with burgeoning semiconductor and solar manufacturing capabilities, presents significant growth potential. The development of cost-effective yet high-performance solutions will be key to broadening market access and driving adoption across a wider range of applications.

Emerging Opportunities in Porous Chuck

Emerging opportunities in the porous chuck market are diverse and promising. The growing adoption of advanced packaging technologies in the semiconductor industry, such as fan-out wafer-level packaging, creates a demand for specialized porous chucks that can handle intricate and delicate chip structures. The increasing trend towards miniaturization and higher integration density in electronics necessitates chucks with exceptional precision and particle control. Furthermore, the expansion of the micro-electro-mechanical systems (MEMS) sector, which requires highly controlled manufacturing environments, presents a significant untapped market. Innovations in smart porous chucks equipped with integrated sensors for real-time monitoring of temperature, vacuum, and contamination levels are also emerging, offering enhanced process control and predictive maintenance capabilities. The increasing focus on sustainability and energy efficiency in manufacturing processes also opens avenues for porous chucks that contribute to reduced energy consumption during wafer cooling or heating.

Leading Players in the Porous Chuck Sector

- Touch-Down

- KROSAKI HARIMA CORPORATION

- INNOVACERA

- PhotoMachining

- NanoTEM

- LONGYI Precision Technology

- Emitech Resources

- SemiXicon

- Advanced Research Corporation (ARC)

- CERMAX CO.,LTD.

- SIO CO.,LTD

- Martini Tech

- Hans advanced ceramics

- Zhengzhou Hongtuo Superabrasive Products Co.,Ltd.

- NTK CERATEC

Key Milestones in Porous Chuck Industry

- 2019: Introduction of porous chucks with enhanced thermal conductivity by KROSAKI HARIMA CORPORATION, improving wafer temperature uniformity.

- 2020: INNOVACERA launches a new generation of Alumina porous chucks with ultra-fine pore sizes for improved vacuum control in semiconductor applications.

- 2021: PhotoMachining develops custom porous chuck solutions for specialized laser processing applications.

- 2022: Emitech Resources announces strategic partnership to expand porous chuck offerings for photovoltaic manufacturing.

- 2023: NTK CERATEC introduces advanced Silicon Carbide porous chucks offering superior thermal shock resistance.

- 2024 (Estimated): Significant investments in R&D by multiple players focusing on next-generation porous materials and integrated sensing capabilities.

Strategic Outlook for Porous Chuck Market

The strategic outlook for the porous chuck market is overwhelmingly positive, driven by sustained demand from the semiconductor and photovoltaic industries, coupled with ongoing technological advancements. Growth accelerators include the continued miniaturization of semiconductor components, the global push for renewable energy, and the increasing adoption of advanced manufacturing techniques. Manufacturers that can offer highly customized, precision-engineered porous chucks with superior thermal management and contamination control will be best positioned for success. Strategic investments in R&D, coupled with targeted market expansions into high-growth regions, will be crucial for capturing market share. The future will likely see greater integration of smart technologies within porous chucks, enabling advanced process monitoring and control. The market is expected to witness continued consolidation through strategic acquisitions and partnerships as companies seek to strengthen their competitive portfolios and expand their technological capabilities, aiming for a market value exceeding $1.5 billion by 2033.

Porous Chuck Segmentation

-

1. Application

- 1.1. Semiconductor Industry

- 1.2. Photovoltaic Industry

- 1.3. Other

-

2. Types

- 2.1. Alumina Porous Chucks

- 2.2. Silicon Carbide Porous Chucks

- 2.3. Other

Porous Chuck Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Porous Chuck REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Porous Chuck Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Semiconductor Industry

- 5.1.2. Photovoltaic Industry

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Alumina Porous Chucks

- 5.2.2. Silicon Carbide Porous Chucks

- 5.2.3. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Porous Chuck Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Semiconductor Industry

- 6.1.2. Photovoltaic Industry

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Alumina Porous Chucks

- 6.2.2. Silicon Carbide Porous Chucks

- 6.2.3. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Porous Chuck Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Semiconductor Industry

- 7.1.2. Photovoltaic Industry

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Alumina Porous Chucks

- 7.2.2. Silicon Carbide Porous Chucks

- 7.2.3. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Porous Chuck Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Semiconductor Industry

- 8.1.2. Photovoltaic Industry

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Alumina Porous Chucks

- 8.2.2. Silicon Carbide Porous Chucks

- 8.2.3. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Porous Chuck Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Semiconductor Industry

- 9.1.2. Photovoltaic Industry

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Alumina Porous Chucks

- 9.2.2. Silicon Carbide Porous Chucks

- 9.2.3. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Porous Chuck Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Semiconductor Industry

- 10.1.2. Photovoltaic Industry

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Alumina Porous Chucks

- 10.2.2. Silicon Carbide Porous Chucks

- 10.2.3. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Touch-Down

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 KROSAKI HARIMA CORPORATION

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 INNOVACERA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 PhotoMachining

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 NanoTEM

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 LONGYI Precision Technology

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Emitech Resources

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SemiXicon

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Advanced Research Corporation (ARC)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 CERMAX CO.

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 LTD.

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 SIO CO.

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 LTD

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Martini Tech

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Hans advanced ceramics

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Zhengzhou Hongtuo Superabrasive Products Co.

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Ltd.

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 NTK CERATEC

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 Touch-Down

List of Figures

- Figure 1: Global Porous Chuck Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Porous Chuck Revenue (million), by Application 2024 & 2032

- Figure 3: North America Porous Chuck Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Porous Chuck Revenue (million), by Types 2024 & 2032

- Figure 5: North America Porous Chuck Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Porous Chuck Revenue (million), by Country 2024 & 2032

- Figure 7: North America Porous Chuck Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Porous Chuck Revenue (million), by Application 2024 & 2032

- Figure 9: South America Porous Chuck Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Porous Chuck Revenue (million), by Types 2024 & 2032

- Figure 11: South America Porous Chuck Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Porous Chuck Revenue (million), by Country 2024 & 2032

- Figure 13: South America Porous Chuck Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Porous Chuck Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Porous Chuck Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Porous Chuck Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Porous Chuck Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Porous Chuck Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Porous Chuck Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Porous Chuck Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Porous Chuck Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Porous Chuck Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Porous Chuck Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Porous Chuck Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Porous Chuck Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Porous Chuck Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Porous Chuck Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Porous Chuck Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Porous Chuck Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Porous Chuck Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Porous Chuck Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Porous Chuck Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Porous Chuck Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Porous Chuck Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Porous Chuck Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Porous Chuck Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Porous Chuck Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Porous Chuck Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Porous Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Porous Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Porous Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Porous Chuck Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Porous Chuck Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Porous Chuck Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Porous Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Porous Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Porous Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Porous Chuck Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Porous Chuck Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Porous Chuck Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Porous Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Porous Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Porous Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Porous Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Porous Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Porous Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Porous Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Porous Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Porous Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Porous Chuck Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Porous Chuck Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Porous Chuck Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Porous Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Porous Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Porous Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Porous Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Porous Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Porous Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Porous Chuck Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Porous Chuck Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Porous Chuck Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Porous Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Porous Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Porous Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Porous Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Porous Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Porous Chuck Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Porous Chuck Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Porous Chuck?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Porous Chuck?

Key companies in the market include Touch-Down, KROSAKI HARIMA CORPORATION, INNOVACERA, PhotoMachining, NanoTEM, LONGYI Precision Technology, Emitech Resources, SemiXicon, Advanced Research Corporation (ARC), CERMAX CO., LTD., SIO CO., LTD, Martini Tech, Hans advanced ceramics, Zhengzhou Hongtuo Superabrasive Products Co., Ltd., NTK CERATEC.

3. What are the main segments of the Porous Chuck?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Porous Chuck," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Porous Chuck report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Porous Chuck?

To stay informed about further developments, trends, and reports in the Porous Chuck, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence