Key Insights

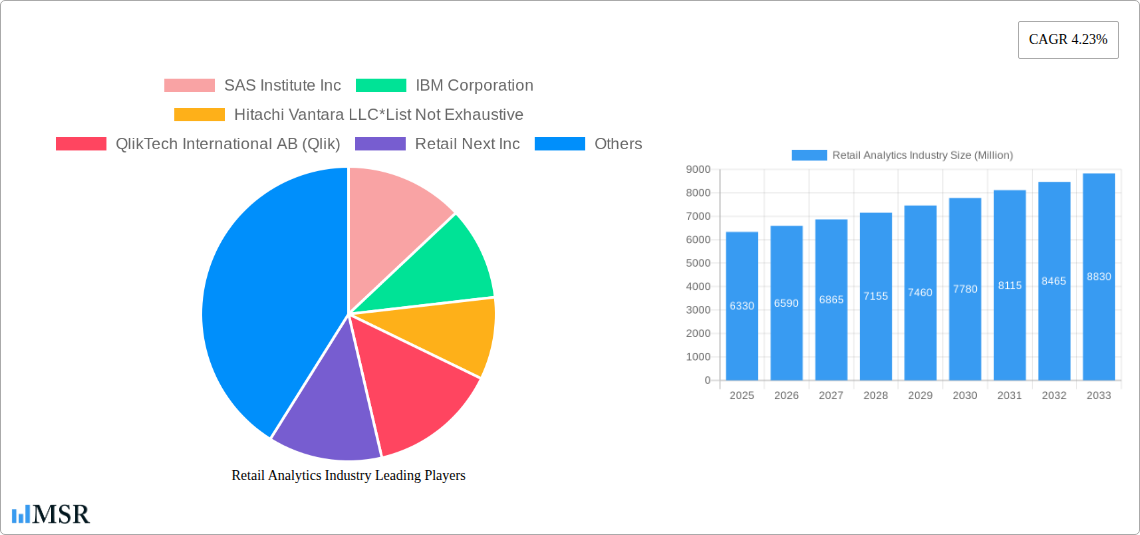

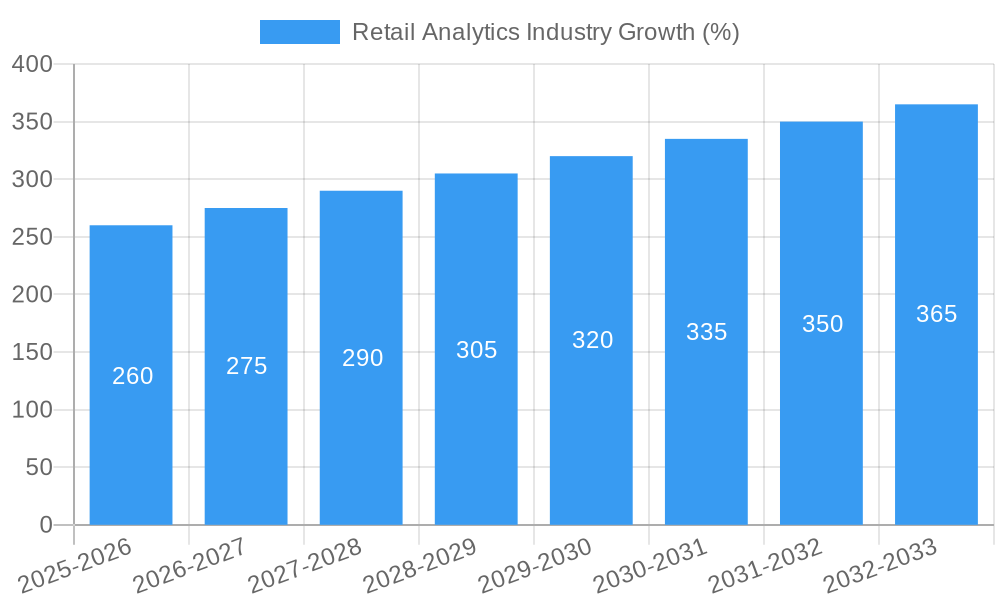

The retail analytics market, valued at $6.33 billion in 2025, is projected to experience robust growth, driven by the increasing need for data-driven decision-making within the retail sector. A Compound Annual Growth Rate (CAGR) of 4.23% from 2025 to 2033 indicates a significant expansion, fueled by several key factors. The rising adoption of cloud-based solutions offers scalability and cost-effectiveness, while advancements in artificial intelligence (AI) and machine learning (ML) empower retailers to gain deeper insights from vast datasets. Specifically, areas like customer segmentation, personalized marketing, predictive inventory management, and optimized supply chain operations are experiencing substantial growth. The shift towards omnichannel retail strategies further necessitates robust analytics capabilities to understand customer behavior across various touchpoints. Competition among major players like SAS Institute, IBM, and Salesforce is driving innovation and making advanced analytics more accessible to businesses of all sizes.

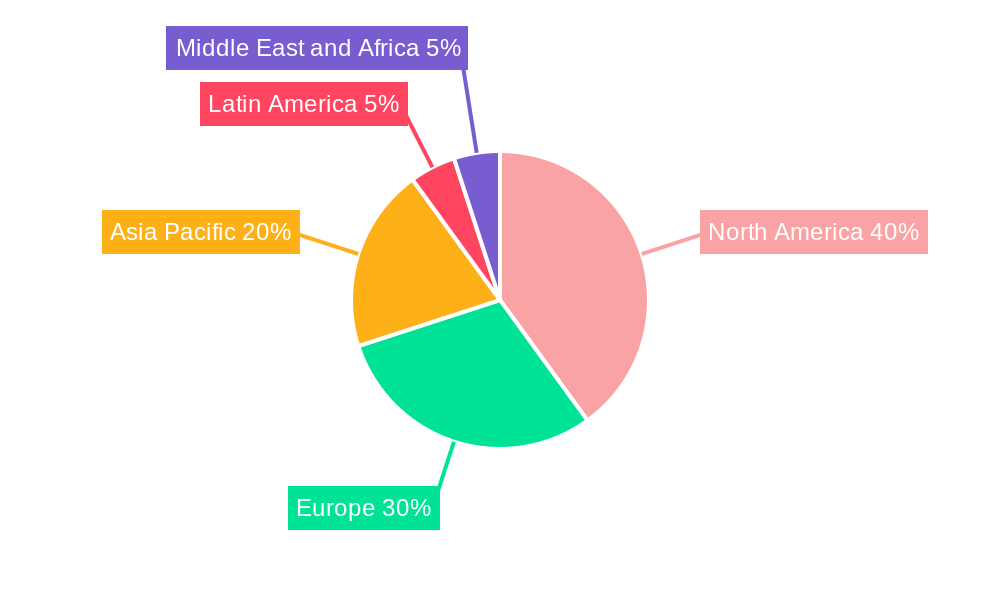

However, challenges remain. Data security and privacy concerns, coupled with the complexity of integrating disparate data sources, pose significant hurdles for many retailers. The need for skilled data scientists and analysts also contributes to the implementation costs. Despite these restraints, the long-term outlook for the retail analytics market remains positive, as the increasing reliance on data-driven strategies becomes essential for survival and competitiveness in the ever-evolving retail landscape. Growth is expected to be particularly strong in regions like Asia-Pacific, driven by rapid e-commerce adoption and the increasing digitalization of retail operations in emerging markets. The segmentation by solution (software, services), deployment (cloud, on-premise), and function (customer management, supply chain, marketing) offers various avenues for growth, with cloud-based software solutions for customer management expected to be a particularly significant segment.

Retail Analytics Industry Market Report: 2019-2033 Forecast

This comprehensive report provides a detailed analysis of the Retail Analytics Industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report projects a market value exceeding xx Million by 2033, presenting a compelling CAGR of xx%. This in-depth analysis covers market segmentation (By Solution: Software, Service; By Deployment: Cloud, On-premise; By Function: Customer Management, In-store Operation, Supply Chain Management, Marketing & Merchandizing, Other Functions), key players (including SAS Institute Inc, IBM Corporation, Hitachi Vantara LLC, QlikTech International AB (Qlik), Retail Next Inc, Altair Engineering Inc, Alteryx Inc, Oracle Corporation, Salesforce com Inc (Tableau Software Inc), and SAP SE), and significant industry developments. Download now to gain a competitive edge.

Retail Analytics Industry Market Concentration & Dynamics

The Retail Analytics market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the presence of numerous smaller, specialized firms fosters innovation and competition. The market is characterized by ongoing mergers and acquisitions (M&A) activity, with xx major deals recorded between 2019 and 2024, reflecting the industry's consolidation and growth. Market share for the top 5 players is estimated at xx% in 2025, with SAS Institute Inc holding an estimated xx% market share.

- Market Concentration: Moderately concentrated, with ongoing consolidation.

- Innovation Ecosystems: Strong, driven by technological advancements and the emergence of new entrants.

- Regulatory Frameworks: Varying by region, impacting data privacy and security.

- Substitute Products: Limited, with specialized solutions often tailored to specific retail needs.

- End-User Trends: Increasing adoption of cloud-based solutions and demand for advanced analytics capabilities.

- M&A Activity: High, with xx M&A deals recorded between 2019 and 2024 (estimated).

Retail Analytics Industry Insights & Trends

The Retail Analytics market is experiencing robust growth, driven by several key factors. The increasing adoption of omnichannel strategies by retailers, coupled with the explosion of consumer data, fuels the demand for advanced analytical tools to enhance decision-making. Technological advancements, including AI and machine learning, are further propelling market expansion. The global market size reached xx Million in 2024 and is projected to exceed xx Million by 2033. The market is experiencing a healthy Compound Annual Growth Rate (CAGR) of xx% during the forecast period. Evolving consumer behaviors, characterized by personalized experiences and high expectations, necessitate the use of retail analytics to understand and respond effectively to customer needs. This trend is further strengthened by the growing adoption of cloud-based solutions, offering scalability and cost-effectiveness to businesses of all sizes. The ongoing rise of e-commerce and the need for optimized supply chains also fuel demand for sophisticated retail analytics solutions.

Key Markets & Segments Leading Retail Analytics Industry

The North American region currently dominates the Retail Analytics market, followed by Europe and Asia-Pacific. Within the market segmentation, the cloud deployment model is experiencing rapid growth, surpassing on-premise solutions. Software solutions hold the largest segment share among solution offerings, though services are also growing steadily. Customer Management, In-store Operations (including Inventory and Performance Management), and Supply Chain Management functions constitute the most significant segments by function.

- Dominant Region: North America

- Dominant Deployment Model: Cloud

- Dominant Solution Type: Software

- Dominant Functional Segments: Customer Management, In-store Operations, Supply Chain Management

Drivers for Growth by Segment:

- Cloud Deployment: Cost-effectiveness, scalability, accessibility.

- Software Solutions: Comprehensive feature sets, advanced analytics capabilities.

- Customer Management: Improved customer understanding, personalized experiences.

- In-store Operations: Enhanced inventory management, optimized store performance.

- Supply Chain Management: Improved efficiency, reduced costs.

Retail Analytics Industry Product Developments

Recent product developments showcase a strong focus on AI-powered solutions, predictive analytics, and real-time data visualization. These advancements enable retailers to gain deeper insights into customer behavior, optimize pricing strategies, and streamline operations. Companies are increasingly integrating different data sources to provide a holistic view of the retail landscape, enhancing decision-making and driving a competitive edge. The introduction of innovative tools for personalized marketing campaigns, automated inventory management, and optimized supply chain logistics exemplifies this trend.

Challenges in the Retail Analytics Industry Market

The Retail Analytics market faces challenges such as the complexity of integrating diverse data sources, the high cost of implementation, and the need for skilled professionals to manage and interpret data. Data security and privacy concerns also pose significant challenges, especially with the increasing adoption of cloud-based solutions. The market is also characterized by intense competition, with established players and emerging startups vying for market share. These factors collectively impact market growth, with an estimated xx% decrease in potential market penetration predicted by 2028 if these issues are not adequately addressed.

Forces Driving Retail Analytics Industry Growth

Several factors are driving market growth, including the increasing availability of large datasets, the rise of cloud computing, and advancements in AI and machine learning. The growing need for enhanced customer experiences, improved operational efficiency, and data-driven decision-making also propel market expansion. Government initiatives promoting digital transformation and favorable economic conditions in key markets further support the industry's growth trajectory.

Challenges in the Retail Analytics Industry Market

Long-term growth depends on addressing data security concerns, fostering innovation in AI and machine learning, and expanding into emerging markets. Strategic partnerships and investments in talent development will also play a crucial role in sustaining future growth. The continuous development of user-friendly interfaces and affordable solutions for small and medium-sized businesses is also vital for long-term success.

Emerging Opportunities in Retail Analytics Industry

Emerging opportunities include the integration of IoT devices into retail operations, the development of predictive maintenance models for equipment, and the application of advanced analytics to personalized promotions and loyalty programs. The expanding market for hyper-personalization, utilizing AI to create uniquely tailored retail experiences, presents significant growth potential. New opportunities also include the deployment of advanced analytics in areas beyond traditional retail, such as supply chain optimization for related industries.

Leading Players in the Retail Analytics Industry Sector

- SAS Institute Inc

- IBM Corporation

- Hitachi Vantara LLC

- QlikTech International AB (Qlik)

- Retail Next Inc

- Altair Engineering Inc

- Alteryx Inc

- Oracle Corporation

- Salesforce com Inc (Tableau Software Inc)

- SAP SE

Key Milestones in Retail Analytics Industry Industry

- September 2023: Priority Software acquires Retailsoft, enhancing its retail management product offerings with innovative solutions for optimized business efficiency and revenue growth. This acquisition significantly strengthens Priority Software's market position and expands its capabilities in providing comprehensive retail management solutions.

- January 2023: AiFi partners with Microsoft to launch Smart Store Analytics, a cloud service providing enhanced shopper and operational analytics for autonomous shopping technologies. This collaboration marks a significant step toward the widespread adoption of AI-powered retail solutions and enhanced data analysis capabilities.

Strategic Outlook for Retail Analytics Industry Market

The Retail Analytics market is poised for continued growth, driven by technological advancements, evolving consumer preferences, and the increasing demand for data-driven decision-making across the retail industry. Strategic opportunities include expanding into untapped markets, developing innovative solutions tailored to specific retail needs, and fostering strategic partnerships to enhance market reach and technological capabilities. The focus on personalized customer experiences, efficient supply chain management, and data security will be critical for success in this dynamic market.

Retail Analytics Industry Segmentation

-

1. Solution

- 1.1. Software

- 1.2. Service

-

2. Deployment

- 2.1. Cloud

- 2.2. On-premise

-

3. Function

- 3.1. Customer Management

- 3.2. In-store

- 3.3. Supply Chain Management

- 3.4. Marketin

- 3.5. Other Fu

Retail Analytics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Retail Analytics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.23% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Volumes of Data and Technological Advancements in AI and AR/VR; Increasing E-retail Sales

- 3.3. Market Restrains

- 3.3.1. Lack of General Awareness and Expertise in Emerging Regions; Standardization and Integration Issues

- 3.4. Market Trends

- 3.4.1. In-store Operation Hold Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Retail Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Solution

- 5.1.1. Software

- 5.1.2. Service

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Cloud

- 5.2.2. On-premise

- 5.3. Market Analysis, Insights and Forecast - by Function

- 5.3.1. Customer Management

- 5.3.2. In-store

- 5.3.3. Supply Chain Management

- 5.3.4. Marketin

- 5.3.5. Other Fu

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Solution

- 6. North America Retail Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Solution

- 6.1.1. Software

- 6.1.2. Service

- 6.2. Market Analysis, Insights and Forecast - by Deployment

- 6.2.1. Cloud

- 6.2.2. On-premise

- 6.3. Market Analysis, Insights and Forecast - by Function

- 6.3.1. Customer Management

- 6.3.2. In-store

- 6.3.3. Supply Chain Management

- 6.3.4. Marketin

- 6.3.5. Other Fu

- 6.1. Market Analysis, Insights and Forecast - by Solution

- 7. Europe Retail Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Solution

- 7.1.1. Software

- 7.1.2. Service

- 7.2. Market Analysis, Insights and Forecast - by Deployment

- 7.2.1. Cloud

- 7.2.2. On-premise

- 7.3. Market Analysis, Insights and Forecast - by Function

- 7.3.1. Customer Management

- 7.3.2. In-store

- 7.3.3. Supply Chain Management

- 7.3.4. Marketin

- 7.3.5. Other Fu

- 7.1. Market Analysis, Insights and Forecast - by Solution

- 8. Asia Pacific Retail Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Solution

- 8.1.1. Software

- 8.1.2. Service

- 8.2. Market Analysis, Insights and Forecast - by Deployment

- 8.2.1. Cloud

- 8.2.2. On-premise

- 8.3. Market Analysis, Insights and Forecast - by Function

- 8.3.1. Customer Management

- 8.3.2. In-store

- 8.3.3. Supply Chain Management

- 8.3.4. Marketin

- 8.3.5. Other Fu

- 8.1. Market Analysis, Insights and Forecast - by Solution

- 9. Latin America Retail Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Solution

- 9.1.1. Software

- 9.1.2. Service

- 9.2. Market Analysis, Insights and Forecast - by Deployment

- 9.2.1. Cloud

- 9.2.2. On-premise

- 9.3. Market Analysis, Insights and Forecast - by Function

- 9.3.1. Customer Management

- 9.3.2. In-store

- 9.3.3. Supply Chain Management

- 9.3.4. Marketin

- 9.3.5. Other Fu

- 9.1. Market Analysis, Insights and Forecast - by Solution

- 10. Middle East and Africa Retail Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Solution

- 10.1.1. Software

- 10.1.2. Service

- 10.2. Market Analysis, Insights and Forecast - by Deployment

- 10.2.1. Cloud

- 10.2.2. On-premise

- 10.3. Market Analysis, Insights and Forecast - by Function

- 10.3.1. Customer Management

- 10.3.2. In-store

- 10.3.3. Supply Chain Management

- 10.3.4. Marketin

- 10.3.5. Other Fu

- 10.1. Market Analysis, Insights and Forecast - by Solution

- 11. North America Retail Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe Retail Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Russia

- 12.1.5 Rest of Europe

- 13. Asia Pacific Retail Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Rest of Asia Pacific

- 14. Latin America Retail Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Retail Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 SAS Institute Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 IBM Corporation

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Hitachi Vantara LLC*List Not Exhaustive

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 QlikTech International AB (Qlik)

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Retail Next Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Altair Engineering Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Alteryx Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Oracle Corporation

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Salesforce com Inc (Tableau Software Inc )

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 SAP SE

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 SAS Institute Inc

List of Figures

- Figure 1: Global Retail Analytics Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Retail Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Retail Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Retail Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Retail Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Retail Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Retail Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Retail Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Retail Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Retail Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Retail Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Retail Analytics Industry Revenue (Million), by Solution 2024 & 2032

- Figure 13: North America Retail Analytics Industry Revenue Share (%), by Solution 2024 & 2032

- Figure 14: North America Retail Analytics Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 15: North America Retail Analytics Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 16: North America Retail Analytics Industry Revenue (Million), by Function 2024 & 2032

- Figure 17: North America Retail Analytics Industry Revenue Share (%), by Function 2024 & 2032

- Figure 18: North America Retail Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Retail Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Retail Analytics Industry Revenue (Million), by Solution 2024 & 2032

- Figure 21: Europe Retail Analytics Industry Revenue Share (%), by Solution 2024 & 2032

- Figure 22: Europe Retail Analytics Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 23: Europe Retail Analytics Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 24: Europe Retail Analytics Industry Revenue (Million), by Function 2024 & 2032

- Figure 25: Europe Retail Analytics Industry Revenue Share (%), by Function 2024 & 2032

- Figure 26: Europe Retail Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Retail Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Retail Analytics Industry Revenue (Million), by Solution 2024 & 2032

- Figure 29: Asia Pacific Retail Analytics Industry Revenue Share (%), by Solution 2024 & 2032

- Figure 30: Asia Pacific Retail Analytics Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 31: Asia Pacific Retail Analytics Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 32: Asia Pacific Retail Analytics Industry Revenue (Million), by Function 2024 & 2032

- Figure 33: Asia Pacific Retail Analytics Industry Revenue Share (%), by Function 2024 & 2032

- Figure 34: Asia Pacific Retail Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific Retail Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Latin America Retail Analytics Industry Revenue (Million), by Solution 2024 & 2032

- Figure 37: Latin America Retail Analytics Industry Revenue Share (%), by Solution 2024 & 2032

- Figure 38: Latin America Retail Analytics Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 39: Latin America Retail Analytics Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 40: Latin America Retail Analytics Industry Revenue (Million), by Function 2024 & 2032

- Figure 41: Latin America Retail Analytics Industry Revenue Share (%), by Function 2024 & 2032

- Figure 42: Latin America Retail Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America Retail Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East and Africa Retail Analytics Industry Revenue (Million), by Solution 2024 & 2032

- Figure 45: Middle East and Africa Retail Analytics Industry Revenue Share (%), by Solution 2024 & 2032

- Figure 46: Middle East and Africa Retail Analytics Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 47: Middle East and Africa Retail Analytics Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 48: Middle East and Africa Retail Analytics Industry Revenue (Million), by Function 2024 & 2032

- Figure 49: Middle East and Africa Retail Analytics Industry Revenue Share (%), by Function 2024 & 2032

- Figure 50: Middle East and Africa Retail Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: Middle East and Africa Retail Analytics Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Retail Analytics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Retail Analytics Industry Revenue Million Forecast, by Solution 2019 & 2032

- Table 3: Global Retail Analytics Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 4: Global Retail Analytics Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 5: Global Retail Analytics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Retail Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Retail Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Russia Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Europe Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Retail Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: India Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of Asia Pacific Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Retail Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Retail Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Retail Analytics Industry Revenue Million Forecast, by Solution 2019 & 2032

- Table 25: Global Retail Analytics Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 26: Global Retail Analytics Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 27: Global Retail Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: United States Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Canada Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Retail Analytics Industry Revenue Million Forecast, by Solution 2019 & 2032

- Table 31: Global Retail Analytics Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 32: Global Retail Analytics Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 33: Global Retail Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Germany Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: United Kingdom Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: France Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Russia Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Europe Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Retail Analytics Industry Revenue Million Forecast, by Solution 2019 & 2032

- Table 40: Global Retail Analytics Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 41: Global Retail Analytics Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 42: Global Retail Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 43: China Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Japan Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: India Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Rest of Asia Pacific Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Global Retail Analytics Industry Revenue Million Forecast, by Solution 2019 & 2032

- Table 48: Global Retail Analytics Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 49: Global Retail Analytics Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 50: Global Retail Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 51: Global Retail Analytics Industry Revenue Million Forecast, by Solution 2019 & 2032

- Table 52: Global Retail Analytics Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 53: Global Retail Analytics Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 54: Global Retail Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Retail Analytics Industry?

The projected CAGR is approximately 4.23%.

2. Which companies are prominent players in the Retail Analytics Industry?

Key companies in the market include SAS Institute Inc, IBM Corporation, Hitachi Vantara LLC*List Not Exhaustive, QlikTech International AB (Qlik), Retail Next Inc, Altair Engineering Inc, Alteryx Inc, Oracle Corporation, Salesforce com Inc (Tableau Software Inc ), SAP SE.

3. What are the main segments of the Retail Analytics Industry?

The market segments include Solution, Deployment, Function.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.33 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Volumes of Data and Technological Advancements in AI and AR/VR; Increasing E-retail Sales.

6. What are the notable trends driving market growth?

In-store Operation Hold Major Share.

7. Are there any restraints impacting market growth?

Lack of General Awareness and Expertise in Emerging Regions; Standardization and Integration Issues.

8. Can you provide examples of recent developments in the market?

September 2023 - Priority Software acquired Retailsoft, a developer of innovative technology solutions for optimizing retail business efficiency and enhancing revenue growth. In addition, Priority is expanding the scope of its Retail Management Products and delivering significant value to Retailers by integrating Retailsoft's solutions. Retailsoft provides a dynamic platform with operational modules tailored to each organization's needs. These modules comprise work scheduling, communication tools, objective setting, and real-time access to POS data across all locations. Such features empower businesses with trend analysis, monitoring, and strategy optimization, facilitating data-driven decisions, sales goal setting, and fostering competition among branches.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Retail Analytics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Retail Analytics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Retail Analytics Industry?

To stay informed about further developments, trends, and reports in the Retail Analytics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence