Key Insights

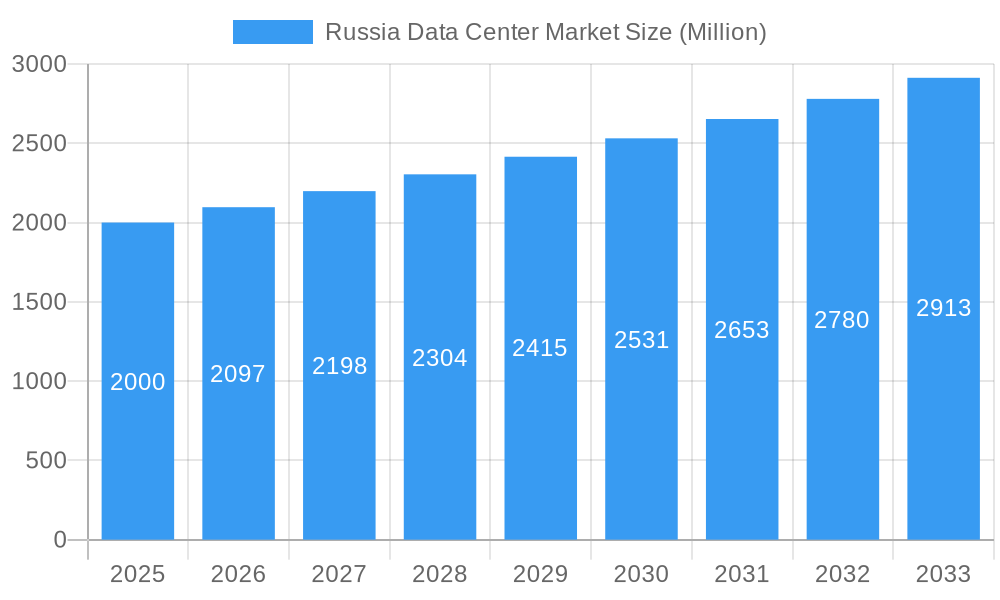

The Russia data center market, valued at approximately $XX million in 2025 (assuming a reasonable market size based on global trends and the provided CAGR), is projected to experience robust growth at a compound annual growth rate (CAGR) of 4.87% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing adoption of cloud computing services and digital transformation initiatives across various sectors, including finance, telecommunications, and government, are significantly boosting demand for data center infrastructure. Furthermore, the rise of big data analytics and the Internet of Things (IoT) are generating massive volumes of data, requiring substantial storage and processing capabilities. Government initiatives promoting digitalization within Russia are also playing a crucial role, alongside the expanding e-commerce landscape and the growing need for reliable and high-speed internet access. However, the market faces certain challenges, including geopolitical uncertainties, economic volatility, and potential infrastructure limitations in certain regions. Segment-wise, the Moscow hotspot is expected to dominate the market due to its concentration of businesses and technological infrastructure. Large data centers are likely to capture a larger share of the market compared to smaller facilities, driven by the scalability requirements of large enterprises and cloud providers. Tier 1 and Tier 3 data centers are expected to be in higher demand for their higher reliability and redundancy. The utilized segment within absorption will naturally have greater market share, reflecting the operational capacity of existing facilities.

Russia Data Center Market Market Size (In Billion)

The competitive landscape is dynamic, with both domestic and international players vying for market share. Companies such as Yandex Cloud LLC, MTS PJSC (MTS Group), Selectel Ltd, and Rostelecom are leading the market, leveraging their established presence and expertise. However, smaller, specialized providers like Nekstremum LLC and IXELERATE LLC are also contributing to the market’s growth, catering to niche segments and providing specialized services. Regional variations exist, with Western Russia anticipated to maintain a significant lead owing to its higher concentration of businesses and technological advancement. Future growth will be significantly influenced by the level of government investment in infrastructure development and policies supporting the digital economy, alongside the overall stability and growth of the Russian economy. The forecast period (2025-2033) presents significant opportunities for data center operators to capitalize on the expanding market while navigating the inherent challenges.

Russia Data Center Market Company Market Share

Russia Data Center Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Russia data center market, offering valuable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic landscape. The report covers the period 2019-2033, with a focus on the estimated year 2025 and a forecast period extending to 2033. It analyzes market concentration, key segments, leading players, recent developments, and future growth opportunities, presenting a 360° view of the Russian data center ecosystem. Discover key trends, challenges, and growth drivers shaping this crucial market. The report incorporates extensive data and analysis, providing actionable insights to inform strategic decision-making. The total market size is predicted to reach xx Million by 2033, representing a robust CAGR of xx%.

Russia Data Center Market Market Concentration & Dynamics

The Russian data center market exhibits a moderately concentrated landscape, with a few major players commanding significant market share. While precise market share figures for each company are unavailable and require further investigation, Yandex Cloud LLC and MTS PJSC (MTS Group) are considered leading contenders. Market concentration is influenced by factors including government regulations, infrastructure limitations, and the level of foreign investment.

Innovation Ecosystem: The Russian data center market is witnessing growing innovation, driven by the need for enhanced digital infrastructure to support the burgeoning digital economy. However, sanctions and geopolitical factors have impacted the adoption of certain technologies.

Regulatory Frameworks: Government policies and regulations significantly influence market dynamics. While specifics need further exploration, these frameworks impact investment decisions, data security standards, and overall market accessibility.

Substitute Products: The absence of easily available substitute products strengthens the existing market players' position. However, increasing cloud computing adoption indirectly provides some form of substitution.

End-User Trends: Demand for data center services is driven by expanding digitalization across various sectors, particularly in finance, government, and telecommunications. The increasing adoption of cloud services and big data analytics are primary growth drivers.

M&A Activities: While specific M&A deal counts for the Russia data center market are not readily available for the period 2019-2024, the recent activity of companies like 3Data suggests a moderate level of merger and acquisition activity.

Russia Data Center Market Industry Insights & Trends

The Russia data center market is experiencing robust growth, propelled by several key factors. The market size reached xx Million in 2024 and is projected to reach xx Million by 2033. This growth is primarily driven by increasing digitalization across various sectors, including e-commerce, fintech, and government services. Government initiatives promoting digital transformation are further accelerating market expansion. However, the ongoing geopolitical situation and associated sanctions present significant headwinds. Technological disruptions, such as the increased adoption of edge computing and AI, are reshaping the market landscape, driving demand for higher capacity and more sophisticated data center solutions. Consumer behavior shifts, marked by a surge in online activities, contribute to the rising demand for reliable and scalable data center infrastructure. This demand is further intensified by the growing need for data sovereignty and security.

Key Markets & Segments Leading Russia Data Center Market

The Moscow region dominates the Russia data center market, owing to its concentration of businesses, advanced infrastructure, and skilled workforce. However, other regions, such as St. Petersburg and the surrounding areas, are also seeing significant growth.

Dominant Segments:

- Hotspot: Moscow significantly leads in terms of data center concentration.

- Data Center Size: Large and Mega data centers account for a significant share of the market due to demand from large enterprises.

- Tier Type: While data on the precise distribution across Tier levels requires further investigation, the opening of Tier IV facilities like DataPro Moscow II shows a drive toward higher standards.

- Absorption: Utilized capacity currently holds the majority of the market.

Growth Drivers by Segment:

- Moscow: Strong economic activity, established infrastructure, talent pool.

- Rest of Russia: Increasing government investment in infrastructure, development of regional digital hubs.

- Large & Mega Data Centers: Growing demand from large enterprises and cloud providers.

- Tier 1 & Tier IV: Demand for higher reliability and resilience.

- Utilized Capacity: Reflects the robust demand for data center services.

Russia Data Center Market Product Developments

Recent product innovations in the Russia data center market focus on enhancing efficiency, security, and sustainability. The introduction of Tier-IV facilities like DataPro Moscow II represents a significant step towards advanced infrastructure. These advancements demonstrate a growing commitment to providing reliable and resilient data center solutions that meet the evolving needs of businesses.

Challenges in the Russia Data Center Market Market

The Russia data center market faces several challenges, including:

- Geopolitical instability and sanctions: These factors significantly impact investment, technology imports, and overall market stability. The exact quantitative impact requires in-depth investigation.

- Regulatory hurdles: Navigating complex regulations related to data sovereignty and cybersecurity adds complexity for businesses.

- Supply chain disruptions: The current geopolitical situation has resulted in supply chain disruptions, affecting the availability and cost of equipment.

Forces Driving Russia Data Center Market Growth

Despite the challenges, several key factors continue to drive growth in the Russia data center market. These factors highlight the increasing importance of digital infrastructure within the country:

- Government Initiatives Promoting Digitalization: The Russian government's ongoing commitment to digital transformation initiatives creates a favorable environment for data center investments. These initiatives often include financial incentives and supportive regulatory frameworks.

- Growing Adoption of Cloud Services: The rising demand for cloud-based services across various sectors fuels the need for robust and scalable data center infrastructure to support these operations. This is a significant driver of capacity expansion.

- Expansion of the Digital Economy: The rapid growth of e-commerce, fintech, and other digital sectors within Russia necessitates increased data storage and processing capabilities, driving demand for data center capacity.

- Increased Demand for Data Security and Resilience: Growing concerns about data security and the need for resilient infrastructure are prompting organizations to invest in robust data center solutions to protect their critical data.

Long-Term Growth Catalysts in Russia Data Center Market

Long-term growth will be driven by continued investment in digital infrastructure, partnerships between technology providers and data center operators, and the expansion of data center services into new regions. Innovations in sustainable data center technologies will also play a crucial role.

Emerging Opportunities in Russia Data Center Market

Emerging opportunities lie in expanding data center capacity in underserved regions, providing specialized solutions for specific industry verticals (e.g., healthcare, finance), and adopting cutting-edge technologies like AI and edge computing. The development of highly secure and compliant data centers to meet the rising demand for data sovereignty presents a significant opportunity.

Leading Players in the Russia Data Center Market Sector

The Russia data center market is characterized by a mix of established players and emerging companies. Key players include:

- Nekstremum LLC

- Rosenergoatom

- IXELERATE LLC

- Yandex Cloud LLC

- MTS PJSC (MTS Group)

- Selectel Ltd

- Linxdatacenter

- Rostelecom

- Stack Net (Stack Group)

- 3Data

- DataPro

- RackStore

Key Milestones in Russia Data Center Market Industry

Recent developments highlight the ongoing dynamism and investment in the Russia data center market:

- October 2022: DataPro's opening of DataPro Moscow II, a Tier-IV data center with 1,600 rack capacity, marked a significant expansion in its market presence and demonstrates the ongoing investment in high-capacity facilities.

- September 2022: Yandex's announcement of a new 63MW data center in Kaluga Oblast signals a major commitment to expanding its capacity and underscores the importance of large-scale infrastructure projects.

- May 2022: The partnership between 3data and Alias Group to build a new data center in Krasnodar exemplifies the expansion of data center presence into geographically diverse regions within Russia.

- [Add other significant milestones here with dates and brief descriptions. Include mergers, acquisitions, new technology deployments, etc.]

Strategic Outlook for Russia Data Center Market Market

The Russia data center market presents a compelling long-term growth story, despite current challenges. Strategic opportunities lie in leveraging technological advancements, securing strategic partnerships, and capitalizing on the growing demand for digital infrastructure across various sectors. Companies that can adapt to the evolving geopolitical landscape and embrace sustainable practices will be well-positioned to succeed.

Russia Data Center Market Segmentation

-

1. Hotspot

- 1.1. Moscow

- 1.2. Rest of Russia

-

2. Data Center Size

- 2.1. Large

- 2.2. Massive

- 2.3. Medium

- 2.4. Mega

- 2.5. Small

-

3. Tier Type

- 3.1. Tier 1 and 2

- 3.2. Tier 3

- 3.3. Tier 4

-

4. Absorption

- 4.1. Non-Utilized

-

4.2. By Colocation Type

- 4.2.1. Hyperscale

- 4.2.2. Retail

- 4.2.3. Wholesale

-

4.3. By End User

- 4.3.1. BFSI

- 4.3.2. Cloud

- 4.3.3. E-Commerce

- 4.3.4. Government

- 4.3.5. Manufacturing

- 4.3.6. Media & Entertainment

- 4.3.7. Telecom

- 4.3.8. Other End User

Russia Data Center Market Segmentation By Geography

- 1. Russia

Russia Data Center Market Regional Market Share

Geographic Coverage of Russia Data Center Market

Russia Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.87% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Automation in the Security Screening Industry

- 3.2.2 Especially to Detect Advanced Threats

- 3.2.3 etc.; Upsurge in Terror Activities Across the Region; Increasing Government Initiatives on Security Inspection in Schools and Colleges; Increasing Government Initiatives for Smart Cities

- 3.3. Market Restrains

- 3.3.1 Supply Chain Issues Caused By Geopolitical Scenario and the COVID-19 Pandemic

- 3.3.2 etc.; High Installation and Maintenance Costs

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Data Center Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 5.1.1. Moscow

- 5.1.2. Rest of Russia

- 5.2. Market Analysis, Insights and Forecast - by Data Center Size

- 5.2.1. Large

- 5.2.2. Massive

- 5.2.3. Medium

- 5.2.4. Mega

- 5.2.5. Small

- 5.3. Market Analysis, Insights and Forecast - by Tier Type

- 5.3.1. Tier 1 and 2

- 5.3.2. Tier 3

- 5.3.3. Tier 4

- 5.4. Market Analysis, Insights and Forecast - by Absorption

- 5.4.1. Non-Utilized

- 5.4.2. By Colocation Type

- 5.4.2.1. Hyperscale

- 5.4.2.2. Retail

- 5.4.2.3. Wholesale

- 5.4.3. By End User

- 5.4.3.1. BFSI

- 5.4.3.2. Cloud

- 5.4.3.3. E-Commerce

- 5.4.3.4. Government

- 5.4.3.5. Manufacturing

- 5.4.3.6. Media & Entertainment

- 5.4.3.7. Telecom

- 5.4.3.8. Other End User

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nekstremum LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Rosenergoatom

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 IXELERATE LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Yandex Cloud LLC5 4 LIST OF COMPANIES STUDIE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 MTS PJSC (MTS Group)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Selectel Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Linxdatacenter

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rostelecom

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Stack Net (Stack Group)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 3Data

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 DataPro

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 RackStore

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Nekstremum LLC

List of Figures

- Figure 1: Russia Data Center Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Russia Data Center Market Share (%) by Company 2025

List of Tables

- Table 1: Russia Data Center Market Revenue Million Forecast, by Hotspot 2020 & 2033

- Table 2: Russia Data Center Market Revenue Million Forecast, by Data Center Size 2020 & 2033

- Table 3: Russia Data Center Market Revenue Million Forecast, by Tier Type 2020 & 2033

- Table 4: Russia Data Center Market Revenue Million Forecast, by Absorption 2020 & 2033

- Table 5: Russia Data Center Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Russia Data Center Market Revenue Million Forecast, by Hotspot 2020 & 2033

- Table 7: Russia Data Center Market Revenue Million Forecast, by Data Center Size 2020 & 2033

- Table 8: Russia Data Center Market Revenue Million Forecast, by Tier Type 2020 & 2033

- Table 9: Russia Data Center Market Revenue Million Forecast, by Absorption 2020 & 2033

- Table 10: Russia Data Center Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Data Center Market?

The projected CAGR is approximately 4.87%.

2. Which companies are prominent players in the Russia Data Center Market?

Key companies in the market include Nekstremum LLC, Rosenergoatom, IXELERATE LLC, Yandex Cloud LLC5 4 LIST OF COMPANIES STUDIE, MTS PJSC (MTS Group), Selectel Ltd, Linxdatacenter, Rostelecom, Stack Net (Stack Group), 3Data, DataPro, RackStore.

3. What are the main segments of the Russia Data Center Market?

The market segments include Hotspot, Data Center Size, Tier Type, Absorption.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Automation in the Security Screening Industry. Especially to Detect Advanced Threats. etc.; Upsurge in Terror Activities Across the Region; Increasing Government Initiatives on Security Inspection in Schools and Colleges; Increasing Government Initiatives for Smart Cities.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Supply Chain Issues Caused By Geopolitical Scenario and the COVID-19 Pandemic. etc.; High Installation and Maintenance Costs.

8. Can you provide examples of recent developments in the market?

October 2022: DataPro Moscow II, the first data center in Eastern Europe with a Tier-IV integrity level, was opened by the DataPro corporation, an independent operator of data processing facilities in Russia. The new DataPro data center can accommodate 1,600 racks in total. The initial batch of 800 racks is currently in use. By the end of 2020, the second lot of 800 racks will be usable. It will enable DataPro to hold second place in the Russian commercial data-center market with 3,600 racks overall in its data centers.September 2022: Yandex plans to construct a brand-new 63MW data center in western Russia's Kaluga Oblast. The brand-new building will be situated in Kaluga's Grabtsevo Industrial Park, around 100 miles south of Moscow. With a 130,000 square meter footprint and 63 MW of power, the new data center can accommodate more than 3,800 server racks with a 15 kW load.May 2022: The Russian data center company 3data and the investment firm Alias Group will build a data center in Krasnodar. A new facility will open in the Krasnodar Territory, according to 3data. According to the business, the facility will open around the end of 2023 under a franchise agreement with the investment firm Alias Group.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Data Center Market?

To stay informed about further developments, trends, and reports in the Russia Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence