Key Insights

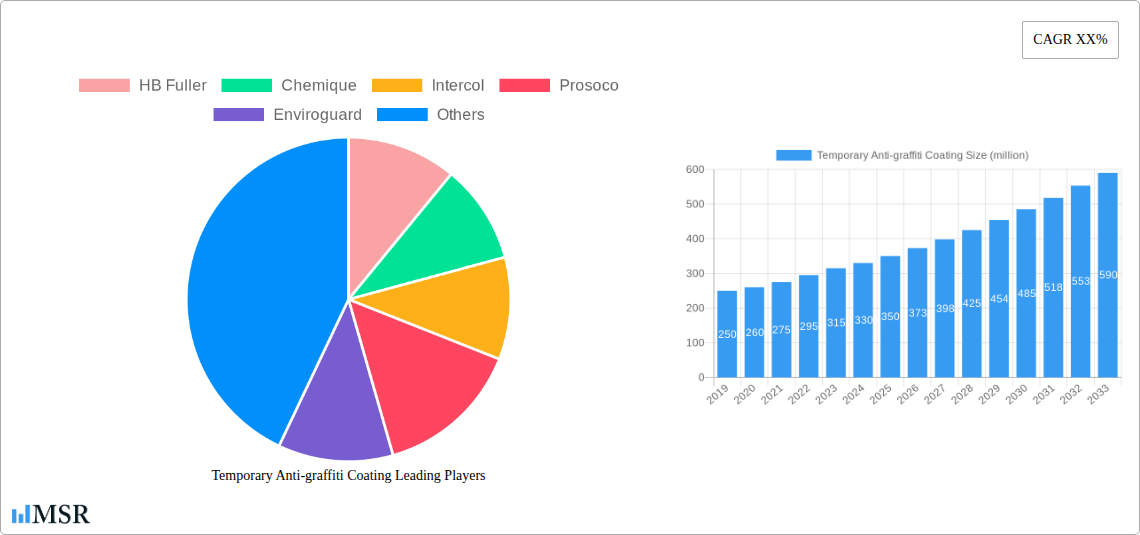

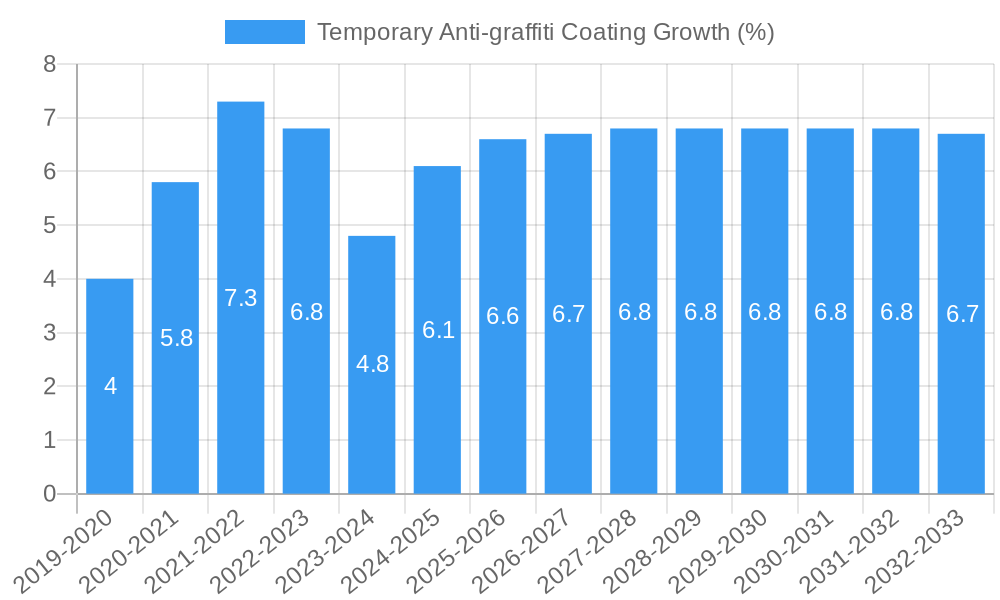

The global market for temporary anti-graffiti coatings is experiencing robust growth, driven by an increasing need to protect public infrastructure and private properties from vandalism and environmental damage. Valued at an estimated \$350 million in 2025, the market is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 6.5% through 2033, reaching an estimated \$620 million. This growth is underpinned by rising urbanization, increased public and private investment in maintaining aesthetic appeal and structural integrity of buildings and transportation networks, and a greater awareness of the cost-effectiveness of preventative measures over extensive cleaning and restoration. Key drivers include the demand for easily removable protective layers that preserve original surfaces, particularly in high-traffic urban areas.

The market is segmented by application and type. Public buildings and transportation infrastructure represent the largest application segments, reflecting the widespread need for anti-graffiti solutions in these areas. The "Wax Coating" segment is anticipated to hold a significant share, favored for its cost-effectiveness and ease of application and removal in temporary scenarios, although "Acrylates Coating" is expected to gain traction due to its enhanced durability and environmental profiles. Restraints, such as the initial cost of application and the development of more aggressive graffiti materials, are being addressed through continuous innovation in coating technology, focusing on longer-lasting, more effective, and eco-friendly formulations. Leading companies are investing in R&D to develop advanced solutions that cater to diverse surface types and environmental conditions, ensuring sustained market expansion.

This in-depth market research report provides an exhaustive analysis of the temporary anti-graffiti coating market, covering the historical period from 2019 to 2024, the base year of 2025, and a comprehensive forecast period extending to 2033. With an estimated market size of XX million in the base year and a projected CAGR of XX%, this report is an indispensable resource for stakeholders seeking to understand the market dynamics, growth drivers, competitive landscape, and future opportunities in the global temporary anti-graffiti coating industry. Explore the latest innovations, segment analyses, and strategic outlooks to inform your business decisions.

Temporary Anti-graffiti Coating Market Concentration & Dynamics

The temporary anti-graffiti coating market exhibits a moderate level of concentration, with several key players vying for market share. The innovation ecosystem is characterized by continuous advancements in coating formulations, focusing on enhanced durability, eco-friendliness, and ease of application. Regulatory frameworks, particularly concerning VOC emissions and environmental impact, are influencing product development and market entry. Substitute products, such as permanent anti-graffiti coatings and innovative cleaning solutions, pose a competitive threat, driving the need for continuous improvement in temporary solutions. End-user trends highlight a growing demand for cost-effective, non-permanent protection, especially in high-traffic public areas and sensitive infrastructure. Mergers and acquisition (M&A) activities, while not overtly dominant, are observed as companies seek to expand their product portfolios and geographical reach. The market share of leading players is estimated to be between XX% and XX%, and the number of significant M&A deals over the study period has been approximately XX.

- Key Dynamics:

- Focus on eco-friendly and sustainable coating solutions.

- Increasing demand for easy-to-apply and remove formulations.

- Impact of local and international environmental regulations.

- Strategic partnerships for R&D and distribution.

Temporary Anti-graffiti Coating Industry Insights & Trends

The temporary anti-graffiti coating industry is poised for significant expansion, driven by escalating urbanization, increased investment in public infrastructure, and a growing awareness of the detrimental effects of vandalism. The market size, estimated at XX million in the base year of 2025, is projected to reach XX million by 2033, growing at a robust Compound Annual Growth Rate (CAGR) of XX%. Technological disruptions are a key theme, with advancements in polymer science leading to more resilient and effective temporary coatings. These innovations are not only enhancing the performance of existing products but also paving the way for novel application methods and tailored solutions for diverse surfaces. Evolving consumer behaviors are characterized by a preference for preventative maintenance over costly remediation. Property owners, facility managers, and municipal authorities are increasingly recognizing the economic benefits of investing in temporary protective coatings to safeguard assets from the persistent challenge of graffiti. This shift is fueled by a desire to maintain the aesthetic appeal of public spaces, preserve the integrity of transportation infrastructure, and reduce the overall cost associated with graffiti removal and subsequent damage. The demand for coatings that are effective against a wide range of graffiti mediums, from spray paints to permanent markers, while also being safe for the underlying substrate, is a growing trend. Furthermore, the development of coatings with extended service life and simplified removal processes without damaging the protected surface is becoming a critical differentiator. The market is also witnessing a rise in demand for specialized temporary anti-graffiti coatings designed for specific materials, such as porous stone, heritage buildings, and delicate architectural features, showcasing a move towards more targeted and application-specific solutions.

Key Markets & Segments Leading Temporary Anti-graffiti Coating

The temporary anti-graffiti coating market is experiencing significant dominance from the Transportation Infrastructure segment, particularly in regions with extensive public transit networks and major highway systems. Countries with substantial government investment in infrastructure development and a high prevalence of public spaces are leading the charge. The Public Buildings application segment also holds substantial sway, driven by the need to protect civic centers, schools, libraries, and museums from vandalism.

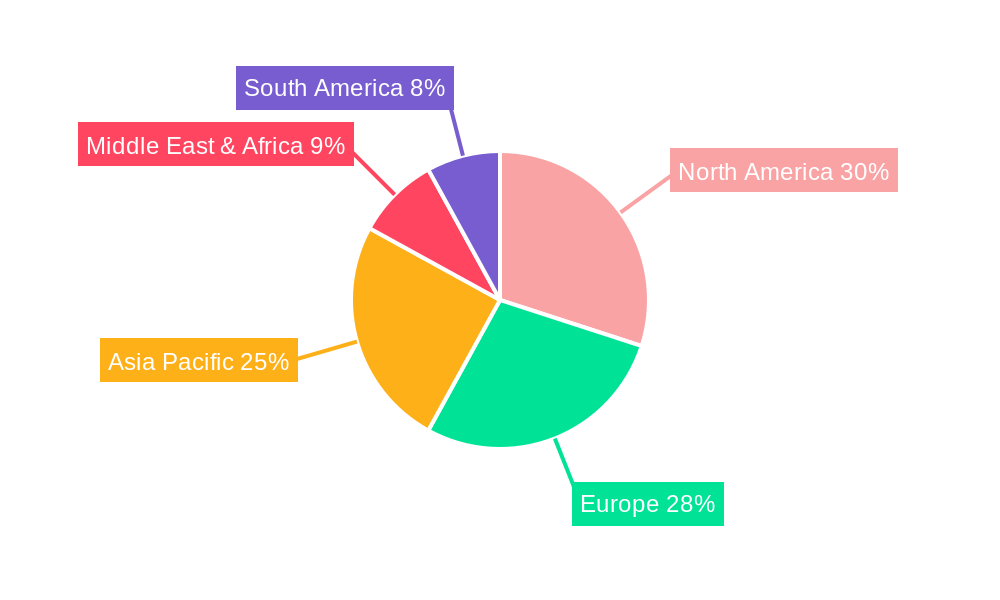

Dominant Region Analysis: North America and Europe currently lead the market due to their established infrastructure, high disposable incomes, and stringent regulations regarding the maintenance and appearance of public assets. Asia Pacific, however, is emerging as a high-growth region, fueled by rapid urbanization and large-scale infrastructure projects.

Dominant Country Analysis: The United States, Germany, and the United Kingdom are key markets, characterized by significant spending on public works and infrastructure. China and India are expected to witness substantial growth due to their ongoing infrastructure development initiatives.

Application Dominance:

- Transportation Infrastructure: This segment benefits from constant exposure to public traffic and is a prime target for graffiti. Coatings for bridges, tunnels, public transport vehicles (buses, trains, stations), and underpasses are in high demand. Economic growth and increased mobility are direct drivers.

- Public Buildings: Educational institutions, government offices, and cultural heritage sites require constant protection. Economic growth directly influences the budgets allocated for infrastructure maintenance and aesthetic preservation.

Type Dominance:

- Acrylates Coating: These coatings offer a balance of durability, cost-effectiveness, and ease of application, making them a popular choice across various applications. Their widespread adoption is driven by their versatility and performance against common graffiti types.

- Wax Coating: While often more temporary, wax coatings are favored for their ease of removal and cost-effectiveness in specific, less demanding applications or as a temporary protective layer during construction or events. Their appeal is linked to their affordability and non-permanent nature.

Temporary Anti-graffiti Coating Product Developments

Recent product developments in the temporary anti-graffiti coating market are centered on enhancing eco-friendliness and improving user experience. Innovations include water-based formulations that significantly reduce VOC emissions, aligning with stricter environmental regulations. Advanced polymer technologies are yielding coatings with superior resistance to a wider range of graffiti mediums, including spray paints and permanent markers, while also offering improved UV stability and extended durability. Furthermore, the development of "sacrificial" coatings that can be easily removed with specific solvents or hot water without damaging the underlying surface is a key competitive edge, simplifying maintenance and reducing long-term costs for asset owners.

Challenges in the Temporary Anti-graffiti Coating Market

Despite robust growth, the temporary anti-graffiti coating market faces several challenges that can impact its trajectory. Regulatory hurdles, particularly those concerning the environmental impact and VOC content of coatings, can lead to increased R&D costs and market entry barriers. Supply chain disruptions, as evidenced by recent global events, can affect the availability and cost of raw materials, impacting pricing and production timelines. Intense competitive pressures from both established players and new entrants, offering diverse product portfolios and pricing strategies, necessitate continuous innovation and cost optimization to maintain market share.

- Key Restraints:

- Stringent environmental regulations on VOC emissions.

- Volatility in raw material prices and supply chain disruptions.

- Intense competition from both established and emerging players.

- Perception of temporary coatings as less durable than permanent solutions.

Forces Driving Temporary Anti-graffiti Coating Growth

The temporary anti-graffiti coating market is propelled by several powerful growth drivers. Increasing global urbanization and the subsequent expansion of public infrastructure, including transportation networks and public buildings, create a consistent demand for protective coatings. Growing awareness of the economic and aesthetic benefits of preventing graffiti, coupled with a desire to maintain clean and appealing public spaces, are significant behavioral drivers. Technological advancements in coating formulations, leading to improved performance, ease of application, and environmental compatibility, further bolster market expansion. Furthermore, proactive government initiatives and urban beautification programs often mandate or encourage the use of such protective measures.

- Key Growth Drivers:

- Escalating urbanization and infrastructure development.

- Rising awareness of the cost and aesthetic implications of graffiti.

- Technological advancements in coating performance and sustainability.

- Supportive government policies and urban renewal programs.

Challenges in the Temporary Anti-graffiti Coating Market

Long-term growth catalysts in the temporary anti-graffiti coating market are intrinsically linked to continuous innovation and strategic market expansion. The development of highly specialized coatings tailored for niche applications, such as historical preservation or sensitive materials, presents a significant growth avenue. Strategic partnerships between coating manufacturers, application service providers, and municipalities can foster wider adoption and create recurring revenue streams. Exploring emerging markets with nascent infrastructure development and increasing concerns about urban aesthetics offers substantial potential for market penetration and long-term revenue generation. Investment in research and development for bio-based and biodegradable temporary coatings will also be a key differentiator and driver of future growth.

Emerging Opportunities in Temporary Anti-graffiti Coating

Emerging opportunities within the temporary anti-graffiti coating market are ripe for exploration by forward-thinking businesses. The development and integration of "smart" coatings that can indicate when they need reapplication or monitor environmental conditions represent a significant technological leap. Growing demand for eco-certified and sustainable coating options, aligned with global green initiatives, presents a substantial market niche. The expansion of services beyond product sales, including consultation, application, and maintenance packages, offers added value and revenue streams. Furthermore, the increasing focus on heritage building preservation and the protection of public art installations opens up specialized, high-value market segments.

- Key Opportunities:

- Development of "smart" and self-indicating coatings.

- Expansion into sustainable and bio-based coating solutions.

- Offering integrated application and maintenance services.

- Targeting niche markets like heritage sites and public art.

Leading Players in the Temporary Anti-graffiti Coating Sector

- HB Fuller

- Chemique

- Intercol

- Prosoco

- Enviroguard

- Urban Hygiene

- A&I Coatings

- Tech-Dry

- WR Meadows

- PHSC Chemicals

- Graffiti Guard

- Paul Jaeger

- RUST-OLEUM

- Remmers Gruppe AG

Key Milestones in Temporary Anti-graffiti Coating Industry

- 2019: Increased adoption of water-based, low-VOC temporary coatings driven by stricter environmental regulations.

- 2020: Significant investment in R&D for more durable and easily removable graffiti protection solutions.

- 2021: Introduction of novel acrylate-based coatings with enhanced resistance to a wider range of graffiti mediums.

- 2022: Growing market interest in "sacrificial" coatings for ease of removal without substrate damage.

- 2023: Emergence of specialized temporary coatings for porous and heritage surfaces.

- 2024: Increased focus on sustainable and biodegradable coating formulations.

Strategic Outlook for Temporary Anti-graffiti Coating Market

The temporary anti-graffiti coating market is set for sustained growth, propelled by ongoing urbanization, infrastructure development, and an increasing emphasis on preserving public spaces. The strategic outlook points towards continuous innovation in product performance, eco-friendliness, and application efficiency. Companies focusing on developing advanced formulations that offer superior protection, easier removal, and longer service life will gain a competitive advantage. Expanding into emerging economies and catering to niche applications, such as heritage preservation, are key strategic opportunities. Furthermore, embracing digital solutions for application guidance and performance monitoring will enhance customer value and drive market penetration in the coming years.

Temporary Anti-graffiti Coating Segmentation

-

1. Application

- 1.1. Public Buildings

- 1.2. Transportation Infrastructure

- 1.3. Others

-

2. Types

- 2.1. Acrylates Coating

- 2.2. Wax Coating

- 2.3. Others

Temporary Anti-graffiti Coating Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Temporary Anti-graffiti Coating REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Temporary Anti-graffiti Coating Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Public Buildings

- 5.1.2. Transportation Infrastructure

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Acrylates Coating

- 5.2.2. Wax Coating

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Temporary Anti-graffiti Coating Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Public Buildings

- 6.1.2. Transportation Infrastructure

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Acrylates Coating

- 6.2.2. Wax Coating

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Temporary Anti-graffiti Coating Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Public Buildings

- 7.1.2. Transportation Infrastructure

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Acrylates Coating

- 7.2.2. Wax Coating

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Temporary Anti-graffiti Coating Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Public Buildings

- 8.1.2. Transportation Infrastructure

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Acrylates Coating

- 8.2.2. Wax Coating

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Temporary Anti-graffiti Coating Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Public Buildings

- 9.1.2. Transportation Infrastructure

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Acrylates Coating

- 9.2.2. Wax Coating

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Temporary Anti-graffiti Coating Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Public Buildings

- 10.1.2. Transportation Infrastructure

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Acrylates Coating

- 10.2.2. Wax Coating

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 HB Fuller

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Chemique

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Intercol

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Prosoco

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Enviroguard

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Urban Hygiene

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 A&I Coatings

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tech-Dry

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 WR Meadows

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 PHSC Chemicals

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Graffiti Guard

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Paul Jaeger

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 RUST-OLEUM

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Remmers Gruppe AG

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 HB Fuller

List of Figures

- Figure 1: Global Temporary Anti-graffiti Coating Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Temporary Anti-graffiti Coating Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Temporary Anti-graffiti Coating Revenue (million), by Application 2024 & 2032

- Figure 4: North America Temporary Anti-graffiti Coating Volume (K), by Application 2024 & 2032

- Figure 5: North America Temporary Anti-graffiti Coating Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Temporary Anti-graffiti Coating Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Temporary Anti-graffiti Coating Revenue (million), by Types 2024 & 2032

- Figure 8: North America Temporary Anti-graffiti Coating Volume (K), by Types 2024 & 2032

- Figure 9: North America Temporary Anti-graffiti Coating Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Temporary Anti-graffiti Coating Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Temporary Anti-graffiti Coating Revenue (million), by Country 2024 & 2032

- Figure 12: North America Temporary Anti-graffiti Coating Volume (K), by Country 2024 & 2032

- Figure 13: North America Temporary Anti-graffiti Coating Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Temporary Anti-graffiti Coating Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Temporary Anti-graffiti Coating Revenue (million), by Application 2024 & 2032

- Figure 16: South America Temporary Anti-graffiti Coating Volume (K), by Application 2024 & 2032

- Figure 17: South America Temporary Anti-graffiti Coating Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Temporary Anti-graffiti Coating Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Temporary Anti-graffiti Coating Revenue (million), by Types 2024 & 2032

- Figure 20: South America Temporary Anti-graffiti Coating Volume (K), by Types 2024 & 2032

- Figure 21: South America Temporary Anti-graffiti Coating Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Temporary Anti-graffiti Coating Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Temporary Anti-graffiti Coating Revenue (million), by Country 2024 & 2032

- Figure 24: South America Temporary Anti-graffiti Coating Volume (K), by Country 2024 & 2032

- Figure 25: South America Temporary Anti-graffiti Coating Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Temporary Anti-graffiti Coating Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Temporary Anti-graffiti Coating Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Temporary Anti-graffiti Coating Volume (K), by Application 2024 & 2032

- Figure 29: Europe Temporary Anti-graffiti Coating Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Temporary Anti-graffiti Coating Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Temporary Anti-graffiti Coating Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Temporary Anti-graffiti Coating Volume (K), by Types 2024 & 2032

- Figure 33: Europe Temporary Anti-graffiti Coating Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Temporary Anti-graffiti Coating Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Temporary Anti-graffiti Coating Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Temporary Anti-graffiti Coating Volume (K), by Country 2024 & 2032

- Figure 37: Europe Temporary Anti-graffiti Coating Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Temporary Anti-graffiti Coating Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Temporary Anti-graffiti Coating Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Temporary Anti-graffiti Coating Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Temporary Anti-graffiti Coating Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Temporary Anti-graffiti Coating Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Temporary Anti-graffiti Coating Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Temporary Anti-graffiti Coating Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Temporary Anti-graffiti Coating Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Temporary Anti-graffiti Coating Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Temporary Anti-graffiti Coating Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Temporary Anti-graffiti Coating Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Temporary Anti-graffiti Coating Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Temporary Anti-graffiti Coating Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Temporary Anti-graffiti Coating Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Temporary Anti-graffiti Coating Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Temporary Anti-graffiti Coating Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Temporary Anti-graffiti Coating Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Temporary Anti-graffiti Coating Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Temporary Anti-graffiti Coating Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Temporary Anti-graffiti Coating Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Temporary Anti-graffiti Coating Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Temporary Anti-graffiti Coating Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Temporary Anti-graffiti Coating Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Temporary Anti-graffiti Coating Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Temporary Anti-graffiti Coating Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Temporary Anti-graffiti Coating Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Temporary Anti-graffiti Coating Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Temporary Anti-graffiti Coating Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Temporary Anti-graffiti Coating Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Temporary Anti-graffiti Coating Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Temporary Anti-graffiti Coating Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Temporary Anti-graffiti Coating Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Temporary Anti-graffiti Coating Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Temporary Anti-graffiti Coating Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Temporary Anti-graffiti Coating Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Temporary Anti-graffiti Coating Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Temporary Anti-graffiti Coating Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Temporary Anti-graffiti Coating Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Temporary Anti-graffiti Coating Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Temporary Anti-graffiti Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Temporary Anti-graffiti Coating Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Temporary Anti-graffiti Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Temporary Anti-graffiti Coating Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Temporary Anti-graffiti Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Temporary Anti-graffiti Coating Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Temporary Anti-graffiti Coating Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Temporary Anti-graffiti Coating Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Temporary Anti-graffiti Coating Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Temporary Anti-graffiti Coating Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Temporary Anti-graffiti Coating Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Temporary Anti-graffiti Coating Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Temporary Anti-graffiti Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Temporary Anti-graffiti Coating Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Temporary Anti-graffiti Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Temporary Anti-graffiti Coating Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Temporary Anti-graffiti Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Temporary Anti-graffiti Coating Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Temporary Anti-graffiti Coating Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Temporary Anti-graffiti Coating Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Temporary Anti-graffiti Coating Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Temporary Anti-graffiti Coating Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Temporary Anti-graffiti Coating Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Temporary Anti-graffiti Coating Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Temporary Anti-graffiti Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Temporary Anti-graffiti Coating Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Temporary Anti-graffiti Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Temporary Anti-graffiti Coating Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Temporary Anti-graffiti Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Temporary Anti-graffiti Coating Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Temporary Anti-graffiti Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Temporary Anti-graffiti Coating Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Temporary Anti-graffiti Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Temporary Anti-graffiti Coating Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Temporary Anti-graffiti Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Temporary Anti-graffiti Coating Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Temporary Anti-graffiti Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Temporary Anti-graffiti Coating Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Temporary Anti-graffiti Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Temporary Anti-graffiti Coating Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Temporary Anti-graffiti Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Temporary Anti-graffiti Coating Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Temporary Anti-graffiti Coating Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Temporary Anti-graffiti Coating Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Temporary Anti-graffiti Coating Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Temporary Anti-graffiti Coating Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Temporary Anti-graffiti Coating Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Temporary Anti-graffiti Coating Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Temporary Anti-graffiti Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Temporary Anti-graffiti Coating Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Temporary Anti-graffiti Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Temporary Anti-graffiti Coating Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Temporary Anti-graffiti Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Temporary Anti-graffiti Coating Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Temporary Anti-graffiti Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Temporary Anti-graffiti Coating Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Temporary Anti-graffiti Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Temporary Anti-graffiti Coating Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Temporary Anti-graffiti Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Temporary Anti-graffiti Coating Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Temporary Anti-graffiti Coating Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Temporary Anti-graffiti Coating Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Temporary Anti-graffiti Coating Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Temporary Anti-graffiti Coating Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Temporary Anti-graffiti Coating Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Temporary Anti-graffiti Coating Volume K Forecast, by Country 2019 & 2032

- Table 81: China Temporary Anti-graffiti Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Temporary Anti-graffiti Coating Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Temporary Anti-graffiti Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Temporary Anti-graffiti Coating Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Temporary Anti-graffiti Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Temporary Anti-graffiti Coating Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Temporary Anti-graffiti Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Temporary Anti-graffiti Coating Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Temporary Anti-graffiti Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Temporary Anti-graffiti Coating Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Temporary Anti-graffiti Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Temporary Anti-graffiti Coating Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Temporary Anti-graffiti Coating Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Temporary Anti-graffiti Coating Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Temporary Anti-graffiti Coating?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Temporary Anti-graffiti Coating?

Key companies in the market include HB Fuller, Chemique, Intercol, Prosoco, Enviroguard, Urban Hygiene, A&I Coatings, Tech-Dry, WR Meadows, PHSC Chemicals, Graffiti Guard, Paul Jaeger, RUST-OLEUM, Remmers Gruppe AG.

3. What are the main segments of the Temporary Anti-graffiti Coating?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Temporary Anti-graffiti Coating," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Temporary Anti-graffiti Coating report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Temporary Anti-graffiti Coating?

To stay informed about further developments, trends, and reports in the Temporary Anti-graffiti Coating, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence