Key Insights

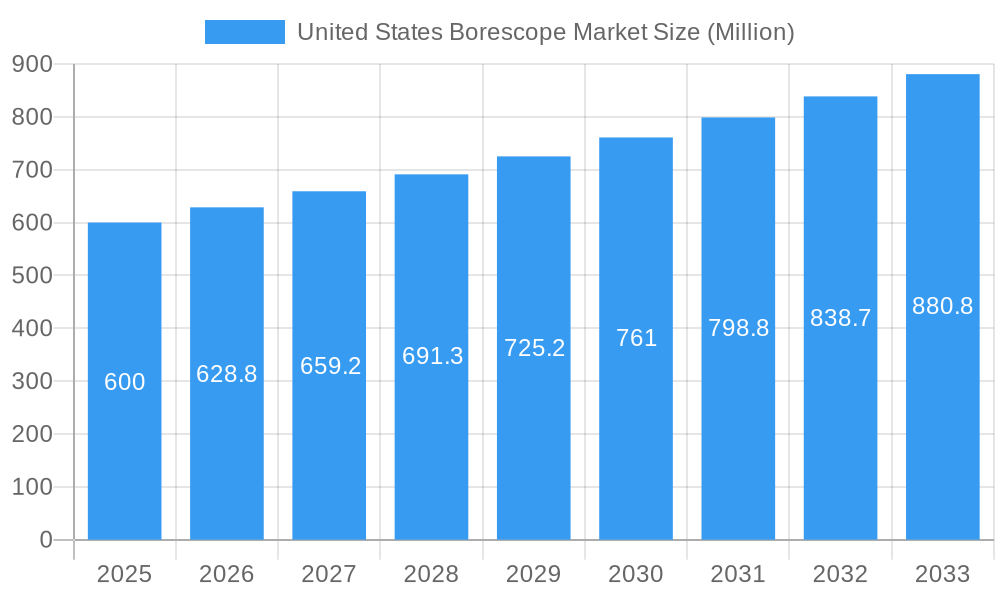

The United States borescope market, a segment of the broader global market exhibiting a 4.80% CAGR, is experiencing robust growth driven by increasing demand across diverse industries. Key drivers include the rising need for non-destructive testing (NDT) in manufacturing, particularly in sectors like automotive and aerospace, where rigorous quality control is paramount. Advancements in borescope technology, including the development of more flexible, higher-resolution endoscopes with improved imaging capabilities, further fuel market expansion. The adoption of borescopes is also increasing in the oil and gas industry for pipeline inspection and maintenance, minimizing downtime and improving safety. While the market faces certain restraints, such as the relatively high initial investment cost of advanced borescope systems and the availability of alternative inspection methods, the overall trend points towards sustained growth. Segmentation within the US market reveals a strong preference for flexible borescopes due to their versatility and ability to access hard-to-reach areas. Larger diameter borescopes (6mm to 10mm and above 10mm) also hold significant market share, reflecting a need for detailed inspections in various applications. The substantial presence of major players like Olympus America Inc. and companies specializing in industrial inspection tools suggests a competitive but dynamic landscape. Given the 2025 market value is not provided, but given the global CAGR of 4.8%, and the significant presence of the US market, a reasonable estimate for the US market size in 2025 would be in the range of $500 million to $700 million, considering the substantial size and technological advancement within the US industrial sector. This estimate takes into account the existing and expanding applications of borescopes across various industries within the US. Future growth will be fueled by continued technological innovations, increasing adoption in new sectors, and a rising focus on preventative maintenance across numerous industries.

United States Borescope Market Market Size (In Million)

The forecast period from 2025 to 2033 anticipates continued market expansion, fueled by technological advancements, such as the integration of advanced imaging and data analytics capabilities into borescopes. This will improve inspection efficiency and accuracy, leading to wider adoption across industries. The growing emphasis on predictive maintenance strategies and regulatory compliance in key sectors such as aviation and energy will contribute significantly to market growth. The expansion of manufacturing and infrastructure projects within the US will also drive demand. Although precise market share figures for each segment are unavailable, the continued adoption of flexible borescopes and the larger diameter borescopes within sectors like aerospace, automotive, and energy are expected to remain a leading driving force throughout the forecast period. Companies are focusing on product development and innovation to improve the overall inspection quality and efficiency further boosting the market.

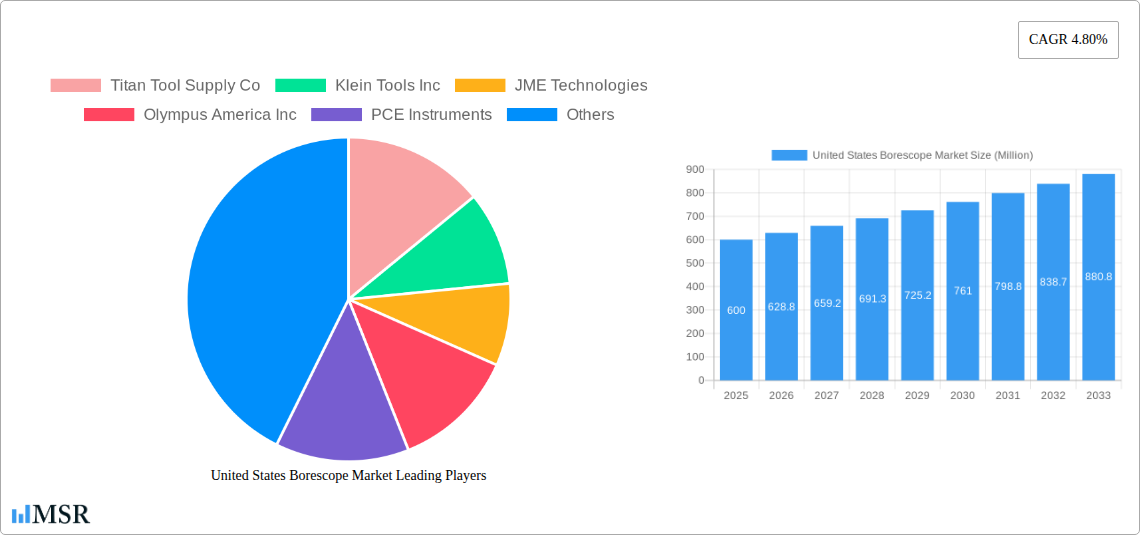

United States Borescope Market Company Market Share

United States Borescope Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the United States Borescope Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033 (Study Period), with 2025 as the Base and Estimated Year, and a Forecast Period of 2025-2033, this report unveils the market's current state and future trajectory. The market is segmented by type (Video, Flexible, Endoscopes, Semi-rigid, Rigid), diameter (0 mm to 3 mm, 3 mm to 6 mm, 6 mm to 10 mm, Above 10 mm), angle (0° to 90°, 90° to 180°, 180° to 360°), and end-user (Automotive, Aviation, Power Generation, Oil & Gas, Manufacturing, Chemicals, Food & Beverages, Pharmaceuticals, Mining and Construction, Other End-Users). The report values the market in Millions USD.

United States Borescope Market Concentration & Dynamics

The United States borescope market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the presence of numerous smaller companies and specialized providers contributes to a dynamic competitive environment. Innovation plays a crucial role, driven by advancements in imaging technology, miniaturization, and AI integration. Regulatory frameworks, particularly concerning safety and quality standards within specific industries (e.g., aviation, oil & gas), significantly influence market practices. Substitute products, such as advanced imaging techniques (e.g., ultrasound), pose some level of competition, though borescopes remain indispensable for specific applications. End-user trends indicate a growing preference for higher-resolution, digitally enhanced borescopes with remote capabilities. M&A activity has been moderate, with a reported xx number of deals during the historical period (2019-2024), primarily focused on strengthening product portfolios and expanding market reach. Key players such as Titan Tool Supply Co and Olympus America Inc, hold substantial market share, estimated at xx% and xx% respectively in 2025. Further consolidation is anticipated in the forecast period.

United States Borescope Market Industry Insights & Trends

The United States borescope market is experiencing robust growth, with a projected CAGR of xx% during the forecast period (2025-2033). The market size was valued at xx Million in 2024 and is expected to reach xx Million by 2033. This expansion is primarily fueled by increasing demand across diverse end-use sectors. The automotive industry, driven by stringent quality control and maintenance requirements, represents a significant market segment. Similarly, the oil & gas, aviation, and manufacturing sectors contribute substantially to market growth, owing to the critical need for non-destructive inspection and preventative maintenance. Technological advancements, including the integration of AI-powered image analysis, are driving the adoption of sophisticated, high-resolution borescopes. This enhances inspection accuracy and efficiency, leading to cost savings and improved operational safety. Furthermore, evolving consumer behaviors are favoring technologically advanced, user-friendly borescopes with enhanced data management capabilities. The growing emphasis on predictive maintenance and digitalization within various industries significantly propels market expansion.

Key Markets & Segments Leading United States Borescope Market

Dominant Segment: The video borescope segment currently dominates the market, accounting for xx% of the total revenue in 2025. This is attributable to its superior image quality, ease of use, and ability to record and store inspection data. The flexible borescope segment is also experiencing significant growth due to its adaptability for inspecting hard-to-reach areas.

Leading End-Users: The oil & gas, automotive, and aviation sectors collectively account for a significant portion of the market demand. The increasing adoption of borescopes for preventative maintenance and non-destructive testing in these industries drives significant growth. The manufacturing sector also shows substantial potential due to the increasing complexities of manufacturing processes and the need for robust quality control measures.

Drivers:

- Stringent regulatory compliance requirements in various industries

- Growing emphasis on predictive maintenance strategies

- Technological advancements leading to improved efficiency and accuracy

- Increasing investment in infrastructure development projects (e.g., power generation)

The 0 mm to 3 mm diameter borescopes hold the highest market share due to their suitability for precision inspection tasks in various sectors. Within the angle segment, 0° to 90° borescopes demonstrate strong demand due to the frequency of use in straightforward inspections.

United States Borescope Market Product Developments

Recent product innovations focus on enhancing image quality, incorporating advanced features such as AI-powered image analysis, and improving user-friendliness through intuitive interfaces. Manufacturers are emphasizing portability, wireless connectivity, and robust construction for demanding environments. These advancements provide competitive advantages by enabling faster, more accurate inspections, ultimately leading to cost reductions and improved safety. The integration of advanced features like AI-powered defect detection is transforming the borescope industry, allowing for quicker, more reliable, and more effective maintenance procedures.

Challenges in the United States Borescope Market

The market faces challenges including the high initial cost of advanced borescopes, potential supply chain disruptions affecting component availability, and intense competition from both established players and new entrants. Regulatory compliance and obtaining certifications for specific industries can also pose significant hurdles for companies. The combined impact of these factors can lead to slower growth compared to the market's potential. The presence of competitive substitute technologies limits market share growth.

Forces Driving United States Borescope Market Growth

The key growth drivers are the increasing demand for non-destructive testing in various industries, technological advancements leading to improved performance and features, and stringent regulatory requirements in sectors such as aerospace and oil & gas. Government initiatives promoting infrastructure development and the adoption of advanced maintenance technologies also contribute to market expansion. For instance, the increased focus on pipeline integrity in the oil & gas sector and the growing demand for airworthiness inspections in aviation directly drive borescope adoption.

Long-Term Growth Catalysts in the United States Borescope Market

Long-term growth will be fueled by continuous innovation in imaging technology, the development of compact and more versatile borescopes for diverse applications, and strategic partnerships between borescope manufacturers and end-users to develop customized solutions. Expansion into emerging markets and the growing adoption of borescopes for applications beyond traditional industries will also contribute to sustained market growth. The increasing integration of borescopes with IoT and cloud platforms enables data-driven maintenance, further boosting market potential.

Emerging Opportunities in United States Borescope Market

Emerging opportunities include the integration of augmented reality (AR) and virtual reality (VR) technologies for enhanced visualization, the development of miniaturized borescopes for minimally invasive inspections, and the expansion into new applications such as medical diagnostics. The growing demand for remote visual inspection solutions further presents significant opportunities in sectors with geographically dispersed assets. Increased focus on sustainability and reduction of environmental impact drives demand for eco-friendly borescope manufacturing practices.

Leading Players in the United States Borescope Market Sector

- Titan Tool Supply Co

- Klein Tools Inc

- JME Technologies

- Olympus America Inc

- PCE Instruments

- SPI Borescopes LLC

- Lenox Instrument Company

- USA Borescopes

- ViewTech Borescopes

- Waygate Technologies (Baker Hughes Company)

- Gradient Lens Corporation

- Danatronics Corporation

Key Milestones in United States Borescope Market Industry

- April 2022: ViewTech Borescopes showcased its VJ-3 Video Borescope Inspection Technology at CastExpo 2022, highlighting its range including the VJ-3 Dual Camera, VJ-3 3.9mm, VJ-3 2.8mm, and VJ-3 2.2mm models.

- February 2022: Waygate Technology (Baker Hughes) upgraded its Everest Mentor Visual iQ (MViQ) VideoProbe with AI capabilities, enhancing remote visual inspection for petrochemicals, energy, and aerospace.

Strategic Outlook for United States Borescope Market

The United States borescope market holds significant long-term growth potential driven by technological advancements, expanding applications across diverse industries, and the increasing emphasis on preventative maintenance. Strategic opportunities exist for companies to focus on developing innovative products with advanced features, expanding their distribution networks, and forging strategic partnerships to penetrate new markets and strengthen their competitive positions. The market's future will be shaped by companies that can effectively adapt to evolving technological trends and effectively meet the growing demand for high-performance, reliable borescope solutions.

United States Borescope Market Segmentation

-

1. Type

- 1.1. Video

- 1.2. Flexible

- 1.3. Endoscopes

- 1.4. Semi-rigid

- 1.5. Rigid

-

2. Diameter

- 2.1. 0 mm to 3 mm

- 2.2. 3 mm to 6 mm

- 2.3. 6 mm to 10 mm

- 2.4. Above 10 mm

-

3. Angle

- 3.1. 0° to 90°

- 3.2. 90° to 180°

- 3.3. 180° to 360°

-

4. End-Uer

- 4.1. Automotive

- 4.2. Aviation

- 4.3. Power Generation

- 4.4. Oil & Gas

- 4.5. Manufacturing

- 4.6. Chemicals

- 4.7. Food & Beverages

- 4.8. Pharmaceuticals

- 4.9. Mining and Construction

- 4.10. Other End-Users

United States Borescope Market Segmentation By Geography

- 1. United States

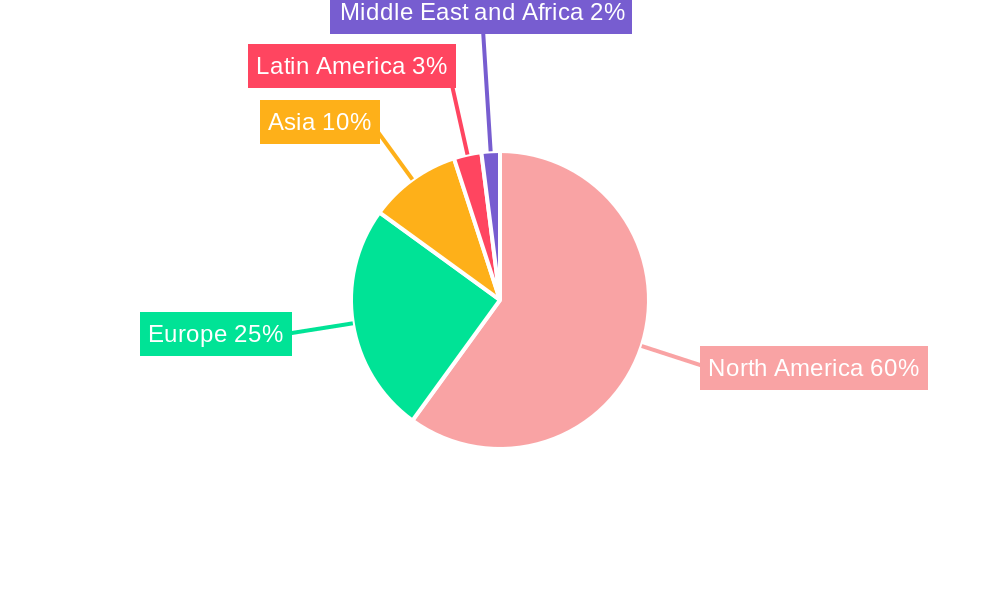

United States Borescope Market Regional Market Share

Geographic Coverage of United States Borescope Market

United States Borescope Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Need for Power Plant Maintenance Borescope; Increasing Requirement for High Operational Productivity

- 3.3. Market Restrains

- 3.3.1. Performance Limitations in Low Light and Extreme Operating Conditions

- 3.4. Market Trends

- 3.4.1. Aviation Sector to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Borescope Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Video

- 5.1.2. Flexible

- 5.1.3. Endoscopes

- 5.1.4. Semi-rigid

- 5.1.5. Rigid

- 5.2. Market Analysis, Insights and Forecast - by Diameter

- 5.2.1. 0 mm to 3 mm

- 5.2.2. 3 mm to 6 mm

- 5.2.3. 6 mm to 10 mm

- 5.2.4. Above 10 mm

- 5.3. Market Analysis, Insights and Forecast - by Angle

- 5.3.1. 0° to 90°

- 5.3.2. 90° to 180°

- 5.3.3. 180° to 360°

- 5.4. Market Analysis, Insights and Forecast - by End-Uer

- 5.4.1. Automotive

- 5.4.2. Aviation

- 5.4.3. Power Generation

- 5.4.4. Oil & Gas

- 5.4.5. Manufacturing

- 5.4.6. Chemicals

- 5.4.7. Food & Beverages

- 5.4.8. Pharmaceuticals

- 5.4.9. Mining and Construction

- 5.4.10. Other End-Users

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Titan Tool Supply Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Klein Tools Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 JME Technologies

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Olympus America Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PCE Instruments

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SPI Borescopes LLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Lenox Instrument Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 USA Borescopes

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ViewTech Borescopes

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Waygate Technologies (Baker Hughes Company)*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Gradient Lens Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Danatronics Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Titan Tool Supply Co

List of Figures

- Figure 1: United States Borescope Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: United States Borescope Market Share (%) by Company 2025

List of Tables

- Table 1: United States Borescope Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: United States Borescope Market Revenue undefined Forecast, by Diameter 2020 & 2033

- Table 3: United States Borescope Market Revenue undefined Forecast, by Angle 2020 & 2033

- Table 4: United States Borescope Market Revenue undefined Forecast, by End-Uer 2020 & 2033

- Table 5: United States Borescope Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: United States Borescope Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 7: United States Borescope Market Revenue undefined Forecast, by Diameter 2020 & 2033

- Table 8: United States Borescope Market Revenue undefined Forecast, by Angle 2020 & 2033

- Table 9: United States Borescope Market Revenue undefined Forecast, by End-Uer 2020 & 2033

- Table 10: United States Borescope Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Borescope Market?

The projected CAGR is approximately 7.1%.

2. Which companies are prominent players in the United States Borescope Market?

Key companies in the market include Titan Tool Supply Co, Klein Tools Inc, JME Technologies, Olympus America Inc, PCE Instruments, SPI Borescopes LLC, Lenox Instrument Company, USA Borescopes, ViewTech Borescopes, Waygate Technologies (Baker Hughes Company)*List Not Exhaustive, Gradient Lens Corporation, Danatronics Corporation.

3. What are the main segments of the United States Borescope Market?

The market segments include Type, Diameter, Angle, End-Uer.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Need for Power Plant Maintenance Borescope; Increasing Requirement for High Operational Productivity.

6. What are the notable trends driving market growth?

Aviation Sector to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Performance Limitations in Low Light and Extreme Operating Conditions.

8. Can you provide examples of recent developments in the market?

April 2022 - ViewTech Borescopes announced to showcase its VJ-3 Video Borescope Inspection Technology at CastExpo 2022. The company would exhibit borescopes, including a VJ-3 Dual Camera, VJ-3 3.9mm, VJ-3 2.8mm, and VJ-3 2.2mm.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Borescope Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Borescope Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Borescope Market?

To stay informed about further developments, trends, and reports in the United States Borescope Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence