Key Insights

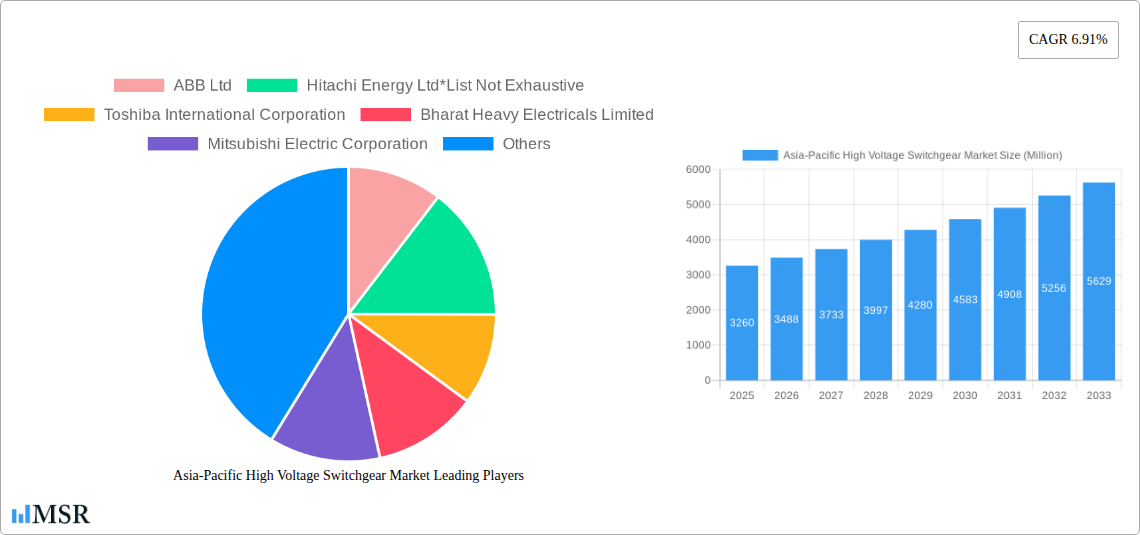

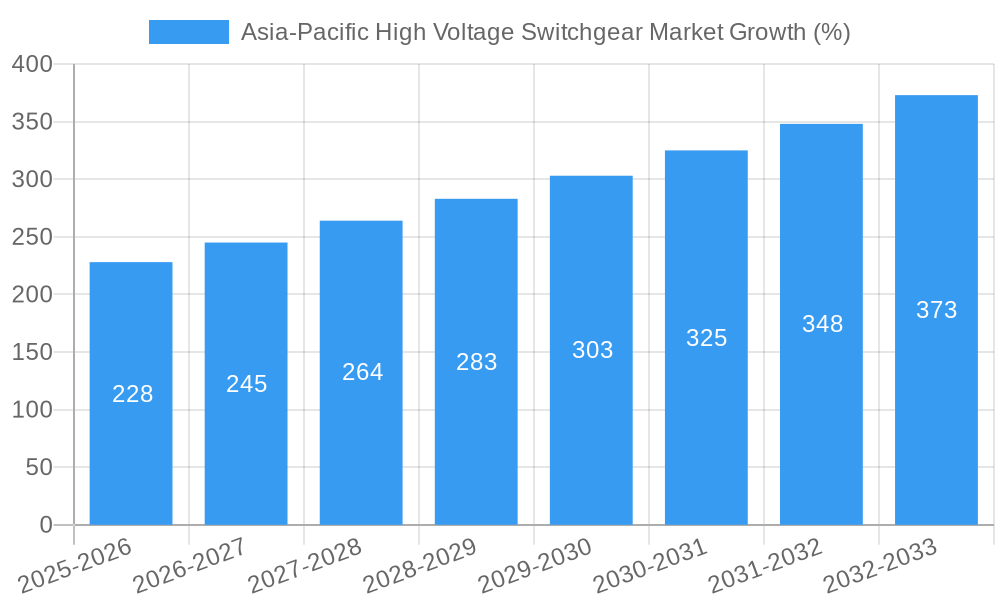

The Asia-Pacific high-voltage switchgear market, valued at $3.26 billion in 2025, is projected to experience robust growth, driven by the region's expanding power infrastructure and increasing investments in renewable energy sources. The market's Compound Annual Growth Rate (CAGR) of 6.91% from 2025 to 2033 signifies a significant expansion opportunity. Key drivers include rising electricity demand fueled by industrialization and urbanization, coupled with the need for reliable and efficient power transmission and distribution networks across countries like China, India, and Japan. Furthermore, stringent government regulations promoting grid modernization and enhanced safety standards are propelling market growth. The segment encompassing gas-insulated switchgear is expected to dominate due to its superior performance and reliability compared to air-insulated counterparts. However, challenges remain, including the high initial investment costs associated with high-voltage switchgear and potential supply chain disruptions. Despite these restraints, the long-term outlook for the Asia-Pacific high-voltage switchgear market remains positive, with significant potential for growth across various segments and applications. Leading players such as ABB, Hitachi Energy, and Siemens are actively expanding their presence in the region through strategic partnerships and technological advancements. The increasing adoption of smart grids and the integration of advanced technologies like digital twins and AI for predictive maintenance are further shaping the market landscape.

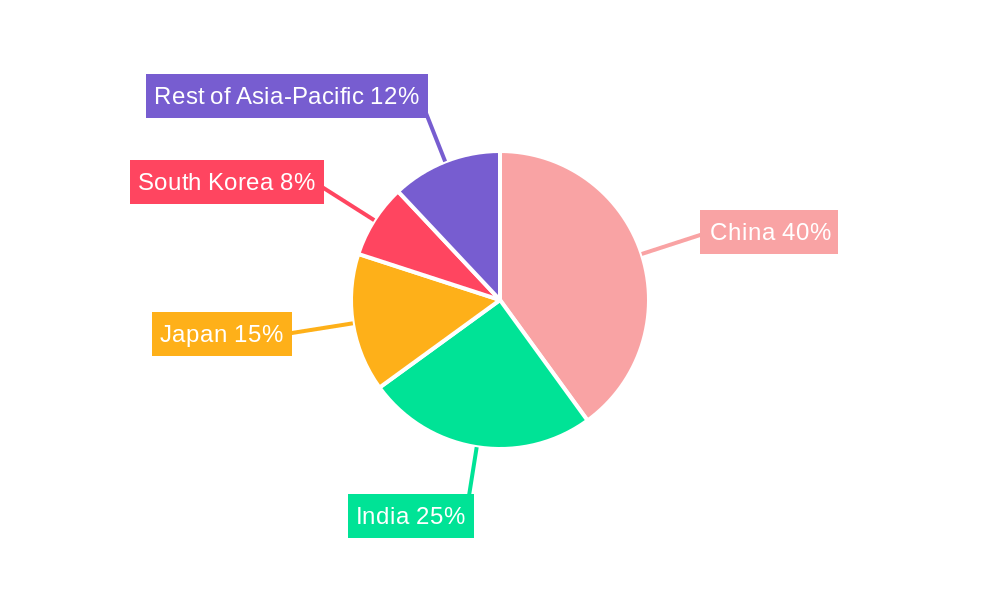

The substantial growth in the Asia-Pacific region is fueled by large-scale infrastructure development projects, particularly in emerging economies. This, coupled with the burgeoning renewable energy sector, necessitates reliable and advanced switchgear solutions. While China and India are currently the leading markets, other countries like Japan, South Korea, and Australia are also witnessing significant growth due to modernization initiatives and investment in smart grids. The competitive landscape is characterized by both established multinational corporations and local players, leading to innovation and a wider range of product offerings. The market's segmentation based on type (air-insulated, gas-insulated, and others) reflects the diverse needs and technological preferences across various applications and geographical locations. Continuous technological advancements, focused on improving efficiency, reliability, and safety, are expected to drive further market expansion in the coming years.

Asia-Pacific High Voltage Switchgear Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia-Pacific High Voltage Switchgear market, covering market size, growth drivers, key players, and future trends. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is essential for industry stakeholders, investors, and anyone seeking a complete understanding of this dynamic market.

Asia-Pacific High Voltage Switchgear Market Market Concentration & Dynamics

The Asia-Pacific high voltage switchgear market exhibits a moderately concentrated landscape, with key players like ABB Ltd, Hitachi Energy Ltd, Toshiba International Corporation, Bharat Heavy Electricals Limited, Mitsubishi Electric Corporation, Siemens AG, Larson & Turbo Limited, General Electric Company, and Hyosung Heavy Industries Corp holding significant market share. However, the presence of numerous smaller players indicates a competitive environment.

Market Concentration Metrics:

- Market share of top 5 players: xx% (Estimated 2025)

- Herfindahl-Hirschman Index (HHI): xx (Estimated 2025)

Market Dynamics:

- Innovation Ecosystems: Significant R&D investments are driving innovation in gas-insulated switchgear and smart grid technologies. Collaboration between manufacturers and research institutions is fostering advancements in materials science and digitalization.

- Regulatory Frameworks: Government regulations promoting renewable energy integration and grid modernization are significantly impacting market growth. Stringent safety standards influence product design and manufacturing.

- Substitute Products: While limited, alternative technologies like solid-state circuit breakers are emerging, although their widespread adoption remains uncertain.

- End-User Trends: The increasing demand for reliable and efficient power transmission from expanding industrial sectors and rising energy consumption is a key driver.

- M&A Activities: The number of mergers and acquisitions in the high voltage switchgear sector has been moderate in recent years. Consolidation is expected to continue, driven by the need for economies of scale and technological advancements. An estimated xx M&A deals occurred between 2019-2024.

Asia-Pacific High Voltage Switchgear Market Industry Insights & Trends

The Asia-Pacific high voltage switchgear market is experiencing robust growth, driven by the region's expanding power infrastructure, increasing energy demands, and a surge in renewable energy projects. The market size reached xx Million USD in 2024 and is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching xx Million USD by 2033. Key growth drivers include sustained economic expansion across several Asian nations, coupled with government initiatives supporting grid modernization and renewable energy integration. Technological advancements, such as the introduction of gas-insulated switchgear with improved performance and enhanced safety features, are also contributing to market expansion. However, challenges such as supply chain disruptions and geopolitical uncertainties could influence growth trajectories. The shift towards smart grids and the increasing adoption of digital technologies in power systems are reshaping the market landscape, favoring manufacturers capable of providing advanced solutions and services.

Key Markets & Segments Leading Asia-Pacific High Voltage Switchgear Market

China dominates the Asia-Pacific high voltage switchgear market, driven by its massive infrastructure development programs and substantial investments in renewable energy. India and other Southeast Asian countries are also experiencing significant growth.

Dominant Segment: Gas-insulated switchgear holds a substantial market share due to its superior performance, reliability, and compactness compared to air-insulated switchgear.

Key Market Drivers:

- China: Rapid industrialization, urbanization, and expanding power grids fuel high demand. Massive investments in UHV transmission lines further boost the market.

- India: Government initiatives to improve power infrastructure and support renewable energy projects are driving market expansion.

- Southeast Asia: Economic growth and increased energy consumption are fueling the demand for reliable power transmission equipment.

Segment Dominance Analysis: Gas-insulated switchgear's dominance is attributed to its superior performance and compactness, particularly in high-density urban areas and demanding applications. The segment benefits from continuous innovation driving efficiency and enhanced safety measures. Air-insulated switchgear retains a significant share due to its established presence and cost-effectiveness in specific applications. Other types of switchgear, though smaller, are showing growth driven by niche applications and technological advancements.

Asia-Pacific High Voltage Switchgear Market Product Developments

Recent product innovations focus on enhancing reliability, improving efficiency, and incorporating smart grid functionalities. Manufacturers are developing advanced gas-insulated switchgear with improved dielectric strength, reduced maintenance needs, and integrated digital sensors for remote monitoring and predictive maintenance. These advancements provide significant competitive advantages by enhancing operational efficiency and reducing downtime. The integration of digital technologies is transforming the market, enabling remote control, automated fault detection, and advanced analytics for optimizing grid operations.

Challenges in the Asia-Pacific High Voltage Switchgear Market Market

The Asia-Pacific high voltage switchgear market faces challenges including:

- Regulatory hurdles: Navigating complex regulations and compliance requirements across diverse markets can be challenging.

- Supply chain disruptions: Global supply chain vulnerabilities can impact the availability of raw materials and components, affecting production and delivery timelines.

- Intense competition: The presence of numerous domestic and international players creates intense competition, pressuring profit margins.

Forces Driving Asia-Pacific High Voltage Switchgear Market Growth

Several factors are driving market growth, including:

- Technological advancements: Innovations in gas-insulated switchgear, digitalization, and smart grid technologies are boosting efficiency and reliability.

- Economic growth: Sustained economic expansion across several Asian countries fuels increased energy demand and infrastructure development.

- Government support: Policies promoting renewable energy integration and grid modernization create a favorable market environment. Examples include China's continued investment in its UHV grid and India's initiatives to improve its electricity infrastructure.

Long-Term Growth Catalysts in Asia-Pacific High Voltage Switchgear Market

Long-term growth will be driven by continued innovation in switchgear technology, strategic partnerships to expand market reach, and exploration of new growth markets within the region. The development of more sustainable and environmentally friendly switchgear will also be a crucial factor.

Emerging Opportunities in Asia-Pacific High Voltage Switchgear Market

Emerging opportunities include:

- Smart grid integration: The increasing adoption of smart grid technologies opens opportunities for advanced switchgear with integrated digital functionalities.

- Renewable energy integration: The growth of renewable energy sources, such as wind and solar power, creates demand for high-voltage switchgear capable of handling intermittent power supplies.

- Expansion into less-developed markets: Untapped potential exists in less-developed regions across Asia, particularly those experiencing rapid economic growth and infrastructure development.

Leading Players in the Asia-Pacific High Voltage Switchgear Market Sector

- ABB Ltd

- Hitachi Energy Ltd

- Toshiba International Corporation

- Bharat Heavy Electricals Limited

- Mitsubishi Electric Corporation

- Siemens AG

- Larson & Turbo Limited

- General Electric Company

- Hyosung Heavy Industries Corp

Key Milestones in Asia-Pacific High Voltage Switchgear Market Industry

- October 2023: Completion of the 1,000 kV Fuzhou–Xiamen UHV AC transmission project by State Grid Corporation of China, significantly boosting power transmission capacity and clean energy integration in Fujian province.

- July 2022: Hitachi Energy's Oceaniq secures a contract to supply transformers and high-voltage switchgear for China's Tuci offshore wind power project, accelerating offshore wind development.

- March 2022: State Grid Corp of China initiates construction of two major UHV transmission projects, totaling USD 1.7 Billion in investment, demonstrating significant commitment to grid expansion.

Strategic Outlook for Asia-Pacific High Voltage Switchgear Market Market

The Asia-Pacific high-voltage switchgear market presents substantial growth potential driven by sustained infrastructure development, increasing energy demand, and the ongoing transition towards cleaner energy sources. Strategic opportunities exist for companies that can leverage technological advancements, establish strong partnerships, and effectively address the regulatory landscape in key regional markets. Focus on innovation, particularly in the areas of smart grid technologies and sustainable solutions, will be critical for long-term success.

Asia-Pacific High Voltage Switchgear Market Segmentation

-

1. Type

- 1.1. Air-insulated

- 1.2. Gas-insulated

- 1.3. Other Types

-

2. Geography

-

2.1. Asia-Pacific

- 2.1.1. India

- 2.1.2. China

- 2.1.3. Japan

- 2.1.4. Rest of the Asia-pacific

-

2.1. Asia-Pacific

Asia-Pacific High Voltage Switchgear Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. India

- 1.2. China

- 1.3. Japan

- 1.4. Rest of the Asia pacific

Asia-Pacific High Voltage Switchgear Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.91% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Electricity Generation and Consumption

- 3.3. Market Restrains

- 3.3.1. 4.; Stringent Environmental and Safety Regulations Related to the High Voltage Switchgear

- 3.4. Market Trends

- 3.4.1. Gas-Insulated Switchgear is Expected to Witness a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific High Voltage Switchgear Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Air-insulated

- 5.1.2. Gas-insulated

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Asia-Pacific

- 5.2.1.1. India

- 5.2.1.2. China

- 5.2.1.3. Japan

- 5.2.1.4. Rest of the Asia-pacific

- 5.2.1. Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia-Pacific High Voltage Switchgear Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific High Voltage Switchgear Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific High Voltage Switchgear Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific High Voltage Switchgear Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific High Voltage Switchgear Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific High Voltage Switchgear Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific High Voltage Switchgear Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 ABB Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Hitachi Energy Ltd*List Not Exhaustive

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Toshiba International Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Bharat Heavy Electricals Limited

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Mitsubishi Electric Corporation

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Siemens AG

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Larson & Turbo Limited

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 General Electric Company

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Hyosung Heavy Industries Corp

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 ABB Ltd

List of Figures

- Figure 1: Asia-Pacific High Voltage Switchgear Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific High Voltage Switchgear Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific High Voltage Switchgear Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific High Voltage Switchgear Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Asia-Pacific High Voltage Switchgear Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Asia-Pacific High Voltage Switchgear Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia-Pacific High Voltage Switchgear Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia-Pacific High Voltage Switchgear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia-Pacific High Voltage Switchgear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia-Pacific High Voltage Switchgear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia-Pacific High Voltage Switchgear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia-Pacific High Voltage Switchgear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia-Pacific High Voltage Switchgear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia-Pacific High Voltage Switchgear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia-Pacific High Voltage Switchgear Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Asia-Pacific High Voltage Switchgear Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: Asia-Pacific High Voltage Switchgear Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: India Asia-Pacific High Voltage Switchgear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: China Asia-Pacific High Voltage Switchgear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Asia-Pacific High Voltage Switchgear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of the Asia pacific Asia-Pacific High Voltage Switchgear Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific High Voltage Switchgear Market?

The projected CAGR is approximately 6.91%.

2. Which companies are prominent players in the Asia-Pacific High Voltage Switchgear Market?

Key companies in the market include ABB Ltd, Hitachi Energy Ltd*List Not Exhaustive, Toshiba International Corporation, Bharat Heavy Electricals Limited, Mitsubishi Electric Corporation, Siemens AG, Larson & Turbo Limited, General Electric Company, Hyosung Heavy Industries Corp.

3. What are the main segments of the Asia-Pacific High Voltage Switchgear Market?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.26 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Electricity Generation and Consumption.

6. What are the notable trends driving market growth?

Gas-Insulated Switchgear is Expected to Witness a Significant Growth.

7. Are there any restraints impacting market growth?

4.; Stringent Environmental and Safety Regulations Related to the High Voltage Switchgear.

8. Can you provide examples of recent developments in the market?

October 2023: China’s transmission grid developer, State Grid of China Corporation (SGCC), has announced the completion of the 1,000 kV Fuzhou–Xiamen ultra-high voltage alternating current power transmission and conversion project, also known as the Fujian North-South Transmission Project. This allows the line to be put into operation as scheduled before the end of 2023. The project involved the construction of a new 1,000 kV double-circuit line spanning 238 km and 832 towers, besides a 6 GW substation. The line passes through the three cities of Fuzhou, Quanzhou, and Zhangzhou, with mountainous terrain, which made the project construction challenging. Once operational, it will increase the power receiving capacity of the Fujian power grid by 4 GW and promote the development of clean energy, such as coastal nuclear power and wind power.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific High Voltage Switchgear Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific High Voltage Switchgear Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific High Voltage Switchgear Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific High Voltage Switchgear Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence